Company Broker Guide- How To Choose A Reliable Business Broker Organisation brokers or company transfer representatives are practical in offering your service at greater costs. A company broker supplies customers as well as vendors for various companies.Company brokers locate customers for you to make a reliable company sale. Company broker can be an individual as … Continue reading Organisation Broker Guide- How To Choose A Reliable Business Broker

Tag: Guide

A Smart Business Women’s Guide to Small Business Loans: Stock Up on Tools to Help Find Loans for Women to Start Business

A Comprehensive Guide for How to Get Loans for Women to Start Business

Research shows that forty percent of brand-new business owners in the United States are ladies. Furthermore, the variety of businesses owned by women is growing at twice the rate of those possessed by males, according to Kauffman. You may assume this indicates that there are more loans for women to start business. That isn’t the situation however.

As a matter of fact, according to research done by Fundera, 3 out of 4 female local business owners do not even apply for company financing. Those that do are requesting much less than their male counterparts.

Are There Business Loans Just for Women?

Not really. There are not a lot of specific business loans for women to start business. There are, however, a ton of resources to help women find loans. Organizations exists that work toward helping women business owners access all their resources and find the funding they need. Also, some loans work better for women business owners than others, and these organizations can help you find the best ones for you.

According to a survey by the Reserve bank, women owned businesses have better chances of getting funding at smaller banks. As a matter of fact, 67% of loans for women to start business are authorized at smaller financial institutions. This compares to only 50% at large banks. Those that have loans with smaller banks are generally more satisfied with the service they receive.

What’s that mean? It’s probably best for female local business owners to stick to smaller, community banks. There are other options though.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Pack Your Tool Bag

The key is to have a stock of tools you can use to help you find loans for women to start business. These are sources and resources that every small company proprietor needs in their arsenal to enhance their chances of funding approval, especially women. Some are even designed specifically to help women, though not all offer funding. Those that do not, however, definitely know how to help you find and get the funding your need.

The Everyday Essential: Small Business Administration

While the SBA exists for all small company owners, their Office of Women’s Business Ownership exists to help women local business owner particularly. According to SBA.gov, The Office of Women’s Business Ownership’s is here to enable and empower business owners that are women via advocacy, outreach, and education as well as assistance.

They work with firms to make sure the best resources are available to women business owners at all stages. Whether starting a business, looking for a company financing, enhancing a currently developed business, or trying to find government agreements, their mission is to support the female company owner. If that’s you, go here first.

National Female’s Service Council

The NWBC is a federal advising council. It works as a resource of guidance to the government on women’s organization problems. The objective is to encourage campaigns, programs, and policies to sustain females in service at all phases, from startup to growth, and hopefully to expansion and sustainability.

Other Tools to Consider

Along with those firms listed above, these agencies provide support to women owned businesses.

The AWBC runs a network of business centers geared toward women. These centers labor to help women succeed by offering training, business development, financing, and mentoring opportunities.

This organization, also known as NAFE, sponsors events, provides training, and offers other resources to help female business owners achieve success.

The NAWBO works across the country to offer training, events, and other resources to women owned businesses nationwide.

With more than 300 chapters and 10,000 volunteers, this is the country’s largest network of expert business mentors that volunteer their time. They match female business owners with mentors, or they can participate in a workshop to help them learn what they need to know to be successful.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

But What About the Loans for Women to Start Business?

Most females carry a bag of some sort, and women business owners need a bag of tricks and tools to help them get the funding they need. It’s not all black and white, and if the statistics listed earlier are any indication, it isn’t always fair either. At some point, all businesses need financing, and these tools are designed to help level the playing field with it comes to getting loans for women to start business.

Make use of these resources for assistance and education, and get prepared for what the lenders will want to see.

What Other Tricks Do You Need in Your Bag to Get a Business Loan?

Now, as for traditional business finance, the best thing to do is be prepared. A lot of loan providers need to see the following:

– Company financial statements or income tax return for the past 3 years.

– Personal Income tax return for the past 3 years.

– A professional business strategy.

– They will certainly run a credit history check, and though 680 is standard, minimal credit rating varies by lender.

– Various other info at the discretion of the lender.

– Constantly ask about the application process on the front end so you can have any type of extra documents prepared.

The more of this you have prepped to go, the faster and smoother the process should run. This info is typical of what a standard loan provider may ask for. There are non-traditional lenders that may call for more, or less, info. You would certainly be hard pushed to find a typical lender that does not need a personal credit history check, but there are other choices.

The Secret Weapon: Business Credit

Business credit is a vital secret weapon to have in your bag of tools. There are choices for funding that count on your business credit rating as opposed to your individual credit score. What is a business credit score? It is like your personal credit, except it is based only on the credit history of your company. It is not influenced by your individual credit report. Also, your personal history is not impacted by anything that is reporting on your business credit history.

This is beneficial for a few reasons. First, you can access funding for your business despite an inadequate credit rating. That one is obvious. What some do not recognize is, even if you pay on time, utilizing your personal credit history for company purchases can be detrimental.

That is because organization transactions are, naturally, big. Individual credit limits are typically much lower than company credit limits. Due to this, business transactions can max out individual credit scores rapidly. Consistently bringing the balances close to your credit limits negatively impacts your debt- to- credit ratio. That, in turn, lowers your credit score even if you are making consistent, on-time payments.

How to Get Business Credit: The Secret to the Weapon

Business credit opens doors to various other choices if the conventional route isn’t working out for some reason. If you have a good company credit report, your business is fundable.

The very first step in developing a business credit report is to ensure your company is recognizable as an entity separate from yourself. It needs to stand on its very own. You have to incorporate instead of operating as a sole proprietorship or partnership. You can organize as an s-corp, LLC, or corporation. They each have their own advantages and costs, but for the purposes of establishing business credit, they work similarly.

Next, you will need to take a few other actions to lay the structure for a business credit rating.

– Obtain a separate company address and also telephone number. Ensure the contact number is via a toll-free exchange, and list both in the directories under the business name.

– Get an EIN. This is a number that identifies your business so you do not need to connect it with your Social Security Number. Obtain one completely free at IRS.gov.

– Get a DUNS number from Dun & Bradstreet. It’s cost-free on their web site, but beware. They will attempt to offer you a bunch of things you do not require. Put on your blinders and power through. All you need is the free number.

– Open a specialized company checking account. Take care to run all organization transactions through this account.

– Set up a professional web site and also committed business e-mail address. The email address needs to have the same URL as the website, and it must not be from a cost-free e-mail service. Gmail and Yahoo will not work right here.

Forging the Weapon

Once you have the foundation for a business credit report, you can begin forging your business credit score. This is performed in layers, or tiers. For example, the initial tier is the vendor credit tier. This is the beginning point because these vendors will extend net 30 terms without a credit score. Then, they will report your payments to the business credit reporting agencies. This is exactly how you start to construct a company credit score without involving your personal credit. By applying with your EIN as opposed to your social security number, you keep your personal name out of the formula entirely.

How do you find these starter vendors? There are loads of vendors that will work with you in this tier. A few of the easiest to get started with are here. They each offer products that pretty much any business can use on a regular basis, so it’s simple to open an account and begin doing business with them.

After you have 5 or so accounts reporting from the vendor credit tier, you can apply for business credit cards from the retail credit tier. These are store cards from retailers such as Best Buy, Amazon, and Office Depot.

Get 10 or more of these reporting and you can apply to cards in the fleet credit tier. Cards from companies like Fuelman and Shell are in this tier. They can be used for automobile maintenance and gasoline purchases.

After that comes the cash credit tier. Once you have enough accounts reporting on time payments from these three tiers, you can apply for general business cards from companies like MasterCard, Visa, and American Express. At this point, your business credit is pretty well established, and it is not attached to your personal credit in any way.

Wielding the Weapon

So, say you have used every tool in your box and you still come up short. What then? That’s when you whip out this secret weapon you forged known as business credit. If you have followed the steps properly and worked through all the tiers, you have business credit cards you can use to fund your business. You also now have other options.

You can use that business credit to help improve terms and interest rates on traditional loans. They may still look at business credit, but stellar business credit can only help, not hurt, when it comes to loans for women to start business.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

In addition, a strong business credit score can help you out when it comes to loans from non-traditional lenders. They can help you with approval and improve your terms and rates. Sometimes alternative lenders will even accept a business score in place of a personal credit score.

Wield Your Weapon Wisely

Even though loans for women to start business specifically are not really a thing, there are options to make the process easier women. A lot of resources are available to help women business owners be successful and find the funding they need. In addition, the challenges female business owners face can be mitigated by solid preparation and education.

Having a strong business credit score is important too. This will open up a world of funding options that would not be available otherwise. Business credit cards and products from non-traditional lenders are a valid option if you find yourself facing issues. Do not be afraid to jump into the fire and forge that business credit weapon. Once you have it, do not be afraid to use it. Not only can it tear down your funding foes, but it can also serve as a key to open the doors to the kingdom.

The post A Smart Business Women’s Guide to Small Business Loans: Stock Up on Tools to Help Find Loans for Women to Start Business appeared first on Credit Suite.

A Guide To Credit Card Debt

A Guide To Credit Card Debt When speaking about charge card financial obligation, the results of financial obligation rely on such aspects as the resources of lending funds, the function for which loaning is done, the conditions under which the financial debt is drifted, the quantity of the existing financial obligation, the rate of interest, …

A Guide To Credit Card Debt

A Guide To Credit Card Debt

When speaking about charge card financial obligation, the results of financial obligation rely on such aspects as the resources of lending funds, the function for which loaning is done, the conditions under which the financial debt is drifted, the quantity of the existing financial obligation, the rate of interest, the kinds of financing utilized and also the basic financial problem of the area.

The results of residential loaning are fairly various from those of international loaning. In inner loaning, there is no rise in the complete amount of sources offered for the usage. Loaning from economic establishments is just a transfer of sources from exclusive to federal government usage.

The results of financial debt likewise depend on the objective for which the financial obligation is developed. The greater the passion price for loaning funds, the more powerful the pull on funds from contending financial investments.

A major diversion of funds from limited ventures would certainly have a tendency to create the latter’s failing and also this, subsequently, would certainly influence manufacturing as well as various other financial procedures, like market value and also rate of interest. This will certainly have a tendency to urge the acquisition of their safeties if the monetary organizations obtain tax obligation exceptions for their car loans.

The impacts of residential loaning are fairly various from those of international loaning. The impacts of financial debt additionally depend on the function for which the financial obligation is produced. The greater the rate of interest price for loaning funds, the more powerful the pull on funds from contending financial investments.

The post A Guide To Credit Card Debt appeared first on ROI Credit Builders.

The Definitive Guide to Mobile Deep Linking

The average consumer is spending five hours per day on their smartphones and this number is only going up.

We do everything on our phones these days, from shopping to browsing social media and managing our businesses.

This is why it’s more important than ever to optimize the user experience to keep people on your app for longer periods, enjoying it more, and sharing it with friends.

If you’re trying to optimize your mobile app, I’m sure you’ve already tinkered with the layout, fonts, copy, and more, but there’s one thing you probably haven’t…

Mobile deep linking.

It’s a small detail that can drastically enhance how users engage with your app but few are taking advantage of it.

That’s why I’m going to be teaching you what mobile deep linking is, why you need it, and how you can implement it yourself.

Let’s dive in.

What is mobile deep linking, anyways?

Mobile deep linking is the practice of funneling users deeper into your app through the use of a uniform resource identifier or URI for short.

This allows mobile app developers to push to a specific page within an application versus simply opening it.

Think of it as a website URL.

If you were trying to sell a product, would you want users landing on the homepage or being forwarded to a sales page found deeper in the website?

The latter, of course.

By helping users go to a certain page within an app, you’re making the customer journey easier by getting them closer to the end goal sooner.

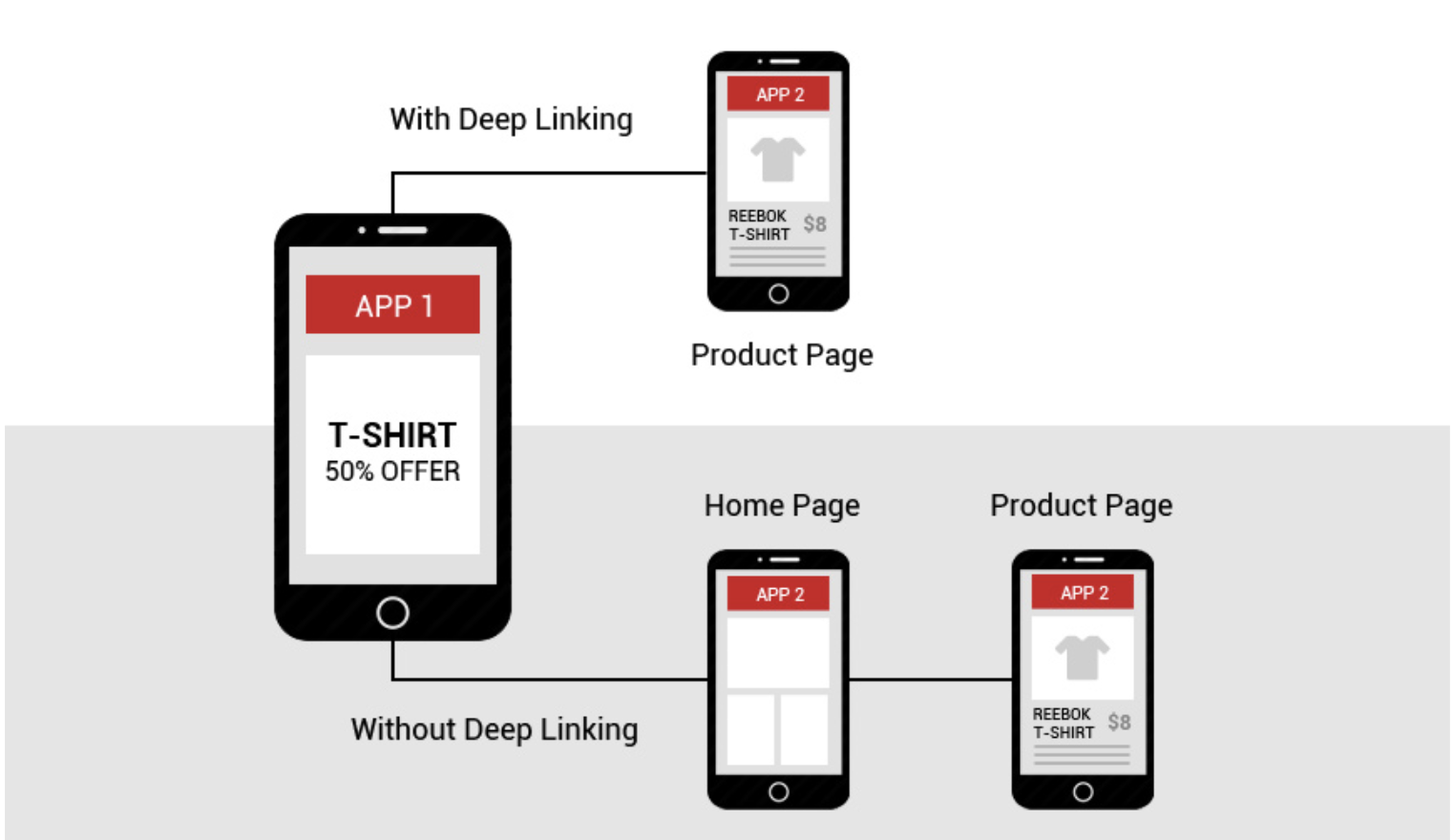

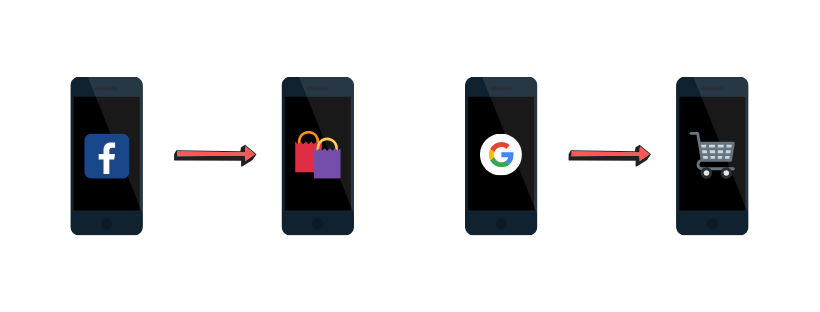

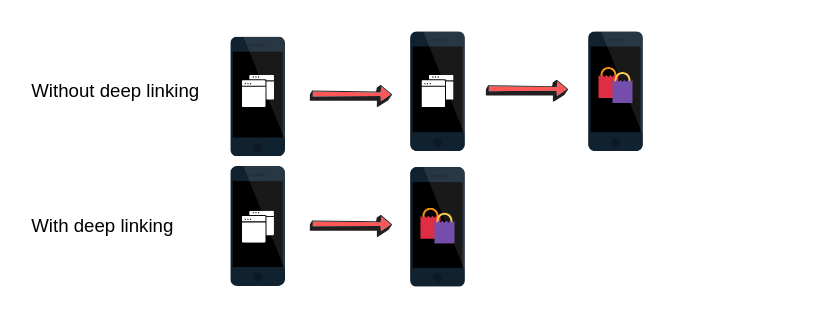

Here’s a visual of what the process looks like:

While it might seem simple, mobile linking comes in three different forms that you need to be aware of. They include the following:

Standard deep linking

This is the straightforward deep linking that forwards a user to a specific part of the app. It’s also known as universal linking.

It only works if the customer already has the app installed.

The problem is within traditional linking is that when a user clicks a link, it won’t open the mobile app, but rather directs them to the browser version.

If someone is on a mobile device, the app version will always be more optimized and streamlined.

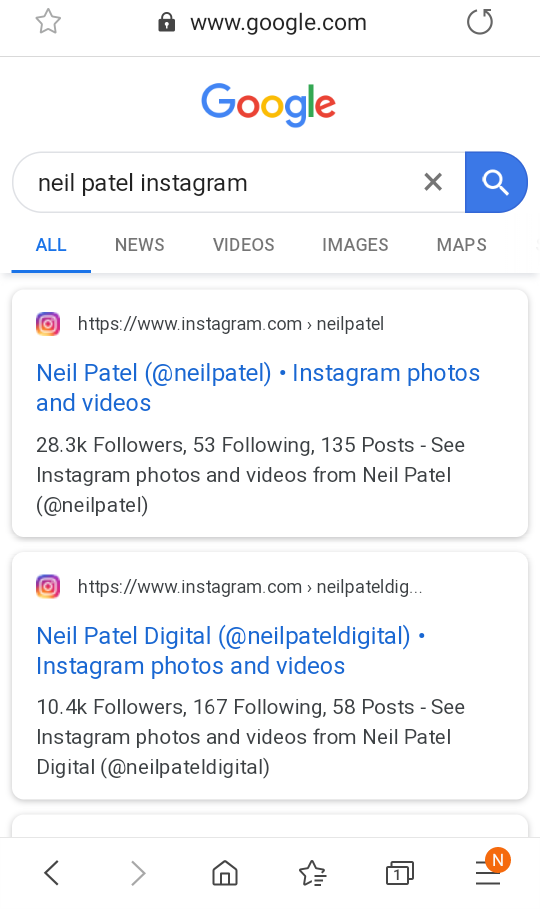

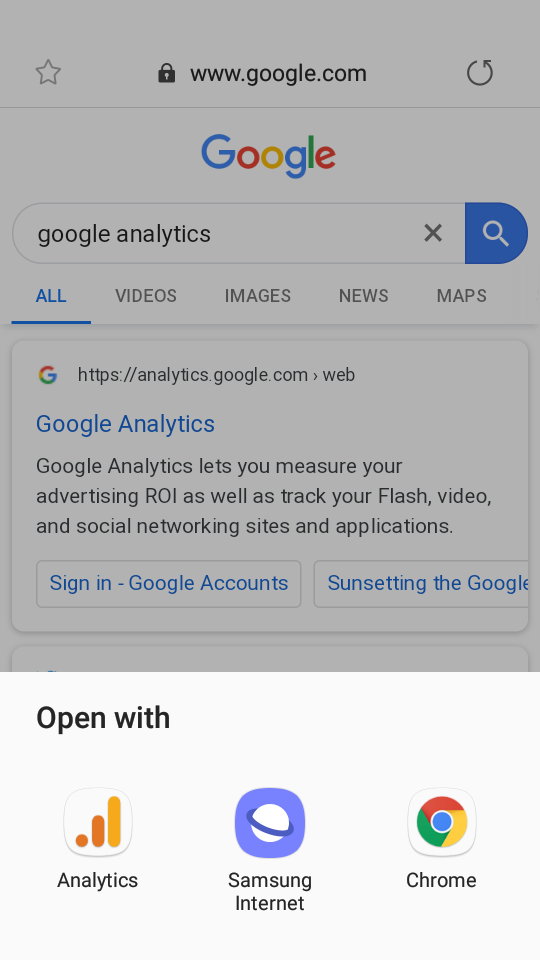

Here’s what happens if you search for my Instagram on Google for example with the app installed.

The results appear to be the exact same whether you have the Instagram app or not, but clicking it opens up the app seamlessly.

This is a good example of basic deep linking.

Someone that doesn’t have the Instagram mobile application installed will be given an error or redirected to a fallback page.

Deferred deep linking

This form of deep linking works the same way as standard linking does with the exception that it will direct users without the app to the download location.

This is beneficial because it can help app developers and companies acquire more customers.

Once the app is installed, the user will be referred to where they were originally navigating.

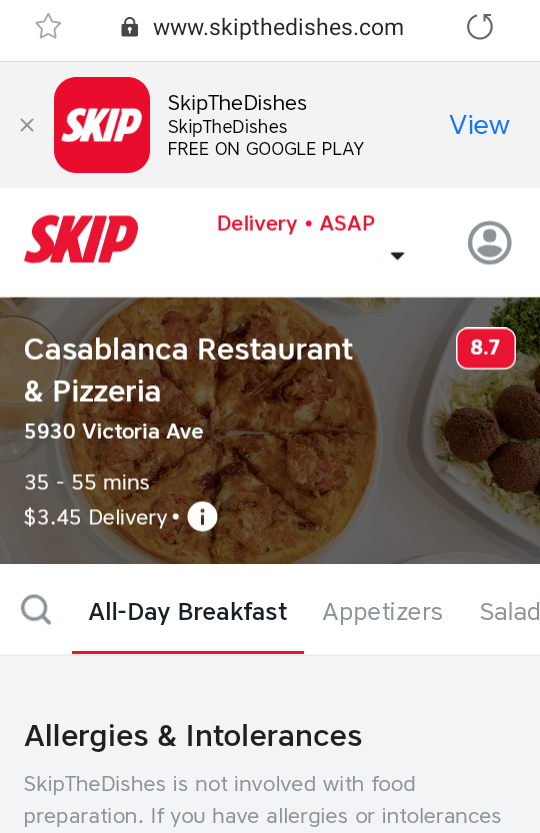

Check out the Skip The Dishes app to see what I mean.

While a user is creating their order, they are able to download the mobile app for Android or iOS.

They are forwarded back to the exact step they were taking, except in the mobile app after downloading it.

This means that they don’t have to manually go through the entire process again to get back to where they were.

Contextual deep linking

Contextual deep linking, also known as onboarding, is commonly used for gathering information on customers to personalize the user experience of an app.

Data such demographics, how users navigate to the app, and more is recorded.

The app onboarding process can be different depending on if the user installed via the Google Play Store, the Apple Store, a Facebook campaign, or another source.

A mobile app downloaded through a Facebook Ad might look different than when it’s downloaded through a Google Display Ad, for example.

The landing page is able to be customized through what is known as a deep view in mobile app development.

Just as the deep link forwards users to a specific deeper page in the application, the deep view is the visual result they see that’s different than others.

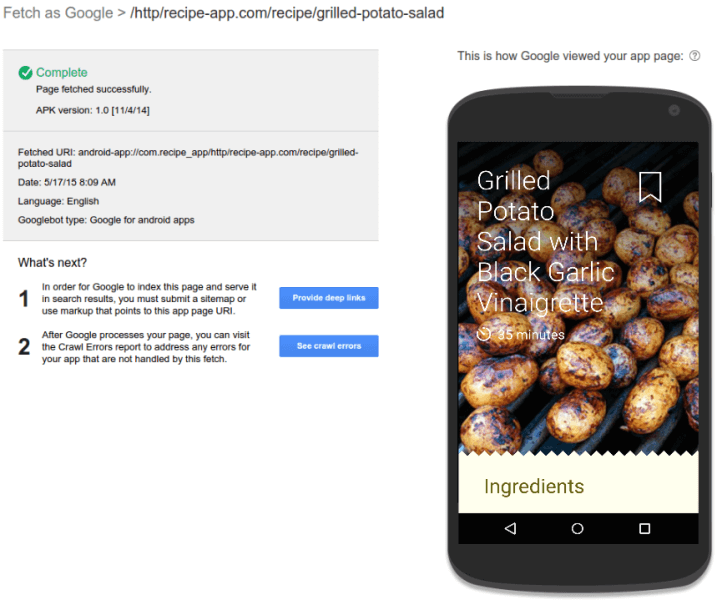

URI schemes

Deep linking is only doable thanks to what is known as URI schemes. These schemes are similar to how a website URL can direct you to a specific page on a website.

They look something like this:

See the fetched URI? Its format is appname://path/to/location.

Custom URIs are simple to set up for developers (Often created by default) and present the opportunity to redirect users wherever you please.

The mobile customer journey and how it applies to deep linking

The mobile buyer’s journey is the individual’s steps a user takes to find, use, and share your application.

It’s similar to the regular funnel a customer goes through when purchasing a product with some small differences you need to be aware of.

Here’s how the various steps in the mobile buyer’s journey can be applied to mobile deep linking.

Discovery

The first step in the mobile customer journey is discovering your app in the first place.

While this can be achieved through strategies like content marketing and SEO, deep linking gives you a nice boost to these tactics.

Google indexes deep links from mobile apps, giving you more opportunities to rank and drive organic traffic.

Users can click the search engine listing and open the link directly through the app instead of an internet browser.

Look at this search for Google Analytics to see what I mean:

This helps businesses acquire more users and increase brand awareness versus having a single search engine listing.

Check out my video on skyrocketing mobile app organic traffic, and pair it with deep linking for mind-blowing results.

Compare

Once a user has narrowed down a few options, they’re naturally going to want to find the best app by comparing them.

They’ll look at factors such as pricing, ease of use, and features.

Deep linking enables you to push users to the best features of your app, reviews, or customize the experience to make your application better than competitors.

By reducing the number of steps it takes to get to important functions of the app, you’re also decreasing the chance of users bouncing.

Decision

The third step in the mobile buyer’s journey is making a decision and commitment to a single app.

Having a clear value proposition and refined user experience is crucial here.

Better yet, contextual deep linking helps you collect data to make the application as tailored as possible to your buyer’s persona.

Marketing campaigns can also be optimized with this information to improve targeting and performance.

Retain

Once you begin acquiring more users, you need to keep them.

Standard and deferred deep linking will help navigate users back to your app when they are on search engines, social media, and other platforms.

This keeps them using your app more often.

Data that can be collected as a result of deep links will assist you in understanding why and how they use your mobile application.

Doubling down on these is what we call Pareto’s Principle or the 80/20 rule.

This rule can be seen everywhere and defines that 80% of results come from 20% of actions.

In the case of mobile app development, you might discover that users are only engaging with a few features and others are taking up space.

You could hypothetically update the features and pages that are used the most, boosting engagement and retention.

Businesses will miss out on discovers like this if they don’t use deep links to collect information.

Why mobile deep linking matters

I know what you’re thinking.

“Why should I bother with mobile deep linking?”

Let me explain.

It improves the user experience

If you can save the user from going through multiple steps instead of one, why wouldn’t you?

That’s exactly what deep linking does, and improves UX because of it.

You’re making the life of users easier by using deep linking to get them where they want to go faster.

This gives them a better experience and impression with your app as a result.

Here’s what the difference between not using mobile deep linking and taking advantage of it looks like:

Much simpler, right?

This brings me to my next point.

It increases customer retention and engagement

Wouldn’t it be nice if every user that downloaded your app stay active all year round?

Unfortunately, that’s not how it works.

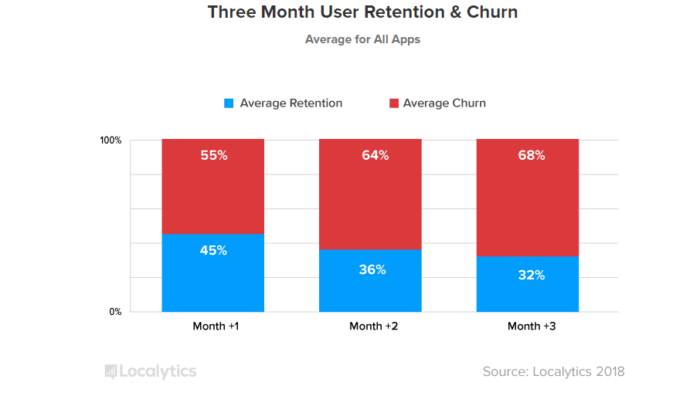

It’s been found that 55% of users will churn after the first month of use. That means nearly half of the new downloads will be lost.

Look at mobile app user retention the same way you approach a website.

It’s common for nearly half of all visitors to leave a website and not take any action.

Do you just sit there and do nothing about it? Of course not!

You implement strategies like email options through popups and exclusive content to capture those users before they leave.

This is precisely what deep linking can be used for but in the sense for a mobile app.

Once a user has visited your app, you can retarget them and use a different style of deep linking to improve their experience.

It improves the onboarding of new users

When a mobile app uses a form of deep linking like the deferred approach, you are capable of acquiring more users.

This is because as a user goes through the mobile browser version of your application, they will be given the option or automatically forwarded to the appropriate download location.

The contextual linking technique can be used to onboard new users in different ways depending on where they originally download the app from.

If you understand that users coming from a Facebook ad campaign regularly navigate to a certain product category, you can push them there automatically.

Furthermore, perhaps users from Google like to learn more about your business first before purchasing.

You can use contextual deep linking to direct those users to the page detailing your company’s history.

You can re-engage users

Once a user has used your app, you have a small window of opportunity to retarget them.

Did you know that 46% of search engine marketers believe that retargeting is the most underused form of marketing right now?

It’s a hidden gem that deep linking enhances.

If a segment of users downloaded your app, viewed product pages, and bounced, you could retarget them in advertising campaigns and use deferred linking to forward them back to the high-interest product pages.

Strengthens your marketing

Personalization is key. Contextual deep linking allows you to customize the user experience, which improves marketing results.

Take into consideration that 39% of consumers will spend more money when given a mobile coupon.

You could collect data on users via contextual deep linking to discover what product categories they enjoy the most, then offer a discount for them to align with this behavior.

Similarly, mobile deep linking has the potential to increase conversion rates.

This is because you are pushing users through the sales funnel quicker. Normally this consists of:

- The user lands on the homepage of your website.

- They navigate to a product page and add a line item to their cart.

- They visit the cart page to confirm their order.

- Finally, they pay and check out.

Mobile deep linking can effectively cut the sales funnel in half by helping customers go straight to sales pages.

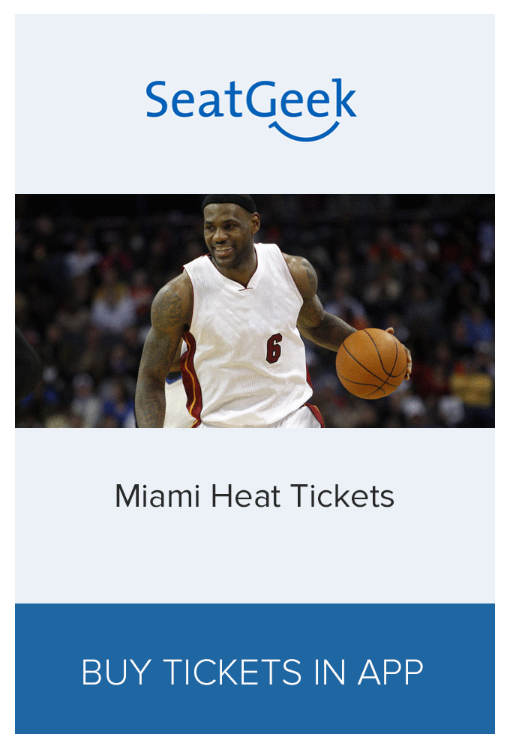

Take the ticket mobile app SeatGeek as an example. They were able to increase revenue by 10.6% and app open rate by 8.8% with deep linking.

Here’s how…

Firstly, they struggled with reminding users to finish their purchases and buy tickets through the app.

They resolved this issue by using deep linked mobile ads. These target ads based on past user activity would display relevant ads in other existing apps the customer used.

SeatGeek noticed that they were getting thousands of new users per day and had to keep them.

Their team began creating ads that would serve different audiences based on previous behavior.

An example of this would be a user adding tickets to their favorite basketball team’s game to cart, but then abandoning before checking out.

When this user was on another application that supported ads, they would see an advertisement for that same basketball game.

The ads were simple in nature, using a related image, and straight forward call to action.

Boosts app discoverability

Don’t you want to get discovered by more customers?

Of course, you do!

And that’s precisely why you need to implement more deep linking in your mobile app.

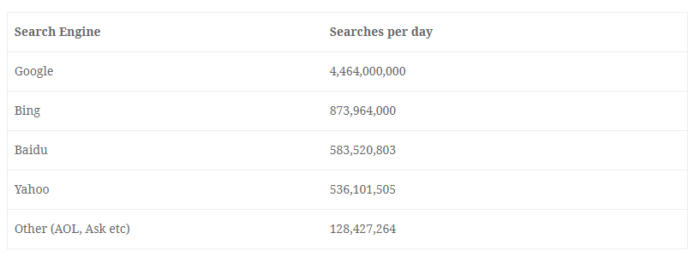

Deep links are indexed on Google, giving you more opportunities to rank and drive traffic to your business.

And seeing as Google receives over four billion searches per day, you don’t want to miss out on the free exposure.

Think about how a website like mine ranks for thousands of pages, and not just the homepage.

You can achieve that same performance but for your mobile app.

Users on search engines like Google will be able to visit deeper functions and features versus landing on the welcome page.

This creates the opportunity to optimize applications for SEO via keywords, meta descriptions, and title tags, as well.

Provides analytics and insight into campaigns

Mobile deep linking allows you to refine your buyer’s persona and better understand their behavior.

This information can be used to improve the effectiveness of marketing campaigns and the overall experience of your app.

You will also be able to discover which links are being clicked the most and by whom.

Doing so creates the opportunity to double down on the best-performing links and optimizing who you target in advertising campaigns.

Deep links also shine light in which parts of your app are used the most and which aren’t.

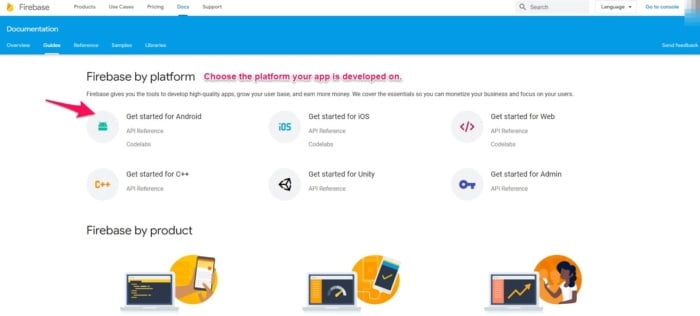

Google offers its Firebase product to track deep linking in an easy to use platform.

You can begin using it by selecting the Android, iOS, C++, web, or Unity options.

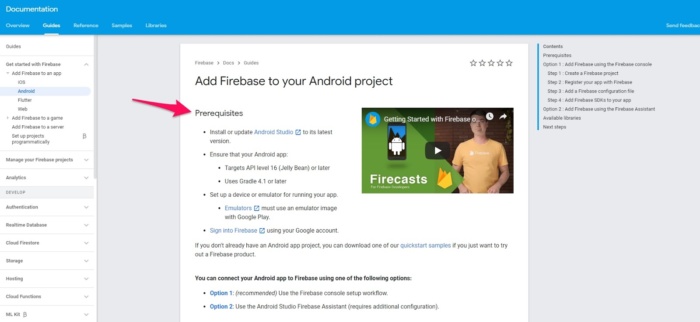

Using Android as an example, you will need to ensure that you meet the prerequisites Google outlines in their documentation.

Firebase’s SDK automatically captures various metrics, user properties, and allows you to create custom events if you wish to track a specific action.

This data is then relayed through the Firebase dashboard which has a very familiar look and feel to other Google products.

You will feel right at home if you’ve ever used Google Analytics.

Which by the way can be connected to Firebase if you need to add events specific to your business like e-commerce purchases.

How to perform mobile deep linking

Now that you’re excited to get started using mobile deep links, here’s how to implement it yourself.

Deep linking on Android

Android devices will select one of three options when a URI is requested:

- It opens a preselected app with the URI.

- It opens the only available app that can handle the URI.

- The user is prompted to choose an available app.

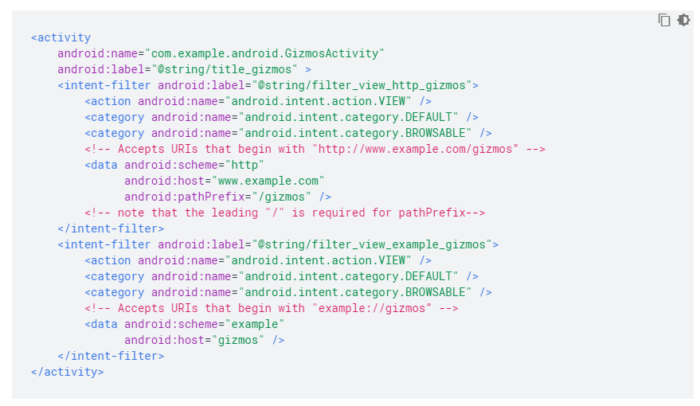

To begin adding deep links to achieve this, you will need to navigate to the AndroidManifest.xml file of your Android mobile app.

You will then have to add the following elements to the file through an intent filter:

- Specify the ACTION_VIEW attribute in the <action> element.

- <data> tags which include the URI scheme, host, and path.

- CATEGORY_DEFAULT and CATEGORY_BROWSABLE attributes to move users from a browser to your app.

Here’s an example from Android’s official documentation on deep linking of what the code will look like:

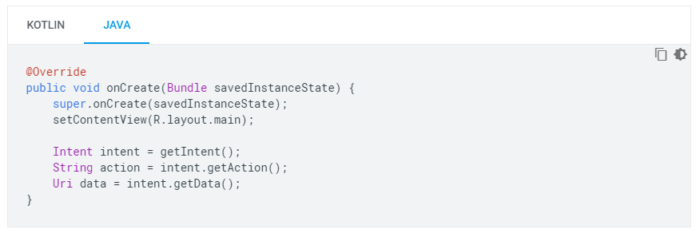

The second step is to ensure that your app can read data from the intent filter you created.

This is achieved through adding getData() and getAction() methods like so:

Deep links should not require users to log in or perform other actions to visit the desired content unless desired like in the case of promoting app downloads through deferred linking.

iOS

Adding deep links to iOS apps begins by enabling them through what is known as Associated Domains Entitlement.

That’s a fancy way to say you’re letting search engines know what app belongs to what website.

This way when a user clicks on your website, it activates the specified type of deep linking you choose.

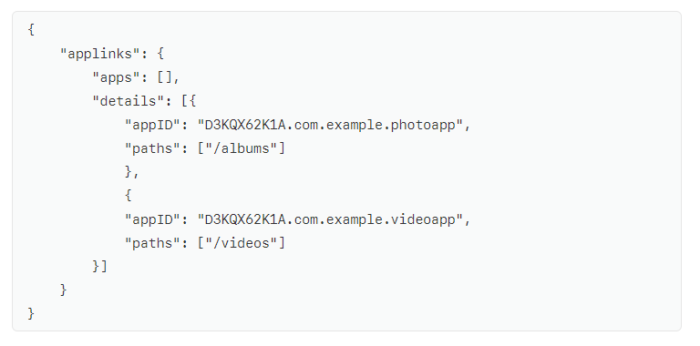

You will then have to add an Apple App Site Association file to your website to verify it.

This association file needs to contain the following code, as you can see from Apple’s official documentation:

Similar to how Android apps have the manifest file, the app delegate file acts as the root of iOS apps.

This is why you will have to program your app delegate file to respond to deep links like Apple shows in this example:

They are specifically handled through the NSUserActivity object and activityType value of NSUserActivityTypeBrowsingWeb.

Your iOS app will be prepared to handle and accept users that navigate to it from browsers like Safari after you complete these steps.

Conclusion

Mobile deep linking is a powerful technique to improve the user experience, on-boarding, and marketing of applications.

The three types of mobile deep linking are standard, deferred, and contextual. It’s important to understand each of these to know when to use them properly.

Standard deep linking is used when customers already have an app installed. When they click on a mobile link, it will give them the option to open it in the app or automatically.

Deferred deep linking works by forwarding users to the appropriate app store to download the app if they don’t have it, then pushing them to the originally intended page.

Contextual linking is the most complicated but allows developers to collection information on users to customize the on-boarding and overall experience of the app.

Mobile deep linking can be implemented in each step of the buyer’s journey to acquire and retain users, too.

How do you use deep linking to improve mobile app performance?

The post The Definitive Guide to Mobile Deep Linking appeared first on Neil Patel.

A Guide To Credit Card Debt

A Guide To Credit Card Debt

When discussing bank card financial debt, the results of financial debt rely on such aspects as the resources of finance funds, the function for which loaning is done, the conditions under which the financial debt is drifted, the quantity of the existing financial debt, the rates of interest, the kinds of financing used as well as the basic financial problem of the area.

The results of residential loaning are rather various from those of international loaning. In inner loaning, there is no rise in the overall amount of sources offered for the usage. Loaning from monetary establishments is merely a transfer of sources from personal to federal government usage.

The impacts of financial obligation additionally depend on the function for which the financial debt is developed. The greater the rate of interest price for loaning funds, the more powerful the pull on funds from completing financial investments.

A significant diversion of funds from low ventures would certainly often tend to trigger the latter’s failing and also this, subsequently, would certainly impact manufacturing and also various other financial procedures, like market value as well as rates of interest. This will certainly have a tendency to urge the acquisition of their protections if the monetary organizations obtain tax obligation exceptions for their finances.

The impacts of residential loaning are rather various from those of international loaning. The results of financial obligation additionally depend on the function for which the financial debt is produced. The greater the passion price for loaning funds, the more powerful the pull on funds from contending financial investments.

The post A Guide To Credit Card Debt appeared first on Buy It At A Bargain – Deals And Reviews.