Article URL: https://www.notion.so/lowkeygg/Lowkey-Job-Board-39a26c1b4a00493fadc26249185df748

Comments URL: https://news.ycombinator.com/item?id=27086360

Points: 1

# Comments: 0

Article URL: https://www.notion.so/lowkeygg/Lowkey-Job-Board-39a26c1b4a00493fadc26249185df748

Comments URL: https://news.ycombinator.com/item?id=27086360

Points: 1

# Comments: 0

Even the best hard money lenders can be problematic. Read on to find out more.

If you’re looking to flip houses, you may have heard these terms. But what is hard money funding, and can it work for you?

Hard money loans are asset-based loans that can fund any real estate investment. These loans are based on the property value. There is no need for background checks or credit scores. Some lenders even offer hard money loans based on the after-repair value of a building. Hard money lenders make finance house flipping with their asset-based loans.

Since it’s based on the real estate value (before or after repair), a borrower with poor credit can get these loans. Hard money loans are fast, sometimes even within 24 hours of application.

Interest rates can be very high, as in three times that of banks. Terms can be very short, as in 6 – 18 months, versus a standard 30-year mortgage.

Plus a hard money lender wants you to have some skin in the game, typically at least 10% of your own money. That way the lender knows their interests are protected, because you don’t want to lose your money. Hard money loans also tend to not be subject to consumer lending regulations. So, caveat emptor.

If you go ahead with hard money funding, its use is virtually always for real estate projects. These are either house flipping, or real estate investments.

House flipping consists of buying a property, repairing it, and selling it for a profit. Fix and Flip loans are one of the most common types of hard money loans. For house flippers, having fast funds for their flips is a necessity. These hard money loans are made for house flippers looking to flip a property by making some upgrades and selling it for a profit.

Fix and flip loans are short term loans (6 – 12 months) covering almost all the house flipping costs. Hard money funding is not only used to cover the property value of the building. It also pays for a portion of the repairs needed to flip. For example, some hard money lenders even offer to base the loan on the after-repair value of the flip. This gives the house flipper more funds to flip with from fix and flip lenders.

Demolish your funding problems with 27 killer ways to get cash for your business.

House flippers don’t always sell the buildings they repair. Many make passive income by renting their properties. For those looking to acquire and upgrade large rentals, hard money funding is essential. This type of flipper financing lends on the underlying asset of the property.

To make the most of long-term rentals, upgrading and repairing the property is necessary. Here, hard money loans are based on the after-repair value of the property. House flipper funding for large one-time repairs to a property helps improve the property for higher rents. It also helps to offset the cost of the repairs.

With alternative rental sites like Airbnb becoming more and more popular, house flippers are looking into flipping vacation rentals with hard money loan lenders. Vacation rentals can turn over large profits but many will require large repairs to get more bookings. These repairs and modern upgrades are necessary to ensure solid bookings throughout the year. Using hard money funding to make upgrades is faster than using a traditional lender. Like all flipper financing, the loan is based on property value and not the applicant’s credit history.

Paying cash for a property is a great way to lower costs for a property. But it leaves gaps for funding repairs. Home rehabs are ideal for one-time large repairs. This can be for a flip that they bought in cash, a rental, or anything in between.

Often when looking to charge more in rent, house flippers will add amenities and upgrades to their properties. Home rehabs can also be for investors looking to sell off property and maximize their return by adding a few upgrades. With only using flipper financing for the repairs, the house flipper can save money on down payments. This means a larger profit margin via hard money lending. Hard money funding can be a way to make sure projects finish on time.

Sometimes house flippers need to refinance properties to prevent foreclosures, get better rates, or get more cash to finish their flip. Bridge loans, a special type of flipper funding, can help flippers complete their projects to save them from foreclosure. Bridge loans work to ‘bridge’ cash gaps for a property. This cash is used to finish the flip, sell the property, or prevent foreclosure.

Sometimes, house flippers will use hard money loans to buy foreclosed properties. This makes them a great option for someone looking to pounce on a great deal in the fast-moving real estate market. Sometimes bridge loans fund short sale loans, or even the acquisition of off-market properties. They can help you get a hard money loan for auction property.

Reasons for refinancing include to prevent foreclosure, fill in cash flow, or make sure a project is done on time. Hard money funding can help with all of these issues. This type of funding works for house flippers who need a one-time influx of capital.

Hard money funding can be used for more than flips. It can also be used for commercial real estate financing. This is for commercial properties such as retail stores. Note: hard money loan rates will vary.

Demolish your funding problems with 27 killer ways to get cash for your business.

Flippers and commercial real estate investors have choices beyond hard money loans. They can try a home equity loan for flipping, or an investment property line of credit for real estate investments. Another option is a business line of credit.

Yet another option is a cash out refinance loan, or a permanent bank loan/online mortgage. Rates and terms will vary. But for great rates, have you checked out what Credit Suite has to offer?

Amounts range from $100,000 – $20,000,000. This financing can be used for refinancing a property, even if you are doing a cash-out refinance. Maximum LTV 70%.

Loan-to-values range from 55 – 65%, depending on the purpose of the loan. Plus your clients can also get SBA loans. Renovations get loan to value of up to 60%.

Credit Suite has funding programs available including conventional property financing, money for investment properties and hard money loans, bridge loans and loans for the purchase of commercial real estate.

Credit Suite offers financing for many different, even unique property types. Get funding for industrial offices (general or medical/dental), light manufacturing buildings, self-storage facilities, and more.

Demolish your funding problems with 27 killer ways to get cash for your business.

Approval amounts go up to $20,000,000. Bad credit is accepted. Use the real estate as collateral. You will need to provide bank statements. House reseller financing or a commercial real estate loan can be a big step, let’s take it together.

Hard money funding can be a good choice for house flippers and commercial real estate investors who have bad credit or want/need to get money fast. But interest rates can be high, and terms can be short. Plus there is little regulation. Credit Suite can help you get funding for commercial real estate or house flipping, with better rates and terms than you would expect.

The post Can the Best Hard Money Lenders Make this Form of Business Funding Worthwhile? appeared first on Credit Suite.

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

A functional online directory plugin will help you deliver business or personal information by location or category for internal or external use.

Whether you want to build a glossary of names and terms for your employees or a comprehensive business index, a good directory plugin for your WordPress website will help you do just that.

Directory plugins serve a simple purpose: to create a user-friendly database with up-to-date details for both your customers and internal team. Your plugin of choice will give you access to this information along with pictures, location information, and contact details.

As there are many directory plugin options out there, I’m here to make it easier for you by narrowing it down to the top five best directory plugins for your WordPress website—so you won’t have trouble finding the right one for you.

If you’re looking for a wide variety of directory categories to choose from, the Business Directory plugin is an excellent option.

This plugin allows you to easily build the directory you want by seamlessly pairing it with any WordPress website.

It doesn’t matter what type of directory you wish to build because the Business Directory plugin has it all. The plugin covers the basic local business directories as well as employee, member, restaurant, medical, tour and travel, hotel, software review sites, and book review site directories.

Along with its extensive category list, Business Directory offers a simple installation process that WordPress users can rely on.

With its easy directory templates, you can change the style and layouts to suit your preferences. This plugin also lets you have full-field control to create your own custom fields for simple list navigation.

Some other helpful features include:

Business Directory offers three pricing plans, including:

These pricing plans may be quite expensive for some, so I recommend the Business Directory plugin for those who need a diverse range of categories for their directory. All pricing plans come with a 14-day money-back guarantee. Try it today.

Customization is important for directory plugins, which is where GeoDirectory comes in. GeoDirectory is an excellent option for website owners who are looking for ultimate flexibility and customization options.

With its incredible compatibility, this plugin works with any WordPress theme and allows you to easily customize your page the same way you do for your actual website and theme. GeoDirectory also lets you customize 40+ widgets, shortcodes, and blocks, and all features are available in any format.

This plugin offers an intuitive drag-and-drop tool that helps you organize and reorder listing pages while easily adding customized tabs, fields, and content.

Custom fields also come with a fully customizable and unique badge system that you can include in your listings. These badges include terms such as new, featured, and recently updated. You can also add badges with counts, video icons, and social links.

By using GeoDirectory, your WordPress website will benefit from multiple advanced features, including:

As one of the most comprehensive directory plugins on the web, GeoDirectory offers four different pricing plans:

Every plan includes all products, add-ons, and premium support for the corresponding period. If recurring subscriptions aren’t your thing, GeoDirectory offers single four, six, and 12-month plans. A 30-day money-back guarantee covers all plans, except for the Lifetime tier. Learn more.

With its high-quality and supportive features, Connections Business Directory is a great free option for those looking for a starter plugin. With over 900,000 downloads, this plugin will help you seamlessly integrate your customized directory with your WordPress website.

The Connections Business Directory system and database have been carefully crafted for maximum compatibility with WordPress, so your installation experience is smooth and simple—especially for website owners with little technical knowledge.

The plugin is also completely scalable and gives you the option to manage hundreds of entries within your directory.

Another outstanding feature of Connections Business Directory is the robust templates. For a free plugin, it offers you a decent range of templates to get you started—with a template pro package available for an additional cost.

Apart from it being free, which is a huge bonus, Connections Business Directory has prominent features, such as:

As you can install Connections Business Directory for free, they don’t have any pricing plans. However, you can purchase premium add-ons and extensions for an affordable price. Some of the most popular add-ons include the Widget Pack for $9.99 and the Custom Category Order for $4.99.

Template bundles include:

Although these prices are very affordable, it’s also important to create a budget not to overspend on the extras. In that case, you may find a different directory plugin with additional features for around the same price.

Create a powerful business directory using the Advanced Classifieds and Directory Pro (ACADP) plugin. With its unique unlimited features, you can build an advanced directory from scratch with little to no effort.

Even though this plugin offers customizable settings and layouts for an easy view of your listings, the multifunctional widgets are by far the best feature to take advantage of.

ACADP has a wide variety of WordPress-compatible widgets that offer a more convenient way for you to add and manage content on your website without complex code, making it a perfect tool for beginners.

ACADP specifically designs the widgets to showcase listing-related information and tools for easy navigation. The widgets include ACADP search/filter, categories, locations, listings, listing address, listing contact, and listing video.

Your website will easily support these widgets and all users need to do is hover and click on the widget they need for extra information.

Being quite a comprehensive plugin, you will benefit from many features, including:

ACADP has two pricing plans you can pay for monthly, yearly, or with a one-time life fee, which includes:

ACADP offers between three and five sites on the Professional plan, but you will have to pay additional costs according to how many sites you want. They also offer a 30-day money-back guarantee for all plans and a 20% discount on the lifetime plan.

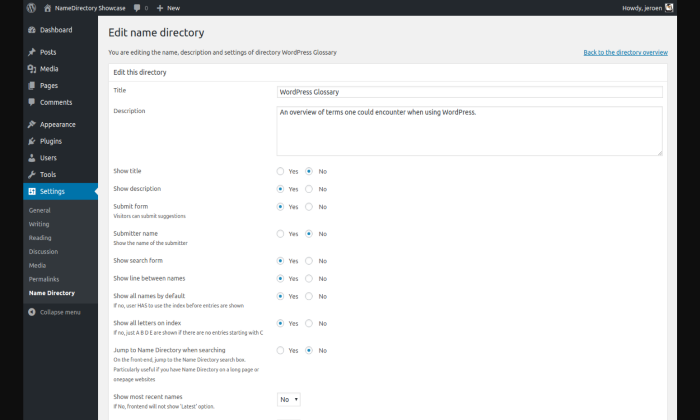

Name Directory is another free plugin, however, it’s a little different from the other options on this list as it isn’t a standard business index plugin. If you are a beginner looking for a more basic database that can build online glossaries for your WordPress website, Name Directory is an excellent option.

With a similar control panel view to the WordPress administration panel, you will have a simple time adding to, navigating, and managing your online glossaries through Name Directory. You can add multiple directories with this plugin with simple shortcodes to copy and paste into the database.

Every online glossary you build also has a few customization options to alter the directory’s layout and functionality.

Even though this is a basic directory, there are still a wide variety of configuration options you can choose from to help maintain your online glossaries.

Some of these include the option to show/hide title, description, and search function, select the number of columns to display, enter the subject of the directory, and limit the number of words in your description with a ‘read more’ link.

Because it is an entirely free plugin, there are limited features, but Name Directory includes:

Name Directory is free to download and install. However, the developer team offers paid customization for anyone looking at a more extensive plugin at a low price.

Now that you know my top five recommendations for the best directory plugin for WordPress, it’s time for you to look for the right product for your website.

To make it easier for you, I narrowed down the top three criteria that helped me find the best options above. All you have to do is weigh up these criteria against your personal needs to find the perfect plugin for you.

Not every plugin will have all three criteria, but it’s important to find a plugin with at least one or two of these for you to use your website to its maximum potential.

Being able to customize your old and new listings is paramount to the success of your business index.

Having a flexible and customizable plugin like GeoDirectory will make sure your listings are up-to-date for your users.

Not being able to customize your directory will heavily impact your business due to lack of functionality, so it’s imperative to find a plugin that offers at least some customizing options.

A rating and review system is paramount for letting your users express their opinions about your listed businesses.

Just like the Business Directory Plugin that offers a rating module, it helps to bring more inclusivity to your website by allowing users to rate businesses on a scale of one to five.

Plus, ratings and reviews help users decide on the most trusted service, and you can risk losing business without it.

A plugin that offers any sort of bookmarking tool will help transform your website.

ACADP is one of the directory plugins that have this tool alongside advanced searching and filtering features.

This tool will allow your users to bookmark individual listings for future reference, making it incredibly convenient while saving time.

Your business index won’t completely suffer without it, but it’s a handy tool that will increase consistent traffic for your website.

Finding the best directory plugin for your WordPress website depends on a few factors like customization, a rating and review systems, and bookmarking tools, among other features.

Looking for these elements is a great place to start, as it will ensure you get the maximum support from your desired plugin.

I’d recommend the GeoDirectory and Business Directory Plugin to anyone looking for extensive and highly customizable directory plugins for your WordPress website.

GeoDirectory is the most customizable option on the list, with excellent WordPress compatibility and an intuitive interface. As a developer-friendly system, anyone can transform and customize the pre-existing databases to suit your every need.

Business Directory Plugin is also great for extensive categories. If you have multiple niches and locations you wish to cater to, this plugin has it all in terms of options. It’s also mobile-friendly and has great payment integration options if you want to earn as you go.

That being said, the other three directory plugins are excellent options that highly suit beginners.

Here’s a quick recap:

The post Best WordPress Directory Plugins appeared first on Neil Patel.

Video Clip Marketing For Free Traffic Making use of video clip advertising to drive website traffic to your internet site is an internet marketing method numerous local business proprietors and also net marketing professionals are starting to welcome, with much success. Having a standard site just permits you to get to those individuals that initially …

The post Video Clip Marketing For Free Traffic first appeared on Online Web Store Site.

IXON | DevOps | Overloon, Netherlands | REMOTE for now | https://www.ixon.cloud/

Keeping machines running, that’s why we do it. A machine builder’s job used to be done after delivering the machine. Nowadays, they remain involved throughout its entire lifespan. All to ensure that the machine runs as optimally as possible. But how? By connecting the machines to the cloud, in a platform in which all machine service and maintenance is managed. With the IXON Cloud platform and supporting hardware, we deliver the technology, so the machine builder can do what they do best: collaborate with clients, provide service, and share insights.

https://grow.ixon.cloud/o/systeembeheerder-linux-devops-32-4…

Article URL: https://www.workatastartup.com/jobs/25893

Comments URL: https://news.ycombinator.com/item?id=24073429

Points: 1

# Comments: 0

Safe Investing With Term Investments

Do you desire a financial investment that offers the versatility to retrieve it should the demand occur? If you addressed yes to any of these concerns, term financial investments would certainly make a superb enhancement to your profile.

Term financial investments, such as Guaranteed Investment Certificates (GICs) and also term down payments, totally ensure your preliminary financial investment and also offer a steady, foreseeable price of return. These kinds of financial investments can be exchanged cash money and also are a few of the best financial investment alternatives readily available.

There is a wide option of term financial investment items to pick from to fulfill everybody’s financial investment demands. Term financial investments are created to aid get to temporary economic objectives, such as purchasing a cars and truck or intending a household trip, along with to include safety and security and also variety to your lasting financial investment profile. They are additionally excellent financial investment cars for Registered Retirement Savings Plans (RRSP), a Registered Education Savings Plan (RESP) or kept in a Registered Retirement Income Fund (RRIF).

” Whether you are a beginner or skilled capitalist, term financial investments are a audio and also clever element of any type of well varied profile,” claims Julie Sheen, Vice-President, BMO Term Investments. “And there is something for every person. Your regional financial institution branch can

aid you to not just establish which items are best matched for you, yet likewise what part of term financial investments you need to integrate right into your profile.”

The vital indicate keep in mind is that whatever your financial investment purposes, every profile ought to have an aspect that is safe.

Details given by BMO Bank of Montreal. For additional information go to www.bmo.com.

– News Canada

If you addressed yes to any of these inquiries, term financial investments would certainly make an exceptional enhancement to your profile.

There is a wide option of term financial investment items to select from to satisfy everybody’s financial investment demands. Term financial investments are created to aid get to temporary monetary objectives, such as getting a vehicle or intending a household trip, as well as to include security as well as variety to your long-lasting financial investment profile.” Whether you are a beginner or knowledgeable capitalist, term financial investments are a audio and also wise element of any type of well varied profile,” claims Julie Sheen, Vice-President, BMO Term Investments.

The post Safe Investing With Term Investments appeared first on ROI Credit Builders.

| Many small business owners don’t realize that business credit scores are distinctly separate from personal credit scores. Your business credit score has no impact on your personal credit score, and vice versa.

Business credit reflects your company’s image to potential lenders and business partners. Yet, unlike personal credit — which can be viewed only with the permission of the report holder — business credit scores are made available to the public. Anyone can view your business credit score for any reason. Furthermore, business credit is expressed with a different numerical range than personal credit. Business credit scores provide a quick view of a company’s risk potential based on a scale of 1 to 100 — the higher the score, the lower the risk. Score Range Risk Class Risk Description Score Range Risk Class Risk Description 76-1001 – Low 51-752 – Low-Medium – 26-503 – Medium 11-254 – Medium-High 1-105 – High |

| Contributing Sources: www.smartbusinessreports.com | www.sbcr.experian.com | www.businesscreditfacts.com |

The post Your Business Credit Report appeared first on ROI Credit Builders.

This financing allowed our client to grow their business and achieve their objectives.

This helped unlock opportunities of growth and our client was very pleased.

We take great pride in our client’s success!

Click Here to see how much funding you can get for your business.

The post Achievement in funding in Durham, NC… $100,000.00 in Private Equity! appeared first on ROI Credit Builders.