How to Use LinkedIn’s Social Selling Index Like a Pro

LinkedIn is a perennially underrated social media platform. It’s not always easy to quantify how effective you are on the platform though. Enter LinkedIn’s Social Selling Index.

This handy metric tells you exactly how effective you are as a social seller while highlighting how you can improve. In this article, I’ll cover everything you need to know about the tool, how to use it properly, and how to improve your score.

What Is LinkedIn’s Social Selling Index?

Launched in 2014, LinkedIn’s Social Selling Index (SSI) measures how effective you are at social selling on the platform.

LinkedIn uses four factors to calculate your SSI:

- establishing a personal brand

- finding the right people

- engaging with insights

- building relationships

Each factor is worth 25 points. Complete them all, and you’ll get a perfect score.

There are several reasons to aim for a high Social Selling Index. For starters, a high score increases your reach on the platform. Even if the LinkedIn algorithm doesn’t directly take your SSI into account when determining the reach of posts, all of the individual factors that go into calculating your SSI help you reach a wider audience.

A high SSI can also result in more connection requests and more people following you—which establishes you as a thought leader in your industry and makes it easier to connect with decision-makers.

LinkedIn provides data to back up some of these claims. According to their Social Selling Index page, leading social sellers create 45 percent more opportunities than lower social sellers and are 51 percent more likely to reach quota. In addition, 78 percent of them outsell peers who don’t use social media.

How to Find Your LinkedIn SSI Score

It’s simple to find your SSI on LinkedIn. If you’re already logged into LinkedIn, follow the link below to see your score.

Find your Social Selling Index.

You can also access your SSI through Sales Navigator by navigating to Admin and clicking User Reporting.

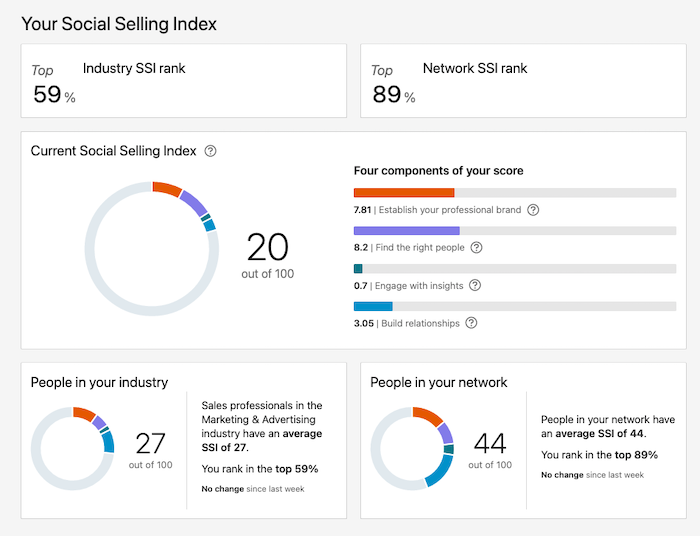

Key dashboard information to pay attention to includes:

- your SSI score

- the score for each of the four components

- how your SSI compares to your industry

- how it compares to your network

We’ll discuss what each of these metrics means in detail next.

LinkedIn Social Selling Index Metrics

As I mentioned above, LinkedIn uses four factors to calculate Social Selling Index: establishing a personal brand, finding the right people, engaging with insights, and building relationships.

But what do each of those metrics actually mean?

Here’s what you need to know.

Establishing a Personal Brand

For this metric, LinkedIn looks at how complete your profile is and the quality of the content you post on the platform. Do you have a cover photo, a complete job history, and recommendations? How many posts are you creating, and how many views and comments are those posts receiving?

Finding the Right People

This metric is heavily focused on Sales Navigator, making it tricky for free users to get a good score. LinkedIn wants you to use its tools to find the right people, reach out to them successfully, and create systems and automation to make the process smoother.

Engaging With Insights

Are you sharing popular content? If not, then you probably won’t score too highly in this metric. The more content you share and the more views, likes, and comments it receives, the better you’ll score.

Building Relationships

The final metric is all about network management. It’s a measure of how often and successfully you reach out to people.

How to Use LinkedIn’s Social Selling Index

Exactly how useful is LinkedIn’s Social Selling Index beyond being a vanity metric? It’s a fair question.

Some people, like Andrew O’Hearn, don’t see much value in the tool. He believes SSI is a way for LinkedIn to push Sales Navigator.

Do we really want to reinforce the ‘keyboard commando’ proclivities of some LinkedIn users who don’t often test their online assumptions in the real (face-to-face) business-related networking communities?

I think there are quite a few things you can do with SSI, however. Here are a few reasons to pay attention to LinkedIn’s Social Selling Index.

Measure Your Personal Brand

Checking your SSI is a great way to understand the strength of your personal brand and take actionable steps to improve it. After all, what gets measured gets managed, and you may not realize just how far you are behind your peers until it’s pointed out.

Because every improvement results in an increased score, SSI also provides a way to gamify the process, making you much more likely to actually do it.

Identify Areas for Improvement

You may think you’re slaying LinkedIn, but perhaps you’re not making enough new connections or posting enough valuable content. Either way, your SSI can easily highlight areas to improve.

Use It as a Benchmark

Perhaps the best use for your SSI is as a benchmarking tool. The tool automatically compares your profile to other people in your industry and your network, so a quick glance will show you where you currently stand.

You can also use your personal score to track improvements and growth as a social seller. This is exactly what Microsoft did with their sales reps. When they first onboarded users onto Sales Navigator, their median SSI was 48. After a few months of training and activity, their average SSI score increased to 56.

The impact of that increase was telling. Those with higher SSIs saw a 37-percent increase in opportunities, and every 10-point increase saw 4.3 more opportunities.

How to Improve Your SSI

It doesn’t matter what your SSI score is, there’s bound to be something you can do to improve it. Below I’ve listed five of the best strategies to improve your SSI and increase your effectiveness on the platform.

Fill out Your LinkedIn Profile Completely

The first and easiest thing you should do to improve your Social Selling Index is to completely fill out your profile. There’s a lot to do here, so here are some jumping off points to get you started.

- add a profile picture

- fill out your job title

- add a helpful, keyword-rich summary

- add your education and skills

- request recommendations from colleagues and clients

- add examples of your work in the featured section

You’ll be amazed at how much your SSI score can jump just by filling out your profile properly. Be careful, though. You don’t want to include so much information that your profile becomes unreadable.

Whenever you are adding information to your profile, always ask yourself whether people would find it useful.

Connect With the Right People on LinkedIn

You need a big network to succeed on LinkedIn. Remember, while quantity is important, so is its quality. That means you shouldn’t send invites to random people. Instead, you take the time to find the right people.

That means people who:

- you know personally

- are thought leaders in your sector

- work in your sector generally

- are people you buy from or sell to

The more cohesion in your network, the stronger it will be.

Use LinkedIn’s advanced search functionality to find the right people to connect with. Some of the features are only available for premium accounts, but even free users can leverage filters to find relevant people to connect with and improve their SSI.

You can also find related connections under “My Network” > “People you may know.”

Post Quality Content Targeted for LinkedIn Users

One of the easiest ways to improve your SSI categories is to post quality content. This will improve your personal brand, build relationships, and engage with other users.

Quality content can come in the form of LinkedIn posts, or you can try more advanced tactics.

Engage With Your Network and Beyond

Having a big network is important, but so is engaging with them. You need to be in regular contact with a good chunk of your network to show the algorithm you’re committed to building long-term relationships.

Don’t just spam a load of people with connection requests. Aim high and start to follow thought leaders in your industry. Engage with their content thoughtfully and try to strike up a conversation. Make sure you’re responding to everyone who comments on your posts, too.

Conversations are becoming more important than ever on the platform. LinkedIn reports a 43 percent year-over-year growth in conversations during Q3 of 2021. The more engaged you are, the higher your SSI score will be, and the more conversations you’ll end up having.

Use Sales Navigator

One of the reasons LinkedIn pushes the SSI is to encourage adoption of Sales Navigator. In fact, it’s impossible to get close to 100 without using the paid-for subscription. If you already are a Sales Navigator user, you’ll want to leverage as many of the tools’ functions as possible.

In particular, use the saved search feature to automate finding relevant people to connect with.

Social Selling Index FAQs

A good LinkedIn SSI score is 70+. Between 40 and 70 can be considered okay, while under 40 is poor.

Simply follow this link to visit the SSI page on LinkedIn.

A good SSI score can help boost your influence on the platform and make sure you are doing all the things you need to do to become a good social seller.

LinkedIn updates the Social Selling Index once a day.

LinkedIn uses four categories to calculate Social Selling Index: establishing a personal brand, finding the right people, engaging with insights, and building relationships. Each category is worth 25 points.

Social Selling Index Conclusion

LinkedIn’s Social Selling Index shows how effectively you’re using the platform. Given the importance of social selling in many B2B industries, that kind of insight is crucial. It’s also a way to see how you compare to your industry rivals and find areas for improvement.

With a little more time spent crafting your profile, growing your network, and engaging with peers on the platform, you can send your SSI soaring. That can mean substantially more leads and sales. So, get out there and start making LinkedIn work harder for you.

What’s your best SSI metric?