You have to pay your taxes. Not only is it illegal not to, but paying your personal and business taxes is a major factor in fundability. If you apply for business funding and a lender sees you have not been paying your taxes, it will likely result in denial. After all, if you can’t pay … Continue reading 11 Tax Write Offs for Small Business That May Surprise You

Author: Shirley Daniels

9 Funding Options to Fit Any Business

What are the business funding options? There are a ton. For example, a startup may choose to seek a business loan, find an angel investor, pitch to a venture capital investor, or try crowdfunding. An established business might look to traditional loans or credit cards. But, what if these options will not work? What if you do not qualify? What if you can’t wait for the cash?

Find the Right Funding Options for Your Business Right Now

There are options for funding that will work for most businesses right where they are. Some require collateral, some do not. Some require good credit, while others look at alternative factors to determine the business’s ability to repay. Here are 9 funding options to help you get the money you need for your business right now.

Learn business loan secrets and get money for your business.

Funding Options With No Collateral

If you are looking for fast, flexible funding options that do not require collateral, you need one of these.

9. Credit Line Hybrid

The credit line hybrid is unsecured business financing. It is available to pretty much anyone for any type of business expense. You can use it for real estate, equipment, working capital, and even startup expenses. There is no down payment, and you do not have to provide income documentation. It is completely no-doc financing.

You do need to have personal credit of 680 or above. Also, there cannot be any late payments in the past 24 months, there can be no open collections or bankruptcies, and there should be less than 6 inquiries in the past 6 months on your consumer credit report. In addition, you need at least 2 open credit cards with a $2,000 limit or higher and 2 years of good payment history on those cards.

If you do not meet these requirements, you can still get this funding. You have the option to take on a credit partner that does meet them. The payments will still be reported on the business’s credit report. That means you will build business credit whether you get the financing on your own or with a credit partner.

You can get up to $150,000, and often interest rates are as low as 0% for the first 6 to 18 months.

8. Business Line of Credit

A traditional business line of credit is like a cross between a traditional loan and a business credit card. You go through a traditional bank and apply just like you would a loan. It may be collateral based or not, depending on your lender’s requirements. You may also use a guarantor to help reduce rates and get better terms if needed.

The difference between a traditional loan and a traditional business line of credit is that the line of credit is revolving credit rather than a term loan. Like a credit card, you only pay back what you use. Also, lines of credit typically have lower interest rates than business credit cards. The trade off is, there are no rewards like cash back or air miles.

At Credit Suite, our funding partners offer an unsecured line of credit that has a minimum FICO score requirements of 600. You also must show business tax returns with net profits over $20,000 if you have been in business between 6 months and a year. If you have been in business for over a year, you need to show $10,000 in monthly revenue. These requirements are much easier to meet than those typically set forth by lenders.

Terms are 6 to 18 months and interest rates range from 12% to 25%. You can get up to $250,000.

Learn business loan secrets and get money for your business.

Funding Options for Bad Credit

If your credit isn’t exactly good, you still have options. The following funding options are available with a minimum credit score of 500.

7. Business Revenue Lending

A business that has consistent revenue of $120,000 per year or more may qualify for this type of funding. Lenders verify revenue using bank statements. There can be no recent bankruptcies, but the minimum credit score to qualify is 500.

The business must also be in operation for a year or more, and it must do over 5 small transactions each month to get business revenue financing.

6. Merchant Cash Advance

A business that accepts credit card payments and has at least a 500 FICO can get up to $750,000 in a merchant cash advance. Credit rates are usually lower compared to traditional financing as well.

There must be $100,000 or more per year in credit card sales, and typical approval equals one month’s credit card financing volume.

5. Accounts Receivable Financing

5. Accounts Receivable Financing

Outstanding account receivables can also be a source of funding for your business. Get as much as 80% of receivables advanced in less than 24 hours. You get the rest of the accounts receivable amount once you collect full payment for the invoice. Closing takes 2 weeks or less.

Receivables should be with the government or another business. Getting financing with receivables from individuals is not as easy.

4. Retirement Account Financing (Rollover for Business Startup, or ROBS)

This Credit Suite program offers a flexible and powerful way for a new or existing business or franchise to leverage assets that are in a 401(k) plan or IRA.

It doesn’t take long either. In as little as 3 weeks you can actually invest a portion of these funds into your own business. Then, you not only have more control over the performance of your retirement plan assets, but you also have the working capital you need.

According to the IRS, a ROBS qualified plan is a separate entity. It has its own set of requirements. The plan technically owns the business, not the individual. That means some filing exceptions for individuals might not apply to the plan. That said, always check with a tax expert when it comes to tax matters.

Learn business loan secrets and get money for your business.

Do You Qualify for a ROBS?

You do not have to submit financials or have good credit to get approval. In fact, all the lender will ask for is a copy of your two most recent 401(k) statements.

If the plan has a value of more than $35,000, you can get approval. This is true even if you have really bad personal credit. You can get however much of your 401(k) is “rollable.” Sometimes, you can secure a low-interest credit line or loan for 100% of your current 401(k) value.

The plan you use cannot be from a business where you currently work. It will have to be from previous employment. Also, you can’t still be contributing to it.

The cost is 5.25% prime + 2, and the term is 5 years. There is a $1995 lender fee. This includes 5 years worth of management and consulting.

Funding Options for Equipment or Real Estate

If your credit is lacking but you do have equipment or real estate to use as collateral, you may find these options to work well.

3. Equipment Financing

You can secure this type of financing by using existing equipment or new equipment you want to purchase as collateral. Funding is available up to $10 million. Terms range from 5 to 60 months, and you need a minimum 550 FICO.

Terms range from 5 to 60 months, and you need a minimum 550 FICO.

The equipment must be new, and most types of equipment are acceptable, including software.

You’ll need to provide details on the equipment to be financed and, depending on the loan amount and certain risk factors, you may need to show 2 years corporate and personal tax returns.

2. Commercial Real Estate Financing

As you might expect, this is a loan that is secured by commercial real estate. You can get up to $10 million with terms from 6 to 60 months and interest rates ranging from 6% to 22%. The minimum credit requirement is 500, so this can be a good option if you don’t have great credit as well.

Funding Options with Good Credit and Collateral

SBA loans are an option if you are close to meeting the requirements for a traditional loan but not quite there. They offer the highest dollar amounts and typically the best terms.

1. SBA Enterprise Loans

1. SBA Enterprise Loans

You need to have collateral worth up to at least 50% of the loan amount, but you only need a FICO of 620. There also can be no bankruptcies in the past 4 years. Only for profit companies qualify, and they must have positive trends in sales growth. Generally amounts are available of up to $12 million with terms up to 25 years.

Which Funding Options Are Best For You?

If you only qualify for one type, this is a no brainer. But, what if more than one option will work? You need to weigh the cost vs. the benefit. For example, is not having to use collateral worth a higher interest rate? Can you get the amount that you need? Will one option get cash in your hands faster than the other? Do you need the money faster, or can you wait a bit to take advantage of better terms or rates?

When it comes to any of these funding options, it is best to work with a business credit expert. This is someone that can listen, take what you need, apply it to what is available to you, and help you choose the best option that you can get.

Not only that, but they can help you evaluate the fundability of your business and make changes if necessary to ensure you can get the best funding options available far into the future.

Start the process now with a free consultation.

The post 9 Funding Options to Fit Any Business appeared first on Credit Suite.

Zentail (YC S12) Is Hiring a Director of Growth Marketing in Columbia, MD

Article URL: https://www.ycombinator.com/companies/zentail/jobs/oHaVmJq-director-of-growth-marketing

Comments URL: https://news.ycombinator.com/item?id=27446900

Points: 1

# Comments: 0

What Are Influencer Engagement Marketplaces (and How to Use Them)

Influencers are everywhere.

There are roughly 37 million influencers on Instagram, and around 1.5 million of them work on YouTube.

Every day, these creators promote brands across social media, talk up great products, and directly influence how people spend their hard-earned money.

Sounds great, right? There’s just one problem.

It’s really hard to actually find a great influencer to grow your business.

Whether you’re digging through social media platforms for ideas, or spending hours pitching creators, it’s a time-consuming process. In fact, according to Mediakix, 61 percent of marketers struggle to find the best influencers for their campaigns.

What’s the answer?

You need a more effective means of sourcing influencer talent and making connections. Influencer marketplaces can help you do just that, so let me show you how they work.

Why You Should Use Influencers in Your Marketing Strategy

Before we get started, let’s touch on influencer marketing more generally. Is it worth your time, or should you leave the influencer trend behind?

While influencer marketing isn’t for everyone, I think you should give it a go if it makes sense for your business.

Why? Because influencer marketing works.

- According to Instagram, 87 percent of users have bought something promoted by an influencer.

- You can make $5.20 for every $1 spent on influencer marketing, as reported by the Influencer Marketing Hub.

- Over 89 percent of marketers agree that influencer marketing works for their business.

While I’m not suggesting you should rely solely on influencer-based marketing, the trend is here to stay, and it’s worth trying.

If you’re still not convinced, here’s another way to think of it. Around 26 percent of consumers use ad blockers to hide ads and improve their browsing experience.

There’s a high chance those ads you’re paying for won’t reach their intended audience! For sales-based companies, influencer marketing could be a promising alternative.

Ready to find influencers for marketing campaigns? Let’s explore the mysteries of the influencer marketplace.

How Businesses Find Influencers

You can find influencers online in four major ways:

- Social media platforms: There’s no shortage of social media platforms to browse for influencer talent, albeit this is a time-consuming process.

- Search engines: Google is a great way to find competitors and identify which influencers they use for their campaigns.

- Influencer marketplaces: These marketplaces help you match with various influencers in your niche.

- Influencer agencies: You can hire an agency to match you directly with the influencer they think suits you best.

Although we’re focusing on influencer marketplaces, remember it’s not the only strategy for finding influencers to market your business.

What Are Influencer Marketplaces?

Influencer marketplaces match businesses with influencers working in their niche, whether it’s beauty, fitness, food, and so on.

It’s a simple premise. You sign up and post a brief describing the services you’re looking for and wait for influencers to respond. If you find an influencer you’re happy with, you can hire them to create content, promote your brand and, well, influence people to buy your products.

You’re not limited to one influencer, either. You can work with multiple influencers across the platform, and you can recruit more talent as you go.

The upshot? Whether you’re running a one-off product campaign or you’re looking for a more stable relationship, influencer marketplaces could work for you.

Some of the more popular influencer marketing platforms include:

- Influence

- Intellifluence

- AspireIQ

- Webfluential

- Famebit

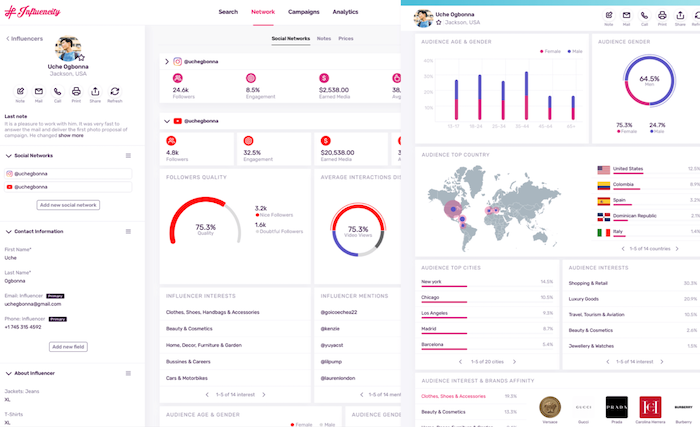

- Influencity

It’s common for influencers listed on marketplaces to work across two or more social media platforms. For businesses, this is great news because you can use one or two trusted influencers for all your content marketing.

Upfluence, for example, primarily pairs businesses with Instagram influencers, but there’s some scope to access influencers working on TikTok and Facebook, too:

While HypeAuditor matches you with influencers working across the likes of Twitch and YouTube:

There’s a huge range of marketplaces out there, so be sure to explore your options. Here are a few things to consider:

Platform Fees

Whichever marketplace you choose, you’ll usually pay a fee for signing up and using their services, so be sure to factor in the cost before you join.

Some platforms, though, like Influence, let you set up a basic account for free. The problem? You’re limited in terms of how many messages you can exchange each month, and how many profiles you can see in the search results. While this might work for one-off campaigns, it may be less sustainable for long-term influencer marketing.

Weigh up the pros and cons of the different fee structures before you commit.

Influencer Marketplaces Vs. Influencer Agencies

We touched on this earlier, but to be clear, influencer marketplaces and influencer agencies are totally different things.

- Influencer marketplaces allow you to work directly with your chosen influencer. You put your brief out there and look for talent.

- Influencer agencies, on the other hand, do some of this work for you. They vet their influencers against your brief and select the ones they think are best suited to your needs.

You can use both marketplaces and agencies if it suits your marketing strategy. Just bear in mind that they’re not the same thing.

In short, think of influencer marketplaces like a matchmaking service. While there’s no guarantee you’ll find the right influencer to collaborate with, there is a chance you’ll find a long-term creative partnership.

How to Use Influencer Engagement Marketplaces

Are you excited to give influencer marketplaces a try? Great! Before you jump into a subscription, though, here are some steps I suggest you work through.

Identify Your Goals

Before you even join an influencer marketplace, be clear on what you’re trying to achieve. For example, are you trying to increase sales, generate hype around your brand, or boost your engagement levels?

Jot all your goals down and try to identify which one is your priority.

Next, clarify your target audience and how they best respond to influencer marketing. That way, you can figure out precisely what role the influencer will play in your campaign.

As an example, say you’re a brand looking to launch a new product aimed at millennials on Instagram. You want to build hype and increase sales. Your main goal is to sell the product, so you’re looking for influencers who can not only help you but who can speak your target audience’s language.

Determine Your Budget

Once you know what you need from an influencer marketplace, it’s time to set your budget. How do you know what’s a “fair” amount to pay your influencer, though? Unfortunately, there’s no right answer, but asking yourself the following questions can serve as a guide.

First, what kind of content do you need? You might, for example, pay more for an in-depth product review video than a few short posts on Instagram.

Next, which platform are you targeting? Each platform requires different creator resources, so they command different rates. On average, you might pay an influencer $10 per 1000 followers for an Instagram post, but that goes up to $25 for a Facebook post.

How big is the influencer’s audience? The bigger the influencer, the more they can charge for their time.

Finally, is it a one-off or long-term campaign? You could potentially get better rates if the influencer knows they’ll get steady work from you. Seasonal campaigns could cost you more, since there’s higher demand around this time.

Don’t forget you’ll need to budget for a monthly or annual marketplace subscription, too. Be sure you can afford the fee before you sign up.

Research Influencer Marketplaces

Should you join every influencer marketplace out there? No.

Instead, research your options and choose one or two platforms to start out with. Here are some tips for moving forward.

- Ensure the marketplace is focused on your industry. For example, if you’re a fitness brand, don’t join a marketplace with only culinary influencers, and so on.

- Make sure the influencers on the marketplace actually work on your chosen social media platforms. Why join a YouTube marketplace if you’re only marketing on TikTok?

- Check the marketplace hosts influencers in your price range. There’s no point opting for a platform where you’ll only find hugely popular influencers, i.e., those with a million or more followers, if your budget doesn’t allow for this.

My suggestion? Look to see if a marketplace offers a free trial, or at least a free membership option, before you commit to a paid plan. This lets you test out the platform without putting a dent in your marketing budget.

Remember, if you’re unhappy with the results, you can always review your strategy and try out different marketplaces. Influencer marketing is flexible like that.

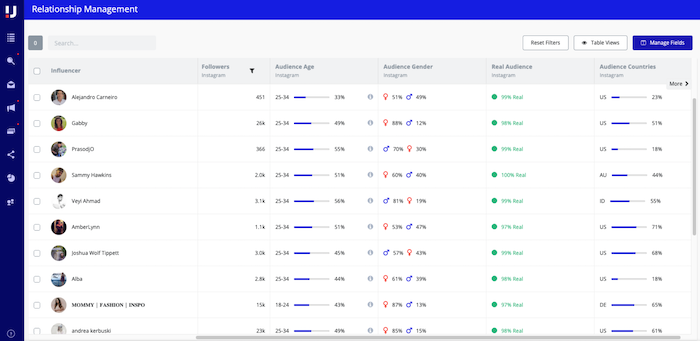

Find Influencers Who Fit Your Business

You’ve set a goal, determined your budget, and signed up with a marketplace. Next comes the hardest part: finding the best influencer for your needs.

Honestly, there’s no “right” way to go about this. However, here’s what is most important to consider when shopping for an influencer.

Engagement

If followers engage with an influencer, for example, by leaving comments or sharing their content, there’s a good chance you’ll see better engagement on your content. Influencers with large follower counts but low engagement levels may not be the best fit.

Authenticity

Authenticity matters. In fact, according to Stackla, 90 percent of customers value authenticity when choosing which brands to buy from, so any influencer you work with must come across as “real” and authentic.

Reach

To be clear, you don’t need influencers with millions of followers. For some niches, it’s even better to target influencers with much smaller audiences, but higher engagement levels.

As a general guide, reach matters, but it may be less important than engagement.

Resonance

Does the influencer resonate with your brand identity? If not, it doesn’t matter how impressive the influencer’s follower count is: they won’t help your marketing strategy in the long run, and they may actually deter your target audience from shopping with you.

Determine Performance Metrics

You need to find a way to track your marketing campaign to ensure it’s working for you. How do you do this? By tracking key performance indicators, or KPIs.

The KPIs depend on your overall goal, but common metrics worth tracking include your impressions, engagement levels, follower count, and conversions.

Ultimately, it’s an influencer’s job to leverage their followers to your advantage, so if you’re not getting more traffic than usual, there could be a problem with your strategy.

Here’s the bottom line, though. You’ll know if your influencer marketing is working if you achieve your goal. In other words, if you set out to sell more products, the campaign most likely worked if you sold more products!

Unsure how to measure your performance? Be sure to check out our consulting services.

Review Your Partnerships Regularly

Just because an influencer comes across well on a marketplace doesn’t mean they’re the best fit for your business. Maybe their communication style doesn’t mesh well with yours, or you just find them difficult to work with.

Whatever the reason, it’s okay to cut ties. Just remember that if you do end your contract with an influencer, do it professionally. Influencers talk, and you don’t want a reputation as a difficult client!

Conclusion

Influencer marketplaces make it easy to match influencers and promoters who can help grow your business and generate hype around your products. That said, these marketplaces aren’t for everyone, and you might prefer curating your list of influencers and reaching out to them directly.

My suggestion? Spend some time researching the different marketplaces before you commit to a subscription, and remember to keep a close eye on your metrics to ensure your influencer partnership is working for you.

Have you tried an influencer marketplace yet?

An Aushcwitz Survivor Dies in a New York Nursing Home

At 94, Felicia Friedman succumbed to Covid-19 and bureaucratic bungling.

The post An Aushcwitz Survivor Dies in a New York Nursing Home appeared first on ROI Credit Builders.

The post An Aushcwitz Survivor Dies in a New York Nursing Home appeared first on Get Funding For Your Business And Ventures.

The post An Aushcwitz Survivor Dies in a New York Nursing Home appeared first on Buy It At A Bargain – Deals And Reviews.

Best POS Systems

Some years ago, POS systems were a luxury reserved for only big enterprise businesses.

Thankfully, not anymore.

Today, there’s an abundance of options to go round for companies of all sizes. But, with too many options came a new challenge: Choosing the best POS system that’s right for your business is now an uphill battle.

It’s why we created this guide to help you make a better and more effective decision.

Our team has done the heavy lifting of reviewing dozens of POS systems in the market. We’ve also done the pricing, features, and critical support comparisons to determine what POS system is best for what.

So, irrespective of your small business type – retail, restaurant, franchise, online store, etc., you’ll find the best POS system that’s right for your company below.

The Top 5 POS Systems For Small Business Owners

- Square POS (our overall best)

- Shopify POS (best for ecommerce retail integrations)

- Vend POS (best for multiple fashion, sports, or homeware stores)

- Toast POS (best for restaurants and food businesses)

- ERPLY POS (best for small franchises)

How to Choose The Best POS System for Your Business

To choose a POS system, start by considering what your business needs are – accept payments, process sales, track inventory, CRM integration, manage employees, etc.

What’s best for you depends on your needs.

In our analysis, we looked at everything from pricing, applicable features to the security of each system, and ease of use. Next, we picked the best POS system best suited for different small businesses with one to 50 outlets.

We’re only recommending POS systems with hardware and software capabilities that will impact your business operations and help you maximize profit.

And for this, key things you should look out for when choosing a POS system are:

Pricing

Complete POS systems come with hardware, software, and payment processing. These are the ones we recommend because you won’t have to buy different parts. The cost for these all-inclusive POS systems is anywhere from $30 for basic plans to $150+ per month for advanced plans. Apart from this monthly cost, most charge fees upwards of 2% (plus some cents) per transaction.

Most POS systems have customized plans if your annual sales volume exceeds $250,000 or if you have to install them on multiple locations. To take advantage of these discounts, contact the sales department before buying, as it could save you some money in the long run.

Ease of Use

If you buy a POS system that’s difficult to use, it defeats the purpose of having one. Having said that, the easiest to use POS systems have intuitive designs and run on technology most people already use. These include iPads or Android tablet devices.

Regardless, before you buy a POS system, sign up for a demo and take it for a test drive. This way, you can determine firsthand if it’s easy enough for you or your employees to use.

Reporting

You’ll find all POS systems talk about their reporting capabilities. But, some are basic with limited customization and only a handful of reports.

On the other hand, others come with tens of advanced and pre-configured reporting filters. The best POS systems offer real-time reports, and you can access them on the go through an app on your mobile device or a browser.

Some core reporting capabilities to look out for are your sales, customers, inventory, and employees’ data. Ensure a POS system offers the reports you need to keep track of relevant business activities.

Employee Management

On most POS systems, you can add employees and give them access to settings, essential sales information, or features. Again, it depends on what your needs are.

Some POS systems allow you to assign role-based permissions to employees, while on others, you can customize different controls for specific employees.

On advanced ones, you can monitor when employees clock in and out, track each employee’s sales, and manage tips. So, before you buy a POS system, decide what employee information you need to track.

Customer Management

The first question to ask is, what depth of customer information do I need? Or, what customer details do I need to deliver exceptional customer service?

It’s best to start with those questions because POS systems offer varying levels of customer management capabilities. With some, you can capture basic info like email addresses to send email marketing campaigns.

Others come with a suite of customer relationship management (CRM) features that allow you to create complete customer profiles, track purchase histories, collect contact information, append notes, etc. Choose a POS system that allows you to capture the depth of customer information you need.

Inventory Management

Basic POS systems will only allow you to manage your catalog inventory. With advanced ones, you can track components, manage vendors, or purchase orders.

It all depends on your needs, so decide if you need basic or advanced inventory management capabilities (and if the POS offers them) before you buy.

Add-ons/Integrations

Most POS systems offer add-ons and integrations, depending on the monthly plan you’re purchasing. On some, you can get these add-ons for an extra fee. Some popular add-ons are gift cards, loyalty programs, reservation systems, or advanced reports.

For integrations, the best POS systems allow you to connect them with relevant business applications like email marketing, accounting, or payroll software. When choosing a POS system, take some time to decide if paying a higher monthly plan that gives you access to add-ons and integrations is more cost-effective than paying extra fees. And, of course, only make this decision after you’ve considered your business needs.

The Different Types of POS Systems

POS apps, mobile POS systems, open-source systems, multichannel systems, touchscreen POS systems, self-serve POS systems, and cloud-based POS systems are the different types of POS systems. Among these types, there are various brands to choose from.

In this guide, you’ll find reviews of cloud-based POS systems, as they’re the most flexible for small businesses and offer a full feature set. On cloud POS systems, transactions happen in-person at your various outlets, while payment processing occurs on the cloud.

These systems connect with Wi-Fi networks, allowing your data from even multiple sales outlets to aggregate and sync automatically to the cloud.

Thus, with cloud-based POS systems, you can access reports, real-time sales data, and other information generated from its use on the go.

The best cloud-based POS systems for small businesses are what follows.

1. Square POS Review – Our Overall Best Small Business POS System

Since our team started reviewing the best POS systems on the market, I’ve come across Square POS systems at multiple locations where I do my in-person shopping.

And that’s for a reason.

Among small businesses of all types, Square is fast becoming the overwhelming choice. This system’s software flexibility allows business owners to start using it to accept payments with their existing devices.

With Square, you can turn the devices you currently use into a POS system in less than an hour.

And you can do this without buying any hardware. But, if you need to purchase Square’s hardware, there’s still flexibility, as you have options to choose from:

- Square Terminal

- Square Register

- Square Reader for magstripe

- Square Standup for chip & contactless

- Square Reader for chip payments & contactless

If you run a location-based business like a boutique clothing store or coffee shop, Square’s register and standup terminal are the best options. The Square Reader of magstripe gives you the option of turning your phone into a POS system to accept payments on the go.

Square’s POS system also handles credit card processing effortlessly. Thus, you don’t need third-party integrations to accept or process payments.

Regardless of your business type, the versatility of Square POS system makes it the popular choice for most small businesses. Besides, Square’s pricing is straightforward and transparent.

Square’s free iPad POS is free to use, only charging you 2.6% + $0.10 per transaction. And this is your only cost, regardless of how many sales you process. For larger businesses, pricing starts at $60/month plus the transaction fee.

There are no hidden charges whatsoever with Square.

If your business processes over $250,000 per annum and your average order size exceeds $15, you can request a custom solution from Square.

Other pros you get with the Square POS system are robust reporting, real-time analytics, and 24/7 customer support. You can also view, manage, update, and track your inventory with Square.

With the Square POS system, you can create and manage your customers’ profiles more effectively from one dashboard.

Square has a few cons.

For non-card transactions, they charge 2.75% and some features needed by mid-sized businesses cost a little more. Finally, this system’s security protocols, which protect against fraudulent payments, place accounts on hold for large volume transactions.

After reviewing dozens of the best POS systems, Square is our overall best today.

Square comes highly recommended for small business owners of all types and even mid-sized and large businesses.

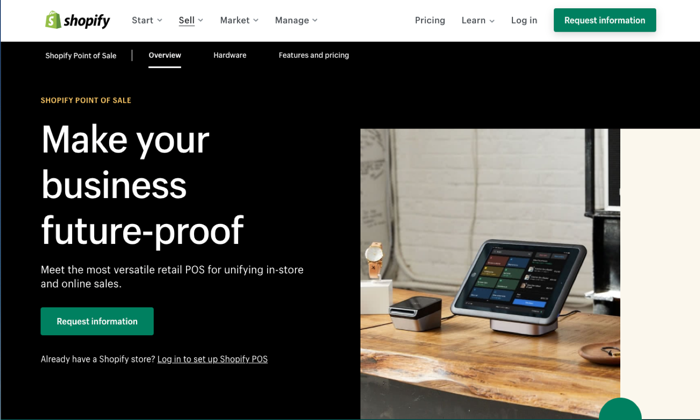

2. Shopify POS Review – The Best For eCommerce Retail Integrations

Popularly known as an ecommerce company, Shopify also offers a retail POS system with excellent ecommerce integrations.

If you already run a Shopify store or plan to expand your retail business online, Shopify’s POS system is a great option.

With Shopify’s POS system, you get a branded online store and can sell through online channels, including eBay, Instagram, and Amazon. Whether in-store or across these online channels, the Shopify POS system lets you manage your sales in one place.

It’s much easier that way, as you won’t need to invest in separate solutions.

Sales, employee, and inventory management are some of the core features you get with the Shopify POS system. In short, the system updates your in-store and online inventory in real-time. Added to this, it comes with exceptional sales analytics with the option to offer discount codes.

Need to manage your business on the go? No problem. Shopify’s POS system comes with a mobile app.

The robust in-store and online integration available with the Shopify POS system gives your customers a seamless checkout experience. And the convenience to replace or return a purchased item in your local store.

The system comes as a free inclusion in your Shopify monthly plans, which starts at $29 $29/month for the basic plan.

Unfortunately, this base plan doesn’t give you advanced reports and other needed features like in-store payments. You’ll need the $79/month plan to process in-store payments at 1-5 locations or the $299/month plan for up to eight locations.

Per in-person transactions, charges are 2.7%, 2.5%, and 2.4% for the three plans, respectively.

On all plans, you get a 14-day free trial and 24/7 live support via phone, email, or live chat. The system’s easy setup is another you’ll love about Shopify POS.

Shopify POS isn’t for you if you have dozens of in-store locations. Other cons include the system’s exclusive focus on ecommerce and retail and the extra charges you must pay if you’re not using Shopify’s payment processors.

However, if you’re already selling online with Shopify or want an easy setup for a few retail locations, Shopify POS is a no-brainer.

We recommend Shopify POS if you want to launch a new ecommerce store or in the market for a new POS system.

3. Vend POS Review – The Best For Multi Fashion, Sports, or Homeware Stores

You can personalize the Ven POS system to suit your unique needs. It’s also a perfect solution if you have multiple physical stores.

Vend is among the best iPad POS systems currently on the market. You can also use it on your PC and Mac. Vend POS system offers data entry options, using mouse, touchscreen, or keyboard.

It integrates seamlessly with a wide range of third-party applications, giving you access to loads of additional features. For instance, you can connect third-party payment processors offered by PayPal, Square POS, Shopify POS, and others.

Vend’s ecommerce integrations make it super easy to sell across your physical store, mobile, and digital channels. Its robust sales analytics, inventory, and customer profiles management capabilities are excellent. Additionally, you can process split and contactless transactions and gift cards.

Regardless of the platform you run Vend on, you get a cross-platform consistency that looks the same. However, the Vend POS system doesn’t come with any hardware, but it makes up for this with its software simplicity and extensive integration options.

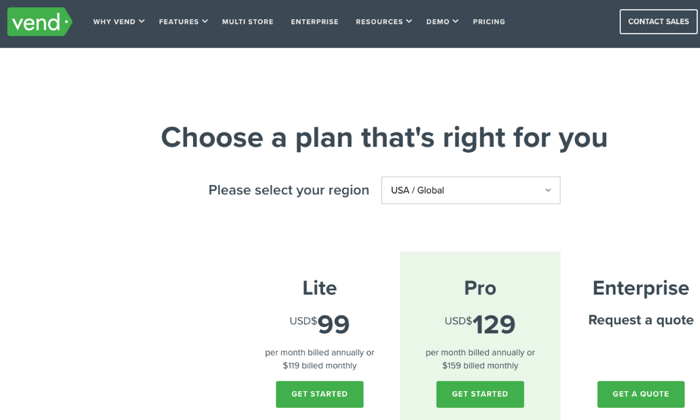

Pricing for Vend’s POS system starts at $99/month when paid annually for the Lite plan with a monthly turnover limit of $20,000. The Pro plan is $129/month if you pay yearly.

All plans come with one register. If you want additional registers, it costs $49 per month. Large retailers can request an Enterprise plan, which comes with a dedicated account officer.

Vend POS’s biggest con is its slow processing speed. Others are that you can only use Google Chrome to run this system, and it’s not suited for food trucks, bars, or restaurant businesses.

However, we recommend the Vend POS system if you have multiple retail outlets such as fashion boutiques, sports, homeware, or outdoor stores, or the likes and need a solution with extensive integration options.

4. Toast POS Review — The Best For Restaurant and Food Businesses

The brains behind the Toast POS system built the platform with food and beverage vendors and their customers in mind. So, if you own a restaurant, bar, or food truck business, Toast POS has features tailored to your needs.

The system’s integrated CRM software builds an inventory of your loyal customers. It also allows you to craft messages and run automatic promotions that keep customers happy so that you can score a backlog of customers returning to your food business.

Toast POS is one of the few systems with excellent Android capabilities.

And this is more suited to restaurants due to the affordability and flexibility of the Android infrastructure, which has faster software updates than the iPad.

Whether you’re a full-service or quick-service food business, the Toast POS system works well for both. You even have options to customize the system for large food chains, pizzerias, or bars.

As a Toast user, you can access its community of like-minded business owners to get or share best practices in your industry.

Overall, Toast POS gives you a holistic restaurant management system, complete with back-office and front-end processes. It enhances staff productivity, improves customer service via its food-focused CRM features, which also comes with detailed analytics and sales reports.

You can easily customize or split menu items and bills among your customers. Taking orders on the fly or sending alerts to customers when their orders are ready are some mouth-watering pros. This makes The Toast POS system a no-brainer for food businesses.

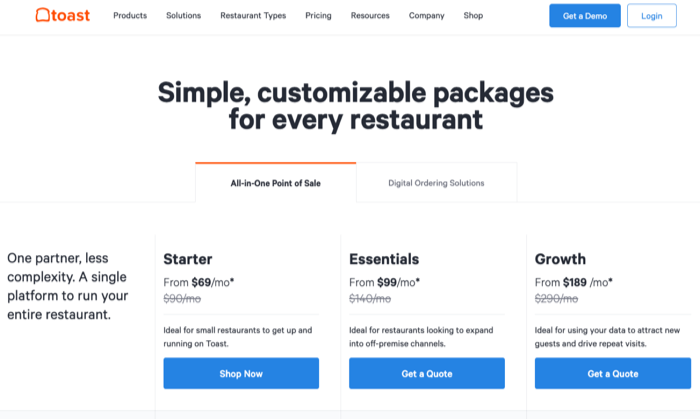

Pricing for the Toast POS system starts at $69/month per terminal, with no trials. It’s hardware prices starts at $999, and there’s no financing option available. Toast POS has a flat processing fee, and there are no hidden fees.

A drawback of the Toast POS system is that it is currently only available for Android users. But, this isn’t a problem, considering Android devices are cheaper than iPads.

Toast POS system is the overwhelming recommendation if you own a food or restaurant of any kind. Its features are tailor-made for such businesses.

5. ERPLY POS Review – The Best For Small Franchises

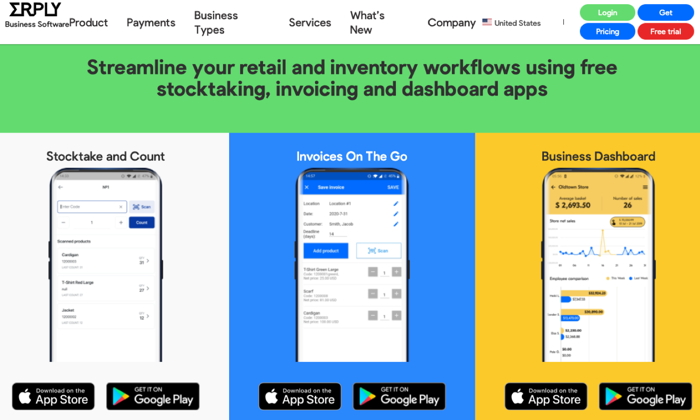

ERPLY POS system is the go-to platform if you own a franchise business. It runs well on Android and iPad tablets and is also accessible on other devices via a browser.

ERPLY POS is one of the few cloud-hybrid systems that is hardware agnostic, and this makes it a favorite for small and large franchise retailers. This robust build allows you to centralize your inventory across stores and manage employees by giving them varying access to the platform.

You get CRM tools and the ability to handle sensitive data with the ERPLY POS system. Besides this, you have other strong franchise-specific features like sales tracking, barcode scanners, and full-scale inventory management across all plans.

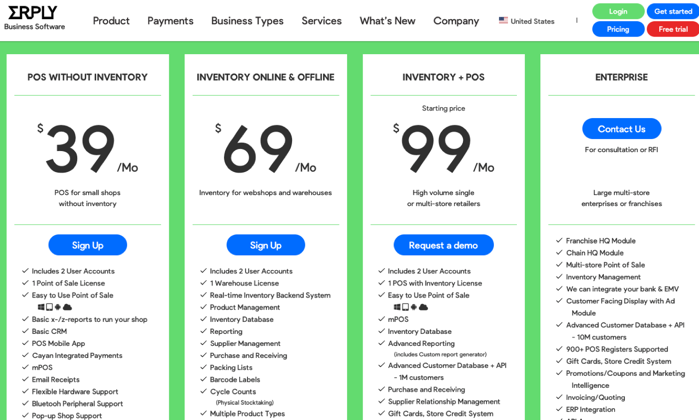

Pricing for the ERPLY POS system starts at $39, but you don’t get inventory controls on this basic plan. If you want that, consider its higher-tier plans, which are upwards of $69.

A known con of the ERPLY POS system is that it is tricky to master. Secondly, there’s limited customer support.

However, ERPLY’s versatile interface and free trial, which allows you to take it for a spin, are strong reasons to consider this POS system. And if you own a franchise business, it comes highly recommended due to its features explicitly designed for such retailers.

Conclusion

The best POS system is subjective. Different business types have different needs, and a POS system that works for one business may not work well for your own.

It’s best to understand your business needs first.

We reviewed dozens of the top POS systems on the market to identify the ones most suited for the different types of small businesses.

We’ve provided you with the best POS for retail, food, ecommerce, franchise, and fashion retail businesses. We also highlighted our recommended overall best.

You won’t regret choosing from any of the above options.

The post Best POS Systems appeared first on Neil Patel.

Efficient Advantages of Forex Trading Training

Efficient Advantages of Forex Trading Training Foreign exchange investors that desired to deal seriously on the foreign exchange market requires foreign exchange trading training to make sure that they will certainly be able to find out the ropes. Correct education and learning on foreign exchange trading makes it possible for the investors in reducing some …

New comment by gvsytov in "Ask HN: Who wants to be hired? (July 2020)"

Location: Chicago, IL

Remote: Yes

Willing to relocate: No

Technologies: C, C++, Java, Python, PHP, JavaScript, SQL, Git, Linux (Debian)

Résumé/CV: See website below

Website: https://sytov.net/

Github: https://github.com/albicant

Email: gv(at)sytov(dot)net

Pagenaud wins IndyCar's 1st virtual oval race

Simon Pagenuad won Saturday’s virtual IndyCar race at Michigan International Speedway, the series’ first virtual race on an oval. Penske Racing teammate Scott McLaughlin was second and Dale Earnhardt Jr., in his virtual IndyCar debut, was third.

The post Pagenaud wins IndyCar's 1st virtual oval race appeared first on Buy It At A Bargain – Deals And Reviews.

How to Qualify for a Business Loan: What Matters and What Doesn’t

Most agree, when you start wondering how to qualify for a business loan, the waters can become muddied with things that do not really matter. As a result, it can be hard to distinguish between what really matters, and what doesn’t. In fact, many factors affect whether or not you qualify for a business loan.

How to Qualify for a Business Loan: What Really Matters?

Truly, there is a lot of conflicting information out there on how to qualify for a business loan. Is it business credit? Is it personal credit? What else makes a difference? Can you get a loan without business credit? Do you really need a business plan? What reports are they looking at? Let’s clear some of this up.

How to Qualify for a Business Loan: What You Don’t Know Can Hurt You

First, you need to know that there are probably a lot of things that make a difference in how to qualify for a business loan that you don’t even realize. At first glance, a lender is going to consider fundability. Usually, most borrowers think this has only to do with your credit score. However, there are many layers to fundability. Together, they can all make a difference in whether or not you are approved.

Find out why so many companies use our proven methods to get business loans.

How to Qualify for a Business Loan: Understanding Fundability

Not surprisingly, one of the main things about fundability that most business owners do not realize is that it actually starts with how your business is set up. For example, even the address and telephone number you use for your business can affect fundability.

Set Your Business Up to Be Fundable

To help, here are some things to consider when setting up your business to appear fundable.

-

Contact Information

It has to be separate from your personal contact information.

-

EIN

If you don’t know, this is the equivalent of an SSN for your business.

-

Incorporate

It’s true, you have to incorporate as either an LLC, and S-corp, or a corporation.

-

Business Bank Account

A dedicated business bank account is vital to fundability.

-

Licenses

Make sure you have all the licenses you need to operate your business.

-

Website

You need a professionally designed website and an email address with the same URL.

Honestly, this is a super simple summary. Get more details on how to set up your business to be fundable here.

Other Things that Affect Fundability

In addition to how your business is set up, there are about a million other things that can affect the fundability of your business. They can all be broken down into the following categories.

Business Credit Report

This is the credit report, much like your consumer credit report, that details the credit history of your business. It is a tool to help lenders determine how credit worthy your business is.

Where do business credit reports come from? There are a lot of different places. Still, the main ones are Dun & Bradstreet, Experian, Equifax, and FICO SBSS. Consequently, you have no way of knowing which one your lender will choose. As a result, you have to make sure all of these reports are up to date and accurate.

Other Business Data Agencies

There are other business data agencies that affect those reports indirectly. This is in addition to the business credit reporting agencies that directly calculate and issue your credit reports. Two examples of other agencies include LexisNexus and The Small Business Finance Exchange. They gather data from a variety of sources, including public records. What does this mean for you? It may surprise you, but they could have access to information relating to automobile accidents and liens, among other things. You cannot access or change the data the agencies have on your business. However, you can ensure that any new information they receive is positive. Enough positive information can help counteract any negative information from the past.

Identification Numbers

In addition to the EIN, there are identifying numbers that go along with your business credit reports. You need to be aware that these numbers exists. Some of them are simply assigned by the agency. One, however, you have to apply to get. It is absolutely necessary that you do this.

Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Every credit file in their database has a D-U-N-S number. To get a D-U-N-S number, you have to apply for one through the D&B website.

Business Credit History

Your credit history has everything to do with all things related to your credit score. Of course, this is a huge factor in the fundability of your business.

Credit history consists of a number of things including:

- How many accounts are reporting payments?

- How long have you had each account?

- What type of accounts are they?

- How much credit are you using on each account versus how much is available?

- Are you making your payments on these accounts consistently on-time?

Of course, the more accounts you have reporting on-time payments, the stronger your credit score will be.

Business Information

On the surface, it seems obvious that all of your business information should be the same across the board everywhere you use it. However, when you start changing things up like adding a business phone number and address and incorporating, you may find that some things get missed.

Find out why so many companies use our proven methods to get business loans.

This is a problem. A lot of loan applications are turned down each year due to fraud concerns simply because things don’t match up. For example, maybe your business licenses have your personal address but now you have a business address. That needs to be changed. Maybe some of your credit accounts have a slightly different name or a different phone number listed than what is on your loan application. Do your insurances all have the correct information?

The key to this piece of the business fundability is to monitor your reports often. When it comes to business credit reports, you can monitor through the reporting agencies directly, or save money here.

Financial Statements

First, both your personal and business tax returns need to be in order. Not only that, but you need to be paying your taxes, but business and personal.

Business Financials

Typically, it is best to have an accounting professional prepare regular financial statements. Having an accountant’s name on financial statements helps your business look more credible and legitimate. If you cannot afford it monthly or quarterly, then at least have professional statements prepared annually. Then, they will be there whenever you need them.

Personal Financials

Usually, this is just tax returns for the previous three years. That is the bare minimum you will need. Other information lenders may ask for include check stubs and bank statements.

Bureaus

There are other agencies that hold information related to your personal finances that you need to know about. Everyone knows about FICO. Your personal FICO score needs to be as strong as possible. It really can affect business fundability and almost all traditional lenders will look at personal credit in addition to business credit.

Other than that, there is also ChexSystems. They monitor bad check activity, and that can affect your bank score. If you have too many bad checks, you will not be able to open a bank account. That will cause serious fundability issues.

For this point, everything comes into play. Have you ever been convicted of a crime? Do you have a bankruptcy or short sell on your record? How about liens or UCC filings? This all affects fundability.

Personal Credit History

Your personal credit score from Experian, Equifax, and Transunion affects fundability as well. If it isn’t great right now, get to work on it. The number one way to get a strong personal credit score or improve a weak one is to make payments consistently on time.

Also, make sure you monitor your personal credit regularly to make sure mistakes get corrected and that there are no fraudulent accounts reporting.

Application Process

So much plays into this that you may not even think about. First, consider the timing of the application. Is your business currently fundable? If not, do some work first to increase fundability. Next, ensure that your business name, business address, and ownership status are all verifiable. Lenders will check that. Lastly, make sure you choose the right lending product for your business and your needs. Do you need a traditional loan or a line of credit? Would a working capital loan or expansion loan work best for your needs?

How to Qualify for a Business Loan: Choose the Right Product and the Right Lender

This falls into that application process section of fundability. You have to know what you need, what you are eligible for, and what type of lender will work best for your needs. This will help you know where to apply and what to apply for, so that you can have the best possible chance of qualifying.

How to Qualify for a Business Loan: Choose the Right Type Business Loan

When it comes to business loans, these are the general types of products available.

Traditional Loans

These are the standard loans that disperse as a set amount of funds, with the borrower repaying with equal payments over a certain period of time. These can be secured or unsecured.

Line of Credit

This is revolving debt similar to credit cards. Borrowers are given a maximum limit of the amount of funds they can use, but only pay back the amount that they actually use.

Invoice Factoring

Factoring invoices is an option if you have receivables. The lender basically buys unpaid invoices from you at a premium, meaning you do not get full value. However, you do get fast cash.

Merchant Cash Advance

If you accept credit card payments, a merchant cash advance can help you out in a cash pinch. It is basically just what is says. It’s a cash advance on predicted credit card sales. They base the amount of the loan on average daily credit card sales, and then take payment from future credit card sales.

Find out why so many companies use our proven methods to get business loans.

How to Qualify for a Business Loan: Choose the Right Type of Lender

A lot of business owners think that a bank is their only option. There are a few different types of lenders to consider however.

-

Large Commercial Banks

-

Community Banks

-

Credit Unions

-

Private Lenders

Of course, which one of these you use will depend on your specific needs and qualifications.

How to Qualify for a Business Loan: You Need an Awesome Business Plan

While there are forms available from most lenders for you to simply write in information related to your business plan, that’s not the best way to do it. A professionally written, complete business plan makes a far better impression on a lender. This is true even if you are an established business applying for a loan. The only difference is, you will write a plan for how you will use the funds in relation to your current business rather than a business you intend to start. In general, a complete and professional business plan contains the following.

Opening

First comes the opening. It includes an executive summary, a more detailed description of the business, and your strategy for getting started.

Market Research

Next, there is a section for market research. As you might guess, this section consists of market analyses including an analysis of your audience and an analysis of any existing competition. It will tell what need exists, how you will fill it, and how you will fill it better than the competition.

How to Qualify for a Business Loan: The Plan

This can also be broken down into two parts.

Plan for Design and Development

This is your plan from start to finish. It discusses what steps are you going to take. In comparison, this is more detailed than your strategies section.

Plan for Operation and Management

This is where a number of questions are answered in relation to the management of the business. For example, who will own or does own the business? Furthermore, who will run or currently runs it from day to day? It could be as easy as stating that you are the sole owner and operator. In contrast, it could be as complicated as laying out a complete partnership plan or board or directors’ format. Truthfully, it just depends on your specific business.

Financials

Lastly, this section includes current financials, projections, and a budget plan for the loan funds you are applying for. As you can imagine, lenders want to see that you know how to handle and funds you get. Furthermore, they want to know that you have a plan for paying them back.

Take note, if you are not a great writer, you may need to hire a writer to help you with this. If you have no clue how to do market research, you may need to outsource that piece as well. Thankfully, most small business development centers offer help with business plans also. Go here to find an SBDC near you.

How to Qualify for a Business Loan: Wrap Up

Hands down, the absolute first step in the process has to be to do an analysis of fundability. Then, you will know where you stand. As a result, you will have a better idea of what you may need to do to increase fundability. Also, you will have a better understanding of what type of lender you need to go with and which type of product will best fit your needs. Then, you can get to work on your business plan. Remember, while nothing is guaranteed, following these steps can help increase your chances of loan approval immensely.

The post How to Qualify for a Business Loan: What Matters and What Doesn’t appeared first on Credit Suite.

The post How to Qualify for a Business Loan: What Matters and What Doesn’t appeared first on Buy It At A Bargain – Deals And Reviews.