Comments URL: https://news.ycombinator.com/item?id=38295638

Points: 0

# Comments: 0

Article URL: https://jobs.lever.co/tesorio/10de016f-be07-4707-ac5c-7029f0398a17

Comments URL: https://news.ycombinator.com/item?id=36683852

Points: 1

# Comments: 0

Article URL: https://www.ycombinator.com/companies/y-combinator/jobs/5JHBtJd-product-engineer-startup-school

Comments URL: https://news.ycombinator.com/item?id=34379577

Points: 1

# Comments: 0

Everyone has ideas. Some of them may be worth running with, while others are probably not so good.

However, even if your project looks awesome on paper, there’s a big difference between that and creating a successful startup company.

Do you have what it takes to be an entrepreneur?

If your answer is yes, then you need a detailed guide on how to start a startup.

For those of you who haven’t launched a business before, it can sound like an intimidating task.

Don’t get me wrong – I’m not saying that getting your startup off the ground is an easy mission.

It takes hard work, dedication, money, some sleepless nights, and, yes, some failures before you succeed.

Nearly 20 percent of businesses fail in the first year, and just because you make it beyond 12 months doesn’t mean your startup is going to continue to thrive.

According to government stats, 30.6 percent of businesses fail after their second year, 49.7 percent fail after five years, and 65.6 percent fail after their tenth year.

Once you get your company off the ground, it doesn’t get any easier: you need to work just as hard to keep it going each year.

With that said, it’s useful to have a guide and a set of instructions to follow to learn how to launch a startup.

When I write about launching a startup, I’m talking from personal experience. I’ve created several startup companies like Crazy Egg, Hello Bar, and NP Digital.

I’m happy to share my knowledge and experience to help make things a little easier and less stressful for you as you go through this process.

Realistically, it takes hundreds of stages to launch your company, but I’ve narrowed down the top 7 steps into a blueprint for you to follow if you want to learn how to start a startup and learn how to create and develop your own business.

In the following article, I outline and discuss each step in detail so you have a better understanding of what I’m talking about.

Let’s begin with the basics.

Have you heard the saying ‘if you fail to plan, you plan to fail?’ That was the thinking of Founding Father Benjamin Franklin.

Well, research appears to back that up. Study after study shows that businesses with a plan are more likely to succeed. In addition, you can find many articles spelling out the importance of a business plan.

However, the Small Business Development Center at Duquesne University explains it most succinctly:

“A business plan is a very important and strategic tool for entrepreneurs. A good business plan not only helps entrepreneurs focus on the specific steps necessary for them to make business ideas succeed, but it also helps them to achieve short-term and long-term objectives.”

It’s pretty straightforward, really. Having an idea is one thing, but having a legitimate business plan is another story.

A proper business plan gives you a significant advantage, but what should you include in a business plan? It helps if you think of it as a written description of your company’s future. Basically, you outline what you want to do and how you plan to do it.

Typically, these plans outline the first three to five years of your business strategy and detail your business’s purpose and aims. Ideally, your document should outline your business goals, strategies, and your plans for achieving them.

Here are the key steps to writing a successful business plan:

If you need some help with your plan, the Small Business Administration has an easy-to-follow guide, along with some templates.

Without adequate funding, your business won’t launch or stay afloat long-term. According to Statista, in 2021, there were nearly 840,000 businesses that had been in operation for less than a year. Many of these startups won’t survive because they underestimate the cost of doing business.

Perhaps you’re wondering what level of financing you need? When it comes to raising cash, there’s no magic number that applies to all businesses. The startup costs vary from industry to industry, so your company may require more or less funding depending on the situation.

Costs also vary depending on whether you’re a brick-and-mortar store, e-commerce enterprise, or service business. If you’re unsure how much you might need, try the SBA’S startup cost templates to get a better idea.

Once you’ve got a clearer picture of the costs, where do you get the funding? These days, most startups get their funding from:

Let’s circle back to our business plan for a minute.

All business plans contain a financial plan. This usually includes a:

You use these financial statements to determine how much funding you need to launch successfully. Additionally, you may discover that the number is significantly higher than you originally anticipated.

For example, I’m sure you’ve heard someone say, “That would make a great app,” or “I should make an app for this.”

Do you know how much it costs to make an app? Depending on the complexity, you’re looking at anything between $40,000 – $300,000, and that’s just to make it.

It doesn’t include the cost of running it or customer acquisition costs.

This is the point I’m making: to secure the appropriate funding, you need to find out how much money you need.

To find this number, you must research and predict realistic financials in your business plan.

Let’s say you discover that your startup needs $100,000 to get off the ground.

What if you don’t have $100,000?

You’ve got some options, like bank loans and commercial lenders, and that’s the way many small businesses go. With this said, banks are less likely to give large amounts of money to new companies with no income or assets to default on, which may make it hard for your typical startup to get the funding they need.

Don’t worry, your dream isn’t dead yet. You can find investors. They could be:

However, whichever method you use, proceed carefully because you don’t want to start giving away significant equity in your company before you launch.

Then, if you get lucky and find a potential investor, you need to know how to pitch your idea quickly and effectively. Here are some tips to help you do that:

One more thing: It’s imperative that your business plan has a proper executive summary to entice busy investors.

Once you secure the appropriate funding, you can proceed to the next step of how to start a startup business: finding the right people.

No one makes it on their own. William Proctor might not have been a high-profile, successful businessman if he hadn’t met James Gamble.

Where would we go for advice if Larry Page hadn’t met Sergey Brin? Not Google, that’s for sure.

Then what if Ben Cohen never met Jerry Greenfield? We would’ve been denied one of the world’s most famous ice cream brands.

Even if you’ve already got a co-founder in place, you need some core staff.

Where do you start? According to Business News Daily, there are eight people your startup needs:

However, your business structure depends on the industry, so look at the above as definitive.

When you’re just starting up, hiring an entire team often isn’t realistic, and you find yourself wearing several business hats. That’s OK, to an extent. Just remember to play to your strengths and outsource if you can’t afford to recruit.

That said, there are some experts you should consider essential, including a:

Unless you’re an expert in law, finances, and accounting, these three people can help save your business some money in the long run.

They can explain the legal requirements and tax obligations based on how you structure your business. For example, it could be a:

While your lawyer, accountant, and financial advisors are not necessarily employees on your payroll, they are still important people to surround yourself with.

Finally, for this section, don’t forget the fundamentals for starting any company:

Now that you’ve got staff, you need to start work on a website and find a place to base your business.

Now you’re ready for the next stage of your how-to start a startup plan: finding a physical location and setting up a website.

Whether it’s offices, retail space, or a manufacturing location, you need to buy or lease a property to operate your business.

Unless you’re working from a home office, your two main options are leasing or ownership. Leasing usually works as out more expensive long term; however, don’t just base your decision on costs. Leasing and ownership both have their pros and cons. Look at the whole picture before making a decision.

I appreciate that it may not be realistic for all entrepreneurs to tie up the majority of their capital in real estate.

Strategize for this in your business plan and try to secure enough funding so that you can afford to buy property. It’s worth the investment and can save you money in the long run.

Let’s move on to setting up a website.

Today, your company can’t survive without an online presence. Don’t wait until the day your business officially launches to get your website off the ground, either, and remember, it’s never too early to start promoting your business.

If customers are searching online for a service in your industry, you want them to know that you exist, even if you’re not quite open for business yet.

The beauty of an online presence is you can even start generating some income through your website before you find premises. If it’s applicable, start taking some pre-orders and scheduling appointments.

For those of you who aren’t convinced about the pre-orders business model, many startups are succeeding with it.

Here are some tips about how to launch and promote a successful website:

Finally, make sure that your website is fast.

I can’t stress this point enough.

I’ve got a video tutorial that explains how to speed up your website.

All of these items combined may sound tough, but it’s really not that difficult. Just focus on one task at a time, and you’ll get there.

Once your website is up and running, you need to expand your digital presence. To do this, use social media platforms like:

Your prospective customers are using these platforms, so you need to be on them, too. However, when choosing a platform, ensure you go where your core audience is. For instance, if you’re targeting a younger market, TikTok may be ideal.

If you’re not a marketing expert, you need to become one.

You might have the best product or service in the world, but if nobody knows about it, then your startup can’t succeed.

To start spreading the word, you must learn how to use digital marketing techniques like:

However, if you’re starting a small business in a local community, some of the traditional methods can still work well. Think:

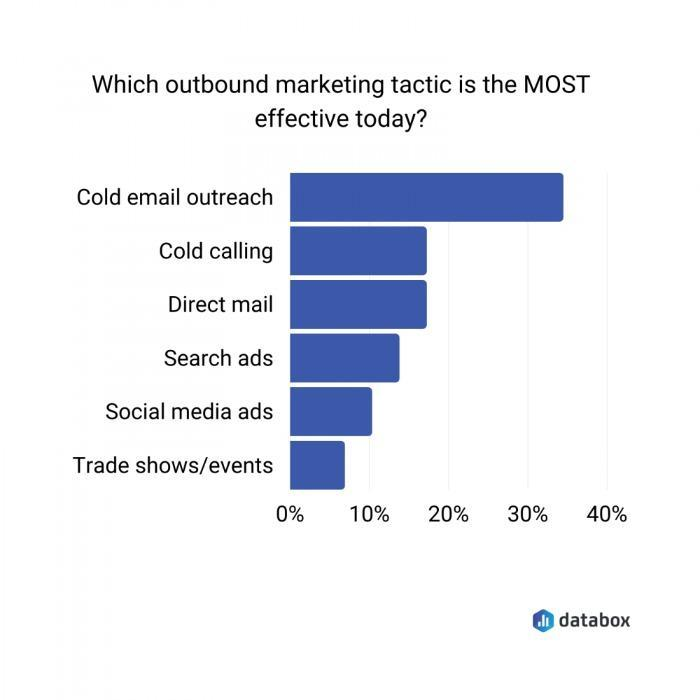

While some would argue that outbound marketing efforts are not as effective these days, research shows that methods like cold emailing and calling still work well.

For those of you who aren’t efficient marketers, there is no shame in hiring a marketing director or even a marketing team, depending on the size of your company.

Your marketing efforts will be one of the most important, if not the most important, components of launching your startup business. To improve your chances of success:

Take these numbers into consideration before you spend your entire budget on something like banner ads.

The bottom line is this: Marketing needs to be a top priority for your startup company.

If you’re following this plan in order, the good news is that you’re already on the right track to building a customer base.

Starting a website, growing your digital presence, and becoming an effective marketer are all steps in the right direction. However, now it’s time to put these efforts to the test. That means:

There are three keys to customer retention:

It’s no secret. The customer needs to be your main priority. They are the lifelines of your business, and they need to be treated accordingly.

Once you establish a steady customer base, you can use it to your advantage.

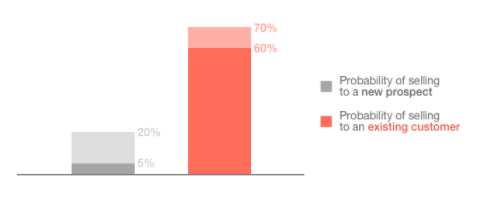

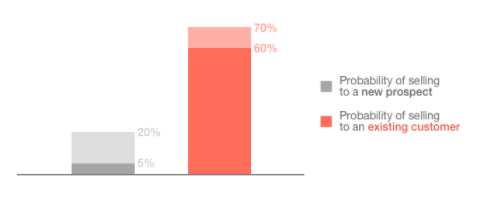

You’ll get more money from your existing customers than from new ones.

It’s a more effective method than cross-selling.

Less than 0.5% of customers respond to cross-selling.

Over 4% of your customers will buy an upsell.

These strategies both double back to having effective marketing campaigns.

Overall, establishing, building, and maintaining a customer base will help you get your startup company off the ground.

Expect the unexpected.

Launching your startup company won’t be easy, and you need to plan for some hurdles along the way.

Don’t let these speed bumps become roadblocks.

You can’t get discouraged when something goes wrong.

Preserve and push through it.

The difficulties that you face while launching your startup company help prepare you for the tough road ahead.

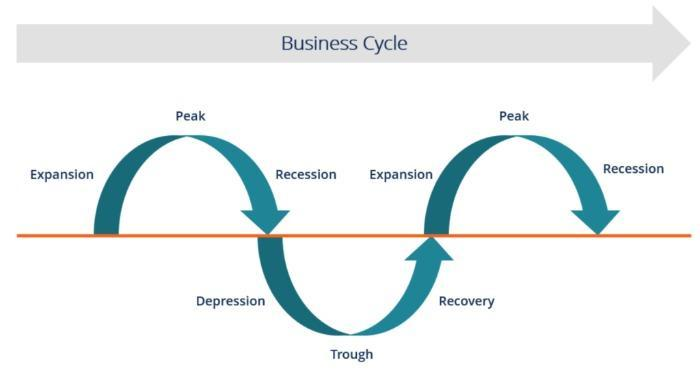

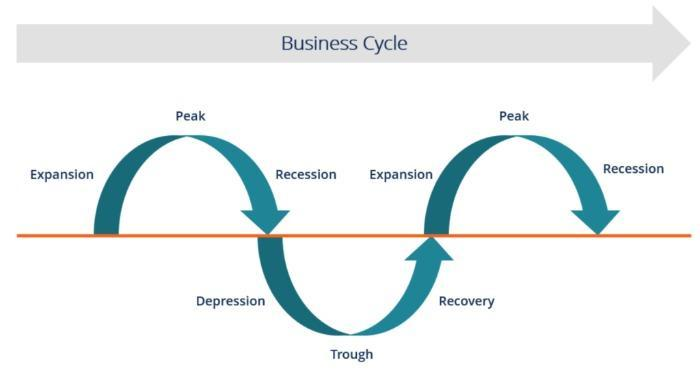

Even after your business is up and running, it won’t necessarily be smooth sailing for the entire lifecycle of your company.

As illustrated above, you face peaks and valleys while your company operates.

Mistakes and setbacks happen.

Some of these things will be out of your control, like a natural disaster or a crisis with the nation’s economy.

Employees will come and go.

You’ll face tough decisions and crossroads.

Sometimes, you’ll even make the wrong decision.

That’s OK.

Part of being an entrepreneur is learning from your mistakes.

It’s important to recognize when you’ve done something wrong, move forward, and try your best to make sure it doesn’t happen again.

Pay your bills.

Pay your taxes.

Operate within the confines of the law.

As long as you’re doing these things, you’ll be able to fight through any obstacle your startup company faces in the future.

Check if your idea is viable. Do some research and ask around. Are people looking for a business/service like yours? Then ask yourself: How are other businesses in your sector performing? Have you spotted a genuine gap in the market?

Then you’re ready to start drawing up a business plan.

There are several sources, including personal financing, banks, crowdfunding, friends, family, angel investors, and venture capitalists.

In the vast majority of cases, yes. You also need a social media presence that is applicable to your audience. After all, social media is a free, efficient way to reach a huge volume of people that you couldn’t otherwise target.

It depends on your budget. Begin with strategies like social media, free press release distribution, and content marketing. As your business grows, you can allocate a budget for affiliates, email marketing, SEO, online ads, and influencer campaigns.

Let’s recap.

Launching a startup company is not easy.

First, you need to determine if your idea is worth turning into a business, then you must determine if you have what it takes to become an entrepreneur.

The percentage of entrepreneurs in the United States is growing strong, and each one of them is going to face challenges along the way.

With that said, having a proper blueprint to follow helps simplify the process. You can get learn the basics of how to start a startup by following the seven steps, and adapting them to suit your individual needs.

With that said, most successful businesses start with validating an idea, creating a comprehensive business plan, and raising adequate funding. Without proper financial planning, your startup doesn’t stand a chance.

Then, surround yourself with the right people and play to your strengths.

For instance, if you’re great at organizing and motivating, focus on that; If marketing just isn’t you, outsource it to a professional who excels in that area.

Don’t forget about lawyers, insurance agents, and accountants to keep your business in order, and make sure you have essentials like an online presence.

Launching your startup is an imperfect journey, and you must prepare for unforeseen circumstances. However, proper planning and execution help limit these hurdles and get your business off to a flying start.

How will you raise funding to get your startup company off the ground?

The post Launch Your Startup: 7 Essential Steps, Tips, Strategies, & Ideas appeared first on #1 SEO FOR SMALL BUSINESSES.

The post Launch Your Startup: 7 Essential Steps, Tips, Strategies, & Ideas appeared first on Buy It At A Bargain – Deals And Reviews.

Everyone has ideas. Some of them may be worth running with, while others are probably not so good.

However, even if your project looks awesome on paper, there’s a big difference between that and creating a successful startup company.

Do you have what it takes to be an entrepreneur?

If your answer is yes, then you need a detailed guide on how to start a startup.

For those of you who haven’t launched a business before, it can sound like an intimidating task.

Don’t get me wrong – I’m not saying that getting your startup off the ground is an easy mission.

It takes hard work, dedication, money, some sleepless nights, and, yes, some failures before you succeed.

Nearly 20 percent of businesses fail in the first year, and just because you make it beyond 12 months doesn’t mean your startup is going to continue to thrive.

According to government stats, 30.6 percent of businesses fail after their second year, 49.7 percent fail after five years, and 65.6 percent fail after their tenth year.

Once you get your company off the ground, it doesn’t get any easier: you need to work just as hard to keep it going each year.

With that said, it’s useful to have a guide and a set of instructions to follow to learn how to launch a startup.

When I write about launching a startup, I’m talking from personal experience. I’ve created several startup companies like Crazy Egg, Hello Bar, and NP Digital.

I’m happy to share my knowledge and experience to help make things a little easier and less stressful for you as you go through this process.

Realistically, it takes hundreds of stages to launch your company, but I’ve narrowed down the top 7 steps into a blueprint for you to follow if you want to learn how to start a startup and learn how to create and develop your own business.

In the following article, I outline and discuss each step in detail so you have a better understanding of what I’m talking about.

Let’s begin with the basics.

Have you heard the saying ‘if you fail to plan, you plan to fail?’ That was the thinking of Founding Father Benjamin Franklin.

Well, research appears to back that up. Study after study shows that businesses with a plan are more likely to succeed. In addition, you can find many articles spelling out the importance of a business plan.

However, the Small Business Development Center at Duquesne University explains it most succinctly:

“A business plan is a very important and strategic tool for entrepreneurs. A good business plan not only helps entrepreneurs focus on the specific steps necessary for them to make business ideas succeed, but it also helps them to achieve short-term and long-term objectives.”

It’s pretty straightforward, really. Having an idea is one thing, but having a legitimate business plan is another story.

A proper business plan gives you a significant advantage, but what should you include in a business plan? It helps if you think of it as a written description of your company’s future. Basically, you outline what you want to do and how you plan to do it.

Typically, these plans outline the first three to five years of your business strategy and detail your business’s purpose and aims. Ideally, your document should outline your business goals, strategies, and your plans for achieving them.

Here are the key steps to writing a successful business plan:

If you need some help with your plan, the Small Business Administration has an easy-to-follow guide, along with some templates.

Without adequate funding, your business won’t launch or stay afloat long-term. According to Statista, in 2021, there were nearly 840,000 businesses that had been in operation for less than a year. Many of these startups won’t survive because they underestimate the cost of doing business.

Perhaps you’re wondering what level of financing you need? When it comes to raising cash, there’s no magic number that applies to all businesses. The startup costs vary from industry to industry, so your company may require more or less funding depending on the situation.

Costs also vary depending on whether you’re a brick-and-mortar store, e-commerce enterprise, or service business. If you’re unsure how much you might need, try the SBA’S startup cost templates to get a better idea.

Once you’ve got a clearer picture of the costs, where do you get the funding? These days, most startups get their funding from:

Let’s circle back to our business plan for a minute.

All business plans contain a financial plan. This usually includes a:

You use these financial statements to determine how much funding you need to launch successfully. Additionally, you may discover that the number is significantly higher than you originally anticipated.

For example, I’m sure you’ve heard someone say, “That would make a great app,” or “I should make an app for this.”

Do you know how much it costs to make an app? Depending on the complexity, you’re looking at anything between $40,000 – $300,000, and that’s just to make it.

It doesn’t include the cost of running it or customer acquisition costs.

This is the point I’m making: to secure the appropriate funding, you need to find out how much money you need.

To find this number, you must research and predict realistic financials in your business plan.

Let’s say you discover that your startup needs $100,000 to get off the ground.

What if you don’t have $100,000?

You’ve got some options, like bank loans and commercial lenders, and that’s the way many small businesses go. With this said, banks are less likely to give large amounts of money to new companies with no income or assets to default on, which may make it hard for your typical startup to get the funding they need.

Don’t worry, your dream isn’t dead yet. You can find investors. They could be:

However, whichever method you use, proceed carefully because you don’t want to start giving away significant equity in your company before you launch.

Then, if you get lucky and find a potential investor, you need to know how to pitch your idea quickly and effectively. Here are some tips to help you do that:

One more thing: It’s imperative that your business plan has a proper executive summary to entice busy investors.

Once you secure the appropriate funding, you can proceed to the next step of how to start a startup business: finding the right people.

No one makes it on their own. William Proctor might not have been a high-profile, successful businessman if he hadn’t met James Gamble.

Where would we go for advice if Larry Page hadn’t met Sergey Brin? Not Google, that’s for sure.

Then what if Ben Cohen never met Jerry Greenfield? We would’ve been denied one of the world’s most famous ice cream brands.

Even if you’ve already got a co-founder in place, you need some core staff.

Where do you start? According to Business News Daily, there are eight people your startup needs:

However, your business structure depends on the industry, so look at the above as definitive.

When you’re just starting up, hiring an entire team often isn’t realistic, and you find yourself wearing several business hats. That’s OK, to an extent. Just remember to play to your strengths and outsource if you can’t afford to recruit.

That said, there are some experts you should consider essential, including a:

Unless you’re an expert in law, finances, and accounting, these three people can help save your business some money in the long run.

They can explain the legal requirements and tax obligations based on how you structure your business. For example, it could be a:

While your lawyer, accountant, and financial advisors are not necessarily employees on your payroll, they are still important people to surround yourself with.

Finally, for this section, don’t forget the fundamentals for starting any company:

Now that you’ve got staff, you need to start work on a website and find a place to base your business.

Now you’re ready for the next stage of your how-to start a startup plan: finding a physical location and setting up a website.

Whether it’s offices, retail space, or a manufacturing location, you need to buy or lease a property to operate your business.

Unless you’re working from a home office, your two main options are leasing or ownership. Leasing usually works as out more expensive long term; however, don’t just base your decision on costs. Leasing and ownership both have their pros and cons. Look at the whole picture before making a decision.

I appreciate that it may not be realistic for all entrepreneurs to tie up the majority of their capital in real estate.

Strategize for this in your business plan and try to secure enough funding so that you can afford to buy property. It’s worth the investment and can save you money in the long run.

Let’s move on to setting up a website.

Today, your company can’t survive without an online presence. Don’t wait until the day your business officially launches to get your website off the ground, either, and remember, it’s never too early to start promoting your business.

If customers are searching online for a service in your industry, you want them to know that you exist, even if you’re not quite open for business yet.

The beauty of an online presence is you can even start generating some income through your website before you find premises. If it’s applicable, start taking some pre-orders and scheduling appointments.

For those of you who aren’t convinced about the pre-orders business model, many startups are succeeding with it.

Here are some tips about how to launch and promote a successful website:

Finally, make sure that your website is fast.

I can’t stress this point enough.

I’ve got a video tutorial that explains how to speed up your website.

All of these items combined may sound tough, but it’s really not that difficult. Just focus on one task at a time, and you’ll get there.

Once your website is up and running, you need to expand your digital presence. To do this, use social media platforms like:

Your prospective customers are using these platforms, so you need to be on them, too. However, when choosing a platform, ensure you go where your core audience is. For instance, if you’re targeting a younger market, TikTok may be ideal.

If you’re not a marketing expert, you need to become one.

You might have the best product or service in the world, but if nobody knows about it, then your startup can’t succeed.

To start spreading the word, you must learn how to use digital marketing techniques like:

However, if you’re starting a small business in a local community, some of the traditional methods can still work well. Think:

While some would argue that outbound marketing efforts are not as effective these days, research shows that methods like cold emailing and calling still work well.

For those of you who aren’t efficient marketers, there is no shame in hiring a marketing director or even a marketing team, depending on the size of your company.

Your marketing efforts will be one of the most important, if not the most important, components of launching your startup business. To improve your chances of success:

Take these numbers into consideration before you spend your entire budget on something like banner ads.

The bottom line is this: Marketing needs to be a top priority for your startup company.

If you’re following this plan in order, the good news is that you’re already on the right track to building a customer base.

Starting a website, growing your digital presence, and becoming an effective marketer are all steps in the right direction. However, now it’s time to put these efforts to the test. That means:

There are three keys to customer retention:

It’s no secret. The customer needs to be your main priority. They are the lifelines of your business, and they need to be treated accordingly.

Once you establish a steady customer base, you can use it to your advantage.

You’ll get more money from your existing customers than from new ones.

It’s a more effective method than cross-selling.

Less than 0.5% of customers respond to cross-selling.

Over 4% of your customers will buy an upsell.

These strategies both double back to having effective marketing campaigns.

Overall, establishing, building, and maintaining a customer base will help you get your startup company off the ground.

Expect the unexpected.

Launching your startup company won’t be easy, and you need to plan for some hurdles along the way.

Don’t let these speed bumps become roadblocks.

You can’t get discouraged when something goes wrong.

Preserve and push through it.

The difficulties that you face while launching your startup company help prepare you for the tough road ahead.

Even after your business is up and running, it won’t necessarily be smooth sailing for the entire lifecycle of your company.

As illustrated above, you face peaks and valleys while your company operates.

Mistakes and setbacks happen.

Some of these things will be out of your control, like a natural disaster or a crisis with the nation’s economy.

Employees will come and go.

You’ll face tough decisions and crossroads.

Sometimes, you’ll even make the wrong decision.

That’s OK.

Part of being an entrepreneur is learning from your mistakes.

It’s important to recognize when you’ve done something wrong, move forward, and try your best to make sure it doesn’t happen again.

Pay your bills.

Pay your taxes.

Operate within the confines of the law.

As long as you’re doing these things, you’ll be able to fight through any obstacle your startup company faces in the future.

Check if your idea is viable. Do some research and ask around. Are people looking for a business/service like yours? Then ask yourself: How are other businesses in your sector performing? Have you spotted a genuine gap in the market?

Then you’re ready to start drawing up a business plan.

There are several sources, including personal financing, banks, crowdfunding, friends, family, angel investors, and venture capitalists.

In the vast majority of cases, yes. You also need a social media presence that is applicable to your audience. After all, social media is a free, efficient way to reach a huge volume of people that you couldn’t otherwise target.

It depends on your budget. Begin with strategies like social media, free press release distribution, and content marketing. As your business grows, you can allocate a budget for affiliates, email marketing, SEO, online ads, and influencer campaigns.

Let’s recap.

Launching a startup company is not easy.

First, you need to determine if your idea is worth turning into a business, then you must determine if you have what it takes to become an entrepreneur.

The percentage of entrepreneurs in the United States is growing strong, and each one of them is going to face challenges along the way.

With that said, having a proper blueprint to follow helps simplify the process. You can get learn the basics of how to start a startup by following the seven steps, and adapting them to suit your individual needs.

With that said, most successful businesses start with validating an idea, creating a comprehensive business plan, and raising adequate funding. Without proper financial planning, your startup doesn’t stand a chance.

Then, surround yourself with the right people and play to your strengths.

For instance, if you’re great at organizing and motivating, focus on that; If marketing just isn’t you, outsource it to a professional who excels in that area.

Don’t forget about lawyers, insurance agents, and accountants to keep your business in order, and make sure you have essentials like an online presence.

Launching your startup is an imperfect journey, and you must prepare for unforeseen circumstances. However, proper planning and execution help limit these hurdles and get your business off to a flying start.

How will you raise funding to get your startup company off the ground?

Article URL: https://www.notion.so/laylo/Lead-Growth-Engineer-3f508fb12dbc4daf86950f4ba5e6b8ee Comments URL: https://news.ycombinator.com/item?id=31739981 Points: 1 # Comments: 0 The post Creator economy startup, Laylo, is hiring a lead growth engineer first appeared on Online Web Store Site.

Article URL: https://laylo.notion.site/Lead-Growth-Engineer-3f508fb12dbc4daf86950f4ba5e6b8ee

Comments URL: https://news.ycombinator.com/item?id=31739981

Points: 1

# Comments: 0

The truth is, even as a startup you can benefit from business credit. Generally, the mindset is that you have to have credit to get credit. Unfortunately, this is more true with business credit than personal. However, it is possible to get credit for your business as a startup. With inflation on the rise, it’s more important now than ever. So, here’s how to use business credit to fight inflation as a startup.

First, starting this process as early as the startup phase has many benefits. In fact, the earlier you start the better. Still, it isn’t easy to find companies that will extend credit to a startup.

In the first 30 days most businesses can get accounts with:

Uline sells shipping, packing and industrial supplies. To get a Net 30 account with them you need to meet the general requirements for a Fundable Foundation. In addition, they may require that you make a few prepaid orders before they offer net terms.

Foundation. In addition, they may require that you make a few prepaid orders before they offer net terms.

Now, how do you use business credit with Uline to fight inflation as a startup? Use your Uline account to buy things you need for your business now, before prices rise anymore. Imagine, even if you buy things you will not use for later, you are probably saving money in the long run. Due to inflation, the price may very well go up before you actually need to buy them again.

Some examples of things you can buy include:

To start, open a Brex cash account. Everyone with a cash account gets a corporate card that works like a debit card. However, as you buy things on it, they report to Dun & Bradstreet like you are making payments on a credit account. Even though this doesn’t include extra funding, it can still be helpful. This is because it can help build your business credit score faster.

Grainger sells hardware, power tools, pumps and more. In addition, they offer fleet maintenance. The account reports to Dun & Bradstreet. To qualify, you need to meet the standard Fundable Foundation requirements, plus be registered with the Secretary of State for at least 60 days.

Foundation requirements, plus be registered with the Secretary of State for at least 60 days.

Furthermore, if you have no established credit, more documents may be necessary. These may include:

You can use your Grainger account to buy:

Just like with Uline, you can buy now to lock in lower prices before inflation causes them to rise.

In the first 60 to 90 days many will qualify for accounts with:

United Rental is the largest equipment rental company in the world. To qualify for a credit account with them, you need to have a Fundable Foundation. There is no minimum time in business and they do not require a minimum purchase to report payments.

Foundation. There is no minimum time in business and they do not require a minimum purchase to report payments.

Use this account to rent tools and equipment, which can help you manage your cash flow better.

Tiger Direct is an online provider of electronic products. They offer pretty much anything you can think of when it comes to electronics, including:

Use your account to buy things you need, run your company more efficiently, manage cash flow, and build business credit.

Everyone knows Amazon is an online retailer of virtually everything. However, they also report payments on business credit accounts to D&B and Equifax.

So, wondering how to use business credit with Amazon to help your company make it through inflation? Like the others, use it to buy things you need for your business while the prices are lower. Then, when you have the cash to pay later, you will not have to worry about the rising prices.

That’s how to use business credit as a startup. Leverage the few credit accounts you can get as a startup, and grow your business credit score through the startup phase. Truly, credit for your company can be an excellent life raft to help you get through the sea of inflation. After that, you can continue to grow your business and thrive well past startup.

The post How to Use Business Credit to Fight Inflation as a Startup appeared first on Credit Suite.

The truth is, even as a startup you can benefit from business credit. Generally, the mindset is that you have to have credit to get credit. Unfortunately, this is more true with business credit than personal. However, it is possible to get credit for your business as a startup. With inflation on the rise, it’s more important now than ever. So, here’s how to use business credit to fight inflation as a startup.

First, starting this process as early as the startup phase has many benefits. In fact, the earlier you start the better. Still, it isn’t easy to find companies that will extend credit to a startup.

In the first 30 days most businesses can get accounts with:

Uline sells shipping, packing and industrial supplies. To get a Net 30 account with them you need to meet the general requirements for a FundableFoundation. In addition, they may require that you make a few prepaid orders before they offer net terms.

Now, how do you use business credit with Uline to fight inflation as a startup? Use your Uline account to buy things you need for your business now, before prices rise anymore. Imagine, even if you buy things you will not use for later, you are probably saving money in the long run. Due to inflation, the price may very well go up before you actually need to buy them again.

Some examples of things you can buy include:

To start, open a Brex cash account. Everyone with a cash account gets a corporate card that works like a debit card. However, as you buy things on it, they report to Dun & Bradstreet like you are making payments on a credit account. Even though this doesn’t include extra funding, it can still be helpful. This is because it can help build your business credit score faster.

Grainger sells hardware, power tools, pumps and more. In addition, they offer fleet maintenance. The account reports to Dun & Bradstreet. To qualify, you need to meet the standard Fundable Foundation requirements, plus be registered with the Secretary of State for at least 60 days.

Furthermore, if you have no established credit, more documents may be necessary. These may include:

You can use your Grainger account to buy:

Just like with Uline, you can buy now to lock in lower prices before inflation causes them to rise.

In the first 60 to 90 days many will qualify for accounts with:

United Rental is the largest equipment rental company in the world. To qualify for a credit account with them, you need to have a FundableFoundation. There is no minimum time in business and they do not require a minimum purchase to report payments.

Use this account to rent tools and equipment, which can help you manage your cash flow better.

Tiger Direct is an online provider of electronic products. They offer pretty much anything you can think of when it comes to electronics, including:

Use your account to buy things you need, run your company more efficiently, manage cash flow, and build business credit.

Everyone knows Amazon is an online retailer of virtually everything. However, they also report payments on business credit accounts to D&B and Equifax.

So, wondering how to use business credit with Amazon to help your company make it through inflation? Like the others, use it to buy things you need for your business while the prices are lower. Then, when you have the cash to pay later, you will not have to worry about the rising prices.

That’s how to use business credit as a startup. Leverage the few credit accounts you can get as a startup, and grow your business credit score through the startup phase. Truly, credit for your company can be an excellent life raft to help you get through the sea of inflation. After that, you can continue to grow your business and thrive well past startup.

The post How to Use Business Credit to Fight Inflation as a Startup appeared first on Credit Suite.

The post How to Use Business Credit to Fight Inflation as a Startup appeared first on Buy It At A Bargain – Deals And Reviews.

Article URL: https://jobs.ashbyhq.com/compound

Comments URL: https://news.ycombinator.com/item?id=30715830

Points: 1

# Comments: 0