Sean Hannity warned President Biden’s continued pleas to pass his party’s socialist socioeconomic takeover is further proof he cares not for the American people but only himself.

Author: Luciana Quinn

How to Add Your Hotel to Google, TripAdvisor, and More

Have you ever wondered how competitor’s hotels are ranking on the first page of Google? Most of them use free directories like Google and Tripadvisor to reach prospective customers.

Using those same services, you too can boost the search visibility of your hotel property. Best of all, these services are free and packed full of features.

Let’s dive into the key reasons you should add your hotel to Google, Tripadvisor, and similar hotel booking engines. Then, I’ll show you how to request listings on the top hotel listing websites.

Why Should You Add Your Hotel to Booking Sites

For hotels small and large, it makes sense to list them on well-known hotel booking sites like Google and Tripadvisor. Here are a few key reasons to do so.

1. Increase Visibility

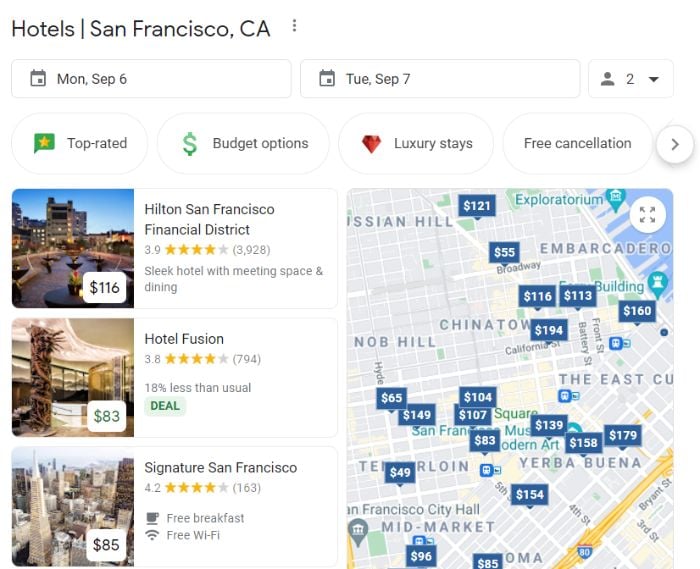

The more platforms your hotel is listed on, the more people will see it. Here is an example of how your hotel could look on Google’s hotel listing search results:

With increased visibility, your website will likely see a boost in visitors and inquiries. This increases the odds of bookings for your hotel, especially if your listing provides accurate information and high-quality photos.

2. Build Trustworthiness

Building trust with search engines and customers takes time when using your hotel website and social media profiles.

How can you speed up the process? When you list your hotel on a website like Google, you “borrow” its trustworthiness.

Customers know that business listing services, like Google and Tripadvisor, vet their listings. Similarly, customers know that businesses care about their standing on these platforms. This naturally boosts your hotel’s trustworthiness in the eyes of potential customers.

3. Make It Easier for Customers

A major pain point for customers is the inability to compare services and prices easily. With hotel listing sites, customers can easily compare accommodations to find the one that meets their needs.

A Google hotel or Tripadvisor listing also makes it possible for customers to book a stay at your hotel at any time. When your listing contains all relevant information, including availability and price, customers can make a quick but educated decision. This puts the power into the hands of your customers.

4. Gain Access to Marketing Tools

Platforms like Google and Tripadvisor have many marketing tools available for business owners. While not all of them are free, there are many affordable options.

Google integrates seamlessly with its suite of industry-trusted marketing tools. These include:

- Google Ads

- Google Analytics

- Google Keyword Planner (now part of Google Ads)

Google requires hotels to be running ads with them in order to appear on Google Hotel results. Tripadvisor also has its own suite of tools and services. As a verified Tripadvisor business, you can purchase storefront stickers and marketing materials through their vendors. You can also download free marketing assets, like icons and logos, to add to your website, social media profiles, and more.

5. Incorporate Advertisements

Take your hotel marketing efforts a step further with paid advertisements.

As mentioned, Google My Business incorporates seamlessly with Google Ads. You can create campaigns that boost your hotel listing to the top of search engine results pages and Google My Business results pages. The aim is to target relevant keywords with high volume and low competition.

How to Add Your Hotel to Google

Google makes it easy to add and verify your business. Just follow these steps, and you’ll be a Google-verified hotel in less than a week.

1. Sign Up for Google My Business

First, search to see if your business already exists. A Google business listing can exist without a Google My Business account connected. If it does not yet exist, you can create the listing in minutes.

You will be asked to provide:

- business name and category

- location for customers (if applicable)

- geographic location for customers you serve

- contact phone number

- website (if applicable)

- mailing address (for verification)

- services

- business hours

- whether you accept messages from customers

- a business description

- photos of your business

You can make edits to your business profile after you complete the steps above. The changes will not be visible on Google until your business has been verified, though.

2. Engage With Customers Reviews and Post Up-to-Date Photos

For larger businesses like hotels, the listing likely exists on Google already. In this case, you might already have customer reviews.

Once you’re verified as the owner or account manager of the hotel, you can respond to ratings and reviews as the business.

Believe it or not, negative reviews are good for your business. They show potential customers the worst-case scenario, as well as how you respond to it.

You should respond to negative reviews promptly, though it’s important to engage with positive reviews, too. This shows you are an active business owner who is attentive to your customers and their feedback.

You should also add up-to-date photos of the hotel and its amenities. While customer photos may exist on the listing, they may not be current or high quality. You want your photos to be front and center on the listing.

3. Add Hotel Information

Your customers should not need to go to multiple websites to find more in-depth information. This may cause them to find other deals elsewhere.

What should you add to your Google business listing?

- prices

- availability

- hours

- amenities

- health and safety guidelines

- up-to-date photos

The more information you add, the greater the benefit to the customer. For example, one benefit of adding pricing to your business listing is the automatic creation of a free booking link.

This brings customers right to your checkout funnel, which can boost your conversion rates. Just be sure to avoid the top reasons for checkout abandonment!

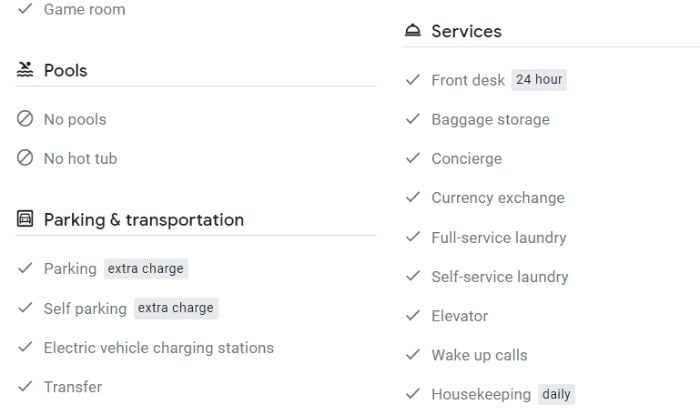

Now onto amenities. There are various categories you should target in your amenities list. These include:

- internet

- food & drink

- policies & payments

- activities

- pools

- services

- parking & transportation

- wellness

- accessibility

- pets

- business & events

- rooms

- bathrooms

- languages spoken

Google provides many options within each category. Check those you offer and add additional information as allowed. For example, whether there is an extra charge or how often a service is performed:

How to Add Your Hotel to Tripadvisor

Tripadvisor provides a streamlined process for requesting your hotel’s listing.

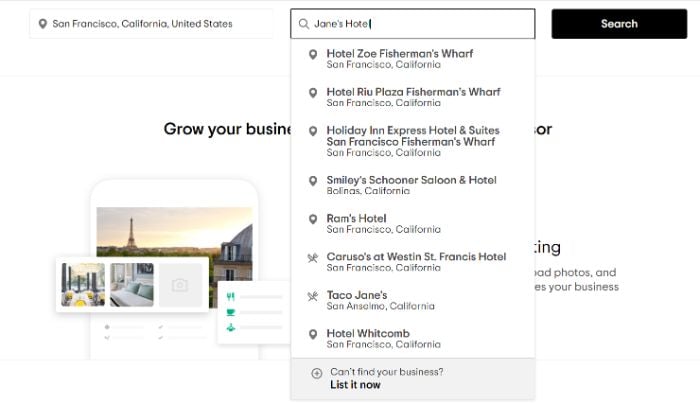

1. Request a Listing

Similar to Google My Business, a listing can be requested without your input. This often occurs when a user writes a review. To see if your hotel already has a listing, go to the Claim Listing page and search your business name.

If your business is not listed, just click the option at the bottom of the search results list that says “List it now:”

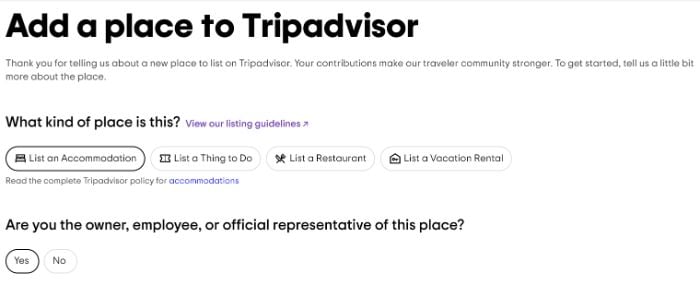

2. Add Your Personal Information

With the request initiated, you will first need to establish who you are and your connection with the business. This will include categorization of your business, your role within the business, and whether the place is currently open:

3. Add Your Hotel Information

Now it’s time to add the name of the hotel, a description (optional), address, and contact information.

This information will be available for customers once the listing is live.

For verification purposes, be sure the information you provide is accurate and up-to-date.

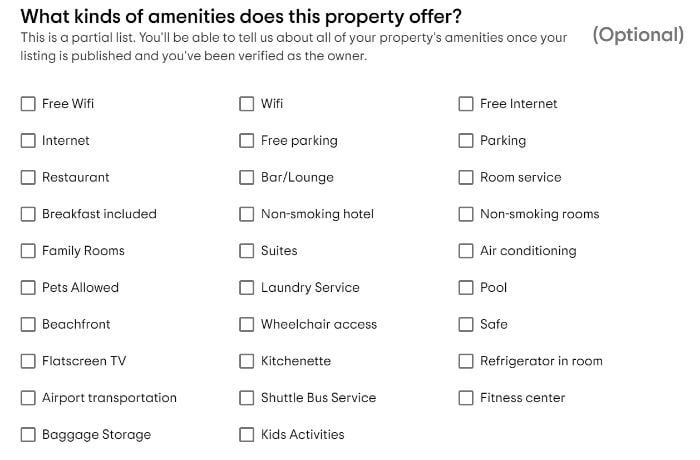

4. Include Property Details

Here, you will have the chance to add more information about your hotel and its services.

To start, Tripadvisor will ask numerous questions to ensure the most information is included in your listing. These questions include:

- What accommodation type best describes this property?

- How many rooms or units does the property have?

- How frequently is the front desk or check-in location staffed?

- What are the check-in hours?

You will also have the chance to select amenities your hotel provides from a list of common options:

The amenities list is not comprehensive, but you can provide more details once your hotel listing is published.

5. Add a Description and Photos

While a description is not required, it is crucial to distinguish your hotel from the competition. Aim to write a customer-focused description of your hotel.

The more photographs a listing has, the more likely it is to convert. A study from Bright Local found that businesses with more than 100 images on Google My Business get 1038 percent more direct searches than the average business.

That’s not the only benefit. Business listings with more than 100 images also see more calls, direction requests, and website clicks.

6. Submit Your Hotel Listing

The final step is to affirm the information you provided is true, and that you have the authority to request a listing. Once that is done, you can submit your listing for review.

With the listing submitted, Tripadvisor will start verifying your details and confirm your property meets their guidelines. The timeframe may vary, though it typically takes five business days.

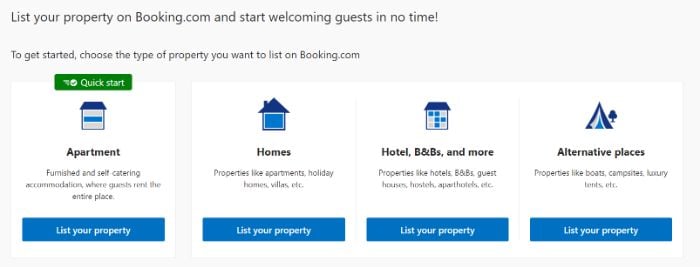

How to Add Your Hotel to Booking.com

Google and Tripadvisor are industry leaders, but Booking.com is another popular option for listing your hotel. Follow the steps outlined below to get started now.

1. Sign Up for Booking.com

It takes just a few steps to sign up for Booking.com. The steps are:

- Go to the sign-up page and click “Get started.”

- Enter your email address and then click “Continue.”

- Enter your first and last name, and phone number.

- Enter the password of your choice and click “Create account.”

2. Request a Hotel Listing

Using the account you created above, you can now click “List your property” under Hotels, B&Bs, and more.

You can add property details, including:

- hotel name

- hotel address

- contact information

- pricing

- facilities & services

- amenities

- policies

- payments

You will also have the chance to upload photos of your hotel. This is your chance to show the best your hotel has to offer.

You should, of course, include images of amenities and luxury services. However, also be sure to include images of your standard rooms. You do not want to set an expectation for customers that is unrealistic.

3. Add More Details

Once your listing is approved, you will receive access to Booking’s Extranet. This is a portal where you can update your availability calendar, prices, and other listing details.

It will be important to update your details regularly to ensure the best experience for customers.

4. Make the Listing Live

Whenever you’re ready, you can make your property listing live on Booking.

Besides these three mentioned, also consider other platforms to add your hotel listing to, like Oyster, HotWire, Priceline, Travelocity, Yelp, and more.

Frequently Asked Questions About Adding Hotel Listings

How Do I Add My Hotel to Google Maps?

With a Google My Business listing, your hotel’s address will automatically appear on Google Maps.

Should I Add My New Hotel to Google?

Yes! The sooner you can get your property listed on Google and other hotel booking websites, the sooner you can begin to build visibility and credibility.

What Other Hotel Booking Websites Should I Add My Hotel To?

Aside from Google My Business, Tripadvisor, and Booking.com, other hotel booking engines to consider include:

How Often Should I Update My Google Hotel Listings?

The more often you update your Google hotel listings, the better. You should update prices and availability daily if needed. For services and amenities, update them as their availability changes. You should also respond to reviews regularly.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “How Do I Add My Hotel to Google Maps?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

With a Google My Business listing, your hotel’s address will automatically appear on Google Maps.

”

}

}

, {

“@type”: “Question”,

“name”: “Should I Add My New Hotel to Google?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Yes! The sooner you can get your property listed on Google and other hotel booking websites, the sooner you can begin to build visibility and credibility.

”

}

}

, {

“@type”: “Question”,

“name”: “What Other Hotel Booking Websites Should I Add My Hotel To?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Aside from Google My Business, Tripadvisor, and Booking.com, other hotel booking engines to consider include:

”

}

}

, {

“@type”: “Question”,

“name”: “How Often Should I Update My Google Hotel Listings?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

The more often you update your Google hotel listings, the better. You should update prices and availability daily if needed. For services and amenities, update them as their availability changes. You should also respond to reviews regularly.

”

}

}

]

}

Google Hotel Guide Conclusion

With hotel booking engines like Google My Business, Tripadvisor, and Booking.com, you can meet the growing demand for contactless service. These websites let hotels provide all of the information customers need to make an informed decision. This gives the customer greater control over their booking experience.

If you’ve not considered using these booking engines before, this guide will provide you with everything you need to get started. There are many benefits to using these websites, including increased visibility and trustworthiness.

Which of the above hotel booking engines will you sign up for first?

New comment by hitwill in "Ask HN: Who is hiring? (August 2021)"

Remote Go (GoLang) developer wanted.

Knowledge of AWS/ Google Cloud

Up to 160K per year depending on experience

See details and apply below.

https://www.indeed.com/job/lead-developer-back-end-go-golang…

The post New comment by hitwill in "Ask HN: Who is hiring? (August 2021)" appeared first on ROI Credit Builders.

Lightning strike instantly kills two surfers

Where militaries window shop

Can I Use a 401K Loan To Fund a Business?

You can use a 401K loan to fund a business. But, just because you can doesn’t mean you should. It appears to be a fabulous option. Your payments will just be going back into your account, and any interest will be paid to yourself. In reality, it is a good idea, until you realize there is an even better way.

Should You Take Out a 401K Loan For Business Purposes?

When it comes to using a retirement plan to fund a business, a 401K loan isn’t the only option. Technically a distribution could work too, but that’s not wise. More about that later. There is actually another option that many do not know about.

Unlock the Mystery of the 401K for Working Capital Program

It’s not so much of a mystery as it is widely unknown. This Credit Suite program offers a flexible and powerful way for a new or existing business or franchise to leverage assets that are in a 401(k) plan or IRA. These are assets which are tied up in stocks.

It doesn’t take long either. In as little as 3 weeks you can actually invest a portion of these funds into your own business. Then, you not only have more control over the performance of your retirement plan assets, but you also have the working capital you need.

This type of program even has the blessing of the IRS. In fact, they have their own name for it. It’s called a Rollover for Business Startups (ROBS).

Will it Cause More Tax Issues Than a 401K Loan?

No it will not. According to the IRS, a ROBS qualified plan is a separate entity. It has its own set of requirements. The plan technically owns the business, not the individual. That means some filing exceptions for individuals might not apply to the plan. That said, always check with a tax expert when it comes to tax matters.

Find out why so many companies use our proven methods to get business loans.

Do You Qualify for a ROBS?

Surprisingly, this type of financing is pretty easy to get. You do not have to submit financials or have good credit to get approval. In fact, all the lender will ask for is a copy of your two most recent 401(k) statements.

If the plan has a value of more than $35,000, you can get approval. This is true even if you have really bad personal credit. You can get however much of your 401(k) is “rollable.” Sometimes, you can secure a low-interest credit line or loan for 100% of your current 401(k) value.

The plan you use cannot be from a business where you currently work. It will have to be from previous employment. Also, you can’t still be contributing to it.

Benefits of a ROBS

The benefits of this option are many. First, you can get 24-hour pre approval. Also, you pay no penalties for the rollover. Plus, you pay no application fees.

You can get approval even with bad credit, and the time from application to funding is 3 weeks or less. A big bonus is this type of funding will report to the business credit reporting agencies. That means you build business credit!

How Does it Work?

It sounds kind of crazy but it works. Credit Suite business credit experts will help every step of the way. First, we’ll help you set up a 401(k) plan in your company. Then, you’ll invest your 401(k) funds in it. Your business then has cash, but no debt. Despite how complicated it sounds, It’s all super easy and fast on your end. We handle the hard stuff.

Also, with our program, you will get more than just the financing. You will work with a CPA that will help you roll over a non-contributing and qualifying account. By doing this, you can cash out half, or $50,000, whichever is lower.

If applicable, they will also structure a self-directing IRA for the rest of the fund. You will get 5 years of management and consulting services for your business.

The Question of Terms

The cost is 1% and the term is 5 years. There is a $4995 lender fee. Remember, this includes 5 years worth of management and consulting.

Find out why so many companies use our proven methods to get business loans.

Why Can’t I Just Take a Distribution to Fund My Business with My Retirement?

Unless you are 59 ½ years old, there is an early withdrawal penalty of 10%. If you think about it, you would be paying a lot to use your own money. Don’t do that.

ROBS vs. a 401K Loan?

First of all, not all plans allow for loans. If your plan does, the IRS will only let you borrow up to 50%, up to $50,000, before you have to start paying taxes.

Also, you would be paying interest. That isn’t terrible, as you are paying interest to yourself. However, you will be making monthly payments, whereas with the 401K Rollover for Working Capital, there is no payment.

This is a unique program. It allows you to tap into your existing retirement account without penalties or taxable distributions. You also avoid loans, banks, or credit checks. There is no debt and no monthly payment.

What if You Need More Than You Can Get with This Type of Financing?

Whether you decide on a 401K loan or you go the ROBS route, you may find you still need more. It’s not uncommon to need other funding options to bridge the gaps between how much is available from your 401(k) and how much you actually need.

One great option that compliments 401K financing well is the Credit Line Hybrid. You can get up to $150,000 in unsecured business financing. Similar to a 401K loan and the 401K for Working Capital program, you do not have to turn in a lot of documents. In fact, this is considered “no-doc” financing.

You do need to have a 680 or above credit score. However, if you do not meet this or other requirements, you can take on a credit partner that does. Many business owners piggy back off the good credit of a friend or family member until they improve their own.

What makes this an especially good compliment to 401K financing, is that it also reports to the business credit reporting agencies. This just speeds up the rate at which you build your business credit score.

Business Credit Score

Even though neither a 401K loan or the 401K for Working Capital Program require good credit, it’s important to understand this one thing. The 401(k) for Working Capital Program does help you build a strong business credit score. It isn’t easy to find accounts that report your business credit report.

Credit Suite works with business owners every day that are struggling with this. Most account holders do not make it clear whether they do this or not. We work with those that we know do, and this program is one of the easiest ways to get another account reporting.

Find out why so many companies use our proven methods to get business loans.

Do not underestimate this benefit of the 401(k) financing program and the Credit Line Hybrid. It is something that should be considered when making a financing decision. Your business credit report can make a difference in whether you are able to get funding from another source in the future.

Funding a Business With a 401K Loan

If your retirement fund allows for loans, and you have enough available in your account, then the answer is yes. You absolutely can. However, there is another, better option, for using your retirement account to fund your business. Contact Credit Suite today to get started.

The post Can I Use a 401K Loan To Fund a Business? appeared first on Credit Suite.

The U.A.E. Needs U.S. Arms to Ward Off Iran

The post The U.A.E. Needs U.S. Arms to Ward Off Iran appeared first on Buy It At A Bargain – Deals And Reviews.

New comment by peeyush_goyal in "Ask HN: Who is hiring? (November 2020)"

Salarybox | New Delhi, India | Onsite | Full time | Sr Backend Engineer

At Salarybox, we are helping 170M+ blue-collar workers avail Salary Advance & other financial services. The founders are financial industry & tech startup veterans; having worked at several Fintech & Enterprise SaaS startups, including YC backed startups after studying at IIT Roorkee & Carnegie Mellon.

We are looking for Senior Backend Engineers with at least 3 years experience. You will be an integral part of building the backend architecture and developing core systems as our first backend hire. Furthermore, you’ll get a front-row seat to the entire startup ecosystem – ranging from fundraising to partnerships to exit strategies.

Looking for experts in Python / Node.js; experience with databases (MongoDB, Redis etc.); good understanding of platforms (Docker, Google Cloud, Azure etc.) & a basic understanding of Dev Ops.

If you are interested in working with us, send your resume to peeyush [at] salarybox [dot] in.

The post New comment by peeyush_goyal in “Ask HN: Who is hiring? (November 2020)” appeared first on ROI Credit Builders.

Here’s a Quick Way to Build Business Credit

COVID-19 turned the economy on its head. Now, with things starting to open back up, businesses are wondering if they are even going to be able to make it. Most are starting to see they need to have business credit if they don’t already. But, is there a quick way to build business credit before it’s too late?

Find Out How To Get Funds Fast While Utilizing this Quick Way to Build Business Credit

The truth is, you can’t snap your fingers. It’s a process, and you have to work through it. However, knowing why you need business credit and how to work that process helps. While it may not be a quick way to build business credit in the terms of a great score magically appearing overnight, it is definitely quicker than not following the process at all.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

Quick Way to Build Business Credit: Business Credit vs Personal Credit

The simplest way to explain it is that business credit is like your personal credit, but it is in the name of your business. That’s not to say there are no other differences, but that is the gist. Basically, if you do things right, you have a totally separate business credit report that is in the name of your business, not your name personally. Your personal accounts do not show up on this report, and your business accounts, that are on this report, do not show up on your personal credit report.

The simplest way to explain it is that business credit is like your personal credit, but it is in the name of your business. That’s not to say there are no other differences, but that is the gist. Basically, if you do things right, you have a totally separate business credit report that is in the name of your business, not your name personally. Your personal accounts do not show up on this report, and your business accounts, that are on this report, do not show up on your personal credit report.

Business credit reports come from Dun & Bradstreet, Experian Business, and Equifax Business. When there is a problem with your business credit, it does not affect your ability to get funding based on your personal credit. Conversely, problems on your personal credit do not affect your ability to get funding for your business based solely on your business credit.

Quick Way to Build Business Credit: Why Is Business Credit Necessary?

Business credit is necessary for a number of reasons. The most obvious is to help you get funding for your business. However, it also helps protect your personal credit. If your business accounts are reporting to your personal credit report, you are going to see some debt-credit ratio issues. This is the ratio of your debt in relation to your available credit. Since business expenses are generally higher than personal expenses, you’re likely to run balances at or near your limits consistently, which will have a negative affect on your personal credit score.

Business credit typically makes you eligible for higher limit cards that are better suited for large business expenditures. It also keeps these large expenditures off your personal cards and personal credit report.

Quick Way to Build Business Credit: There Are No Magic Beans

So, now you understand why you need business credit, but you need to know how to build it in a crazy economy, and fast. The thing is, there are no magic beans when it comes to a quick way to build business credit. Remember what I said. A great business credit score will not appear magically overnight like a beanstalk. You do have to actually work all the way through the process. However, there are a few shortcuts you can try once your business is set up properly. More on how to do that later.

Quick Way to Build Business Credit: How to Make it Faster

Okay, so let’s assume for a minute that you already have your business set up in a way that it is a separate entity from yourself. This is how you get accounts reporting to your business credit report rather than your personal report. If you’ve done that, there are a few things you can do to get the ball rolling, and give it a little push even.

Ask Current Vendors for Credit

The first step is to ask those vendors with which you already have a relationship to extend credit. Since you are already working with them, they may be more willing to do so without requiring a credit check. Be sure to ask if they will report payments to the business credit reporting agencies. If they will not, then it won’t matter if they give you credit or not. Accounts not reported do not help build your credit score.

Ask Utilities to Report

You already pay things like rent, telephone, internet, electricity, and water bills on a regular basis. You can ask providers to report those payments to the business credit reporting agencies. They do not have to do it. However, they might, and it can only help build your score faster.

Establish Tradelines With Starter Vendors

After those two things, the next step is to open tradelines with starter vendors. These are vendors that offer net 30 invoices without any type of credit check, and then they will report your payments on those invoices to the business credit reporting agencies.

The kicker is starter vendors do not usually market themselves as such. This makes them a little hard to find without some expert guidance. As a general rule, you need to have 3 to 5 vendor tradelines reporting to get a good solid start to your business credit score. Here are a few of the easiest to get started with.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

Crown Office Supplies

Crown Office Supplies offers paper and other office supplies. They report to all three of the major business credit reporting agencies, which of course include D & B, Experian, and Equifax. It can be hard to find vendors which report to Equifax, so getting credit with Crown is a good move.

To qualify, you will need to be an entity in good standing with Secretary of State and an EIN number with IRS. A business address that matches everywhere (both online and offline), a D-U-N-S number, a business license (if applicable), as well as a business bank account are all necessary. Your business must be at least 60 days old. There is also a membership fee of $99 annually upon approval.

Uline

Uline sells shipping, packing, and industrial supplies. They report to Dun & Bradstreet as well. This means, you guessed it, you have to have a D-U-N-S number.

In addition, they ask for 2 references and a bank reference. The first few orders might need to be paid in advance to get approval for Net 30 terms.

Grainger Industrial Supply

Grainger sells power tools, pumps, hardware and other things. In addition, they can handle maintenance of your auto fleet. You need a business license and EIN to quality, as well as a D-U-N-S number.

After you pay on several tradeline accounts that report for a while, you should have a solid foundation to start applying for other types of business credit. Store cards are the easiest to get first and continue building your score. Next are fleet cards, and then finally, the regular cards that are not limited by where they can be used or what they can be used to purchase.

Quick Way to Build Business Credit: What to Do In the Meantime?

So, let’s say you start this process, but you need funds right now. What can you do? The credit line hybrid may be just the answer. You can get approval with personal credit that is lower than what most traditional lenders require, and if you are set up properly it will report to the business credit reporting agencies and help build your business credit even faster.

It allows you to fund your business without putting up collateral, and you only pay back what you use.

Credit Line Hybrid: Qualifications?

What does it take to qualify? I’m going to tell you, but don’t stop reading if you don’t meet all of the requirements. There are ways around some of them.

First, your personal credit score should be at least 685. Also, you can’t have any liens, judgments, bankruptcies or late payments. Furthermore, in the past 6 months you should have less than 5 credit inquiries, and you should have less than a 45% balance on all business and personal credit cards. It is preferred that you already have established business credit, but not necessarily required.

Are you thinking there is no way you qualify? Stop thinking that. If you do not meet all of the requirements, you can take on a credit partner that does. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you access funding, but you still get the benefits.

Quick Way to Build Business Credit: Credit Line Hybrid Benefits

There are many benefits to using a credit line hybrid. First, it is unsecured, meaning you do not have to have any collateral to put up. Next, you don’t have to provide any bank statements or financials.

Even better, typical approval is up to 5x that of the highest credit limit on the personal credit report, and often you can get interest rates as low as 0% for the first few months. This allows you to put that savings back into your business.

The process is pretty fast, especially with a qualified expert to walk you through it. Also, with the approval for multiple credit cards, competition is created. This makes it easier, and likely even if you handle the credit responsibly, that you can get interest rates lowered and limits raised every few months.

The credit line hybrid is a fast way to get cash while working on a quick way to build business credit.

Quick Way to Build Business Credit: What’s This About Setting Up?

Remember how I said earlier all of this only works if your business is set up properly. That’s because unless your business is set up to be an entity separate from you as the owner that is fundable all on its own, your accounts will report to your personal credit. There will be no separate business credit. How do you accomplish this separation?

Separate Contact Information

The first step is to make sure your business has its own phone number, fax number, and address. That doesn’t mean you have to get a separate phone line, or even a separate location. You do not even have to have a fax machine. You can get a business number that will ring to your personal phone and a virtual address online quickly and easily.

Apply for an EIN

The next thing you need to do is get an EIN for your business. This is an identifying number for your business that works in a way similar to how your SSN works for you personally. You can get one for free from the IRS.

You Have to Incorporate

Incorporating your business as an LLC, S-corp, or corporation is necessary to fundability. It lends credence to your business as one that is legitimate and offers some protection from liability. It also solidifies your business as a separate entity from yourself.

Business Bank Account

You have to open a separate, dedicated business bank account. There are a few reasons for this. First, it will help you keep track of business finances. It will also help you keep them separate from personal finances for tax purposes. The big one for building business credit is, you got it, it separates your business from you as the owner.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

Licenses

If a business does not have all the necessary licenses it needs to run, red flags are going to fly up all over the place. Do the research you need to do to ensure you have all of the licenses necessary to legitimately run your business at the federal, state, and local levels.

Website

These days, you do not exist if you do not have a website. However, having a poorly put together website can be even worse. It is the first impression you make on a lot of people. Spend the time and money necessary to ensure your website is professionally designed and works well. Pay for hosting too. Don’t use a free hosting service. Furthermore, your business needs a dedicated business email address. Make sure it has the same URL as your website. Don’t use a free service such as Yahoo or Gmail.

D-U-N-S Number

Lastly, you have to have a D-U-N-S Number. It’s imperative. Dun & Bradstreet is hands down the largest and most commonly used business credit reporting agency. You cannot have a score with them if you do not have a D-U-N-S number. It’s free on their website.

Remember Business Credit Is Just One Piece of Fundability

There is so much more to fundability than business credit. It is a tangled web indeed. If you are looking for a quick way to build business credit, keep this in mind. Furthermore, if your business isn’t set up properly, nothing else you do to build fundability or business credit will matter. Get that done today.

The post Here’s a Quick Way to Build Business Credit appeared first on Credit Suite.

5 Real Estate Influencers With Exceptional Personal Brands

Real Estate is not only about selling and buying. It serves a higher purpose. When we think about fulfilling our goals and ambitions, we want only the best for ourselves and those who surround us. …

The post 5 Real Estate Influencers With Exceptional Personal Brands appeared first on Paper.li blog.