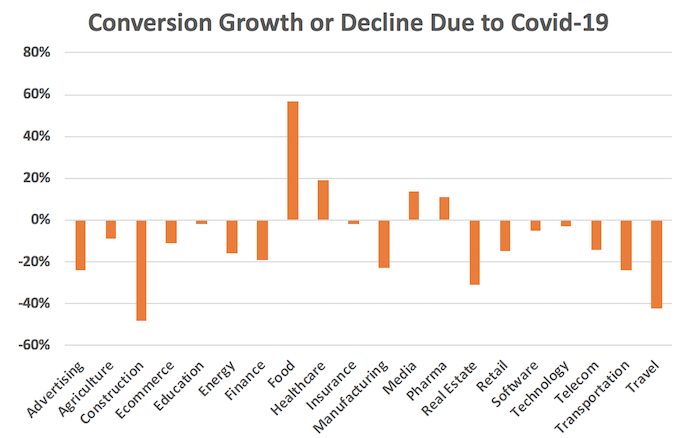

The introduction of COVID-19 into our world crashed the global economy. The federal government has taken action to try and help business owners. The Paycheck Protection Program Loans and Economic Injury Disaster Loans are both included in the CARES Act as help for small business owners. What are the SBA loan requirements for each of these business funding programs, and do you qualify? Maybe. The money is pretty much already gone however. They say more is coming, but when, and how much? In the meantime, the credit line hybrid could be what gets you through.

Get funding to help your business thrive right now.

Credit Line Hybrid Financing: The Top Option for Unsecured Business Financing You Probably Don’t Know About

Whether the economy is booming or in the depths of a recession, one thing never changes. All businesses need funding. What does change, are the funding options available. This is not because the options go away. Rather, it is due to the fact that some businesses may lose their eligibility for certain business funding options during hard economic times. To know which one will work best for you in your current situation, you need to know about and understand all of them. Here is a quick 101 on what is available, how you get it, and a bonus option you probably did not know about, the credit line hybrid.

It is hard to understand how awesome a credit line hybrid is if you do not understand the different types of funding out there. Specifically, it helps to understand what the government is offering, the pros and cons related to the government relief, and the difference between secured and unsecured financing.

Why Apply for a Credit Line Hybrid When There Is Government Covid-19 Relief

The Paycheck Protection Program is a business lending program. It is designed to help businesses keep paying employees even when they are shut down due to the coronavirus pandemic. Allowable uses of funds include:

- Payroll Expenses

- Employee Salaries

- Mortgage Interest

- Rent and Utilities

- Interest on debt incurred before February 15, 2020

The annual percentage rate for these loans is 4%. You do not make any payments for the first 6 months. However, interest does accrue during this time. After that, you have 2 years to pay. These loans are up to 100% forgivable with approval.

Loan Forgiveness

To request forgiveness, you will submit a request to the lender that is servicing the loan. It should include documents that verify the number of full-time employees and pay rates. Also, you will need to verify the payments on eligible mortgage, lease, and utility obligations. You have to certify that the documents are true. In addition, you will have to show that you used the forgiveness amount to keep employees. If not, you will have to show the funds were used to make eligible mortgage interest, rent, or utility payments. The lender must make a decision on the forgiveness within 60 days.

First, the program is open through June 2020. Not only does that not give you a lot of time, but you need to apply as soon as possible anyway. There is a cap on the funding, and processing applications will take time. Consequently, some lenders are limiting the number of applications they will accept in a single day.

SBA Loan Requirements: Who Can Apply, When Can they Apply, and Where Can They Apply?

Existing SBA lenders started accepting applications on April 3, 2020 from small businesses and sole proprietorships with less than 500 employees. Beginning on April 10, independent contractors and individuals that are self- employees can apply through SBA lenders.

Other lenders besides those that are currently working with the SBA are able to get in on the fun as well. In an effort to relieve some of the burden of processing, other lenders are able to enroll in the program and will be able to start accepting applications as soon as they get approval. Additionally, many private lenders have joined a petition to be able to work with the SBA to process applications and distribute funds.

SBA Loan Requirements: What Do You Need to Apply?

It is pretty straight forward. If you meet the SBA definition of a small business or contractor, you just have to make a few good faith certifications. These include:

- Current economic uncertainty makes the loan necessary to support your ongoing operations.

- You will use the funds to keep workers and maintain payroll or to make mortgage, lease, and utility payments.

- This is the only loan you have or will have under the program.

- You will provide all documentation necessary to verify the number of full-time employees on payroll and how much their payroll costs. Also, you will provide any necessary documentation needed to verify mortgage interest payments, rent payments, and covered utilities for the eight weeks after getting this loan.

- Loan forgiveness will be available for the sum of documented payroll costs, covered mortgage interest payments, covered rent payments, and covered utilities.

- All the information you provide in your application and supporting documents and forms is true and accurate.

- You realize that the lender will calculate the loan amount using the tax documents you submitted. You guarantee that the tax documents are identical to those you submitted to the IRS.

SBA Loan Requirements: The Economic Injury Disaster Loan Program

These are funds you apply for directly from the SBA. They can be used to cover the following expenses:

- Payroll

- Fixed Debts

- Accounts Payable

- Other expenses that cannot be paid because of the impact of the disaster. In this case, the disaster being COVID-19.

These loans are available up to $2 million dollars at an annual percentage rate of 3.75%. The terms go up to 30 years. These are not forgivable loans.

Why Apply for a Credit Line Hybrid with Government COVID-19 Relief Available?

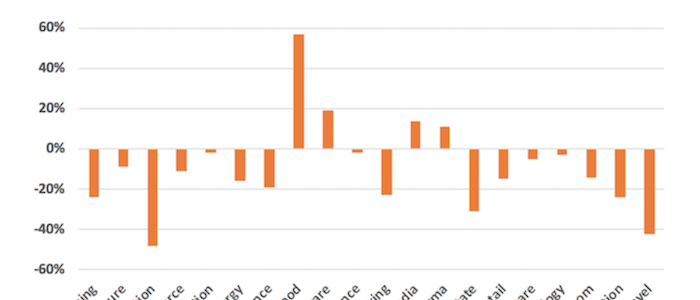

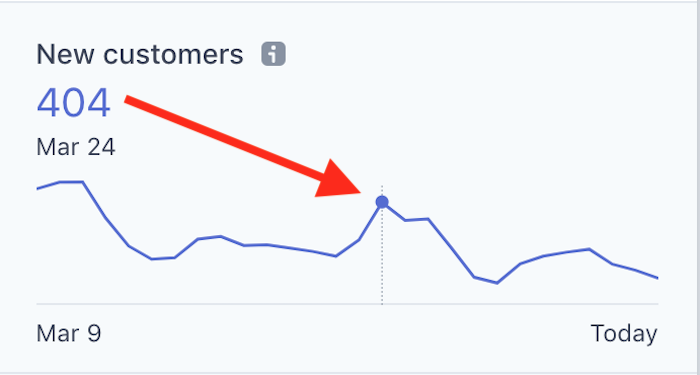

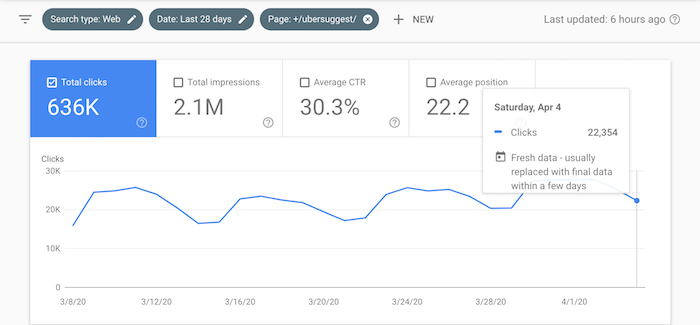

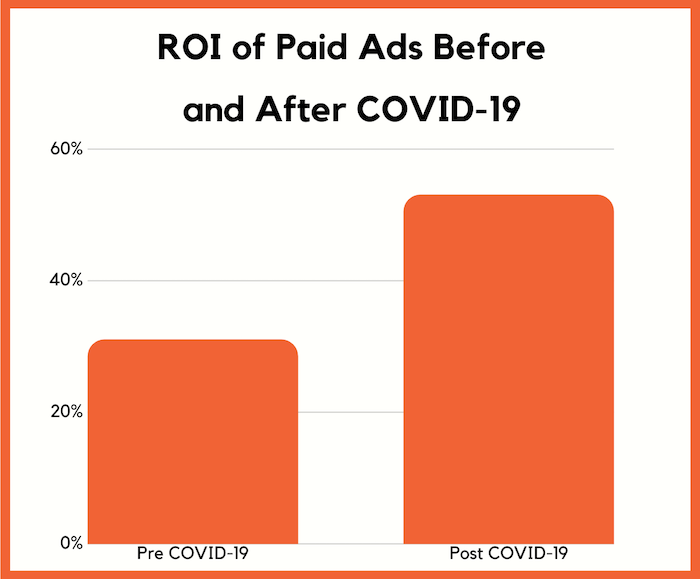

New funding was recently allotted. But how long will it last this time around? And how soon can the funds come to a business? The truth is, most business owners need money right now. There are other options, and the credit line hybrid is at the top of the list.

Credit Line Hybrid: Secured vs. Unsecured

Next, it can be helpful to fully understand the difference between secured funding and unsecured funding. The foundational difference is that secured funding uses collateral to lower the lender’s risk. This allows the lender to offer lower interest rates and better terms. Unsecured funding does not require collateral, but the lender’s risk is mitigated by higher interest rates.

Credit Line Hybrid: Why Choose Unsecured?

If unsecured financing has higher interest rates, why would you choose it? First, if you do not have anything available to use as collateral, you do not have a lot of choice. Next, even if you do have assets you can use to secure the loan, you may not want to take that risk. If you use your home or some other asset as security for debt, you’ll lose it if for some reason you cannot meet the obligation.

By choosing an unsecured loan, you protect your personal assets, to a point. You will not lose your business to the lender, or any other type of collateral, because there is no collateral.

Credit Line Hybrid: The Downside to Unsecured Financing

Of course, every rose has its thorn. While you will not be losing an asset directly because it secures the loan, you will still be liable for the debt. This is especially true if the debt is based on your personal credit, meaning it is in your name and not the name of an incorporated business.

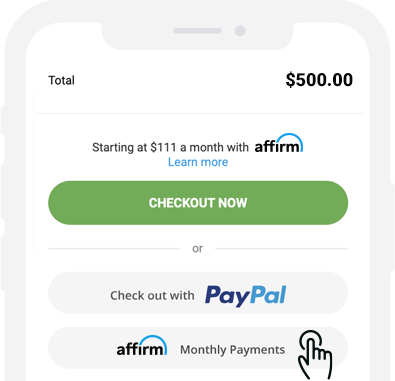

Credit Line Hybrid: An Amazing Happy Medium

What if there were an option that allowed you to have an even better interest rate than a secured loan, and yet get the money faster and easier than any type of traditional funding. What if you could get business funding without having to supply bank statements or credit stubs? Imagine that you could get funding in a few days rather than weeks without supplying any collateral or documents? This is exactly the credit line hybrid allows you to do.

What is a Credit Line Hybrid?

A credit line hybrid is basically revolving, unsecured financing. It allows you to fund your business without putting up collateral, and you only pay back what you use.

Credit Line Hybrid: Qualifications?

How hard is it to qualify? Not as hard as you may think. You do need good personal credit. That is, your personal credit score should be at least 685. In addition, you can’t have any liens, judgments, bankruptcies or late payments. Furthermore, in the past 6 months you should have less than 5 credit inquiries, and you should have less than a 45% balance on all business and personal credit cards. It is also best that you have established business credit as well as personal credit.

If you do not meet all of the requirements, it is okay. You can take on a credit partner that meets each of these requirements. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding.

What are the Benefits of a Credit Line Hybrid?

There are many benefits to using a credit line hybrid. First, it is unsecured, meaning you do not have to have any collateral to put up. Next, the funding is what is referred to as “no doc”. This means you do not have to provide any bank statements or financials.

Not only that, but typically approval is up to 5x that of the highest credit limit on the personal credit report. Additionally, often you can get interest rates as low as 0% for the first few months, allowing you to put that savings back into your business.

The process is pretty fast, especially with a qualified expert to walk you through it. One other benefit is this. With the approval for multiple credit cards, competition is created. This makes it easier, and likely even if you handle the credit responsibly, that you can get interest rates lowered and limits raised every few months.

How to Best Use the Funds Available Through a Credit Line Hybrid

Maybe you think you do not need funding. Everything is bumping along just fine, and there is no reason to access any additional funds. Even if you are not in a dire situation, there are a ton of ways to use additional funds to help your business continue to grow. Here are some tips on how to use funds from a credit line hybrid to best benefit your business.

Tips for Using a Credit Line Hybrid

- Pay off higher interest debt to lower monthly payments and increase credit score. Imagine using a 0% interest credit line to pay off a number of high interest credit cards. You could literally save yourself hundreds of dollars a month that can then be put back into your business.

- Bridge a cash gap due to slow collections or seasonal issues. You could never have to worry or stress about large invoices being paid slowly or slow business in the off season ever again.

- Cover bills during a global pandemic. Can you relate? COVID-19 turned the whole economy on its head. Funds from a credit line hybrid can help you stay above water without waiting for or just hoping you can get government relief.

- Buy inventory in bulk to take advantage of promotional pricing. You know you’ve seen it happen. Your best seller goes on sale with the wholesale company. But you can’t buy as much as you want at the discounted price because of cash flow.

- Grow and expand your business by adding equipment, adding on to your building, or even opening a new location.

- Fund updates and repairs. Do not let the little things, or big things, slide any longer because you can’t pay for it. Get the repairs you need, do the updates that need doing, and watch your business thrive.

- Nothing. Leave it alone until you need it. None of us can see into the future. A safety net is always a good idea.

Bonus: You can even use a credit line hybrid to help with the cost of starting a brand new business.

A Credit Line Hybrid Can Help You Build Business Credit

Building business credit is vital to the success of your business, and a credit line hybrid can help you do just that. The key is, a credit line hybrid includes approval for multiple business credit cards at once. If your business is set up properly, they will report your on-time payments to the business credit reporting agencies. These include Dun & Bradstreet, Experian, and Equifax mostly, though there are others. Not all of them report to all of the CRAs, but some of them report to at least one. Each account reporting consistent on-time payments helps you build strong business credit.

You Have to Set Your Business Up Properly to Build Business Credit with the Credit Line Hybrid

Your business has to be set up a certain way to build business credit, period. If it is not, then payments on business accounts will simply report to your personal credit. Here is how to do it.

Get Separate Contact Information Before You Apply for the Credit Line Hybrid

Really, all of these steps should be completed before you apply for any type of business credit. First, make sure your business has its own phone number, fax number, and address. Surprisingly, that does not mean you have to get a separate phone line, or even a separate location.

In fact, you can get a business phone number and fax number that will work over the internet instead of phone lines. In addition, the phone number will forward to any phone you want. You can just use your personal cell phone or landline.

For a business address, you can use a virtual office. This is not what you may think. It is a business that offers a physical address for a fee. Sometimes they even offer mail service and live receptionist services. Some of them even offer space for face-to-face meetings.

Apply for an EIN to Use on Credit Applications

The next thing you need to do is get an EIN for your business. This is an identifying number for your business that works like your SSN does for you personally. You can get one for free from the IRS.

Be wary of using a CPN to try to fake good credit. What is a CPN? It stands for Credit Protection Number, Credit Privacy Number, and a number of other similar terms. A CPN is a number that you can use in place of your social security number, in some situations. They are completely legal, if you get them the right way.

The thing is, there are very specific rules about who actually qualifies for a legal CPN. In addition, you have to go through an attorney to get a legal CPN. However, there are some unscrupulous companies that will sell them claiming that you can use them to apply for credit, and thus elude your poor credit scores.

Many of the numbers for sale come from children or dead people. Once you use one, you have just committed identity fraud. Also, it will not even really help you that much. The only number you can use to apply for credit other than your SSN is an EIN. Even then, you may have to give your SSN for identity purposes, even if it is not used to verify credit worthiness.

Incorporate Your Business

Incorporating your business as an LLC, S-corp, or corporation is necessary. It officially separates your business from you as the owner. It also offers some protection from liability.

Which option you choose does not matter as much for business credit as it does for your budget and needs for liability protection. Talk to your attorney or a tax professional about that.

Open a Business Bank Account

You have to open a separate, dedicated business bank account. There are a few reasons for this. First, it will help you keep track of business finances. It will also help you keep them separate from personal finances for tax purposes.

It is necessary to take care of all of these things before applying. First, you need your EIN and your separate contact information on the application. Next, the fact that you are incorporated and your business has a separate, dedicated account will help solidify it as an entity separate from you personally.

Why Does Building Business Credit Matter?

Business credit is one piece of your business’s overall fundability. In fact, it is the biggest piece of fundability. However, the other things that contribute to the fundability of your business are important as well. Each one is needed, and the stronger each piece is the stronger your overall fundability is. In contrast, one weak link can bring it all tumbling down. Still, without strong business credit, none of it really works.

Business credit allows you to access money for your business without putting your personal credit at risk. If your business goes south and your business credit tanks, it will not impede your ability to buy a car or a house.

Also, you can access more funds using business credit than with personal credit. That is because credit limits on business credit cards are typically much higher than those on personal cards.

Fundability, in the simplest terms, is the ability of your business to get funding. When lenders consider funding your business, does it appear to them to be a good idea to make the loan? What do they look at to make that determination? What plays into fundability other than business credit?

Credit Line Hybrid: Other Fundability Factors

It is a complicated web of data that creates business fundability. Pretty much, everything in the history of ever can affect the fundability of your business, but time is kind. The more positive, recent information out there, the better off you are. New positives allow older negatives to not matter as much, eventually.

Licenses

For a business to be legitimate it has to have all of the necessary licenses it needs to run. If it does not, red flags are going to fly up all over the place. Do the research you need to do to ensure you have all of the licenses necessary to legitimately run your business at the federal, state, and local levels.

Website

I am sure you are wondering how a business website can affect your ability to get funding. The thing is, these days you do not exist if you do not have a website. However, having a poorly put together website can be even worse. It is the first impression you make on almost everyone. If it appears to be unprofessional it will not bode well for you with consumers or potential lenders.

Spend the time and money necessary to ensure your website is professionally designed and works well. Pay for hosting too. Do not use a free hosting service. Along these same lines, your business needs a dedicated business email address. Make sure it has the same URL as your Website. And do not use a free service such as Yahoo or Gmail.

Information from Other Business Data Agencies

In addition to the business credit reporting agencies that directly calculate and issue credit reports, there are other business data agencies that affect those reports indirectly. Two examples of this are LexisNexis and The Small Business Finance Exchange. These two agencies gather data from a variety of sources, including public records. This means they could even have access to information relating to automobile accidents and liens. While you may not be able to access or change the data the agencies have on your business, you can ensure that any new information they receive is positive. As mentioned earlier, enough positive information can help counteract negative information from the past.

Identification Numbers

In addition to the EIN, there are identifying numbers that go along with your business credit reports. You need to be aware that these numbers exist. Some of them are simply assigned by the agency, like the Experian BIN. One, however, you have to apply to get. It is absolutely necessary that you do this.

Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Every credit file in their database has a D-U-N-S number. To get a D-U-N-S number, you have to apply for one through the D&B website.

Business Information

On the surface, it seems obvious that all of your business information should be the same across the board everywhere you use it. However, when you start changing things up like adding a business phone number and address or incorporating, you may find that some things get missed.

This is a problem because a ton of loan applications are turned down each year due to fraud concerns simply because things do not match up. Maybe your business licenses have your personal address but now you have a business address. That sets off red flags. Perhaps some of your credit accounts have a slightly different name or a different phone number listed than what is on your loan application. Do your insurances all have the correct information?

Financial Statements

This includes both personal and financial. First, tax returns need to be in order. Not only that, but you need to be paying your taxes, both business and personal. That is not all there is to it though.

Business Financials

It is best to have an accounting professional prepare regular financial statements for your business. Having an accountant’s name on financial statements lends credence to the legitimacy of your business. If you cannot afford this monthly or quarterly, at least have professional statements prepared annually. Then, they are at the ready whenever you need to apply for a loan.

Personal Financials

Often tax returns for the previous three years will be good enough. Get a tax professional to prepare them. This is the minimum you will need. Other information lenders may ask for include check stubs and bank statements, among other things.

Bureaus

There are several other agencies that hold information related to your personal finances that you need to know about. Your personal FICO score needs to be as strong as possible. Almost all traditional lenders will look at personal credit in addition to business credit.

In addition to FICO reporting personal credit, there is ChexSystems. Basically, they keep up with bad check activity that can affect your bank score. If you have too many bad checks, you will not be able to open a bank account.

Personal Credit History

Your personal credit score from Experian, Equifax, and Transunion are all important to fundability. If it is not so great right now, get to work on it. The number one way to get a strong personal credit score or improve a weak one is to make payments consistently on time.

The Application Process

It is hard to imagine that even the very process of applying for funding can affect fundability. First, consider the timing of the application. Is your business currently fundable? If not, do some work first to increase fundability. Next, ensure that your business name, business address, and ownership status are all verifiable. Lenders will check into it. Lastly, make sure you choose the right lending product for your business and your needs. Is a credit line hybrid right for you? It is pretty much right for everyone that either meets the requirements or have family or friends who do. Would a working capital loan or expansion loan work best for your needs? Choosing the right product to apply for can make all the difference.

Get funding to help your business thrive right now.

Other Funding Options Besides a Credit Line Hybrid

The credit line hybrid really is a great option. In fact in most cases, it is likely the best option. However, it is not always enough. What other business funding options are out there?

SBA Loans

In addition to the SBA funding set up through the CARES Act, regular SBA programs are still out there. SBA loans are guaranteed by the Small Business Administration. Typically, they are issued by participating lenders, mostly banks.

While they sound awesome, they are not as easy to get as you might imagine. The process is certainly more complicated and lengthy than that of applying for a credit line hybrid. Basically, SBA loans are traditional loans from traditional lenders, but they come with a government guarantee. This means lenders can relax a little on credit score requirements. Also, interest rates are lower. However, there is still a lot of red tape and time involved.

SBA Loan Documentation

Here is what you’ll need to apply.

- The SBA borrower loan information form

- Statement of personal history

- Personal financial statement

- Personal income tax returns for the previous 3 years

- Tax returns for the business for the previous 3 years

- Business certificate or license

- Business lease

- Loan application history

- Good business credit helps also

It can take a considerable amount of time to finish the application process, and even longer to get your money.

Once you have this general information together, you need to choose the program that will work best for your needs. Note that each program may have additional requirements.

7(a) Loans

This is the Small Business Administration’s flagship loan program. It offers federally funded term loans up to $5 million. The funds can be used for expansion, purchasing equipment, working capital and more. Banks, credit unions, and other specialized institutions in partnership with the SBA process these loans and disburse the funds.

The minimum credit score to qualify is 680, and there is also a required down payment of at least 10% for the purchase of a business, commercial real estate, or equipment. The minimum time in business is 2 years. In the case of startups, business experience equivalent to two years will fulfill this requirement.

This is by far the most popular of the SBA loan programs, and the funds are available for a broad range of projects. This program is great for working capital, refinancing debt, and even buying a new business or real estate.

504 Loans

These loans are also available up to $5 million and can buy machinery, facilities, or land. They are generally used for expansion, and private sector lenders or nonprofits process and disburse these SBA government loans. They work well for commercial real estate purchases especially.

Terms for 504 Loans range from 10 to 20 years, and funding can take from 30 to 90 days. They require a minimum credit score of 680, and collateral is the asset it is financing. There is also a down payment requirement of 10%, which can increase to 15% for a new business.

There is also a requirement you be in business at least 2 years, or that management has equivalent experience if the business is a startup.

Microloans

Microloans are available in amounts up to $50,000. They work for starting a business, purchasing equipment, buying inventory, or for working capital. Community based non-profits administer microloan programs as intermediaries. Unlike most other SBA loans, financing comes directly from the Small Business Administration.

Interest rates on these loans are 7.75% to 8% above the lender’s cost to fund. The terms go up to 6 years. Microloans can take upwards of 90 days to fund, and the minimum credit score requirement is 640. Collateral and down payment requirements vary by lender.

SBA disaster loans

The disaster loan program is designed to help out in times of disaster, such as hurricanes and tornadoes. Recently, the program has been ramped up to provide COVID-19 relief as part of the CARES Act.

Available in amounts up to $2 million, these loans are processed directly through the SBA. They are available to small-business owners that have been affected by natural disasters. Terms go up to 30 years. The maximum interest rate is 4%. Apply for disaster loans directly at SBA.gov.

The minimum credit score for disaster loans is 660. Collateral is necessary if the loan goes over a certain amount, usually $25,000, if it is available or when it becomes available. For a military economic injury disaster that amount is $50,000. A down payment is not necessary.

SBA Express loans

These loans top out at $350,000. They have a maximum interest rate of 11.50%. Terms range from 5 to 25 years, and the SBA guarantee is less than with their other loan programs at 50%. To qualify, your credit score must be above 680, and you must have a debt to service ratio of 1.1 or higher. If the loan is greater than $25,000, collateral may be necessary depending on the lender.

The turnaround for express loans is much faster, with the SBA taking up to 36 hours to give a decision. Necessary paperwork for application is less also, making express loans a great option for working capital, among other things, if you qualify.

SBA CAPLine

There are 4 distinct CAPline programs. The differences between them relate mostly to the expenses they can fund. Each of them carries a maximum amount of $5 million and an interest rate that ranges from 7% to 10%. Funding can take 45 to 90 days.

The four different programs are:

- Seasonal CAPLines -Financing for businesses preparing for a seasonal increase in sales.

- Contract CAPlines -Financing for businesses that need funding to fill a contract.

- Builder’s CAPLines -Financing for businesses taking on a real estate or construction project.

- Working capital CAPLines -Financing for businesses that are struggling with a short-term slump in sales.

Credit score must be at least 680 to qualify, and there is no minimum time in business requirement unless you are getting a seasonal CAPline. That one carries a one year in business requirement.

You may have noticed that the credit score requirements for the SBA loans are generally in the same range as what is required to qualify for a credit line hybrid. As a result, it is highly possible you could get both an SBA loan and a credit line hybrid, if you meet the qualifications for both. This would greatly increase your business funding power.

Private Lender Loans

These are term loans, but they are offered by private lenders rather than traditional financial institutions. The appeal of these lenders is that they generally offer loans to those with much lower credit scores than what is offered by regular banks and credit unions. Some will lend funds without even checking credit.

Typically, you get the money very fast. Sometimes you can have funding in your account in as little as a couple of days.

There is a trade-off, however. Private loans almost universally have higher interest rates and less favorable terms.

BlueVine

BlueVine offers invoice factoring and lines of credit. For invoice factoring, there are no reserves or minimums. The BlueVine system syncs with your accounting software and they connect to QuickBooks Online. They also work directly with FreshBooks and Xero.

Bond Street

Bond Street offers term loans of $10,000 – $1 million. Terms are for 1 to 3 years. Bond Street will ask for both EIN and SSN.

Lending Club

Lending Club offers term loans. Business loans from $5,000 to $300,000. Loan terms 1 – 5 years.

Get a quote in less than 5 minutes. Funds are available in as little as 48 hours if approved. There are no prepayment penalties. The good thing is the annual revenue requirement is not too high. Also, funds are available quickly. Still, the max interest rates are pretty high.

OnDeck

OnDeck offers short term loans and lines of credit. For short term loans: $5,000 – $250,000. Terms range from 3 to 24 months.

You must have annual revenue of $100,000 or more. Personal FICO Score of 600 or better. You must be in business 3 years or more. There is an 8.5% – 79% APR.

For lines of credit: $5,000 – $100,000 available. There is a term of 6 months.

You must have annual revenue of $100,000 or more. Personal FICO Score of 600 or better. You must be in business 9 months or more. There is a 13.99% to 36% APR.

Advantages include the low FICO score requirement for term loans. There is some flexibility for term lengths. Disadvantages are the maximum APR for both term loans and lines of credit are extremely high. If your company cannot pay back a loan or line of credit, it could sink you financially.

QuarterSpot

Quarter Spot offers short term loans of $5,000 – $150,000. Terms range from 9 to 18 months. They will only do a soft credit check when you apply. Borrowers must own at least 50% of the business. Rates are 25% – 40%.

Rapid Advance

Rapid Advance offers standard, select, and preferred loans. For standard loans amounts range from $5,000 to $1 million available. Terms range from 4 to 12 months.

Benefits including a few choices for loan types and high maximum amount limits. On the downside, minimum bank balance requirements are fairly high. Annual revenue requirements are also high.

More on Invoice Financing

You may have noticed some of the online lenders mentioned above offer invoice factoring. This is a form of business funding that uses open invoices as security. Money comes fast, but interest rate and terms can vary depending on the age of the invoices.

That of course, means that you must have open invoices to qualify. Consequently, you must be extending credit to customers in some form. Usually this involves invoices with net terms, such as net 30, 60, or 90.

Then, you turn those invoices over to a factoring company. They give you an agreed upon percentage of the total of the invoices, such as 80%. You get this amount of money immediately. When your customer pays, the factoring company keeps their agreed upon fee, and they send you the rest.

Details

This is different from selling invoices, in which you sell your invoices at a premium and do not collect anything else. The buyer then tries to collect the full price from the customer and keeps it, profiting from the premium they were sold at. This is more typical with severely delinquent invoices.

You can factor invoices on an ongoing basis to help with cash flow, or you can do it to aid in a one-time cash crunch. It is quick, but it can be costly. If you are an established business that has little problem collecting on invoices however, this funding option is easy to qualify for. Since the funds are secured with the invoices, there is little worry about credit rating.

Merchant Cash Advance

This is similar to inventory financing, except funding is based on average daily credit card sales. Then, payment is made from future credit card sales, automatically.

Lines of Credit

These come from all of the same types of lenders we’ve mentioned already, with the same general requirements. However, this is revolving credit, more like a credit card. Interest rates are typically lower than credit cards, and the application process is virtually exactly like that of a term loan at the corresponding lender. They are available through both traditional banks and private lenders.

Business Credit Cards

This is revolving credit that is usually easier to get than a line of credit. However, the interest rate is almost universally higher, depending on your credit score. In some cases, there are rewards that, in addition to easy access, make these a good option.

Examples of Business Credit Cards to Get You Started

Benefits can vary. So, make certain to choose the card with the ones that will work best for your needs.

Brex Card for Startups

This Brex Card has no yearly fee. You will not need to supply your Social Security number to apply. Also, you will not need a personal guarantee. However, This card does not work for every industry.

To determine creditworthiness, Brex checks a company’s cash balance, spending patterns, and investors. Rewards include 7x points on ride share and 4x on Brex Travel. Also, you can get triple points on restaurants and get double points on recurring software payments. Get 1x points on everything else.

Capital One® Spark® Classic for Business

The Capital One® Spark® Classic for Business is another to check out. It has no annual fee and there is no introductory APR offer. The regular APR is a variable 24.49%. However, you can get unlimited 1% cash back on every purchase for your company and there is no minimum to redeem.

While this card is within reach if you have fair credit scores, be aware of the APR. If you can pay promptly, and completely, it is a good deal.

Ink Business Unlimited℠ Credit Card

The Ink Business Unlimited℠ Credit Card has no annual fee and a 0% introductory APR. After that expires, the APR is a variable 14.74 to 20.74%.

You can earn unlimited 1.5% Cash Back rewards on every purchase made for your company and get $500 bonus cash back after spending $3,000 in the initial 3 months from account opening. Rewards rewards for cash back, gift cards, travel and more using Chase Ultimate Rewards®. You will need superb credit to get approval for this card.

Blue Business® Plus Credit Card from American Express

The Blue Business® Plus Credit Card from American Express also has no no annual fee and a 0% introductory APR for the first year. After that, the APR is a variable 14.74 to 20.74%.

You can get double Membership Rewards® points on everyday business purchases like office supplies or client dinners. This applies to the first $50,000 spent each year. You get 1 point per dollar after that. You will need great to exceptional credit to qualify.

American Express® Blue Business Cash Card

Another one to look into is the American Express® Blue Business Cash Card. Note: the American Express® Blue Business Cash Card is identical to the Blue Business® Plus Credit Card from American Express. However its rewards are in cash instead of points. You get 2% cash back on all eligible purchases up to $50,000 per calendar year. After that, it is 1%.

There is no yearly fee, and there is a 0% introductory APR for the first one year. Afterwards, the APR is a variable 14.74 to 20.74%. You will need great to superb credit to qualify.

Capital One ® Spark® Cash for Business

Check out the Capital One® Spark® Cash for Business. It has an introductory $0 annual fee for the initial year. After that, this card costs $95 per year. There is no introductory APR deal. The regular APR is a variable 18.49%.

You can get a $500 one-time cash bonus after spending $4,000 in the first 3 months from account opening. Get unlimited 2% cash back. Redeem any time without any minimums. You will need great to outstanding credit scores to qualify.

Discover it® Business Card

Another one to check out the Discover it® Business Card. It has no yearly fee. There is an introductory APR of 0% on purchases for twelve months. After that is over, the regular APR is a variable 14.49 to 22.49%.

You get unlimited 1.5% cash back on all purchases, with no category restrictions or bonuses. Also, they double the 1.5% Cashback Match™ at the end of the first year. There is no minimum spend requirement either.

You can download transactions easily to Quicken, QuickBooks, and Excel. Note: you will need great to exceptional credit to get approval for this card.

Get funding to help your business thrive right now.

Crowdfunding

Crowdfunding sites allow you to inform thousands of micro investors about your business or business idea. Anyone who wants to can invest as much or as little as they want. Investors pledge various amounts depending on the campaign and the platform in use. They may give $50, they may give $150, or they may give over $500. Pledges can even go as low as $5.

Though not always necessary, most offer rewards to investors for their giving. Typically, this comes in the form of the product the business will be selling. Different levels of giving result in different rewards. For example, a $50 gift may get you one incentive, and a $100 gift will get you an upgraded version of that incentive, or something different all together.

Where Do You Get Started with Crowdfunding?

There are many crowdfunding sites, but the most popular are Kickstarter and Indiegogo. Many crowdfunding resources are geared toward aiding in success on these two platforms. The two are similar, but there are some glaring differences. The most obvious is when you actually get the funds you raise.

For example, with Kickstarter you have to reach your preset goal before you can receive the funds. If you set a goal to raise $12,000, investments have to reach that amount before you get your hands on any of the money.

Indiegogo on the other hand lets you choose if you want to receive funds as they come in or wait until you reach your goal. In addition, they have the option for InDemand, which lets you continue to raise funds after your initial campaign is over. There is no need to start a new campaign.

Indiegogo also has a flexible funding option for those who may need it.

To make the choice for yourself, you need to figure out who your audience is, and which platform will best reach them.

Angel Investors

According to Investopedia, this is what an angel investor is:“… [They] invest in small startups or entrepreneurs. Often, angel investors are among an entrepreneur’s family and friends. The capital angel investors provide may be a one-time investment to help the business propel or an ongoing injection of money to support and carry the company through its difficult early stages.”

These investors are usually only in for a one-time deal. Many do not lend to the same person twice, even if that person paid them back perfectly. They choose to spread their risk out over many people and many businesses to ensure they get a safe return on their investment.

Angels tend to be a lot more informal than most types of funding. They can be people you know or connect with through networking or other means. Even your mom can be an angel investor.

Angels are not covered by the Securities Exchange Commission’s (SEC) standards for accredited investors. But a lot of them are accredited investors anyway.

Who Else Can be This Kind of Investor?

There are a number of angels who are not millionaires. They could be friends or colleagues sitting on home equity, or local professionals who are looking to invest. Consider people you know well and people you do not know so well. If you’re asking, where are angel investors near me, they could be people you grew up with or have done business with.

How Do You Find These Types of Investors?

The best way to find these kinds of investors is to ask. Try an angel investors website or an angel investors network. Also look online. One site to try is Gust, which used to be called Angel Soft. They keep a database of investors, companies, and programs. Startups can search for business plan competitions and more as well.

Gust gives the search for these kinds of investors more organization. But it is not the only way to find angels.

Other Ways to Find These Sorts of Investors

Entrepreneur Magazine suggests angel investors list sites like Funding Post and ACE-NET. They also suggest trying every possible investor because being turned down by 100 investors does not mean the 101st will turn you down. Entrepreneur notes that these kinds of investors will often start small. So, if you can prove your concept to them, and they start to see success, they might add more funding.

Credit Line Hybrid: Know Where You Stand

How do you know whether or not you qualify for any of these options? How do you know if your personal credit score is at least 685 so you can access a credit line hybrid? What indicates your business credit is growing strong because accounts are reporting on-time payments?

The secret is credit monitoring. To be fair, business credit monitoring and personal credit monitoring are two totally different animals. The main difference is that with personal credit, you can monitor it for free. You have the right to one copy of your complete credit report each year. Also, there are numerous free services out there that will give you a peek at your score and some information on your report on an ongoing basis, also for free. All you have to do is answer some identifying questions and you are all set.

Business Credit Monitoring

However, business credit monitoring is not so easy. First, it is never free, really. There are a few ways to get a peek at your business credit for free one time, but that is it. As a general rule you have to pay for business credit monitoring. The question is, how do you get the most bang for your buck.

Just as there are credit reporting agencies for your personal credit score, there are also business credit reporting agencies. The largest one, and the one lenders use most often, is Dun & Bradstreet. However, there are actually several others. The other two most common are Experian and Equifax.

They do not just give out credit reports for free however. In fact, the prices for reports directly from the top 3 most commonly used credit reporting agencies are pretty steep. For example:

- Dun & Bradstreet reports range in price from $61 to $229 per report.

- Experian reports are $49.95 per report.

- Equifax is $99.95 per report.

The prices range so broadly due to the varying complexity and detail of the information provided in each report. For example, Dun & Bradstreet has multiple types of scores and a report for each one.

Or, you can monitor with Experian and D&B both for a fraction of the price.

How to See Your Business Credit for Free

The only real way to get a free copy of your credit report is if you are denied a loan based on your business credit. There are ways to see what is on it, one time, for free however.

Nav

Nav is a service that will let you see a summary of your credit reports from all three of the major credit reporting agencies. However, these are only summaries, not full reports. Generally, that means you can see your score, and maybe the accounts you have listed. While this will help you see where you stand, it will not suffice for the purpose of correcting mistakes or even to show you what you need to do to improve your score. You do have the option to pay for more information though.

Credit.net

Credit.net does not offer ongoing free business credit reports, you can access a free trial. There is no credit card required, and after you pull the report, you have 30 days to check it out. This means at least once you can get a totally free look at your report, because there is no fear of missing a cancelation deadline and having to pay anyway.

Scorely

This is a lesser known credit reporting agency that will let you see your credit report for free before you pay for an ongoing subscription. Unlike Nav or Credit.net, they actually calculate their own score similar to the big 3 (Experian, Equifax, and Dun & Bradstreet.) They strive to be totally transparent and to make their reports easy to understand.

Credit Line Hybrid: What Can a Lender See on Your Business Credit Report?

Each reporting agency offers different types of reports and information, but they all contain the same general data.

Dun & Bradstreet

Dun & Bradstreet offers several different types of business credit reports. In fact, there are six different reporting options in all. They all offer different information related to credit worthiness, and it takes all of them to get the whole picture. The price range listed above is dependent on which reports you want to order.

The report used most often is the PAYDEX. Likely, this is because it is the easiest to understand, due to it being the most like the consumer FICO score. It measures how quickly a customer makes payments and ranges from 1 to 100. A Score of 70 or higher is acceptable. For example, a score of 100 shows payments are made in advance, and a score of 1 indicates that they are 120 days late, or more.

The other Dun & Bradstreet Credit Reports include:

- Dun and Bradstreet Delinquency Predictor Score

The delinquency predictor score measures how likely it is that the company will not pay, will be late paying, or will fall into bankruptcy. The scale is 1 to 5, and a 2 is good.

The financial stress score measures pressure on the balance sheet. It shows how likely the company is to shut down within a year. These scores range from 5 to 1, with a score of 2 being “good.”

- Supplier Evaluation Risk Rating

This rating ranks the odds of a company surviving 12 months. The minimum score is a 9 and the maximum is 1. A “good” score is 5.

- Credit Limit Recommendation

The credit limit recommendation reflects a business’s borrowing capacity. It is a recommendation for how much debt a company can handle. Typically, creditors use this to determine how much credit to extend.

This one ranks overall business risk on a scale of one to four. A score of 2 is good. The rating is given in conjunction with letters, the combination of which indicate a company’s net worth.

Even if there is not enough information on a business to assign a regular rating, Dun and Bradstreet will assign what they call a Credit Appraisal Score. This is based on the number of employees. Another option is an alternative rating based on what data is actually available.

Experian

Experian uses what it calls Intelliscore as its credit ranking. There are more than 800 different factors that they use to predict a company’s credit risk. With Intelliscore, a score of 76 or higher indicates a low risk of default or late payment. If a score falls between 51 to 75, it indicates a low to medium risk. Scores from 26 to 50 are medium risk, and from 25 down to 1 is medium high to high risk.

Here is where Experian gets tricky. Intelliscore is a blended score of both the business and business owner’s personal information. That means it offers insights into a business’s public record findings, collections, and payment trends, as well as overall business background. Experian is also unique in that it does not ask businesses to self-report. Instead, they collect all the information themselves. You will have to give permission for a lender to view this report, due to it containing personal information.

Equifax

Equifax collects information similar to Dun and Bradstreet, including: information from public records, financial data from the business, and payment history from creditors. Credit utilization is also a factor, which accounts for how much credit you are using versus the amount of credit you have available to use.

The information is used to calculate various scores, including the business credit risk score and the business failure score. The first measures how likely it is that a business will become 90 days or more delinquent on bills over the next year. The score ranges from 101 to 992. The second ranges from 1,000 to 1610 and predicts how likely it is that the business will file for bankruptcy over the next 12-month period. A lower score indicates higher risk.

More About Equifax

They also calculate what they call the business payment index. This is the Equifax version of Dun & Bradstreet’s PAYDEX. It even runs on the same scale of 0 to 100. This is an indicator payment history over the past year. It is different from the PAYDEX, however, in that you must reach a score of 90 or higher for it to be a “good” score.

In addition, Equifax offers business identity reports to confirm a company actually exists. It verifies details such as the company’s tax ID number, number of employees, and yearly sales.

Equifax does not allow business owners to request reports on their own company. They decide themselves when to start a credit file on a specific company.

A Note on CreditSafe

They offer 3 packages: Standard, Plus, and Premier. The problem is, they do not list their prices on their website. You have to request a quote to determine what your pricing would be, as they also allow you to purchase individual products.

They are quickly growing in popularity. No doubt that is partly due to the subscription service it offers, which allows easy insight into your own company’s credit report. The free trial allows for test driving, which sweetens the deal even more.

Their main score, the CreditSafe rating, works on a scale of 1-100. It predicts the likelihood that payment performance will become 90 plus days beyond terms within the next 12 months or that the business will go bankrupt. They offer a variety of other scores and reports that provide a ton of information however.

CreditSafe Business Credit Reports

This score is derived from the CreditSafe rating. It allows for a comparison of credit risk between companies that are registered in different countries.

The Creditsafe recommended credit limit uses information from the business payment records and those of similar companies to calculate a dollar amount recommendation of the maximum amount of credit a company should receive at any one time.

Compares how many days late a business pays its bills in comparison to other companies in the industry.

This is a report on the number and value of tax liens and judgements that have been filed in the past 6 years and 9 months. It also includes bankruptcies filed in the last 9 years and 9 months

A report designed to highlight at a glance substantial changes in how a company is paying its bills.

This one lets you know whether the total annual business spending is going up or down when compared to the previous year.

Subscription packages come in levels, and the prices are dependent completely on your business’s individual needs. You will have to speak to a consultant to get a quote.

Credit Line Hybrid: What if Your Business Credit Score is Bad, or Non-Existent?

If you have never set your business up to build business credit as discussed above, then it is very likely there is no business credit report to check. The steps we gave you to set your business up so a credit line hybrid could help build business credit help separate you from your business. This means that your business accounts report to the business credit reporting agencies, no personal credit reporting agencies.

How can you get accounts in your business name however, without any business credit to begin with? The secret is starter vendors. A lot of business owners do not understand how starter vendors work, or how they help build business credit because what they do does not really seem like credit in the traditional sense.

Specifics

It is not like a credit card account or a charge account. What starter vendors do is they offer invoices with net terms. For example, net30. That means you have to pay the invoice in full within 30 days. They do two helpful things relating to this however. First, they do not check your credit score. There are typically some other criteria you must meet, but bad credit will not keep you from getting accounts with starter vendors.

Next, when you pay those invoices, they will report those payments to one or more business credit reporting agencies. If you get enough starter vendors reporting positive payment history, your score will be strong enough to apply for credit from those credit issuers who will check your business credit score.

How Do I Find Starter Vendors?

They may not advertise themselves as such, but they are out there. It is usually smart to get a little help finding enough to build your business credit score quickly. Here are a few that are easy to get started with.

Strategic Network Solutions

This company sells eBooks, software, and even office supplies. You do have to register to see their products, but the process is fast and easy. You will have to make a $75 or more initial purchase to be eligible for a net30 account of up to $1,000 for a new business. The credit line can increase in increments of $500 if balances are paid in full and on-time. Strategic Network Solutions reports to Experian and Credit Safe.

Grainger Industrial Supply

Granger industrial supply sells industrial equipment for outdoors as well as standard tools, and more. To gain net 30 approval you will need a business license, a DUNS number, and bank reference. They report to Dun & Bradstreet.

Summa Office Supplies

Another office supply provider, you can order anything from paper to staples, pens to printer ink, and pretty much anything you can think of in between from Summa. They require a $75 initial purchase, and will approve up to $2,000 on net 30 terms. They report to Eqifax and D&B.

Quill Office Supplies

Quill also sells standard office supplies. You will need to make an initial purchase. They’ll usually put you on a 90 day prepay schedule, but after ordering for 3 months in a row, they’ll typically approve net 30 terms. They report to Dun & Bradstreet.

Uline

Uline sells a lot of things, but they specialize in packing and shipping equipment and janitorial supplies. You’ll need to place an initial order, and they do ask for a bank reference and two other references. They report to Experian and Dun & Bradstreet, so you’ll of course need a D-U-N-S number too.

Now, a credit line hybrid does require a personal credit score of 685, as mentioned. However, if your business is set up properly, payment can still be reported to business credit reporting agencies, thus building your business credit score even faster.

Get funding to help your business thrive right now.

Credit Line Hybrid and Other Business Funding Options :Tying it All Together

So, which one of these options will be the best one for your business? It depends on a huge number of factors. First, you have to figure out what you qualify for. That means knowing both your personal and business credit score.

Then, you have to determine exactly how much you need, and how fast you need it. That will make a huge difference in the type of lender and the type of product you apply for. Remember, a credit line hybrid will allow you to access a fairly large amount quickly.

If you have the personal credit score, apply for a credit line hybrid now. It is unsecured, no documents required, typically low introductory interest rates, and it works even for brand new businesses. After that, if you still need more funding, you can look at other options such as SBA loans or credit cards.

More Options

If your credit score is not the best, then consider private lenders. At the same time, work with starter vendors to improve and grow your business credit. Once you have your business and personal credit stronger, you can access financing from a variety of sources.

Of course, get your free copy of your personal credit report and monitor your business credit report as well. By knowing what is on each report you can get a handle on what is causing your score to be lower than it needs to be and fix it.

This may mean contesting mistakes. If you do find a mistake, you need to request that it be removed in writing. Send copies of all supporting documents as well. Do not, for any reason, send originals.

Credit Line Hybrid: This Could Be the Answer

The truth of the matter is that there are many options for business funding. However, most business owners do not know about the credit line hybrid. It can be a great option for low introductory rates and building business credit if your personal credit is okay. Even if your personal credit is not so great, you can use a credit partner to help you access this funding option.

Then, you can access the financing you need and build business credit at the same time. You can also combine credit line hybrid funds with any of the other business funding options mentioned to bridge any gaps that may show up for whatever reason. As our global economy continues to change, you can still get funding for your business. Our hybrid credit line could be just what you need to survive and thrive – and come out of the COVID-19 crisis in an even better financial place than before.

The post Credit Line Hybrid: The Top Option for Unsecured Business Financing You Probably Don’t Know About appeared first on Credit Suite.