Article URL: https://newstorycharity.org/careers/digital-marketer

Comments URL: https://news.ycombinator.com/item?id=24236375

Points: 1

# Comments: 0

Article URL: https://newstorycharity.org/careers/digital-marketer

Comments URL: https://news.ycombinator.com/item?id=24236375

Points: 1

# Comments: 0

Are you looking for a merchant cash advance bad credit notwithstanding? A merchant cash advance is a way to get money for your business quickly. You do so by borrowing against your future credit card sales. Because your personal credit score does not matter, you really can get a merchant cash advance bad credit or any kind of credit.

One thing about a merchant cash advance bad credit is that it is probably not going to be helpful during an economic downturn. They may even be impossible to get during a recession. But in a better economy, they are a proven way to fund a business and keep your doors open.

These loans use your past and current credit card history to determine how much financing you can get approval for.

Money is advanced to you. The amount has a basis in how much you process each month in credit card transactions.

A small portion of each future credit card sale goes towards paying back the merchant advance loan. It does not interfere with your cash and check receipts.

There are no fixed repayment amounts or terms for merchant cash and capital. So this gives flexibility to your business if you are having a slow month.

One of the best benefits of merchant advances is you can get money in your bank account. So you can get it as soon as 24 hours after approval.

The chief benefit of a merchant cash advance bad credit is you do not have to have good credit to qualify. These loans leverage your positive credit card processing history to get you approval, not your credit scores.

There are some credit score restrictions, but in most cases, you can get approval with even below average personal credit scores.

And there is no personal guarantee necessary. Plus, no collateral is necessary.

Demolish your funding problems with 27 killer ways to get cash for your business.

You can get merchant loans for up to $150,000. How much you process in credit card transactions each month will determine how much you will get approval for.

So, every business has its strengths and weaknesses.

Do you use credit cards as a payment source for your clients? If so, then a merchant advance can be the perfect way for you to get a lot of money in a short period of time.

These loans are available for businesses that process as low as $3,500 monthly in credit card transactions. So the more you process, the higher advance loan you will get approval for.

So there are no application fees and there are no out of pocket costs for merchant cash advance relief.

And you can use the funds for payroll, marketing, or to increase business inventory. Get a loan to pay taxes, pay rent, or for advertising. So, try a loan to order supplies and equipment. Or you can expand your business and open an additional location. Or you can use the funds for working capital.

Company credit is credit in a small business’s name. It doesn’t link to an entrepreneur’s personal credit, not even if the owner is a sole proprietor and the only employee of the company.

As a result, an entrepreneur’s business and personal credit scores can be quite different.

Because small business credit is distinct from consumer, it helps to protect a business owner’s personal assets, in the event of litigation or business bankruptcy.

Also, with two distinct credit scores, a business owner can get two different cards from the same vendor. This effectively doubles buying power.

Another benefit is that even startup businesses can do this. Visiting a bank for a business loan can be a recipe for frustration. But building company credit, when done right, is a plan for success.

Consumer credit scores depend upon payments but also additional considerations like credit usage percentages.

But for business credit, the scores actually merely hinge on if a company pays its debts on time.

Establishing small business credit is a process. It does not happen automatically. A business needs to proactively work to establish small business credit.

Yet, it can be done readily and quickly, and it is much speedier than developing consumer credit scores.

Merchants are a big component of this process.

Doing the steps out of order leads to repetitive rejections. No one can start at the top with small business credit. For example, you can’t start with retail or cash credit from your bank. If you do, you’ll get a rejection 100% of the time.

Demolish your funding problems with 27 killer ways to get cash for your business.

A small business needs to be fundable to loan providers and vendors.

That’s why, a business needs a professional-looking website and e-mail address. And it needs to have site hosting bought from a vendor like GoDaddy.

Also, business phone and fax numbers need to have a listing on 411. You can do that here: http://www.listyourself.net.

In addition, the business telephone number should be toll-free (800 exchange or comparable).

A business also needs a bank account devoted solely to it, and it must have all of the licenses necessary for operating.

These licenses all have to be in the perfect, appropriate name of the business. And they must have the same small business address and phone numbers.

So note, that this means not just state licenses, but potentially also city licenses.

Visit the IRS web site and get an EIN for the business. They’re free of charge. Pick a business entity like corporation, LLC, etc.

A business may begin as a sole proprietor. But they absolutely need to switch to a sort of corporation or an LLC.

This is to minimize risk. And it will make best use of tax benefits.

A business entity matters when it concerns taxes and liability in case of litigation. A sole proprietorship means the entrepreneur is it when it comes to liability and taxes. No one else is responsible.

The best thing to do is to incorporate. You should only look at a DBA as an interim step on the way to incorporation.

Begin at the D&B website and get a cost-free D-U-N-S number. A D-U-N-S number is how D&B gets a company into their system, to produce a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s sites for the small business. You can do this at www.creditsuite.com/reports. If there is a record with them, check it for correctness and completeness. If there are no records with them, go to the next step in the process.

In this way, Experian and Equifax have activity to report on.

First you should build tradelines that report. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can start to get credit for numerous purposes, and from all sorts of places.

These sorts of accounts have the tendency to be for things bought all the time, like marketing materials, shipping boxes, outdoor work wear, ink and toner, and office furniture.

But to start with, what is trade credit? These trade lines are credit issuers who give you starter credit when you have none now. Terms are generally Net 30, rather than revolving.

Hence, if you get an approval for $1,000 in vendor credit and use all of it, you must pay that money back in a set term, like within 30 days on a Net 30 account.

Net 30 accounts need to be paid in full within 30 days. 60 accounts need to be paid fully within 60 days. In comparison with revolving accounts, you have a set time when you must pay back what you borrowed or the credit you made use of.

To kick off your business credit profile the proper way, you ought to get approval for vendor accounts that report to the business credit reporting bureaus. When that’s done, you can then use the credit.

Then pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Not every vendor can help in the same way true starter credit can. These are vendors that grant approval with a minimum of effort. You also need them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

As you get starter credit, you can also start to get credit from retailers. This is to continue to confirm you are trustworthy and pay on time. Here are some stellar choices from us: https://www.creditsuite.com/blog/5-vendor-accounts-that-build-your-business-credit/

Store credit comes from a variety of retail businesses.

You must use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, use the company’s EIN on these credit applications.

Fleet credit is from service providers where you can purchase fuel, and repair and take care of vehicles. You must use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, make certain to apply using the company’s EIN.

These are companies such as Visa and MasterCard. You must use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, use your EIN instead.

These are typically MasterCard credit cards.

Know what is happening with your credit. Make certain it is being reported and address any mistakes as soon as possible. Get in the habit of taking a look at credit reports. Dig into the specifics, not just the scores.

We can help you monitor business credit at Experian and D&B for 90% less than it would cost you at the CRAs.

At Equifax, you can monitor your account at: www.equifax.com/business/business-credit-monitor-small-business.

Demolish your funding problems with 27 killer ways to get cash for your business.

So, what’s all this monitoring for? It’s to challenge any inaccuracies in your records. Mistakes in your credit report(s) can be corrected. But the CRAs usually want you to dispute in a particular way.

Disputing credit report inaccuracies usually means you send a paper letter with copies of any proof of payment with it. These are documents like receipts and cancelled checks. Never send the original copies. Always mail copies and retain the original copies.

Fixing credit report errors also means you precisely spell out any charges you challenge. Make your dispute letter as understandable as possible. Be specific about the problems with your report. Use certified mail to have proof that you sent in your dispute.

Always use credit smartly! Never borrow beyond what you can pay off. Monitor balances and deadlines for repayments. Paying on time and in full does more to raise business credit scores than pretty much anything else.

Establishing company credit pays. Great business credit scores help a company get loans. Your lender knows the business can pay its debts. They know the small business is authentic.

The business’s EIN connects to high scores and loan providers won’t feel the need to demand a personal guarantee.

Merchant cash advances are a creative way to leverage future sales. They can help your business get past a financial hurdle. And don’t forget about building company credit! Because even when business cash advances are hard to get, you can build business credit. And your merchant cash advance bad credit could even be enhanced by business credit.

The post Get a Merchant Cash Advance Bad Credit No Problem appeared first on Credit Suite.

The Federal government recently passed the CARES Act. CARES stand for Coronavirus Aid, Relief, and Economic Security Act. This bill addresses and responds to the economic impacts of the COVID-19 outbreak. It authorizes emergency loans to distressed businesses by providing federal funding for forgivable bridge loans, as well as for grants and technical assistance.

Note: the PPP keeps changing, and money sometimes is held up in Congress. Fundability, on the other hand, is achievable and helpful no matter what Congress is doing.

Paycheck Protection Program Loans and Economic Injury Disaster Loans are both included in the CARES Act as help for small business owners. What are the SBA loan requirements for each of these business funding programs, and do you qualify?

Want to review your options with one of our consultants? Give us a call at 877-600-2487.

The Paycheck Protection Program is a business lending program. It is designed to help businesses keep paying employees even when they are shut down due to the coronavirus pandemic. Allowable uses of funds include:

The annual percentage rate for these loans is 1%. You do not make any payments for the first 6 months. However, interest does accrue during this time. Loans issues before June 5 must be paid within 2 years. If your loan was issued after June 5, the loan matures in 5 years rather than 2. These loans are up to 100% forgivable with approval.

To request forgiveness, you will submit a request to the lender that is servicing the loan. It should include documents that verify the number of full-time employees and pay rates. Also, you will need to verify the payments on eligible mortgage, lease, and utility obligations. You have to certify that the documents are true. In addition, you will have to show that you used the forgiveness amount to keep employees. If not, you will have to show the funds were used to make eligible mortgage interest, rent, or utility payments. The lender must make a decision on the forgiveness within 60 days.

First, the program was recently extended to stay open through August 8, 2020. Not only does that not give you a lot of time, but you need to apply as soon as possible anyway. There is a cap on the funding, and processing applications will take time. Consequently, some lenders are limiting the number of applications they will accept in a single day.

Existing SBA lenders started accepting applications on April 3, 2020 from small businesses and sole proprietorships with less than 500 employees. Beginning on April 10, independent contractors and individuals that are self- employees were able to apply through SBA lenders.

Other lenders besides those that are currently working with the SBA are able to get in on the fun as well. In an effort to relieve some of the burden of processing, other lenders are able to enroll in the program and will be able to start accepting applications as soon as they get approval. There is a list of participating lenders, by state, at SBA.gov.

It’s pretty straight forward. If you meet the SBA definition of a small business or contractor, you just have to make a few good faith certifications. These include:

Want to review your options with one of our consultants? Give us a call at 877-600-2487.

These are funds you apply for directly from the SBA. They can be used to cover the following expenses:

These loans are available up to $2 million dollars at an annual percentage rate of 3.75%. The terms go up to 30 years. These are not forgivable loans.

Let’s start with what not to do. Do not get in your car and drive to the bank. While most lenders are back open for business inside, it is best to have an appointment to handle a PPP application. Even getting an appointment can take a while however.

The best option is to find someone, a middle man, to help you navigate these loan programs. This way you ensure you get the best lender for you, and you get your SBA coronavirus relief funds as soon as possible.

In addition to the above relief for businesses, the CARES Act also provided relief for individuals. The bill also provided funding for $1,200 tax rebates to individuals, with additional $500 payments per qualifying child. The rebate phases out when incomes exceed $75,000,or $150,000 for joint filers. Most of these payments have already been distributed, but some are still waiting for theirs. The bill also establishes limits on requirements for employers to provide paid leave.

With respect to taxes, the bill establishes special rules for certain tax-favored withdrawals from retirement plans. It also delays due dates for employer payroll taxes and estimated tax payments for corporations.

The bill also authorizes the Department of the Treasury to temporarily guarantee money-market funds.

Here are the facts. The federal government does not want to see a collapse of the economy any more than we do. They want to do what they can to help small businesses. They are taking steps to do just that.

State governments are in the same boat. They want to ensure their states are able to survive and thrive economically despite the coronavirus business impact.

Here’s the bad news, as if you didn’t already know. Businesses lost tons of income during the shut downs caused by the virus. Even opeinig back up, people aren’t going out as much as they did pre-pandemic. Even more, some states and cities are shutting down certain businesses again. Spending is vastly curtailed. Without a steady flow of income, eventually businesses will not be able to make payments on existing debt.

The good news in light of all of this darkness is that no one wants this to happen. That means measures are being taken to try and stop the spiral. These include those mentioned above. It’s not just the Federal and state governments that are coming to the rescue however. Local governments, along with many charitable and professional organizations, are tossing in life rafts as well.

However, you have to do your part. You aren’t helpless, though it likely very much seems this way. First, do everything you can to access all the help you can now. Find someone that can walk you through the process to ensure you get all you can as fast as you can.

However, you have to do your part. You aren’t helpless, though it likely very much seems this way. First, do everything you can to access all the help you can now. Find someone that can walk you through the process to ensure you get all you can as fast as you can.

That’s not the end of the story however. You need to do all you can to make certain you can get back to business as usual as fast as you can when this is all over. How do you do that? You need to adapt your business to the current situation. The relief funds can help you. With those funds, you can do many things to not only keep your business afloat, but to make it stronger than ever.

These are the times that breed creativity and innovation. Use the funds to keep your employees on board, but don’t forget you can use them as well. Is there some way you and your employees can provide products and services for your customers? Can you do anything online or go to customers’ homes?

For example, some local bakeries and ice cream shops have been taking food trucks out to neighborhoods during this time to increase sales. To aid in social distancing, they take orders online first, and of course take all protective precautions.

Beauticians and barbers that are even allowed to open are having to reduce the number of clients they can serve at one time. Of course, they are taking all necessary safety measures to ensure that disease isn’t spreading. Gyms are offering online fitness classes for their members since they cannot have as many people inside at one time. Pet groomers are going mobile even if they do not usually provide mobile services. Speech therapists, counselors, and more are working via video chat. Small boutiques are doing giveaways online and offering curbside pickup to reach those that are not comfortable getting out yet. There are options, and these funds can help you take advantage!

The relief funds available through the CARES Act are available to both businesses and those that are self-employed. However, beyond this, a business has to be fundable to get financing to build, grow, and thrive. This will still be the case long after COVID-19 has passed. Now is a great time to assess the fundability of your business and make changes to improve it if need be.

The first part of this process includes making sure your business is set up to be fundable. What does that mean? It means that your business:

That doesn’t mean you have to get a separate phone line, or even a separate location. You can still run your business from your home or on your computer if that is what you want. You do not even have to have a fax machine.

Want to review your options with one of our consultants? Give us a call at 877-600-2487.

The next thing you need to do is get an EIN for your business. This is an identifying number for your business that works in a way similar to how your SSN works for you personally. You can get one for free from the IRS.

Incorporating your business as an LLC, S-corp, or corporation is necessary to fundability. It lends credence to your business as one that is legitimate. It also offers some protection from liability.

You have to open a separate, dedicated business bank account. There are a few reasons for this. First, it will help you keep track of business finances. It will also help you keep them separate from personal finances for tax purposes. In light of SBA loan requirements, it can help you prove how you used loan funds for the purpose of qualifying for loan forgiveness.

For a business to be legitimate it has to have all of the necessary licenses it needs to run. If it doesn’t, red flags are going to fly up all over the place. Do the research you need to do to ensure you have all of the licenses necessary to legitimately run your business at the federal, state, and local levels.

What does this have to do with anything. Well in light of the COVID-19 pandemic, a website can help you stay operational despite social distancing standards. Not just any website will do however. You need to make sure it is professional and that it is easy for your customers to use. Likely, this means you need to hire someone to help you with this. The cost is well worth it.

This doesn’t have to be the end of your business story. Help is available and you do have options. At this point, the very first thing you need to do is find help to navigate the SBA resources available to you. Next, be sure you use the resources in a way that your business comes out even stronger. Lastly, use this downtime wisely. Take a look at the fundability of your business and see what you can do to improve it. Then, when the time comes, you will be able to sail out of the storm and into the light.

The post Your Complete Guide to SBA Loan Requirements and the Paycheck Protection Program appeared first on Credit Suite.

AWS Security| Software Development Engineer | Arlington, VA | Full-Time | VISA | ONSITE (remote for now) I’m the Hiring manager for this role, not a recruiter. Contact me directly first and I’ll make the referral. Looking for an experience SDE who wants to get on the ground floor of an exciting opportunity in the …

Placing Your Money Where Your Small Business Mouth Is With Secured Lending Protected financing is almost take the chance of totally free financing and also a lot the chosen kind of finance for the banks or home mortgage business. For many personal people, the most significant car loan they will certainly obtain is their residence …

Pulsar | Digital Marketing Lead | ONSITE in London, NYC or L.A. | Fulltime

Pulsar is an audience intelligence company: we help organizations understand their audiences and spot trends for better insights & marketing strategy.

We’re looking for a bright, organized junior marketer to execute and manage web, email and growth campaigns.

About you:

• you know your way around HubSpot, WordPress & Google Analytics

• you have run a variety of marketing campaigns from start to finish

• you know how to use PowerPoint, InDesign and Adobe Illustrator

Other skills that are not required but would make you stand out:

• an understanding of HTML/CSS, JavaScript, PhP

• an understanding of SEO, PPC, display, and paid social campaigns

• a familiarity with video production tools

Full job post: https://www.pulsarplatform.com/career/digital-marketing-lead…

Email your application at marketing@pulsarplatform.com

Thanks 🙂

You

all know SEO is a long-term game… at least when it comes to Google.

And yes, who doesn’t want to be at the top of Google for some of the most competitive terms? But the reality is, we don’t all have the budget or time.

So

then, what should you do?

Well, what if I told you there were simple ways to get more organic traffic and, best of all, you don’t have to do one bit of SEO?

Seriously.

So,

what is it? And how can you get more organic traffic?

Well,

this story will help explain it…

When

I first started my journey as an SEO, I got really good at one thing.

Getting

rankings!

Now to be fair, this was back in 2003 when it wasn’t that hard to rank on Google (or any other search engine for that matter).

Stuff some keywords into your page, your meta tags, and build some spammy rich anchor text links and you were good to go.

You

could literally see results in less than a month.

SEO wasn’t too complicated back then. So much so, that I even started an SEO agency and created a handful of sites.

I was starting to rank my sites at the top of Google but they didn’t make a dollar. Literally, not a single dollar.

In fact, I was actually losing money on them because I had to pay for the domain registration expenses and hosting.

So, one day I decided that I was tired of losing money and I was going to do something about it. I took the keywords that I was ranking for and started to type them into Google to see who was paying for ads for those terms.

I hit up each of those sites and tried to get a hold of the owner or the person in charge of marketing.

I asked them how much they were paying for ads and offered them the same exact traffic for a much lower price. I was able to do this because I already had sites that ranked for those keywords.

In other words, I offered to rent out my website for a monthly fee that was a fraction of what they were paying for paid ads.

Next thing you know I was collecting 5 figures in monthly checks and my “renters” were ecstatic because they were generating sales at a fraction of the costs compared to what they were spending on paid ads.

Well, it’s simple. Back in the day, I used to rent out my websites… the whole site.

These

days I’ve learned how to monetize my own site, so I don’t rent them out.

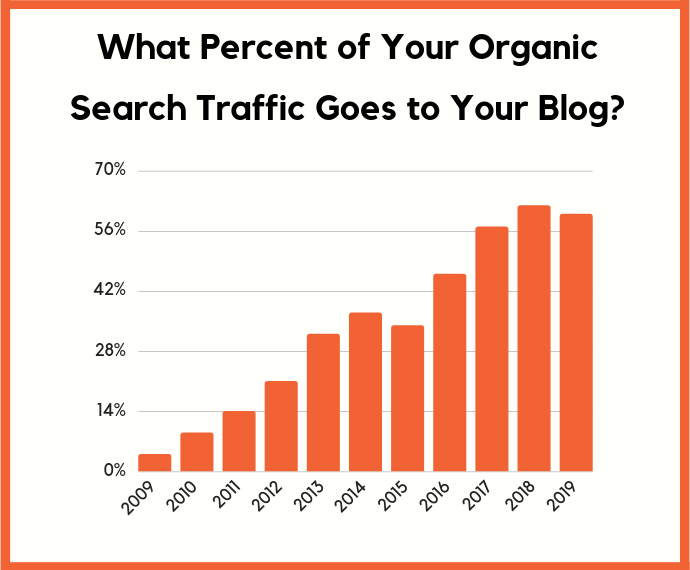

But you know what, most of the sites that rank on Google are content-based sites. Over 56% of a website’s organic traffic is typically going to their blog or articles.

So why not rent a page on someone else’s site? From there, modify that page a bit to promote your products or services?

I

know this sounds crazy, but it works. I have one person that just reaches out

to site owners asking if we can rent out a page on their site. We do this for

all industries and verticals… and when I look at how much we are spending

versus how much income we are generating, it’s crazy.

Here are the stats for the last month:

Rental

fees: $24,592

Outreach costs: $3,000

Legal

costs: $580

Copywriting

and monetization costs: $1,500

Total

monthly cost: $29,672

Now

guess what my monthly income was?

It

was $79,283.58.

Not

too bad.

Now

your cost on this model won’t be as high as mine because you can do your own

outreach, monetize the page you are renting on your own, and you probably don’t

need a lawyer.

And don’t be afraid of how much I am spending in rental fees as you can get away with spending $0 in the first 30 days as I will show you exactly what to do.

Remember, it’s also not what you are spending, it’s about profit and what you are making. If it won’t cost you any money in the first 30 days and you can generate income, your risk is little to none.

Here

are the exact steps you need to follow:

If

you already know the terms you want to rank for, great, you can skip this step.

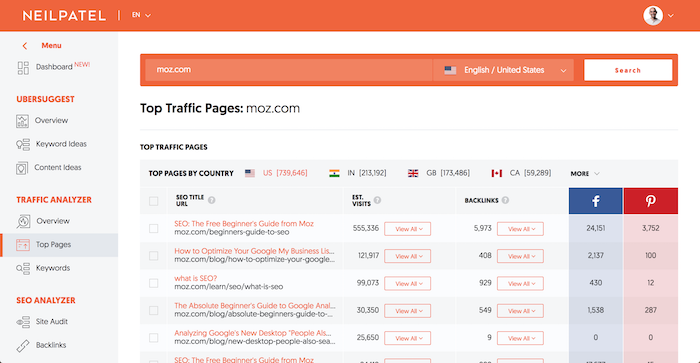

If you don’t, I want you to head to Ubersuggest and type in a few of your competitors’ URLs.

Head

over to the top pages report and look at their top pages.

Now

click on “view all” under the estimated visits column to see a list of

keywords that each page ranks for.

I want you to create a list of all of the keywords that contain a high search volume and have a high CPC. Keywords with a high CPC usually mean that they convert well.

Keywords

with a low CPC usually mean they don’t convert as well.

When

you are making a list of keywords, you’ll need to make sure that you have a

product or service that is related to each keyword. If you don’t then you won’t

be able to monetize the traffic.

It’s

time to do some Google searches.

Look

for all of the pages that rank in the top 10 for the term you ideally want to

rank for.

Don’t

waste your time with page 2.

What

I want you to look for is:

Typically, through their contact page, they should have their email addresses or phone number listed. If they have a contact form, you can get in touch that way as well.

If

you can’t find their details, you can do a whois

lookup to see if you can find their phone number.

What’ll

you want to do is get them on the phone. DO NOT MAKE YOUR PITCH OVER EMAIL.

It

just doesn’t work well over email.

If

you can’t find their phone number, email them with a message that goes

something like this…

Subject: [their website name]

Hey [insert first name],

Do you have time for a quick call this week?

We’ve been researching your business and we would like to potentially make you an offer.

Let me know what works for you.

Cheers,

[insert your name]

[insert your company]

[insert your phone number]

You

want to keep the email short as I have found that it tends to generate more

calls.

Once you get them on the phone, you can tell them a little bit about yourself. Once you do that, tell them that you noticed they have a page or multiple pages on their website that interest you.

Point

out the URL and tell them how you are interested in giving them money each

month to rent out the page and you wouldn’t change much of it… but you need

some more information before you can make your offer.

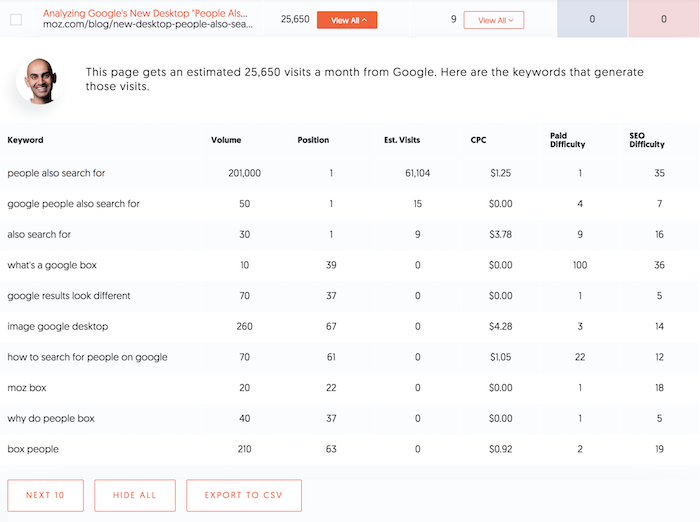

At this point, you’ll want to find out how much traffic that page generates and the keywords it ranks for. They should have an idea by just looking at their Google Analytics (you’ll find most of these sites don’t use Google Search Console).

Once

you have that, let them know that you will get in touch with them in the next

few days after you run some numbers.

Go back, try to figure out what each click is worth based on a conservative conversion rate of .5%. In other words, .if 5% of that traffic converted into a customer, what would the traffic be worth to you after all expenses?

You’ll

want to use a conservative number because you can’t modify the page too

heavily or else you may lose rankings.

Once

you have a rough idea of what the page is worth, get back on the phone with

them and say you want to run tests for 30 days to get a more solid number on

what you can pay them as you want to give them a fair offer.

Typically,

most people don’t have an issue because they aren’t making money from the page

in the first place.

If

you are selling a product, the easiest way to monetize is to add links to the

products you are selling.

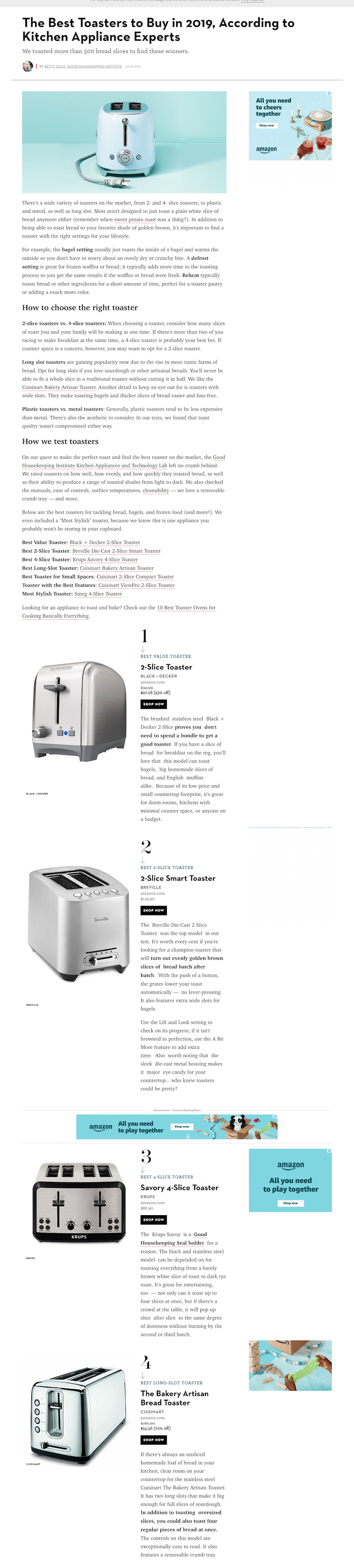

For

example, if you are selling a kitchen appliance like a toaster, you can add

links from the article to your site.

The easiest way to monetize a blog post is to add links to products or services you are selling.

Don’t delete a lot of the content on the page you are modifying… adding isn’t too much of an issue but when you delete content sometimes you will lose rankings.

As

for a service-based business, linking out to pages on your site where people

can fill out their lead information is great.

Or you can just add lead capturing to the page you are renting out. Kind of like how HubSpot adds lead forms on their site.

I’ve actually found that they convert better than just linking out to your site.

When monetizing the page you are renting, keep in mind that you will need disclaimers to let people know that you are collecting their information for privacy purposes. You also should disclose you are renting out the page and nofollow the links.

Once you are monetizing the page for a bit, you’ll have a rough idea of what it is worth and you can make an offer on what you’ll page.

I recommend doing a 12-month contract in which you can opt-out

with a 30-day notice.

The reason you want a 12-month agreement is that you don’t want to have to keep renegotiating. I also include the 30-day opt-out notice in case they lose their rankings, you can opt-out.

And to clarify on the op-out clause, I have it so only I can opt-out and they are stuck in the agreement for a year.

SEO isn’t the only way you can get more organic traffic.

Being creative, such as renting pages that already rank is an easy solution. Best of all, you can get results instantly and it’s probably cheaper than doing SEO in the long run.

The only issue with this model is that it is really hard to

scale.

If I were you, I would do both. I, of course, do SEO on my own site because it provides a big ROI. And, of course, if you can rent out the pages of everyone else who ranks for the terms you want to rank for, it can provide multiple streams of income from SEO.

The beauty of this is model is that you can take up more than one listing on page 1. In theory, you can take up all 10 if you can convince everyone to let you rent their ranking page.

So, what do you think of the idea? Are you going to try it out?

The post How to Get More Organic Traffic Without Doing Any SEO (Seriously) appeared first on Neil Patel.

Just how To Get The Best Child Life Insurance Quotes

Obtaining youngster life insurance policy prices estimate on the web can be hassle-free, yet are you certain that you are seeing the large photo?

You can see life insurance coverage details kid plans, however the words can be puzzling. Due to the fact that kid life insurance coverage prices cash, it’s crucial to understand specifically what life insurance policy protection you can obtain.

Inquiry You Should Ask About Your Child Life Insurance

Several inquiry the value of kid life insurance policy. While this is undoubtedly a legitimate disagreement, there are benefits to obtaining kid life insurance policy.

It’s not a lot the advantages as it has to do with future qualification. If your household has a background of clinical health problem, youngster life insurance coverage is particularly vital. You see, if you obtain youngster life insurance policy, your kid can instantly obtain any type of sort of life insurance policy in the future.

The majority of kinds of kid life insurance policy are in fact term life insurance policy. In order to be affordable, some life insurance policy companies are offering kid life insurance policy some functions comparable to entire life insurance coverage.

As a basic policy, moms and dads ought to initially obtain themselves insurance coverage, prior to their kids. Moms and dads will certainly do well to simply obtain the most inexpensive youngster life insurance policy bundle since the primary function of youngster life insurance coverage is future qualification.

Past whatever else, they have to make certain that the kid life insurance policy will certainly enable their youngsters to have instant accessibility to life insurance policy later.

Since kid life insurance coverage prices cash, it’s crucial to understand specifically what life insurance policy protection you can obtain. You see, if you obtain kid life insurance coverage, your youngster can instantly obtain any kind of kind of life insurance policy later on.

The majority of kinds of kid life insurance policy are in fact term life insurance coverage. In order to be affordable, some life insurance policy companies are offering youngster life insurance policy some functions comparable to entire life insurance coverage.

The post Just how To Get The Best Child Life Insurance Quotes appeared first on Buy It At A Bargain – Deals And Reviews.

Properly to Become an internet marketing Consultant Web marketing is a profitable company. There are lots of people that are gaining significant incomes by simply marketing their product and services online while at the exact same time recommending the product and services of various other Internet online marketers. Profits are spurting of various electrical outlets– … Continue reading The Proper Way to Become an Internet Marketing Consultant

Funding a small business is no easy task. There are an overwhelming number of funding options. From small business loans to crowdfunding, and a seemingly infinite number of possibilities in between, it can be hard to choose. For most, it will take some combination of these to get the job done. It can help to know your small business loan options. There may be more than you think.

The first decision to make is what type of lender to use. A lot of business owners think that it’s a bank or bust. There are a few different types of lenders to consider when looking at your small business loan options however.

Learn business loan secrets with our free, sure-fire guide.

These are those nation-wide institutions like J.P. Morgan Chase and Wells Fargo. As a general rule, they are not a friend to small business. There is nothing specific that they hold against smaller businesses. It is simply that these businesses do not generally meet their lending requirements. It’s all numbers. If you don’t have the numbers, you don’t get the funding.

Community banks are the smaller, local financial institutions. They are the “hometown” banks, if you will. These guys are friendlier toward small businesses. They are able to look a little deeper and see a tad bit more than the numbers. Their small business loan options may have slightly less strict eligibility requirements. However, it is still a numbers game. Whatever those numbers are, whether credit score, annual income, years in business, or some combination, you will have to have them to be eligible.

Credit unions come in large and small sizes as well. The main thing to remember is that you must be a member to get a loan from a credit union. They do usually offer more favorable interest rates however. If you are a member of one, be sure not to count them out when shopping around for loans.

Alternative lenders generally function online, though some do have brick and mortar locations. Their main draw is that they offer small business loan options to those that may not qualify with traditional lenders. Their credit score requirements are lower. They may or may not require a certain amount of time in business or minimum revenue amounts. The main drawback is that their small business loan options typically have higher interest rates.

In addition to the types of lenders, there are various types of loans including:

These are the standard loans that disperse a set amount of funds, with the borrower repaying over a certain period of time. The payment is the same each month, and they can be either secured or unsecured. Unsecured small business loan options usually have higher interest rates.

This is revolving debt similar to credit cards. Borrowers are given a maximum limit of the amount of funds they can use, but only pay back the amount that they actually use. For example, a borrower may have a $5,000 line of credit and use $2,000 to buy a new printer. They will only pay back $2,000, until the time comes that they choose to use more. Lines of credit can also be secured or unsecured.

Factoring invoices is an option if you have receivables. The lender basically buys unpaid invoices from you at a premium, meaning you do not get full value. You then have immediate cash however, for those open invoices. The lender collects from the consumer directly at full value. The older the invoice, the higher the premium. This is due to the fact that the likelihood of collecting on the invoice goes down the older the invoice gets.

Learn business loan secrets with our free, sure-fire guide.

If you accept credit card payments, a merchant cash advance can help you out in a cash pinch. It is basically just what is says. It’s a cash advance on predicted credit card sales. They base the amount of the loan off of average daily credit card sales, and then take payment from future credit card sales. This usually happens electronically. Most often, the process is automatic. The draw is that you get the funds fast, and there are usually more flexible options for repayment terms depending on your eligibility.

No discussion of small business loan options would be complete without mentioning the SBA. While they do not lend funds themselves, they do administer a number of loan programs that help small businesses get the funds they need through partner lenders.

This is the Small Business Administration’s most known program. It provides federally funded term loans up to $5 million. The funds can be used for a number of purposes. These include expansion, purchasing equipment, working capital and more. Banks, credit unions, and other specialized institutions, in partnership with the SBA, process these loans and disburse the funds.

504 loans are also available up to $5 million and can buy machinery, facilities, or land. Typically, they are used for expansion. They work especially well for commercial real estate purchases.

These are $50,000 or less. They are good for starting a business, purchasing equipment, buying inventory, or general working capital.

This is a program available to businesses that have fallen victim to natural disasters. These loans are different because, unlike the others, the SBA actually processes them directly rather than using partner lenders.

The turnaround for express loans is much faster, with the SBA taking up to 36 hours to give a decision. There is less paper work as well, making express loans a great option if you qualify.

There are 4 different CAPLine programs. They differ mostly in how the funds can be used. The maximum on each is $5 million. It can take 45 to 90 days for the funding on CAPLines to come through.

Learn business loan secrets with our free, sure-fire guide.

This is a pilot program. It will either expire, or the SBA will extend it in 2020. Its purpose is to promote economic growth in underserved areas and markets. Decision makers look past such things as poor credit or low revenue if the business has the potential to create jobs or promote economic growth in underserved areas.

These are some of their most popular programs. The Small Business Administration does so much more for small businesses in addition to these. Get more details on the SBA, these loan programs, and additional resources offered by the Small Business Administration here.

Now, you are probably here because you need to know specifically where to go to get a small business loan. As you have seen, the possibilities are endless. However, here are some of our favorite online lenders for those that may be having trouble qualifying for loans.

Upstart is a fairly new online lender that is using cutting edge technology. They question whether financial information and FICO alone can really determine the risk associated with a specific borrower. Instead, they are using a combination of artificial intelligence and machine learning to gather alternative data. They then use this data in the credit decision making process.

Alternative data includes such things as mobile phone bills, rent, deposits, withdrawals, and even other information less directly tied to finances. Software from the company uses this data, then learns and improves on its own.

They offer various types of financing products to fit a broad range of needs. From credit card refinancing to student loans, and pretty much anything in-between, there is something for everyone. Debt consolidation and personal loans are included, in addition to business loans.

You can get a quote on a loan to start or expand a business. Quotes are available online in a matter of minutes. Learn more in this comprehensive review.

StreetShares started as a service to veterans. Now, they offer term loans, lines of credit, and contract financing. They also offer small business loan investment options. The maximum loan amount is $250,000. Pre-Approval only takes a few minutes. They use a soft pull on your credit so it doesn’t affect your score.

To be eligible, you must be in business for at least 12 months with annual revenue of $25,000. Exceptions are possible, with loans to companies in business for at least 6 months with higher earnings happening on a case by case basis. The borrower’s credit score must be at least 620. For more on StreetShares, see our in-depth review.

Kabbage is a well know online lender. They offer a small business line of credit that can help businesses accomplish business goals quickly. The minimum loan amount is $500 and the maximum is $250,000. They require you to be in business for at least one year and have $50,000 or more in annual revenue, or $4,200 or more per month in the previous 3 month period.

They are great if you need cash quickly. Also, their non-traditional approach puts less weight on your credit score, so they may work better for some borrowers than other lenders.

Fundation provides both term business loans online and lines of credit. It is most known for its working capital funding options. These are funds meant to help cover the day-to-day costs of running a business rather than larger projects. Typically, these funds come in the form of a line-of-credit.

Their minimum loan amount is $20,000 while the maximum loan amount they offer is $500,000. They require you to be in business for at least 12 months and have annual revenue of at least $100,000. To be eligible, your personal credit score must be no less than 600. Additionally, you must have at least 3 full time employees. That number can include yourself. Business owners cannot live or operate their business in North Dakota, South Dakota, or Nevada.

If you want the convenience of online lending but need to look toward products offered by the SBA, then SmartBiz is for you.

With the help of the Small Business Administration, SmartBiz offers loans that are government backed. While SBA loans typically take a lot of time and paperwork, SmartBiz found a way to speed things up. This makes getting loans through the Small Business Administration easier than ever. The minimum loan amount is $30,000 and the maximum is $5,000,000.

As stated, SBA loans are government-backed business term loans for business owners who’ve had difficulty qualifying for other types of financing. As such, the requirements are a little stricter. Your credit score has to be 650, and you have to be in business for 2 years or more. In addition, annual revenue has to be $50,000 at least, and there can be no outstanding liens, bankruptcies, or foreclosures in the past 3 years.

Of course, a lot of the choosing will be done for you based on your qualifications. Your credit score, length of time in business, and annual revenue will make a difference. Still, knowing where to start based on what you have to work with is a huge first step.

If you are eligible for a loan with a traditional lender, you may find the lowest interest rates there. They tend to have the most favorable terms and rates. Their online counterparts typically have higher interest rates, but the loans are easier to qualify for.

However, if you are struggling with credit or just starting out, one of these 5 options for alternative lenders could be great. In addition, there is the option of traditional loans with the SBA programs, if you fall somewhere in between. Whatever you do, don’t jump in without doing your research.

Shop around with a variety of lenders to compare what they offer, what their requirements are, and figure out which lenders and loans will work best for your specific business. A little time spent on the front end doing this can save you a lot of time and money after the fact.

The post 5 Small Business Loan Options (Some of Which You’ve Probably Never Heard of) appeared first on Credit Suite.