The post British Labour Leader Steps Up on Russia appeared first on Buy It At A Bargain – Deals And Reviews.

Tag: Steps

British Labour Leader Steps Up on Russia

Keir Starmer sees Putin clearly, unlike some on the American right. The post British Labour Leader Steps Up on Russia appeared first on #1 seo FOR SMALL BUSINESSES. The post British Labour Leader Steps Up on Russia appeared first on Buy It At A Bargain – Deals And Reviews.

British Labour Leader Steps Up on Russia

The post British Labour Leader Steps Up on Russia appeared first on Buy It At A Bargain – Deals And Reviews.

British Labour Leader Steps Up on Russia

Keir Starmer sees Putin clearly, unlike some on the American right.

The post British Labour Leader Steps Up on Russia appeared first on #1 SEO FOR SMALL BUSINESSES.

The post British Labour Leader Steps Up on Russia appeared first on Buy It At A Bargain – Deals And Reviews.

10 Steps for Creating a Fundable Business Setup in 2022

It’s a new year. Whether you have a new business or you have been running your business for a while, these tips will help make sure you have a business setup for success in 2022 and beyond.

Why Does Your Business Setup Matter?

The way you set your business up affects its fundability. It cannot be fundable if it is not built on a foundation of fundability. What is fundability, and what are the building blocks of a fundable foundation?

Fundability is a business’s current ability to get funding. Of course, there are things you cannot control related to fundability. Yet, there are plenty of factors you can control. These are what you need to focus on. They include setting your business up with a fundable foundation, and more.

Business Setup: a Fundable Foundation

Follow these steps to build a fundable foundation for your business.

Step 1: Don’t Neglect Your Business Name

This is more important than you may think. It includes a lot more than just choosing a name. First, check with your Secretary of State to find out if they require that a business name be unique.

Then, keep any indication of a high-risk or restricted industry out of your business name. Your business can be Rachel’s rather than Rachel’s Gas Station. This can help prevent an automatic or nearly automatic denial from a lender just because of the type of business. It can increase the chances that your business actually gets a chance at funding.

If your business is perceived as high risk from the beginning, the application may not even get to the underwriting process.

Step 2: Address Your Business Address

A fundable business setup includes a physical address where you can receive mail. Never use an UPS box or a P.O. Box. In fact, some lenders will not approve and fund unless this is the case. If you don’t want to use your home address, you can use a virtual address. In fact, it’s not a bad idea if you need to hold a meeting or an interview. Regus, Davinci, and Alliance Virtual Offices are all good options. Still, keep in mind that there are credit providers that will not accept virtual addresses.

Step 3: Make the Right Call With Your Business Phone Number

Not surprisingly, toll-free phone numbers are best. Lenders see them as a sign of business credibility. It’s very easy and inexpensive to set up a virtual local phone or a toll free number. If you want to avoid a separate phone, just have your business number forwarded to your personal phone.

Additionally, your business number needs to be listed with 411 for most credit issuers and lenders to approve you. Check for your record to see if you’re listed. While you’re at it, make sure your information is accurate. No record? Then use ListYourself.net to get a listing.

Step 4: Jump in With An EIN

Now, get a free EIN for your business at IRS.gov. This is an identifying number for your business. It’s similar to your personal Social Security Number. You’ll use it on all of your business documents.

Step 5: Set Up an Incorporated Business Entity

Incorporating gives you more credibility in many cases. It sets up your business as separate from you, its owner. Of course, by default incorporating reduces your personal liability. Other entities, like sole proprietorships and partnerships, do neither.

Step 6: Get Licensed

Contact State, County, and City Government offices to see if there are any required licenses and permits to operate your type of business. Licensing requirements differ depending on state, town, and industry. Always make sure you have the proper licensing for your corporation. Often, your Secretary of State will have this information.

Step 7: Open a Business Bank Account in the Business’s Name

You must have a separate, dedicated business bank account. Keep in mind, you have to keep business and personal funds separate for the IRS anyway. Having a separate business account makes that process easier and reduces the risk of audit at tax time.

More than that, many credit issuers require a business bank account before they will approve you for an account. In addition, the date you open your business bank account is the day that lenders consider your business to have started.

As a result, it doesn’t matter if you incorporated your business 10 years ago. If you just opened the business bank account yesterday, then in the eyes of credit issuers your business started yesterday. Since there is a minimum time in business requirement on almost all business credit accounts, the sooner you open your business bank account, the better.

A business bank account is also required for getting a merchant account, so your business can accept credit cards. For years, studies have shown that customers spend more with plastic than with cash.

Step 8: Do Not Underestimate the Importance of a Business Web Domain and Professional Website

It’s highly likely that lenders and credit providers will research your business online. As you can imagine, it is best if they learn everything directly from your business website. Not having a company website can hurt your chances of getting business credit. Keep in mind though, an unprofessional website can do just as much damage.

You need it to be a professional website. That means it’s got to have helpful information for anyone who finds your company online. Additionally, it should be hosted professionally. Buy web hosting from a hosting company like GoDaddy or HostGator. Try to avoid a free version of a hosting service like Weebly or Wix.

Your domain should be your business name, if possible. A free Wix or Weebly domain does not look professional. For example, www.yourbusiness.com appears much more professional than www.yourbusiness.wix.com.

Furthermore, you need a company email address for your business. Guess what? It needs to be on the same domain as your website. It often comes with a website domain provider such as GoDaddy. Do not use Yahoo, AOL, Gmail, Hotmail, or other free email services. Again, owner@yourbusiness.com appears much more professional than yourbusiness@yahoo.com.

Beyond the Foundation

After you set your business up with a fundable foundation, the next business setup consideration is risk. For some businesses this isn’t an issue at all when it comes to funding. Yet, for others, it can be tricky.

Step 9: Choose NAICS Codes Wisely

The North American Industry Classification System (NAICS) is the standard used by Federal statistical agencies. You choose your NAICS code on the IRS website.

There are inherent issues in every single industry. However, those listed under certain NAICS codes are considered riskier than others. It doesn’t matter if the business is prospering, they are still considered a risky business. Usually higher risk comes from chances of injury or frequently engaging in cash transactions, or a low barrier to entry.

The IRS, lenders, banks, insurance companies, and business CRAs use NAICS codes. They are trying to determine if your business is in a high-risk industry classification. The NAICS puts out a list of high-risk and high-cash industries. Higher risk industries include casinos, pawn shops, and liquor stores but the NAICS list is old and has not been updated in years.

Why Risk Matters

When it comes to funding, risk matters big time. There are several industries where lending institutions are hesitant to do business. In those particular cases, there are stricter underwriting guidelines. In contrast, some industries are considered so risky they are automatically denied.

Those businesses are left looking for other business funding solutions.

These can include:

Using a Different NAICS Code

Of course you want to be impeccably honest when it comes to selecting your NAICS code. Still, if more than one can apply, you don’t have to choose the one that’s higher risk. It pays to check and be careful when making your selection.

If only high risk codes apply, there’s nothing at all wrong with changing your business to match a related but lower risk code.

Step 10: Be Consistent!

A big reason for many credit and loan denials is inconsistent business information. This makes it hard for the lender to locate a business offline or online. It also sets off fraud alarms in the minds of those making lending decisions.

To avoid this, make certain your business name and other information is the same everywhere. That includes incorporation papers, licenses, utility statements, and bank statements among other things.

If you change your business name, be sure to change it everywhere.

This means you change it in these places, among others:

- Your website

- 411 listing

- Your records with the business CRAs (D&B, Experian, and Equifax)

Minor details such as using an ampersand in your name in one place and the word “and” in another can cause a lot of problems. Be careful and consistent with all business information.

First Funding Options

While you are working on setting up your business, you are going to need funding. If your business setup is not yet conducive to fundability, you’ll need to pursue some alternative options. One great possibility is the Credit Suite Credit Line Hybrid.

Credit Line Hybrid

A credit line hybrid is a form of unsecured funding. Our credit line hybrid has an even better interest rate than a secured loan. You can get 0% business credit cards with stated income, and many of these report to business CRAs. That means you can build business credit at the same time.

This will get you access to even more cash with no personal guarantee.

Credit Line Hybrid: Terms and Qualifying

You need a credit score or a guarantor with a credit score of at least 680. There is no requirement for financials, and you can often get up to $150,000. Be aware, some cards may report on your personal credit.

Business Setup for Fundability

Honestly, you cannot build a fundable business without first having a fundable foundation. This is what the business setup is all about. All other aspects of fundability hinge on the foundation, so don’t neglect it. Don’t skip it. If your business is already operating and you need to backtrack to make this happen, do it now. The sooner the better.

The post 10 Steps for Creating a Fundable Business Setup in 2022 appeared first on Credit Suite.

Six Steps to Launching Your New Content-Based Project

The new year is upon us and it is safe to assume that most of us were looking forward to it. Are you read for making your resolutions happen? If you are one of many …

The post Six Steps to Launching Your New Content-Based Project appeared first on Paper.li blog.

WARNING: Do Business Credit Cards Affect Personal Credit? They Can… UNLESS You Take These Important and Easy Steps …

Do business credit cards affect personal credit? They can, and in fact most do. But, they don’t have to. There are steps you can take to make sure they don’t. The key is to build your business credit score, and choose the right business credit cards.

Do Business Credit Cards Affect Personal Credit? It Depends

If you are asking yourself “Do business credit cards affect personal credit?” you are obviously trying to fund a business. And yes, most high limit business credit cards report to your consumer credit report. In fact, some report to both your personal credit and your consumer credit. There are even some business cards that will report negative payment information, but will not report anything if the account is in good standing. If you are trying to keep your business accounts from affecting your personal credit score, you need cards that will not report to personal credit bureaus.

Do Business Credit Cards Affect Personal Credit? Does it Even Matter?

Yes, it matters. Here’s why. You know that if an account, business or personal, is not in good standing, it can be detrimental to your personal credit if reported. Yet, did you know that even if an account is in good standing, it is possible that it may still damage personal credit.

Check out how our reliable process will help your business get the best business credit cards.

This is due to one of the fundamental differences in business credit vs. personal credit. Your personal credit score is affected by your debt-to-credit ratio. That’s a measure of how much debt you have, relative to how much credit you have available. A high debt-to-credit ratio can negatively impact your personal credit score. This is further complicated by the fact that many business credit cards stay at or near their limit, even if you are making regular payments. It is a function of the fact that business expenses are typically much higher than personal expenses.

As a result, if those accounts are on your personal report, they can bring your credit score down even if they are not delinquent. The question then becomes, how do you make sure this doesn’t happen? There are two key parts to this.

Do Business Credit Cards Affect Personal Credit? Make Sure They Don’t

First, if you are getting business credit cards with a personal guarantee, you have to make sure they will not report to your personal credit report. There are a handful that will not, even though they do ask for a personal guarantee. It is important to note that a personal guarantee means there will be a personal credit check. That will create an inquiry that may affect your personal credit for a bit. However, if the account does not report payment information to your personal credit report, the impact will be minimal.

A Few Examples of Business Credit Cards that Will Not Report to Personal Credit

If you have bad personal credit, the Wells Fargo Business Secured Credit Card is a good option.

You can get approved with a credit score as low as 580 currently, but that can change of course.

You do have to make at least a $500 deposit. Also, they do not report to consumer credit agencies, but they DO report to Dun & Bradstreet. That is, assuming you have your D-U-N-S number.

That means it can help you build business credit even with a bad personal credit score. They also report to the Small Business Finance Exchange. While the SBFE does not issue credit reports, they do share information with certain lenders, vendors, and credit agencies.

Wells Fargo will review your account periodically, and they may move you up to an unsecured account if you are eligible, based on a number of factors, including FICO.

If you have good credit, you have even more options for credit cards that will not report to personal credit. A few include:

CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

Costco Anywhere Visa® Business Card (have to be a Costco member)

Wells Fargo Business Platinum Credit Card

Remember, even though these cards do not report to your personal credit report, they do require a personal guarantee. That means they will do a personal credit check, and that inquiry will affect your score for a bit.

Do Business Credit Cards Affect Personal Credit? Business Credit Cards That Will Not Affect Personal Credit Scores Without a Personal Guarantee

Using a personal guarantee to begin building your credit portfolio is okay to start with. The goal, however, is to get as much as you can without a personal guarantee. To do this, you need to lay the groundwork before you apply for any cards. After all, they cannot report to your business credit profile if there is not one to report to.

Check out how our reliable process will help your business get the best business credit cards.

Do Business Credit Cards Affect Personal Credit? They Do if You Do Not Establish a Business Credit Profile

In contrast to a personal credit profile, you have to intentionally build a business credit profile. While a personal credit builds passively, business credit scores do not. With consumer credit, all you have to do is get credit accounts and they almost all end up on your consumer credit report.

How Do You Establish a Business Credit Profile?

First, you have your business up to be fundable. This includes a number of factors, some of which include:

- A business name that does not indicate you are in a high risk industry

- A physical business address, not a P.O. Box or UPS box

- Business phone number listed with 411

- A business bank account

- An EIN and a D-U-N-S number

You can get your EIN on the IRS website for free, and apply for the D-U-N-S number on the Dun & Bradstreet website, also for free. This is vital, because if you do not have that D-U-N-S number, accounts will not be able to report your payments to Dun & Bradstreet, because you will not have a profile there for them to report to.

The EIN is what you will use when you apply for business credit instead of your social security number. You may have to provide your SSN for identification purposes, but it will not be used to determine approval. This is one way you ensure your business credit accounts are not reporting to your personal credit report.

Do Business Credit Cards Affect Personal Credit? How to Get Business Credit Cards That Do Not Affect Personal Credit

Once your business is set up in the right way so that you have a business credit profile, you need accounts that report to that profile. However, if you start applying for high limit credit cards using your business credit profile right away, you are going to get denied.

You have to find accounts that will extend credit to your business without any sort of credit check. You don’t yet have a business credit score, and you are trying to avoid personal credit all together. To do this, you start with starter vendors.

These are accounts that will extend net terms and report payments, but they will approve you based on factors other than your credit score. These factors may include time in business, revenue, average balance in your business bank account, or other factors.

How to Find Starter Vendors

The trick is, these types of vendors are not easy to find. They do not advertise themselves as “starter vendors.” They do not make it easy to find out whether or not they report payments to business credit profiles. Business owners need help finding this information.

Here are a few options to get you started:

Grainger

Uline

Marathon

Still, you need more accounts than this reporting before you can build a strong enough business credit score to apply for higher limit accounts.

Check out how our reliable process will help your business get the best business credit cards.

Do Business Credit Cards Affect Personal Credit? They Don’t Have To

How to Build a Strong Business Credit Portfolio With Minimal Effect on Personal Credit

The secret to building a strong business credit profile as fast as possible and with minimal effect on your personal credit, is to work with a business credit expert. A business credit expert makes this whole process faster and easier.

They can help ensure you have your business set up the right way, and guide you toward those starter vendor accounts that will help you initially build your business credit score. They will help you know when you have enough accounts reporting to start applying for higher limit accounts and be approved.

In addition, our business credit experts have the knowledge and expertise to help you find the best accounts to flesh out your business credit portfolio. There is more to this than just building strong business credit with accounts that report. An expert can guide you toward the best vendor accounts for your specific business, whether they report or not.

The best way to start this process with no risk is to have a free consultation with a business credit expert. They can help you figure out where you stand now, and where you need to start so that you can build your business credit portfolio in the most effective and efficient way possible.

The post WARNING: Do Business Credit Cards Affect Personal Credit? They Can… UNLESS You Take These Important and Easy Steps … appeared first on Credit Suite.

How to Get More Twitter Followers Fast (7 Easy Steps)

What if I told you that you could get 10,000 Twitter followers without having to follow others or spend a bunch of money on ads?

What if I also told you that it would be pretty easy to do?

Well, I’ve got seven simple, straightforward, and super effective Twitter tips to help you do just that.

Twitter is still among the top social networks today for users with over 192 million daily active users.

Twitter could be the secret ingredient to connecting with the biggest possible audience, and I am going to help you do it.

First, though, let’s talk about why you would even want more Twitter followers.

Why do Twitter Followers Matter?

Sure, Facebook is the biggest social network with the most monthly active users.

However, you shouldn’t underestimate Twitter’s importance.

It’s a global powerhouse.

Even though nearly a quarter of Americans use Twitter regularly, much of Twitter’s user base is international users.

This means that Twitter allows you to connect with a global audience.

There are other factors to consider, too.

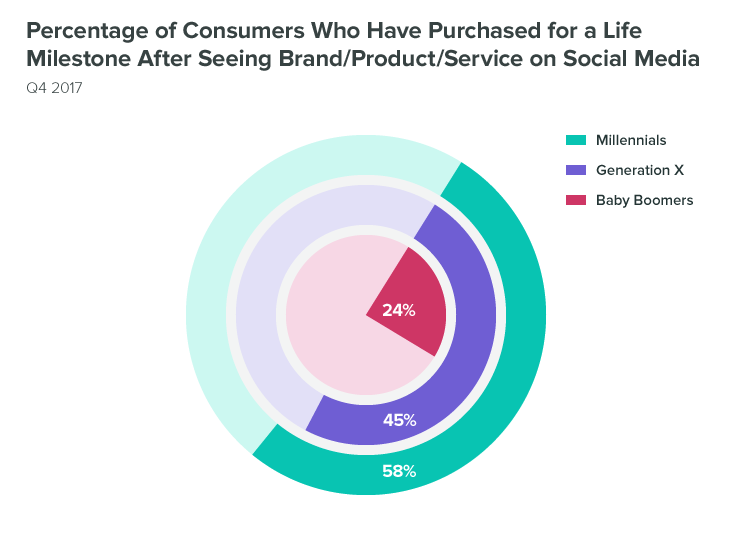

Such as how Twitter’s millennial and Gen Z audience is a coveted one from a marketing perspective.

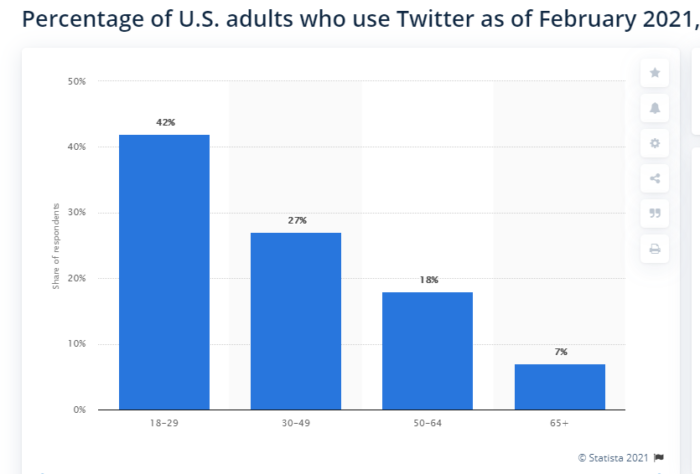

In fact, 42 percent of Twitter users are between the ages of 18 and 29, and 27 percent are between the ages of 30 and 49.

Not only are there tons of millennials on Twitter, millennials more frequently use social media as a tool for discovering new brands.

Statistically speaking, millennials and Gen Z are an ideal target demographic for many companies because they make up a huge market.

So why not reach out to them where they live?

Millennials eat out more, love trying new products, and they’re always looking for unique experiences with brands and companies.

In fact, the rise of the millennial generation has forever changed the world of marketing, from the strong focus on video to the rise of influencer marketing, and the emphasis on emotional connection.

There’s another reason Twitter is so attractive to marketers, and that’s because it gives you 100 percent reach.

However, there’s a caveat.

When you post to Twitter, your tweets are only seen by your followers or when your tweets are shared with others’ Twitter followers.

You have 100 percent reach only with your followers and their followers.

This means 100 percent reach on Twitter doesn’t matter if there aren’t people seeing your content.

According to recent research, 74 percent of the people who follow small and medium businesses on Twitter are following these businesses because they want updates on future products.

Additionally, nearly half of those who follow brands and businesses are more likely to visit those companies’ websites.

So your Twitter followers will often become people who visit your website and invest in your brand through purchases.

Fortunately, I can help you get followers quickly and effectively.

How to Get Twitter Followers Fast

Now that you know why Twitter followers matter, let’s talk about how to get them. Keep in mind, quality is always better than quantity. 100K followers is great — but not if they don’t care about your business.

1. Optimize Your Twitter Profile to Attract Twitter Followers

For all the power you stand to gain by using Twitter for your business, not having a professional, up-to-date profile can be a major turn-off to prospective followers.

So one of the first steps on the road to amassing tons of followers is to make sure your Twitter profile rocks.

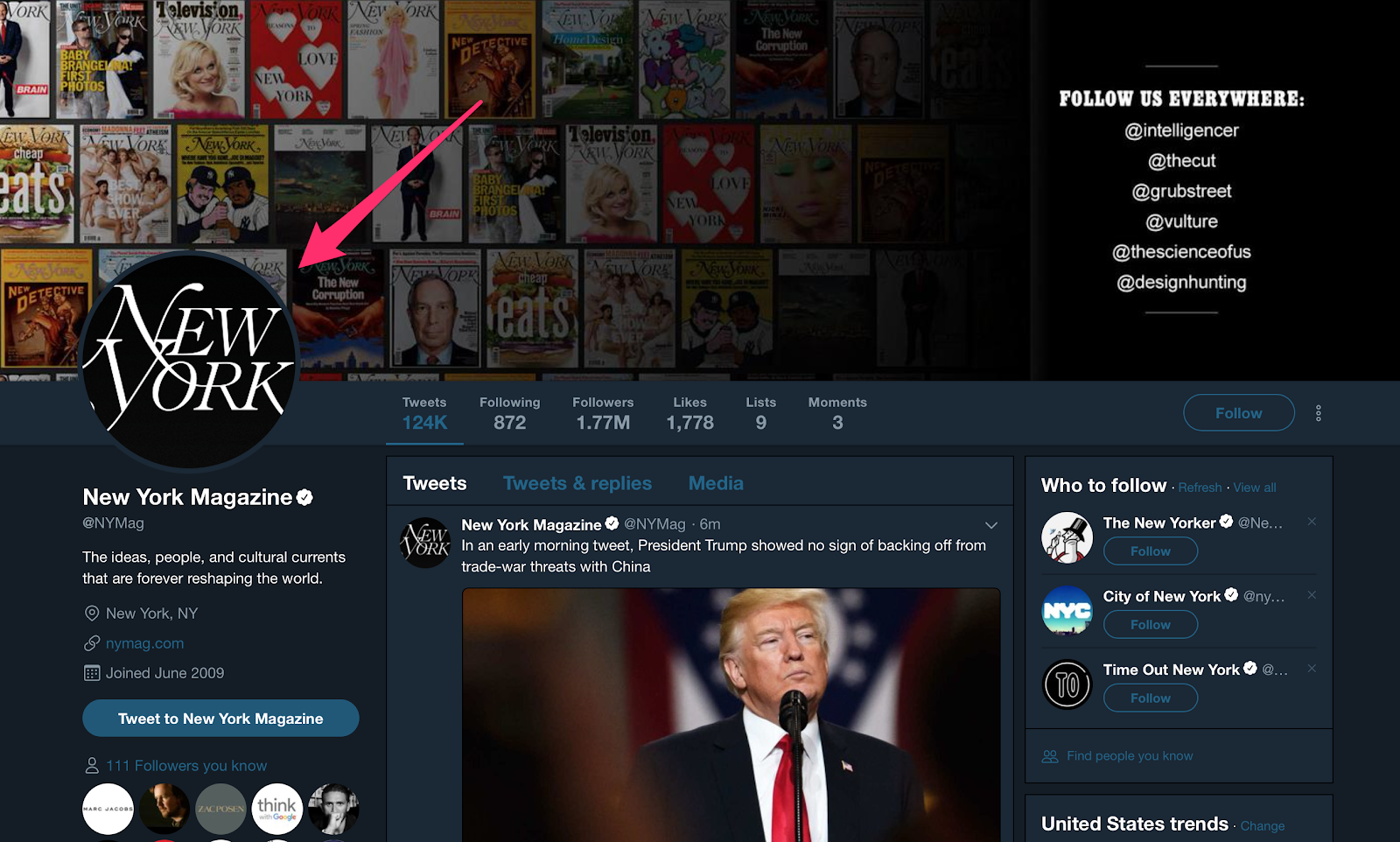

Your profile picture is the centerpiece of your Twitter profile.

It’s the part of your Twitter profile people probably notice and look at first.

Aside from your username, it’s the one profile element that doesn’t just appear on your profile. It’ll show next to your tweet in the other users’ feeds when you post.

So, choose a photo that’s appropriate for your business or brand.

Whether you’re using a professional photo of yourself or your brand’s logo, you want to make sure that the most important elements appear toward the center of the image.

Due to the circular format, anything that appears toward the edges of your profile photo won’t show on your profile.

It’s even a good idea to resize your image. Although you can upload higher-res files, your profile image doesn’t need to be any bigger than a 400px by 400px square.

Here are some examples of how these profile image best practices can be implemented:

Bitfinex — a cryptocurrency exchange company — uses their logo for their profile image.

Similarly, you can see New York Magazine’s iconic logo as the profile pic used for their Twitter account.

However, Virgin Group founder and colorful businessperson Richard Branson uses a photo of himself. The photo looks professional yet casual and relatable.

Not only is this smart for promotional purposes, but it also helps people make stronger associations between your brand and logo.

Your profile photo should draw attention because it will be the identity that your followers will come to see behind all the content you post on Twitter.

Using a branded logo as a profile image, like Louis Vuitton, is an easy and quick way to get followers to recognize your posts instantly.

Beyond the profile photo, there’s the ‘Bio.’

This is the area of your Twitter profile where you provide a little — just 160 characters in total — information about your brand or business.

Here’s an example from the Washington Post’s Twitter profile:

As you can see, the goal of your profile is to give a prospective follower an idea of (a) what your business is and (b) what they can expect by becoming a follower.

There’s another reason why your bio is important: it’s searchable.

Of course, you’ll want to include all the essential info, such as your website, location, and possibly a phone number.

You’ll want to include keywords that are relevant to your brand or company in your bio.

PlayStation does this well.

PlayStation’s bio includes common variants of the company’s name as well as their products’ names, such as “PS4” for “PlayStation 4.”

A consumer tech outlet called Gadgets Now uses keywords in the bio, too.

Another element you can include in your Twitter bio is hashtags.

News network CNN incorporates a single hashtag in the bio.

CNN’s hashtag is a great example because “Go There” is the slogan for the network, emphasizing ingenuity and tenacity in journalism.

So the hashtag reinforces the network’s desired brand image.

Your bio can be an opportunity to show some personality, so don’t be afraid to get a little creative.

Content marketer and author Ann Handley’s profile is an excellent example.

Ann’s use of the phrase “waging a war on mediocrity in content marketing” is accurate and effective while also showcasing her personality.

Once you’ve chosen your profile photo and written your bio, the next step in a great Twitter profile is to find (or even create) your header image.

Though it changes from time to time, the current dimensions that your Twitter header image should be are 1500px by 500px.

This can be a great opportunity to reinforce your brand or to promote your latest product or service.

If you have trouble finding the right image with the appropriate dimensions, use a tool like Canva to create your own header image for free online.

Besides being free, Canva also offers tons of templates.

Now that you’ve spent some time ironing it out, your profile will leave a strong impression on visitors who view your profile, making them much more likely to follow you.

2. Engage With Your Twitter Followers

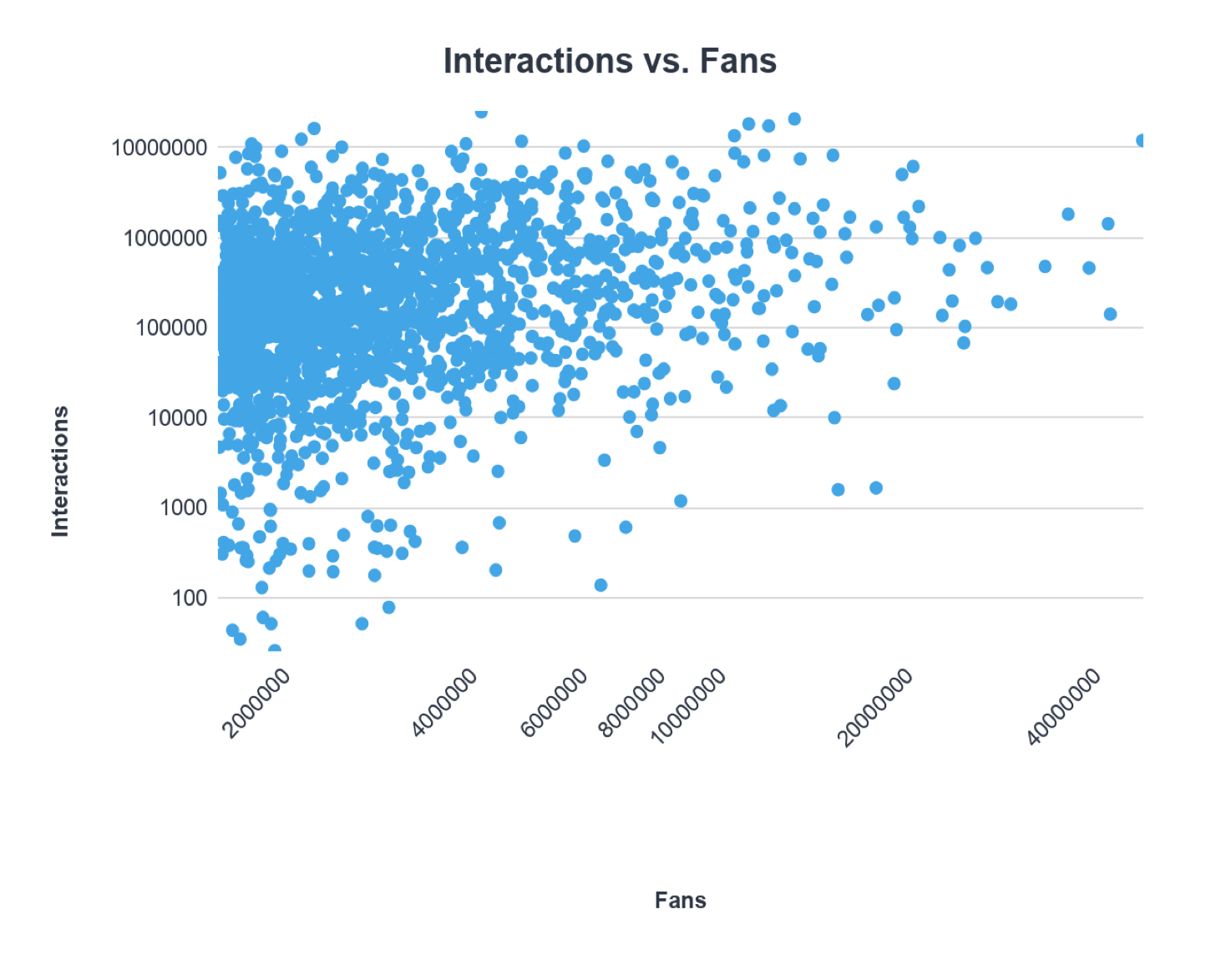

Although your follower count is a convenient metric, many social media marketers have begun putting more stock into engagement than followers.

In fact, Socialbakers account manager Jeraldine Tan actually considers follower growth an outdated metric.

“It is extremely important for brands to stop looking at outdated metrics like fan growth,” Jeraldine said in an article posted on LinkedIn.

“The overall fans number doesn’t matter if the audience isn’t consuming your content.”

So if you have a million Twitter followers but your posts get zero engagement, what are those followers really worth?

Jeraldine’s perspective is reinforced by Incite Group’s State of Corporate Social Media Survey.

According to Incite’s data, there’s no correlation between the number of followers and engagement, meaning that more followers doesn’t mean more engagement.

But when followers interact with and share your content on Twitter, their followers see that engagement and often become curious. The engagement serves almost as an endorsement.

So engagement does lead to increased reach and visibility, which, in turn, yields more followers.

However, interactions your followers are having with your Twitter content isn’t the only type of engagement you should care about.

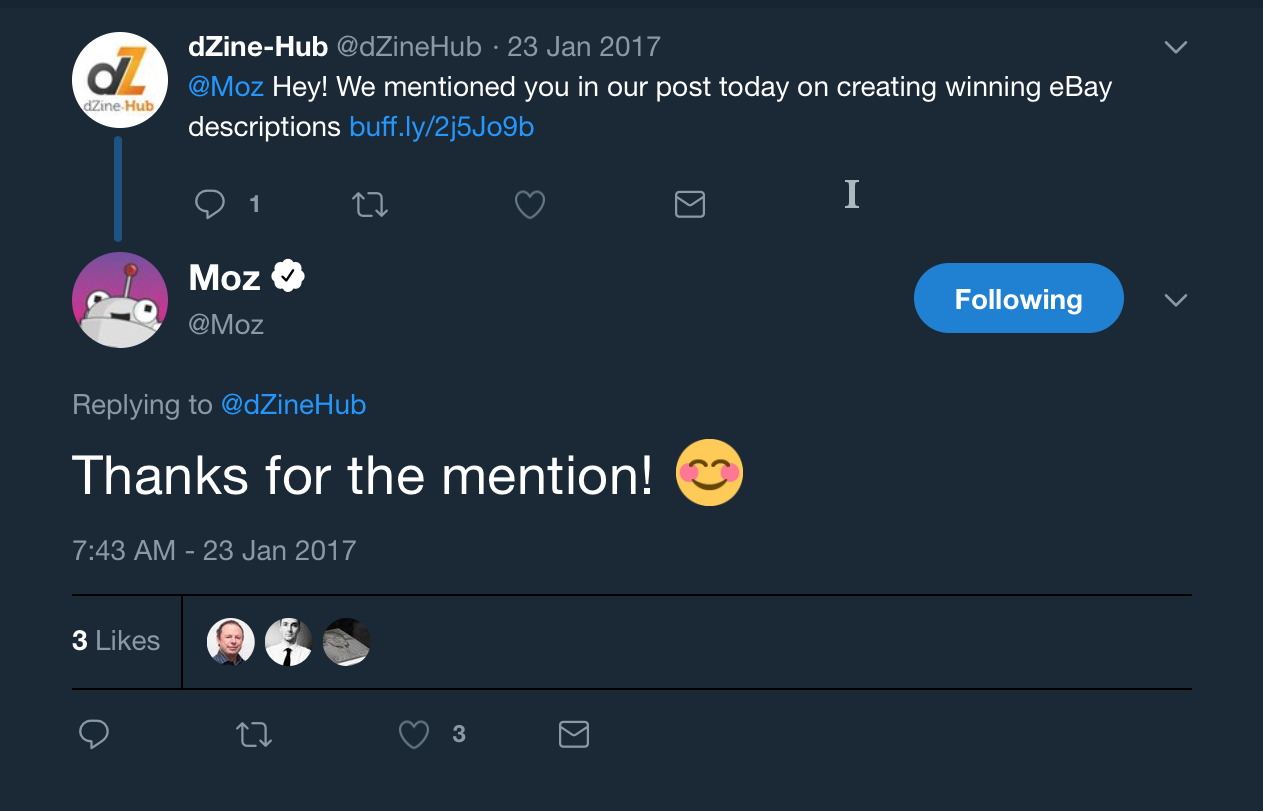

If you really want to grow your Twitter audience, you should be actively engaging back with them.

Responding to the comments and mentions of your followers reinforces their engagement and makes them more inclined to engage with you in the future.

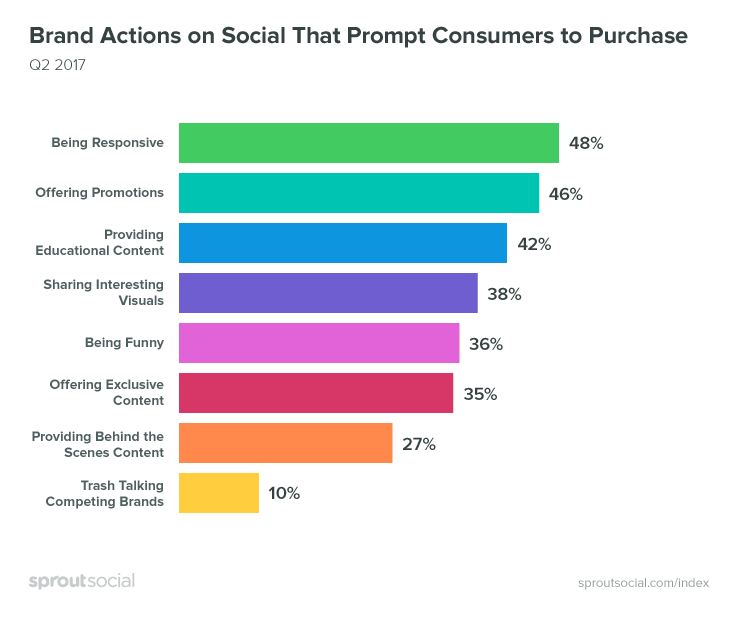

Engaging with your audience yields more tangible results, too.

According to data from Sprout Social, 48 percent of social media users cite responsiveness as the top characteristic that prompts audiences to purchase from a brand or company.

Fortunately, engaging with your Twitter audience is easy to do and something you can start doing right away.

There are three main strategies for actively engaging with your audience:

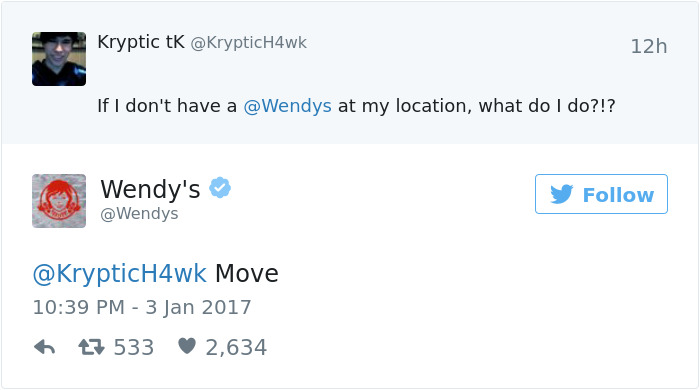

Respond to Comments and Mentions

Responding is certainly the simplest and easiest of these strategies, but it’s also effective.

It’s as simple as this:

When a user tweets to you or comments on one of your tweets, respond.

The acknowledgment will give them a sense of validation.

If you can make the exchange memorable in some way, they may actively seek out your content in the future. So don’t be afraid to show a little personality.

Don’t just respond to other people’s comments — pay attention to your own tags as well. Responses like these build good will and increase your reach on Twitter.

Respond to Direct Messages from Twitter Followers

Take the time to respond to direct messages. Today, customers expect brands to monitor their social platforms.

A lot of big brands and companies are finding success with DMs, including 1-800-FLOWERS and T-Mobile.

2. Host or Engage With Twitter Chats to Increase Twitter Followers

Twitter chats are live conversations that use a specific hashtag. They function sort of like a chat room, but are visible to a wider audience due to the use of the hashtag.

Public relations professional Janet Murray considers live chats an incredibly effective marketing strategy for Twitter.

According to Janet Murray, one way to get even more out of your live chat is to like and retweet other participants’ replies.

“Retweeting the posts of [other users] is a great way to build relationships,” Janet says.

She offers another useful tip: When you’re responding to other participants’ tweets, “don’t forget to use the hashtag so people can follow along.”

Or if you want to tweet someone privately, simply “don’t include the hashtag.”

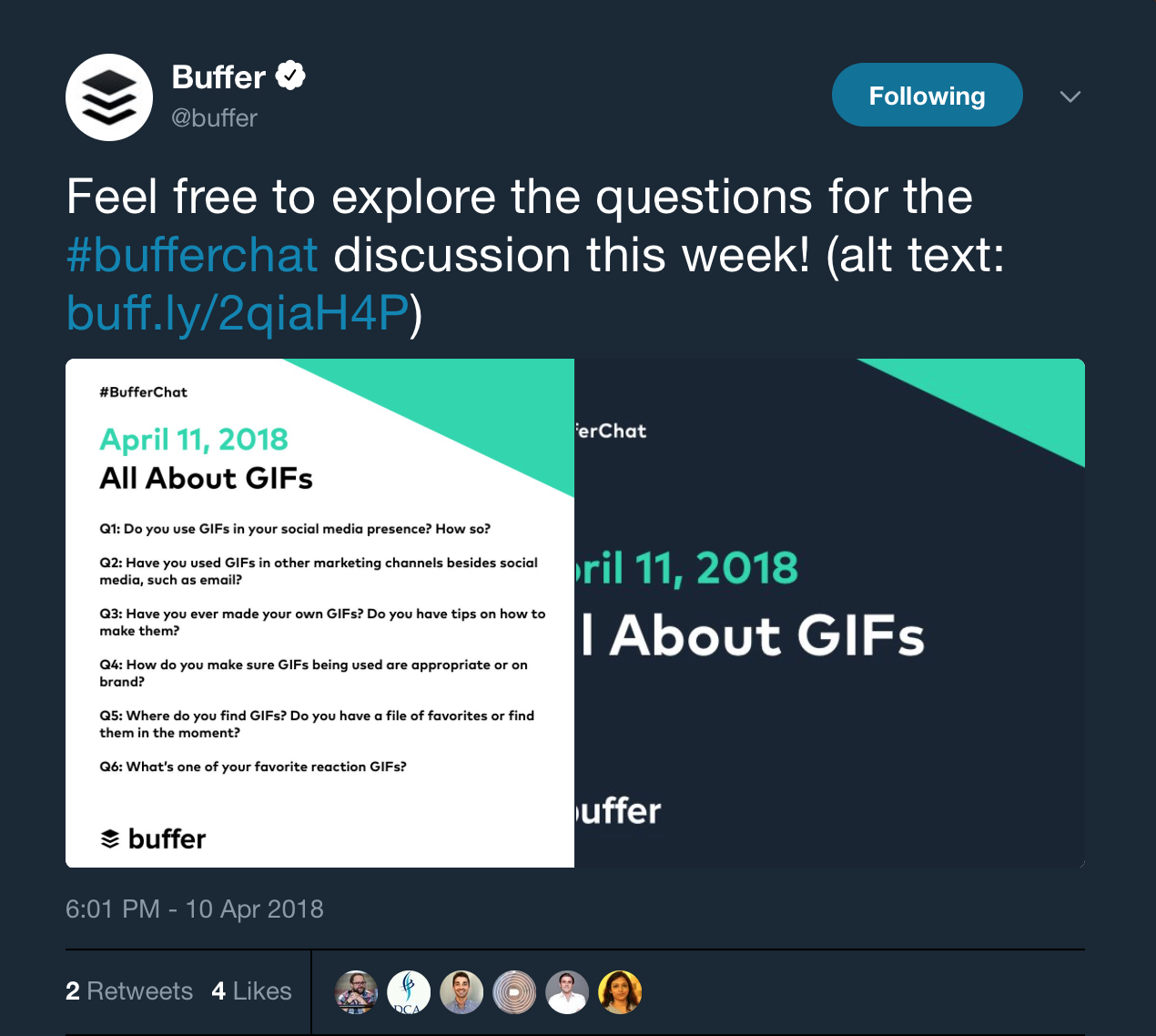

Buffer — a well-known social media management app — hosts weekly Twitter chat sessions using their own hashtag, “#BufferChat.”

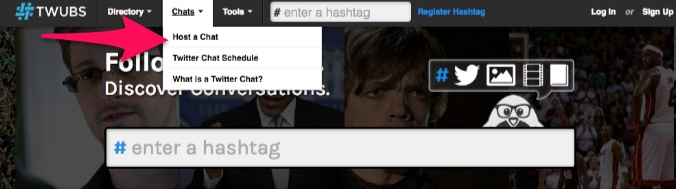

As far as actually hosting the chat, tools like tchat.io and Twchat can turn your hashtag into a more chat-like live stream.

You can access the live Twitter chat directory on Twubs without even needing to register for a free account.

Additionally, you can put your own live chat on Twubs so that others can find it more easily.

Another tip is to either post your questions or ask your followers for some questions ahead of time.

When it comes down to it, actively engaging your audience reinforces the decision to follow you.

Plus, their own followers can see how interactive you are with your audience, which makes a strong impression at large.

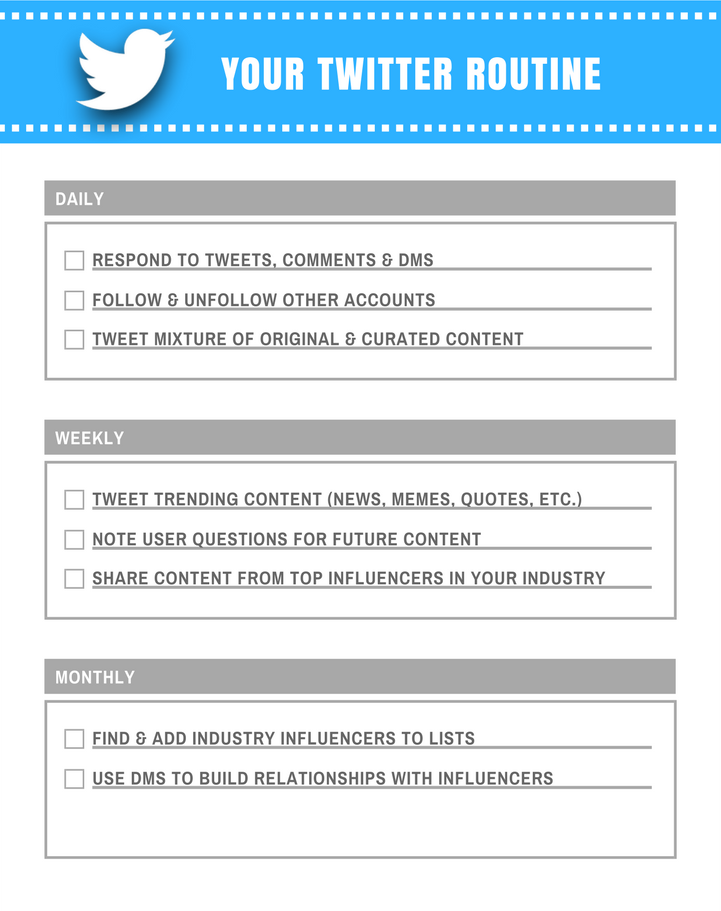

3. Stay Active by Creating Daily Twitter Routines

If your goal is to gain followers, I can’t stress enough the importance of staying active.

It’s not enough to post a few times a week or even once per day like you probably do on Facebook.

You could even lose followers if you’re not tweeting regularly.

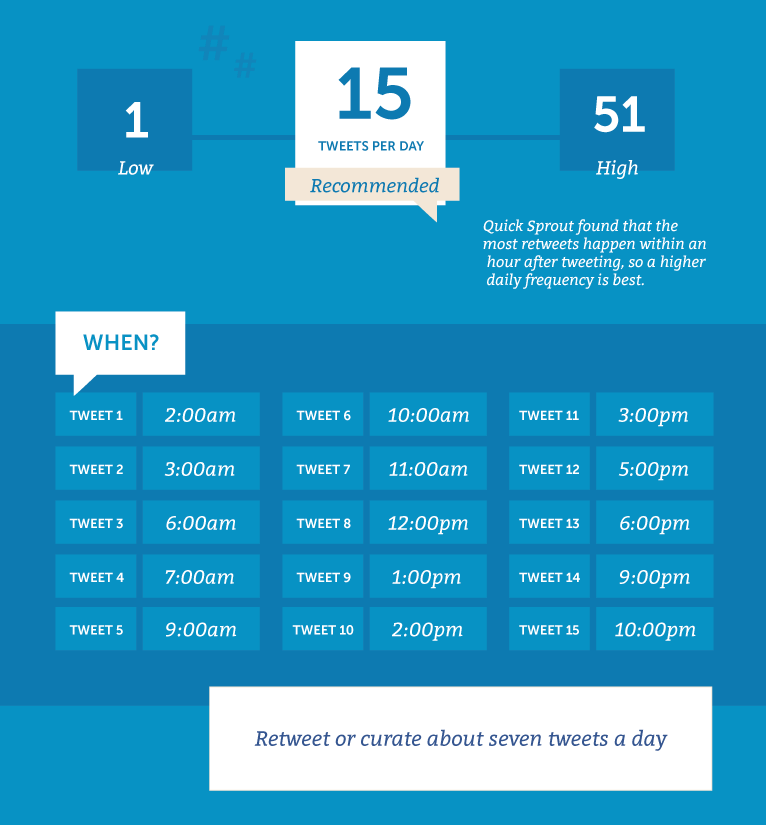

According to CoSchedule, you should post curated content — quotes and retweets — three to seven times per day. Including your own original content, it should be about 15 tweets daily.

Do you have time to sit on Twitter 24 hours per day to make sure you’ve got awesome tweets going out at all the right times? Probabley not.

That’s where your routine can be a life-saver.

The best way to create your Twitter routine is to create separate daily, weekly, and monthly routines.

Automate and schedule out your posts in advance with a tool like IFTTT.

Your daily Twitter routine should consist of things like following and unfollowing other users, replying to DMs and mentions, and responding to comments on your tweets.

On a weekly basis, you should focus on broader and more long-term aspects of your marketing strategy.

Your monthly routine should include things that could result in big payoffs down the road.

As such, it largely includes networking with industry influencers, which tends to increase your Twitter reach and visibility.

4. Plan and Schedule Tour Tweets

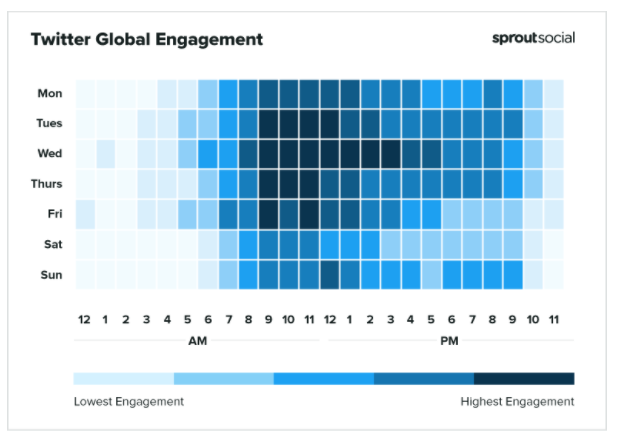

Compared to a non-chronological network like Facebook, the time of day you post on Twitter matters.

If your tweets are posted when your followers aren’t on the platform, those tweets won’t be seen, and less visibility means less engagement, less traffic, fewer followers.

The logical solution to this problem is to post when the most users are on the platform.

Sprout Social compiled data and found that average global engagement on Twitter is highest on Tuesday between 9 AM and 1 PM, Wednesday between 9 AM and 3 PM, Thursdays between 1 and 11 AM, and Fridays from 9 to 10 AM.

The problem is you’ve got a lot of other tweets to compete with during those times.

That’s where knowing your audience comes in handy.

Different demographic groups have different usage habits when it comes to Twitter.

For instance, there are differences between businesses and consumers.

Twitter content that targets businesses — or B2B content — performs best during business hours.

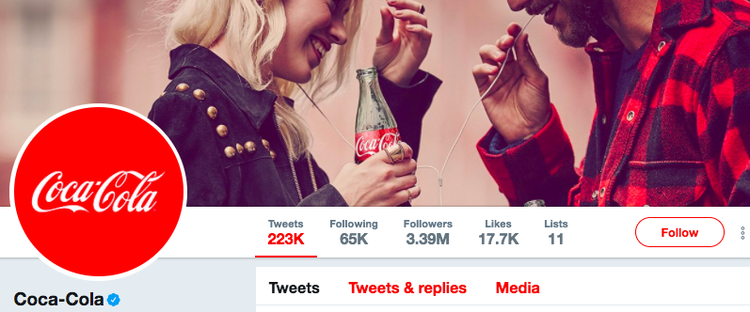

Content that’s consumer-oriented — or B2C content — performs better on the weekend, according to CoSchedule.

The same study also found that branded content does better overall on Wednesdays.

Branded content like this tweet from Coca-Cola:

Optimal performance on Twitter means knowing your audience and knowing when you can reach them.

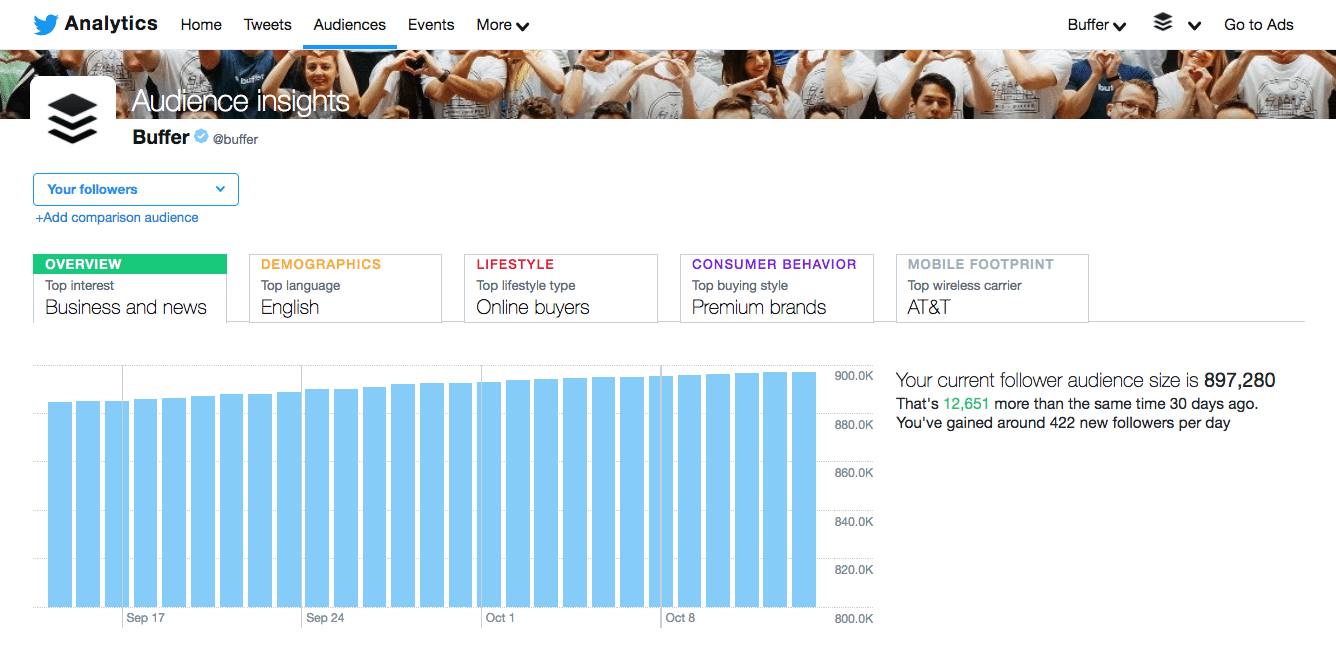

Twitter gives you an audience overview right inside the Twitter platform. With this information, you can tailor your content to your audience’s demographics and interests.

Just go to analytics.twitter.com for information about your audience, including what topics they’re into, what type of consumers they are, and even the wireless carriers they’re using.

With this information, you can choose the best times to tweet to your audience for optimal engagement and reach.

From this point, you can proceed in one of two ways:

You can make sure your daily Twitter routine coincides with your audience’s most active time of day, or you can schedule your tweets to post during that time.

Just know that you need a constant flow of content posting to Twitter, and the best resources to make that happen are readily-available data and possibly a tweet-scheduling app.

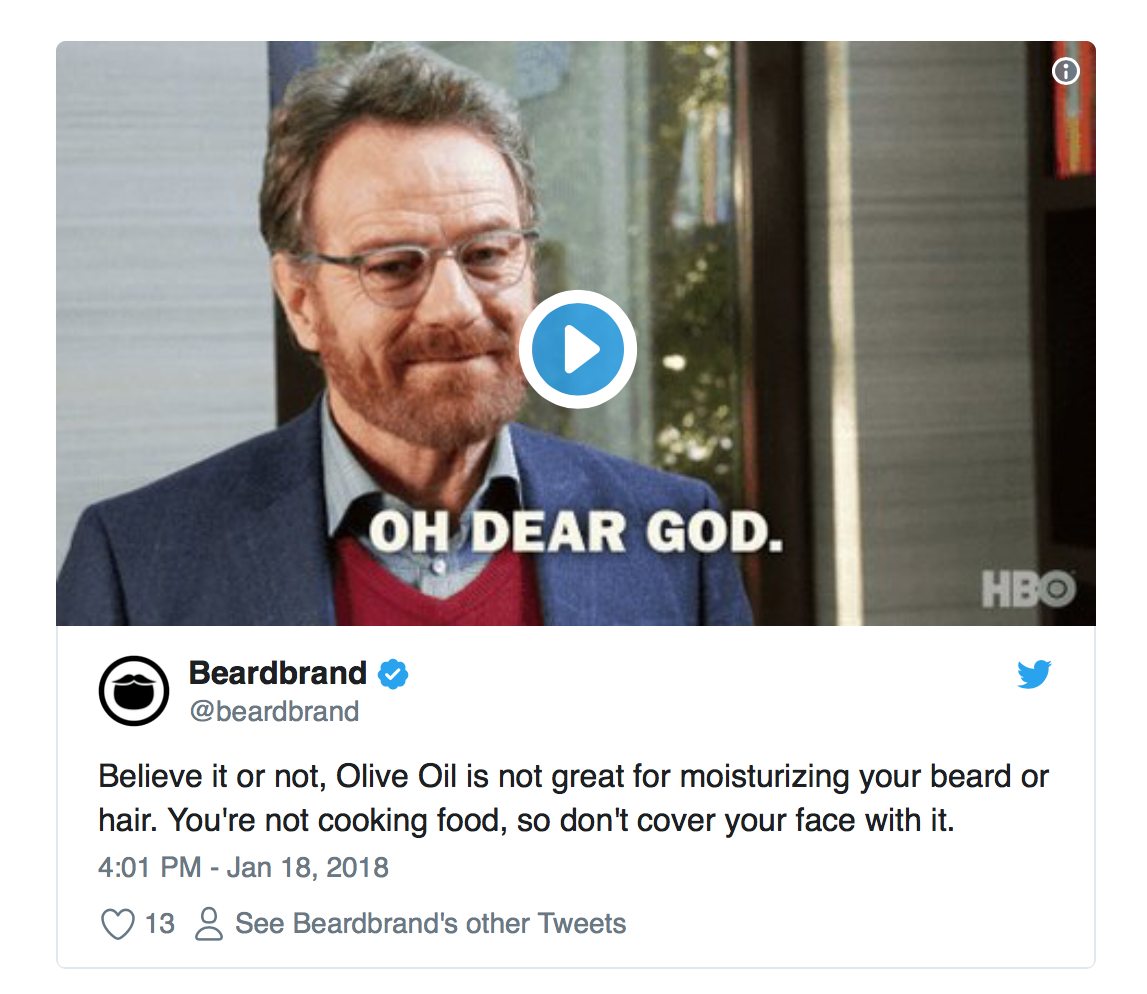

5. Make Sure There’s Value in Your Tweets

Twitter marketing is like any other type of marketing in that you’ll experience the greatest success with high-quality content.

With so much competition in most industries, great content helps you stand out from the crowd.

Great content is even more important when you’re trying to build your audience on Twitter.

It’s as simple as this:

Good tweets get likes, comments, shares, and followers. Bad tweets don’t.

So what separates a good tweet from a bad tweet?

Value.

Every time you tweet, you must provide value to your audience.

Because when your content is deemed valuable and relevant, your audience is more likely to connect with your brand.

Isn’t value subjective?

Yes, but only to the extent that what’s considered the most ‘valuable’ can vary from one person and demographic to the next.

It’s no lie that people tend to prefer content that’s informative or educational.

This can include an infographic, how-to article, or even current events coverage.

Others put more value on entertainment.

This can include things like memes, gifs, funny videos, or even the actual entertainment industry.

Then there are those who want to be inspired.

Inspirational content largely equates to popular quotes as well as inspirational true stories (weight loss, rescued animals, etc.).

Don’t forget interactive content.

Interactive content refers to things like polls, quizzes, web browser-based games, etc.

Another common type of content on Twitter is promotional.

Typically, promotional content consists of advertisements, coupons, customer testimonials, etc.

Each of these types of content represents a particular perspective in regards to value.

When people find value in your tweet, it gets more engagement. That’s just the way it works.

Of course, this is another reason why knowing your audience is important.

You gain a better sense of what they find valuable and can personalize your content accordingly.

6. Pick the Right Tweet to Pin to Your Profile

Pinning a tweet is like putting a spotlight on that tweet, calling the attention of anyone who visits your Twitter profile.

There are a couple of ways you can approach choosing the right tweet to pin to your profile.

The first strategy is to pin a tweet that has performed particularly well.

If it gained lots of attention from your followers when you initially posted it, the tweet will probably appeal to others who are visiting your profile.

It will certainly get more views and is likely to get more likes, comments, and shares as well.

Since new tweets push older tweets further down in your timeline, your newer followers are unlikely to ever see your best ones.

Pinning a tweet that was well-received by your followers will ensure that profile visitors and potential followers get to see it, too.

It’s also common to pin a tweet that highlights a temporary promotion or an upcoming event that your business is involved with.

When the promotion or event is over, you simply unpin the tweet and pin a new tweet for your next one.

Another strategy for choosing the right tweet to pin is to pick a tweet that promotes your business or brand.

For example, if you tweeted a link to an interview you participated in.

In effect, it’s actually someone else’s promotion of your brand or business, but you’re pinning it to highlight the value that others have placed on what your brand offers.

Much like a job interview or a business pitch, a pinned tweet gives you a small opening to make a big impression.

7. Link to your Twitter Account on Your Website and Other Social Media Profiles

It may seem counterproductive to be diverting traffic from your website to your Twitter profile.

After all, don’t you want traffic going to your website so they can make a purchase?

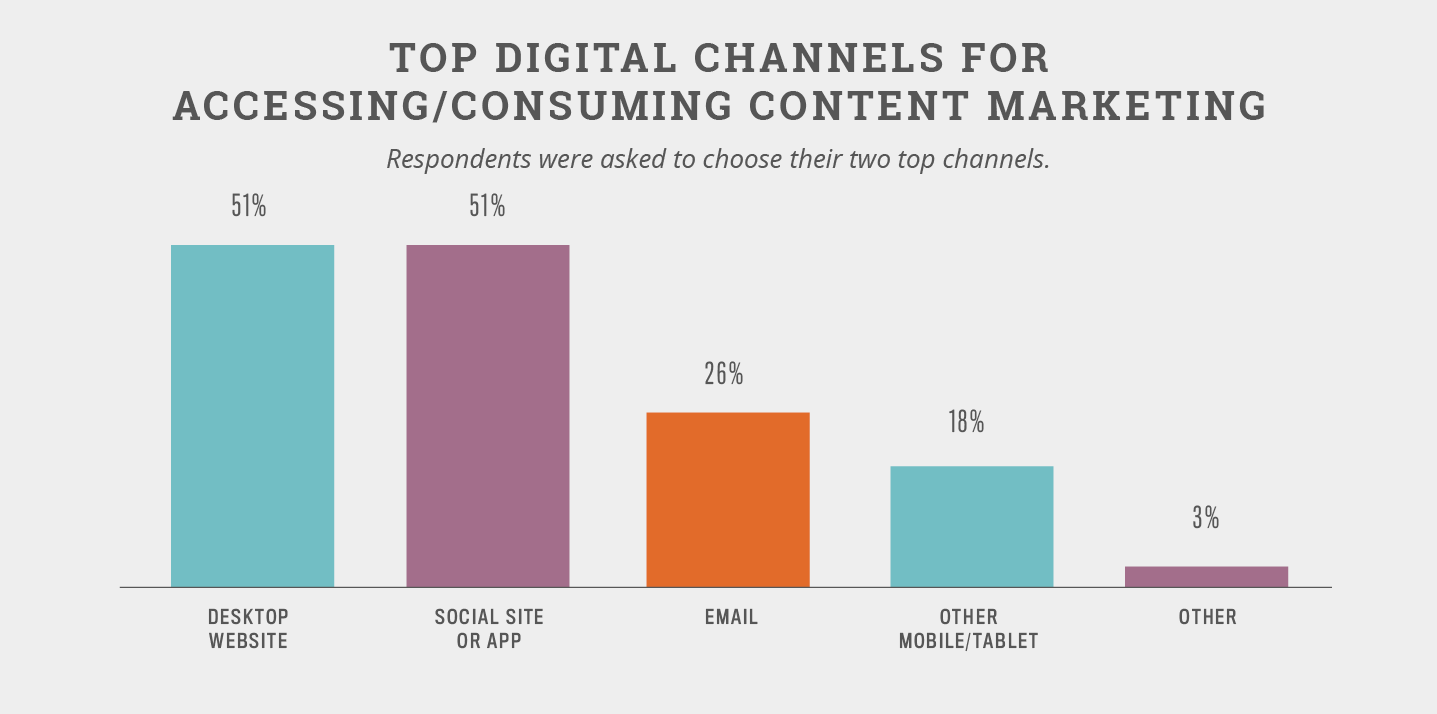

But surveys show your social media profiles are just as effective for content marketing as your own website.

This makes a lot of sense.

So to a large degree, sending traffic to your website actually gives you more opportunities for conversion.

Of course, you don’t want to simply drop a raw link into the body of your website.

Instead, you should link to your Twitter profile in a way that’s a bit more professional.

It could be as simple as attaching the link to an icon.

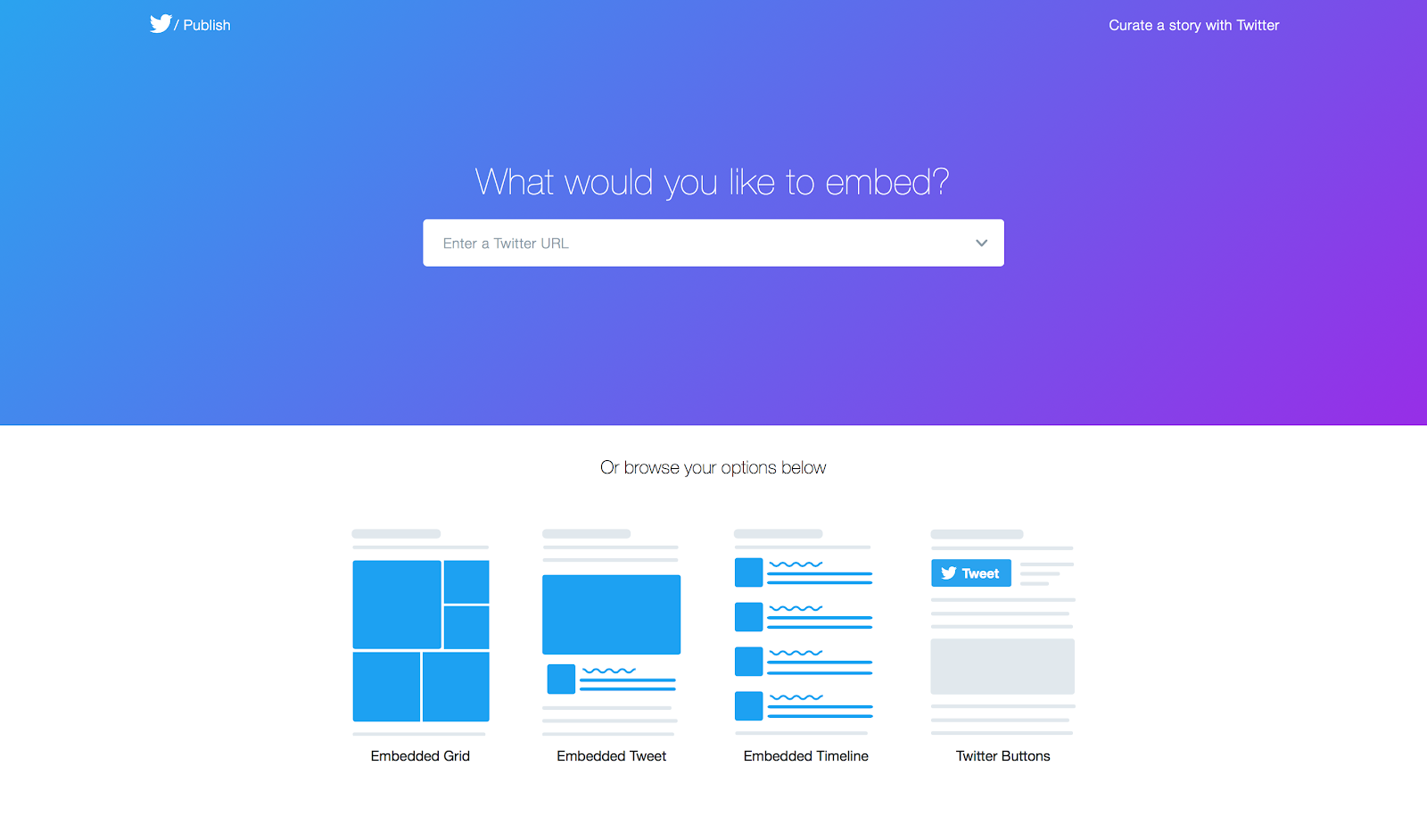

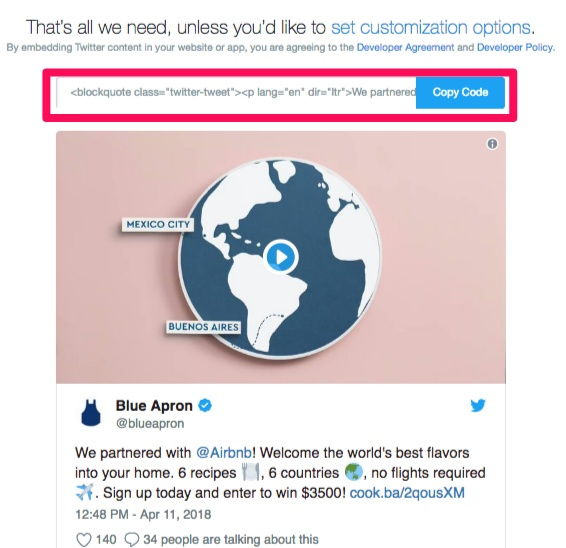

If you want something a little fancier, you could even link to your Twitter profile by embedding a tweet into your website or blog:

Simply go to publish.twitter.com where you’ll find options to embed a grid, tweet, timeline, or a button.

All you need to do is copy the link you want to use and paste it into the prompt at the top of the page.

Similarly, you should link to your Twitter profile on other social media.

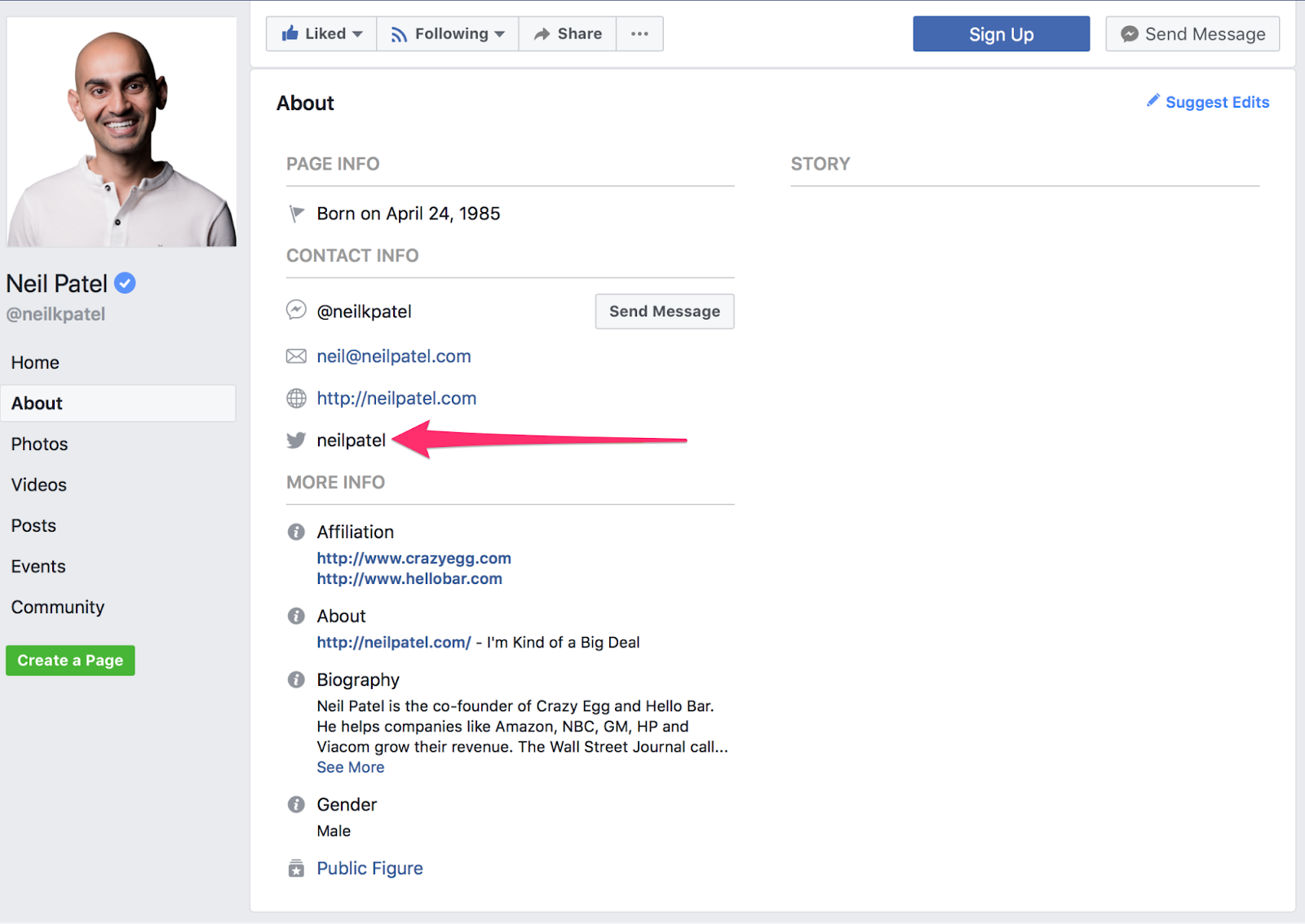

For example, Facebook gives you the option to include your Twitter username in a specific section of the ‘About’ section on your Page.

It gives any of your Facebook followers who also happen to use Twitter the ability to access your Twitter profile easily.

Because if you have people following you on other social networks, there’s a good chance that any of them using Twitter would want to follow you on that platform, too.

Gain Twitter Followers FAQs

What does my Twitter profile need to increase followers?

Make sure all available fields are completed, like your URL, name, and bio. Include applicable keywords or hashtags in your bio to get found by people searching.

How can I engage with my Twitter followers?

Engagement leads to increased reach and visibility, so be sure to answer mention tweets, participate in Twitter chats, and reply to tweets from accounts you follow.

How often should I tweet to increase Twitter followers?

Many studies recommend tweeting 5-15 times per day.

What should I tweet about?

Make sure your tweets offer value to your audience, either through knowledge, humor, customer support, and answering questions.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What does my Twitter profile need to increase followers?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Make sure all available fields are completed, like your URL, name, and bio. Include applicable keywords or hashtags in your bio to get found by people searching.”

}

}

, {

“@type”: “Question”,

“name”: “How can I engage with my Twitter followers?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Engagement leads to increased reach and visibility, so be sure to answer mention tweets, participate in Twitter chats, and reply to tweets from accounts you follow.”

}

}

, {

“@type”: “Question”,

“name”: “How often should I tweet to increase Twitter followers?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Many studies recommend tweeting 5-15 times per day.”

}

}

, {

“@type”: “Question”,

“name”: “What should I tweet about? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Make sure your tweets offer value to your audience, either through knowledge, humor, customer support, and answering questions.”

}

}

]

}

How to Get 10,000 Twitter Followers Conclusion

Twitter is an international platform with millions of users. It’s just as valuable (if not more valuable) for racking up an audience than sites like Instagram or Facebook.

Getting as many as 10,000 Twitter followers doesn’t have to be hard.

First, you need to optimize your profile. Add a high-quality profile picture, since it’s the first thing people will see when they come across your brand on Twitter.

Complete your bio and don’t forget a header image, too.

Start engaging with your followers by responding to comments, mentions, direct messages, and live chats.

Create a Twitter routine you can stick to. If you aren’t active, your engagement will dip. Make a daily, weekly, or monthly Twitter schedule.

Make sure that what you’re sharing is valuable. Share interactive content, like a poll, quiz, or infographic for best results.

Pin a relevant tweet to your profile. If you have an ongoing promotion or upcoming event, tweet about it and pin it to the top of your page.

Finally, be sure to link your Twitter account to your website and on your other social profiles for maximum exposure.

Each of these steps will result in substantial growth but put them together, and you are likely to see some pretty phenomenal gains.

What are your favorite Twitter follower growth hacks?

Six Steps to Launching Your New Content-Based Project

The new year is upon us and it is safe to assume that most of us were looking forward to it. Are you read for making your resolutions happen? If you are one of many …

The post Six Steps to Launching Your New Content-Based Project appeared first on Paper.li blog.

5 Steps to Get a Business Credit Card, Bad Credit or Not

If you have bad personal credit, you may find yourself struggling to get a business credit card. The key to getting a business credit card, bad credit or not, is business credit.

You Can Get a Business Credit Card, Bad Credit Not Being an Issue

You’re likely aware business credit is a good thing. You know you need it to help you fund your business. But do you know how it helps you specifically get credit cards, even if you have bad personal credit? Furthermore, do you know how to get it?

How Do You Get Business Credit?

Business credit doesn’t just happen like personal credit does. You have to work to build business credit intentionally. While not hard, it is a process, and a time consuming one at that. The sooner you start the better, especially if you need a business credit card, bad credit being an issue.

Business Credit Card Bad Credit: Separation is Key

First thing’s first. You have to establish your business as an entity separate from yourself the owner. This means not using your own name or address. That doesn’t mean you have to get a separate phone line, or even a separate location.

You do need separate contact information however. You can get a business phone number pretty easily that will work over the internet instead of phone lines. In addition, the phone number will forward to any phone you want it too so you can simply use your personal cell phone or landline if you want. Whenever someone calls your business number it will ring straight to you.

You can use a virtual office for a business address. This is a business that offers a physical address for a fee, and sometimes they even offer mail service and live receptionist services. In addition, there are some that offer meeting spaces for those times you may need to meet a client or customer in person.

Learn more here and start building business credit with your company’s EIN, not your SSN.

Business Credit Card Bad Credit: EIN not SSN

The next thing you need to do is get an EIN for your business. This is an identifying number for your business that works in a way similar to how your SSN works for you personally. Some business owners used their SSN for their business. This is what a lot of sole proprietorships and partnerships do. However, it really doesn’t look professional to lenders, and it can cause your personal and business credit to get all mixed up. You can get one for free from the IRS.

This step is vital. When you apply for a business credit card, bad credit can get in the way mainly because your SSN signals a look at your personal credit. If you use your EIN instead of your SSN, the lender will only be seeing the credit attached to your business.

Business Credit Card Bad Credit: Incorporation is Not Optional

Incorporating your business as an LLC, S-corp, or corporation is necessary for separation of business from the owner, and many other things. . It lends credence to your business as one that is legitimate. It also offers some protection from liability.

Which option you choose does not matter as much for these purposes as it does for your budget and needs for liability protection. The best thing to do is talk to your attorney or a tax professional.

Business Credit Card Bad Credit: Separate Bank Account

You have to open a separate, dedicated business bank account. There are a few reasons for this. First it helps solidify the separation between yourself and your business. Also, it will help you keep track of business finances. This is important for tax purposes.

There’s more to it however. There are several types of funding you cannot get without a business bank account. Many lenders and credit cards want to see one with a minimum average balance. In addition, you cannot get a merchant account without a business account at a bank. That means, you cannot take credit card payments. Studies show consumers tend to spend more when they can pay by credit card.

Learn more here and start building business credit with your company’s EIN, not your SSN.

Business Credit Card Bad Credit: Starter Vendors

Now, once you have these things in place, you need to get accounts that will report your payments to the business credit agencies. It sounds easy enough, but the catch is, you have to find vendors that will extend credit without you first having credit.

We call these vendors starter vendors. They will extend net terms on invoices with little requirement. They don’t check credit. Typically, they require a certain number of days in business, a minimum average balance in a business bank account, minimum annual revenue, or some combination of these things.

Extending the credit isn’t enough however. There are some that do this, but there are far fewer that will actually report those payments. You need vendors to report payments to the business credit reporting agencies, thus building your business credit score.

The Snowball Effect

Of course you are wondering what any of this has to do with applying for a business credit card, bad credit being in the way. Here’s how. Once you have several of these starter vendor accounts reporting, your score will be strong enough to support store credit.

A business store account is usually issued for that specific store or website specifically. Their limits are usually on the lower side as well. However, after you get a few of them and use them responsibly. Your score will grow even strong. These are cards from places like Home Depot, Staples, or Best Buy.

Then, you should qualify for fleet credit. These are cards from places like Shell that are used specifically for gasoline and automotive repair and maintenance.

After a few of those are reporting your consistent, on-time payments, you should have a strong business credit score and be able to apply for standard business credit cards that are not limited by where you use them or what you use them to buy. By using your EIN and not your SSN, you can get a business credit card, bad credit on your personal credit report and all. It’s all a big snowball effect.

Learn more here and start building business credit with your company’s EIN, not your SSN.

In the Interim

In the meantime, you can give your business credit building efforts a kickstart with a card like the Brex card for startups. It is one of the few true options if you are looking for a business credit card, back credit not being an issue. Even a FICO as low as 300 may qualify. There is no annual fee, and you can apply with your EIN rather than your SSN. There is no personal guarantee requirement.

The only catch is, not all industries qualify, and some industries require more paperwork than others.

You could also try getting accounts that you already have a relationship with to report to the business credit reporting agencies. This could be vendors you work with already. Maybe ask them if they will consider net terms and reporting payments. If you already make your payments consistently on time, they may be willing to do so without a credit check.

You could also consider asking utilities that you already pay regularly to report your payments. They may say no. They don’t have to do it. But they might, and if they do it can only help your business credit grow faster.

A credit line hybrid can be another great option to help speed things along. You have to have a 680 or better personal credit score, but you can take on a credit partner if you don’t meet that. The account still reports to your business credit, so you can keep building your score. And, you can get up to $150,000 unsecured financing for your business.

An Expert Can Help You Through the Steps

It sounds easy enough to do all of this on your own. However, there are some steps that are easier than others. Specifically, it can be very difficult to find starter vendors that will report to your business credit. For this and other difficult steps, it can be very helpful to have a business credit expert help you out. It’s definitely worth considering.

The post 5 Steps to Get a Business Credit Card, Bad Credit or Not appeared first on Credit Suite.