Article URL: https://jobs.cambly.com/?utm_source=hackernewsjobs&utm_medium=organic&utm_campaign=20201117 Comments URL: https://news.ycombinator.com/item?id=25139187 Points: 1 # Comments: 0

Month: November 2020

Stocks Slip After Dow, S&P Hit Records

The Dow Jones Industrial Average pared losses, but finished lower a day after closing just shy of its 30000-point milestone on optimism about new Covid-19 vaccines.

The post Stocks Slip After Dow, S&P Hit Records first appeared on Online Web Store Site.

The post Stocks Slip After Dow, S&P Hit Records appeared first on ROI Credit Builders.

Stocks Slip After Dow, S&P Hit Records

The Dow Jones Industrial Average pared losses, but finished lower a day after closing just shy of its 30000-point milestone on optimism about new Covid-19 vaccines.

The post Stocks Slip After Dow, S&P Hit Records first appeared on Online Web Store Site.

The post Stocks Slip After Dow, S&P Hit Records appeared first on ROI Credit Builders.

Stocks Slip After Dow, S&P Hit Records

The Dow Jones Industrial Average pared losses, but finished lower a day after closing just shy of its 30000-point milestone on optimism about new Covid-19 vaccines.

The post Stocks Slip After Dow, S&P Hit Records first appeared on Online Web Store Site.

The post Stocks Slip After Dow, S&P Hit Records appeared first on ROI Credit Builders.

How to Write PPC Ad Copy Using AI

It’s no secret: the world of PPC advertising is not for the faint-hearted. If you don’t know what you’re doing, you could end up throwing money down the drain.

How can you increase the chances of the right people clicking on your ads? You need to learn how to write ad copy that converts.

Thankfully, technological advancements like artificial intelligence (AI) are here to save the day. AI tools can help you write ad copy that produces results.

How Can Artificial Intelligence Help Your PPC Campaigns?

Just so we’re on the same page, let’s quickly look at a simple definition of AI.

Artificial intelligence (AI) is a multidisciplinary branch of science that includes machine learning (ML), natural language processing (NLP), deep learning, and many other emerging technologies.

The main benefits of AI when it comes to creating compelling PPC ad copy include:

- Unmatched data processing power

- Ability to better “predict” click-through rates and quality scores

- Identify bids that will get the most traffic

- Saves you time managing campaigns

However, no matter how much data you have at your fingertips and how well you can identify lucrative bids, all that will be to no avail if your ad copy sucks.

AI can help you with that. I’ll show you how below.

6 Ways AI Can Help You Write Good PPC Ad Copy

Many tools can help you write ad copy. However, many AI-powered tools have one huge advantage: unlike their predecessors that relied on historical data, AI-powered tools give you real-time data. This process allows you to refine your copy to better suit the market situation when the content is created and published.

These are tips that will help optimize your ad copy, whether you’re advertising on Google, Bing, Facebook, or any other of the myriad platforms available.

Use AI for Audience Research

The very first thing you need to do before writing ad copy is to understand your target audience. The key to successful ad copy is to know not only who your target audience is, but also to know:

- What they’re looking for

- Why they’re looking for it

In short, understanding your audience will help you understand the intent behind your prospect’s search. Knowing this could help you write personalized ad copy that will resonate with your audience, eliciting a click through to your offer.

It will also help you create ads that are so targeted that only the right people will click on them. Additionally, it will help you write ad copy that addresses any objections your audience may have.

When you know how to write ad copy that speaks directly to your audience, you’ll likely enjoy a reduction in wasted clicks and an increase in your return on ad spend (ROAS).

How do you get to know your audience? This process is where AI shines best.

AI-powered audience research tools like IBM’s Watson are great for helping you with predictive audiences. These consumers may not look anything alike but have some common threads that make them relevant targets for your PPC ads. By processing data from multiple sources, AI helps you understand the type of people you should target with your ads.

These insights help you significantly reduce the risk of ad waste, as your ad copy will be hyper-personalized, making it appealing to the right people. With ad spend steadily increasing across all industries, AI will help ensure that you get a good ROI from your campaigns.

Conduct Competitor Research Using AI

Before you put pen to paper, you must study the competitive environment.

You must conduct competitor research. This data will help you understand (among other things):

- The type of ad copy that generates clicks

- Ad formats that work best in your niche

- Opportunities your competitors are missing that you can leverage

The data you get from your competitors’ ad campaigns is invaluable in helping you know how to write ad copy that will perform exceptionally well.

This process is where AI-powered competitor research tools like Adthena come to play.

By gaining insights into your competitors’ PPC activity and market shifts, you’ll be better armed to write compelling PPC ad copy.

The real-time data AI technologies provide may help you gain or keep a corner the market by ensuring you’re up-to-date with trends and news that affect your market audience. Real-time data is also essential when conducting competitor analysis, as any lag in time could result in the competition cornering the market.

Don’t delay to get on the AI bandwagon, especially when it comes to writing ad copy.

AI Can Help You Discover Keyword Opportunities

Everyone knows keywords are the foundation of every good PPC campaign. Unfortunately, with more businesses vying for the same target audience, relevant keyword opportunities are becoming harder to find.

AI can help.

With the competition for profitable keywords being uber-stiff, normal keyword research just doesn’t cut it anymore. You must leverage AI to help you uncover hidden keyword gems.

This fact is especially true since keyword research for SEO and PPC is not the same. For PPC, your money rides or sinks on the keywords you use. That’s why you must find keywords that will give you a good return when you bid for them.

AI-powered tools like BrightEdge, for example, not only help you discover profitable keywords but are also able to give insight into the intent behind those keywords.

Because they offer real-time data, you are in a better position to write ad copy based on keyword opportunities as they arise. Of course, this will give you an edge over the competition, as your ads will have a better chance of being served to users while keeping your ad spend low.

Headline Optimization Is Easy with AI

Saying that your headline is a critical part of your ad copy is an understatement. Its value can never be overstated because it’s your first chance to hook your customers.

If your headers are poorly crafted, users will just scroll past your ad. But if you write your headline well, it will stop them from scrolling so they look at the rest of your ad copy. AI can help you craft headlines that stop people in their tracks by helping you write headlines that result in much-coveted clicks.

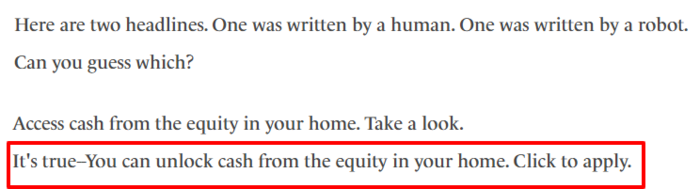

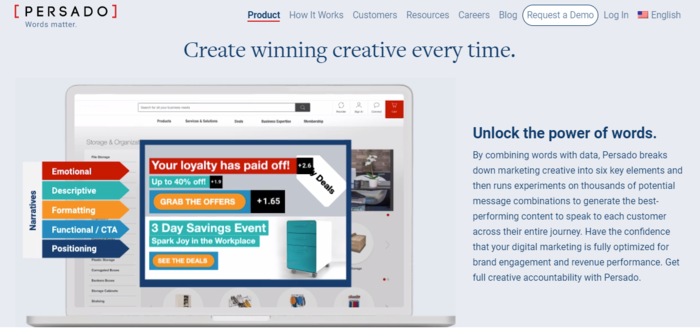

A great example is Persado. The AI-powered copywriting tool helped Chase Bank increase the CTR on their ads by as much as 450%. How? By crafting headlines that resonate more with their target audience.

There are AI-powered tools that are designed to help you optimize your headers to elicit users to click on your ads.

The success of your ad campaigns rides on your headlines.

The next part users look at is the ad description.

Use AI to Nail Your Ad Description

Next to your headline, your ad description is the most crucial part of your ad copy. While the headline is the hook that grabs your prospect’s attention, your ad description is the sales pitch that gets them to click on your ad.

However, there’s a catch: you have a limited number of characters to use to convince your prospects to click-through to your offer. This means every character counts. It must help elicit a positive reaction from users. That’s why you must make sure you know how to write ad copy that drives clicks.

Fortunately, AI can help you write compelling ad copy.

With AI copywriting tools like Phrasee, you don’t have to guess what kind of copy works.

Using machine learning and gathering data from different platforms, AI copywriting tools have “mastered” the art of writing great ad copy.

Using machine learning (ML), natural language generation (NLG), deep learning, and other technologies, AI-powered copywriting tools can help you create compelling ad copy that stands out from the crowd. AI takes into consideration many facets, such as language, semantics, sentence structure, and a whole lot more to help you create optimized ad copy at scale.

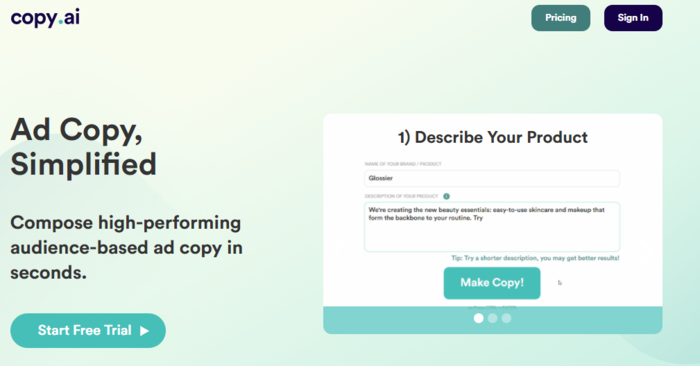

Another great AI-powered ad creation tool you can consider is CopyAI.

Copy AI is designed to take the grunt work out of brainstorming unique ad ideas. It will help you increase your ROAS by helping you come up with relevant audience-based copy that your customers won’t be able to resist. The deep learning platform that powers CopyAI can personalize your ad copy to suit any holiday, occasion, or campaign.

AI-powered copywriting tools are a great way to save time and money as they work faster and more efficiently. And at the end of the day, they’ll help you boost your bottom line.

Calls-to-Action: AI Can Help With That Too

Calls-to-action (CTAs) are a tricky part of writing ad copy. That’s because your CTA is usually made up of 2-5 words to inspire people to take action.

While platforms like Google and Facebook give you some CTA options to choose from as you create your campaigns, it’s always better to create your own CTAs. After all, if you use the options generated by search engines and social media platforms, you won’t stand out from the competition.

Your CTA plays a crucial role in pushing your prospects across the finish line. As such, give it careful consideration. You may get every other element of your ad copy correct, but if your CTA is weak, your hard work will be in vain.

What makes for a strong clickable CTA? One word: personalization.

Different audiences respond differently to CTAs. That’s why you must pay special attention to the language your audience uses and try as much as possible to implement it in your CTAs. This is one area where audience research pays off because it helps you craft personalized CTAs. Studies show that personalized CTAs perform up to 202% better than generic ones.

Note: make sure to create a different CTA for each campaign. Don’t just regurgitate past CTAs, even if they worked well in previous campaigns.

Yes, it may be a lot of work if you do it manually. That’s why you shouldn’t do it manually; use AI instead.

Again, tools like Persado make creating impactful CTAs easier.

Leveraging data such as sentiment analysis (or emotion AI), AI-powered tools help you create CTAs that tug at your prospects’ heartstrings. Of course, every marketer knows that it is easier to loosen your prospects’ purse strings if you can do that.

By leveraging AI in crafting your CTAs, you increase your ad copy’s chances of achieving its goal of boosting your bottom line.

Conclusion

It’s impossible to ignore AI as a digital marketer. It’s everywhere around us. From AI SEO to AI in website design, every facet of digital marketing is becoming more efficient thanks to artificial intelligence.

As a marketer, if you’re looking to know how to write ad copy that converts, you must lean heavily on AI-powered tools to help you. From the planning stage to deployment, AI can help you optimize every part of your PPC ad campaigns.

Though remember: without good ad copy, your ad spend will be wasted. How do you write good ad copy? By using AI.

Sure, AI may not be able to handle the creative side of writing ad copy completely alone. However, it does go a long way in helping you create ad copy that sells.

Are you ready to embrace the power of AI in your ad copy creation?

The post How to Write PPC Ad Copy Using AI appeared first on Neil Patel.

How to Become a Successful Vlogger

If I told you that you could become a sucessful vlogger, would you believe me? Or do you think that there is too much competition? YouTube is saturated — 500 hours of video are uploaded to YouTube every minute. There are dozens of million-dollar YouTubers creating thousands of hours of video a year. How could you …

The post How to Become a Successful Vlogger first appeared on Online Web Store Site.

New comment by brsmith110 in "Ask HN: Who is hiring? (November 2020)"

Trellis, Inc. | Multiple Positions | Full-time / Part-time | ONSITE | Atlanta, GA| https://mytrellis.com/ Trellis is a hardware and software company that enables farmers to make better decisions about their farm. We sell sensors that farmers install in their fields in addition to a web dashboard that allows them to view their aggregated data. …

The post New comment by brsmith110 in “Ask HN: Who is hiring? (November 2020)” first appeared on Online Web Store Site.

Get a Balance Transfer Recession Business Credit Card

The economy is changing. But you can still get a balance transfer recession business credit card.

You Can Get a Balance Transfer Recession Business Credit Card Today

Do you need a balance transfer recession business credit card? For that and any other sort of reward, we’ve got you covered.

Per the SBA, small business credit card limits are a whopping 10 – 100 times that of consumer cards!

This shows you can get a lot more money with small business credit. And it also shows you can have personal credit cards at retailers. So you would now have an additional card at the same stores for your company.

And you will not need collateral, cash flow, or financial data in order to get small business credit.

Credit Card Benefits

Perks vary. So, make sure to choose the benefit you prefer from this array of alternatives. Because you may find something you like even better than a balance transfer recession business credit card.

Get a Reliable Low APR/Balance Transfer Recession Business Credit Card for Lavish Travel Points

Flat-rate Travel Rewards

Capital One® Spark® Miles for Business

Check out the Capital One® Spark® Miles for Business. It has an introductory yearly fee of $0 for the first year, which after that rises to $95. The regular APR is 18.49%, variable due to the prime rate. There is no introductory annual percentage rate. Pay no transfer fees. Late fees go up to $39.

This card is fantastic for travel if your expenses don’t fall under basic bonus categories. You can get unlimited double miles on all purchases, without any limits. Get 5x miles on rental cars and hotels if you book with Capital One Travel.

Get an initial bonus of 50,000 miles. That’s the same as $500 in travel. But you just get it if you spend $4,500 in the initial 3 months from account opening. There is no foreign transaction fee. You will need a good to exceptional FICO score to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-miles/

Bonus Travel Categories with a Sign-Up Offer

Ink Business Preferred℠ Credit Card

For a fantastic sign-up offer and bonus categories, take a look at the Ink Business Preferred℠ Credit Card.

Pay an annual fee of $95. Regular APR is 17.49 – 22.49%, variable. There is no introductory APR offer.

Get 100,000 bonus points after spending $15,000 in the initial 3 months after account opening. This works out to $1,250 towards travel rewards if you redeem via Chase Ultimate Rewards.

Get 3 points per dollar of the first $150,000 you spend with this card. So this is for purchases on travel, shipping, internet, cable, and phone services. Plus it includes advertising purchases made with social media sites and search engines each account anniversary year.

You can get 25% more in travel redemption when you redeem for travel via Chase Ultimate Rewards. You will need a great to superb FICO score to qualify.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/business-preferred

No Yearly Fee

Bank of America® Business Advantage Travel Rewards World MasterCard® credit card

For no yearly fee while still getting travel rewards, take a look at this card from Bank of America. It has no annual fee and a 0% introductory APR for purchases during the initial 9 billing cycles. Afterwards, its regular APR is 13.74 – 23.74% variable.

You can get 30,000 bonus points when you make at least $3,000 in net purchases. So this is within 90 days of your account opening. You can redeem these points for a $300 statement credit towards travel purchases.

Get unlimited 1.5 points for each $1 you spend on all purchases, everywhere, every time. And this is despite how much you spend.

Also get 3 points per every dollar spent when you book your travel (car, hotel, airline) via the Bank of America® Travel Center. There is no limit to the number of points you can get and points don’t expire.

You will need outstanding credit to get this one (as in, 700s or better).

Find it here: https://www.bankofamerica.com/smallbusiness/credit-cards/products/travel-rewards-business-credit-card/

Hotel Credit Card

Marriott Bonvoy Business™ American Express® Card

Have a look at the Marriott Bonvoy Business™ Card from American Express. It has a yearly fee of $125. There is no introductory APR offer. The regular APR is a variable 17.24 – 26.24%. You will need good to outstanding credit to get this card.

Points

You can get 75,000 Marriott Bonvoy points after using your card to make purchases of $3,000 in the first 3 months. Get 6x the points for eligible purchases at participating Marriott Bonvoy hotels. You can get 4x the points at US restaurants and gas stations. And you can get 4x the points on wireless telephone services bought straight from American service providers and on American purchases for shipping.

Get double points on all other eligible purchases.

Rewards

Also, you get a free night every year after your card anniversary. And you can get an additional free night after you spend $60,000 on your card in a calendar year.

You get Marriott Bonvoy Silver Elite status with your Card. Plus, spend $35,000 on eligible purchases in a calendar year and earn an upgrade to Marriott Bonvoy Gold Elite status through the end of the next calendar year.

Also, each calendar year you can get credit for 15 nights towards the next level of Marriott Bonvoy Elite status.

Find it here: https://creditcard.americanexpress.com/d/bonvoy-business/

Trustworthy Credit Cards for Fair to Poor Credit, Not Calling for a Personal Guarantee

Get a great alternative to a balance transfer recession business credit card.

Brex Card for Startups

Have a look at the Brex Card for Startups. It has no yearly fee.

You will not need to supply your Social Security number to apply. And you will not need to supply a personal guarantee. They will take your EIN.

Nonetheless, they do not accept every industry.

Likewise, there are some industries they will not work with, as well as others where they want more documentation. For a list, go here: https://brex.com/legal/prohibited_activities/.

To determine creditworthiness, Brex checks a corporation’s cash balance, spending patterns, and investors.

You can get 7x points on rideshare. Get 4x on Brex Travel. Likewise, get triple points on restaurants. And get double points on recurring software payments. Get 1x points on everything else.

You can have poor credit scores (even a 300 FICO) to qualify.

Find it here: https://brex.com/lp/startups-higher-limits/

Secure Corporate Credit Cards for Fair Credit Scores

Grab another terrific alternative to a balance transfer recession business credit card.

Capital One® Spark® Classic for Business

Check out the Capital One® Spark® Classic for Business. It has no annual fee. There is no introductory APR offer. The regular APR is a variable 24.49%. You can earn unlimited 1% cash back on every purchase for your business, without any minimum to redeem.

While this card is within reach if you have fair credit, beware of the APR. Yet if you can pay in a timely manner, and in full, then it’s a bargain.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines. Get a balance transfer recession business credit card now!

Flexible Financing Credit Cards – Check Out Your Alternatives!

The Plum Card® from American Express

Check out the Plum Card® from American Express. It has an introductory yearly fee of $0 for the first year. Afterwards, pay $250 each year.

Get a 1.5% early pay discount cash back bonus when you pay within 10 days. You can take up to 60 days to pay without interest when you pay the minimum due by the payment due date.

You will need excellent to superb credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/the-plum-card-business-charge-card/

Outstanding Company Credit Cards with No Annual Fee

No Annual Fee/Flat Rate Cash Back

Ink Business Unlimited℠ Credit Card

Check out the Ink Business Unlimited℠ Credit Card. Past no annual fee, get an introductory 0% APR for the initial twelve months. Afterwards, the APR is a variable 14.74 – 20.74%.

You can get unlimited 1.5% Cash Back rewards on every purchase made for your business. And get $500 bonus cash back after spending $3,000 in the first 3 months from account opening. You can redeem your rewards for cash back, gift cards, travel and more via Chase Ultimate Rewards®. You will need outstanding credit to receive this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/unlimited

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines. Get a balance transfer recession business credit card now!

Company Credit Cards with a 0% Introductory APR – Pay Nothing!

Blue Business® Plus Credit Card from American Express

Have a look at the Blue Business® Plus Credit Card from American Express. It has no yearly fee. There is a 0% introductory APR for the first 12 months. Afterwards, the APR is a variable 14.74 – 20.74%.

Get double Membership Rewards® points on day to day company purchases like office supplies or client dinners for the initial $50,000 spent per year. Get 1 point per dollar afterwards.

You will need good to exceptional credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/bluebusinessplus-credit-card/

American Express® Blue Business Cash Card

Also have a look at the American Express® Blue Business Cash Card. Keep in mind: the American Express® Blue Business Cash Card is identical to the Blue Business® Plus Credit Card from American Express. Yet its rewards are in cash instead of points.

Get 2% cash back on all eligible purchases on up to $50,000 per calendar year. Then get 1%.

It has no annual fee. There is a 0% introductory APR for the initial twelve months. After that, the APR is a variable 14.74 – 20.74%.

You will need great to exceptional credit to qualify.

Find it here: https://creditcard.americanexpress.com/d/business-bluecash-credit-card/

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines. Get a balance transfer recession business credit card now!

The Perfect Balance Transfer Recession Business Credit Card for You

Your absolute best balance transfer recession business credit card will hinge on your credit history and scores.

Only you can choose which features you want and need. So make sure to do your homework. What is excellent for you could be disastrous for another person.

And, as always, make sure to establish credit in the recommended order for the best, fastest benefits.

The economy will change again, and you will be able to get a balance transfer recession business credit card even more easily.

The post Get a Balance Transfer Recession Business Credit Card appeared first on Credit Suite.

Get a Business Credit Report in a Recession

Get a business credit report in a recession and stay on top of your scores.

Here’s How to Get a Business Credit Report in a Recession

You got this: we show you exactly how to get your business credit report in a recession.

Get a Business Credit Report in a Recession: Recession Funding

In a recession, inevitably banks and other credit issuers get more conservative. So it pays to get your business credit report in a recession so you can pounce on any mistakes immediately.

Your best bet as a company owner is to stay on top of every business credit report from PAYDEX, Equifax, and Experian.

There are three big credit reporting agencies for companies and you really should check all three of them frequently. This is because they use moderately different yardsticks. Hence moving the needle for one can move the needle for both of the others. Although maybe not as much.

Do not permit your business credit scores slide, as you have to catch any mistakes as fast as you can. Plus, you need to identify anything which is dragging your scores down. And then take remedial measures. You can get a business credit report in a recession easily and stay on top of all three scores by following a few straightforward steps.

Get a Business Credit Report in a Recession: D&B (PAYDEX) Business Credit Report

Dun & Bradstreet’s PAYDEX score of your company can end up being one of the primary reasons that your business receives credit in any manner.

A Dun & Bradstreet Report (also known as a D&B Report) is a database-generated report. The business services giant produces such a report in order to assist its clients in making decisions regarding new credit applications.

The primary reason for a client using this kind of a report is to engage in credit risk monitoring of vendors, suppliers, and business partners. This helps companies make informed business credit determinations and avoid bad debt.

Dun & Bradstreet takes several factors into account in generating such a report. These include a predictor of payment delinquency; how financially stressed a company is compared to comparable businesses; an evaluation of supplier risk; credit limit recommendation; D&B rating; and PAYDEX score. Let’s consider all these factors in turn.

Delinquency Predictor

Dun & Bradstreet uses predictive models to ascertain how likely a company is to be late with its payments. Predictive scoring is a means of using historical information to attempt to predict future outcomes. It entails identifying the risks inherent in a future decision. It does this by examining the relationship between historical information and the future event.

This represents an objective and statistically derived counterpart to subjective and intuitive assessments. Such scoring allows a business to rank and order accounts based upon the probability of an event occurring, such as delinquent payments. However, note that Predictive Scoring only represents a statistical probability, and not a guarantee.

PAYDEX Score

A PAYDEX Score is Dun & Bradstreet’s proprietary dollar-weighted numerical indicator of how a firm has paid its bills over the past year. The score is based upon trade experiences reported to Dun & Bradstreet by various vendors. In addition, the D&B PAYDEX Score ranges from 1 to 100; higher scores indicate a better payment performance.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

Monitoring PAYDEX

D & B offers Credit Signal, which is a means to keep track of your credit score by having the business credit report come immediately to you, for a cost. You may discover the expense is well worth it in order to avoid the frustrations that can emerge from letting this score slip. And you will not need to produce and handle the organizing and reminders you might need to stay up to date with if you don’t use it.

Alternatives to Credit Signal

Don’t wish to make use of Credit Signal? Not a problem, as you can obtain your PAYDEX report through D & B and, if need be, you can get in touch with their Customer Service department (this department exists as a section of Dun & Bradstreet itself).

In addition, in order to review your PAYDEX report, check out what D & B provides, which is a specimen report and even some higher level tips in the way to analyze it.

D&B Data

Any report is only as good as the data it comes from. Dun & Bradstreet’s database contains over 250 million firms spanning the globe, which includes around 120 million active companies and about 130 million businesses which are out of business but kept for historical purposes.

D&B constantly gathers data and works to improve its analyses to ensure the greatest degree of accuracy possible.

Get a Business Credit Report in a Recession: Equifax Business Credit Report

Equifax, one of the large credit reporting bureaus, furnishes a risk monitoring service which is more convenient as it allows for a business credit report to come directly to you.

If you don’t want to purchase continuing reports, you can instead order your company’s Equifax report.

Additionally, if you have to question your small business’s Equifax report, you can do so by following the information on their website.

You can learn how to go over your Equifax report by checking out a specimen of their reports.

Improve Your Equifax Report

Now that you know what enters into it, you can see that some of the more crucial pieces of information Equifax looks into are public records, credit usage, and how you take care of your financial and nonfinancial accounts.

Start getting rid of your debts as quickly as possible and not going delinquent. And keep your credit utilization within reason. Less than 30% of your overall available credit is best. And start staying away from overdue payments. Then you should have the ability to build up your Equifax score.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

Get a Business Credit Report in a Recession: Experian Business Credit Report

Experian, one more big credit reporting firm, also offers a way having their business credit report sent to you for a fee. As a result you can keep an eye on your Experian small business credit score here and the setup is simple.

However, if you prefer to not get continuing reports (and pay for them), then you can order a single Experian report for your firm on their site.

Business Credit Report Score Improvement Tips

Experian provides a handy list of ways to improve your own, specific report.

You can get your company’s real Experian report and can dispute any errors on your company’s Experian report by following the directions on their website.

Now that you know what goes into it, you can see what some of the more important pieces of data Experian looks into are. These include payment history and credit utilization. And they also include the amount of time in business. Or at least they show the amount of time your company has had an Experian listing.

Beyond anything else, improving your payment history will increase your Experian credit scores.

Keep your credit utilization within reason. So this is because less than 30% of your total available credit is best. Clear your debts as quickly as you are able to. And don’t go delinquent. Also, avoid any late payments. Then, you should be able to improve your Experian score over time.

Likewise, if there are any problems or matters of contention, you can question any errors on your business’s Experian report if you follow the directions on their web site.

Find out about assessing your Experian report by assessing a sample Experian company credit report.

Get a Business Credit Report in a Recession: Monitoring Any Business Credit Report For Less

Know what is happening with your credit. Make sure it is being reported and deal with any errors ASAP. Get in the habit of taking a look at credit reports. Dig into the details, not just the scores.

We can help you monitor business credit at Experian and D&B for 90% less than it would cost you at the CRAs.

At Equifax, you can monitor your account at: www.equifax.com/business/business-credit-monitor-small-business.

Update Your Record

Update the details if there are inaccuracies or the data is incomplete. At D&B, you can do this at: https://iupdate.dnb.com/iUpdate/viewiUpdateHome.htm. For Experian, go here: www.experian.com/small-business/business-credit-information.jsp. So for Equifax, go here: www.equifax.com/business/small-business.

Get a Business Credit Report in a Recession: Fix Your Business Credit

So, what’s all this monitoring for? It’s to challenge any problems in your records. Mistakes in your credit report(s) can be fixed. But the CRAs typically want you to dispute in a particular way.

Get your business’s PAYDEX report at: www.dnb.com/about-us/our-data.html. Get your company’s Experian report at: www.businesscreditfacts.com/pdp.aspx?pg=SearchForm. And get your Equifax business credit report at: www.equifax.com/business/credit-information.

Disputes

Disputing credit report mistakes generally means you send a paper letter with duplicates of any evidence of payment with it. These are documents like receipts and cancelled checks. Never send the originals. Always send copies and keep the original copies.

Fixing credit report errors also means you specifically itemize any charges you dispute. Make your dispute letter as crystal clear as possible. Be specific about the issues with your report. Use certified mail so that you will have proof that you mailed in your dispute.

Dispute your or your small business’s Equifax report by following the instructions here: www.equifax.com/small-business-faqs/#Dispute-FAQs.

You can dispute errors on your or your business’s Experian report by following the instructions here: www.experian.com/small-business/business-credit-information.jsp.

And D&B’s PAYDEX Customer Service contact number is here: www.dandb.com/glossary/paydex.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

Get a Business Credit Report in a Recession: Takeaways for How to Get a Business Credit Report

At times, it pays to hand over a few dollars to ensure you get a business credit report in a recession consistently. It’s a lot less troublesome than to have to remember to do this.

And you’ll probably look at these reports more thoroughly, as they come at a price tag.

Continue track and make use of the tools that these credit reporting companies provide, and make your life simpler. After all; you’ve already got enough on your plate.

Because of recent data breaches, there are even more reasons to assess your business and personal credit reports and be vigilant about any errors you find. In a recession, you need the highest business credit scores you can get. When you get a business credit report in a recession, you’re doing just that.

The post Get a Business Credit Report in a Recession appeared first on Credit Suite.

Impraise (YC S14) is hiring a UX Copywriter (part-time)

Article URL: https://jobs.impraise.com/o/ux-copywriter-freelancer-parttime-16hweek-3-months

Comments URL: https://news.ycombinator.com/item?id=25122737

Points: 1

# Comments: 0