Land Minority Small Business Loans to Fund Your Business

If you are a person of color who runs a business, you could end up having some trouble finding traditional loans that will work with your unique needs. Typically, there are not a lot of loans designed specifically for minority business owners. However, there are some loan options that work better than others.

How to Find Minority Small Business Loans: What You Need to Know

What’s the trick to finding minority small business loans? Where is a minority business owner to go when the traditional options for loans do not work out? There are a few options for minority small business loans that you may not realize are out there. Some involve the government through the Small Business Administration, while others involve going a more non-traditional route with private lenders.

Find out why so many companies use our proven methods to get business loans.

Where to Start with Minority Small Business Loans: The Small Business Administration

You cannot talk about minority small business loans without some discussion on the SBA. While they do not lend funds themselves, they do handle the administration of a number of loan programs that help all small businesses get the funds they need through partner lenders.

Minority Small Business Loans: 7(a) Loans

This is the Small Business Administration’s most known program. It provides federally funded term loans up to $5 million. The funds can be used for a number of purposes. These include expansion, purchasing equipment, working capital and more. Banks, credit unions, and other specialized institutions in partnership with the SBA process these loans and disburse the funds.

Minority Small Business Loans: 504 Loans

504 loans are also available up to $5 million and can buy machinery, facilities, or land. Typically, they are used for expansion. They work especially well for commercial real estate purchases.

Minority Small Business Loans: Microloans

These are $50,000 or less. They work well for starting a business, purchasing equipment, buying inventory, or general working capital.

Minority Small Business Loans: SBA Express Loans

These are fast turnaround loans, with the SBA taking up to only 36 hours to give a decision. There is less paper work as well, which is part of what makes express loans great if you qualify.

Minority Small Business Loans: SBA Community Advantage Loans

This is a pilot program running through 2020, with the potential for extension. Its purpose is to promote economic growth in underserved areas and markets. Decision makers look past such things as poor credit or low revenue if the business has the potential to create jobs or promote economic growth in underserved areas.

These are some of their most popular programs. The Small Business Administration does so much more for small businesses in addition to these. Get more details on the SBA, these loan programs, and additional resources offered by the Small Business Administration here.

Other Options for Minority Small Business Loans: Private Lenders

Though not specific to minorities, some private lenders offer products that work better with the unique needs and challenges of minority business owners than others.

OnDeck

OnDeck offers lines of credit and term loans with fixed interest rates. You can get up to $500,000 with a term loan. Also, they have an A rating with the Better Business Bureau. The minimum FICO they require is 600. In addition, you must have $100,000 minimum annual revenue and be in business for at least one year. Find out more about OnDeck in our review.

BlueVine

BlueVine offers a number of financing options including term loans, invoice financing, equipment financing, lines of credit, and merchant cash advances. As a requirement, you have to be in business for at least 6 months. If you need a term loan or a line of credit, then they require a minimum annual revenue of $100,000. For those looking for invoice factoring, the minimum credit score is just 530! If you want a line of credit or term loan, you will need a minimum credit score of 600. They have an A+ rating with the BBB. Find out more about BlueVine in this review.

Funding Circle

If you’re looking for a low APR, then Funding Circle is your go-to. They have fixed rate term loans and require a credit score of 620 or above. Unlike BlueVine, there is no minimum revenue requirement. However, they do require you to be in business for at least 2 years. They have an A+ BBB rating. Find out more in our Funding Circle review.

StreetShares

This company offers invoice financing, term loans, and lines of credit. Similar to others, there is a number of years in business requirement. However, they require less minimum annual revenue than others at only $25,000. Additionally, the minimum credit score is 600. They also have an A+ rating with the Better Business Bureau. Find out more about StreetShares in our review, here.

SmartBiz

SBA loans typically take a lot of time and paperwork. Still, SmartBiz found a way to speed things up. They make it easier than ever. Unfortunately, they do have stricter requirements. For example, your credit score has to be at least 650. Also, you have to be in business for 2 years or more. Further, annual revenue has to be $50,000 at least. There can be no outstanding liens, bankruptcies, or foreclosures in the past 3 years either.

Tips for Landing A Minority Small Business Loan

Once you know where to go to get minority small business loans, you need to know how to get them. Meeting all the requirements is the first part, but these tips can help you out even more.

Appear Fundable

A business that appears fundable to a lender is an established business separate from its owner. It is complete, organized, and either has solid revenue or a solid startup plan.

Find out why so many companies use our proven methods to get business loans.

To appear fundable, a business needs:

- To be formally incorporated as an S-corp, LLC, or a corporation.

- An EIN from the IRS. This is an identifying number for your business that functions similar to the way your SSN does for you personally.

- A dedicated business bank account.

- Contact information that is different from the owner’s. A separate telephone number on a toll-free exchange and a dedicated physical address are imperative.

- A professional website and an email address that has the same URL. Free web hosting and email services won’t do the job in this case.

Find out more about fundability here.

You Must Have a Business Plan

Lenders want to see a professional business plan. Even if you are not a startup a plan is necessary. Startups need a plan so that lenders can see they know what they are doing. Established businesses need to show how they plan to use the funds. Lenders want to see that they have research to show the market supports that plan. Find out more about business plans here.

Be Prepared

It is almost impossible to over prepare when applying for a loan. Consequently, you should try to anticipate any questions. Pull together forms and documentation they may ask for. Items such as past tax returns, financials, and licenses are common. The more you have ready to go before you start, the faster and easier the process will be.

Your Personal Credit Has to Be Strong

You need a solid personal credit score to land the best small business loans. There is just no way around it. As you can see above, a score of 600 or above is required almost across the board with the exception of some invoice factoring options.

Remember, it is possible to improve your personal credit score. The first step is to get a copy of your credit report. You can get a free copy each year. Look for what may be having a negative impact. If there are mistakes, contact the credit agency in writing to have them removed. If late payments are the issue, start paying on time. You cannot fix a problem until you know what the problem is.

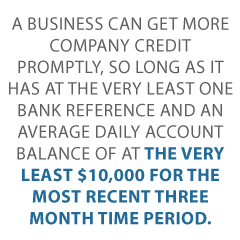

Business Credit Is Important Too

Of course, when it comes to minority small business loans, you cannot ignore business credit. While it isn’t listed as a primary requirement for most lenders, having a strong business credit score can only help you.

If a lender sees a personal score that isn’t exactly what they need, they may take business credit into consideration when making their decision. In addition, if you qualify for the loan and have good business credit, you may be able to get a lower interest rate.

Additional Options for Funding a Minority Owned Business

Grants are also an option for minority business owners. They can help bridge funding gaps and stretch funds from minority small business loans. However, they are highly competitive. Many are only available to those that meet very specific criteria. Here is just a sample of some minority business grants that are out there.

First Nations Development Institute Grants

The mission of this group is to offer grants that help Alaska Natives, Native Hawaiians, and Native Americans. Not only that, but there are a wide range of opportunities from the First Nations Development Institute. There is a mailing list you can join to receive information about new opportunities as they become available.

National Black MBA Association Scale-Up Pitch Challenge

Also known as NBMBAA, the Scale-Up Pitch Challenge offers cash prizes ranging from $1,000 to $50,000. The association says its purpose is to help newer businesses that have an African founder that maintains equal ownership.

A business must be a member of the NBMBAA to compete. There is a $10 monthly membership fee. After that, there is an online application. If chosen, you must submit a pitch that lasts three minutes. After that, finalists go on to compete at the NBMBAA annual conference.

Other Grant Options: Non-Minority Specific

There are grant options that can work well even though they are not exclusively for minorities. They are available to everyone, including minorities. Some examples include the following.

FedEx Small Business Grant

This grant is how FedEx is working to strengthen small business innovation. There are 10 grants the company awards each year. They range from $15,000 to $50,000, and if you’re a business with a cutting-edge product, this could be a great opportunity.

A business must use the FedEx website to submit entries. There are a few questions to answer about your business. In addition, there is a requirement for an elevator pitch about what makes your business special. Also, you have to explain how you would use the funds. A 90 second video submission is an option as well.

Find out why so many companies use our proven methods to get business loans.

NASE Growth Grants

The National Association for the Self-Employed (NASE) has small business Growth Grants of up to $4,000. They are for micro-businesses, and proceeds can be used for a number of things. They can be utilized for marketing, advertising, expansion, and even to hire employees. These grants are open to everyone. However, you do have to be an NASE member to apply. Membership fees vary based on the membership level chosen.

USDA Value Added Producer Grant

The USDA’s Value-Added Producer Grant (VAPG) program offers grants for small businesses. It includes minority owned business. Grants range up to $250,000. They are specifically to help agricultural producers with activities that add value to their products. As a result, grants are open to those in rural areas. They must be operating as one of the following:

- Cooperative

- Farmer

- Rancher

- an independent agricultural producer

- or an agricultural producer group

Know Your Options for Minority Small Business Loans and Other Resources

As a minority business owner, it is important that you know what options are available to you regarding funding and support. The list above is a starting point, but here is so much more out there. Be sure to do your own research. In addition, get your personal and business credit in order, and be sure your business is fundable, so that you do not miss out on an opportunity.

The post Land Minority Small Business Loans to Fund Your Business appeared first on Credit Suite.