5 AI Copywriting Tools to Make Writing Content Easier

Copywriting is hard. Whether you’re writing product descriptions or PPC ads, there’s a huge volume of work involved, and the repetitive nature of the tasks can drain your creativity.

Could you give a machine a few instructions and let it generate engaging copy while you focused on more pressing tasks?

Well, now it’s possible, thanks to AI copywriting tools powered by machine learning. Let me introduce you to how it works and how it could transform your marketing strategy.

What Is AI Copywriting and How Does It Work?

AI copywriting is essentially computer-generated writing created using natural language processing tools.

First, you decide what you want to write about and the type of content you need. This could be anything from a blog post to a short ad. Then, you set certain parameters for the AI tool to follow. For example, maybe you decide you want a social media post advertising a new yoga class.

Once the machine receives the instructions, it generates content based on these parameters by analyzing similar preexisting content from around the web and processing it into something new and plagiarism-free.

How are companies using AI copywriting? I’ll give you an example.

JPMorgan Chase used an AI copywriting tool to improve its CTAs and online ad copy for home equity lines of credit. They asked human copywriters to perform a similar task, and then they compared the results.

The findings? While the “human” copy generated 25 home equity applications, the AI copy generated 47. With the help of AI, JPMorgan Chase generated more potential customers than before. Impressive, right?

Why Should You Use an AI Copywriting Tool?

There are a few reasons why marketers and copywriters might check out AI copywriting tools.

First, AI copywriting saves you time. These tools can analyze data much quicker than humans can, so they can instantly generate full articles. They work 24/7, too, so you can literally craft content in your sleep!

Also, just think about how convenient AI copywriting is. If you need bulk content, such as product descriptions, AI copywriting handles these jobs for you, so you’re free to focus on more demanding marketing tasks like lead generation and KPI tracking.

Finally, AI copywriting tools can save you from the dreaded “writer’s block” that every writer experiences at some point. Whether you need help brainstorming ideas or generating some content, an AI tool can help you get going again.

If you’re a busy content creator with multiple deadlines or dreams of scaling your content production, it’s worth exploring how AI copywriting may help you.

AI Copywriting Limitations

Like any digital marketing tool, AI copywriting has its limitations.

First, although AI tech is impressive, AI copywriting tools don’t write anything truly original. Remember, we’re talking about a machine. They’re “fed” articles and content written by human copywriters and essentially mix them up to create something new.

AI tools produce great copy, but just because it’s “new” copy doesn’t mean it’s original.

What’s more, AI tools can’t replicate human emotion. Why is this a drawback? Well, emotion matters in marketing. In fact, when it comes to consumer buying behavior, feelings are more influential than any other variable, so you should try to invoke emotion through your content.

In short, while it’s great for bulk projects, you might not find AI copywriting helpful for crafting those more emotive posts that need a personal touch and true creative thought.

Finally, the AI tools we have right now aren’t great at picking up “awkward” phrasing. Although the writing (usually) makes grammatical sense, you’ll still need to proofread the copy to identify any incorrect phrases and awkward wording.

The takeaway? AI copywriting tools can support your marketing efforts, sure, but they’re not a complete substitute for human content creation. Just think of them as another highly useful tool in your toolbox.

5 AI Copywriting Tools for Content Creation

Ready to try out some AI copywriting tools? There are plenty out there, but here are the five I suggest you try first.

1. CopyAI

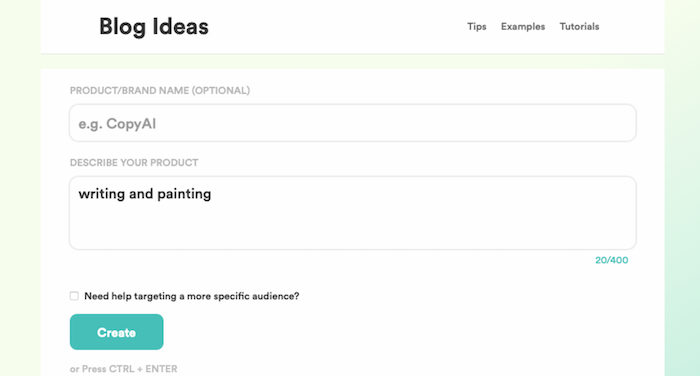

Got writer’s block? CopyAI is here to help. From brainstorming topics to crafting social media posts, CopyAI can help you go from stuck to inspired within minutes.

How does it work? It’s a simple enough concept. CopyAI uses a highly advanced machine language model, GPT-3, to produce authentic, human-like copy almost instantly. You just select a copy type, provide some words, phrases, and descriptions to base content around, and watch CopyAI do the rest.

Key Features

One thing that’s great about CopyAI is how simple it is to get going. You only need to provide a few words to generate copy including Instagram captions, product descriptions, and even product value propositions in seconds.

What makes CopyAI stand out, though, is its suite of idea generation tools. Whether you need a viral post idea or you’re just stuck on what to write about next, CopyAI gets you moving again.

Pricing

You can choose from two packages. The “Solo” package costs $420 a year (billed monthly at $35) or $49 for rolling monthly subscriptions, and it gives you access to all CopyAI tools, unlimited runs, and around-the-clock support.

The “Multiple Seats” package is better for larger businesses because it includes collaboration tools to support multiple teams. Prices are on request.

Not sure if CopyAI is right for you? You can try it free for seven days.

2. Wordtune

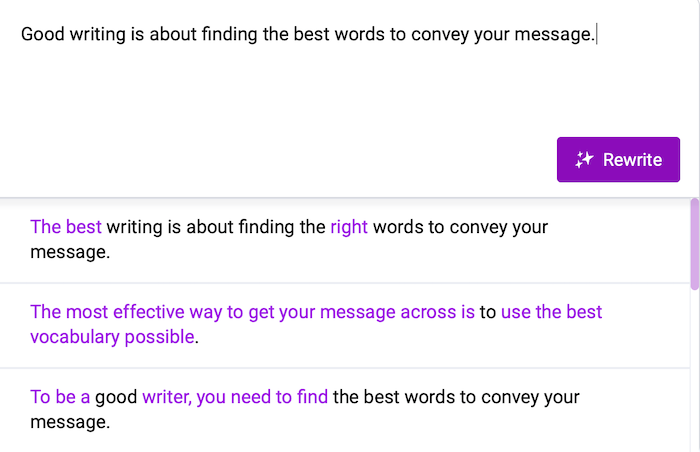

Do you have trouble saying exactly what you mean? Wordtune can help you get the words right. This AI copywriting companion works alongside you in real-time, helping you rephrase and reword your content without sacrificing flow, tone, or meaning.

Since it’s not a fully-fledged article generator like CopyAI, it’s best for marketers who want to write copy and need help shaping it. It could save you time spent agonizing over word choice and sentence structure while giving you the creative freedom to write your content.

Key Features

Designed with the discerning content writer in mind, Wordtune can assist with everything from sentence length to full-length article rewrites. This could be great for marketers looking to repurpose content across different platforms who want help condensing and rewording their copy.

Once you add the Chrome extension, you can instantly use it across popular websites such as Twitter, Grammarly, and LinkedIn, making it one of the most efficient AI copywriting and grammar-assistance tools out there.

Pricing

If you just want help rewording a sentence or two, there’s a free plan.

However, if you want access to features like sentence length controllers, tone controllers, and word searches, sign up for Premium. You can either pay $24.99 a month or save money and pay $119 for the year. You’ll get access to all features other than team billing.

Do you have a larger business or multiple teams working together? Check out the Premium for Teams tier. The prices vary depending on the scope of the services you require.

3. Copysmith

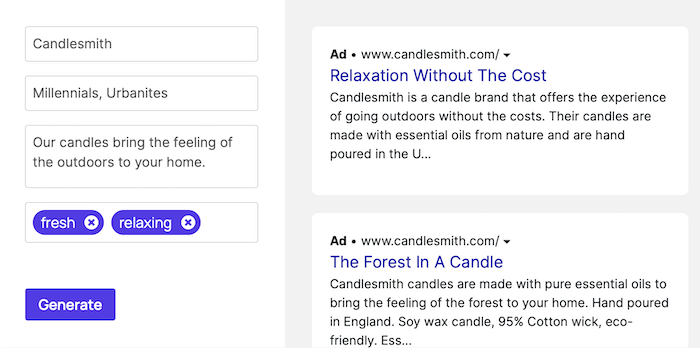

Need help scaling your marketing and driving growth through copy? Check out Copysmith.

Whether you’re a freelancer or you’re managing an in-house marketing team, Copysmith gives you the tools you need to actually accelerate your growth through tailored marketing, not just create great copy.

Key Features

Copysmith boasts a really impressive range of tools for busy marketing teams and copywriters.

For example, if you run an online store, Copysmith can generate a whole FAQ section for you plus unlimited product descriptions. Need taglines to boost your brand profile? Copysmith can turn your brand vision into engaging, memorable ad copy, and you can store all your client copy in one place.

Pricing

Unfortunately, there’s no free option, but if you’re happy paying for AI copywriting support, you have three choices.

First, we’ve got the Starter package. For an annual subscription, it’s $192 which works out at $16 per month. However, you can instead opt for a monthly subscription, which is $19 per month. For your money, you’ll get 20 plagiarism checks per month, Google Ad integrations and Chrome extensions so you can access copywriting support within your browser.

Next, there’s the Professional tier, which costs $600 per year (working out at $50 per month) or $59 for a monthly subscription. You’ll get everything in the Starter package, plus extra plagiarism checks and 100 generated blog posts to get your creative juices flowing.

Finally, there’s the Enterprise package, which comes in at $5,088 annually or $499 if you pay monthly instead. It comes with unlimited plagiarism checks and blog ideas, plus a suite of integrations including Shopify, so you’ll never be stuck for a product description again!

4. Wordsmith

Do you rely heavily on data for your day-to-day decision-making? If so, check out Wordsmith. This platform generates natural-sounding content based on analyzing large data sets, so you can use it for everything from journalism to financial reporting.

Key Features

Like Copysmith, Wordsmith is all about scale. All you need to do is create one template, set up a few variables, and Wordsmith will generate multiple alternative scripts. For example, you can write chatbot scripts for responding to various complex customer requests or write a video game script.

Wordsmith is also great for presenting financial data in understandable English to help you with your financial reporting and tracking needs: The AP uses it to publish more than 3,000 financial reports every quarter!

Pricing

The pricing structure isn’t public, so you’ll need to request a free demo and tell Wordsmith a little more about your business and content needs to get a quote.

5. Writesonic

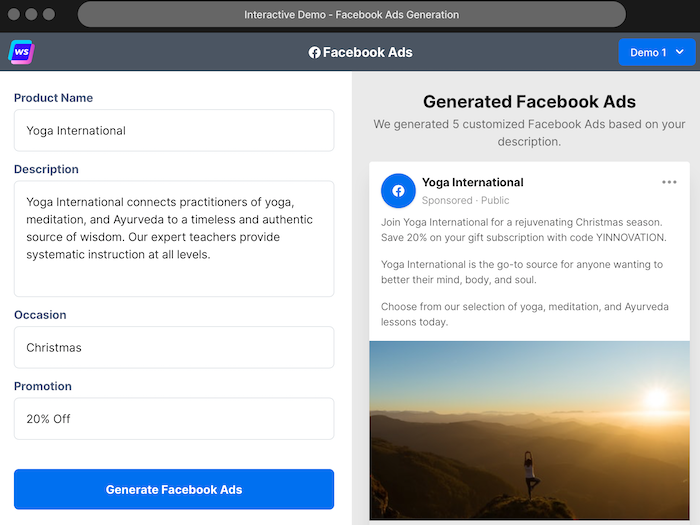

Looking for an AI tool you can scale as your business grows? Writesonic might be for you.

“Trained” on successful copy from popular brands, Writesonic can help you generate everything from landing pages to Facebook ads, and it’s designed to maximize your chances of ranking well on search engines. Simply select a template and supply a few lines of description, and Writesonic will provide multiple copy samples for you to choose from.

Key Features

Writesonic is great for marketers who want to automate their more mundane writing tasks like welcome emails and SEO meta descriptions. The billing structure is really flexible, too, so you can scale your package to suit your evolving business needs.

However, one of the standout features is the landing page generator. By supplying just a few key details, you can instantly generate an optimized, engaging landing page. Check out an example of a landing page for Monday.com.

Pricing

There are three pricing tiers.

- Starter: It’s $29 per month (or $25 per month if you pay for an annual subscription) to get 75 credits and access to basic features like SEO tags and the content rephraser.

- Professional: You can pay $99 for monthly rolling subscriptions, but it’s cheaper to buy an annual subscription and pay $89 per month. However, you’re capped at 150 credits per month for features such as blog outlines.

- Business: Coming in at $449 per month for annual subscriptions or $499 for a single month, you get everything in the Professional package plus 1200 credits for advanced features like full article writing.

Writesonic offers 10 free credits so you can check out the functionality before committing to a paid package. You can also pay-as-you-go rather than buy a monthly subscription if your content needs vary from month to month.

Conclusion

Whether you’re a digital marketer or a busy copywriter, AI copywriting tools can help you scale your content creation and achieve your business goals. They’re easy to learn and fun to use, and best of all, they produce natural, engaging copy to support your content needs.

Since every AI copywriting tool is slightly different, it’s best to check out a free trial or two before you commit to a purchase. This way, you’ll get a sense of how the tools work and which one best supports your business strategy.

Have you tried AI copywriting tools yet?