How Can 401k Financing Help a Business?

The world of business involves many risk-taking attempts. Business owners experience numerous obstacles from the moment they plan and start their business to maintain it and make sure it grows. From developing your business ideas to looking for qualified people to hop on board your venture, starting a business takes a lot of courage, patience, and knowledge. Financing via a 401k could be an avenue you haven’t thought of.

All businesses face different kinds of hurdles and challenges in the process of starting and growing their venture. The Small Business and Trade Alliance conducted the Small Business Trends survey on over 2,400 current and aspiring business owners in the United States. This survey included questions about their current biggest obstacles as business owners.

It’s Even More Important Now

Although the pandemic, without a doubt, can be considered one of the greatest challenges of 2020, the survey also contained questions about non-pandemic-related challenges. Among these top challenges include recruiting and retaining employees, marketing and advertising, time management, administrative work, and managing and providing benefits. The number one challenge, at 23%, however, is the lack of capital or cash flow.

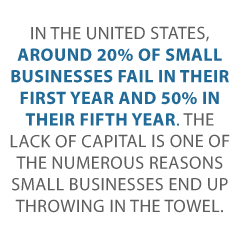

In the United States, around 20% of small businesses fail in their first year and 50% in their fifth year. The lack of capital is one of the numerous reasons small businesses end up throwing in the towel.

Business owners are usually thoroughly aware of and keep a close watch on how much money is needed to keep the company or the business going. It includes expenses such as daily spending, payroll funding, paying fixed and varied overhead expenses like rent and utilities, and payments for external vendors or suppliers. They also make sure to explore various and alternative investment strategies as a way to increase their funds.

Keep on Top of Things

On the other hand, business owners who do not closely monitor expenses and revenue generated from sales of products or services are more likely to fail than succeed. In addition, it can lead to inadequate funding, which could ultimately put the business out of operation.

With this, it is critical for aspiring and current business owners to be in tune with the financial state of their business. Financial challenges and hurdles are inevitable and are part of the business process. However, business owners must explore various ways to fund their venture. There are several ways to get financing for your business. Getting business loans is one of the most common methods to do this.

Another way to solve your business’ lack of capital is to consider 401(k) financing. What is 401(k) financing? First, this article will discuss what 401(k) financing is and how it works. Next, it will tell you more about how 401(k) financing can solve your business’ lack of capital and, lastly, the benefits and possible risks that come with it.

Demolish your funding problems with 27 killer ways to get cash for your business.

What is 401k Business Financing?

401(k) business financing is one way your small business can solve its lack of capital. Also referred to as Rollovers for Business Start-Ups (ROBS), 401(k) business financing is a small business financing method. This method allows you to withdraw money from your retirement account to start or fund your business without having to pay a tax penalty or an early withdrawal fee.

401(k) business financing is one way your small business can solve its lack of capital. Also referred to as Rollovers for Business Start-Ups (ROBS), 401(k) business financing is a small business financing method. This method allows you to withdraw money from your retirement account to start or fund your business without having to pay a tax penalty or an early withdrawal fee.

An important thing to note is that Rollovers for Business Start-Ups merely gives you access to the funds you have in your existing retirement account. This method is ideal for those aspiring and current business owners who lack capital but do not qualify for a loan, do not want to go into debt or do not have any cash-on-hand available to fund their business. This method does not consider your credit score, on-hand collateral, or past experiences to qualify for it. The main components of this method would be the retirement account you have. Such as a 401(k) or an Individual Retirement Account (IRA), and the amount of money you have in it.

Demolish your funding problems with 27 killer ways to get cash for your business.

How does 401k Business Financing Work and How Does It Solve a Business’ Lack of Capital?

In 401(k) business financing, your retirement plan serves as your investor. To access these funds without having to pay a tax penalty for early withdrawal fees, it is critical to, first and foremost, establish a ROBS (Rollover Business Start-Ups). This structure consists of several components which must adhere to certain requirements for compliance with the Internal Revenue Service, or IRS—the federal agency responsible for overseeing, administering, and collecting taxes.

The first step would be to establish a C corporation, also known as a regular corporation. It is the only entity type allowed to sell shares to a retirement account and within the ROBS structure. In this way, it will help release your business’s funds.

Your New Plan

Next, put together a retirement plan for your new business. Although there are other options such as profit sharing and defined benefits, most business owners opt for the standard 401k. You will need a custodian to manage the investments in the plan and have the responsibility to keep records, administer the plan, and modify its investments the way you deem fit.

After this, roll your existing retirement funds from your plan into the new retirement plan under the C corporation. Since the funds have already been rolled over to the company retirement plan, the plan then buys stock in the C corporation through a QES transaction or a Qualified Employer Securities transaction. Thus, it is the step wherein the money is rolled over and made available for the business to use.

Why Do It This Way?

The first step is essential since you would not be able to do a QES transaction without it. Finally, once the QES transaction is finished, your retirement funds can now be accessed by the corporation. You can use them to solve your business’s lack of capital. Or you can pay off the pending expenses you may have.

The Benefits of 401k Business Financing

401(k) financing, also known as ROBS or Rollover Business Start-Ups, offers numerous benefits for aspiring and current business owners alike. This financing technique may come off as complex. Still, it is one of the ways to solve your business’ lack of capital. Here are some of the benefits of 401(k) business financing:

Flexibility and control over investments

In 401(k) financing, you have control over your retirement funds. It allows you to support your business and make it grow financially. Through this, your business has the potential to earn a significant return with tax-deferred growth.

Terminate or reduce debt

Most loans require monthly payments, which may eventually turn into debt. Unlike most loans, 401(k) financing gives you the ability to use the funds you already have. In addition, since 401(k) financing does not require you to pay interest, it helps reduce your day-to-day costs and other operating expenses you may have.

Collateral free

The only requirement of 401(k) financing is a qualified retirement account. You will not need to put up a down payment or sign over a property to receive the funds. This is unlike most financing methods that will require you to do so.

No credit check

Since 401(k) financing is not considered a loan, a credit check is not included in its requirements. With this, no evaluation will occur, and you can proceed with 401(k) business financing even if you have a low credit score, as long as you have a retirement plan.

Deposit via ROBS

The funds in your 401(k) plan may also be used as a down payment for your small business loan (SBA). Reducing debt is considered to be one of the top benefits of 401(k) business financing.

Demolish your funding problems with 27 killer ways to get cash for your business.

Final Thoughts on Using Your 401k for Business Funding

Aspiring and current business owners are no strangers to the challenges and obstacles of starting up and growing a business. Although these hurdles may be intimidating and sometimes overwhelming, you can overcome them.

One of the top challenges small business owners face, aside from the impact and effects of the pandemic, is the lack of capital. However, this is a matter that you can solve through 401(k) business financing. When done correctly, it helps business owners fund their venture. And it does so without worrying about tax penalties, early withdrawal fees, and falling into debt.

Navigating 401k business financing and how it can help solve your business’ lack of capital can seem intimidating if it is new and unfamiliar to you. However, finding the right company that offers a 401(k) financing program can help ease your worries.

We Can Help!

Let Credit Suite help you with that! Credit Suite offers a wide range of programs, from their 401(k) financing program to other business loans and business credit programs. So whether it be a 401(k) financing plan or other business loan and credit programs, Credit Suite has got you and your business covered!

Jill Santos is an early childhood educator and a freelance content writer for The Stock Dork. She is passionate about serving others through research, education, and the arts.

The post How to Solve Your Business’s Lack of Capital with 401k Business Financing appeared first on Credit Suite.