Do you want to be instafamous?

Well, who doesn’t?

Over the last few months, I’ve been running numerous Instagram experiments and I’ve finally figured out how to grow my Instagram following.

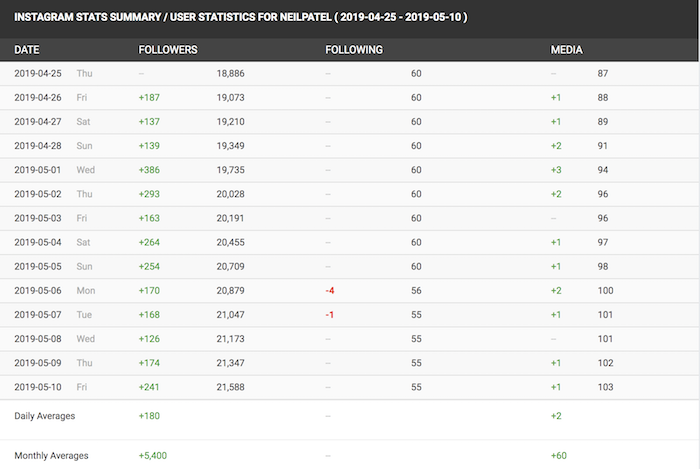

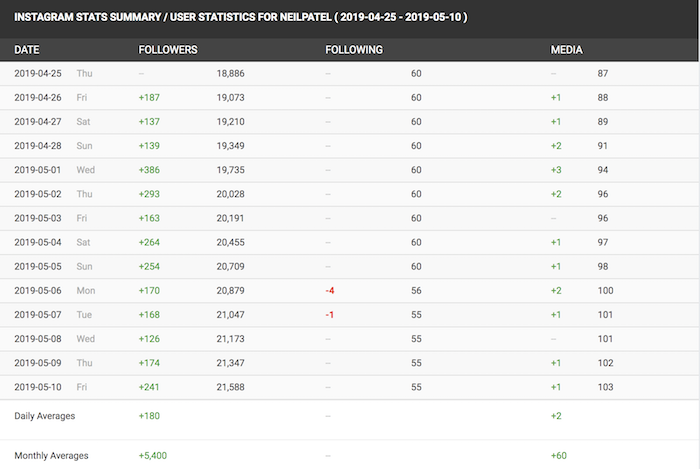

My Neil Patel account has been growing by 1,260 followers per week.

And I know what you are thinking… Neil, you are already well known, this can’t be replicated by anyone else.

Right?

Well, not only did we test this strategy out on my profile, but we also did it on 2 other profiles.

It works no matter what industry you are in. Heck, it works even better if you aren’t in B2B like me.

Just look at Dhavalilama. His likes per image have been growing by just using the heart trick, which I will explain in a bit, and he isn’t using my whole strategy. :/

So, how do you gain more Instagram followers each week without spending money?

Tip #1: Instagram wants long videos

You’ve heard everyone say that you need to upload videos. Social networks like Instagram aren’t just competing with other social networks, they are competing with traditional media and even companies like Netflix for your attention.

If you upload videos, you’ll find that you’ll get more engagement than if you just upload images.

But the key isn’t to just upload any video… it ideally needs to be engaging and long.

By long I am not talking about a 60-second video, I’m talking minutes. You’ll have to leverage IGTV for this, but that’s what they want as not enough people are using that feature.

Hence, if you use IGTV, they’ll push your video more.

That way when someone is watching a 5-minute video you just posted, they’ll be able to watch the first 60 seconds on their feed and then they’ll be pushed over to IGTV.

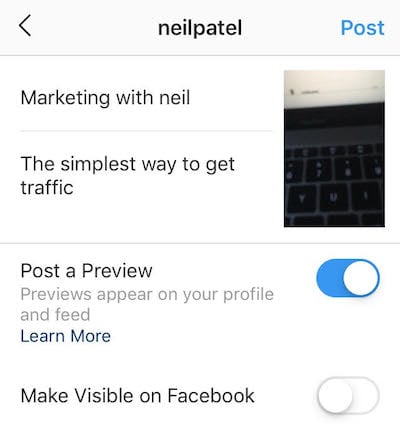

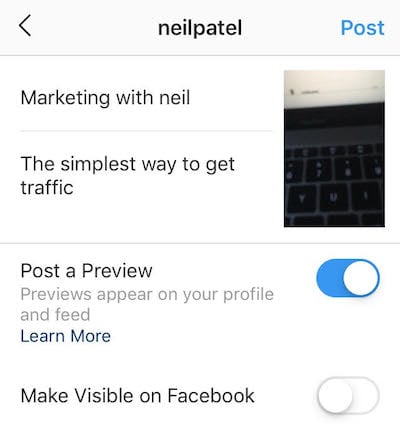

All you have to do is upload the video to IGTV and select the “post a preview” option.

What this does is, it uploads the video to IGTV and then also promotes the video through your feed.

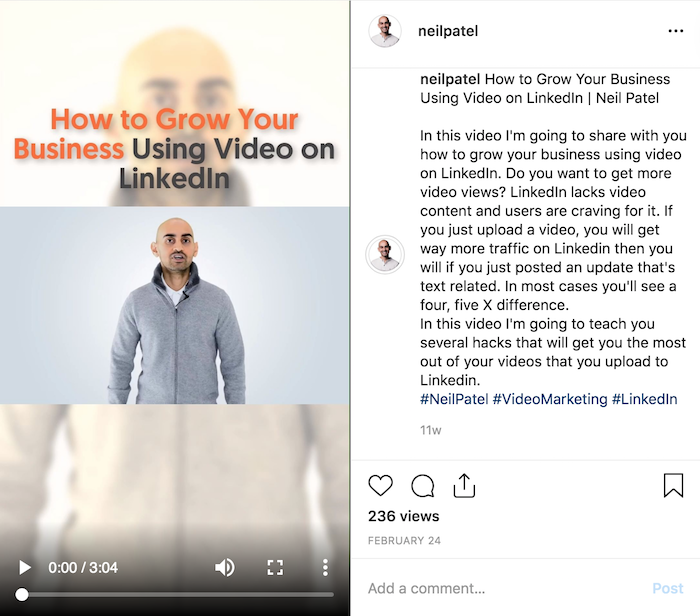

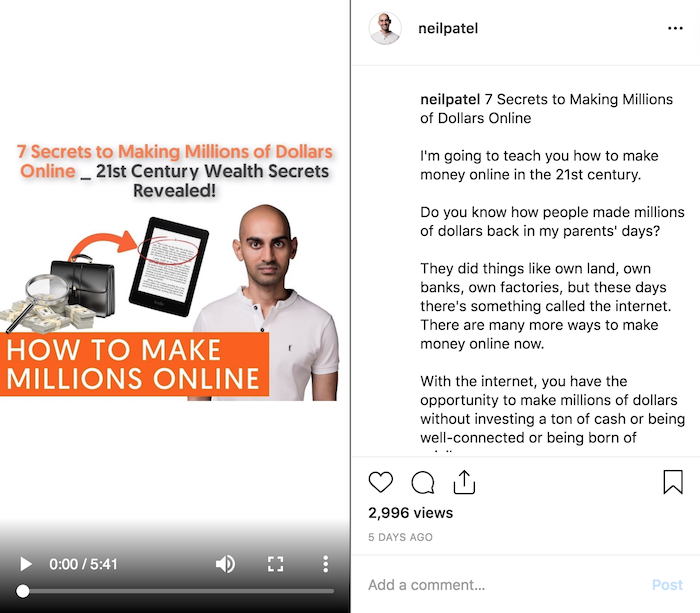

Just look at this video that I only posted on IGTV.

It had 236 views before writing this blog post.

When I posted that video, I had 9,078 followers, which means I had an engagement rate of 2.59%.

Now if you look at this video that I posted…

It had 2,971 views before writing this blog post.

When I posted that video I had 21,047 followers, which means I had an engagement rate of 14.11%.

What’s crazy is, that one simple change increased my video engagement by 444%.

Tip #2: Ask and you will receive

Instagram’s algorithm is simple… the more views and likes your videos and images receive, the more people will see them, which increases engagement and your follower count over time.

There’s not too much more to the algorithm.

Of course, they are looking at things like what percentage of your followers actually engage… but still, the algorithm from a conceptual standpoint is simple.

So, have you thought about asking for people to “like” your image?

Now with Instagram, people are using it via their cell phone so it’s more of a “double tap” than a like… but you get the point.

On average, when I post an image on Instagram I can generate 945.6 likes.

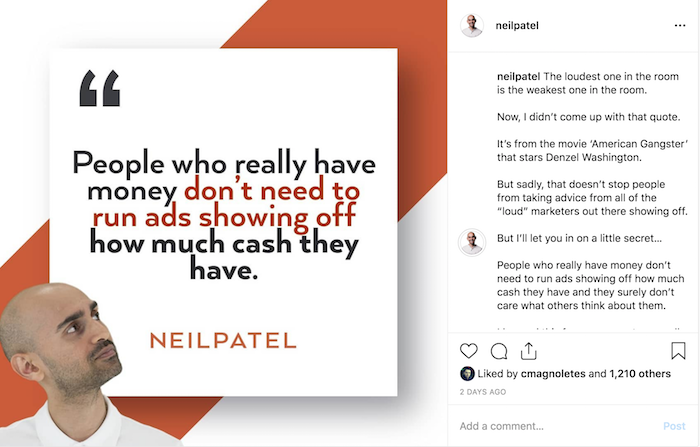

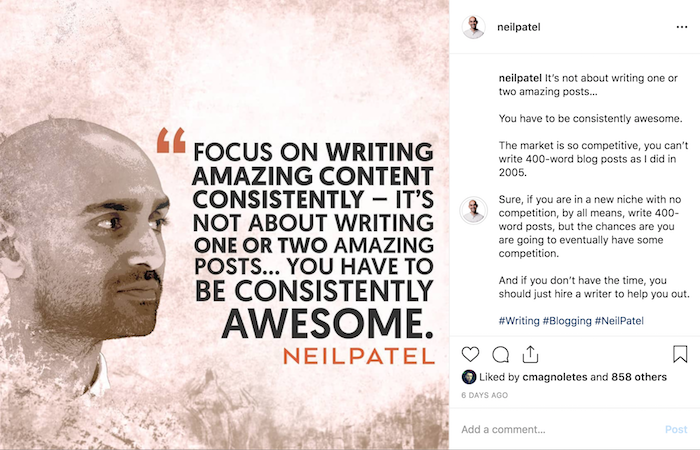

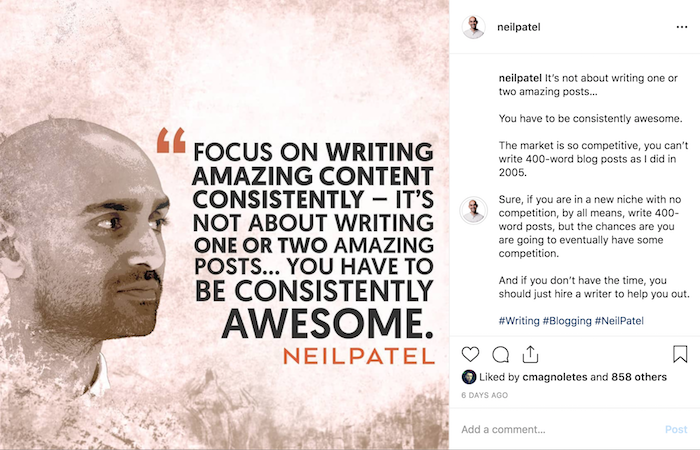

Here’s an example of one of those images:

And as you can see from the engagement, that one did better than most of my images as it has over 1,000 likes.

Plus, the messaging resonates with a lot of people.

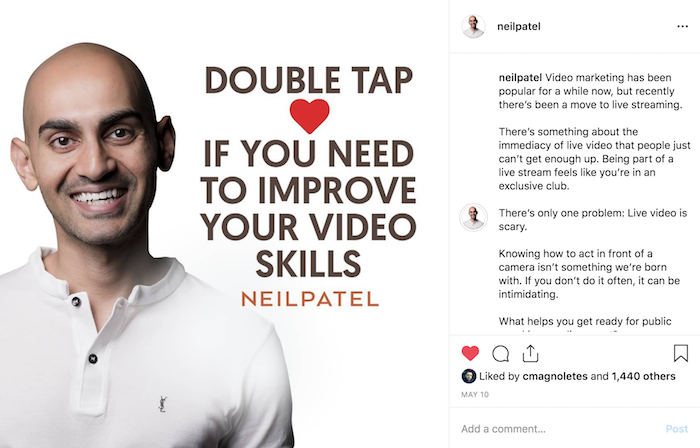

But here is one that is simple…

I just asked people to “double tap” if they need to improve their video skills.

It didn’t take much creativity to come up with that image and it received 1,441 likes. In other words, it produced 51.96% more engagement.

You should give it a try… I tend to use this tactic a few times a month and it works really well.

Just be careful though, if you use it every day or every week, people will get sick of it and it will stop working. Hence, I only use it a few times a month max.

Tip #3: Go live

Did I already mention that Instagram is competing with television networks and Netflix?

Because of that, what kind of content do you think they want more of?

Well, yes they want more video content, but we already talked about that.

They want more live content.

Think… reality TV.

Now the live content you produce doesn’t have to be like Keeping up with the Kardashians… they just want live content that people are looking forward to viewing.

You know how you will tune into shows like American Idol or the latest soccer or football match because it’s live and you want to see what’s happening in real time? That’s the effect Instagram is hoping for with live content.

Now, when you go live, Instagram is promoting it heavily so you’ll get more viewers. It doesn’t matter what you talk about… they just want to see more people go live.

Every time I go live, I am able to get at least 1,000 views. Just look at the live I just did…

In the first 6 hours, it’s already received 718 views and I did this live session on a Sunday during non-peak hours. Within the first 24 hours, it will easily surpass 1000 views.

In other words, go live! It’s a simple and quick way to grow your following count. Ideally, you should be going live on a weekly basis.

Heck, you can’t go live too much… feel free to go live daily.

Tip #4: Respond to comments

This one is simple, but no one really does it.

Social networks are supposed to be social. That means you should participate.

And no, I am not talking about just liking other images and viewing videos. I’m talking about engaging with people and talking to them.

So, when you like something that someone else posts, leave a comment.

And when someone leaves a comment on one of your posts… what do you think you should do?

You should respond to them with a comment.

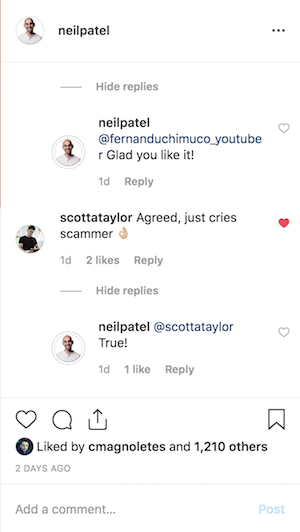

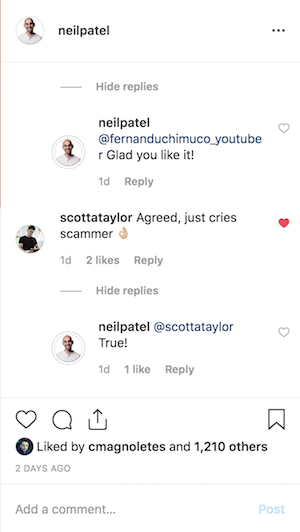

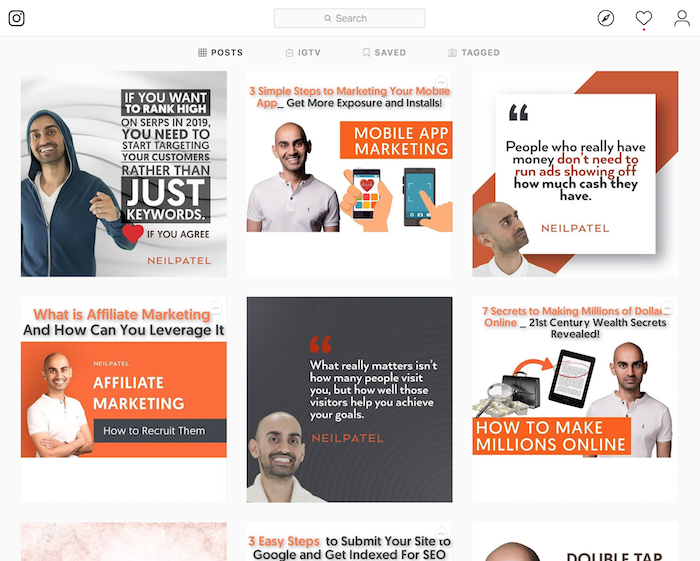

Now, let’s look at some of my posts for a minute. You’ll see decent engagement, but more so, you’ll see me being very active.

Just look at all of my responses.

By engaging with people, you’re more likely to build a relationship with these individuals, which makes it more likely that they will back and continually engage with your posts.

Tip #5: The heart trick

Alright, are you ready for the heart trick? You know, the one Dhavalilama has been using to boost his like count by 300%.

The concept is simple, but it will take a bit of finesse to implement.

A part of Instagram’s algorithm is how much engagement you get from other Instagram users within the first hour of you posting anything.

Now, I’ve done a lot of tests with this… if you can get Instagram users who have more followers than you to like your image or video when it first goes live you’ll find that your content is much more likely to show up on the discovery page.

From a lot of testing, here’s what seems to be the most effective:

- Get people with larger following accounts to like your image or video within the first hour it comes out.

- Ask them to not like anything else within that hour. We’ve found that if they like too many images or videos it doesn’t work.

- And if they are feeling extra generous, have them leave a comment.

The heart trick isn’t that complex, but it is hard to implement because you have to convince users who are more popular than you to like your content right when you publish.

And ideally, you need 6 people who have large accounts (the bigger the better), for this to work extremely well.

Tip #6: Create multiple stories each day

What do Tai Lopez, Gary Vaynerchuk, and Grant Cardone have in common?

Well, other than the fact that they all have over a million Instagram followers…

They all post a ton of stories per day.

And when I mean a ton, sometimes they are posting over 20 stories a day… literally.

The more stories you post, the more engagement you’ll create, which will lead to more followers.

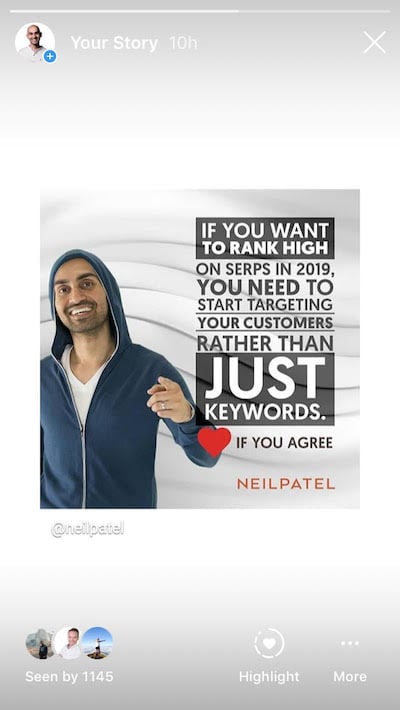

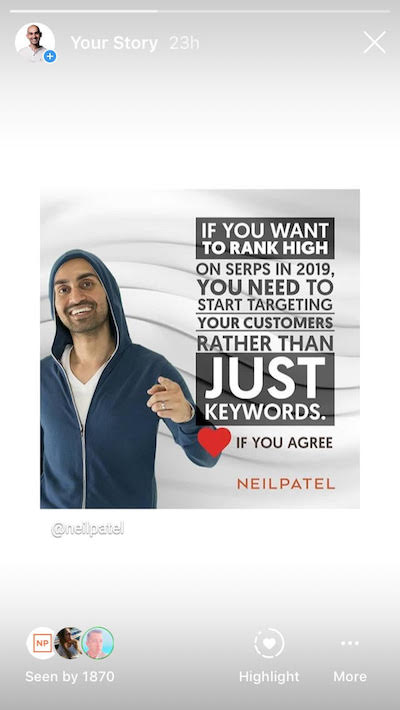

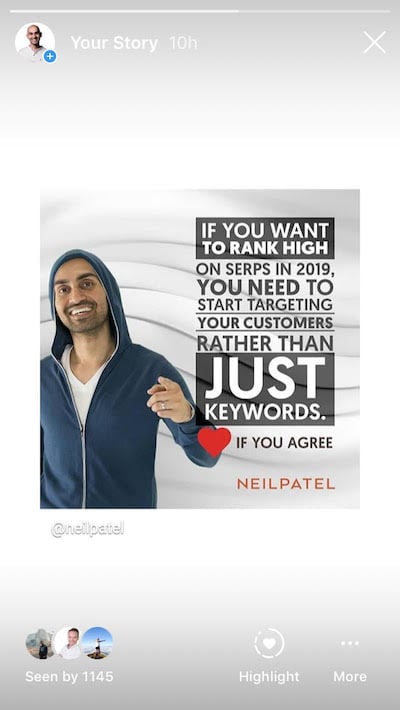

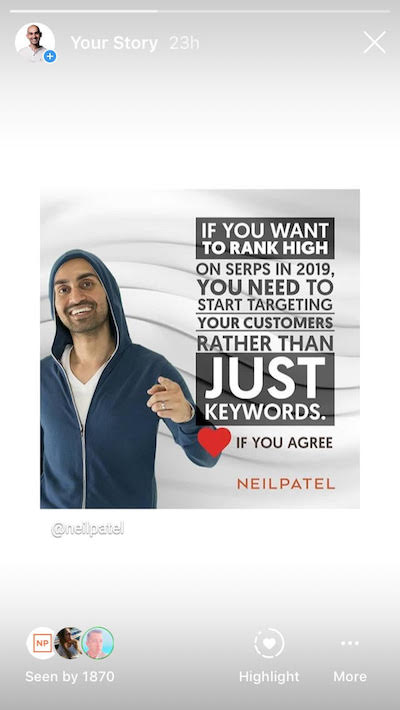

Just look at the stats from the stories I just posted:

I can generate over 1,000 views within 8 hours of posting a story and generally in the range of 1,600 to 2,000 views within 24 hours.

The same story 23 hours later received 1870 views.

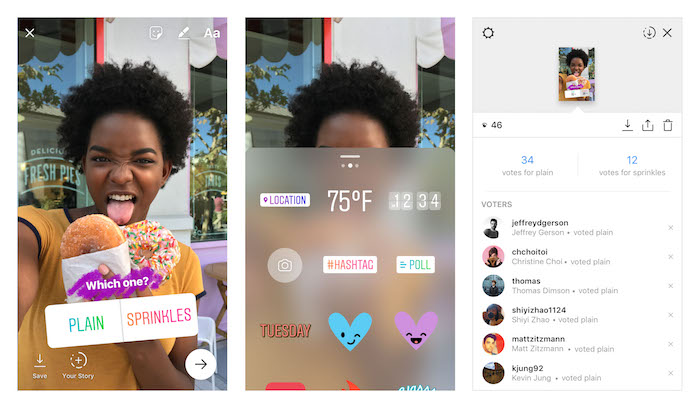

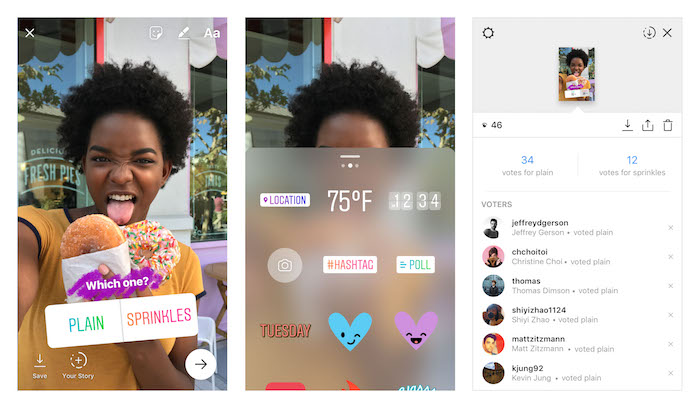

Here are some things to keep in mind if you want to maximize stories:

- Don’t post all of your stories at once, spread them out throughout the day. This will cause people to keep coming back and engaging with your profile.

- Use a combination of both images and videos within your stories. Overall, you’ll find that videos create more engagement.

- The more stories you publish, the better off you are.

- Add polls to your stories, this also helps boost engagement.

Tip #7: Quality matters

Have you noticed that some images get more likes than others? Or certain videos get more engagement?

Instagram is a visual social network. So the visual part is important… you want your images and videos to look great no matter what.

Now, they don’t have to be perfect, but you do want to make sure you are posting images that people enjoy.

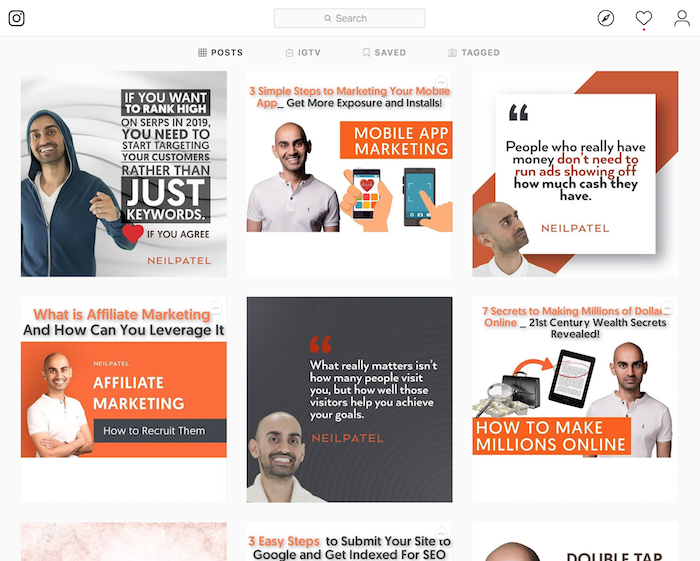

Here’s what I mean…

When you look at my profile, you’ll see a ton of images of me that contain quotes.

Some of those images perform really well, while others don’t. For example, every time I post a quote using this image template…

It gets 21.4% less engagement then when I use this template…

Keep track of what your followers like and don’t like. Post more of what they like and stop posting the stuff that has low engagement.

Tip #8: Test, test, test

Speaking of posting more of what your followers like and less of what they don’t, you need to constantly test.

Even though quality matters, when you are testing you shouldn’t aim for perfection. Just aim for speed.

Once you find something that people like, do more of it.

For example, I ask people to double tap as I talked about in tip number 2 because I learned it through testing.

Here are some other things I’ve learned through testing:

- Simplicity is the ultimate sophistication – people prefer clean images that are simple.

- Use bright colors – images that are darker, such as night photography don’t perform as well.

- Switch things up – if you do the same thing every week you’ll find your engagement starting to drop.

- People want to get to know you – they don’t want to get to know the Photoshop version of you. Be realistic and personal. Connect with your followers.

- Filters don’t matter – don’t waste too much time modifying or adjusting your images. Little things like filters don’t make the biggest difference.

- Hashtags aren’t game changing – I know everyone says you have to use hashtags and you should here and there… but they aren’t game-changing. So don’t spam and use 20 hashtags per image you post. And when you do use them, pick relevant and popular ones. You can use Ubersuggest to figure out what keywords are popular.

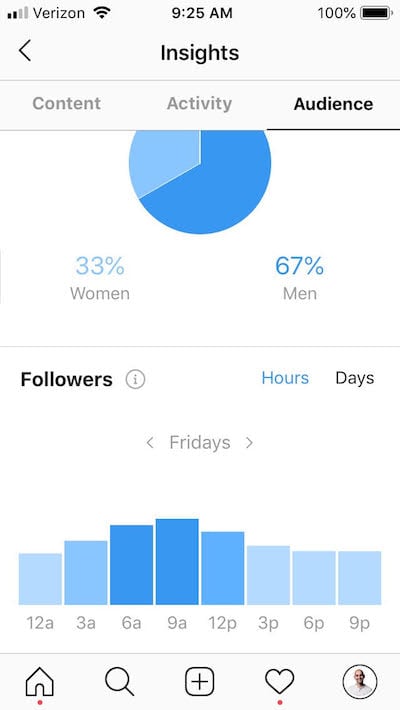

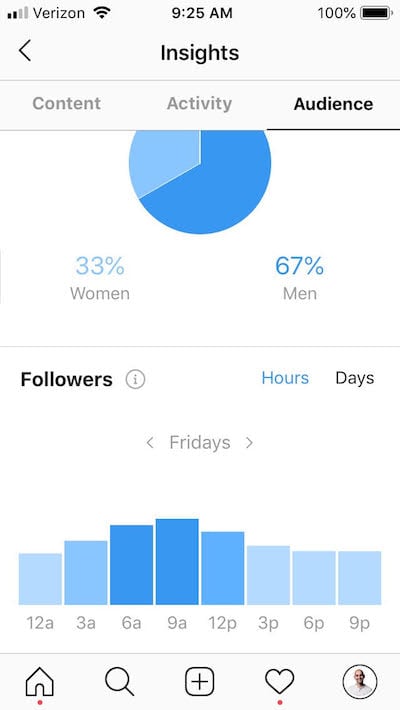

- Use Instagram analytics – it tells you when your followers are online so you know when to post. If you post when they are online you’ll get much more engagement.

A good example of a test I’ve run is when I post on my feed. As you can see from my stats…

My followers are most likely to be on Instagram at 9am. So I try to post around that time, which has helped me get 8.41% more likes per image.

Every little bit adds up!

Conclusion

You don’t have to spend money on ads to grow your Instagram following. If you follow the tips above, you’ll do well and find that you can grow your weekly following count by over 1,000 net new followers each week.

Now, I know you may not want to use Instagram because it doesn’t have your “ideal” audience, but you can drive conversions from Instagram.

For example, when I went live on Instagram and I told the audience to check out my ad agency Neil Patel Digital, I was able to generate 2 leads.

Neither of the leads were ideal customers, but it is a numbers game. If I continually do it I will be able to generate clients.

In the past, I have closed 3 deals from Instagram… one paid $120,000, the other paid $1,000,000, and the last paid $300,000.

They were all consulting arrangements, so I had substantial costs associated with the revenue, but it shows that Instagram does work.

Heck, if it didn’t, I wouldn’t be back on Instagram again (this is my 3rd profile, I no longer use the other 2).

You can also use the swipe up feature to drive people to your site and this will help you generate leads and sales.

So, what do you think about Instagram? Are you using it on a daily basis?

The post How I Gain 1,260 Instagram Followers Per Week appeared first on Neil Patel.