Article URL: https://www.ycombinator.com/companies/alloy-automation/jobs/v3wXAAb-customer-success-manager

Comments URL: https://news.ycombinator.com/item?id=27320440

Points: 1

# Comments: 0

Article URL: https://www.ycombinator.com/companies/alloy-automation/jobs/v3wXAAb-customer-success-manager

Comments URL: https://news.ycombinator.com/item?id=27320440

Points: 1

# Comments: 0

hello again | React Native Developer | Austria or Remote | Full-time

React Native, Redux

https://www.helloagain.eu/ has already published 300+ apps to the App Store and Play Store. On the way to 1000+ apps in the next 2 years. Those apps are white label loyalty apps for small and medium sized businesses. Very compact team with highly optimised internal processes (building, testing, publishing, etc.). Apps consist of generic modules + configs & theming.

https://helloagain.bewerberportal.at/Job/150494

Selling goods online? Then you might need Ecommerce business inventory financing.

While there was already a lot of online commerce, in March of 2020, due to COVID-19, a good 42% of Americans bought groceries online at least once per week. Orders for grocers from Amazon increased 50 fold!

Statista says about 227.5 million Americans were buying online in 2020, so with 330.7 American citizens, that’s just under 69% of all Americans. They are buying a lot more than groceries online. And that’s only continuing in 2021.

According to Investopedia, “Inventory financing is a revolving line of credit or a short-term loan that is acquired by a company so it can purchase products for sale later. The products serve as the collateral for the loan.”

Online businesses are doing relatively well right now. You already have experience with doing all of your commerce online. With a lot of brick and mortar businesses closed right now, or only tentatively reopening, ecommerce businesses can continue to do well.

Use your existing inventory as collateral for business financing. You’ll need inventory valued at $300,000 or more. You can get approved for a line of credit for 50% of inventory value. Rates are usually 5 – 15% depending on type of inventory. Get funding within 3 weeks or less. It can’t be lumped together inventory, like office equipment.

But there may be restrictions on the type of inventory you can use. This can include not allowing cannabis, alcohol, firearms, etc., or perishable goods. There can be revenue requirements. There may also be minimum FICO score requirements.

There are a number of other ways to get financing for your online business. Your business – and you – have assets beyond inventory. You can tap these assets as collateral. You can use: a 401(k) or IRA, accounts receivable, or stocks or bonds. The 401(k), stocks, or bonds don’t have to be yours. You can work with a partner with these kinds of assets.

Use existing stocks as leverage to get business financing. Borrow as much as 90% of their value. You continue to earn interest on the stocks pledged as collateral. Closing and funding takes less than 3 weeks.

Rates can be as low as 1.6%. This is a working capital line of credit. You will have challenged personal credit.

Demolish your funding problems with 27 killer ways to get cash for your business.

Use your existing 401(k), or IRA as collateral for business financing. This program uses IRS proven strategies. You will pay no tax penalties.

You still earn interest on your 401(k). pay low rates, often less than 5%. Close and fund in less than 3 weeks. You can usually get up to 100% of what’s “rollable” within your 401(k).

Follow these steps. A new corporation is formed; a retirement plan is created to allow for investment into the corporation; funds are rolled over into the new plan. Then the new plan purchases stock in corporation and holds it. The corporation becomes debt free and cash rich.

Use your outstanding account receivables for financing. Get as much as 80% of receivables advanced ongoing in less than 24 hours. The remainder of the accounts receivable are released once the invoice is paid in full. Closing takes 2 weeks or less. Factor rates as low as 1.33%. Accounts receivable credit line with rates of less than 1% with no consumer credit requirement

Receivables should be with the government or another business. If you also have purchase orders, you can get financing to have those filled. You won’t need to use your cash flow to do so.

Get revolving or pay in full. You can authorize multiple buyers on a single account and download order history reports and pay by purchase order.

With the pay in full credit line, you get net 55-day billing terms to pay in full with no interest. You can set up primary and secondary accounts for multiple purchasers. And you will get a Dedicated Account Manager.

For the revolving credit line, you can make minimum payments or pay in full monthly. Pay 12.99% purchase APR (the minimum interest charge is $1). You get an option to apply as a personal guarantor to build business credit. And enjoy 24/7 Customer Service.

If your business is eligible, you will see funding options when you log into Seller Central. Currently, lines of credit are offered by Marcus by Goldman Sachs. Loans come from Amazon Lending – specific terms are tailored to the business. Get access to loan funds within 5 days.

You can finance your next inventory purchase with financing from customers and brand supporters and fundraise directly to them. The way it works is, customers buy through what’s called a Consignment Opportunity. Customers own the products they helped fund until they are sold by the brand. As soon as the products sell, the customer earns payments. Kickfurther also offers an online store for businesses to market and sell their products.

With Shopify Capital, you can get 12-month terms. Pay back with a percentage of daily sales. Borrow between $200 and $1 million. The total owed and daily repayment rate depend on risk profile.

OnDeck offers inventory loans and business lines of credit. Term loans runs $5,000 to $250,000, with 12-month terms paid back daily or weekly. Lines of credit run from $6,000 to $100,000. Pay back over 12 months, with automatic weekly payments.

Demolish your funding problems with 27 killer ways to get cash for your business.

Check out this form of unsecured funding. Unsecured funding does not require collateral, but the lender’s risk is mitigated by higher interest rates. Our credit line hybrid has an even better interest rate than a secured loan. Yet you can get the money faster and easier than any type of traditional funding. Get business funding without having to supply bank statements or credit stubs. You can get funding in a few days rather than weeks without supplying any collateral or documents.

You can get some of the highest loan amounts and credit lines for businesses. Get 0% business credit cards with stated income. No financials required. These report to business CRAs. You can build business credit at the same time. This will get you access to even more cash with no personal guarantee.

You can often get a loan of 5 times the amount of current highest revolving credit limit account. This is up to $150,000. Easily five times what you could get on your own when applying for cards. Get cash out on this program as well.

There will be NO impact on your personal credit with this type of financing. You need a good credit score or a guarantor with good credit to get an approval. With good personal credit, get unsecured credit cards with a personal guarantee. And with good business credit, get unsecured credit cards without a personal guarantee.

Check out business credit. It should be your goal to build business credit, even if you can get funding elsewhere. Business credit will help your company for years to come. Business credit is credit linked to your EIN and not your SSN.

This credit is available without a personal guarantee. It is available regardless of personal credit. You can get business credit immediately. Business credit is the only way to get money for a business when you don’t have collateral, cash flow, good personal credit, or a guarantor.

Demolish your funding problems with 27 killer ways to get cash for your business.

Due to current circumstances, online businesses are doing relatively well. You can get inventory financing for your ecommerce business. Or use personal or business assets as collateral for business loans. Amazon and Kickfurther offer even more options. Our hybrid credit line is a stellar choice if you or a guarantor have good personal credit. And don’t forget to build business credit, for even more money for your ecommerce business.

The post Ecommerce Business Inventory Financing appeared first on Credit Suite.

Millennials are something of a mythical bunch in society. Much is said about their behaviors and preferences, yet many of the stories seem to contradict. Even narrowing down what age group millennials represent is challenging, and many people have differing views.

This confusing picture makes it challenging to target millennials through paid ads, but don’t let it put you off. Let’s look at who millennials are and how you can use that data to create targeted ads that will convince them to convert.

Millennials are defined as “people reaching young adulthood in the early 21st century.” The Pew Research Center further defines the group as those born between 1981 and 1996, though that time period has shifted over time.

Millennials are now the most populous group in the US, making up 21.97 percent of the population, and this trend is set to continue well into the 2050s.

This makes understanding millennials crucial to creating paid ads that actually drive revenue.

One of the key things that make millennials unique is their relationship with technology.

Millennials were born into a world where modern technology hadn’t yet taken hold in daily life like it has today. However, they did grow up in an age where technology was transforming the way we live, so they aren’t new to it.

Generation X adapted to digital technology as adults, and Generation Z have never known life without the smartphone or super-fast internet, but millennials have a foot in both worlds.

The rapid shift to a digital world means millennials’ lives have followed a different path to those generations before and after them. This has influenced them in many different ways.

Of course, it’s hard to ascribe common characteristics to such a diverse group, but some traits seem to be common in this generation, including:

Keep in mind; this is just a rough picture of millennials. There are still individual people with unique politics, education levels, likes, and dislikes. However, these insights need to inform your paid ad strategy.

If you successfully target millennials through paid ads, you’ll engage 21.97 percent of the US population and 2 billion people worldwide. While millennials are more receptive to certain products, this is a huge market for virtually any business.

However, millennials pose several challenges to marketers. First, it is a large, diverse group, and secondly, they’re so accustomed to advertising that some think they’ve become immune to it.

Nobody is immune to advertising, and millennials click paid ads every day. The trick is finding the right strategy.

It starts with understanding your target audience. If your product doesn’t solve the problems millennials have or fit their view of the world, then this group shouldn’t be your primary target.

For example, businesses that provide traditional weddings and razor blade manufacturers have a notoriously difficult time advertising to millennials. This isn’t because this generation is immune to advertising, it’s because the products aren’t as closely aligned to the people’s wants and needs (think of the proliferation of beards in society today versus 20 years ago).

Instead, it’s businesses in travel, tech, fast food, and other sectors where the products match millennials’ specific pain points that are finding success.

If millennials are a key part of your target audience, then paid advertising is an effective option, because it allows you to reach these people where they’re “hanging out.” Ninety percent of millennials are on Facebook, making it exceptionally easy to reach these people with your message.

A key part of marketing is getting your message seen, and millennials give you ample chances to do this.

To successfully target millennials through paid ads, you have to remember this group is very tech-savvy, and they’ve grown up with online advertising.

They see through the cheap gimmicks and aren’t coerced into clicking for no reason. Therefore, you should focus on offering genuine value. The strategies you use to target millennials through paid ads must add to the experience, rather than just serving your own purposes.

Here’s a few ways to successfully target millennials with paid ads.

The good thing about millennials is they are easy to reach. A huge percentage are active on social media, but to make the most of this, we need to understand what platforms millennials are using.

In the past, this was pretty easy. People had Facebook, Twitter, and maybe Instagram. There weren’t many other popular options. Today there are dozens of social media platforms, with new ones popping up every day.

Let’s look at what percentage of millennials use some of the most popular platforms weekly:

Additionally, LinkedIn’s audience is 38 percent millennials aside from these platforms, and 19 percent of millennials are using TikTok.

There are plenty of opportunities out there to target millennials through paid ads. The ability to reach this group isn’t difficult; the tricky part is getting your medium and message right.

These platforms rely on marketing revenues though, so they’re constantly innovating and finding new ways for advertisers to engage their users. For example, Pinterest Story Pins, or Instagram filters let you offer the experience millennials are looking for.

Many studies point to millennials closely held values, and three that are commonly referenced are personal responsibility, diversity, and sustainability.

It’s no surprise, given that millennials make up such a large percentage of the population that these values are being highlighted more in advertising. We often see ads that reference issues that are close to millennials’ hearts, such as climate change and equality.

If your brand is active in these issues, then this is something you should be highlighting in your advertising.

Take Allbirds shoes. they entered the highly-saturated shoe market in 2015, where they faced huge competition. Through a highly-effective advertising campaign that played on their shoes’ sustainable credentials, sales have exploded, and today the company is worth $1.4 billion.

There’s no crazy marketing strategy, it’s just clear messaging that hits on people’s (millennial’s) values.

Millennials grew up in the digital age, and for the most part, they’ve seen all the tricks. They’re used to gimmicky advertising tricks to get their attention, and they learned to filter these out.

What cuts through the noise with millennials (and this is closely related to their values) is being honest and upfront with your advertising. This group knows if something sounds too good to be true, then it probably is, so there’s no point in over-promising and under-delivering.

This ties in with creating paid ads that appeal to millennials’ values; if you’re not serious about sustainability, or equality, or whatever it might be, then millennials are more likely to hold you to account.

This group grew up in a world of big (often faceless) corporations, but thanks to technology, they have a chance to see behind the branding and see the values behind a company. This can be a great opportunity for your advertising, but it’s got to be done in a clear, honest way.

For example, Allbirds doesn’t just use convenient slogans about sustainability in their paid ads. It’s a theme that’s central to its entire customer journey, and it delivers on its promises.

Fifty-five percent of 13 to 35-year-olds send memes every week, and 30 percent do so daily. That’s a lot of memes!

Humor plays a huge role in millennial culture, and it’s something you can use in your paid ads. Funny ads are nothing new; just take a look back at some of the classic TV ads, but for some brands keep things very straightlaced online.

When used in content and ads, memes can have many benefits:

People enjoy humor, and there’s certainly a place for it when you target millennials through paid ads. Just make sure your ads reflect the values of your business and resonate with your target audience. Otherwise, it can backfire.

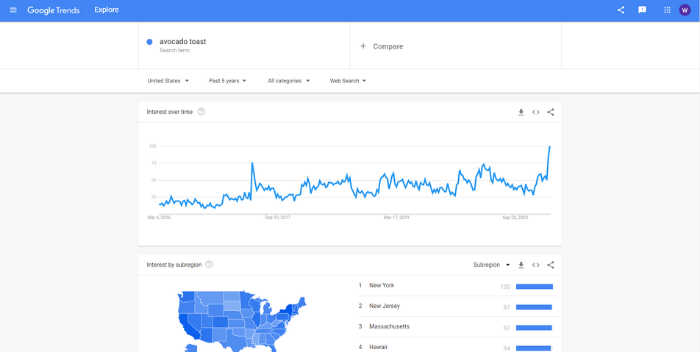

The boozy brunch, avocado toast, and emojis are just some of the reported millennial trends in recent years. When 21.97 percent of the population enthusiastically gets behind something, you can bet it’s a factor to target with your marketing.

If you keep seeing something crop up in popular culture, then check it on Google Trends and see if it’s worth factoring into your marketing.

Remember that millennials are cynical consumers of advertising, so if it’s a reach to link your products to the trend, it’s probably best to leave it alone rather than look like you’re just trying too hard.

One of the best ways to learn about your target audience is simply to ask them questions. Millennials now make up the largest proportion of the workforce, so there are bound to be some in your office.

Obviously, your co-workers have jobs to do, but it won’t hurt to run a few ideas by them. Millennials are a very diverse group, so they won’t be able to speak for everyone, but they might be able to give you some ideas about what works and what doesn’t with this generation.

Brands are always trying to reach millennials through paid advertising, so there are lots of examples, some of which have had tremendous success, and others that are best forgotten. Let’s take a look at the best and the worst of the bunch.

Here are a few ads that nailed millennial marketing.

This is a great example of brands capitalizing on millennial trends in a positive way.

In 2013, a series of YouTube videos found huge success by taking video footage of normal events and overlaying them with “bad lip reading.” One of the most successful videos was “The NFL: A Bad Lip Reading,” which has over 72 million views.

Rather than take offense at the light-hearted fun, the NFL embraced the trend and teamed up with McDonald’s to create their own version.

Airbnb was founded in 2008 and was valued at over $100 billion when it went public in 2020. Part of its success has been a product that is closely aligned with the values of millennials, and its advertising continues to capitalize on this.

Messages such as “Let’s Keep Travelling Forward,” and “We Accept” fit perfectly with the ideals millennials respond to, and this has helped bring the company great success.

What does it look like when millennial marketing goes wrong? Here are a few ads that missed the mark.

It was widely accepted that McDonald’s missed the mark with its fish fillet ad because it’s seen as emotional manipulation.

Emotion is a big part of any ad, but it’s got to be done in the right way. This ad just seems like McDonald’s is using a child’s grief to sell its sandwiches, and that’s something millennials will see through.

Millennials tend to feel a personal responsibility to make a positive change in the world, but brands that exploit that drive will suffer. For many people, this Pepsi ad featuring Kendall Jenner did just that.

Aired during a time of heightened tension around America, the ad seemed to trivialize the cause of the protests and struck the wrong chord with millennials.

Millennials are a diverse, tech-savvy group that were brought up with advertising, so it’s no surprise that it takes some fine-tuning to get your targeting right.

When you take the time to understand millennials, discover what values they hold dear, the platforms they engage with, and the types of content they respond to, then you will find you can successfully advertise to this group.

For some businesses, millennials simply won’t be part of their target market, but with this group making up over a fifth of the population, the majority of businesses are going to have to learn how to target them through paid ads.

Have you had success advertising to millennials?

The post How to Target Millennials Through Paid Ads appeared first on Neil Patel.

Article URL: https://jobs.lever.co/xix

Comments URL: https://news.ycombinator.com/item?id=25275586

Points: 1

# Comments: 0

The post Xix.ai (YC W17) Is Hiring Engineers appeared first on ROI Credit Builders.

Just How To Hide Assets

*(Maybe a poor choice of words! Protecting your ‘assets’ is a better choice of words in my opinion)

In functions, I constantly obtain inquired about “How do I conceal my possessions?” From that are you attempting to conceal your properties from? Exists a legit means to conceal your properties?

If you have actually done well in concealing your properties if a possession search by a very interested event does not expose your identification, you will certainly understand. In an article 9/11, it’s not feasible. Every little thing has actually ended up being extra clear with the flow of federal government financial acts.

Interested events have a means of locating real proprietor for the best cost. The Internet is working on high steroids. Anything you do is open secret.

The initial proprietor and also its existing proprietor can lawfully be transformed without having to go offshore. Reputable repositioning of possessions from you to an irreversible count on is completely lawful. The reality is, if your possessions are possessed by a subchapter S. Corporation or a Limited Liability Company as well as consequently the shares of the Sub S or subscription systems of the LLC are had by an unalterable count on, it’s the citadel people Asset Protection.

CONCEAL YOUR ASSETS WITH IRREVOCABLE TRUSTS

Just how to conceal your possessions is a basic as the rearranging your possessions via an unalterable depend on with a real independent trustee. The secret to the transfer is the exchange of equivalent worth in return for the property, or the invoice of a reasonable market price for the property moved.

If you do not very own possessions, no one will certainly desire to sue you; no one will certainly desire to track you; no one will certainly desire to recognize your name. United States Laws, United States courts will certainly protect and also sustain your property defense system.

QUIT CONTROL OF YOUR ASSETS TO AN INDEPENDENT TRUSTEE

These regulations have actually been specified by many lawsuit, over as well as over, right as much as the Supreme Court. You need to nevertheless, give-up control over your possessions to a real independent trustee. When a Limited Liability Company additionally re-defines your property defense system, your property security system is boosted.

HOW THE LLC CAN HELP PROTECT YOUR ASSETS

The LLC is absolutely nothing brand-new, however (till lately) states rejected to pass its presence. The LLC appears like the German GmbH the French SARL as well as the South American Limitada types of working. The LLC permit tiny teams of people to appreciate restricted individual obligation while running under partnership-type regulations (as opposed to the complicated regulations that put on corporate-type frameworks).

The LLC is identified by the IRS as a “pass-through kind” of overlooked tax obligation entity. That is, the earnings or losses of the LLC go through business as well as are shown as well as tired on the specific’ participant’s income tax return of the proprietors, as opposed to being reported as well as exhausted at a different service degree.

Various other pass-through entities consist of restricted and also basic collaborations, single proprietorships and also “S” companies. If it desires it by submitting IRS Form 8832, the IRS currently allows an LLC choose business tax obligation therapy. Speak with your tax obligation expert or call Estate Street Partners toll-free 888-938-5872.

From that are you attempting to conceal your possessions from? Is there a genuine method to conceal your properties?

You will certainly recognize if you have actually prospered in concealing your possessions if a possession search by a very interested celebration does not expose your identification. The truth is, if your properties are possessed by a subchapter S. Corporation or a Limited Liability Company as well as in turn the shares of the Sub S or subscription systems of the LLC are possessed by an unalterable depend on, it’s the citadel of United States Asset Protection.

Your property defense system is boosted when a Limited Liability Company better re-defines your possession defense system.

The post Just How To Hide Assets appeared first on ROI Credit Builders.

Vital Facts regarding Payday Loans An individual normally in poor demand of cash money as a result of unexpected or emergency situation spending plan needs will certainly often count on this type of payday advance systems simply to correct his/her existing financial issues, although intentionally that they are heading to a much tougher monetary setting … Continue reading Vital Facts regarding Payday Loans

‘If you hold the stock, you have to weather the storm and be comfortable with the volatility.’

The post Want to hitch a ride on Tesla stock? Financial advisers offer rookie investors tips, but suggest proceeding with caution appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND.

The post Want to hitch a ride on Tesla stock? Financial advisers offer rookie investors tips, but suggest proceeding with caution appeared first on Buy It At A Bargain – Deals And Reviews.

Traveling isn’t hard right? I mean, you just jump in your automobile of choice and hit the road. It’s a whole lot easier however, if you map out your trip. The same is true of building better credit. It isn’t hard, but it is easier if you map out the steps you need to take first .

If you are going on a trip, you map out your route, right? You plan your stops along the way. You research potential roadblocks, and you estimate the time you will arrive at your destination. The same things need to happen when working on building better credit.

Before you can map out your route, you have to know where you are and where you are going. Sometimes, especially when flying, the best route is from an airport other than the one closest to you. You have to be sure you start from the right spot. That is the first step in building better credit for your business as well.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

Of course, the best place to start is from the beginning. This isn’t always possible however. Sometimes, you have to backtrack. Take stock of your surroundings and determine where you are, versus where you need to be to get the best start.

That sounds complicated, but it isn’t really. Fundability is key. If your business is already fundable, you are set. If not, then you have a little extra work to do, but you can do it. We’ll show you how. The first thing to do is take stock and ensure your business is fundable.

This step is much easier to take if you understand exactly what fundability is. Fundability is, for our purposes, how desirable an entity is for funding. When we want to talk about building business credit, we mean funding from creditors. Some things that make you appear fundable you can control. Somethings you cannot control. For example, you can control whether your business has its own separate contact information. However, you cannot control the length of time you have been in business. You have to work with what you can control.

Okay, so the first step in mapping out the steps to building business credit is to check the fundability of your business. This includes more than you may think. Of course, it is related to the financial standing of your business, like whether or not you can pay back debt. However, many businesses are turned down for business credit not because they cannot repay the debt, but because of fraud concerns.

Making sure your business is set up as a separate, fundable entity that is separate from the owner will not only help with this, but it will also ensure that business credit accounts are reported properly. This too is a big part of building business credit. So, let’s get to it. Here is your business fundability checklist.

This is like tuning up your car before a trip. You need to work down the list to ensure everything is in working order. The first things to check off the list are related to how your business is set up:

If you set your business up in this way when you first opened, you’re good. If not, you may need to backtrack to get things how they need to be.

The next steps have to do with the information that is out there on your business both online and offline.

At this point you see you are either in good shape, or you have some work to do. The next step, if you need to get yourself in a position more useful for building business credit, is to do whatever you need to do to take care of those items listed above. Once you are good there, move on to the rest of the checklist.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

Evaluate the following and see where you stand.

Lenders aren’t in the business of giving handouts. Rather, they need to know you can pay back the funds they lend you. Thus, if you are bleeding funds, you are going to have a hard time getting approval.

How do you turn it around? Do some financial triage. Look for ways to cut expenses. Do you need to close a location, cut some hours, or explore other options? Maybe leaning harder on your clients with unpaid invoices would help.

Lenders will want to see that you have a clear strategy for how you intend to use the funds they lend you. First of all, they want you to demonstrate you will be responsible with their money. In addition, they also want to know how you will use the money they give you to make more money.

Why is this important to building better credit? You need accounts reporting to the business CRAs. To do this, you will have to use vendor and retail credit. They will not ask how you intend to use the funds, but you need to have a clear idea of how you are using the funds to build your business other than for building credit.

Here’s what I mean. You will need to get a business credit card that will report to the business CRAs. You will need to charge things on that card. What you do not want to do is charge things on that card that you do not need or will not benefit your business at all.

If you do not have a plan for success, you will not appear fundable to lenders. They’ll want to see that you have a clear strategy for taking your business all the way.

Okay, so you’re all tuned up and ready to hit the road. Now you need to check your route. It can be tempting to take the most direct route, but often that is not the best route. When building credit, it can seem that simply using your personal credit is the best way. It’s not. You can’t just willy nilly start applying for business credit cards though either. You’ll get denied, and that won’t do you any good.

We know the best route, and while it doesn’t appear to be the fastest, it is. This is because it is really the only route. The others are viciously misleading and will not take you where you want to go.

This route to building business credit travels across what we like to call the credit tiers. The idea is that you get accounts reporting in tiers, so that they can build on each other. You have to do it in order, because if you apply to a higher credit tier first, you will not have strong enough credit to get approval.

The first of these tiers is the vendor credit tier. Here is why it is the best way to start building business credit. This tier is made up of retailers that will extend net 30 terms without even checking your credit. Not only that, but they will report your payments on these invoices to the business credit reporting agencies. This is how you get positive accounts reporting on your credit report before you actually have a credit score. Find a few to get started with here.

As you get more and more of these accounts reporting, you credit will grow stronger and stronger. If you want to work toward building better business credit even faster, consider talking to those you already have a relationship with. Sometimes vendors you already work with will extend credit without a credit check. You can also ask utilities, telephone companies, and your landlord to report payments you make to them. They don’t have to, but some will if you ask.

Once there are 5 to 8 or more vendor trade accounts reporting to at least one of the CRAs, then you can move on down the road to the retail credit tier. These companies are retailers also, but they do not extend credit so easily as those in the vendor credit tier. They include those retailers that issue credit cards that can only be used at their own stores such as Office Depot, Staples, and Lowes.

For example, Lowes reports to D&B, Equifax, and Business Experian. They want to see a D-U-N-S and a PAYDEX score of 78 or more. You cannot get that 78 PAYDEX without accounts first reporting to the CRAs. That’s why you have to hit the vendor credit tier first.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

After 8 to 10 accounts are reporting from the retail credit tier, you can follow the route to the fleet credit tier. It includes companies like BP and Conoco that limit the expenses their cards can be used for. Fleet credit cards can only be used for fuel and vehicle repair and maintenance cost.

The final destination along the route to building better business credit is the cash credit tier. These are those credit cards with higher limits, lower rates, and nice rewards that do not limit the place they can be used or the type of expense they can be used to pay. If you stay on the path, you should reach this destination with no problem.

Staying on the path means, of course, that you handle your credit responsibly and make your payments on time. You also need to monitor your progress along the way, and make sure nothing is slowing you down.

Know what is happening with your credit. Make sure it is being reported and attend to any mistakes as soon as possible. We can help you monitor business credit at Experian and D&B for only $24/month. Go to www.creditsuite.com/monitoring to find out more. You can also monitor with the CRAs directly, but it will cost considerably more.

You are looking for a few things when monitoring your business credit. First, you want to see that each of your accounts are reporting payments. If they aren’t, contact them to find out why. Next, you want to make sure all of the information is correct. If you see a mistake, send a letter to the reporting agency in writing, along with copies of backup documentation.

Lastly, you need to see how many accounts are reporting so that you will know when it is time to start applying for cards in the next credit tier. This will save you a lot of time, because you will not be applying for cards for which you cannot yet get approval.

Building better credit is possible if you know the steps. Once you make sure your business is set up properly to begin building business credit, you have the whole road open to you. Along the way, as you are working, you can take any other steps necessary to ensure your business is fundable. When the time comes to apply for loans, you will be set because you will have built the best business credit score possible for your business.

The post Mapping Out the Steps to Building Better Credit appeared first on Credit Suite.

If you know anything about business credit is it probably about the Dun & Bradstreet PAYDEX score. D&B is the largest and most commonly used business credit reporting agency. The PAYDEX score is the score from Dun & Bradstreet that lenders use most often. This is likely because it is the most comparable to the consumer FICO, so they feel like they can easily understand the information it is telling them. Follow these tips to build PAYDEX score fast.<

Your Dun & Bradstreet report is among the first things a lender will look at when determining whether to do business with you. They offer database-generated reports to their clients to help them decide if you, a potential vendor, supplier, or business partner, are a good credit risk.

A company will rely on the D & B Report about your firm to make informed business credit determinations and avoid bad debt. Dun & Bradstreet takes several factors into account in creating such a report. Let’s look at all of these factors in turn, starting with the PAYDEX. Afterall, you cannot understand how to build PAYDEX score fast without understanding what exactly the PAYDEX is.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

The PAYDEX Score is Dun & Bradstreet’s score that tells the lender how well your business has paid the bills over the past year. D & B bases this score on trade experiences documented by vendors. It ranges from 1 to 100. The higher the score, the lower the perceived risk.

We will discuss this more in depth later, but the quick answer to how to build PAYDEX score fast is to pay your business obligations on-time and consistently. The trick is getting those payments reported to D&B and not personal credit reporting agencies.

In addition to the PAYDEX, D&B uses the following.

To estimate how likely a company is to be late in paying debts, Dun & Bradstreet uses predictive models. They use predictive scoring, which takes historical data to try to predict future results. They do this by figuring out the potential risk of a future decision, then they compare the historical information to a future event. Thus, predictive scoring only represents a statistical probability, and not a guarantee.

The Financial Stress Percentile compares companies in categories such as region, industry, number of employees, or number of years in the business. Financial Stress Score Norms determine an average score and percentile for similar firms.

Dun & Bradstreet generates Financial Stress Scores to predict how likely it is a business will fail over the next twelve months. These scores range between from 1,001 to 1,875. A score of 1,001 represents the highest probability while a figure of 1,875 shows the lowest probability of business failure.

This is a rating from D&B that places business in classes from 1 to 5. Class 1 includes businesses least likely to fail, while class 5 includes those firms most likely to fail. Therefore, a D & B customer can rapidly divvy their new and existing accounts by risk and then determine how to proceed. If your business is shown as being Discontinued at This Location; Higher Risk; or Open Bankruptcy, you are going to automatically get a 0 score.

This score has a 1-100 ranking where a 1 percentile is most likely to fail and a 100 percentile is least likely to fail. If D&B identifies a company as financially stressed, that indicates it has stopped operations following assignment of bankruptcy, voluntarily withdrawn from business operation with unpaid obligations, or closed up shop with a loss to creditors. It could also mean a company is in receivership, reorganization, or has made some sort of an arrangement for the benefit of creditors.

The Supplier Evaluation Risk Rating (also called a SER Rating) predicts how likely it is a company will get legal relief from creditors or end operations without paying creditors in full over the next twelve months. Once Dun & Bradstreet calculates the Financial Stress Score percentile for your company, they apply a second set of rules to calculate the SER Rating, on a scale of 1 – 9. A 1 means your company is least likely to fail to pay suppliers. A 9 is the opposite, showing the highest likelihood.

A D&B Credit Limit Recommendation includes two recommended guidelines:

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

D & B bases these dollar guideline levels on a historical evaluation of the credit demand for similar businesses, with respect to employee size and industry. Dun & Bradstreet assesses how likely a business is to continue to pay your according to the agreed-upon terms, and how likely it is to experience financial stress in the next twelve months.

A D&B Rating helps lenders swiftly assess a business’s size and credit potential. Dun & Bradstreet bases this rating on details in your company’s balance sheet, plus an overall evaluation of the firm’s creditworthiness. The scale goes from 5A to HH.

This number, between 1 through 4, makes up the second half of your firm’s rating. It reflects Dun & Bradstreet’s overall rating of your business’s creditworthiness. They analyze company payments, financial information, public records, business age, and other factors.

If your company does not supply current financial information, you cannot get a Composite Credit Appraisal rating of better than a 2. The 1R and 2R rating categories show company size only based on the total number of employees. Consequently, these ratings are assigned only if your company’s file does not contain a current financial statement. Employee Range (ER) Ratings apply to specific lines of business not lending themselves to categorization under the D & B Rating system. These kinds of businesses receive an Employee Range symbol based upon the number of employees and nothing else.

In general, when Dun & Bradstreet does not have all of the information they need, they will show that in their reports. However, omitted information does not necessarily mean your firm is a poor credit risk.

Finally, any report is only as good as the data it originates from. Dun & Bradstreet’s database includes over 250 million companies around the world. It includes around 120 million active companies and about 130 million companies which are out of business but kept for historical reasons. D & B continuously gathers data and works to improve its systems to ensure the greatest degree of accuracy feasible. Businesses should provide D&B with a complete financial statement to ensure as accurate a report as possible.

While it is tremendously helpful to understand all the different reports Dun & Bradstreet can generate for your business, when it comes to getting funding you need to know how to build PAYDEX score fast. Keep in mind however, fast is relative. Will it take years like it does to build a personal credit score? No, it won’t. Will it happen overnight? That’s a resounding no as well.

It also will not happen on its own. You cannot passively do business and expect to build PAYDEX score fast. You have to take intentional steps toward building your business credit score. It’s a process, and it starts with how your business is set up. Some of these steps may already be done, as often they happen in the course of opening a business. Some of them however, may not have seemed necessary at the time. When it comes to building PAYDEXs however, they are absolutely necessary.

Regardless of where you are in the life of your business, it is never too late to take the steps necessary to build PAYDEX score fast.

Many times, in the early days of a business, business owners find it easy to run the business as an extension of themselves. They operate as a sole proprietorship, using their own address and phone number as contact information. There seems to be no reason for a separate bank account, and an SSN works just find when asked for.

To build PAYDEX score fast however, this will not work. Your business needs to be separated from yourself as the owner. It needs to appear to lenders to have fundability on its own merits, not yours.

Contact information is an identifying factor. If you apply for credit with your personal address and phone number, that application is going to pick up you’re your personal credit report. Your business needs its own phone number and address. If you don’t have an actual location or separate phone line, you can still accomplish this. There are a number of options for phone numbers that will ring to your current line, and virtual offices offer a physical mailing address along with many other services.

This is easy to do and completely free. It can be done online at IRS.gov in a matter of minutes. The point is to use this number, instead of your social security number, to apply for credit in your business name. This way, the account will report your information to the business CRAs, including Dun & Bradstreet.

Whether you choose to incorporate as a corporation, S-corp, or LLC does not matter when it comes to fundability. Make that decision based on other factors, like how much liability protection you need and your budget. You do need to choose one though. Operating as a sole proprietorship will not work well if when building business credit.

If your follow every single step and do not do this one, you will never build PAYDEX score fast. In fact, you cannot have a PAYDEX score at all if you do not have this number. It’s free also, and easy to get on the D&B website. However, they will try to sell you a ton of other services that you really do not need. Just get the number and move on.

Not only will this help you keep your business expenses separated from your personal expenses for tax purposes, but it will also help you when you apply for credit in your business name. Some vendors and lenders like to see a business bank account with a minimum average balance before extending credit.

Separating your business from yourself is not the whole story. That’s really just laying the foundation that you can build on. You have to stack the blocks, and they have to be stacked in order. You can’t just follow all these steps and then go apply for regular business credit cards with your business credit. It still doesn’t exist.

The key to building PAYDEX score fast is the vendor credit tier. This is how your will initially build your PAYDEX score so that you can apply for credit from those lenders that will want to see a strong score.

The vendor credit tier includes starter vendors that will issue invoices with net 30 terms without even checking your credit. Set up your account in your business name, and they will report your on-time payments to the business credit reporting agencies. It is important to note that not all of them report to all the CRAs, so be sure you find those that report to Dun & Bradstreet if you want to build PAYDEX score fast. The more of these vendors your have reporting, the faster your score will grow. Remember though, you have to pay on time.

At the same time, you can talk to vendors you already do business with. In light of the fact that you already have a relationship with them, they may be willing to offer net terms without checking credit and report payments. Check with utilities too. They will sometimes report payments to D&B if you ask. The more accounts you get reporting, the faster your score will build. With each on time payment your score will only get stronger.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

This process is not only important for building PAYDEX score fast, but really for building PAYDEX, or any business credit at all. If you do not separate your business from yourself, any credit accounts you get approval for will report payments to your personal credit. That doesn’t affect your business credit score. If you follow these steps however, you will be able to build your business credit score on each report, including your PAYDEX report, faster.

The post How to Build PAYDEX Score Fast: And Other Dun & Bradstreet Reports You Need to Know About appeared first on Credit Suite.