Location: Vancouver (PST, can work EST timezone too) Remote: Optional Willing to relocate: Yes Technologies: Typescript, Javascript, Node, React (Redux + RxJS), HTML, CSS, SQL, Python, Java, GIS, Postgres, PostGIS, Mapbox, GCP, AWS Résumé/CV: See LinkedIn LinkedIn: https://www.linkedin.com/in/chingiz-bakhishov I’m deeply passionate about creating tech-focused, loved, and trusted products to solve people’s pain points requiring extraordinary … Continue reading New comment by chingiz19 in "Ask HN: Who wants to be hired? (April 2024)"

Author: Wilma Radtke

Aviator (YC S21) is hiring a part-time developer advocate

Article URL: https://www.ycombinator.com/companies/aviator/jobs/yrtnjnp-developer-marketing-part-time-social

Comments URL: https://news.ycombinator.com/item?id=39541631

Points: 0

# Comments: 0

JESSE WATTERS: Biden's DOJ using obscure federal statutes to put Trump in prison for the rest of his life

Jesse Watters analyzes charges Special Counsel Jack Smith filed against former President Donald Trump in the Jan. 6 investigation on “Jesse Watters Primetime.” SPECIAL COUNSEL JACK SMITH SAYS JAN 6 ‘FUELED BY LIES’ FROM TRUMP, PRAISES ‘HEROES’ WHO DEFENDED CAPITAL JESSE WATTERS: The last time Jack Smith charged a politician, the case was so weak … Continue reading JESSE WATTERS: Biden's DOJ using obscure federal statutes to put Trump in prison for the rest of his life

Rutter (YC S19) Is Hiring a Senior Software Engineer in NYC

Article URL: https://jobs.ashbyhq.com/rutter/7b222f5f-cd46-4592-9cf8-6cd1f5e09931 Comments URL: https://news.ycombinator.com/item?id=33967720 Points: 1 # Comments: 0

Get a Credit Card Statement Credit with These 4 Dynamite Business Credit Cards

Did You Know There Are Credit Cards Where You Can Get a Credit Card Statement Credit?

What is a statement on a credit card? A credit card statement credit—often in the form of a signup bonus—is a popular way for business credit cards to give you perks. It’s a great win-win. For the credit card company, it’s a bookkeeping matter. They don’t have to issue a check and they don’t have to keep track of points. For you, it’s money off your credit card statement balance. And who doesn’t want that?

Keep in mind: all business credit card terms can and do change. As a result, be sure to check the credit issuer’s website before choosing a business credit card. Check out our top choices.

#4. Get a $150 Credit Card Statement Credit from the Marriott Bonvoy Business Card

Card

With the Marriot Bonvoy Business Card, you can earn up to $150 back in statement credits on eligible purchases made in the first 3 months. You can also earn sextuple points on eligible purchases at hotels participating in the Marriott Bonvoy program.

Card, you can earn up to $150 back in statement credits on eligible purchases made in the first 3 months. You can also earn sextuple points on eligible purchases at hotels participating in the Marriott Bonvoy program.

APR on purchases will be a variable rate, 15.74%—24.74%, based on creditworthiness. There is a $125 annual fee.

#3. Get a $150 Statement Credit in the form of 2% Cash Back with a Cash Back Bonus: TD Business Solutions Credit Card (Visa)

With the TD Business Solutions Credit Card, you can earn $150 cash back as a statement credit when you spend $1,000 in the first 90 days. Earn up to 2% cash back rewards when you redeem them into an eligible TD Bank Deposit Account. Get 1% cash back on purchases. There are no cash back limits. A 13.99%, 18.99% or 23.99% APR is based on creditworthiness for purchases and credit card statement balance transfers.

Pay no annual fee, but there is a 3% foreign transaction fee. Since every business needs a bank account, opening a deposit account at TD Bank could be a good idea. The minimum spend should be easy to achieve, but the reward bonus isn’t as big as ones you can get from other banks. Plus, you can often get a higher percentage of cash back from several other providers, without having to open a bank account.

#2. Get a $250 Credit Card Statement Credit from the American Express Blue Business Cash Card

Card

With the American Express Blue Business Cash Card, you can earn a $250 credit on your remaining statement balance. So, this is for after you spend $3,000 in purchases on in the first 3 months. It has a 0.0% introductory APR on purchases for the first 12 months. After that APR is variable, from 13.24%—19.24%, based on creditworthiness. Plus, there is no annual fee.

Card, you can earn a $250 credit on your remaining statement balance. So, this is for after you spend $3,000 in purchases on in the first 3 months. It has a 0.0% introductory APR on purchases for the first 12 months. After that APR is variable, from 13.24%—19.24%, based on creditworthiness. Plus, there is no annual fee.

#1. Get a $300 Credit from the Business Advantage Travel Rewards World Mastercard®

We saved the best for last. With the Business Advantage Travel Rewards World Mastercard®, you can earn 30,000 online bonus points after spending at least $3,000 in the first 90 days. You can redeem your points for a $300 credit card statement credit towards travel or dining-related purchases.

It has a 0% Introductory APR on purchases for the first 9 billing cycles. After the intro APR offer ends, a variable APR of 12.24%—22.24% will apply. This card has no annual fee.

Bonus: Get a Statement Credit with Conditions from Spark 2X Miles

With Spark 2X Miles, you can earn unlimited double miles on every purchase. Plus, earn a 50,000 miles bonus when you spend $4,500 in the first 3 months. Pay a $0 intro annual fee for the first year, then $95 after.

You can get a credit card statement credit in one of two ways. One is if you use your card to complete the Global Entry application and pay the $100 application fee. The other ways is to complete the TSA Pre✓® application and pay the $85 application fee. Credit will appear within two billing cycles. It will apply to whichever program you apply for first. You can only get one statement credit per account every four years.

You are eligible for one $100 statement credit per account, OR one $85 statement credit per account. This is for every 4 years in connection with the Global Entry or TSA Pre ® program application fee.

® program application fee.

Also, to apply the credit, your account must be open and in good standing. You cannot get a statement credit for fees charged to a Spark Miles Select card, or any Capital One card that is not a Spark Miles card. And you cannot get a statement credit for fees paid for with PayPal®.

Bonus: Get a Choice of Statement Credit Amounts from the Business Platinum Card® from American Express

With the Business Platinum Card® from American Express, you have a choice of statement credit types and amounts.

You can get a $400 statement credit on purchases from Dell Technologies. Or earn a $360 statement credit on purchases from Indeed. Another option is a $150 statement credit for subscriptions from Adobe Creative Solutions. And another choice is a $120 statement credit for wireless telephone service purchases.

Other perks include quintuple points on flights and prepaid hotels. You can also get credits and bonuses for airline and other travel costs.

Pay a 0.0% intro APR for the first 12 months, on purchases eligible for their ‘Pay Over Time’ program, then a 14.24%—22.24% variable APR.

But this card, as you would expect from platinum, has a $695 annual fee. We put this one a bit ahead of the Delta card (see below) because there are more and larger statement credit options. Plus they don’t seem to award statement credits on a quadrennial basis. If you travel a lot for business, and if you need to impress clients, then this one may be worth your while. But an annual fee that runs over 1/3 of a typical monthly mortgage payment is an extremely high hurdle to get over.

Bonus: Get a $100 Credit Credit from Delta SkyMiles® Reserve Business American Express Card

With the Delta SkyMiles® Reserve Business American Express Card, you can get a $100 statement credit after you spend $4,000 in the first 3 months. Also, Basic Card Members can get a statement credit for a five-year membership every 4 years after applying for Global Entry ($100). Or get a statement credit every 4.5 years after applying for TSA Pre✓® (up to $85) through any Authorized Enrollment Provider.

APR on purchases will be a variable rate, 15.74%—24.74%, based on creditworthiness.

But there is a ridiculously high $550 annual fee! The statement credit is nice, but it is not worth it.

Takeaways

The business credit cards we reviewed offer statement credit deals running from $85 to $400. Annual percentage rates run from 0% t0 24.74%, with many cards offering a 0% introductory APR for a limited time. Some cards offer monetary bonuses, often dependent upon spending a minimum amount during a short window of time. And always check a provider’s website for the latest and most accurate details on any business credit card that interests you.

The post Get a Credit Card Statement Credit with These 4 Dynamite Business Credit Cards appeared first on Credit Suite.

How to Do Quarterly Ad Planning

Perhaps you have a yearly marketing plan that provides an overview of the year. This can be helpful in understanding your overall goals but too vague to implement. That’s why a campaign plan with a narrower window—such as a quarter—is essential to marketing success.

A quarterly ad campaign plan provides a more granular view of your objectives, goals, and success. This will enable you to keep your priorities in line and respond accordingly to KPIs and metrics as results become available.

This in-depth guide provides actionable tips for successfully planning your quarterly ad campaign. By the end of this article, you will feel confident in your ability to create a thorough campaign plan you and your team can execute.

Review Last Quarter’s KPI and Metrics

The first step to future campaign planning is to look at the previous quarter’s performance. Using Key Performance Indicators (KPIs) and metrics, you can gain a deeper understanding of the success of previous campaigns.

The KPIs can vary depending on the marketing campaign and its ultimate purpose, but a few KPIs to consider closely are:

- customer acquisition cost (CAC)

- customer lifetime value (LTV)

- return on investment (ROI)

- marketing qualified lead (MQL)

- traffic-to-lead ratio (new contact rate)

- lead-to-customer ratio

- return on ad spend (ROAS)

- conversion rate

- website traffic

- customer retention

This list is a healthy mix of short-term and long-term KPIs, which is crucial to agile marketing. You don’t need to include all of them in your quarterly business review. Instead, you should focus on one or two that most closely align with each of your objectives.

When choosing KPIs to track, ask yourself whether it is easily quantifiable and something you can influence. The more control you have over a KPI, the more valuable its inclusion in your performance tracking.

With the information above, you can make new quarterly campaign decisions based on what worked, what didn’t, and what ideas could have been better executed.

Set Campaign Goals and Metrics to Track

It’s not enough to create a plan. You should do so with specific goals in mind. However, setting marketing goals you can achieve requires an in-depth approach. I recommend the SMART method for goal setting. This stands for:

- specific

- measurable

- achievable

- relevant

- timebound

What does this look like for a marketing campaign?

Let’s say you’re running a campaign with the overall goal of bringing more qualified leads into your funnel. A SMART goal might look like this:

“Increase the number of MQL’s in our funnel by 8 percent by the end of Q3 via a targeted social media campaign.”

This goal hits all of the marks of a SMART goal by being specific, measurable, achievable, relevant, and timebound. By the end of the campaign, you can easily answer yes or no on whether the goal was achieved. If not, you can reevaluate for the next quarter.

Evaluate Campaign Targeting

Your ad campaigns will only be as effective as the audience they reach. Identifying your target market is a crucial step in ensuring a successful quarterly campaign season.

You should first take a closer look at the data from your existing audience. This means digging in to further determine geography, age ranges, and lifestyle. How did your audience respond to the previous campaigns, and what can you do to improve those responses?

For example, did one segment of your audience interact with the campaign media but not convert? This indicates a surface-level interest. You should not abandon your efforts with this segment entirely but instead shift your objective to a higher level of the marketing funnel (e.g., attention or interest).

You may want to consider target audience expansion, too. Based on the previous quarter’s data, perhaps you found you were reaching demographics not previously on your radar. This would be a good time to reconsider the various segments of your target audience and add new ones if needed.

Fortunately, there are free tools like Google Analytics to help you further evaluate and segment your audience.

Decide Which Platforms to Use

The list of platforms is long and growing longer. The most popular platforms include Google, Facebook, Instagram, Bing, Amazon, and YouTube.

Before you choose which platforms to advertise with, though, you should first determine how many you will use.

With just one or two platforms, you can focus more intently on a more segmented part of your audience. This may result in a higher ROI. If your interest is more in testing various ad types and audience segments, though, then three, four, or even five platforms may be a good idea.

You should focus on quality as well as quantity. Each platform offers its own ad types, and using the right one for your audience is important. Google, for example, has eight different campaign types to choose from:

With so many platforms, you may feel compelled to spread your campaign budget across the spectrum. After all, doesn’t more platforms mean an increased reach? While true in theory, it’s more important to target the right audience.

Review Campaign Budget

You can make your ad campaigns effective, whether on a small or large budget. However, it’s essential to set the budget from the start so you can plan accordingly.

The different platforms will have different tips and tricks for budget optimization. Before you consider the specifics of your budget for each platform, though, you need to determine all-in advertising costs.

It helps to use a top-down approach. This means setting a maximum budget for the quarter that includes all advertising costs. You can then split the budget for each platform based on a few different factors, such as:

- previous platform success

- target market share

- ad type and opportunity

Even further, you can split the platform budget into per-advertisement costs. For example, spending more per day on a sale campaign can make more sense if the ROI is expected to be higher.

Outline Campaign Messages and Offers

While you don’t need to have all of the copy and digital assets completed before the quarter, you should have a solid idea of the campaign messages and offers. This outline will act as your framework for the work to come.

The outline can be a simple list of dates with corresponding messages and offers, or it can be baked into your workflow. The most important thing is to answer these three questions:

- Who is the target audience?

- What is the purpose of the advertisement?

- On what platform will this advertisement be displayed?

The more detailed your campaign messages and offers are at the outset, the easier it will be to plan your workflow. It also takes a lot of guesswork out of the process so the campaign goal is clear for all members of the marketing team.

The drawback of being too detailed is the plan can feel a bit rigid. You should discuss internally just how detailed you want to get at the beginning of the quarter. Your team may prefer to flow a bit more freely, or they may prefer to have the campaigns locked in place 90 days in advance.

You can easily enter campaign details into a spreadsheet or word document. There are also more detailed campaign offer templates for those who prefer them.

Create Asset Production Workflow

At the beginning of the quarter, the list of work to be done can be long and overwhelming. It’s at this point that establishing an effective workflow is crucial to future campaign success.

An asset production workflow ensures campaign assets (including copy, images, videos, and other digital elements) are completed on time. A good workflow ensures team collaboration and clear communication.

The workflow will vary depending on the type of asset and the number of collaborators. The basic steps of creative production include ideation, creation, review, approval, and launch.

You can manage these steps in a spreadsheet, though many project management platforms exist. These platforms often offer templates to spark your creativity.

Platforms like Trello and Asana enable you to create a seamless workflow. You can add multiple collaborators to each board, as well as use deadlines, checklists, and triggers to keep on task. These platforms help you focus more thoroughly on the process and less so on process management.

Create a Campaign Testing Plan

Testing your campaigns on an ongoing basis is important to future marketing optimization. The results of campaign testing provide insight into your target audience so you can better refine your marketing campaigns.

With this in mind, it’s important to include campaign testing within your overall campaign planning. This ensures assets are created early in the process and properly vetted.

A few examples of campaign tests include:

- target audience

- budget

- time of week and day

- calls to action (CTAs)

- word order

- power words in headlines

It can be tempting to perform campaign testing off-the-cuff. However, it’s best to plan for these tests at the outset and include them in your asset workflow. You can use the results of these tests going forward.

Frequently Asked Questions About Ad Campaign Planning

If you still have questions about ad campaign planning, take a look at the answers to these frequently asked questions on the topic.

How often should I review my ad campaign plan?

The quarterly planning session is important for setting the outline and goals of the quarter. It is important to reevaluate regularly throughout the quarter, though, and pivot as needed. You should look at least weekly at your campaign plan to determine success.

How early should I plan my ad campaigns for the holiday season?

When it comes to holiday ad planning, the earlier, the better. For best results, you should begin to plan the next holiday season as soon as the previous holiday season concludes. If you’re already behind, then you’ll want to keep it simple and be ready to adapt.

What should an ad campaign analysis include?

An ad campaign analysis should include at least three steps: review, take-aways, and next steps. This means you should review the results, highlight the key take-aways (i.e., what the results show worked and what didn’t), and outline recommended next steps (e.g., reevaluate how goals can be improved for the next quarter).

What type of objectives should I set for my ad campaigns?

When creating an ad campaign, you should do so with one key objective in mind. The objectives can be split into three categories: awareness, consideration, and conversion. An awareness campaign aims to increase reach, a consideration campaign aims to drive engagement, and a conversion campaign aims to drive conversions.

Quarterly Ad Campaign Planning Conclusion

When you transition to quarterly ad campaign planning, you will feel more confident in your ability to carry out and evaluate your marketing goals. This is true whether you are transitioning from an annual campaign plan, which can be too vague, or a weekly campaign plan, which can be too granular.

A quarterly campaign plan enables you to break down your goals, objectives, and budget into bite-sized chunks. This cuts down on the overwhelm while also providing flexibility.

More importantly, the 90-day window a quarterly campaign plan includes is just enough time to flawlessly execute while also evaluating your success along the way. This agile framework enables you to respond accordingly to the results of your campaign so you can become proactive.

What objectives do you want to highlight with your next quarterly ad campaign plan?

New comment by jyacoubi in "Ask HN: Who is hiring? (October 2021)"

Remote (Must reside in North America) | Position Type: Full-Time Contractor Avante IO is seeking experienced Django full-stack engineers interested in helping our team build out cutting-edge insurance underwriting technologies. We are building out exciting technologies (using Agile methodologies) at scale on AWS using some of the following technologies: Django/Python/DRF, React/Redux/Typescript , Postgres, Redis, Docker/ECS/Terraform, … Continue reading New comment by jyacoubi in "Ask HN: Who is hiring? (October 2021)"

10 Practices for Wix SEO

If you’ve ever built a website, or you’re looking for a suitable website builder, you’ve no doubt heard of Wix.

It’s renowned for its easy-to-use interface, its suitability for beginners, and it gets good reviews for its flexibility, professional-looking templates, and support.

On the downside, Wix SEO limitations often come in for criticism, but that doesn’t mean you can’t enhance your site’s SEO considerably by applying a few best practices.

This article details ten SEO best practices that can improve your Wix website rankings.

Before getting into that, though, let’s describe the pros and cons.

Pros and Cons of Wix

Wix is a web development platform with many advantages. First, you don’t need any coding knowledge and it uses simple drag and drop features to build a fantastic looking website.

Then there’s the Wix SEO tool. It helps you optimize your site for search engines by offering information on page names, meta descriptions, keywords, and more.

With some light guidance, anyone can create a website and get it up and running fast, and uncompetitive niches can rank on Google’s front page.

Additionally, Wix:

- is incredibly customizable

- has a wide range of features

- has a simple drag and drop interface

- offers ample templates to choose from

- is free

However, Wix has its disadvantages too.

Although a drag and drop interface makes web design straightforward, it can limit creativity and create a generic look.

Also, Wix SEO isn’t as simple as it could be, and the free version has limited features. It does, however, have some tools to assist in overcoming this.

Another disadvantage is that you must upgrade your plan to remove advertisements. Entry-level plans still display ads on your site, and premium websites are costly.

How Popular is Wix?

Wix is hugely popular with an audience of approximately 200 million, availability in 190 countries, and more than 1000 plus features.

The platform is especially popular among:

- small businesses

- entrepreneurs

- startups

- freelancers, like photographers, designers, and writers

You can use Wix to create great-looking portfolios and landing pages too.

10 Best Practices for Wix SEO

If you’ve done any research, you know that Wix’s SEO gets a bad rap, but that shouldn’t be the case anymore.

Wix has worked to improve SEO and offers advice to website owners who want to work on this aspect of website promotion. In addition, the platform includes an SEO tool, which I describe below.

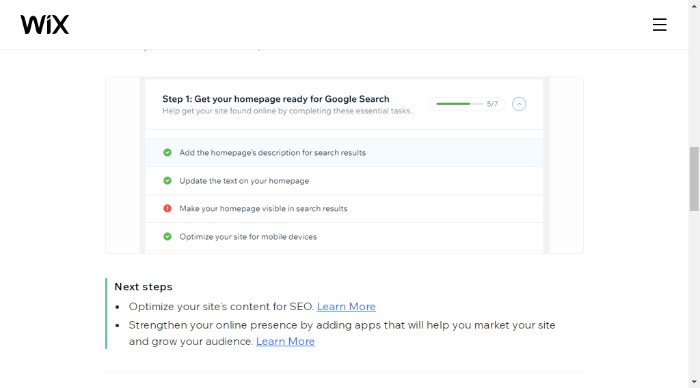

1. Use Wix SEO Wiz

To get started with optimizing your site, use the Wix SEO Wiz. It’s free and allows you to optimize your content.

The SEO Wiz consists of a step-by-step plan detailing areas of improvement and giving advice for enhancing SEO.

In addition, it gives you:

- easy-to-follow tutorials

- tracking capabilities

- access to numerous SEO articles

You can find the Wix SEO Wiz by going to “Marketing & SEO” and then “Get Found On Google” from your site’s dashboard.

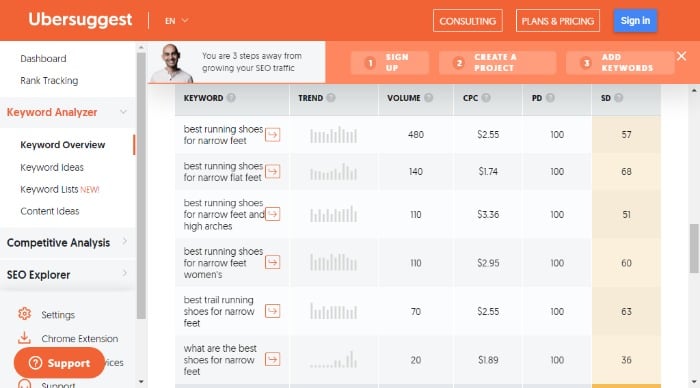

2. Use Longtail Keywords

You know all about keywords and keyword research. These are a crucial part of SEO, but you shouldn’t overlook longtail keywords.

Longtail keywords are more specific keywords with low search volume that use longer phrases. For example, “running shoe” is a head keyword, while “best running shoes for narrow feet” is a longtail keyword.

There’s no shortage of free tools available to find longtail keywords for your Wix SEO strategy, including Ubersuggest, Google’s Autocomplete, and wordtracker.com.

3. Make It Mobile-Friendly

A mobile-friendly (responsive) website is accessible from any device, and it makes a website simple to use regardless of how a visitor is accessing a page.

Responsiveness is vital because Google uses mobile-friendliness as a ranking feature, and more people are using mobile devices.

How do you make your website responsive? By:

- creating a layout that adapts well for any screen size and orientation

- using responsive design techniques where possible

- optimizing images for smaller screens using tools like Photoshop or Photopea

- creating content that considers the constraints of smaller screens such as videos, photos, and text length

Wix also advises on how to make your website more responsive.

4. Boost Your Local SEO

Local SEO is a form of internet marketing to rank highly in search engine results for keywords relevant to a physical location. For example, using local SEO is especially beneficial to small businesses and physical storefronts, such as restaurants or beauty salons.

Local SEO includes two categories: on-site and off-site.

On-site involves optimizing your website and online business to rank for local searches. Off-site includes building backlinks and getting reviews and mentions in blogs and directories related to your industry or niche.

Fortunately, it’s not difficult to enhance your site’s local SEO.

One way to improve your site’s ranking is by using geographic keywords in the title of your page and the content.

You should also include city names, states, counties, and zip codes on your page each time they are relevant; this will make it easier for Google to find you.

Another way you can improve your site’s ranking is by including a map on the web page with pins on it. This will allow people to view locations more easily through Google Maps or an embedded map on the web page.

5. Create a Sitemap

Sitemaps are critical for any website because they allow the user to know what to expect when they visit and give the webmaster a way to see how visitors interact with their site.

Additionally, a sitemap provides navigation for visitors, which is essential considering how many visitors may land on your site every day.

Sitemaps are an integral for two reasons:

- They allow you to see your website’s structure at a glance.

- They help search engines index your site more efficiently.

Further, a sitemap helps you understand where your visitors are going on your site so you can optimize content for them more effectively. You can also identify any broken links that might be preventing visitors from finding what they want.

You don’t need to worry about getting your Wix site map picked up by Google.

When you connect your Wix account to Google, it gets submitted to the search engine. Wix also has a tutorial on how to do this manually.

6. Use Wix SEO Tools

Wix SEO is about more than following a plan. It gives you plenty of other tools to improve your rankings, including:

- analytics, to make sure you’re on the right track

- a professional-looking blog for posting high-quality content and gaining organic traffic

- a solid infrastructure to aid organic search

- customizations of slugs, meta tags, and structured data

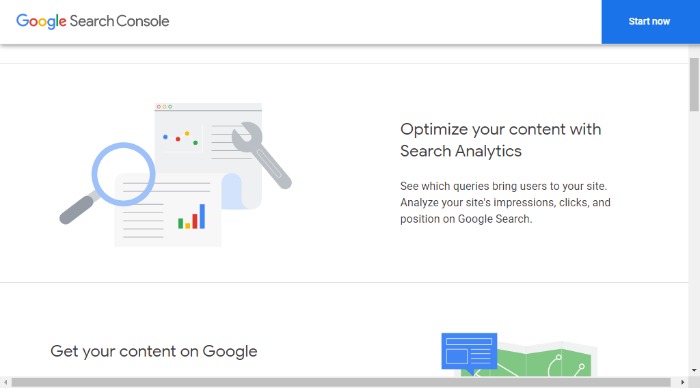

7. Set Up Google Search Console and Analytics

Google Search Console is a free service offering insights about your website’s performance in Google search results.

You can use it to monitor a wide range of things, such as:

- which keywords people are using to find your site

- what errors or warnings Google has detected

- the number of times users have clicked on links from your site that lead to pages on other sites

- providing insights into how users interact with your content

- sharing data on where people are coming from and going to when they visit your site

To add a site to Google’s Search console:

- Go to the Search Console and log in.

- Select “Add a new property.”

- Open the drop-down list.

- Select the property type.

- Verify your site.

8. Optimize Your Wix SEO Throughout the Site

To further optimize your Wix site, look beyond keywords. There are many other areas you can work on, including:

- managing the navigation menu

- using SEO-friendly URLs

- optimizing content by choosing relevant topics that will interest readers

- optimizing design by making sure it is consistent with your product

Further, you can optimize your website images to make them load faster.

For example, you can reduce the width of the images to the size that Wix requires, which is at least 2560 X 1440 pixels.

Finally, use a text editor for simpler HTML code and fewer unwanted tags.

9. Keep Posting Content for Wix SEO

It’s important to post quality content on your blog to generate traffic.

You can use these posts to build backlinks which will also help you rank higher in the search engines.

However, the importance of posting regular quality content on your blog isn’t just about getting traffic or backlinks. It’s also about building your search results for readers who find your site via Google Search.

Consider creating a content calendar to streamline production and keep content fresh and relevant.

10. Add Links

Google values both internal and external links as they give context and meaning, thus improving the quality of search results for readers who find your site via Google Search.

Internal links are links that point to pages on the same website. External links are links that point to other websites, and they’re equally important.

Finally, you can add a line of code within the webpage’s HTML tag at the top of the web page code, so they have an internal link directly from their home page.

External links, on the other hand, are a great way to bring value to your site.

You can get external links from different sources such as:

- guest blogging

- content syndication

- networking events

- press releases

- email outreach to influencers within your niche industry

Wix SEO Frequently Asked Questions

Is Wix Good for SEO?

Wix SEO hasn’t always had a great reputation, but it’s come on in leaps and bounds and now offers a good selection of (free) tools to help your SEO efforts.

Additionally, Wix websites have customization features, allowing you to increase your Wix SEO that way.

Do Wix Sites Rank on Google?

Yes. According to Ahrefs, its data “shows that Wix sites don’t have a hard time ranking on Google.”

Ahrefs research also shows that Wix does well for organic traffic.

Is SEO on Wix Free?

Wix offers free and paid plans, but the paid plans offer more features. If you need to get your website ranked higher in search engines, this is something worth considering if it’s within your budget.

Additionally, Wix offers some SEO tips and techniques for users to build their site and a customized SEO plan for free.

Is Wix or WordPress Better for SEO?

There are many different factors to take into account when comparing Wix and WordPress for your business.

Wix is a web development company that provides website builders with drag and drop technology to build professional-looking websites quickly. This is beneficial for beginners who are not tech-savvy enough to use WordPress. Wix has come a long way to make SEO easier for site owners to manage with a wide range of SEO tools to get started.

WordPress is a free, open-source software powering 455 million websites, making it the most popular content management system globally. It also provides all the blogging, hosting, social media integration, e-commerce capabilities, video integration. It also has access to more plugins and tools than Wix, which allows you to manipulate more technical aspects of SEO.

With that being said, both are great options that depend on what you need.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “Is Wix Good for SEO?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Wix SEO hasn’t always had a great reputation, but it’s come on in leaps and bounds and now offers a good selection of (free) tools to help your SEO efforts.

Additionally, Wix websites have customization features, allowing you to increase your Wix SEO that way.

”

}

}

, {

“@type”: “Question”,

“name”: “Do Wix Sites Rank on Google?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Yes. According to Ahrefs, its data “shows that Wix sites don’t have a hard time ranking on Google.”

Ahrefs research also shows that Wix does well for organic traffic.

”

}

}

, {

“@type”: “Question”,

“name”: “Is SEO on Wix Free?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Wix offers free and paid plans, but the paid plans offer more features. If you need to get your website ranked higher in search engines, this is something worth considering if it’s within your budget.

Additionally, Wix offers some SEO tips and techniques for users to build their site and a customized SEO plan for free.

”

}

}

, {

“@type”: “Question”,

“name”: “Is Wix or WordPress Better for SEO?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

There are many different factors to take into account when comparing Wix and WordPress for your business.

Wix is a web development company that provides website builders with drag and drop technology to build professional-looking websites quickly. This is beneficial for beginners who are not tech-savvy enough to use WordPress. Wix has come a long way to make SEO easier for site owners to manage with a wide range of SEO tools to get started.

WordPress is a free, open-source software powering 455 million websites, making it the most popular content management system globally. It also provides all the blogging, hosting, social media integration, e-commerce capabilities, video integration. It also has access to more plugins and tools than Wix, which allows you to manipulate more technical aspects of SEO.

With that being said, both are great options that depend on what you need.

”

}

}

]

}

Wix SEO Conclusion

Wix is an all-in-one website builder and hosting service. It’s a convenient and user-friendly platform that can help you build and host your website easily. It also provides Wix SEO guidelines to make sure your website ranks well on search engines.

Wix SEO is an essential aspect of the Wix platform. It isn’t that difficult, and you could achieve results with a few simple steps.

- Step 1: Keyword research

- Step 2: Website content optimization

- Step 3: Writing unique meta descriptions

- Step 4: Designing for mobile

Do you use Wix? Share your tips for optimizing your Wix SEO.

Quadrant Eye (YC W21) Is Hiring a Head of Research, Engineering, Design

Article URL: https://www.notion.so/quadranteye/Welcome-to-the-Quadrant-Eye-jobs-page-daca8963683b4435bd871032224343c0

Comments URL: https://news.ycombinator.com/item?id=28459877

Points: 1

# Comments: 0

Get to Know Your Experian Business Credit Report

Do You Want to Learn About Your Experian Business Credit Report?

This is a good time to learn about your Experian business credit report.

But first we should start with some definitions and background on business credit.

Business Credit

This is credit in the name of a business. It is not tied to the creditworthiness of its owner or owners. Rather, business credit scores will depend on how well a company can pay its bills. Hence consumer and business credit scores can vary dramatically.

Business Credit Benefits

There are no demands for a personal guarantee. You can quickly get business credit regardless of personal credit quality. And there is no personal credit reporting of business accounts. Business credit use won’t affect your consumer FICO score. Plus the business owner won’t be personally liable for the debt the business incurs.

Business Credit Details

Being accepted for business credit is not automatic. Building business credit requires some work. Some of the steps are intuitive, and some of them are not.

Fundability

Fundability is the current ability of our business to get funding. Some factors are within your control. Others (like your time in business) are not. Your online presence and data are one area which is at or close to 100% with your control.

The better your business credit and fundability are, the more likely you will get approval for business financing.

Build Fundability on Business Credit Applications to Avoid Denials

Keep your business looking fundable (legit) with:

- A professional website and email address

- A toll-free phone number

- List your phone number with 411

- A business address (not a PO box or a UPS box)

- Get all necessary licenses for running your business

Online Fundability

There are some aspects of fundability where you should pay particular attention to what is online. Such as:

- Business owners listed and listed ownership uniform

- Business name and address uniform

- Industry aligned

- Company domain

- Data uniform on all records

Business Ownership Listings

Records consistency matters here. Your website should show who owns your business. And that info must be consistent. So if the owner is named Susan Johnson on your website’s About page, then she should not be listed as Sue Johnson on your Contact page. If your business ownership changes, you need to show that here.

Business Name and Address Uniformity

Abbreviations can be your downfall here, as can punctuation like hyphens, commas, and colons. Maybe your Contact page says your main office is on Main Street. Then your About page should not say it is on Main St.

If your business moves, or you add subsidiaries and other locations, then you need to update that info everywhere. This even means whether you use your 5-digit ZIP code, or a ZIP plus 4 code (9 digits).

Fundability: Industry Alignment

If your business is over the road trucking, then it needs to be listed that way. Pro tip: when your industry can be called several different names, mention those other phrases on your site.

Your Business Email and Website: Company Domain

When your company domain matches your business name, it helps with fundability. Pro tip: try to match what people are searching for online. So if the word ‘brothers’ is in your company name, then determine if ‘brothers’ or ‘bros’ is used by people searching for your company online.

Keep your business protected with our professional business credit monitoring.

There are Three Different Credit Bureaus – But What Makes Your Experian Business Credit Report Special?

What distinguishes an Experian business credit report from reports through the two other big credit bureaus? And can you use that data to your advantage?

There are three major credit bureaus for business: Dun & Bradstreet, Experian, and Equifax. FICO SBSS and CreditSafe are also players.

In the business world Equifax and Experian are up there. But it is Dun & Bradstreet which is the major player.

Dun and Bradstreet has more than 10 times the records of the next closest reporting agency. See dnb.com/about-us/company.html. It makes sense to start with Dun and Bradstreet even when going over your Experian business credit report. This is because you must start the business credit building process with them anyway.

Dun & Bradstreet

Go to the Dun and Bradstreet website and look for your business, at dnb.com/duns-number. But just what happens if you are unable to find it? Then get a free D-U-N-S number. You will always need a D-U-N-S number to start building business credit. Go here to get a D-U-N-S number: dnb.com/duns-number/get-a-duns.html.

A D-U-N-S number is how Dun and Bradstreet gets your company into their system. And a D-U-N-S number plus 3 payment experiences leads to a PAYDEX score. A payment experience is a record of a purchase from a business which reports to a credit reporting agency. In this case, Dun and Bradstreet. Once your business is in Dun and Bradstreet’s system, search Equifax and Experian’s sites for your business. You can do so at creditsuite.com/reports.

Your Experian Business Credit Report

Business credit is in a business’s name. And it depends on how well a company can pay its bills. But Experian uses both consumer and business credit data to gauge risk.

They have found that blended data and reports work a lot better for them. For troubled businesses, blended scores dropped an average of 30% over the four quarters leading up to a bad event. The owner’s consumer scores showed no statistically significant decline during the same period.

53% of the time, the first signs of credit problems were on the business credit reports. 46% of the time, the first signs of credit problems were on the owner’s personal report. Blended scores outperformed consumer or business alone by 10 – 20%.

Per Experian:

“By combining personal and commercial credit information in one report, Experian provides a complete picture of the creditworthiness of small businesses”

You Must Get Set Up with Experian

Get a BIN (Business Identification Number) from Experian. Experian’s BizSource assigns a BIN.

How Long Data Stays on Your Reports at the Different Credit Bureaus

Per Experian Business, bankruptcies stay for 7 to 10 years. Chapter 13 bankruptcy rolls off your credit report 7 years from the filing date. While Chapter 7 bankruptcy stays for 10 years from the filing date. Trade data stays on for 36 months. Judgments, collections, and tax liens stay on for 6 years and 9 months. UCC filings stay on for 5 years. See experian.com/small-business/how-long-credit-report. There are similar time frames for the two other big business credit bureaus.

Keep your business protected with our professional business credit monitoring.

Your Experian Business Credit Report: The Particulars

We’ll look at a Typical Experian Business Credit Advantage SM Report. Experian provides a sample report where you can get an idea of what to expect. Experian changes its reports at times. So the best, most accurate and up to date source for this info is the Experian website. Find it online at https://sbcr.experian.com/pdp.aspx?pg=Sample-BCAI&hdr=report.

Business Background Information

The first part of a report has:

- Name

- Address

- Main phone number

- Experian BIN

- Annual sales

- Business type (corporation, etc.)

- Date Experian file established

- Years in business

- Total number of employees

- Incorporation date and state

Experian Business Credit Score

Business Credit Scores range from 1 to 100. Higher scores mean lower risk. This score predicts the chance of serious credit delinquencies within the next 12 months. This score uses tradeline and collections info, public filings as well as other variables to predict future risk. This part of the report has a graph to show the score.

Key Score Factors:

- Number of commercial accounts with terms other than Net 1-30 days

- The number of commercial accounts that are not current

- Number of commercial accounts with high utilization

- Length of time on Experian’s file

Experian Financial Stability Risk Rating

Financial Stability Risk Ratings range from 1 to 5. Lower ratings indicate lower risk. A Financial Stability Risk Rating of 1 indicates a 0.55% potential risk of severe financial distress. So this is within the next 12 months.

Experian puts all businesses in one of five risk segments. This rating predicts the chance of payment default and/or bankruptcy, in the next 12 months. This rating uses tradeline and collections data. It also uses public filings and other variables to predict future risk.

Key Rating Factors:

- Number of active commercial accounts

- Risk associated with the business type

- Risk associated with the company’s industry sector

- Employee size of business

Credit Summary

This part has several counts of various data points. For the most part, the details are further within the report.

The data outlined shows:

- Current Days Beyond Terms (DBT)

- Predicted DBT for a particular date

- Average industry DBT

- Payment Trend Indicator (stable, or not)

This part also shows:

- Lowest 6 month balance

- Highest 6 month balance

- Current total account balance

- Highest credit amount extended

- Median credit amount extended

- Number of payment tradelines

- Also, how many lender consortium experiences

- Number of business inquiries

- Number of UCC Filings

More on the Credit Summary

This part also has:

- Number of Banking/Insurance/Leasing

- A percentage of businesses scoring worse than the company in the report

- Number of bankruptcies

- How many liens

- Also the number of judgments filed

- Number of accounts in collections

- Company background

Company background has info on founding date, and where the company’s headquarters are. Plus there’s a basic background of what the business does.

Payment Trend Summary

This part starts with two graphs. They show the company in question versus its industry on Monthly payment trends and Quarterly payment trends.

These are percentages of on-time payments by month and quarter, respectively.

This part then shows tables with recent payment info by month and quarter. Then there are three more graphs:

- Continuous Payment Trends: continuous distribution with DBT (days beyond terms)

- Newly Reported Payment Trends: newly reported distribution with DBT

- Combined Payment Trends: combined distribution with DBT

Trade Payment Information

This next part shows details on payment experiences (financial trades). There is also data on lender consortium experiences (financial exchange trades):

- Tradeline experiences (continuous trades)

- Aged trades

- Payment trend detail

- There is also a link to send any missing payment experiences

Keep your business protected with our professional business credit monitoring.

Inquiries, Collection Filings, and Collections Summary

The Inquiries part shows the industry making the inquiry and a total made during a given month. The Collection Filings sector has the date, name of the agency, and status (open or closed). If a collection is closed, the Collection Filing sector also shows the closing date. The Collections Summary shows: status, number of collections, dollar amount in dispute, and amount collected (even if $0).

Commercial Banking, Insurance, Leasing

For leasing, this part shows:

- Leasing institution name and address

- Product type

- Lease start date and term

- Original and remaining balances

- The scheduled amount due

- Also the number of payments per year

- The number of payments which are current, late, or overdue

Judgement Filings

This part shows:

- Date and plaintiff

- Filing location

- Legal type and action

- Document number

- Liability amount

This part shows cases where the company in the report is plaintiff or defendant.

Tax Lien Filings

This part has:

- Date and owner

- Filing location

- Legal type and action

- Document number

- Liability amount

- Description

UCC Filings

This part has:

- Date

- Filing number

- Jurisdiction

- Secured party

- Activity (filed, or not)

UCC Filings Summary

This part shows:

- Filing period

- Number of cautionary filings

- Total filed

- Also the total released

- Total continued

- Amended/Assigned

Cautionary UCC Filings have one or more of the following collateral:

- Accounts

- Accounts receivable

- Contracts

- Hereafter acquired property

- Leases

- Notes receivable, or

- Proceeds

Score Improvement Tips

Experian offers suggestions on how to improve your reports. Such as:

- Get net-30 terms, if possible, from existing and future tradeline suppliers

- Pay accounts on time or work with the tradeline supplier on a payment plan so a business is not delinquent

- Lower credit utilization

- Make sure all the data in the report is correct

Disputing Issues with Your Experian Business Credit Report

None of the different business bureaus will change your scores without proof. They are starting to accept more and more online disputes. But include proofs of payment with it. These are documents like receipts and cancelled checks.

Fixing credit report errors also means you specifically spell out any charges you challenge. Make your dispute as crystal clear as possible. If you need to snail mail anything in, use certified mail. This is so that you have proof that you sent in your dispute. With all the different credit bureaus, be specific about the concerns with your report.

You can correct Experian issues at: experian.com/small-business/business-credit-information.

Monitoring Experian Credit Scores and Reports

The costs of monitoring at all three big business credit reporting agencies can add up fast. At Experian, your best (least expensive) bet would be a Business Credit Advantage. Subscription Plan. It currently costs $189 per year. See sbcr.experian.com/pdp.aspx?pg=Sample&link.

Monitor Business Credit at D&B, Experian, and Equifax for Less

All of Experian’s reports are expensive! But did you know that you can get business credit monitoring for all 3 of the big business CRAs. And all in one place – for less? Credit Suite offers monitoring through its Business Finance Suite (through Nav). See what credit issuers and lenders see. So you can directly improve your scores and get the business credit and funding you need. See suitelogin.com and creditsuite.com/monitoring.

Your Experian Business Credit Report: Takeaways

So Experian has revamped their reports dramatically. They no longer use the term ‘Intelliscore’. This major business credit reporting agency is committed to correct data, and to helping companies improve their reports. To monitor Experian, Equifax, and Dun and Bradstreet for a lot less, monitor through Credit Suite!

The post Get to Know Your Experian Business Credit Report appeared first on Credit Suite.