The Great CPC Hoax: Why Cost Per Click Doesn’t Matter for High-ROI Ad Campaigns

People always ask me the same question about AdWords:

“What’s a ‘good’ cost per click?”

My response back to them is always the same:

“Why do you care?”

See, most people have AdWords wrong. They obsess over the costs.

They know that more and more competitors are advertising on the platform, which drives up prices.

So they’re zeroed-in on how much they’re going to have to spend.

That’s the wrong approach.

Instead, they should be concerned with what they’re going to get back in return.

I know this sounds counterintuitive. However, I almost never worry about the Cost Per Click for keywords.

In fact, I almost always ignore them.

I’m going to show you why CPC’s don’t matter in many cases. I’ll show you how worrying about keyword costs can mislead you time and time again.

Then, I’ll show what you should be analyzing to make sure you’re not leaving tons of money on the table.

Why Cost Per Click Doesn’t Matter (and What to Analyze Instead)

Each year, companies analyze the most expensive keywords in the country.

These are typically competitive phrases in law or insurance and can cost as much $50 for just a single click.

The insane thing is almost none of those clicks will turn into customers immediately.

Instead, they’ll usually opt-into a form, first.

That means you might have to front the bill for 50 or 100 clicks before someone ever converts.

We’re talking thousands of dollars for a single customer.

It makes sense on the surface; CPC ultimately determines how much you need to spend.

WordStream, for example, always releases an annual update on Cost Per Click benchmarks across industries.

The businesses I own are all software-related. But we work with clients across different industries. So it’s always interesting to look at these cost breakdowns.

Average ecommerce CPC’s might only be around a dollar, while law might run up to around six dollars (these are higher than most Bing Shopping campaigns, which should be considered for e-commerce businesses as well).

To be honest, though, I don’t obsess over costs, alone.

The first reason comes down to what the study says at the top: Averages.

Average CPCs don’t really mean all that much.

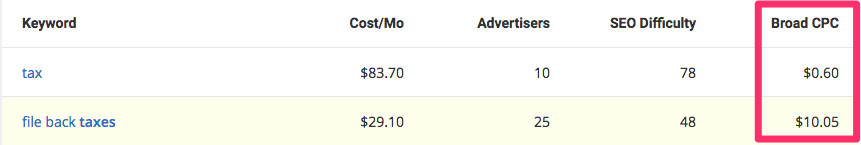

Popular, generic terms aren’t usually all that expensive.

Only a tiny percentage of the people who ever click on those will convert. Whereas, a more commercial long-tail keyword will be incredibly expensive.

Just compare the difference in costs between “tax” and “file back taxes”:

See? It’s not even close.

That makes it hard to use a standard, “industry average benchmark” for any in-depth analysis.

There’s another reason why I don’t like to just look at costs — because you’re often forgetting the other side of the equation.

Conversions ultimately have a much bigger impact than costs.

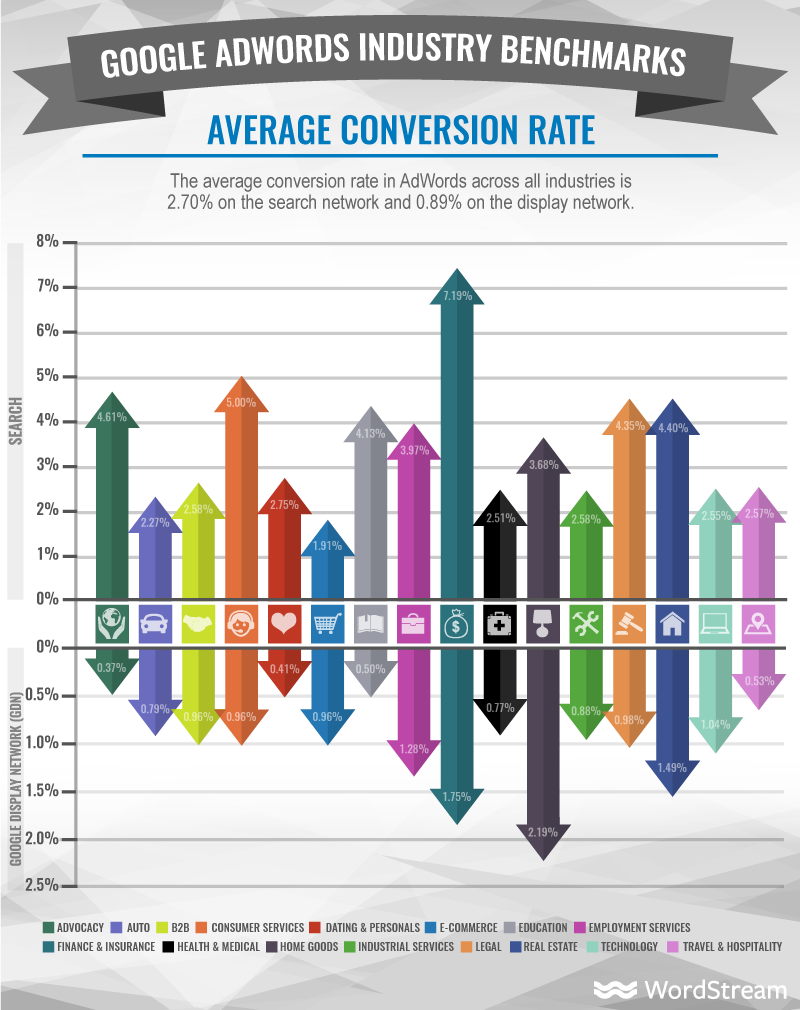

Now, let’s check out those industry average conversions from the same study:

Ok, now we’re getting a little closer.

If you remember, the industry average CPC for ecommerce was only around a dollar. In fact, it was one of cheapest CPC’s on the entire list.

But if you now look at the average conversion rates, you’ll see why.

Their conversion rates are also among the lowest.

What does it matter if CPCs are ‘inexpensive’ if the conversions are equally low?

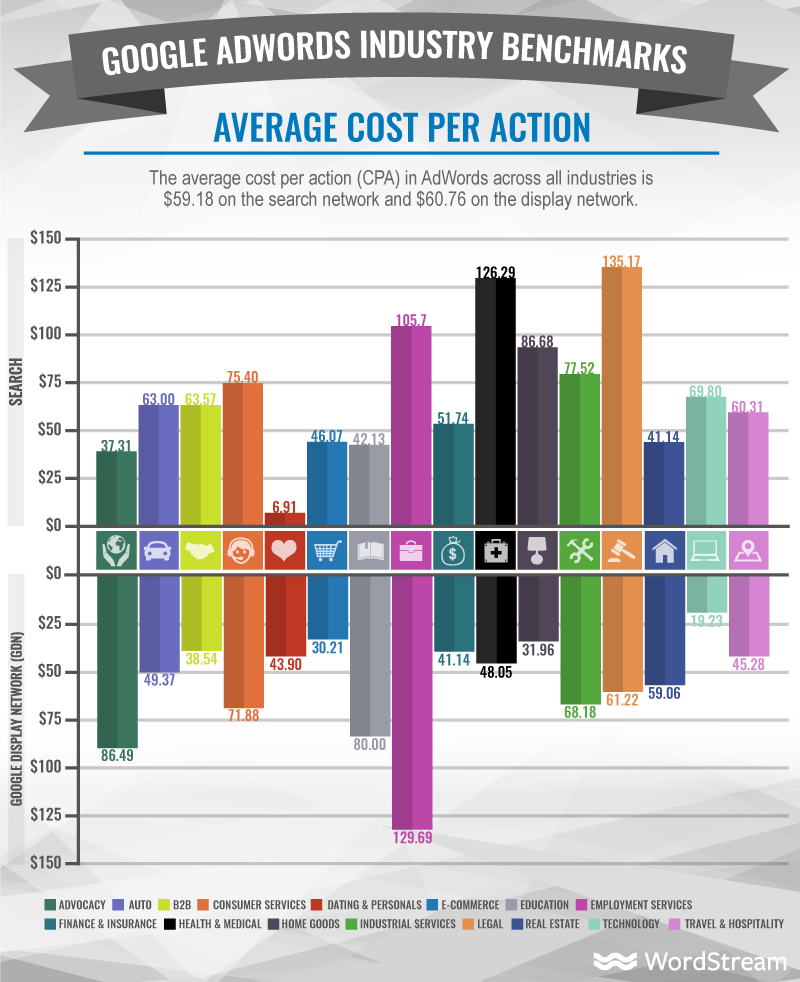

That’s why you often want to look at the Cost Per Action (or Acquisition) when putting together advertising estimates.

This is the effective price you pay to generate a lead, for instance.

It’s a performance ratio. It starts to take into account things like costs vs. conversions to help you determine a much better figure: ROI.

The industry average Cost Per Action for ecommerce lines up with education on the search network.

So from an ROI standpoint, there’s almost no difference.

This is why CPC is almost meaningless.

Yes, it’s important to a point because it drives things like your Cost Per Action.

However, what’s ultimately more important is the revenue you can generate.

It doesn’t matter whether we’re talking about Google AdWords, Facebook, or even Twitter ads. The message is still the same.

Digital Marketer once ran a Twitter Lead Gen campaign, testing the effective Cost Per Action (or Lead).

One campaign was able to see a $7.81 cost per lead.

They then ran the same study with the same ad and audience targeting. But this time, they optimized the campaigns to increase conversions.

It generated a $1.38 Cost Per Lead, which came out to a five time lead increase on the same ad budget.

They were able to 5X conversions simply by focusing on conversions and Cost Per Lead. They didn’t even have to touch the CPC.

You can see this time and time again.

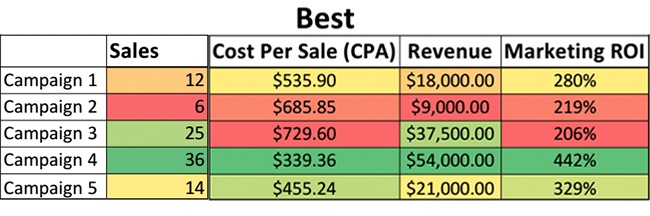

Jacob Baadsgaard of Disruptive Advertising confirms that the best PPC metrics are revenue-focused. They track lead data all the way through to closed sales.

Then, and only then, will they make a decision about which ad campaign is best.

It’s not that costs don’t matter. They do, of course. But they only matter in context to how much revenue you can generate from it.

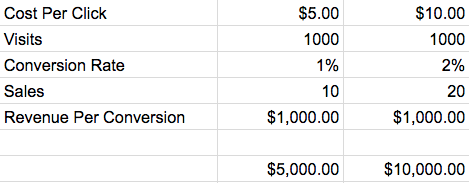

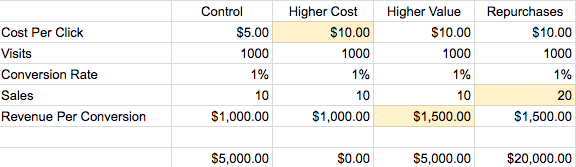

Here’s a very simple example to illustrate.

Let’s say you run two ad campaigns side-by-side.

The Cost Per Click for the second campaign is twice as much as the first. But because the conversion rate is 2% instead of 1%, you’re able to double revenue.

Would you pay twice as high a Cost Per Click to generate twice as much revenue? Of course you would!

This is after reducing revenue by your ad costs. So it’s already accounting for the higher ad budget.

At the end of the day, you’re still doubling revenue. It’s totally worth it!

Obsessing over CPC doesn’t just leave money on the table. It can also make you waste a ton of what you’re already spending.

Here are a few examples.

Obsessing Over CPCs Can Make You Pull The Plug Too Early (or Too Late)

There are many things that separate big companies from small ones.

But here’s one of the biggest: Big companies spend more on advertising than small ones do.

Duh, right? Of course big companies have bigger budgets.

We’re not just talking about dollars spent, but percentage of revenue

Salesforce, the world’s biggest CRM company, spends up to 46 percent of their budget on marketing and advertising!

Crazy, right?

The question is why?

Why don’t small companies spend more on advertising?

In my experience, I find that they’re often too risk averse.

They don’t have the same access to capital. So they tend to obsess over costs, as opposed to revenues.

The classic scenario is when a business owner spends a few hundred bucks on new Facebook ads, only to conclude that they “Don’t work” five days later.

So they pull the plug too early.

In almost all cases, they just need to let the campaigns run longer.

Jennifer Shaheen found that campaigns should run at least 45 days before stopping. And that makes sense when you think about it.

Look at it this way.

How many sales do you need to break even? Let’s hypothetically say two or three.

So what are the chances that those two or three sales land in the first few days?

Pretty slim!

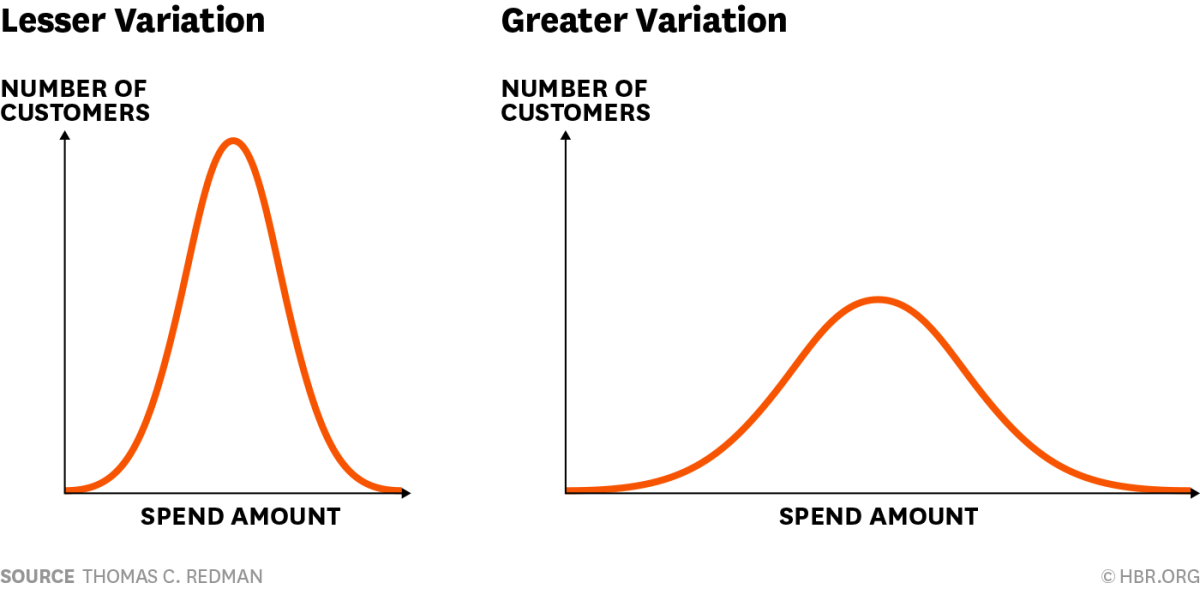

It’s the law of averages at work. You need a big sample size before numbers start to meet projections.

It’s going to take a few weeks, at least, to get statistically significant numbers. Otherwise, you’re just guessing.

All of this assumes that you know the ‘right’ ad campaign variables ahead of time. Which, in all likelihood, you don’t.

Not because you’re not smart. But because it takes awhile to figure these things out!

Here’s the other thing:

Many times, you actually need to increase ad spend.

Yes, you heard me right.

Listen, the reason you spend money on advertising is to make money — not save it.

That means you need to get to statistical significance as quickly as possible.

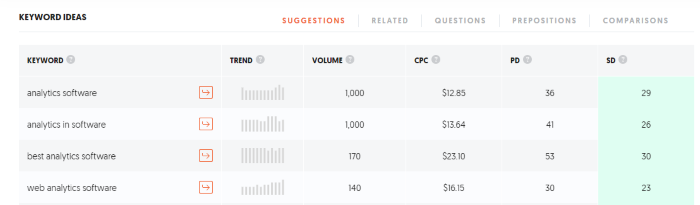

For example, go check out a few CPC ranges for keywords you’re about to bid on.

I like to use Ubersuggest to get a this data:

The average CPC for “analytics software” is estimated to be around $12.85 Ok, not bad I guess.

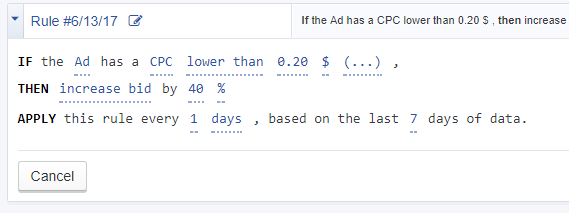

Let’s use that as the upper limit. We can create automated rules in the Facebook Business Manager.

If you’re having a hard time hitting those numbers, you can set a rule to actually increase CPCs.

That will make sure I get better placement over the competition and as many conversions as possible.

Here’s how that might look inside AdEspresso:

Of course, this approach isn’t ideal.

Because you still might leave a lot of money on the table.

If your CPCs start edging up, the campaigns will back off or stop.

Then your lead flow will stop, too.

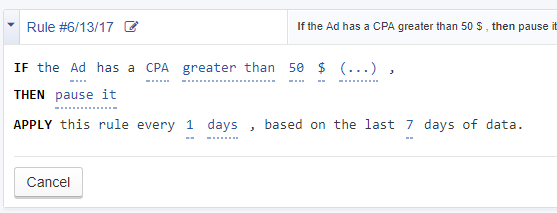

That’s why I like using CPAs as targets if possible, instead of CPCs.

Watch CPA Instead of CPC

Cost Per Action is a better performance than Cost Per Click.

It’s not as good as Revenue, though–and there’s the problem.

CPAs can still be subjective.

Is a ‘high’ CPA bad? Maybe, maybe not.

If your CPA is over $100 in ecommerce, that might be bad.

Almost every single campaign CPA will be over $100 in law, for example. So it’s not bad at all.

Its still a much better metric to control ad campaign performance, though.

You can still figure out an upper range that starts to make ad campaigns unprofitable. You’ll base this on your average sale per customer. (More on this later.)

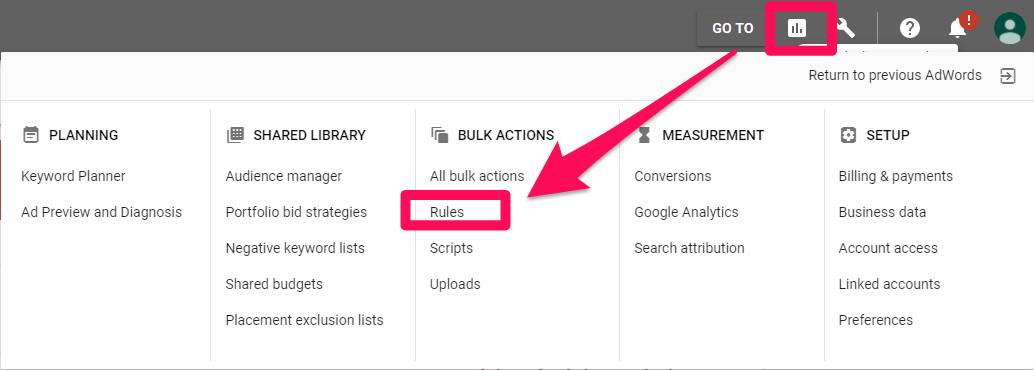

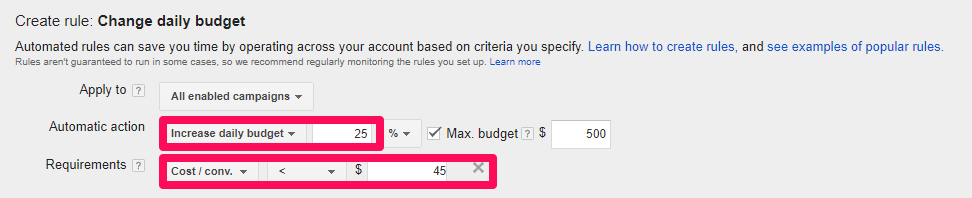

For starters, you can set automated rules to increase or decrease the total budget based on your CPA.

Inside AdWords, you can go to “Bulk Actions” and create new “Rules” for these ranges:

Under “Change budgets,” you can set an automated rule to either increase or decrease budgets based on cost per conversion numbers.

This tells AdWords to automatically increase your daily budget 25 percent if the CPA is within a certain dollar range.

You can do this same exact strategy inside Facebook, too.

You’ll set a rule to increase, decrease, or stop a campaign if the CPA hits a certain threshold.

Managing ad campaigns by CPA can net you more customers and revenue.

There’s still one big section we’re forgetting.

Keyword pricing or competitive pressure aren’t the only factors to worry about.

Many times, your customer base could be going through their own issues, and that’s not something you can change.

That’s why focusing on revenue is always the best approach.

Increase the Revenue-Side of the Equation to Overcome Outside Factors

Spearmint Love is one my favorite success stories.

They went from a baby blog to growing revenue over 991% year over year, and they did it almost exclusively through Facebook and Instagram ads.

The craziest part is that it almost didn’t happen.

They were growing like a weed, until…everything just stopped.

Results were declining across the board and they couldn’t figure out why.

Until, one day while on a walk, it dawned on one of the co-founders.

Parents will buy baby clothes until that baby grows up. In other words, their customers were kind of ‘moving on’ from the company.

The ad campaign decline had nothing to do with costs or his ad campaigns per se.

It had everything to do with their customer base.

How on Earth do you solve this problem?

By focusing on increasing revenue — not touching costs.

If the CPA is ‘too high’ to make your numbers work, start by increasing average order values.

Upsells are easy, for example, when you bundle similar products.

Think about the last time you flew somewhere. Chances are, you bought a travel-sized product at a store before going through TSA.

But that product probably only cost a few bucks, right?

Check out what Jack Black does here, bundling several travel products together.

You arguably need all of these products if you’re flying somewhere.

Instead of only charging you a few bucks each, they’re charging you $35 for the whole pack!

Simply bundling similar products allows them to charge 10x more. Which means you can afford a much higher initial advertising cost now, too.

You can also cross-sell products to try and raise the average order value.

For example, right underneath this travel bundle, Jack Black offers a few related products to take with you:

One interesting thing to note is the price of all three items. They’re all slightly less than the initial $35 purchase.

Why?

They’re using price anchoring effect to make these additional products seem less expensive.

The Economist included a middle pricing tier for a print-only subscription. It was the same exact price as the ‘big’ plan for both the print and web editions.

Most people chose the combined third option because it seemed like the best deal.

Removing the middle plan on a subsequent test, however, led people to overwhelmingly pick the cheap option, instead.

Price anchoring changes someone’s perception of cost vs. value.

That’s why you should lead with the more expensive option. Then, showcase a few related products to cross-sell that are slightly less expensive.

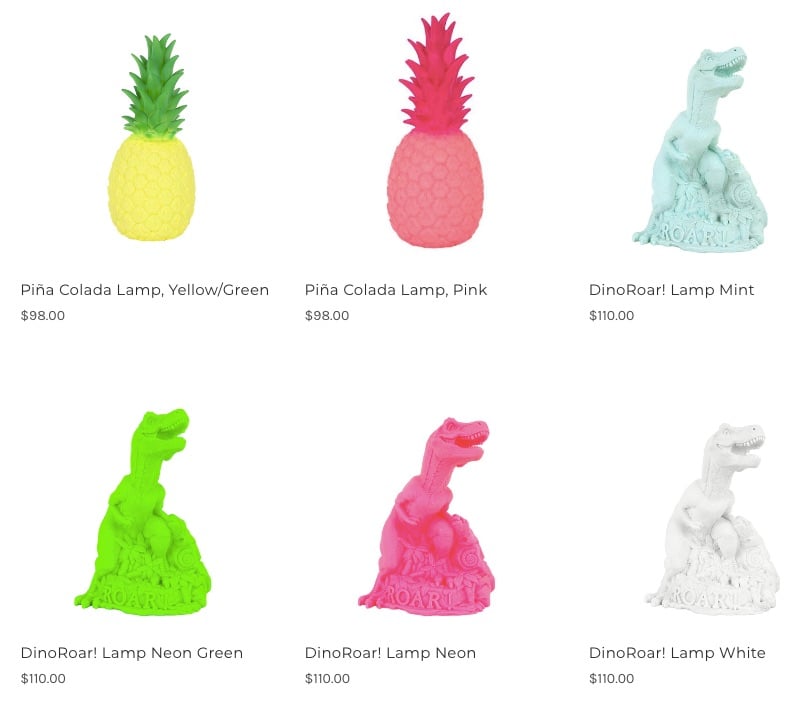

Spearmint Love also expanded their product line to increase average order values.

They came out with decor pieces, like hundred-dollar baby lamps.

The age of a child mattered less in this type of purchase. So it kept the company relevant longer in their eyes of their customers.

After increasing average order values, you should increase the lifetime value of each customer.

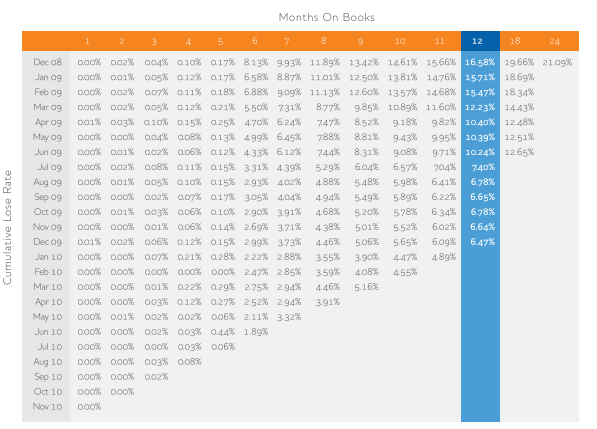

One technique is a vintage analysis, which shows you which customer cohorts are worth the most already.

This way, you can identify trends or patterns.

You can see what the most lucrative customers are doing and then apply those lessons across the board.

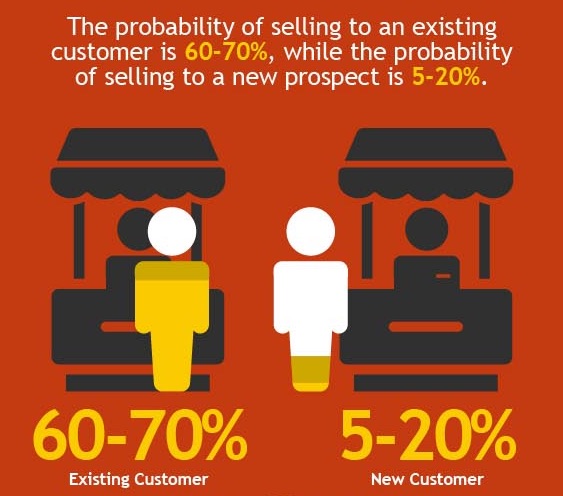

Constantly acquiring new customers is expensive. You have to spend a lot more to get them to buy.

Increasing repurchases from your existing customers has a massive impact on your bottom line.

Let’s revisit that initial ad model to see why.

Keep in mind this is a simplistic example. But I think it still does a decent job showing how this works.

The first campaign has a higher initial cost; you’re barely breaking even.

This is what most companies are scared of. They worry about spending more money on keywords.

As a result, they completely neglect optimizing conversions, average order values, or repurchases.

So yes, they might bring in a few sales. But the higher costs deplete their ad budget before long.

The end result is a wash.

The second campaign has a higher average order value.

In this case, you’re not even getting more conversions. All you’re doing is bundling a product, for example.

Already, you’re back in the black. Not bad.

However, the third campaign?

Not only are the average order values higher, but you’re getting more repeat purchases, too.

You’re basically generating more purchases from the same number of customers. Many times, you don’t even have to spend a single dollar to get them.

All you have to do is send out an email campaign. These loyal customers don’t take a lot of extra persuading.

More sales, without increasing ad costs, skyrockets revenue.

You make several times the other few campaigns.

Best of all, you didn’t sweat a single CPC. You willingly paid at the top-end of the budget range to maximize your opportunities.

Then, you doubled-down on the other side of the equation.

Increasing conversions and revenue spent can act as a lever to double or triple ad campaign ROI.

Conclusion

There’s only one reason to spend money on ads at the end of the day: to make money.

Chasing the keywords with the lowest CPC is a losing proposition.

If anything, you should be spending more money. You should actually search out the highest CPC’s in your industry.

Why?

Often, they offer the most potential. You want to maximize the most sales per dollar spent.

So you know all those “industry benchmark CPC” numbers? Don’t worry about them.

Instead, start focusing on CPA. That’s the number it costs for you to acquire each new customer.

It’s not perfect by any stretch. But it’s a better number to optimize around than CPC.

From there, try to dig into revenue numbers.

Can you bundle a few products to raise the average order value? Can you cross-sell recommended products and use price anchoring to lower their perceived cost?

Then, figure out how you can keep customers around longer.

That might mean introducing new, related product lines. Or it might mean introducing ‘consumable’ products that people need to repurchase again and again and again.

The point is to drive up the lifetime value of each customer as high as possible.

When you do that, CPC will matter even less.

There will be so much revenue generated per customer that you can afford to spend almost anything to get them in the first place.

How have you boosted ad campaign performance by focusing on conversions instead of costs?

The post The Great CPC Hoax: Why Cost Per Click Doesn’t Matter for High-ROI Ad Campaigns appeared first on Neil Patel.