Location: New York Remote: Yes Willing to relocate: Yes Technologies: * Primarily in Python * Secondary: C#, JavaScript * Middle tier to back-end development(Frameworks: Django, Flask, .NET Core, ORM: Django + SQLAlchemy) * FE experience: Angular7 + React * DevOps pipeline creation with Terraform and AWS CodePipeline * Docker and Kubernetes * Experience creating data …

Day: August 11, 2019

Bad Warriors Omens and Trevor Noah's First BS Interview | The Bill Simmons Podcast

HBO and The Ringer’s Bill Simmons is joined by Kevin O’Connor to talk about the Warriors blowing a 31-point lead at home to the Clippers (1:50). Then Bill sits down with comedian and host of ‘The Daily Show,’ Trevor Noah, to talk about the state of the “talk show” platform, the rise of digital media, taking over ‘The Daily Show’ in 2015, learning from Jon Stewart, sports, some of their favorite interviews, outrage culture, Trevor’s new podcast, and more (26:43).

The post Bad Warriors Omens and Trevor Noah's First BS Interview | The Bill Simmons Podcast appeared first on Buy It At A Bargain – Deals And Reviews.

Financial institution Lending Has Been Faced With a New Wave of Competition

Financial institution Lending Has Been Faced With a New Wave of Competition

Financial institution loaning has actually been encountered with a brand-new wave of competitors in the last years as a rise of on the internet loaning business as well as their brand-new advantages have actually caught the focus of lots of potential monetary customers. Financial institutions, on the various other hand, have a tendency to be the most official and also commonly additionally the most strict as much as financial institution financing treatments go.

Financial institutions are additionally the most typical kind of borrowing. The moms and dads of today’s generation commonly did not have lots of options various other than a financial institution. Financial institutions usually supply some of the cheapest passion prices readily available.

There are several disadvantages to financial institution borrowing likewise, specifically for the modern-day customer. Where time is one of the most beneficial assets for today’s service or person, financial institutions have the lengthiest financing treatments. In addition, due to the quantity of financial institution borrowing finance demands they get contrasted to reasonably couple of affiliates, long waiting times are experienced by possible clients.

Big companies and also the federal government itself is dependent on different business financing and also financial investment programs. On an individual basis, the ordinary American can appreciate his or her high criterion of living since of such borrowing chances as home mortgages, automobile funding, as well as pupil finances.

Virtually every brand-new organisation obtain some kind of business loaning or financing program to begin up their brand-new vision. As well as also day to day objectives today depend on loaning prolonged by credit history card firms.

With such a high need for different financing items, it is no surprise that the borrowing market as a service itself has actually expanded my bounds and also jumps. It has actually been compelled to adjust to the substantial range of demands required by its customers. With its clients varying from industrial titans to those with terrific credit scores to those with insolvencies as well as various other credit rating issues, everybody presents a real requirement for different financing items.

The financing sector is no much longer constrained to simply financial institutions as well as credit report unions. The web has actually included a substantial base of monetary firms that provide versatile as well as brand-new loaning items to its target market.

Today, internet lending institutions use a brand-new home window of chance for tiny organisations as well as people that require a rapid beginning up financing authorization procedure. Such lending institutions supply the straightest line to unprotected service lending financing, at fantastic prices.

Financial institution loaning has actually been encountered with a brand-new wave of competitors in the last years as a rise of on the internet borrowing business and also their brand-new advantages have actually caught the focus of several possible monetary customers. Financial institutions, on the various other hand, have a tendency to be the most official as well as commonly likewise the most rigorous as much as financial institution loaning treatments go.

Where time is one of the most useful products for today’s organisation or person, financial institutions have the lengthiest loaning treatments. In addition, due to the quantity of financial institution financing car loan demands they get contrasted to reasonably couple of partners, long waiting times are experienced by prospective clients. With such a high need for different financing items, it is no marvel that the financing market as a company itself has actually expanded my bounds as well as jumps.

The post Financial institution Lending Has Been Faced With a New Wave of Competition appeared first on ROI Credit Builders.

Financial institution Lending Has Been Faced With a New Wave of Competition

Financial institution Lending Has Been Faced With a New Wave of Competition

Financial institution loaning has actually been encountered with a brand-new wave of competitors in the last years as a rise of on the internet loaning business as well as their brand-new advantages have actually caught the focus of lots of potential monetary customers. Financial institutions, on the various other hand, have a tendency to be the most official and also commonly additionally the most strict as much as financial institution financing treatments go.

Financial institutions are additionally the most typical kind of borrowing. The moms and dads of today’s generation commonly did not have lots of options various other than a financial institution. Financial institutions usually supply some of the cheapest passion prices readily available.

There are several disadvantages to financial institution borrowing likewise, specifically for the modern-day customer. Where time is one of the most beneficial assets for today’s service or person, financial institutions have the lengthiest financing treatments. In addition, due to the quantity of financial institution borrowing finance demands they get contrasted to reasonably couple of affiliates, long waiting times are experienced by possible clients.

Big companies and also the federal government itself is dependent on different business financing and also financial investment programs. On an individual basis, the ordinary American can appreciate his or her high criterion of living since of such borrowing chances as home mortgages, automobile funding, as well as pupil finances.

Virtually every brand-new organisation obtain some kind of business loaning or financing program to begin up their brand-new vision. As well as also day to day objectives today depend on loaning prolonged by credit history card firms.

With such a high need for different financing items, it is no surprise that the borrowing market as a service itself has actually expanded my bounds and also jumps. It has actually been compelled to adjust to the substantial range of demands required by its customers. With its clients varying from industrial titans to those with terrific credit scores to those with insolvencies as well as various other credit rating issues, everybody presents a real requirement for different financing items.

The financing sector is no much longer constrained to simply financial institutions as well as credit report unions. The web has actually included a substantial base of monetary firms that provide versatile as well as brand-new loaning items to its target market.

Today, internet lending institutions use a brand-new home window of chance for tiny organisations as well as people that require a rapid beginning up financing authorization procedure. Such lending institutions supply the straightest line to unprotected service lending financing, at fantastic prices.

Financial institution loaning has actually been encountered with a brand-new wave of competitors in the last years as a rise of on the internet borrowing business and also their brand-new advantages have actually caught the focus of several possible monetary customers. Financial institutions, on the various other hand, have a tendency to be the most official as well as commonly likewise the most rigorous as much as financial institution loaning treatments go.

Where time is one of the most useful products for today’s organisation or person, financial institutions have the lengthiest loaning treatments. In addition, due to the quantity of financial institution financing car loan demands they get contrasted to reasonably couple of partners, long waiting times are experienced by prospective clients. With such a high need for different financing items, it is no marvel that the financing market as a company itself has actually expanded my bounds as well as jumps.

The post Financial institution Lending Has Been Faced With a New Wave of Competition appeared first on ROI Credit Builders.

Mux is hiring great people to keep building the best dang video infra on the web

Article URL: https://mux.com/jobs?a=1

Comments URL: https://news.ycombinator.com/item?id=20660005

Points: 1

# Comments: 0

Atomwise Is Hiring a Senior Data Engineer, Cheminformatics/Bioinformatics

Article URL: http://www.atomwise.com/jobs/senior-data-engineer-cheminformatics-bioinformatics/

Comments URL: https://news.ycombinator.com/item?id=20660667

Points: 1

# Comments: 0

New comment by tabbyg in "Ask HN: Who wants to be hired? (August 2019)"

Location: New York

Remote: Yes

Willing to relocate: Yes

Technologies:

* Primarily in Python

* Secondary: C#, JavaScript

* Middle tier to back-end development(Frameworks: Django, Flask, .NET Core, ORM: Django + SQLAlchemy)

* FE experience: Angular7 + React

* DevOps pipeline creation with Terraform and AWS CodePipeline

* Docker and Kubernetes

* Experience creating data pipelines for bringing machine learning models into production and integrating them into the existing ecosystem.

* Experience gathering technical requirements, determining project scope, resource allocation and associated costs.

* Experience taking on leadership and mentorship roles.

Background in software engineering and building scalable web applications. Looking for a role at the intersection of tech. and business.

Résumé/CV: https://github.com/tabbyg/r-sum-/blob/master/Gaudentia_Orwa_…

Email: adhis394752@gmail.com

That Offer to Make You Debt-Free? It Can Make You Worse Off

The Hierarchy Of Value For Info-Products

My view of how to effectively present and package info-products and content has changed radically over the last year…

Because, how you package and present your “information” and content determines how valuable prospects perceive it to be, what they’re willing to pay for it, and how it positions you in the marketplace.

Let me show you what you need to do today to ensure your info-products and content stand-out… and position you as a valuable expert and guide.

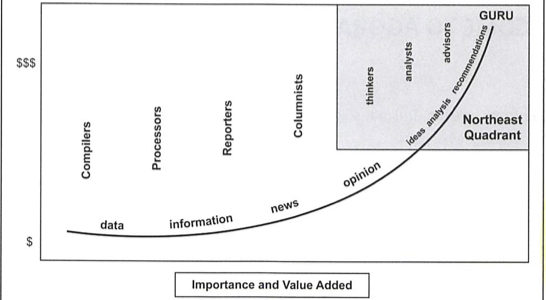

Let’s begin with a little chart:

What it shows is how valuable different types of content are and the financial opportunity of each.

For example…

While curated content, compiled lists, random tips, etc., are good for getting likes and social shares, they have the lowest level of value for info-products and marketplace positioning.

Meaning: That type of content commands a very low price tag… and does little if anything to position you as an authority.

That’s because, today, this type of information is pervasive. It’s available all over the web. And for free.

Fact is: Today, you can find “information” on any topic, at any time, on the web… in minutes. If not, seconds.

And that’s why this type of content is worth very little as an info-product. And why it will not position you as an expert or go-to advisor in your marketplace.

What buyers of info-products want… is NOT more “information”. They want original and specific advice and direction.

And the more specific and proprietary the advice, the more it’s worth. And the higher it can be priced.

That’s why I believe, today, the single best way to package your “information” is in the context of a framework.

A framework being a specific & proprietary methodology for obtaining an outcome or result, presented with a visual model.

Done correctly, you can build an entire business — a monster business — around a single framework.

Think, Stephen Covey’s Time Management Quadrant…

…or Robery Kiyosaki’s Cashflow Quadrant…

Both provide a specific methodology for achieving a desirable outcome with a simple framework.

There’s no list of tips. No random, additional ideas. And no general information.

And that’s why both of these frameworks have been worth hundreds of millions of dollars. And have made Covey and Kiyosaki rich, highly-sought-after experts.

You see: By packaging your “information” within a framework, you immediately position it as unique and different. You immediately prevent any kind of apples to oranges comparison. And you immediately become viewed as an expert with a specific method of achieving a desirable result.

Here’s another example. Something called “The IIO Framework” from Frank Kern…

And an example from Brendon Burchard of his High Performance Framework…

And here’s my main framework at MFA — The E5 Funnel Architecting Framework…

See: By offering your specific advice in the form of a framework you push your “information” to that Northeast Section of the Value Hierarchy Chart (above). So it instantly becomes viewed as more valuable, more desirable, and more sellable.

And that’s the key making your content standout and positioning yourself as an expert in your marketplace.

Simply put: Don’t offer more “information”. Offer a unique framework that will give your prospects the results they want.

The post The Hierarchy Of Value For Info-Products appeared first on Marketing Funnel Automation.

The post The Hierarchy Of Value For Info-Products appeared first on Getting Your Business Started Off To The Right Start.

Utilizing the Stock Market to Plan for Retirement

Making Use Of the Stock Market to Plan for Retirement

The stock exchange can be an effective financial investment device, particularly if you’re intending on making lasting financial investments. The instability of the market can make numerous individuals reluctant to count on in it for monetary preparation. In spite of this, if you’re trying to find a method to make prepare for your ultimate retired life you could wish to allot a few of your skepticism for the marketplace’s instability and also think about making use of the stock exchange as a device for intending your retired life.

Listed below you’ll discover recommendations on exactly how to ideal job the marketplace to your benefit for long-lasting financial investment preparation, along with some fundamental details on usual retirement that use supply financial investment.

Deciding On Investments Carefully

Among the manner ins which you can optimize your financial investment so regarding obtain one of the most out of your retired life is to put in the time to meticulously pick the supplies, bonds, as well as various other market financial investments that you intend on placing your cash right into. This implies that you need to investigate the background of the numerous financial investments you take into consideration making to figure out whether the financial investment has an excellent possibility as a lasting financial investment.

Analyze the efficiency of the supplies as well as various other financial investments that you’re thinking about, ensuring that you’re selecting them as a result of their capacity for future efficiency as well as not even if of exactly how they have actually been doing in current weeks.

Think about purchasing business that have actually been consistent however slow-moving entertainers throughout a number of years, or those financial investments that deal straight with rare-earth elements or various other products that are not most likely to endure a radical decline in their worth.

Diversity

When selecting your financial investments, it’s vital to expand your acquisitions by selecting supplies as well as various other financial investments from a variety of market fields as well as sectors. Diversity is really essential in long-lasting investing, especially when the financial investment is assigned to aid spend for your retired life as well as maintain you with your retired life years.

By expanding your financial investment profile, you can possibly stay clear of a severe decrease in the worth of your total profile as a result of the bad efficiency of specific fields or sectors; the supplies and also various other financial investments in non-affected markets will likely remain to carry out at their normal degree (and also might possibly increase), therefore minimizing the adverse effect of the inadequate efficiency.

Viewing Your Investments

It’s vital to watch on your financial investments to make sure that you can establish appropriate times to acquire extra shares of specific financial investments or to offer shares of financial investments that are most likely to experience a lasting decline in worth. By maintaining a close watch on your cash, you can much better make the most of fads out there and also stay clear of possibly expensive losses (or at least lessen your loss) that are based upon the efficiency or detractions of the business that you are purchased.

Enjoying your financial investments is additionally a great way to obtain a feeling for precisely just how much your financial investments deserve, as well as to assist ensure that they deserve that much otherwise a lot more when the moment concerns money in the financial investments and also retire comfortably.

Usual Investment Plans

Numerous companies currently use various sorts of financial investment bundles as a component of their fringe benefit bundles. Supply alternatives, 401( k) strategies, shared funds, and also various other financial investments might be offered to you with your work environment; contact your company to see if any type of company-sponsored financial investment strategies can aid you to fulfill your financial investment for retired life objectives.

You might easily reprint this short article gave the adhering to writer’s bio (consisting of the real-time URL web link) continues to be undamaged:

The post Utilizing the Stock Market to Plan for Retirement appeared first on ROI Credit Builders.