Article URL: https://www.ycombinator.com/companies/draftbit/jobs/Fj0Gn7Y8I-senior-software-engineer

Comments URL: https://news.ycombinator.com/item?id=27887198

Points: 1

# Comments: 0

Article URL: https://www.ycombinator.com/companies/draftbit/jobs/Fj0Gn7Y8I-senior-software-engineer

Comments URL: https://news.ycombinator.com/item?id=27887198

Points: 1

# Comments: 0

Article URL: https://www.pachyderm.com/careers/#positions Comments URL: https://news.ycombinator.com/item?id=26843617 Points: 1 # Comments: 0

The post Pachyderm Is Hiring Senior Demand Gen, TMM, and Product Marketing Roles first appeared on Online Web Store Site.

Increasing sales isn’t necessarily the best way to improve your bottom line. A better solution may be to reduce your Cost of Goods Sold.

Paying less to acquire the products you sell can result in higher gross revenue figures and bigger profits, even when the amount of product you sell stays the same.

If you’re ready to make more money without selling more products, here’s a recap of COGS and specific strategies to lower expenses.

The Cost of Goods Sold (COGS) is all the costs of producing and acquiring the products you sell. You can separate COGS into two parts: direct costs and indirect costs.

Direct costs are the expenses incurred when producing the products you sell. They include:

Indirect costs are all the other expenses incurred when you manufacture products that aren’t tied directly to the process. They include:

It’s also worth clarifying what COGS is not.

Your COGS is not the same as your operating expenses, for example. Both are expenditures, but operating expenses (also known as OPEX) are not tied to your products’ production. Instead, they include costs like rent, utilities, marketing, and legal.

They also aren’t the cost of sales either, as this infographic from EDUCBA shows.

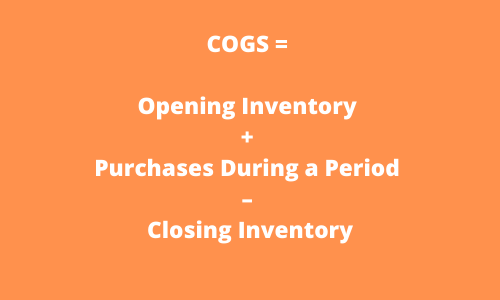

Businesses can calculate COGS using a standard formula that considers inventory levels and all of the direct and indirect costs listed above.

COGS = Opening Inventory + Purchases During a Period – Closing Inventory

Here’s an example:

Let’s say we want to calculate an e-commerce brand’s COGS during the 2019 financial year. The opening inventory would be the inventory recorded at the end of the 2018 fiscal year. Let’s say it’s $2 million.

The closing inventory would be the inventory recorded on the company’s balance sheet at the end of the 2019 fiscal year. Let’s say that is $3 million. Finally, the company purchased $5 million worth of inventory during the 2019 fiscal year.

The COGS for the 2019 financial year is:

2 + 5 – 3 = $4 million

The COGS is $4 million.

If you want to see what calculating COGS looks like in the real world, Investopedia provides an example using J.C. Penney’s 2016 financial report.

The calculation can also change depending on how you define closing inventory. There are three options:

COGS is a crucial line on your balance sheet. By paying attention to it, you can:

Now that you’re up to speed, it’s time to get to the heart of the matter and look at how you can reduce your company’s COGS.

I’ve outlined seven strategies below that almost any business can leverage.

Do you have a large amount of deadstock sitting in your warehouse? These are products that haven’t been sold and are unlikely to sell in the future. If so, they could be killing your margins and contributing massively to your COGS. Remember, the COGS calculation takes into account the inventory you have at the start and end of your accounting period. It doesn’t matter how long it’s been sitting there: it’s going to be in the calculation.

Deadstock isn’t great, but there’s an easy way to make sure it doesn’t increase your COGS going forward: Stop making products that don’t sell.

Of course, no business owner starts out intending to make a product consumers hate, but it happens. Even the biggest businesses have flops now and again. New Coke, anyone? I didn’t think so.

Don’t worry about creating the wrong products, only worry about identifying ones that aren’t selling well. Use inventory management software to identify products languishing at the back of your warehouse.

Encourage customers to review your products to drive real-time feedback from the people that matter most. Then act quickly. As soon as you identify an under-performing product, take steps to decrease production or cease selling it altogether.

Material costs are probably one of the largest components of your COGS. Typically, there’s no shortage of material suppliers, which means you may be able to find cheaper products somewhere else.

Shopping around for materials from different suppliers is one solution, but you could also consider whether a part of your finished product could be replaced with a cheaper alternative. You may think that your customers love the sturdy metal used in your product, for example, but they could be just as happy with a plastic substitute.

It may also be worth revisiting technology used in production to identify whether new processes mean cheaper materials can be used.

Whichever strategy you use, be careful of using cheaper materials at the expense of your end product. Providing a consistent experience is one of the best ways to build trust in your brand, and customers expect to receive the same product every time.

Even loyal customers can quickly switch to competitors if your products are not up to their expectations. A drop in sales can be far more significant than any savings you’ve gained by switching materials.

That’s not the only downside you need to consider, however. Inferior materials can also reduce the durability of your product. Changing materials may necessitate a change in the manufacturing process. This could increase production overheads or labor costs to such an extent that they nullify any costs saved.

There’s bound to be waste somewhere in your supply chain. Your manufacturing process may be inefficient, for example, and waste a lot of raw materials. You may even need to pay to dispose of them. Shrinkage may also be significant. This is when products are damaged, stolen, or go missing.

Waste doesn’t have to be physical. There could be plenty of time wasted in the manufacturing or shipping process that could be reduced to improve your COGS. Downtime can be expensive, whether that’s on the factory floor or when products are at sea.

Investigate all instances of waste in your supply chain, physical or otherwise, and take actions to reduce or eliminate the most expensive culprits.

One strategy could be to redesign the manufacturing process if material waste is significant. Another could be to alter transport arrangements if shrinkage is high and many products are arriving damaged.

Labor can be a significant part of your COGS. Luckily, you may be able to automate some of those expenses away. Every part of the manufacturing or shipping process that you can replace with a machine can save huge costs. Machines are typically cheaper to operate in the long run, there is less risk of error and have practically no downtime.

Once you’ve done your part, ask the same of your suppliers. Request they invest in automation to reduce costs if they haven’t already. You may even be able to use this as part of a negotiation strategy as discussed below. If they’re not willing to play ball, consider switching to another supplier investing in automation. If they aren’t cheaper right now, they could well be in the future.

Manufacturing in the U.S. (or your country of origin) can often be a huge selling point. It can also be incredibly expensive. That’s why so many of the world’s biggest brands outsource manufacturing operations to countries like China, Taiwan, and Vietnam.

Both raw materials, labor, and utility costs are often much cheaper in these countries than they are at home, meaning your business stands to save in multiple ways. Even when you factor in increased shipping costs, your COGS could still plummet when you outsource manufacturing.

Only large enterprises should consider this strategy, however. The upfront costs can be substantial, and there are a lot of risks involved.

Quality problems may arise, for instance, and you may have to deal with PR issues as a result of labor conditions in these countries. Currency fluctuations and customs duties can complicate matters further.

For some businesses, however, the opportunity to drastically reduce their COGS will be well worth it.

One of the biggest contributing factors to COGS is inventory purchases made throughout the year. The more products you buy, the more costs rise.

Rather than stock products that may not sell, brands could reduce their COGS by using a manufactured on-demand strategy. In essence, you only make or order products when a customer has already paid.

Print-on-demand sites like Printful and dropshipping are two of the most-common ways to leverage this strategy.

With Printful, products are printed in real-time as soon as an order is made. There’s not even a minimum order limit.

It’s the same with dropshipping. Businesses only pay for products when the customer pays for them. In both cases, items can be shipped directly to customers, meaning stores don’t need to hold any inventory.

You can and should be regularly negotiating prices with every company in your supply chain. The prices you pay suppliers are a core part of your COGS. Reduce them, and your COGS will decrease, too.

When I say every company, I really do mean all of them. Manufacturers, raw material providers, logistics companies, storage facilities, and wholesalers are all able to give you a lower price if you ask.

Here are some deals you could ask for:

Remember, negotiation is a two-way street. While some companies will be willing to lower prices just to keep your business, others will require something in return to sweeten the deal. Improving their payment terms, for instance, is always a useful bargaining chip.

It’s also important to remember your negotiations may have unintended consequences. Asking for bulk discounts will require you to store more products, for example, and come with a cost increase that may eclipse any savings you made. Asking for lower prices in return for faster payments may require you to improve your cash flow.

Think carefully about what you are asking for and make sure you can handle the consequences of your negotiations. The last thing you want to do is renege on a deal because you negotiated poorly.

Boosting your sales is essential, but so is reducing your company’s COGS. Whether it’s negotiating hard with suppliers, reducing waste, or automating your processes, look to reduce costs in every way possible.

I’ve given you seven strategies to get started with, but there are always more ways to reduce costs.

What innovative ways to reduce costs have you found?

Need to know how to get funding for your business? Of course, you do! There is so much to consider. For example, what stage your business is in and overall fundability each makes a difference. Most people know that though. The big question is, what exactly is fundability? More than that, what exactly affects fundability? That’s getting a little ahead of things though. You have to know what types of funds are available, and you need to know your fundability makes you eligible for whatever you need.

The first step is to figure out what type of funding will work best for you at this current stage in your business. The next step? That would be to figure out whether you qualify, and if not, how to fix that. Here’s what you need to know.

Demolish your financing problems with 27 killer ways to get cash for your business.

Before you can figure out what type of funding you need, you have to know what type of funds are out there.

These are loans from traditional banks and credit unions. As a business, your business credit score can help you get some types of funds even if your personal score isn’t awesome. That isn’t necessarily the case with this type of cash however.

With a traditional lender term loan, you are almost always going to have to give a personal guarantee. This means they will check your personal credit. If your personal credit score isn’t in order, you’ll probably have trouble.

So how high does your credit score have to be? If you have at least a 750 you are in pretty good shape. Sometimes you can get approval with a score of 700+, but the terms will not be as favorable.

If you have really great business credit, your lender might be willing to be more flexible. However, your personal credit score will still weigh heavily on the terms and interest rate.

These are the hardest types of funds to get, but they typically have the best rates and terms.

SBA loans are traditional bank loans, but they have a guarantee from the federal government. The Small Business Administration, or SBA, works with lenders to offer small businesses financing solutions that they may not be eligible for based on their own credit history. Because of the government guarantee, lenders are able to be more flexible with personal credit score requirements.

In fact, it is possible to get an SBA microloan with a personal credit score between 620 and 640. These are very small loans, up to $50,000. They may require personal collateral as well.

The trade-off with SBA loans is that the application process is lengthy. There is a ton of red tape connected with these types of loans.

This is basically the traditional lender’s version of a business credit card. The credit is revolving, meaning you only pay back what you use, just like a credit card. Rates are typically much better than a credit card. The application and approval process, however, is more similar to that of a traditional term loan.

If you need revolving credit and can qualify for a term loan, this is the best of the available business money types for you. It is great for bridging cash gaps and covering short term expenses without the high credit card interest rates.

There are no cash back rewards or loyalty points, though. This makes some business owners prefer business credit cards in some cases.

If you are an established business with accounts receivable, invoice factoring is one type of financing that you have access to. This is where the lender buys your outstanding invoices at a premium, and then collects the full amount themselves. You get cash right away, without waiting for your customers to pay the invoices.

This is a good option if you need cash fast, or you do not qualify for other types of funds. The interest rate varies based on the age of the receivables.

These are lenders other than traditional banks and credit unions that offer terms loans. Usually they operate online. The difference between these guys and traditional lenders is that the loans have less strict approval requirements. In addition, the application process is usually much faster. Most often you can simply apply online, get approval in as little as 24 hours, and the funds are in your account within 24 to 48 hours after approval.

These are an option if your personal credit isn’t terrible and you need funds fast.

Demolish your financing problems with 27 killer ways to get cash for your business.

Crowdfunding is a newer option for finding investors. It is not always possible to find one or two large investors. With crowdfunding, you can literally have multiple investors fund your business $5 and $10 at the time.

There are many crowdfunding sites, but the most popular are Kickstarter and Indiegogo. The platforms are similar but there are some important differences. The most obvious is when they release the funds raised..

Kickstarter requires you to set a goal, and you do not receive your funds until that goal is reached. For example, if you set a goal of $10,000 when you start your campaign, you will not receive any money that investors offer up until you reach that $10,000.

Indiegogo requires a goal as well, but they offer the option to receive funds as you go if you want. They also have something called InDemand. This program allows you to continue raising funds after your original campaign is over without starting a whole new campaign. It is more of an extension of the first one.

There are other crowdfunding sites also. These are not the only two. Different ones work better for certain businesses and vendors. To figure out which one you might have the most luck with, you will have to research. Keep in mind your type of business and the specific business each one appeals too.

Generally, these are offered by professional organizations. There are some government grants available also. Competition can be stiff, but they are definitely worth a shot if you think you may qualify.

While requirements vary from grant to grant, and most are only awarded to a certain number of recipients, they are worth looking into if you fall into one of these basic categories.

There are also some corporations that offer grants in a contest format that do not require anything really other than that you meet the corporation’s definition of a small business and win the contest.

Business Credit Cards

These get a bad rap. However, if there isn’t another option, they can actually work well. The draw is that they are available much more readily even with a credit score that isn’t great. To be fair, the lower the credit score, the higher the interest rate. Also, there are limits on how low they will go with a credit score.

Still, most of the general public is eligible for this type of financing. They do a credit check, but your credit doesn’t have to be as high as it would be to get approval for a traditional loan.

The downside of business credit cards is that they typically have a high interest rate. The upside is that many of them offer rewards in the form of cash or points.

Which type of funds will work best for you depends on a lot of factors. The main two include which types you qualify for and what phase your business is in. Assuming you are eligible for all types of financing, here is what to consider at each stage.

In the startup phase, there are a couple of things to think about when determining which business capital type might work best for you.

If you fall into one of those categories that make grants an option, that is the best first stop. Grants are free and clear. That money is yours, without repayment, to use in your business. They usually do not rely on the success of the business or the credit worthiness of the owner. The business or proposed business only has to meet the requirements set forth to apply, and then win the grant.

Crowdfunding is also a viable option here, but there has to be a backup plan in case the goal isn’t met.

Traditional term loans are a good idea for the startup phase also, if you qualify. The interest rates and terms are more favorable than other types of financing for those that meet the credit requirements.

If you do not meet the credit requirements for traditional term loans, then non-traditional lenders are the next best option. They may have higher interest rates, but they get the job done. Plus, they can help build your business credit score if you make your payments on time.

While not impossible, it is not usually a good idea to start a business using credit cards if you can help it. Of course, invoice factoring is not an option because you have to already be in business to have the invoices necessary.

Demolish your financing problems with 27 killer ways to get cash for your business.

There are several aspects of growth that can benefit from different funding options.

If you see the growing demand and need to increase inventory, a revolving credit line is going to work best.

If already in place, these are available as needed to accomodate a large inventory purchase. They also allow for taking advantage of special pricing when possible.

A business line of credit works well due to the lower interest rate, business credit cards will work in this situation also. In fact, if they have really great rewards attached to them, they could even be the better choice. It can’t hurt to have both available if you can so that you have options.

If available, grants work well for growth projects as well.

For large equipment, it is best to use traditional term loans if available. This is because they are typically longer term loans for larger amounts. Lower interest rates and favorable repayment terms are key. We all know, however, this isn’t always possible. In a pinch, other types can work for this.

Grants may be an option if there is not a time crunch. If time is of the essence, it is possible to purchase equipment on credit cards, but you could run into problems with cost versus credit limit.

If you want to add on to your current building or add another location, term loan financing is the best option. Whether it needs to come from a traditional or non-traditional lender will depend on your specific situation.

Working capital is the cash you have available to run your business. Everything from payroll to repairs, maintenance, seasonal cash gaps, and emergencies are all things working capital covers.

Working capital is the cash you have available to run your business. Everything from payroll to repairs, maintenance, seasonal cash gaps, and emergencies are all things working capital covers.

It can come from various funding types. There are working capital loans available, but lines of credit and business credit cards can work in these situations too. Unless you already have a working capital loan before it is needed, you will likely have to access business credit cards or some form of non-traditional financing for this.

In a pinch to cover a cash gap, a merchant cash advance or invoice factoring can work well.

The main factor in whether or not you can get funding for your business is fundability. The fundability of your business includes many things. It has to do with how your business is set up, both personal and business credit, and even things you would never think about like parking tickets and outstanding liens. The most controllable part of course, is business credit. If you work hard to keep that strong, it is possible to get the cash you need.

The post How to Get Funding for Your Business appeared first on Credit Suite.

You can get the best balance transfer business credit cards in a recession! We can show you how!

Per the SBA, corporate credit card limits are 10 – 100 times that of personal cards! This shows you can get a lot more cash with small business credit.

And this also means you can have personal credit cards at retail stores, and now have an additional card at the same stores for your business. And you won’t have to provide collateral, cash flow, or financials to get business credit.

Features vary, so make certain to select the perk you prefer from this range of choices.

Take a look at the Capital One® Spark® Miles for Business. It has an introductory annual fee of $0 for the first year, which then rises to $95. The regular APR is 18.49%, variable due to the prime rate. There is no introductory annual percentage rate. Pay no transfer fees. Late fees go up to $39.

This card is terrific for travel if your costs don’t come under basic bonus categories. You can get unlimited double miles on all purchases, with no limits. Get 5x miles on rental cars and hotels if you book via Capital One Travel.

Get an initial bonus of 50,000 miles. That’s the same as $500 in travel. But you only get it if you spend $4,500 in the initial 3 months from account opening. There is no foreign transaction fee. You will need a great to outstanding FICO rating to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-miles/

For an excellent sign-up offer and bonus categories, take a look at the Ink Business Preferred℠ Credit Card.

Pay an annual fee of $95. Regular APR is 17.49 – 22.49%, variable. There is no introductory APR offer.

Get 100,000 bonus points after spending $15,000 in the initial 3 months after account opening. This works out to $1,250 towards travel rewards if you redeem with Chase Ultimate Rewards.

Get 3 points per dollar of the first $150,000 you spend with this card. So this is for purchases on travel, shipping, internet, cable, and phone services. Plus it includes advertising purchases made with social media sites and search engines each account anniversary year.

You can get 25% more in travel redemption when you redeem for travel via Chase Ultimate Rewards. You will need a good to superb FICO score to qualify.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/business-preferred

For no annual fee while still getting travel rewards, have a look at this card from Bank of America. It has no yearly fee and a 0% introductory APR for purchases during the initial nine billing cycles. After that, its regular APR is 13.74 – 23.74% variable.

You can earn 30,000 bonus points when you make a minimum of $3,000 in net purchases. So this is within 90 days of your account opening. You can redeem these points for a $300 statement credit towards travel purchases.

Get unlimited 1.5 points for every $1 you spend on all purchases, everywhere, every time. And this is no matter how much you spend.

Also get 3 points per every dollar spent when you reserve your travel (car, hotel, airline) through the Bank of America® Travel Center. There is no limit to the number of points you can earn and points do not expire.

You will need excellent credit to get this one (as in, 700s or better).

Find it here: https://www.bankofamerica.com/smallbusiness/credit-cards/products/travel-rewards-business-credit-card/

Take a look at the Marriott Bonvoy Business™ Card from American Express. It has an annual fee of $125. There is no introductory APR offer. The regular APR is a variable 17.24 – 26.24%. You will need great to superb credit to get this card.

You can get 75,000 Marriott Bonvoy points after using your card to make purchases of $3,000 in the initial 3 months. Get 6x the points for qualified purchases at participating Marriott Bonvoy hotels. You can get 4x the points at United States restaurants and gasoline stations. And you can get 4x the points on wireless telephone services bought straight from US service providers and on US purchases for shipping.

Get double points on all other eligible purchases.

Also, you get a free night each year after your card anniversary. And you can earn an additional free night after you spend $60,000 on your card in a calendar year.

You get free Marriott Bonvoy Silver Elite status with your Card. Also, spend $35,000 on eligible purchases in a calendar year and get an upgrade to Marriott Bonvoy Gold Elite status through the end of the following calendar year.

Plus, each calendar year you can get credit for 15 nights towards the next level of Marriott Bonvoy Elite status.

Find it here: https://creditcard.americanexpress.com/d/bonvoy-business/

Check out the Brex Card for Startups. It has no annual fee.

You will not need to provide your Social Security number to apply. And you will not need to provide a personal guarantee. They will take your EIN.

Nevertheless, they do not accept every industry.

Likewise, there are some industries they will not work with, and others where they want added documentation. For a list, go here: https://brex.com/legal/prohibited_activities/.

To determine creditworthiness, Brex checks a corporation’s cash balance, spending patterns, and investors.

You can get 7x points on rideshare. Get 4x on Brex Travel. Also, get triple points on restaurants. And get double points on recurring software payments. Get 1x points on everything else.

You can have poor credit (even a 300 FICO) to qualify.

Find it here: https://brex.com/lp/startups-higher-limits/

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

Check out the Capital One® Spark® Cash for Business. It has an introductory $0 yearly fee for the first year. After that, this card costs $95 per year. There is no introductory APR deal. The regular APR is a variable 18.49%.

You can get a $500 one-time cash bonus after spending $4,000 in the first 3 months from account opening. Get unlimited 2% cash back. Redeem any time without minimums.

You will need good to outstanding credit scores to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash/

Take a look at the Discover it® Business Card. It has no annual fee. There is an introductory APR of 0% on purchases for year. Then the regular APR is a variable 14.49 – 22.49%.

Get unlimited 1.5% cash back on all purchases, with no category restrictions or bonuses. They double the 1.5% Cashback Match™ at the end of the first year. There is no minimal spend requirement.

You can download transactions| quickly to Quicken, QuickBooks, and Excel. Keep in mind: you will need great to outstanding credit scores to qualify for this card.

https://www.discover.com/credit-cards/business/

Take a look at the Ink Business Cash℠ Credit Card. It has no yearly fee. There is a 0% introductory APR for the first year. Afterwards, the APR is a variable 14.74 – 20.74%. You can get a $500 one-time cash bonus after spending $3,000 in the initial 3 months from account opening.

You can earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on web, cable, and phone services each account anniversary year.

Get 2% cash back on the initial $25,000 spent in combined purchases at filling stations and restaurants each account anniversary year. Get 1% cash back on all other purchases. There is no limitation to the amount you can get.

You will need excellent credit scores to qualify for this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/cash?iCELL=61GF

Check out the Bank of America® Business Advantage Cash Rewards MasterCard® credit card. Get an 0% introductory APR for the initial 9 billing cycles of the account. After that, the APR is 13.74% – 23.74% variable. There is no annual fee. You can get a $300 statement credit offer.

Get 3% cash back in the category of your choice. So these are gasoline stations (default), office supply stores, travel, TV/telecom & wireless, computer services or business consulting services. Get 2% cash back on dining. So this is for the initial $50,000 in combined choice category/dining purchases each calendar year. Then get 1% after, with no limits.

You will need outstanding credit scores to qualify.

Find it here: https://promo.bankofamerica.com/smallbusinesscards2/

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

Check out the Blue Business® Plus Credit Card from American Express. It has no annual fee. There is a 0% introductory APR for the initial 12 months. Afterwards, the APR is a variable 14.74 – 20.74%.

Get double Membership Rewards® points on everyday company purchases like office supplies or client dinners for the first $50,000 spent each year. Get 1 point per dollar afterwards.

So you will need good to outstanding credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/bluebusinessplus-credit-card/

Also take a look at the American Express® Blue Business Cash Card. Keep in mind: the American Express® Blue Business Cash Card is identical to the Blue Business® Plus Credit Card from American Express. Yet its rewards are in cash as opposed to points.

Get 2% cash back on all eligible purchases on up to $50,000 per calendar year. Then get 1%.

It has no annual fee. There is a 0% introductory APR for the initial twelve months. Afterwards, the APR is a variable 14.74 – 20.74%.

So you will need great to superb credit to qualify.

Find it here: https://creditcard.americanexpress.com/d/business-bluecash-credit-card/

Check out the Capital One® Spark® Cash Select for Business. It has no yearly fee. You can get 1.5% cash back on every purchase. There is no limit on the cash back you can earn. And earn a one-time $200 cash bonus once you spend $3,000 on purchases in the initial three months. Rewards never expire.

Pay a 0% introductory APR for 9 months. Then pay 14.49% – 22.49% variable APR after that.

So you will need great to excellent credit to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash-select/

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

Have a look at the Ink Business Unlimited℠ Credit Card. Beyond no annual fee, get an introductory 0% APR for the first one year. After that, the APR is a variable 14.74 – 20.74%.

You can earn unlimited 1.5% Cash Back rewards on every purchase made for your corporation. And get $500 bonus cash back after spending $3,000 in the initial 3 months from account opening. You can redeem your rewards for cash back, gift cards, travel and more via Chase Ultimate Rewards®. So you will need exceptional credit scores to get approval for this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/unlimited

Your absolute best balance transfer business credit cards in a recession will be based on your credit history and scores. Just you can decide which benefits you want and need, so be sure to do your homework. And, as always, make sure to build credit in the recommended order for the best, fastest benefits.

The economy will change again – and your prospects for getting cards will be even better.

The post Excellent! Get the Best Balance Transfer Business Credit Cards in a Recession appeared first on Credit Suite.

Credit Scores Help For Mortgage Financing

Funding a brand-new home mortgage? Be cautious of “aggressive loan providers.”

In November 2005, Montgomery County, Maryland’s region council established regulation to broaden the groups of inequitable financing tasks connected with inequitable real estate techniques as well as enhanced the optimum penalty for such tasks from $5,000 to $500,000. The council sited techniques such as billing excessive quantities for early repayment charges, factors, as well as fines; guiding consumers towards much more costly home loans; and also re-financing present home mortgages with brand-new ones that customers will not have the ability to pay off based upon their earnings or credit score.

Predacious lending institutions normally target what’s called the nonprime home loan market, where individuals with poor credit rating documents attempt to obtain cash for houses in much less preferable communities, which implies that it’s typically minority teams, such as African-Americans and also Latinos, that are the targets of aggressive loaning techniques.

February 2006, the American Financial Services Association (AFSA), tested the judgment, competing that just the state has the power to establish regulation concerning home loan loaning techniques– although the AFSA went on document as opposing violent as well as biased financing techniques. The brand-new legislation was expected to work the 2nd week in March, yet home mortgage lending institution attorneys convinced a court to postpone the brand-new legislation, pending a hearing. It’s yet to be established if the Montgomery County regulation will certainly stay on the publications.

No matter of the result in Montgomery County, nevertheless, predacious borrowing techniques are unlawful in the majority of states. An additional typical method is firmly insisting that debtors likewise buy such points as debt life insurance coverage or various other items– once more, mainly made to produce even more revenue for the loan provider.

The lower line is that there are offering organizations that make a lot of cash by billing added charges to those customers that can the very least manage them, thus either robbing those debtors of the American desire for own a home or, even worse yet, establishing them up for ultimate repossession.

As the realty market decreases and also rate of interest approach, it’s more vital than ever before to come to be an educated customer. Find out the essentials of home mortgage loaning, so you’ll understand when you’re being billed excessive for a finance or for points you do not require. Search to see what’s readily available, and afterwards see to it you’re comfy with your financing repayment, due to the fact that you’ll be paying that quantity for several years.

Copyright © & duplicate; 2006 Jeanette J. Fisher

February 2006, the American Financial Services Association (AFSA), tested the judgment, competing that just the state has the power to pass regulation relating to home loan borrowing methods– although the AFSA went on document as opposing violent and also prejudiced loaning methods. The brand-new legislation was expected to take result the 2nd week in March, however home mortgage loan provider attorneys convinced a court to postpone the brand-new regulation, pending a hearing. Find out the fundamentals of home mortgage loaning, so you’ll recognize when you’re being billed as well a lot for a finance or for points you do not require.

The post Debt Help For Mortgage Financing appeared first on ROI Credit Builders.

Article URL: https://boards.greenhouse.io/logdna/jobs/4686727002

Comments URL: https://news.ycombinator.com/item?id=22699188

Points: 1

# Comments: 0

We looked at a lot of fair credit business credit cards, and did the research for you. So here are our choices.

Per the SBA, company credit card limits are a whopping 10 – 100 times that of personal credit cards!

This demonstrates you can get a lot more cash with small business credit. And it also means you can have personal credit cards at retailers. So you would now have an extra card at the same shops for your company.

And you will not need collateral, cash flow, or financial data in order to get company credit.

Benefits can differ. So, make certain to select the perk you like from this variety of fair credit business credit cards and reasonable alternatives.

For fair credit, we like the Capital One Spark Classic for Business. It has no yearly fee. There are cash-back rewards. The card earns an unlimited 1% cash back on all purchases. There is an annual fee of $0.

With this card, you will get benefits including an auto rental collision damage waiver, and purchase security. And you also get extended warranty coverage. And you get travel and emergency assistance services.

But BEAR IN MIND: the ongoing APR is 24.74% variable APR. And the penalty APR is even higher, 31.15%. Also, there is no sign-up bonus.

Get it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

For another choice in fair credit business credit cards, take a look at the Wells Fargo Business Secured Credit Card. It charges a $25 yearly fee per card (up to 10 employee cards). It also requires a minimum security deposit of $500 (up to $25,000) and it is designed to help cardholders establish or rebuild their credit.

Choose if you want to earn 1.5% per dollar in purchases with no limits or get one point for every dollar in purchases. You also earn 1,000 bonus points for every month your company makes $1,000 in purchases on the card.

Also, you get free FICO scores every month. There are no foreign transaction fees. It is possible to upgrade to unsecured credit. Your account is regularly reviewed.

And you may become eligible for an upgrade to an unsecured card with responsible use over time. Approval is not guaranteed and depends on factors including how you manage this and your other accounts.

APR is the current prime rate plus 11.90%. There is no introductory APR period and no sign-up bonus. This is not a card for balance transfers.

Get it here: https://www.wellsfargo.com/biz/business-credit/credit-cards/secured-card/

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Build your credit and you will end up no longer needing fair credit business credit cards.

Be sure to check out the Discover it® Student Cash Back card. It has no annual fee. The credit card also offers a six-month introductory period of 0% APR on purchases. And there is an APR of 14.99 – 23.99% variable on all purchases after that period.

One one-of-a-kind feature is that it provides an incentive for students to maintain good grades with a $20 statement credit. If students earn a GPA of 3.0 or better each school year, the card will award the $20 statement credit each year for up to five years.

Use this card to build personal credit. While this is a personal credit card versus a company card, for new credit users, their FICO scores will be important. And this credit card provides an excellent way to raise FICO while also getting rewards.

You can earn 5% cash back at different places each quarter such as grocery stores, gas stations, restaurants or Amazon.com up to the quarterly maximum. After that, this credit card offers unlimited 1% cash back on all purchases.

In the initial year, all cash back rewards are matched 100%.

Downsides include a cash advance fee of either $10 or 5% of the amount of each cash advance, whichever is more. And though they waive the first late payment fee, a fee of up to $37 applies on all other late payments. There is also a returned payment fee of up to $37.

Get it here: https://www.discover.com/credit-cards/cash-back/it-card.html

Cards for transferring balances are another great alternative to fair credit business credit cards.

Check out the Discover it® Cash Back card. There is a 10.99% introductory APR for six months from date of first transfer. So, this is for transfers under this offer which post to your account by January 10, 2019.

After the introductory APR expires, your APR will be 14.99% to 23.99%. So, this is based on your creditworthiness. Your APR will vary with the market, which is based upon the Prime Rate.

You can get 5% cash back at different places every quarter. So, these are establishments like gas stations, grocery stores, restaurants, Amazon.com, or wholesale clubs. But this is up to the quarterly maximum each time you activate. Plus, automatically get unlimited 1% cash back on all other purchases.

You will get an unlimited dollar-for-dollar match of all the cash back you have earned at the end of your first year, automatically.

Get it here: https://www.discover.com/credit-cards/cash-back/it-card.html

Cards with 0% APR can make for a terrific alternative to fair credit business credit cards.

The Bank of America® Business Advantage Travel Rewards World Mastercard® credit card has no annual fee and comes with a 0% introductory APR on purchases for the first nine months. Afterwards, the card has a 13.24 – 23.24% variable APR

Earn 3 points/dollar spent when you book travel with the Bank of America Travel Center and 1.5 points/dollar on all other purchases. You can earn unlimited points and points never expire.

There is a 25,000-point sign-up bonus when you spend $1,000 in the initial 60 days of opening up the account. Cardholders get travel accident insurance, and lost luggage reimbursement.

They also get trip cancellation coverage, trip delay reimbursement and other perks.

There is no introductory rate for balance transfers. Also, bonus categories are limited.

Get it here: https://www.bankofamerica.com/smallbusiness/credit-cards/products/travel-rewards-business-credit-card/

Have a look at the JetBlue Plus Card for an additional offer of a 0% introductory APR

Get six points/dollar on JetBlue purchases, two points/dollar at eateries and grocery stores. And get one point/dollar on all other purchases.

Spend $1,000 in the initial 90 days and pay the annual fee, and get 40,000 bonus points. New cardholders receive a 12 month, 0% initial APR on balance transfers made within 45 days of account opening.

Afterwards, the variable APR on purchases and balance transfers is 17.99%, 21.99% or 26.99%, based upon creditworthiness. Benefits include a free first checked bag and 50% savings on in-flight purchases.

There is a $99 annual fee for this card.

Get it here: https://cards.barclaycardus.com/cards/jetblue-card/

Not paying an annual fee is always helpful. Cards with this feature are a great alternative to fair credit business credit cards.

Check out the Uber Visa Card. Uber is the very first ride-sharing service to offer a credit card, in a partnership with Visa and Barclays.

The card provides 4% back per dollar spent at restaurants, takeout and bars, including UberEATS. Also, earn 3% back on hotel, airfare and vacation home rentals. And get 2% back on online purchases.

So, this includes retailers and subscription services like Uber and Netflix. And get 1% back on all other purchases. Each percent/point has a value of 1 cent. Redeem points for cash back, gift cards or Uber credits directly in the app.

By spending a minimum of $500 in the first 90 days, users can earn a $100 sign-up bonus. Cardholders spending a minimum of $5,000 annually are eligible to receive a $50 credit toward online subscription services.

If you pay your cellphone bill with this card, you are insured up to $600 for cellphone damage or theft.

Cardholders are eligible for exclusive access to certain events and offers. Uber anticipates the majority of these offers to be available in major cities like New York, San Francisco, Los Angeles, Chicago and DC. There is no foreign transaction fee.

But there is no introductory rate. The APR is a variable 16.99%, 22.74% or 25.74%, based on your creditworthiness. Cardholders with less than stellar credit will be on the higher end of the range.

Also, there are restrictions on Uber credits. To redeem points as credits in the Uber app, accrue at least 500 points, or $5. Cardholders can convert a maximum of 50,000 points, or $500, in a given day.

Get it here: https://www.uber.com/c/uber-credit-card/

Not taking Uber? Then you’ll need to fill your gas tank someway. Why not do so with the Costco Anywhere Visa® Business Card by Citi?

This card earns cash back with every purchase. Earn 4% cash back on the first $7,000 spent on eligible gas purchases annually (1% after that). Get 3% cash back at restaurants and on eligible travel purchases. Also, get 2% cash back at Costco and Costco.com. And earn 1% cash back on all other purchases.

Keep in mind: the $0 annual fee is only for Costco members. And an active Costco membership is required. Cardholders will get access to damage and theft purchase protection, extended warranty coverage and travel accident insurance.

Also, there is no sign-up bonus available with this card.

Get it here: https://www.citi.com/credit-cards/credit-card-details/citi.action?ID=Citi-costco-anywhere-visa-business-credit-card

Look at the Ink Business Cash ℠ Credit Card. Companies can earn cash back with every single purchase. Spend $3,000 in the first three months from account opening. And you’ll earn a $500 bonus cash back.

There is a $0 yearly fee with a 0% introductory APR for 12 months on purchases and balance transfers. Afterwards, the APR is a 15.24 – 21.24% variable.

The card features travel and purchase coverage benefits. So, this includes an auto rental collision damage waiver and extended warranty protection.

Earn extra cash back on business categories. So, these include office supply stores, telecommunications, gas stations and restaurants.

Note: this card has a balance transfer fee. Pay 5% of the amount transferred or $5, whichever is greater. Also, there is a foreign transaction fee of 3%.

Get it here: https://creditcards.chase.com/small-business-credit-cards/ink-cash

Get a good look at the United MileagePlus Explorer Business Card.

Earn 2 miles/dollar with United and at restaurants, filling stations and office supply stores. All other purchases get 1 mile/dollar. Earn a 50,000-mile sign-up bonus after spending $3,000 in the initial three months from account opening.

Benefits include priority boarding, a free first checked bag for you and a companion on the same reservation.

Also, get two United Club passes annually. And get hotel and resort perks including upgrades. Additionally, get early check-in and late checkout. And get an auto rental collision damage waiver.

Also, get baggage delay insurance, lost luggage reimbursement, trip cancellation and interruption insurance. Finally, get trip delay reimbursement, purchase protection, price protection and concierge service.

After the first year, the card has an annual fee of $95. APR of 17.99% – 24.99%, based on creditworthiness.

Get it here: https://creditcards.chase.com/small-business-credit-cards/united-mileageplus-explorer-business

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Another possibility is the Starwood Preferred Guest Business Credit Card from American Express.

This credit card is for those who stay at Starwood Preferred Guest and Marriott hotels often. Earn six points per dollar of eligible purchases at participating SPG and Marriott Rewards hotels.

And get four points per dollar at American restaurants, American gas stations, and on US purchases for shipping.

Also, earn four points to the dollar on wireless telephone services purchased directly from US service providers. For all other eligible purchases, earn two points per dollar.

Get 75,000 bonus points when you spend $3,000 in the initial three months of account opening. Benefits include free in-room premium internet access, Sheraton Club lounge access, and purchase protection.

Plus you get car rental loss and damage insurance. And you get baggage insurance. There is also a global assistance hotline. And there is a roadside assistance hotline. And get travel accident insurance and extended warranty coverage.

The biggest issue is the annual fee. There is a $0 introductory annual fee for the first year, then it’s $95 after that. Plus there is no 0% introductory APR. Instead, there is a 17.74 – 26.74% variable APR

Get it here: https://www.americanexpress.com/us/credit-cards/business/business-credit-cards/spg-amex-starwood-credit-card

Take a look at the Capital One® Quicksilver® Card. It offers flat-rate rewards of 1.5% on all purchases. There are no limits to the amount of cash back rewards which cardholders can earn. Also, the card has a $0 yearly fee.

New cardholders have a 0% APR on purchases and balance transfers for the first 15 months after opening the account. Then afterwards they have a 14.74 – 24.74% (variable) APR after that.

A cash bonus of $150 is available for those who make a minimum of $500 in purchases in 3 months of account opening.

Also, cash back rewards do not expire for the life of the account. And there is no limit to how much you can earn.

This card also offers travel accident insurance. And you get an auto rental collision damage waiver. There are no foreign transaction fees. And there is extended warranty coverage.

Downsides are the flat reward rate, not allowing for any more than that. And the higher APR after the first 15 months.

Get it here: https://www.capitalone.com/credit-cards/quicksilver/

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Take a look at the IHG ® Rewards Club Premier Credit Card. it earns hotel rewards worldwide. For each dollar spent at participating IHG hotels, get 10 points. Get two points per dollar spent at gas stations, grocery stores and restaurants.

Plus all other purchases earn one point. New cardholders can get an 80,000-point sign-up bonus when they spend $2,000 in the first three months of account opening.

This card provides a free one-night hotel stay per year. Plus there is a variety of benefits like travel and purchase coverage and an upgrade to Platinum Elite status with the IHG Rewards Club. The club offers complimentary room upgrades when available and guaranteed room availability.

The most significant issue is that the card does not offer a zero percent APR introductory rate. And the standard APR is 17.99 – 24.99% variable. Also, the annual fee is $89.

Get it here: https://creditcards.chase.com/a1/ihg/premiernaep

Get a look at the Ink Business Preferred Credit Card from Chase. Cardholders earn 3 points for every dollar spent on travel, shipping, internet, cable, phone and qualifying advertising with the card. So, this is up to $150,000 each year. And all other purchases earn an unlimited one point per dollar spent.

This is a Visa credit card.

Cardholders get benefits like purchase protection, trip cancellation or interruption insurance. They also get cellphone protection. And they get extended warranty coverage. And they get an auto rental collision damage waiver.

Earn 80,000 bonus points when you spend $5,000 in the first 3 months from account opening. There is an annual fee of $95. You can add employee credit cards at no additional cost.

This credit card only offers 3 points per dollar to a limit of $150,000 a year. So, this is for travel, shipping, internet, cable, phone and qualifying advertising. All other purchases earn an unlimited flat rate of one point per dollar. And there is no introductory APR

Get it here: https://creditcards.chase.com/small-business-credit-cards/ink-business-preferred

Your absolute best fair credit business credit cards hinge on your credit history and scores.

Only you can select which features you want and need. So make sure to do your homework. What is excellent for you could be disastrous for somebody else.

And, as always, make sure to establish credit in the recommended order for the best, fastest benefits.

The post Awesome – Get Fair Credit Business Credit Cards appeared first on Credit Suite.

You know, one of the coolest things a brand can do on social media is to host a social media contest. I mean, what part of a social media contest is not fun? The sense of competition, funny and interesting entries and the best part, winning amazing prizes! The whole point of having a brand …

The post Achievement in funding… $29,554.00 in Accounts Receivable financing! appeared first on Buy It At A Bargain – Deals And Reviews.