Best SSL Certificate Provider

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

You want people to trust your site, and that requires a valid secure sockets layer (SSL) certificate.

SSL certificates are issued by a certificate authority (CA) and they build trust in two important ways:

- The CA authenticates the identity of the organization that wants the certificate. This way, people know that they are in fact sending their information to PayPal, for example, and not someone who has set up a fake PayPal site.

- The SSL certificate encrypts the data travelling between your website and visitors. This way, potential attackers can’t steal the information people share on your site, such as their username, password, or credit card number.

Today, all of the popular browsers like Google Chrome will warn users anytime they attempt to visit a site without an SSL certificate. It’ll say something like “This site is not secure,” or “Any information you share may be vulnerable to attackers.”

Would-be visitors are going to head to a different site where they feel comfortable entering their credit number. I know I would.

There are a lot of different CAs to choose from and they sell a range of SSL certificates designed to help companies establish their online identity and protect their customer’s privacy.

For some people, going with a free SSL certificate is going to be fine. All that’s required is a quick demonstration that you control a particular domain. These are known as DV (domain validated) SSL certificates.

But they are not enough to protect a major website or online store.

For companies that need to establish a greater level of trust, OV (organization validated) or EV (extended validation) SSL certificates involve real-world background checks on the organization making the request.

The rigorous authentication process isn’t free, but it conveys a much higher level of trust. Paid SSL certificate providers also make the process of obtaining and renewing certificates much easier through an intuitive online platform.

Choosing the right provider can seem tricky at first, given that they are all selling the same essential service. There are important differences, though, and you want to figure them out before you decide.

In this post, I’ve reviewed the top SSL certificate providers. These are big names with a long history of protecting websites. The reviews are followed by a short guide that will help you make sense of your options and ask the right questions moving forward.

#1 – SSL.com Review — The Best for Budget-Friendly SSL Certificates

SSL.com is perfectly suited for small and growing businesses that need to secure their sites, but can’t afford to spend thousands of dollars a year.

They are a mid-range product which works for companies that have outgrown their ability to use free SSL certificates, but don’t have especially complex security needs that justify the premium pricing of DigiCert or GlobalSign.

The best part about the budget prices is that the level of encryption is the same as you get with much more expensive SSL certificates.

You might think that the downside would be lower-quality customer service, but nothing could be further from the truth.

SSL.com offers 24/7 chat, email, and phone support. In review after review, happy customers have thanked their SSL.com customer service agent for walking them through installing their first SSL certificate or helping them handle a complex issue.

I think SSL.com has struck a good balance between price and customer service. It’s not dirt cheap, by any means, but it’s certainly less expensive than some of the enterprise-focused SSL certificate providers.

Along with affordable pricing, SSL.com offers a range of certificates flexible enough to accommodate the needs of many different businesses:

- Basic SSL: starting at $36.75/year (domain validation)

- Premium SSL: starting at $74.25/year (comes with three subdomains)

- High Assurance SSL: starting at $48.40/year (organization validation)

- Enterprise EV SSL: starting at $239.50/year

- Wildcard SSL Certificate: starting at $224.25/year

- Multi-domain UCC/SAN: starting at $141.60/year

- Enterprise EV UCC/SAN SSL: $319.20/year

Like other SSL certificate providers, you have to sign a longer contract to get the lowest price. With SSL.com, however, the single-year pricing still comes in lower than competitors.

As you can see above, SSL.com has really low rates for wildcard and Subject Alternative Name (SAN) certificates. This can save a ton of money and streamline certificate management.

Wildcard certificates cover an unlimited number of subdomains. Instead of buying, installing, and renewing a separate certificate for neilpatel.com, info.neilpatel.com, and so on, I just need one Wildcard.

SAN Certificates protect multiple domains. The exact number depends on the SSL certificate provider. More domains covered with fewer certificates will make your life much easier.

Just for comparison, GlobalSign’s EV SSL certificate starts at $599 and it costs extra to add domains and subdomains from there.

With SSL.com, on the other hand, the Enterprise EV UCC/SAN SSL lets you secure up to 500 additional domains for a lot less money. And with GlobalSign, you are limited to 100 additional subdomains per SAN certificate.

Compared to Digicert, the difference is more pronounced as a multi-domain EV is nearly $3,000 per year.

If you think that SSL.com is coming in at the right price for you, give it a shot. The 30-day unconditional refund is not a marketing gimmick. If you are not happy, they will credit your account immediately. Get started now.

#2 – GlobalSign Review — The Best Managed SSL for Enterprise

GlobalSign is the SSL certificate provider of choice for large organizations with complex needs. They have some of the highest rates in the industry, but also some of the happiest customers because of the quality of their service.

If you just need a couple SSL certificates, I would go with something less expensive. On the other hand, if you need a lot of certificates, and managing so many of them is starting to cause problems, then GlobalSign is a wise choice.

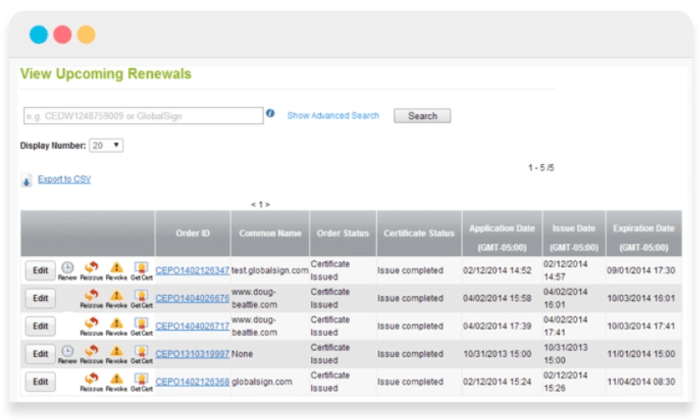

Its best-in-breed certificate monitoring and inventory tool, combined with heavy discounts for volume licensing, reduces the total cost of ownership for complete SSL security.

Decrease the frequency of the costly problems associated with certificate expiry, regardless of how many you have to manage. You can even set policy preferences and receive reminders when certificates aren’t compliant, regardless of who issued the certificate.

No more having to track down certificates manually. Everything is available with a quick scan.

Think about it. If your staff saves an extra couple hours each month due to GlobalSign’s intuitive platform and concierge support, then the service has already paid for itself.

I highly recommend GlobalSign for businesses that can’t play the normal waiting game to get new certificates. After GlobalSign authenticates your business, they can issue certificates virtually on-demand because they have pre-vetted all domains.

The initial authentication process is fairly quick (between three and four business days for EV). Some people have reported being able to get certificates quicker due to emergency situations simply by calling up GlobalSign.

GlobalSign offers the full range of traditional SSL certificates:

- DV SSL certificate: starting at $249/year

- OV SSL certificate: starting at $349/year

- EV SSL certificate: starting at $599/year

- DV Wildcard SSL certificate: starting at $849/year

- OV Wildcard SSL certificate: starting at $949/year

GlobalSign offers SAN SSL certificates for multiple domains at $199/year on top of the base certificate price. So, an OV SAN SSL from GlobalSign would run you $549/year. A single SAN certificate will cover up to 100 additional domains.

You can choose to add subdomains for an additional cost, as well, though a wildcard SSL certificate will be more cost effective if you need coverage for a lot.

The warranty for the GlobalSign EV tops out at $1.5 million. If your digital certificates don’t provide the protection promised, GlobalSign will foot the bill for damages.

This is half a million less than a comparable certificate from DigiCert. Ideally, you’ll never have to worry about the difference, but it’s something to be aware of.

Another nice aspect for enterprise customers is that GlobalSign supports document signing, code signing, digital signatures, and secure email. Being able to centralize all of these SSL security concerns in a single platform can make managing them much easier.

GlobalSign also offers intranet SSL for securing internal servers and applications. This means companies no longer have to run their own CA or use self-signed certificates.

For companies that provide cloud-based services, GlobalSign’s CloudSSL can help them meet the complex security requirements of these next-generation environments.

Not every company will realize the benefit from GlobalSign’s premium suite of managed SSL certificates and services. For simple websites, it’s overkill.

But for enterprises, especially companies with complex SSL security needs, going with GlobalSign is worth every penny.

Request a GlobalSign managed SSL demo today, and see the difference it makes.

#3 – DigiCert Review — The Best for Premium SSL Certificates

Digicert Group owns a handful of the most trusted CAs (GeoTrust, RapidSSL, Thawte, and Verisign) and has become one of the largest SSL certificate providers in the world.

It’s one of the more expensive options, for sure, but Digicert includes security features with its premium SSL certificates that can make a huge difference for the right businesses.

This includes automatic malware detection across all your sites, PCI (payment card industry) compliance scans, and blocklist checks, which ensure that your site isn’t under suspicion on any government or country-specific blocklist.

Importantly, most of these features only come with Digicert’s higher-tier plans. The provider breaks down its offerings into three tiers: Basic, Secure Site, and Secure Site Pro.

You can buy different types of certificates for each tier, but I don’t recommend going with Basic. It costs a lot more than comparable protection from other SSL certificate providers and you miss out on the extra security features that make Digicert’s premium pricing a good buy.

If you need the basic domain validation that comes with Digicert Basic, I’d go with SSL.com. On the other hand, if you are running an ecommerce website where users are entering financial information, Digicert offers a high level of protection that is very appealing.

At the Secure Site tier (which comes with organization validation), pricing breaks down as follows:

- Secure Site SSL: starting at $399/year

- Secure Site EV SSL: starting at $995/year

- Secure Site Multi-domain SSL: starting at $1,296/year

- Secure Site Multi-domain EV SSL: starting at $2,785/year

- Secure Site Wildcard SSL: starting at $1,999/year

All Secure Site certificates are backed by a $1.75 million Netsure Protection Warranty for your businesses, and a $2 million aggregate Relying Party Warranty for your customers.

This is one of the most comprehensive warranties out there, and this isn’t even the premium DigiCert plan.

You also get priority support, which means that Digicert agents will respond to your concerns faster than they would if you went with the Basic tier. Another good reason to avoid that.

Of course people still run into issues, but Digicert customers with priority support constantly praise the company for their responsiveness and expert advice.

The company really does walk their customers through the installation process for free. They expect you to have questions and they are ready to help.

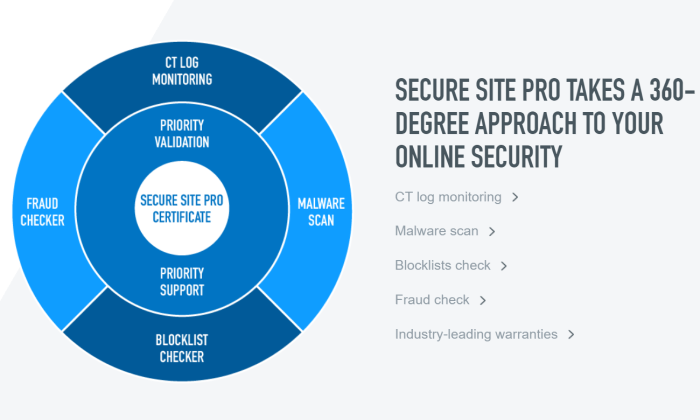

All of this and more comes with the SecureSitePro tier:

- Secure Site Pro SSL: starting at $995/year

- Secure Site Pro EV SSL: starting at $1,499/year

These plans are backed by a slightly better warranty, which covers your business up to $2 million. There’s also certificate transparency log monitoring that alerts businesses whenever an unauthorized certificate is assigned to one of their domains.

In addition to priority support Secure Site Pro also includes priority validation, which cuts down the time it takes to issue new certificates.

Not every company needs the extra security, but those that do will appreciate the totality of what Digicert offers with its Site Secure Pro certificates:

All Digicert certificates are managed via CertCentral, which is remarkably easy to use. CertCentral is designed to work at scale, so it doesn’t matter how many certificates you have—it’s going to be easy to manage.

Digicert backs all of their SSL certificates with a 30-day, money-back guarantee. No questions asked, no hassles.

What I Looked at to Find the Best SSL Certificate Provider

You want people to know, without a doubt, that your site is safe and trustworthy.

The exact range of SSL certificates and capabilities you need will depend on the type and number of websites your company operates.

Price is an important factor—especially when you look at long-term costs—but it can’t be the only thing you focus on. In a very real sense, you get what you pay for.

Some companies will be completely covered by the bargain SSL certificates. Others will be extremely grateful they went with a premium product that really delivers the security they need.

To find out which SSL certificate provider is going to work best for your specific situation, pay attention to the following X criteria as you evaluate your options.

Types of SSL Certificates

You want to get the right type of SSL certificates for your site. Understanding the basic differences between them will help you avoid buying more than you need, or not getting enough.

There are three types of SSL certificates you’ll encounter. They vary according to validation level:

- Domain Validated (DV): DV certificates show that the certificate authority has validated that you are the owner of a particular domain. These are typically free, but since you don’t have to demonstrate anything beyond control over a domain, they have the lowest level of trust.

- Organization Validated (OV): OV certificates show that the certificate authority has validated that your organization is real, has a known physical location, and controls the domain. These are not free and may take several days to acquire, as they require a real-world identity check. As such, OV certificates have a higher level of trust than DVs.

- Extended Validation (EV): EV certificates have the most extensive validation process. In addition to checking everything required for an OV, an EV also requires the examination of corporate documents.

Generally speaking, different types of SSL certificates from the same provider will have the same level of encryption. It’s the authentication process that adds the extra level of trust.

The encryption that comes with DV certificates is key. But when encryption is tied to the rigorous identity check of and OV or EV certificates, it becomes much harder for bad actors to carry out phishing or man-in-the-middle attacks.

In some industries, like finance and healthcare, you may have to get an EV SSL certificate. This is just a bullet to bite. This is also true if you have a high-profile website that could be a juicy target for attackers.

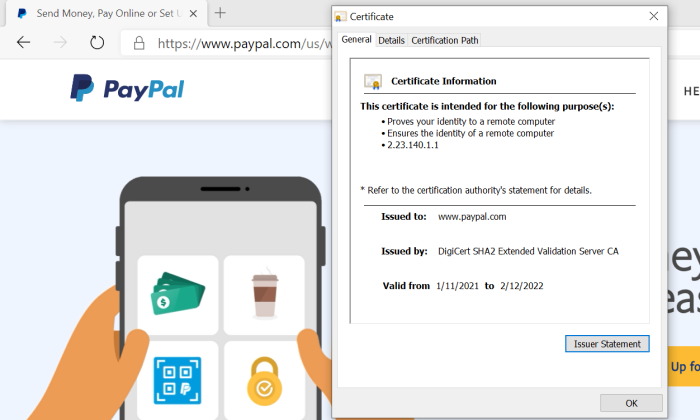

Some choose to get OV or EV certificates for branding purposes. This was more important when browsers like Chrome showed a green padlock next to the site’s URL.

Google started phasing that out and now everyone gets the same gray padlock, regardless of the type of validation. Even PayPal doesn’t have a green lock in Chrome any more:

There is, of course, more information about the organization in the certificate details if you get an OV or EV, but who is checking that?

If you can avoid paying for OV or EV, I recommend doing that. Just check to make sure that it’s going to work for your industry and with any payment gateway software you use.

In terms of picking between different vendors, be sure you are making an apples-to-apples comparison.

For example, Secure Site SSL from Digicert is an OV certification, though it doesn’t say so by name, whereas a Single Domain OV certificate from Sectigo makes it more obvious.

Speaking of single domain certificates, there are two important subtypes of SSL certificates:

- Wildcard SSL certificates cover an unlimited number of subdomains.

- Subject Alternative Name (SAN) SSL certificates cover a certain number of additional domains. These may also be called “multi-domain” or UCC (unified communications certificate).

The exact limitations will vary from provider to provider. With GlobalSign, for example, you purchase the type of SSL certificate you want (DV, OV, or EV) and then pay an extra $199/year for every additional domain, and $99/year for each subdomain.

Alternatively, GlobalSign offers a Wildcard SSL that will secure an unlimited number of subdomains for $849/year.

If you need to secure multiple domains or lots of subdomains on a tight budget, I recommend SSL.com. They have Wildcards starting as low as $225 and SAN certificates that can secure up to 500 domains for $142/year.

One final note: it’s possible to use multiple certificate providers. Many company’s use free SSL certificates from Let’s Encrypt for everything they can, and use paid SSL certificates to cover everything else.

Speed to Issuance

How fast can you get the SSL certificates you need?

While DV SSL certificates can be issued more or less instantly, the OV and EV SSL certificates can take several days and possibly longer.

If you need one of these higher validation certificates badly, then definitely go with an SSL certificate provider who promises in the 1-3 day range, like DigiCert. Of course, you’ll want to check the reviews to see if they walk the walk when it comes to shipping certificates quickly.

SSL.com has some of the fastest turn-around-times, judging from reviews, so they can be a good choice if you need an SSL certificate yesterday.

For companies that develop software, Digicert and GlobalSign solve the problem of issuing certificates at the speed of DevOps.

They set up an enterprise account which lets you pre-validate domains. With Digicert and Globalsign, this is simple to manage, so you pre-validate as many domains as you think you might need, and certificates can then be issued on-demand.

Warranty Policy

One of the major benefits to going with a paid SSL certificate over a free one is that you are covered by a warranty. It’s like an insurance policy. If an incorrectly issued SSL certificate causes problems, you won’t be on the hook for making it right.

These warranties vary depending on which type of certificate you choose. DV SSL certificates are backed by warranties of around $10,000, whereas EV SSL certificates may cover more than $1 million.

DigiCert has one of the most comprehensive warranties. For their EV SSL certificate, your business is covered by a $2 million warranty and your customers are backed by a separate $2 million warranty.

Hopefully you will never need this, but if you do, it’s important to know which companies are backing you with a suitable warranty.

Customer Service

Whether you are purchasing a single SSL certificate or thousands a week, the quality of customer service matters a lot.

There can be a lot of steps to installing and renewing SSL certificates. It’s a little different for every host and type of server. Sometimes the “easy installation” process is going to be more difficult based on your specific hardware.

Being able to pick up the phone and talk to an expert who can walk you through the process is worth a lot. SSL.com has a great reputation, with hundreds of reviewers describing reassuring customer service throughout their first installation of an SSL certificate. The agents stay on the line, from start to finish, ensuring that everything is done right.

Let’s Encrypt is a great option for free SSL certificates, but are you saving money if it takes your paid employees several hours a month to finagle with an unfamiliar system?

This is why companies like GlobalSign and Digicert can charge a lot more for SSL certificates than others. You are paying for the on-demand, concierge customer service so that you don’t have to hire experts yourself.

Conclusion

If you can’t use the best free SSL certificates to protect your sites, it’s important to find the right paid option.

Much is going to depend on finding an SSL certificate provider who offers the range of certificates you need at a price that makes sense. My recommendations are a good place to get started:

- SSL.com – Best for budget-friendly SSL certificates

- GlobalSign – Best managed SSL for enterprise

- DigiCert – Best for premium SSL certificates

For companies looking for affordable SSL certificates, make SSL.com your first and only stop. On top of their excellent prices, they have a great reputation for helping their customers. If you need a Wildcard or SAN certificate, going with SSL.com could save you thousands of dollars each year.

If you only need OV or EV certificates, and you want a serious warranty to back them up, Digicert is a great choice. There’s definitely a higher price tag, but the platform comes with many additional tools to maintain top-level SSL security across all of your sites.

GlobalSign is my recommendation for enterprise customers who want a provider that helps them manage their complex SSL needs. There is no more user-friendly certificate management system out there, and you can depend on their customer service agents to be there when you need them.

There are many, many more options out there for SSL certificates. These are my top three. They have stood the test of time, helped thousands of companies keep their sites secure, and continuously evolve their technology to stay on top.

To recap: