Article URL: https://jobs.lever.co/themuse/43458248-0813-4d77-aedc-ce7d1f92a77e?lever-origin=applied&lever-source%5B%5D=YC

Comments URL: https://news.ycombinator.com/item?id=27117015

Points: 1

# Comments: 0

Article URL: https://jobs.lever.co/themuse/43458248-0813-4d77-aedc-ce7d1f92a77e?lever-origin=applied&lever-source%5B%5D=YC

Comments URL: https://news.ycombinator.com/item?id=27117015

Points: 1

# Comments: 0

Did you know that 73 percent of sellers prefer working with agencies that use real estate video marketing? Whether it’s a walkthrough of the property or a Q&A session, sellers expect their agents to use video marketing to reach the right buyers and sell their properties.

For real estate agents, this demand presents a few challenges. How do you make an engaging real estate video to impress both sellers and buyers alike, and how do you track a video’s performance for your marketing purposes?

Luckily it is not as hard as it might seem. Although real estate videos serve a unique purpose, they’re similar to regular marketing videos in many ways, so don’t be intimidated by them.

Let’s take a closer look at why real estate videos are worth the effort and how you fit them into your overall video marketing strategy.

Real estate videos do two things: they attract buyers to your listing, and they encourage prospective sellers to choose your agency over your competitors.

Are they worth the effort, though, when you could create social media ads or optimize your listings? Maybe with the current market, you think it will be a waste of resources. Let’s look at what the numbers say.

What’s more, 84 percent of video marketers feel they’ve generated more leads thanks to video marketing, and 94 percent of us use videos to learn more about the products we’re buying.

The takeaway? To draw traffic to your listings and impress your sellers, try out real estate video marketing.

Before we dig into strategies, let’s cover the basics.

There’s no need to spend a fortune on top-of-the-range lighting, props, or cameras. However, you’ll still need some recording equipment before you shoot your first real estate video. How much you spend depends on your marketing budget, but let’s break down the basics.

First, you’ll need a camera capable of shooting in 4K or HD to make sure the videos are high quality and not blurry or pixelated. A smartphone works, too.

If you opt for a camera, make sure it’s capable of capturing both high-quality video and images. Practice shooting with the camera before filming day to ensure you get the most from the equipment.

Using a smartphone? Clip on a wide-angle camera lens. This allows you to shoot larger scenes while minimizing glare and improving image quality. Here’s what the lens looks like:

Lenses like this one shown above are cost-effective and widely available, so shop around.

Want to go all-out? You can always buy a drone for 360 aerial footage. However, you’ll probably need a permit to fly a drone in most areas, so keep that in mind.

Next, you’ll need lighting filters. Use a neutral density filter for shooting outside, and get a pocket-sized LED light you can attach to the camera (or smartphone) for filming in poorly-lit areas.

Got the lighting sorted? Now you’ll need a microphone. You can either buy a mic attachment for your smartphone, or a portable mic for attaching to any camera device.

You’ll also need editing software. Check out tools like Adobe Premiere Pro and Final Cut Pro X for professional editing support. You’ll likely pay for a subscription, but they’re easy enough to master, and you’ll produce the sharpest, most professional videos this way. Alternatively, you could outsource editing to a freelancer.

Finally, you’ll probably need a stabilizer like a selfie stick or a gimbal. These tools keep your camera steady and minimize shaking while you walk around a property.

A real estate video is all about setting a great first impression. You want to bring the property to life, connect with potential buyers, and ultimately set yourself apart from other realtors with your professional marketing skills.

To help ensure your content achieves these goals, here are ten tips to produce the highest-quality real estate video ads.

Be clear about what you can afford to spend on video marketing. Unsure how to allocate your budget? Let me give you a few pointers.

First, consider your target audience. It’s worth watching real estate videos in your listing’s price range to see how your efforts compare to your competitors’ video ads.

Next, think about how much you’ll spend on actually promoting your videos. From social media ads to targeted email marketing, the costs can eventually add up. To keep things more cost-effective, repurpose your real estate videos into digital ads so you can double your content output without spending more.

Also, take the time to research paid ad strategies, or hire a digital marketing consultant to take care of the budget, targeting, and testing.

A great real estate video doesn’t just happen. It takes planning. Remember, you’re trying to tell a story, so you need to spend time thinking about what story you want to tell.

For example, determine what equipment you’ll need, whether you’ll hire actors to play any roles, and what time of day or night you plan on filming. Do you want to sell your own real estate skills or help a buyer fall in love with an unusual property?

Depending on the seller, you might also need their approval before you start filming or sending the video out to prospects, so factor in time for adjusting your angle and making changes as required.

The length of your real estate video depends on where you’re marketing it. For example, according to HubSpot, popular Twitter videos average around 43 seconds, while popular YouTube videos run a little longer at two minutes.

A real estate video can be as long as six minutes, but it’s not always wise to fill this time. Why? People have short attention spans. Don’t risk losing a potential buyer’s attention just because you’ve added 30 or 40 seconds of filler to your video.

For example, here’s a video for a property listed by Douglas Elliman. It’s just over 90 seconds long, but it’s visually engaging and covers every angle a potential buyer needs to see without extra fluff:

Great real estate videos typically follow a three-act story structure, according to research by Vimeo.

Remember, you’re telling a story, so following a traditional story structure works!

If you want to ensure a prospect watches your video the whole way through, keep it engaging. Be enthusiastic. Show people why you’re excited about the property, and inspire potential buyers to envision themselves living in the property.

Focus on the possibilities. What could make this property truly special for the right buyer? How might the property be flexible over time? For example, a first-floor bedroom can be an office now and a bedroom for an aging parent or partner later. A basement can be a game room, an in-law suite, or an at-home gym. Drive home how the property can meet their needs over time.

No matter the price range, every property boasts a special, unique, or at least intriguing feature.

Maybe there’s cool history attached to the building, or there’s a custom marble countertop in the kitchen. Or, maybe it’s just the first house to come to market in the area for a long time.

To identify unique features, ask the buyer what changes they’ve made since they bought the house, and if it’s an older property, identify if they kept any key features like original wooden flooring.

Special features can be anything from dual sinks to fully-landscaped gardens, so look for those little quirks that make the property unique compared to similar properties.

For example, this property in Montecito has a wine rack:

Plus, it boasts a hot tub:

Capturing these features in the video highlights the unique aspects of this home.

It’s great to show off a property, but what’s going on around it? Include a few clips of the surrounding area, even if you just zoom out to capture the apartment block and a couple of nearby amenities. Make sure to include any famous landmarks, fun events, schools, and even sidewalks.

Is the neighborhood a little rundown or potentially off-putting? An aerial view might work best, so you don’t focus too much on the finer details.

When you’re looking for a property, it’s not just about the unit. It’s about the life the buyer will lead when they live there. For example, if you’re near the beach or a park, talk up the family-friendly vibes. Are you close to the buzz of shops, restaurants, and cafes? Highlight the walkable, cosmopolitan lifestyle.

Use the property to sell the lifestyle, too. For example, going back to the Montecito property, the landscaping gives off seriously chilled, secluded vibes:

People make neighborhoods. After all, who better to tell you what a neighborhood is really like than the residents? Try to get a testimonial or two to add some authenticity and personality to your real estate videos.

Unless it’s a new neighborhood, try to find residents who’ve lived there a few years. Otherwise, potential buyers might wonder why people don’t stay there very long!

From CTA buttons to clickable links, interactive elements help bring your videos to life. Use your editing software to add a CTA inviting people to book a showing, or include a link to a page where buyers can learn more about the listing and the services you offer.

Remember, real estate videos are a marketing tool. Use them effectively and treat them as you would, say, a YouTube video or digital ad.

You’ve filmed your real estate video and launched some ads. How do you know if it’s working for you? The answer’s in your metrics. Here are five key metrics to track if you’re trying to measure your success rate.

To get this data, either integrate your videos with your usual marketing platform to track metrics, or use a dedicated video analytics platform like Vidyard.

Video ads bring a whole new dimension to real estate marketing. With the right editing tools, a sharp eye for detail, and some enthusiasm, you can bring your property to life or show possible clients why you are the best choice.

There’s one final point to remember. You can shoot a clear, engaging, and professional real estate video with little more than a smartphone.

Don’t feel like you need to splurge to create successful video ads unless it’s within your budget to do so!

Need any more help with marketing? Check out my consulting services.

Have you made a real estate video ad for a listing yet? How did it go?

Do YOU need a first time business credit card?

We researched lots of company credit cards for you. So, here are our choices.

Per the SBA, business credit card limits are a whopping 10 – 100 times that of personal credit cards!

This shows you can get a lot more money with company credit cards.

And you will not need collateral, cash flow, or financials to get small business credit.

Benefits can vary. So, make sure to pick the benefit you would prefer from this selection of alternatives.

And always check rates on the appropriate website.

Look into the Brex Card for Startups. It has no yearly fee.

You will not need to provide your Social Security number to apply. And you will not need to supply a personal guarantee. They will take your EIN.

Nevertheless, they do not accept every industry.

Likewise, there are some industries they will not work with, as well as others where they want more paperwork. For a list, go here: https://brex.com/legal/prohibited_activities/.

To determine creditworthiness, Brex checks a company’s cash balance, spending patterns, and investors.

You can get 7x points on rideshare. Get 4x on travel. Likewise, get triple points on restaurants. And get double points on recurring software payments. Get 1x points on everything else.

You can have bad credit (even a 300 FICO) to qualify.

Find it here: https://brex.com/lp/startups-higher-limits/

Have a look at the Capital One® Spark® Classic for Business. It has no annual fee. There is no introductory APR offer. The regular APR is a variable 26.99%. You can earn unlimited 1% cash back on every purchase for your company, without any minimum to redeem.

While this card is within reach if you have average credit scores, beware of the APR. However if you can pay on schedule, and completely, then it’s a bargain.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

Have a look at the Ink Business Unlimited℠ Credit Card. There is no yearly fee for the first year. Then pay $250 per year. There is no introductory APR deal. If you pay your bill early, you get a 1.5% discount, with no cap on what you can earn back.

Earn 5% cash back at office supply stores and on cellular and landline phone service, internet, and cable TV; 2% cash back at gas stations and restaurants; and 1% cash back on everything else.. 5% and 2% cash-back bonus rewards apply only to the first $25,000 spent on the corresponding bonus categories each account anniversary year. You will need exceptional credit scores to get this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/unlimited

Score the best business credit cards for your business. Check out our professional research.

Check out the Blue Business® Plus Credit Card from American Express. It has no yearly fee. There is a 0% introductory APR for the initial year. Afterwards, the APR is a variable 13.24 – 19.24%.

Get double Membership Rewards® points on day to day business purchases like office supplies or client suppers for the initial $50,000 spent per year. Get 1 point per dollar afterwards.

You will need good to excellent credit to qualify.

Find it here: https://creditcard.americanexpress.com/d/bluebusinessplus-credit-card/

Also have a look at the American Express® Blue Business Cash Card. Note: the American Express® Blue Business Cash Card is identical to the Blue Business® Plus Credit Card from American Express. Yet its rewards are in cash as opposed to points.

Get 2% cash back on all qualified purchases on up to $50,000 per calendar year. After that get 1%.

It has no yearly fee. There is a 0% introductory APR for the initial 12 months. After that, the APR is a variable 13.24 – 19.24%.

You will need great to excellent credit to qualify.

Find it here: https://creditcard.americanexpress.com/d/business-bluecash-credit-card/

Check out the Capital One® Spark® Cash for Business. It has an introductory $0 yearly fee for the first year. Afterwards, this card costs $95 per year. There is no introductory APR offer. The regular APR is a variable 20.99%.

You can get a $500 one-time cash bonus after spending $4,500 in the initial three months from account opening. Get unlimited 1.5% cash back with Cash Select.

You will need great to outstanding credit to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash/

Check out the Discover it® Business Card. It has no yearly fee. There is an introductory APR of 0% on purchases for one year. After that the regular APR is a variable 14.49 – 22.49%.

Get unlimited 1.5% cash back on all purchases, with no category restrictions or bonuses. They double the 1.5% Cashback Match at the end of the first year. There is no minimal spend requirement.

at the end of the first year. There is no minimal spend requirement.

You can download transactions quickly to Quicken, QuickBooks, and Excel. Note: you will need good to outstanding credit to qualify for this card.

https://www.discover.com/credit-cards/business/

Score the best business credit cards for your business. Check out our professional research.

Check out the Ink Business Cash℠ Credit Card. It has no yearly fee. There is a 0% introductory APR for the initial year. After that, the APR is a variable 13.24 – 19.24%. You can get a $750 one-time cash bonus after spending $7,500 in the initial 3 months from account opening.

You can get 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on web, cable, and phone services each account anniversary year.

Get 2% cash back on the first $25,000 spent in combined purchases at gasoline stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases. There is no limitation to the amount you can earn.

You will need exceptional credit to qualify for this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/cash?iCELL=61GF

Have a look at the Bank of America® Business Advantage Cash Rewards MasterCard® credit card. Get an 0% introductory APR for the first 9 billing cycles of the account. Afterwards, the APR is 12.24% – 22.24% variable. There is no annual fee. You can get a $300 statement credit offer.

Get 3% cash back in the category of your choice. So these are gas stations (default), office supply stores, travel, TV/telecom & wireless, computer services or business consulting services. Earn 2% cash back on dining. So this is for the initial $50,000 in combined choice category/dining purchases each calendar year. After that earn 1% after, with no limits.

You will need superb credit to qualify.

Find it here: https://www.bankofamerica.com/smallbusiness/credit-cards/products/cash-rewards-business-credit-card/

Check out the Plum Card® from American Express. It has an introductory yearly fee of $0 for the first year. Afterwards, pay $250 each year.

Get a 1.5% early pay discount cash back bonus when you pay within 10 days. You can take up to 60 days to pay without interest when you pay the minimum due by the payment due date.

You will need excellent to exceptional credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/the-plum-card-business-charge-card/

Take a look at the Capital One® Spark® Cash Select for Business. It has no annual fee. You can get 1.5% cash back on every purchase. There is no limit on the cash back you can earn. Also earn a one-time $200 cash bonus as soon as you spend $3,000 on purchases in the first 3 months. Rewards never expire.

Pay a 0% introductory APR for 9 months. Then pay 13.99% – 23.99% variable APR after that.

You will need good to exceptional credit to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash-select/

Score the best business credit cards for your business. Check out our professional research.

Your straight-out ideal company credit cards depend upon your credit history and scores.

Just you can choose which features you want and need. So, to do your research. What is outstanding for you could be disastrous for another person.

And, as always, make sure to develop credit in the recommended order for the best, speediest benefits.

The post Yes! You Can Get a First Time Business Credit Card appeared first on Credit Suite.

Article URL: https://jobs.lever.co/givecampus/44af3199-546a-404a-95fd-a097ef37e915 Comments URL: https://news.ycombinator.com/item?id=27108182 Points: 1 # Comments: 0

The post GiveCampus (YC S15) Hiring remote (US) Sr engineers passionate about education first appeared on Online Web Store Site.

Fuel prices are already high, for reasons unrelated to gasoline supply. A prolonged shutdown of Colonial’s line could make for an expensive summer for drivers.

The post Colonial Pipeline Attack Highlights Additional Obstacles first appeared on Online Web Store Site.

The post Colonial Pipeline Attack Highlights Additional Obstacles appeared first on #1 SEO FOR SMALL BUSINESSES.

The post Colonial Pipeline Attack Highlights Additional Obstacles appeared first on Buy It At A Bargain – Deals And Reviews.

Rackspace Technology Inc. shares dropped in the extended session Monday as the cloud-technology services company’s forecast and results met with a chilly reception from Wall Street.

The post : Rackspace stock drops 10% as outlook meets with chilly reception appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND.

The post : Rackspace stock drops 10% as outlook meets with chilly reception appeared first on Buy It At A Bargain – Deals And Reviews.

SumUp | Technical Lead | ONSITE or REMOTE (Boulder, CO)

SumUp is a fintech company focused on empowering small businesses. We’re primarily focused on enabling merchants to accept payments, and we build a number of tools including POS devices (similar to Square). As a company we’ve primarily operated in European markets and Brazil, but we’re hiring in the US to build out our Global Expansion team which will be responsible for establishing new markets including the United States.

We’re looking for experienced engineers with a history of technical leadership on big projects. We use tools like Elixir, Ruby, Golang, (among others) to work on a myriad of technical projects related to establishing new markets.

We’re especially interested in engineers who have experience with hardware certification and payments infrastructure, and those who have experience working on open source projects.

Send me an email at austin.tindle@sumup.com and mention hackernews if you’re interested.

Social media is one of the fastest-changing industries out there. It is changing everything: Your customers’ expectations, the way they find and interact with you. Is your business keeping up? Here are a few ideas … The post Three Social Media marketing Trends to Embrace This Year! appeared first on Paper.li blog. The post Three … Continue reading Three Social Media Marketing Trends to Embrace This Year!

Article URL: https://www.legalist.com/careers?gh_jid=4016511004 Comments URL: https://news.ycombinator.com/item?id=27097594 Points: 1 # Comments: 0

The post Legalist is hiring a Director of Sales/Investments first appeared on Online Web Store Site.

The post Legalist is hiring a Director of Sales/Investments appeared first on ROI Credit Builders.

Starting a new paid marketing campaign is no easy feat.

There are logistical considerations, financial considerations, audience considerations, duration considerations.

Let’s imagine you’ve decided to start a new Google Ads campaign. You have a vague idea how much everything will cost, and you’re eager to get started.

Before you hit the green light on your new campaign, you need to know about your future profitability, particularly when your profits will break even with your costs.

Why does that matter?

At that point in your campaign’s lifespan, you’re primed to start turning a profit rather than existing in the red.

How do you determine that point?

By conducting a breakeven analysis.

Whether you’re running a PPC campaign, adding a new advertising stream to your ongoing strategy, setting up an e-commerce store, or even opening a brick-and-mortar store, you need to conduct a breakeven analysis.

As we mentioned above, it lets you know when you can anticipate your endeavor to start paying off.

Beyond that, this analysis lets you know if your endeavor is viable or if it will be impossible to achieve financial success given your business model.

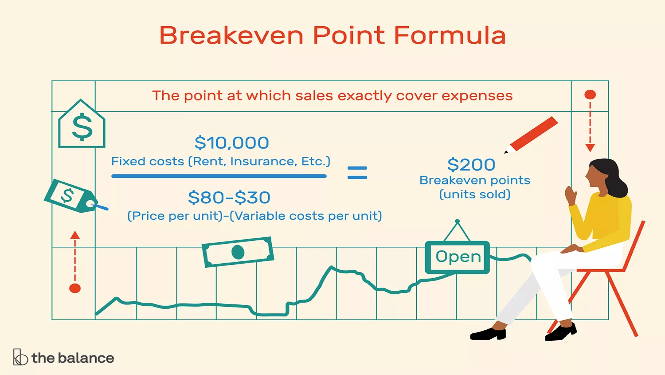

By helping you determine fixed costs (expenses like rent) and variable costs (like materials), you can set prices that reflect these expenses and predict when your business will move into the liminal space between expense and profit.

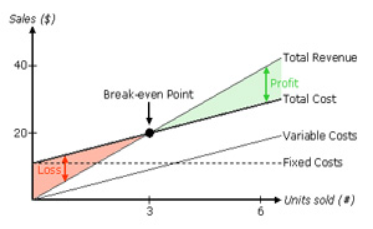

This stage of in-between profit and expense is referred to as the breakeven point (BEP), the stage when revenues equal costs. Once you’ve identified your BEP, assess all your costs from rent to labor to pricing structure to ensure you’re not spending any unnecessary money.

First, determine if your costs are too high or your prices too low to reach your BEP in a manageable timeframe.

Next, decide if your plan will be sustainable.

Not only does your BEP alert you to a specific event that should signal your move out of the red, but it also lets you know if you need to adjust your business spend.

The breakeven analysis is a hallmark of every good business plan. It allows you to determine cost structures and if you should move forward.

While it may seem like a breakeven analysis can only be completed before starting your business, this process can be helpful well beyond business launch.

By assessing and reassessing your business’ cost structures, you can forecast several different outcomes regardless of where you are in your company’s lifespan.

Benefits to conducting this type of analysis include:

A breakeven analysis can be conducted at any time. However, there are four distinct actions that should trigger this analysis at your business:

As we mentioned above, conducting a breakeven analysis for a new business is vital for determining viability and pricing structure.

If you’re adding a costly new product to your business, you must calculate your BEP to ensure the potential gain is worth the cost.

Costs change whenever you incorporate a new sales channel. Whether those costs are contingent on the channel itself or the associated marketing expenses, be sure to conduct a breakeven analysis every time you add a new sales channel.

When you switch to a new business model, your costs can change drastically. To make sure the new model is sustainable, conduct a breakeven analysis.

Hopefully, we’ve conveyed the value of this type of analysis, regardless of where you are in your campaign or business journey.

Below, we break down the steps to run an analysis.

Identify all the expenditures you foresee for your business and divide those costs into two categories: fixed and variable.

After you’ve identified all of these costs, decide on an average amount for each expenditure. These aren’t set in stone, but they should be within the realm of possibility for each commodity.

The formula for breakeven analysis is a two-step process.

This final breakeven sales volume point allows you to determine if your business is sustainable if your goals are reasonable, and how to adjust your pricing and spend accordingly.

While your breakeven point isn’t the final word in the ultimate success of your venture, it’s still a milestone indicative of your business’ growth.

As you launch your campaign, store, or product, keep an eye on your breakeven analysis and adjust as revenue rolls in or unforeseen expenses occur.

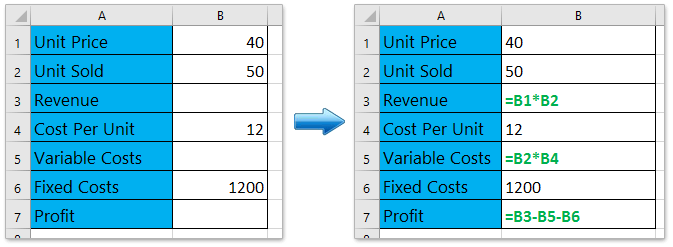

To keep your analysis up-to-date, you could use Microsoft Excel to crunch the numbers for you.

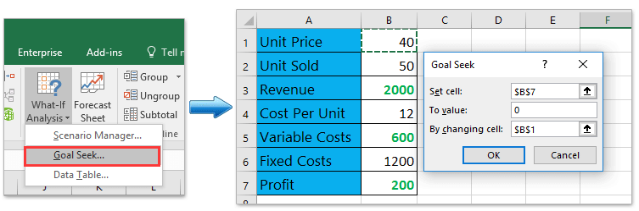

Use Excel’s Goal Seek, a tool that allows users to define by either unit or price.

The Goal Seek function allows users to break out specific amounts and conduct auditable adjustments.

To complete this function, follow these five steps:

Using Excel’s Goal Seek functionality, you can plug and play different scenarios as they arise. This tool also allows users to forecast what-ifs, enabling planning for eventualities that may or may not occur.

Through experimentation, you can help prepare your campaign, business, or product for any eventuality.

While a breakeven analysis can be highly beneficial for assessing the sustainability of your campaign or project, the formula is not without its limitations.

Unanticipated external factors can wreak havoc on your formula, resulting in incorrect projections and measurements.

These factors can include:

These five factors can dramatically impact your breakeven analysis.

In addition to these external forces, what if the result of the breakeven formula is unattainable for your budget?

Should you ditch that new advertising channel altogether or give up on your dreams of a brick-and-mortar store?

The answer is no.

Below, we break down three strategies to enact if your breakeven analysis shows unsustainability for your next venture.

Is there an opportunity to reduce your fixed costs? Take it. The lower your fixed costs can go, the fewer units you need to sell to reach your breakeven point.

When you increase your prices, you reduce the number of units you need to sell to break even. A general caveat is to be mindful of the expectations that come with an increased price and what the market will realistically pay. The more you charge, the better product or service your consumers expect.

Reducing variable costs can be challenging, but the more you can scale, the more you can lower variable costs. Regardless of what industry you’re in, consider changing your processes, negotiating with your suppliers, or changing materials.

Regardless of whether you’ve decided to start advertising on Instagram for the first time or are opening the doors to a brick-and-mortar store, the accuracy of a breakeven analysis is complicated.

To ensure you get as close as possible to the correct figure, be sure to get into granular detail on the costs and prices that correlate with your business.

In addition to possessing a thorough understanding of the costs associated with delivering your message or product to consumers, you must know the right price to charge for your product. Miscellaneous expenses add up; consider all possible variable and set costs.

To ensure you’re identifying the right price points for these items, analyze every product, service, or resource your business uses, produces, sells, or plans to sell. By organizing these items by profitability priority, you can further reduce costs and potentially reach your BEP sooner.

As you near the breakeven point, be sure to continuously monitor your performance through other metrics—breakeven analysis is just a tool in many that can help your business succeed.

What’s your best practice for identifying all variable and fixed expenses?