How to Make Money on Instagram With & Without Followers

There’s no hiding it, Instagram is one of my favorite social media channels. Not only is it a great way to share your life with friends and family and promote your business, but it’s also a great way to make a lot of money.

Best of all, you don’t need a big following and there are several different ways to earn an income. In this article, I’m going to show you how to make money on Instagram using seven of my favorite strategies:

- Get paid for sponsored posts.

- Promote affiliate links.

- Start an Instagram shop.

- Make money from your content.

- Become an Instagram coach.

- Advertise your brand.

- Get paid for teaching your audience.

Ready? Let’s get to it.

Why Should You Try to Make Money on Instagram?

Instagram remains one of the most popular social media apps.

In fact, it was one of the top five downloaded apps in the App Store and Google Play in 2020. As of January 2021, it was second only to TikTok in download count. The platform’s active user numbers are equally impressive. At the end of 2020, Instagram surpassed one billion global users.

If the sustained growth of Instagram wasn’t enough to convince you that it’s a great platform to make money on, maybe the comments of Mark Zuckerberg may help. At the company’s first Creator Week in June 2021, he said of Instagram: “Our goal is to be the best platform for creators like you to make a living,”

That’s exactly what’s transpired.

Instagram accounts with over one million followers can make in excess of $1000 per post, according to influence.co.

That’s not all.

You don’t need to be a mega-celebrity to make money on Instagram. Plenty of micro-influencers with followers in the thousands make a decent income through our 7 strategies.

What You Need to Make Money on Instagram

There are three things you need to make money on Instagram: reach, influence, and engaged followers.

Reach and Influence

The only reason businesses pay money to Instagram users is the exposure to the audiences they receive in return. They hope to make money from those followers. For it to be worth their time, these brands are only interested in influencers with large audiences. The bigger the audience, the more money they can make.

If you only have a few hundred Instagram followers to begin with then your potential audience size is low. With such a small sample space, your content won’t get seen by lots of people, let alone drive sales to your or a brand’s products.

To get started, you’ll definitely need at least a few thousand followers to be able to make money.

Engaged Followers

Sure, more followers will boost your ego. Mathematically, it increases your probability to appear in more Instagram feeds. However, a high follower count doesn’t necessarily mean high engagement, and shadow-banning on Instagram can leave you with little to no reach.

If everyone is cold to your posts, they probably won’t be inclined to buy anything you promote.

So on your Instagram account, if you rarely get people commenting, liking, sharing, and following you, then it doesn’t matter how big your following is, you probably won’t make much money.

On the other hand, even if you only have 1,000 followers and they are actively engaging with your posts, the potential to make money is there. Brands are willing to invest in you because of the profitable actions you’ll drive through your account.

7 Ways to Make Money on Instagram

Okay, so now you know why I think Instagram is a great platform to make money on and what you need to make serious bank. Now let’s look at my favorite ways of doing just that.

1. Become an Influencer and Get Paid to Advertise Products

I’ll preface this first strategy by stating that this is the easily most common tactic to earn money on Instagram.

Again, it isn’t viable for people with a few hundred followers. You need a minimum following of about 5,000 followers and a high engagement rate.

People with this reach can earn up to six figures per post.

All you have to do is post pictures around your interests that show your personality, helping you build up a glamorous personal brand.

Sure, you can follow a planned marketing strategy, but Instagram followers love when you are being true to your authentic self. As you share pictures and build your influence organically, relevant brands are likely to approach you rather than the other way round.

Once you satisfy these criteria, here’s a simplistic version of how making money works:

- you create a sponsored Instagram post (it could be a photo or video)

- you include a branded hashtag, mention, or link to promote a brand

- you share it with your audience

- you get paid

There is one warning going into this though: don’t pursue sponsored posts simply to make money without believing in the brand you’re promoting. Taking too many of such posts will also burn your audience’s interest and lead to loss of trust in your brand. For example, if you’ve built a following based on visiting fast food restaurants and writing greasy food reviews—suddenly partnering with a weight-loss brand could damage your reputation.

Simple enough to remember, right?

Let’s look at a few people who do this well in real life.

Adam Gonon is a fashion and lifestyle influencer from New York. With a touch over 50,000 followers, he certainly doesn’t have the biggest audience in the world, but that doesn’t stop him from creating sponsored content every few days.

You don’t have to promote fashion or other lifestyle products to get paid for sponsored posts. Amanda Holtzer is a health, diet, and nutrition influencer who works with brands like Costco and Juice Press to create sponsored content.

2. Promote Affiliate Offers

Promoting affiliate offers is not dissimilar to getting paid for sponsored posts. The difference is that you only get paid if people buy the product or service you’re promoting rather than receive payment for your post.

This can be both positive and negative, depending on your audience. While sponsored posts have guaranteed income, you could make a lot more by promoting the right affiliate offer. On the other hand, you could also make a lot less.

Being an affiliate on Instagram is a lot harder than running affiliate ads on your website. Not only do you require a launch audience, but Instagram doesn’t allow clickable links anywhere except your bio. The only way to promote an offer and make sure you receive the affiliate income you’re due is by using promo codes. These are trackable and can be added to your post or story easily. Of course, you’ll still need your followers to visit the affiliate website on their own.

3. Start an Instagram Shop

With an Instagram Shop, you can integrate your e-commerce store with your Instagram profile. This is the only way you can promote your products directly to Instagram followers through your posts, Stories, the Explore tab, and the Shop tab on your profile.

There used to be a lot of friction for e-commerce store owners who wanted to sell through Instagram, but not anymore. Instagram Shopping completely removes friction, letting customers easily check out products in the app and then head to your store at the click of a button.

Let’s say you’re a clothing store and you want to promote an outfit. Simply upload a picture of your model wearing your outfit, and Instagram will let you tag up to five products per post (you can tag up to 20 products per carousel.) You can also promote products in stories and videos, too.

I would like to show you one specific Instagram page that’s completely killing it.

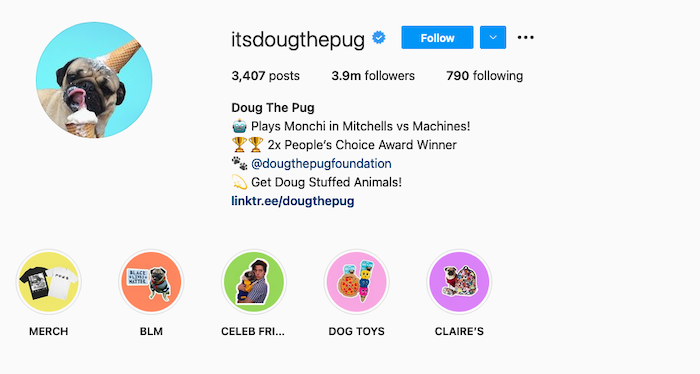

It’s called Doug the Pug. As the name implies, it’s all about the life of one of the Internet’s coolest and cuddliest pugs, Doug.

This page chronicles Doug’s life and takes followers along on his adventures. As of August 2021, Doug the Pug had 3.9 million followers. Doug has his own book entitled Doug the Pug: King of Pop Culture (which is pretty impressive considering that he can’t actually write.) He even does appearances all around the country.

In other words, Doug’s owner has created a massive brand.

Guess what? The popularity they’ve generated is centered around their Instagram page. With 3.9 million followers, you can bet that they’re driving plenty of high-quality traffic to the store and consequently getting paid handsomely for it.

This is a brilliant example of how Instagram can be used to build a brand from scratch. Doug the Pug is a template you could use to launch your own brand and sell from your online store.

Just use your creativity and come up with an interesting angle that will get people excited and eager to invest in your brand.

There’s no doubt that there is a significant time investment involved, but it can pay dividends if you’re able to establish a large and loyal audience. The best part is all of the different ways you can monetize your brand later on.

4. Make Money From Your Content

Just like YouTube, you can monetize your content directly on Instagram. Try one of the three ways below.

IGTV Ads

IGTV ads are a great way to monetize your Instagram content. In March 2021, Instagram made ads available to creators in the U.S., the UK, and Australia. They appear when you watch IGTV from a creator’s feed.

Instagram’s COO, Justin Osofsky, says creators receive 55 percent of the advertising revenue generated through IGTV. That’s the same rate as YouTube making it a great alternative.

Live Badges

If you broadcast live on Instagram, Badges are a fantastic way for your followers to show their support. Think of them as tips your audience can give you when you broadcast. Your viewers can buy a badge during a broadcast, selecting from three levels of hearts that each have a different price point (one for $0.99, two for $1.99, or 3 for $4.99.)

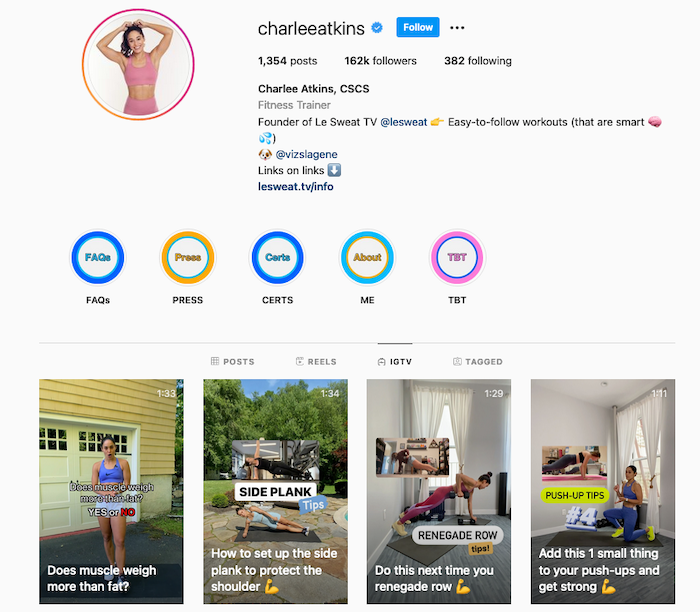

Badges have gone down well with creators. Fitness influencer @charleeatkins said: “Badges in Instagram couldn’t have come at a better time for fitness creators like me. It’s an easy way to channel the love we already see in our Live feeds so we can continue building and creating for our fans.”

Patreon and Only Fans

You don’t have to rely on Instagram’s in-platform features to pay your bills. Third-party sites like Patreon and Only Fans are another great way to make money from your content. In both cases, you’ll want to give away a ton of free value on Instagram before encouraging your audience to follow you on one of the two platforms for exclusive content.

5. Become an Instagram Coach or Consultant

If you are killing it on Instagram and have a massive, engaged following, why not make money by teaching others to do the same thing?

People want to know how to build a following on Instagram and monetize it—it’s why I’m writing this article, after all. If you know how to do it, and have done so yourself, you can make a lot of money.

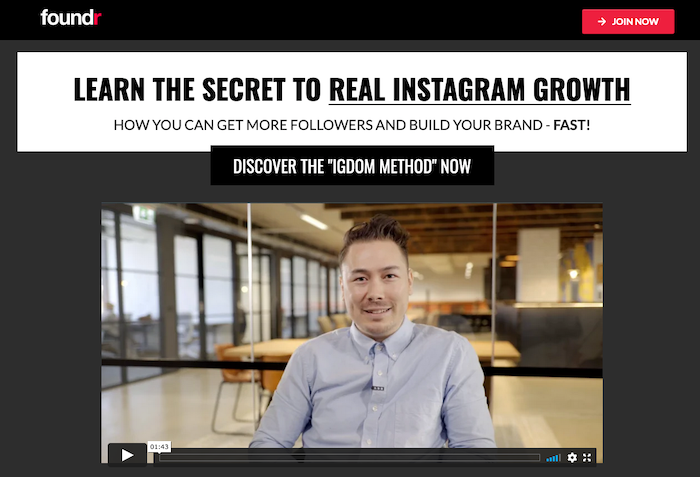

Take a look at Foundr as an example.

Right now, they have built a massive audience to the tune of 3.3 million on Instagram. And since it’s their strong suit, Foundr founder Nathan now sells his Instagram marketing expertise in an online course called Instagram Domination at a whopping price of $1,997.

Given that businesses that are passionate about Instagram marketing follow them, Foundr has a great pool of potential qualified buyers in their audience with them on Instagram. Many of these prospects are likely to buy their course.

The best news? Anyone can do this if they have a big enough following.

Travel bloggers, food bloggers, marketing consultants—if people are active in your niche and are trying to grow a following doing what you do, launching a course could be highly profitable.

6. Indirectly Make Money by Advertising Your Brand

You don’t have to have a business that’s directly tied to Instagram in order to use the platform to generate sales. Thousands of canny entrepreneurs have leveraged their Instagram following to make money through a separate business. It really doesn’t matter what kind of business you operate; Instagram is a great way to get the word out and generate traffic and sales.

Instagram is particularly powerful if you have a physical product that you can show people using. Service-based businesses like travel agents also work incredibly well.

Hashtags will be particularly important here if you want to increase the reach of your Instagram account. The more followers you have, the more people will see your posts and consider using your business in the future.

My article on boosting Instagram followers will be a big help in this regard.

7. Teach Your Audience and Get Paid

Promoting other people’s products via affiliate links or selling physical products through an online store are both great options to make money on Instagram. What if I revealed there was a way to earn more money than affiliate marketing without having to handle physical inventory?

There is, and it’s called selling info products.

Info products have become a bit of a dirty term, but you don’t need to sell dating advice or weird diets to make money on Instagram this way. If your Instagram account teaches your audience how to do something—whether that’s learning a foreign language, practicing yoga, or woodworking—you can create a premium info product that you can sell for upwards of $100.

There are hundreds of Instagrammers doing this right now.

One doing particularly well is Minimalist Baker, a food blogger who creates recipes with ten ingredients or less and sells a course on Food photography. As you can see, you don’t even need to sell something directly related to your niche. Minimalist Baker isn’t selling a cooking series or a recipe book—she’s teaching Instagrammers how to take pictures as well as she does—and raking in the cash.

Making Money on Instagram Frequently Asked Questions

How easy is it to make money on Instagram?

It’s never easy to make money online, but making money on Instagram is easier than a lot of other methods.

2. What’s the best way to make money on Instagram?

The best way to make money on Instagram will depend on you and your following. Getting paid for sponsored posts, starting an Instagram shop, or getting paid to create content through IGTV ads are all great options.

How much do Instagram influencers get paid?

Instagram influencers can get paid north of six figures for every sponsored post. The larger and more engaged your following, the higher the fee you can command.

4. How many followers do you need to make money on Instagram?

You need at least a couple of thousand followers to make money on Instagram. The more engaged your followers are, the less you will need, however.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “How easy is it to make money on Instagram?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

It’s never easy to make money online, but making money on Instagram is easier than a lot of other methods.

”

}

}

, {

“@type”: “Question”,

“name”: “2. What’s the best way to make money on Instagram?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

The best way to make money on Instagram will depend on you and your following. Getting paid for sponsored posts, starting an Instagram shop, or getting paid to create content through IGTV ads are all great options.

”

}

}

, {

“@type”: “Question”,

“name”: “How much do Instagram influencers get paid?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Instagram influencers can get paid north of six figures for every sponsored post. The larger and more engaged your following, the higher the fee you can command.

”

}

}

, {

“@type”: “Question”,

“name”: “4. How many followers do you need to make money on Instagram?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

You need at least a couple of thousand followers to make money on Instagram. The more engaged your followers are, the less you will need, however.

”

}

}

]

}

How to Make Money on Instagram Conclusion

Instagram has been one of the most popular social media platforms for some time, and it’s continuing to launch new and engaging features. In other words, it’s well worth investing your time to make money on the platform.

If you can build an audience and establish trust, there are loads of ways to make money on Instagram. With so many potential business opportunities, anyone can earn money from Instagram.

Yes, even you.

Which tactic are you going to use to make money on Instagram?