Leap Motion/Ultraleap | R&D Positions for Machine Learning, Computer Vision, or Unity3D | San Francisco, CA | Full-time | Onsite We’ve got some great positions open for people who love bleeding edge R&D, AI, computer vision, user interfaces, AR/VR and design! Please reach out at let’s talk! david.holz@ultraleap.com

Month: February 2020

Specificity In Marketing GONE WRONG!

Specifics sell. Vague generalities do not.

This is an accepted and well-established marketing principle. And for good reason.

Specificity, used correctly, makes your marketing message more believable.

Yet, when applied incorrectly, specificity can actually damage the credibility of your marketing message. And suppress sales conversions.

Specificity in marketing is all about giving specific details within your marketing stories, claims, promises, benefit statements, and case studies.

Specifics can increase the credibility and believability of your message. And allow prospects to conjure a more vivid image in their mind’s eye of the picture you’re painting.

While vague, general statements and promises in your marketing roll off your prospects back like water off a duck. And are viewed as typical “salesman’s hype”.

This is why specificity in your marketing is essential.

But, there are two different types of specificity you need to be aware of. And, different instances where you should be using each.

2 Types Of Specificity To Use

The first type of specificity is: Past Specificity

The second type of specificity is: Future Specificity.

The main difference between the two is in the detail of specifics given.

Let me explain…

Past specificity applies when you’re talking about something that’s taken place in the past (e.g. the result you or a customer has experienced from using your product or service, method, etc.).

In the case of Past Specificity, the more accurate and specific you are, the more believable your marketing message becomes. The less specific, the less believable.

For example, saying you earned $100,000 in 90 days is not as believable as saying you earned $97,856.72 in 83 days.

The reason for this is simple…

When talking about something that has already happened, you should have all the details to provide. So, if you don’t provide them, prospects can feel you’re not telling the complete truth or you’re simply using hype.

So Past Specificity is all about being as specific as possible.

But what about Future Specificity?

What about when talking about something the prospect can experience in the future? Like, when you’re presenting your Primary Marketing Promise (i.e. a promise of outcome, transformation, change, etc.)?

This is where lots of marketers go wrong.

Here, lots of marketers misapply the idea of specificity. They use the same level of specifics for their marketing promise as they would for describing a past experience.

The result?

Headlines like…

“How to make an extra $16,345.89 every month…”

“How to lose 2.89 pounds of fat every week…”

“How to attract 12,396 new visitors to your website every 30 days…”

These headlines are an example of applying Past Specificity to a future promise.

It’s using Past Specificity when Future Specificity should be used.

In laymen’s terms: these headlines are too specific to be believed.

- How could you promise what a prospect will earn, every month, down to the penny?

- How could you promise how much fat a prospect will lose, each week, down to the decimal?

- How could you promise the exact number of website visitors a prospect will get?

You can’t. And prospects know that.

You see, when describing something you’ve experienced in the past you can be ultra-specific. Because it’s already happened. So you have all the details.

Like, “How I’ve made an extra $16,345.89 every month using…” (Past Specificity)

But, you can’t be ultra-specific like that when presenting your marketing promise.

Why?

Because you don’t have a crystal ball. You’re not Nostradamus. You can’t predict the future with that level of detail.

And, again, prospects know this.

So, you need to have something like, “How to make a minimum of $16,000 every month using…”. (Future Specificity)

Make sense?

Simply put:

Be specific when making your promises.

Be ultra-specific when describing the past.

For more examples, review the sample headlines below. These are expanded versions of the headlines from above:

“How I’m banking an average of $16,345.89 every month with one Facebook ad… and how you can easily do the same to bank a quick 5K in the next 30 days!”

“How I eliminated one food from my diet and have since lost an average of 2.89 pounds every week for the last 26 weeks straight!”

“Finally, you can use the same media buying method that’s generated an average of 12,396 new website visitors for me every 30 days for the last 8 months straight!”

*Notice the application of Past Specificity when referencing what’s already happened for me. But, Future Specificity when talking about what the prospect can expect.

The post Specificity In Marketing GONE WRONG! appeared first on Marketing Funnel Automation.

The post Specificity In Marketing GONE WRONG! appeared first on Getting Your Business Started Off To The Right Start.

Bank card financial obligation loan consolidation financing

Bank card financial debt combination car loan

Bank card financial obligation loan consolidation financing

Credit scores card financial debt loan consolidation car loan is one of the means of settling credit report card financial obligation. Some individuals kind of fail to remember regarding credit score card financial obligation loan consolidation finance being offered as a technique of credit score card financial debt loan consolidation. Credit report card financial debt combination finance as well is essential to think about when going for credit history card financial debt loan consolidation.

What do we imply by credit scores card financial debt loan consolidation car loan?

In other words, bank card financial debt combination finance is a reduced passion financing that you look for with a financial institution or banks in order to erase your high passion bank card financial debt. Credit rating card financial debt loan consolidation car loan also is based on very same concept as equilibrium transfers i.e. relocating from one or even more high rate of interest financial obligations to a reduced rate of interest one. The charge card financial obligation loan consolidation car loan needs to be repaid in regular monthly instalments and also based on the problems and also terms concurred in between you and also the dispenser of bank card financial debt loan consolidation funding.

If you have a truly poor credit score background as well as you desire go for credit history card financial debt negotiation making use of credit score card financial obligation loan consolidation funding, the debt card financial debt combination lending will certainly take the kind of a safeguarded credit scores card financial debt combination car loan. Even worse the credit scores ranking, the a lot more tough it is to obtain a credit scores card financial obligation loan consolidation car loan.

Equilibrium transfers as well as credit report card financial obligation loan consolidation lendings have the very same goal behind them, the credit report card financial obligation combination finances are occasionally thought about much better since you finish up shutting many of your credit report card accounts which have actually been the primary perpetrator in touchdown you in this challenging scenario. Equilibrium transfers have their very own benefits which are not readily available with credit scores card financial obligation combination financings. Selecting in between charge card financial debt loan consolidation funding and also equilibrium transfer is truly an issue of individual option.

Debt card financial debt combination funding also is essential to take into consideration when going for credit history card financial obligation loan consolidation.

The credit report card financial obligation loan consolidation funding has actually to be paid back in regular monthly instalments and also as per the problems as well as terms concurred in between you as well as the dispenser of credit rating card financial debt combination finance.

If you have a truly negative credit rating background as well as you desire go for debt card financial debt negotiation utilizing credit report card financial debt combination funding, the credit report card financial debt combination financing will certainly take the kind of a protected credit scores card financial debt loan consolidation car loan. Equilibrium transfers as well as credit rating card financial obligation loan consolidation finances have the exact same goal behind them, the credit rating card financial obligation combination lendings are occasionally taken into consideration far better since you finish up shutting many of your credit rating card accounts which have actually been the primary perpetrator in touchdown you in this challenging circumstance.

The post Bank card financial obligation loan consolidation financing appeared first on ROI Credit Builders.

Home mortgage Can Be A Long Engagement

Home loan Can Be A Long Engagement

Home loan is a lawful device that vows a genuine estate building as payment in order to get a lending. Needs to the debtor stop working to pay for the lending, the loan provider might recoup the quantity of lending by repossession and also sale of the mortgaged home.

A note, defining the monetary regards to a lending arrangement is one component of the home mortgage loaning procedure. The 2nd component, the home loan paper explains the lawful specifics of the residential property as well as additional assurances the residential property as warranty for the settlement of the financing.

Home mortgage loan providers are typically financial institutions, cooperative credit union or various other funding establishments. These lending institutions mainly need the consumer to install a specific quantity of money as deposit for the acquisition. If the consumer intends to get a 200,000-dollar-home, he needs to pay initially the called for deposit of $10,000 from his very own funds after that make an application for a mortgage in the quantity of $190,000 to cover the distinction.

Financing companies are fairly stringent on giving home loan. Lenders need info details of the debtor and also utilize it to evaluate the consumer’s capacity as well as preparedness to pay the lending. Obviously, the customer must reveal to the loan provider, individual in addition to organisation realities, from whom he is protecting the mortgage.

Prior to a mortgage is approved, the residential or commercial property set up as assurance will certainly be assessed for its projected market price by a specialist evaluator. The loan provider wishes to ensure that the worth of the residential property is just as worth as the funding in instance the debtor defaults on the funding as well as loan provider needs to confiscate claimed home.

Home loan is approved nevertheless the needs are completely satisfied. The home loan arrangement will certainly define the existing rates of interest as well as car loan payment terms like quantity as well as regularity, etcetera.

The mortgage rate of interest and also variety of years will certainly identify the quantity of regular monthly repayments. Period of home mortgage arrays from the quickest, 1 year approximately 25 years or perhaps a lot more.

There are various other problems the debtor has to abide when he approves the home mortgage funding. Failing on the component of the customer to accomplish these responsibilities makes up a default on the home mortgage car loan and also will certainly suggest repossession on the building by the loan provider.

The home mortgage lending absolutely will have various other expenses to be birthed by the debtor. These costs or expenses are normally refining cost, fees for credit score records, assessment charge as well as various other solution charges family member to the application for the home mortgage funding.

Home mortgage settlements plans will greatly depend upon the rates of interest as well as repayment duration. Passion settlement is the very first component as well as primary repayment is the 2nd component of the home mortgage repayment.

In a home mortgage settlement, passion is the price for utilizing the cash of the lending institution while principal is the quantity the debtor still owes the lending institution. The procedure of settlement of home mortgage is call amortization.

The information of home mortgage payment will certainly be extensively reviewed by the loan provider with the customer throughout the deal to ensure that both celebrations will certainly understand the complete extent of the contract. Regular monthly repayment routine of the mortgage will certainly be offered to the consumer and also enters into the home mortgage files.

At the end of the home loan deal, both celebrations arise better – the loan provider, for having offered a completely satisfied client; the consumer, that has actually simply gotten his desire job.

Must the customer stop working to pay for the finance, the lending institution might recoup the quantity of finance by repossession as well as sale of the mortgaged building.

If the consumer intends to acquire a 200,000-dollar-home, he has to pay initially the called for down repayment of $10,000 from his very own funds after that use for a home mortgage financing in the quantity of $190,000 to cover the distinction.

Unnecessary to state, the debtor must divulge to the lending institution, individual as well as organisation realities, from whom he is protecting the home mortgage financing.

There are various other problems the debtor has to conform when he approves the home mortgage financing. Failing on the component of the debtor to meet these commitments makes up a default on the home mortgage funding as well as will certainly indicate repossession on the residential property by the lending institution.

The post Home mortgage Can Be A Long Engagement appeared first on ROI Credit Builders.

Bank card financial obligation loan consolidation financing

Bank card financial debt combination car loan

Bank card financial obligation loan consolidation financing

Credit scores card financial debt loan consolidation car loan is one of the means of settling credit report card financial obligation. Some individuals kind of fail to remember regarding credit score card financial obligation loan consolidation finance being offered as a technique of credit score card financial debt loan consolidation. Credit report card financial debt combination finance as well is essential to think about when going for credit history card financial debt loan consolidation.

What do we imply by credit scores card financial debt loan consolidation car loan?

In other words, bank card financial debt combination finance is a reduced passion financing that you look for with a financial institution or banks in order to erase your high passion bank card financial debt. Credit rating card financial debt loan consolidation car loan also is based on very same concept as equilibrium transfers i.e. relocating from one or even more high rate of interest financial obligations to a reduced rate of interest one. The charge card financial obligation loan consolidation car loan needs to be repaid in regular monthly instalments and also based on the problems and also terms concurred in between you and also the dispenser of bank card financial debt loan consolidation funding.

If you have a truly poor credit score background as well as you desire go for credit history card financial debt negotiation making use of credit score card financial obligation loan consolidation funding, the debt card financial debt combination lending will certainly take the kind of a safeguarded credit scores card financial debt combination car loan. Even worse the credit scores ranking, the a lot more tough it is to obtain a credit scores card financial obligation loan consolidation car loan.

Equilibrium transfers as well as credit report card financial obligation loan consolidation lendings have the very same goal behind them, the credit report card financial obligation combination finances are occasionally thought about much better since you finish up shutting many of your credit report card accounts which have actually been the primary perpetrator in touchdown you in this challenging scenario. Equilibrium transfers have their very own benefits which are not readily available with credit scores card financial obligation combination financings. Selecting in between charge card financial debt loan consolidation funding and also equilibrium transfer is truly an issue of individual option.

Debt card financial debt combination funding also is essential to take into consideration when going for credit history card financial obligation loan consolidation.

The credit report card financial obligation loan consolidation funding has actually to be paid back in regular monthly instalments and also as per the problems as well as terms concurred in between you as well as the dispenser of credit rating card financial debt combination finance.

If you have a truly negative credit rating background as well as you desire go for debt card financial debt negotiation utilizing credit report card financial debt combination funding, the credit report card financial debt combination financing will certainly take the kind of a protected credit scores card financial debt loan consolidation car loan. Equilibrium transfers as well as credit rating card financial obligation loan consolidation finances have the exact same goal behind them, the credit rating card financial obligation combination lendings are occasionally taken into consideration far better since you finish up shutting many of your credit rating card accounts which have actually been the primary perpetrator in touchdown you in this challenging circumstance.

The post Bank card financial obligation loan consolidation financing appeared first on ROI Credit Builders.

Entrepreneur’ Views of Business Credit Cards

Entrepreneur’ Views of Business Credit Cards

There are rather a variety of reasons local business owner pick to get organisation bank card, yet current researches validate that service charge card are checked out most helpful for maintaining service and also individual financial resources different. Entrepreneur claim that their key factor for making use of service charge card is to prevent their overhead from obtaining blended with their individual costs: Using service charge card divides both, consequently adding in the direction of preserving the honesty of their accountancy documents.

90% of all small company proprietors make use of service bank card simply to make service associated acquisitions, with greater than 90% suggesting that the key demand for company charge card is organisation traveling. They think that airline company trips, vehicle services as well as resort keeps would certainly be troublesome without company charge card.

Maybe as a result of this close organization in between company traveling as well as service bank card, you will not be shocked to listen to that nearly a 3rd of business proprietors take into consideration cash money back compensates as one of the most appealing attribute, while one-fifth worths the constant leaflet mile awards most. To a minimal level, the all set approval of organisation charge card by providers and also suppliers was considered to be a vital factor to consider. Local business owner are likewise satisfied with the ‘no yearly charge’ attribute used by a lot of organisation charge card companies.

Company proprietors have a tendency to utilize their organisation credit rating cards with really details functions in mind as well as are much more aware concerning resolving company credit history card equilibriums in complete. Company proprietors would certainly recommend you to pay your service credit rating cards in complete or do not utilize them.

Surprisingly, almost fifty percent (46%) of local business owner believed that rates of interest and also relevant terms were their crucial factors to consider when they looked for organisation charge card. They suggested a gratitude for the short-lived capital support that company bank card supply, however revealed a disapproval for paying passion costs and also for financial debt buildup. This worry for rate of interest as well as their persistance in settling service bank card costs to stay clear of charges suggests that bank card firms do not make much cash from local business proprietors.

A lot of company owner discover one– or at a lot of, 2– organisation bank card enough for their functions. Contrasted to the typical American that holds 4 to 8 individual bank card, the study located that the ordinary local business proprietor just has a couple of company charge card at many.

86% of tiny service proprietors think their company debt card costs restriction was high sufficient for their requirements and also that also several company credit rating cards would certainly lure them to invest even more than is actually essential. This perspective in the direction of credit line and also several bank card might be since local business, unlike normal people, do have accessibility to alternative resources of financial obligation funding– something that the common person does not.

Possibly due to the fact that of this close organization in between company traveling as well as service credit history cards, you will not be amazed to listen to that practically a 3rd of the service proprietors take into consideration cash money back awards as the most eye-catching function, while one-fifth worths the constant leaflet mile compensates most. Service proprietors often tend to utilize their company debt cards with extremely details functions in mind as well as are a lot more aware concerning clearing up organisation credit rating card equilibriums in complete. Company proprietors would certainly suggest you to pay your company credit rating cards in complete or do not utilize them.

Surprisingly, virtually fifty percent (46%) of service proprietors assumed that rate of interest prices and also relevant terms were their most essential factors to consider when they used for service credit rating cards.

Padlet (YC W13) Is Hiring Designers in the Presidio of San Francisco

Article URL: https://padlet.jobs

Comments URL: https://news.ycombinator.com/item?id=22407698

Points: 1

# Comments: 0

CareRev (YC S16) Is Hiring a Senior Back End Engineer in Los Angeles

CareRev (YC S16) | Senior Back End Engineer | Los Angeles, CA (Marina/Culver City) | Full-Time | Onsite

Us:

We build software to help the health care industry fully staff RNs, CNAs, MAs, Therapists, and Technologists efficiently. We are experiencing strong growth selling to both Surgery Centers and Hospitals.

Role:

Senior Back End Engineer with 7+ years experience. We’re looking for someone that tends to think data and data structures first and loves RDBMS.

Our Back End Tech Stack:

* Postgresql

* Redis

* Ruby

* Rails

* Linux

Compensation Package:

* 140-160k/y salary

* Stock Options

* Health/Dental Insurance

* 401k

* 2.5k/y continuing education (conferences, books, online courses, etc)

Email us at derrek at carerev.com

Comments URL: https://news.ycombinator.com/item?id=22410044

Points: 1

# Comments: 0

A Step-by-Step Guide to Growing Your SEO Traffic Using Ubersuggest

There are a lot of tools out there and a ton of SEO reports.

But when you use them, what happens?

You get lost, right?

Don’t worry, that’s normal (sadly). And maybe one day I will

be able to fix that.

But for now, the next best thing I can do is teach you how to grow your SEO traffic using Ubersuggest. This way, you know exactly what to do, even if you have never done any SEO.

Here we go…

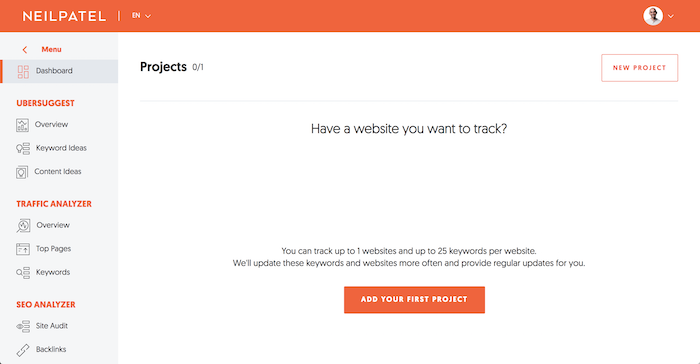

Step #1: Create a project

Head over to the Ubersuggest dashboard and

register for a free account.

Once you do that, I want you to click on “Add Your First Project.”

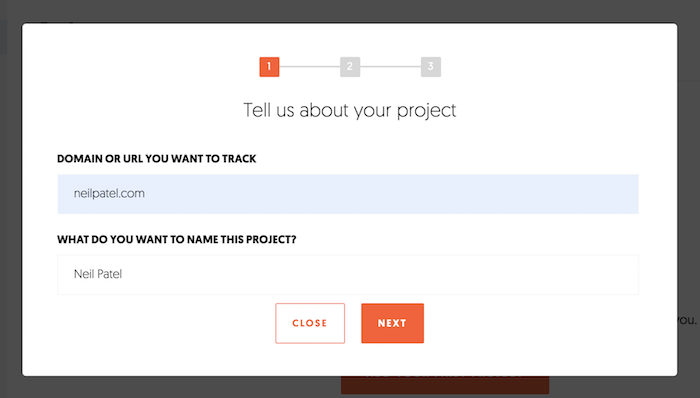

Next, add your URL and the name of your website.

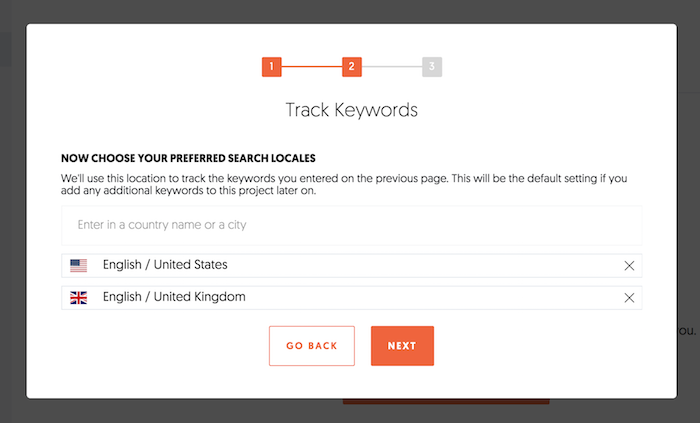

Then pick the main country or city that you do business in. If you are a national business, then type in the country you are in. If you are a local business, type in your city and click “Next.”

If you do business in multiple countries or cities, you can type them in one at a time and select each country or city.

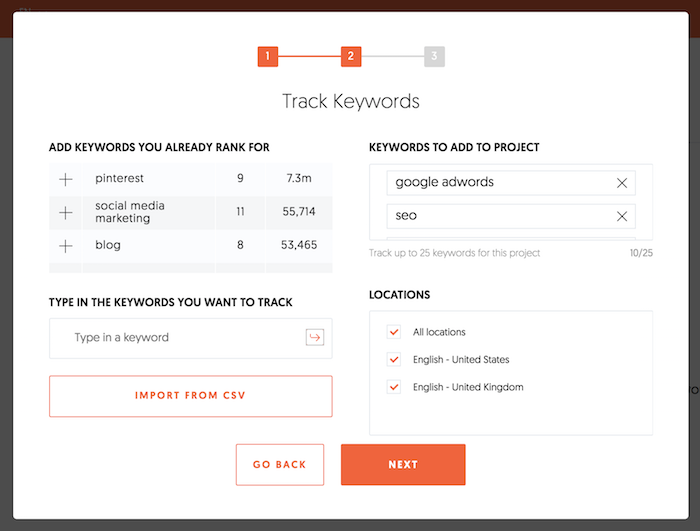

Assuming you have your site connected to Google Search Console, you’ll see a list of keywords that you can automatically track on the left-hand side. Aside from tracking any of those, you can track others as well. Just type in the keywords you want to track in the box and hit the “Enter” key.

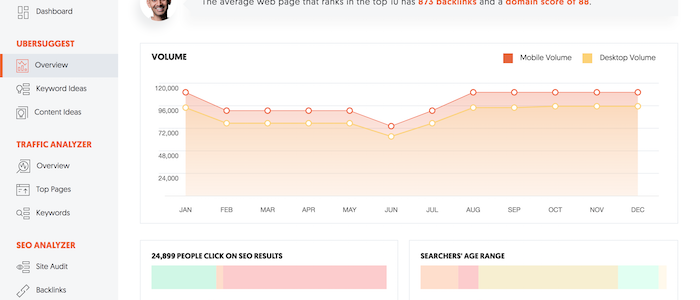

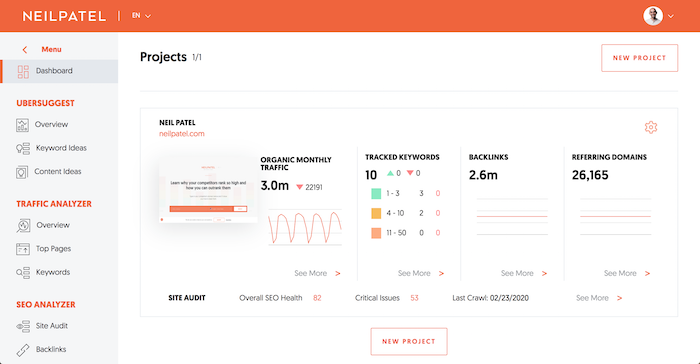

After hitting the “Next” button, you will be taken to your dashboard. It may take a minute but your dashboard will look something like this:

Click on the “Tracked Keywords” box and load your website profile.

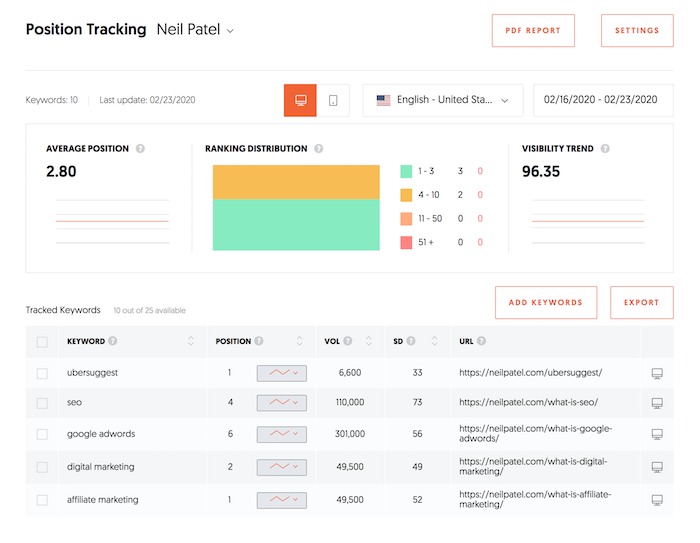

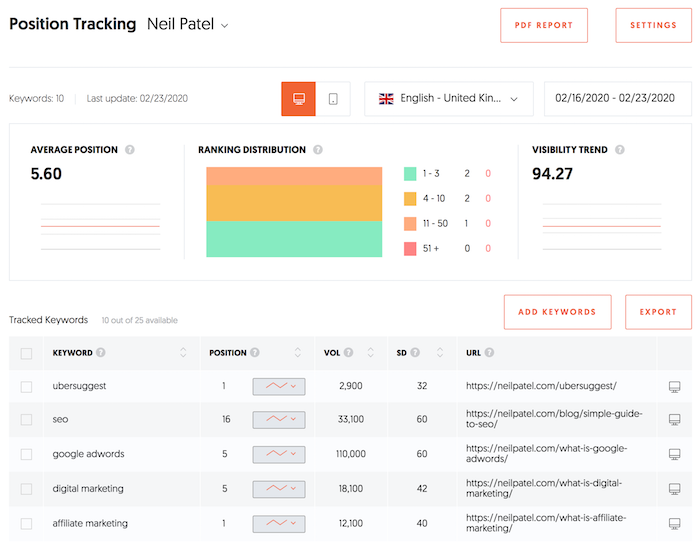

What’s cool about this report is that you can see your rankings

over time both on mobile and desktop devices. This is important because Google

has a mobile index, which means your rankings are probably slightly different

on mobile devices than desktop.

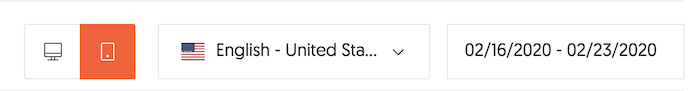

If you want to see how you are ranking on Google’s mobile index, you just have to click the “Mobile” icon.

The report is self-explanatory. It shows your rankings over time for any keyword you are tracking. You can always add more keywords and even switch between locations.

For example, as of writing this blog post, I rank number 4 on desktop devices for the term “SEO” in the United States. In the United Kingdom, though, I rank number 16. Looks like I need to work on that. 😉

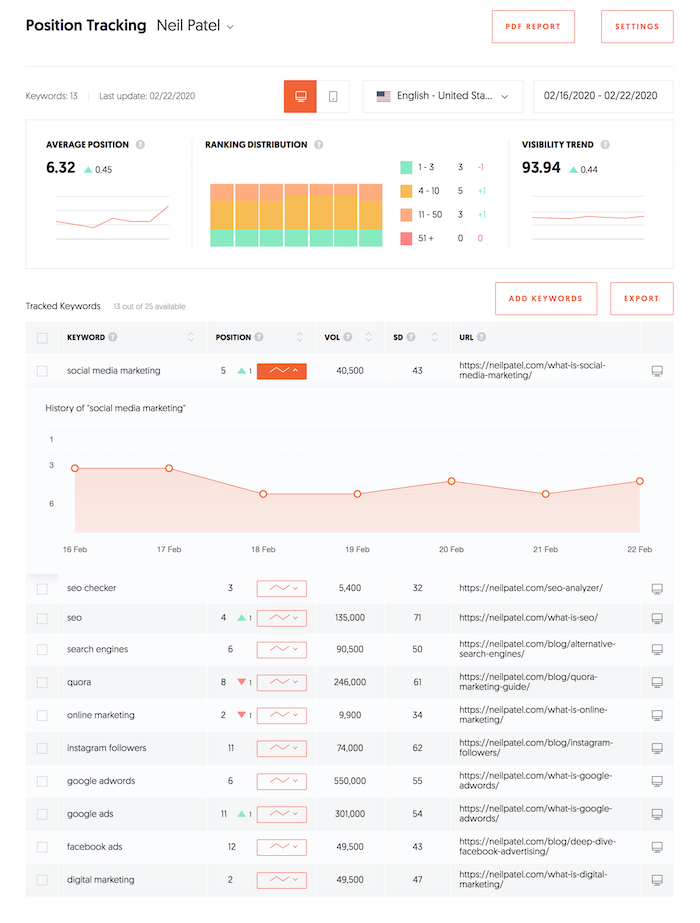

What’s cool about this report is you can drill down on any

keyword and track your rankings over time. For example, here’s what my site

looks like now…

The purpose of this report is to track your SEO progress. If you are heading in the right direction, your rankings should be going up over time.

Sure, some weeks your rankings will be up and other weeks it

will be down, but over time you should see them climb.

Step #2: Fixing your SEO errors

Once you have created your first project, it’s time to improve your rankings.

Let’s first start off by going to the “Site Audit” report. In the navigation, click on the “Site Audit” button.

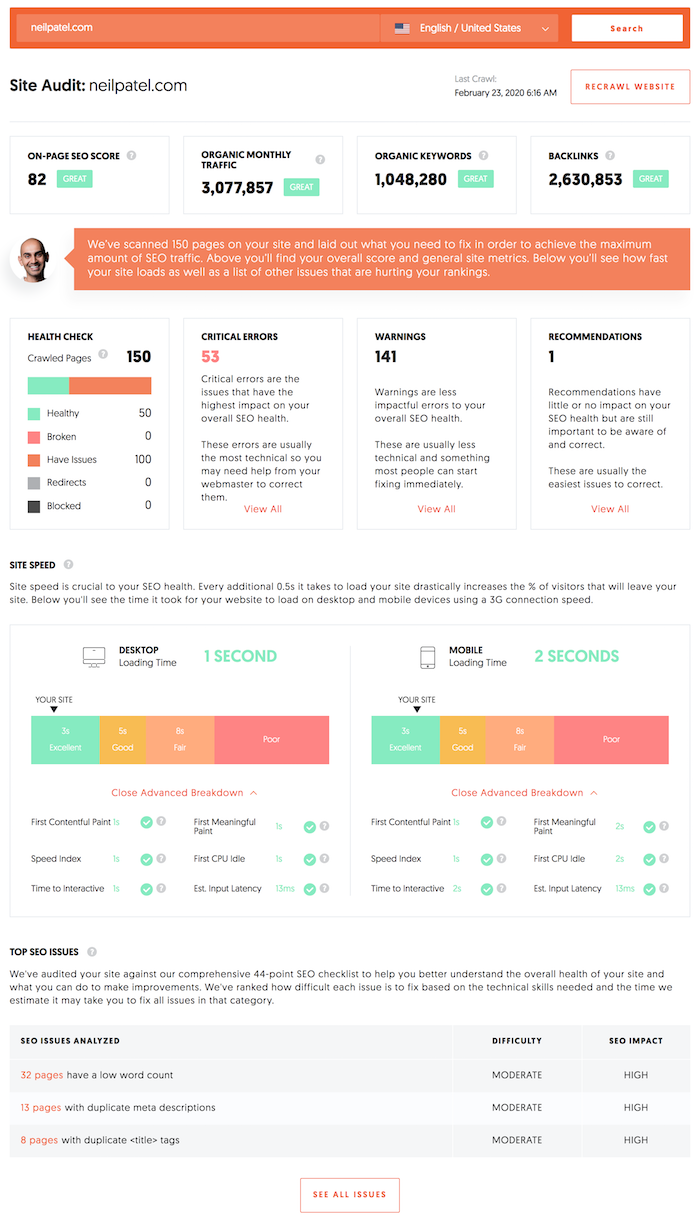

Once you are there, type in your URL and click the “Search” button.

It can take a few minutes to run the report, but once it is

done it will look something like this.

Your goal is to optimize your site for as high as an SEO score as possible. Ideally, you want to be reaching for 90 or higher.

Keep in mind that as you add more pages to your site and it gets bigger, it will be increasingly harder to achieve a 90+ score. So, for sites that have more than a few hundred pages, shoot for a score that is at least 80.

As you can see above, I’m getting close to the 80 mark, so I’ll have to get my team to go in and fix some of my errors and warnings.

When looking at this report, you’ll want to fix your critical errors first, then your warnings if you have time. Eventually, you want to consider fixing the recommendations as well.

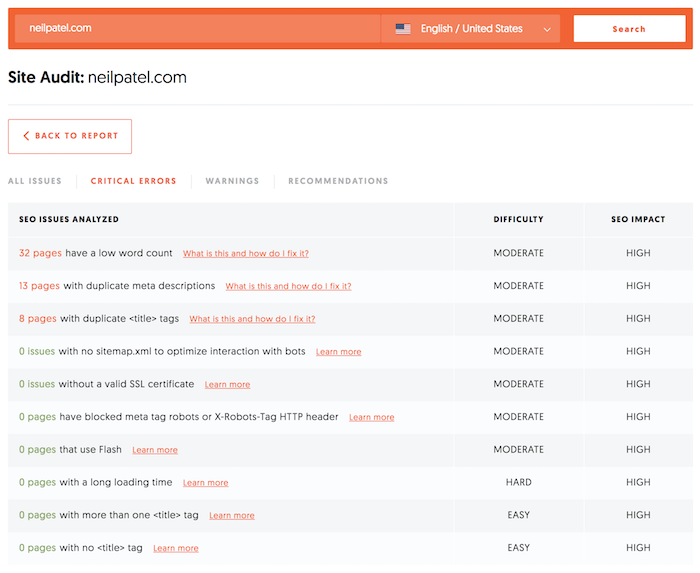

Click on “Critical Errors” if you have any. If not, click on the Warnings” option. You’ll see a report that looks something like this:

Your errors are probably going to be different than mine, but your report will look similar.

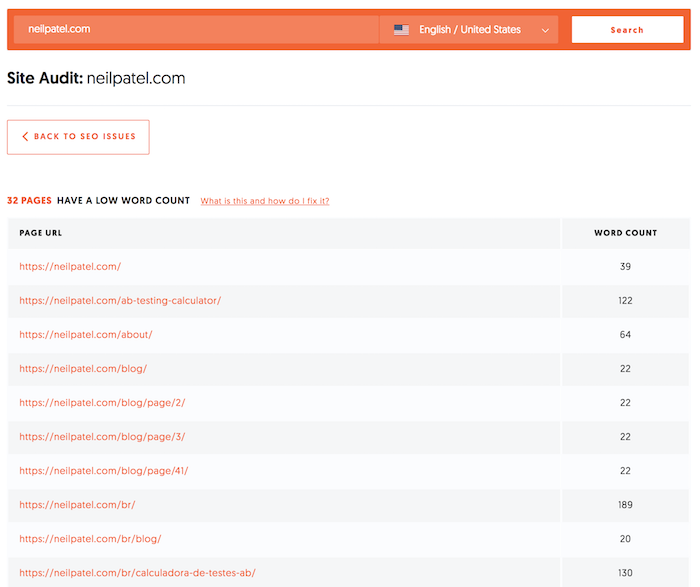

Click through on the first issue on the report and work your way down. The report sorts the results based on impact. The ones at the top should be fixed first as they will have the highest chance of making an impact on your traffic.

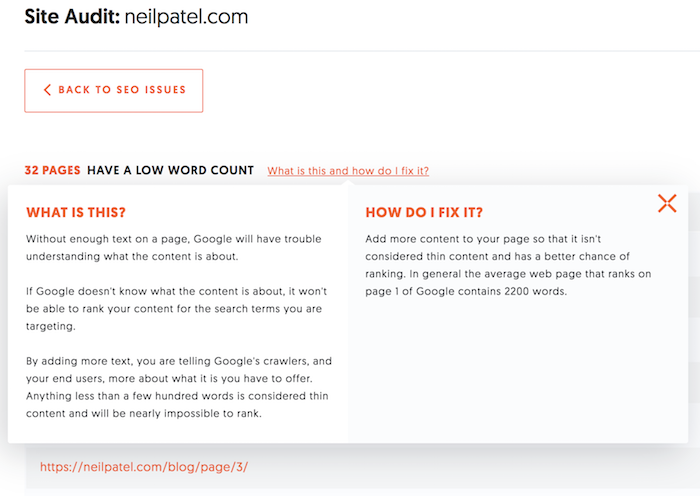

If you aren’t sure of what to do or how to fix the issue, just click on the “What Is This” and “How Do I Fix It” prompts.

Again, you will want to do this for all of your critical

errors and warnings.

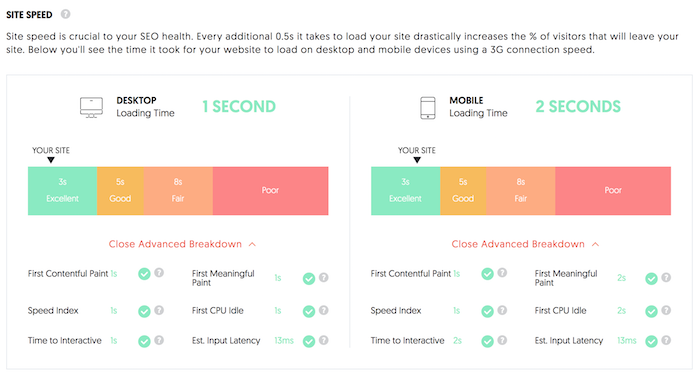

Once you do that, go back to the “Site Audit” report and scroll down to where you see your site speed results.

Your goal should be to get an “Excellent” ranking for both mobile and desktop devices. If you are struggling to do this, check out Pagespeed Insights by Google as it will give you a detailed explanation of what to fix.

If you are like me, you probably will need someone to help

you out with this. You can always find a developer from Upwork and pay them 50 to 100 dollars to fix

your issues.

After you fix your errors, you’ll want to double-check to make sure you did them right. Click on the “Recrawl Website” button to have Ubersuggest recrawl your site and double-check that the errors were fixed correctly.

It will take a bit for Ubersuggest to recrawl your website

as it is going through all of your code again.

Step #3: Competitor analysis

By now you have probably heard the saying that “content is king.”

In theory, the more content you have, the more keywords you will have on your site and the higher the chance that you’ll rank on Google for more terms.

Of course, the content needs to be of high quality and people have to be interested in that topic. If you write about stuff that no one wants to read about, then you won’t get any traffic.

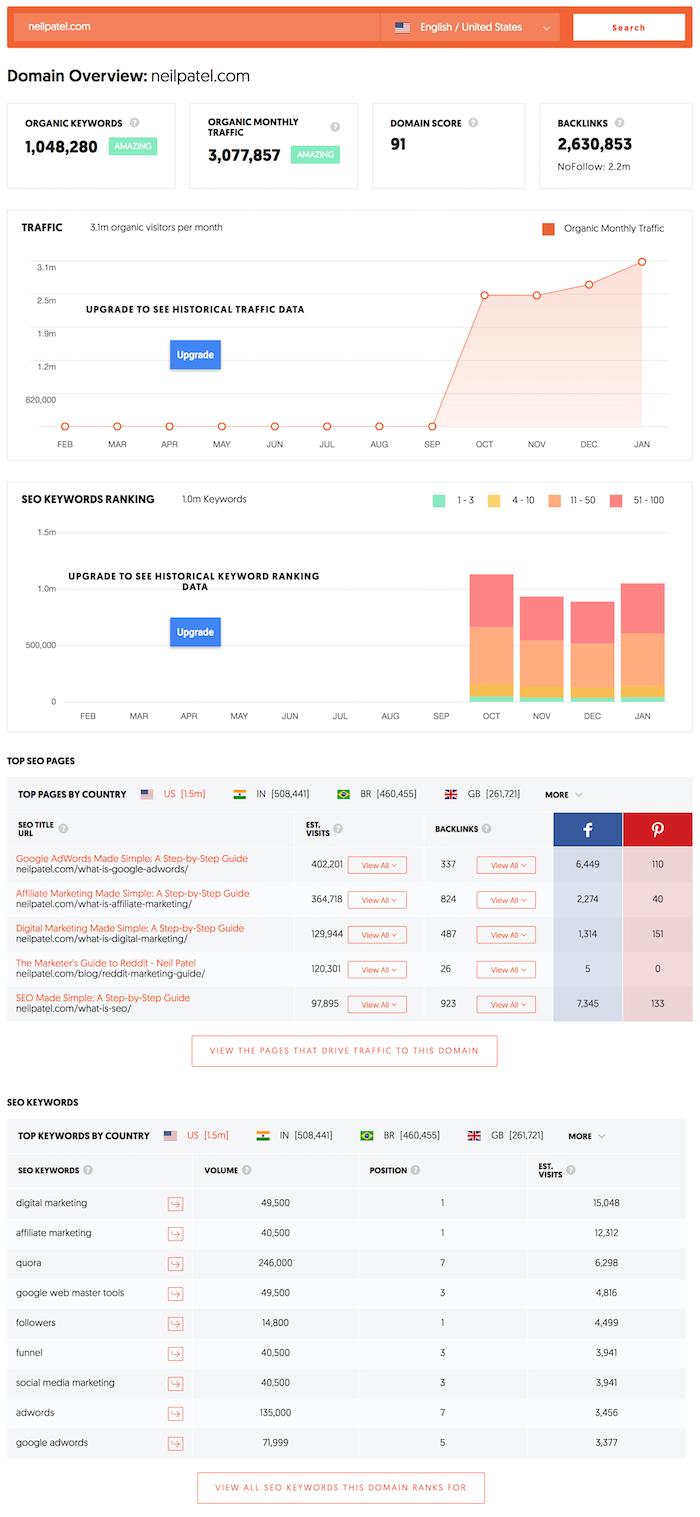

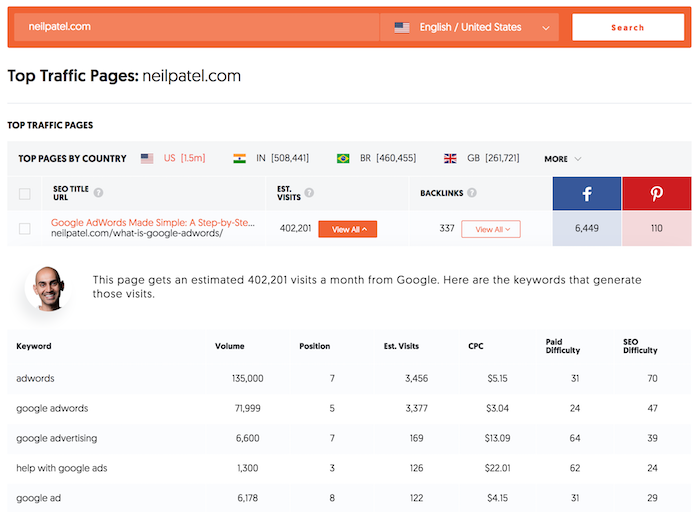

Now, I want you to go to the “Traffic Analyzer Overview” report.

Put in a competitor’s URL and you will see a report that

looks something like this.

This report shows the estimated monthly visitors your competition is receiving from search engines, how many keywords they are ranking for on page 1 of Google, their top pages, every major keyword they rank for, and the estimated traffic each keyword drives to their site.

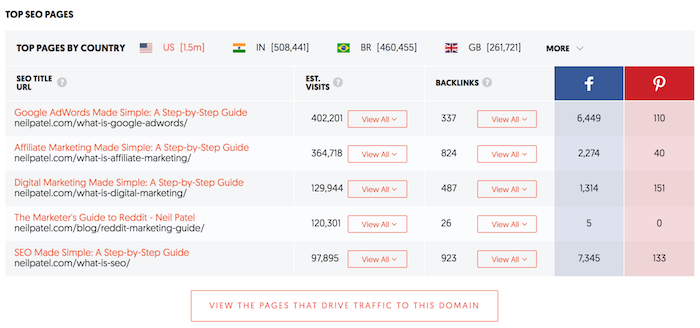

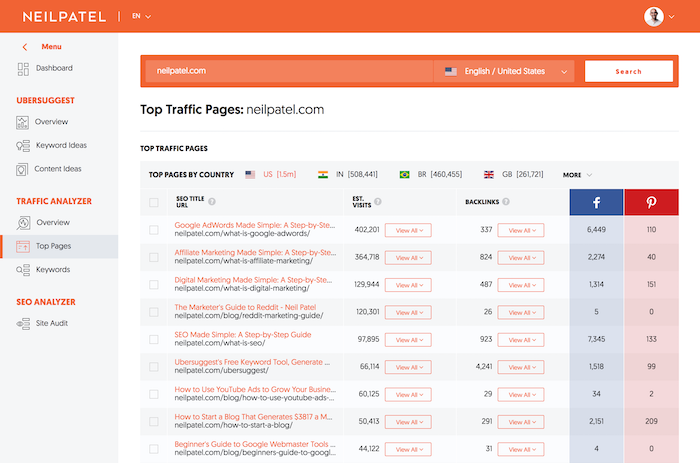

I want you to go to the “Top Pages” section and click the button that says “View The Pages That Drive Traffic To This Domain.”

You’ll be taken to the “Top Pages” report.

Here, you will see a list of pages that your competition has on their site. The ones at top are their most popular pages and as you go down the list you’ll find pages that get less and less traffic.

Now I want you to click “View All” under “Estimated Visits” for the top page on your competition’s site.

These are the keywords that the page ranks for.

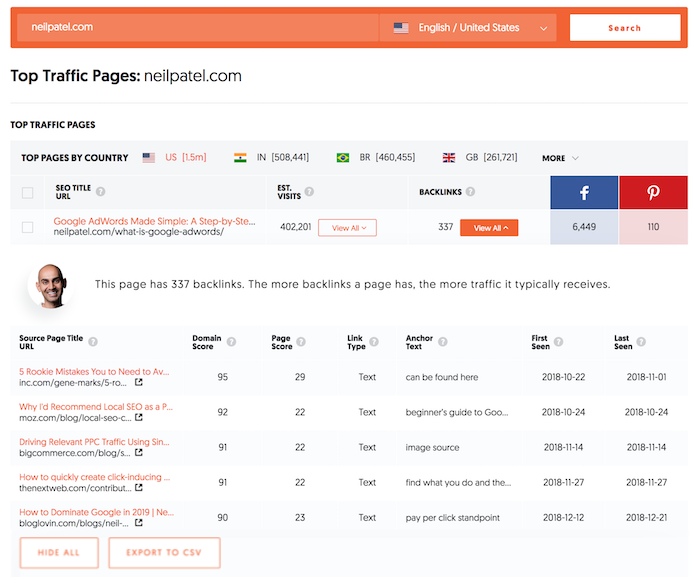

And you’ll also want to click “View All” under links to see who links to your competition.

Save that list by exporting the results (just click the export button) or by copying them.

I want you to repeat this process for the top 10 to 20 pages for each of your main competitors. It will give you an idea of the keywords that they are going after that drive them traffic.

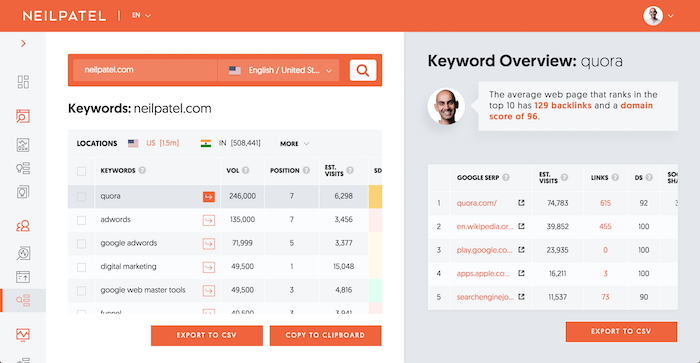

Next, I want you to click on the “Keywords” navigation link under the “Traffic Analyzer” heading.

You’ll see a list of all of the keywords your competitor ranks for and how much traffic they are getting for those keywords.

This list will give you an idea of the keywords that your

competition is targeting.

Now, by combining the data you saw from the “Top Pages” report and the data you got from the “Keywords” report, you’ll now have a good understanding of the type of keywords that are driving your competition traffic.

I want you to take some of those keywords and come up with

your own blog post ideas.

Step #4: Come up with blog post ideas

You can come up with ideas to blog on using a few simple

reports in Ubersuggest.

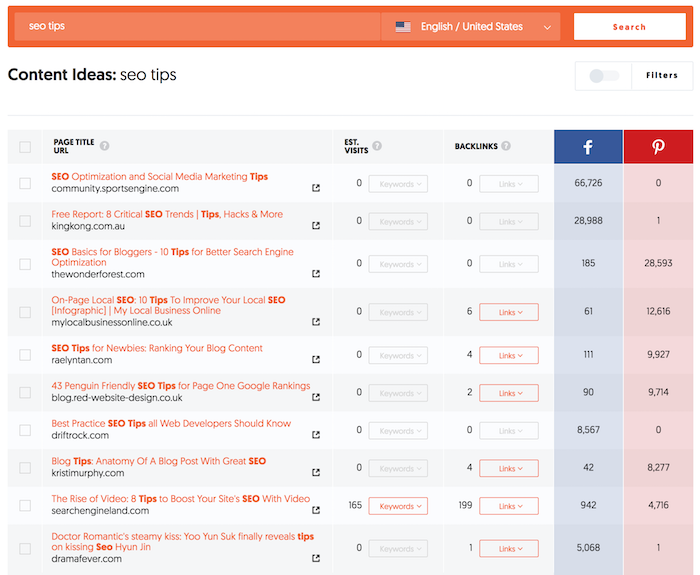

The first is the “Content Ideas” report. In the navigation bar, click on the “Content Ideas” button.

I want you to type in one of the keywords your competition

is ranking for that you also want to rank for.

For example, I rank for “SEO tips.” If you want to rank for that term, you would type that into the content ideas report and hit the “Search” button.

You’ll then see a list of blog posts that have done well on that topic based on social shares, backlinks, and estimated visits.

It takes some digging to find good topics because ideally, a post should have all 3: social shares, backlinks, and estimated visits.

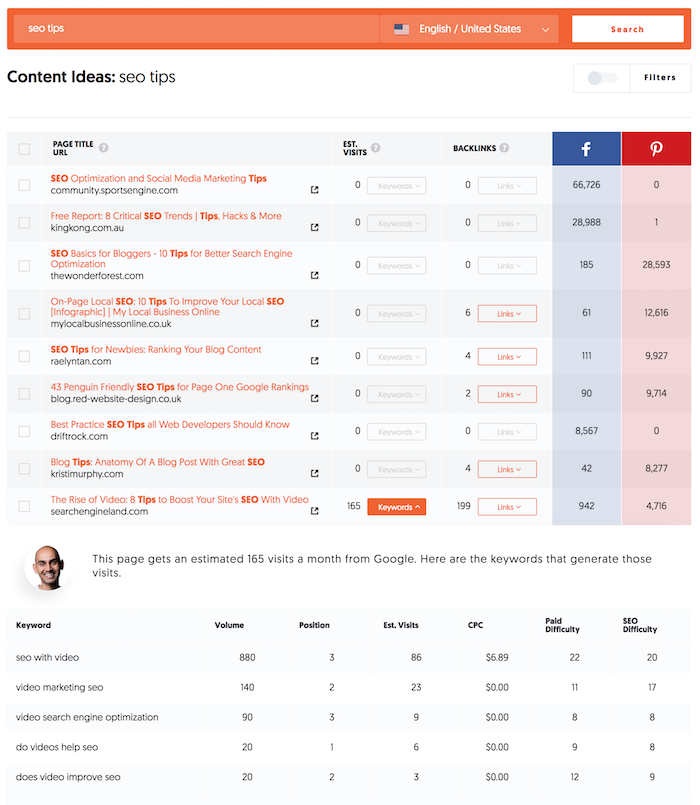

When you find a good one, click “View All” under “Estimated Visits” to see the keywords that the post ranks for.

If you write a similar post, you’ll want to make sure you include these keywords.

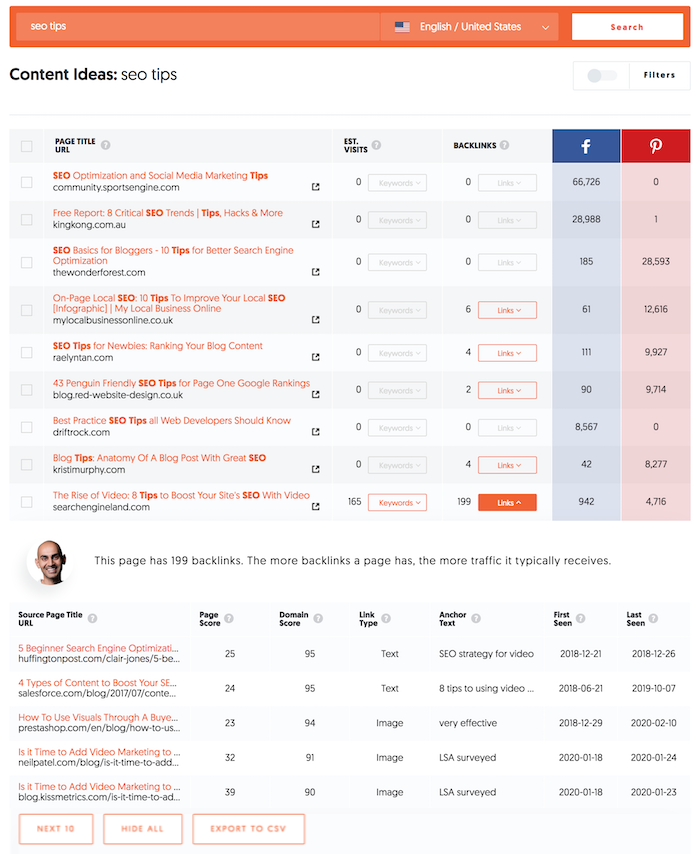

And you’ll want to click “View All” under links to see who links to your competition. Keep track of this as you will use it later. You can do this by copying the list or by clicking on the export button.

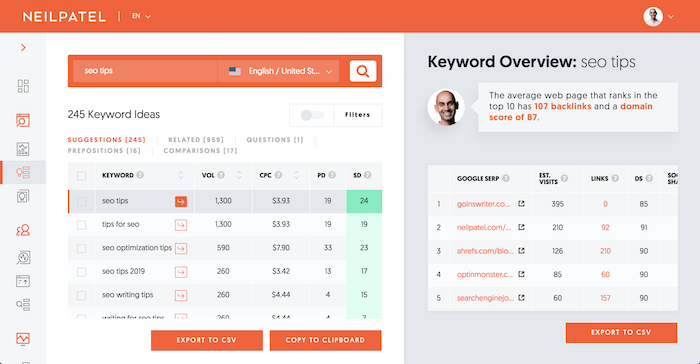

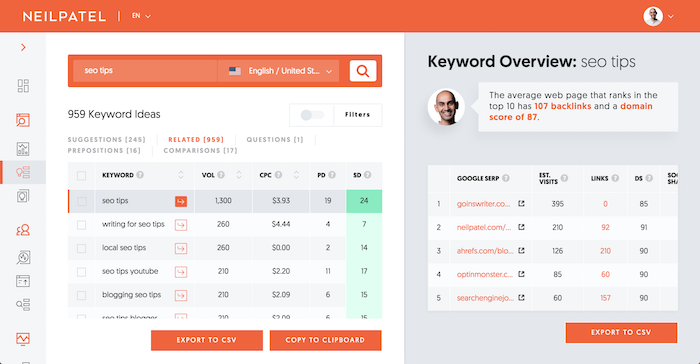

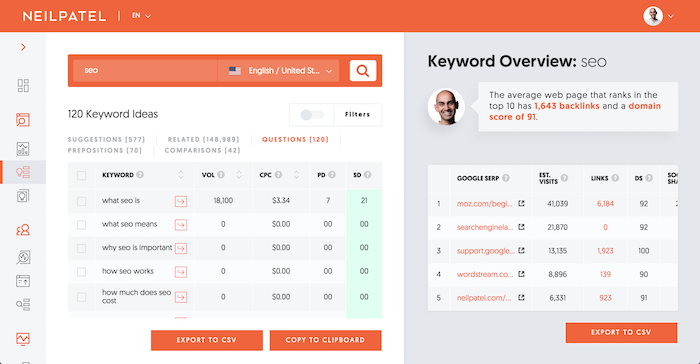

You can also get more ideas by going to the keyword ideas report. So, in the navigation bar, click on the “Keyword Ideas” button.

From there, type in keywords related to what your competition ranks for and you will see a list of long-tail suggestions that are similar.

You can also click on the “Related” link in that report to see a bigger list of related keywords.

And you can click on “Questions,” “Prepositions,” and “Comparisons” to see even more keyword and blog post ideas.

Typically, the more search volume a keyword has the more

traffic you’ll get when you write about it.

Now that you have a list of keywords and topic ideas, it’s time for you to write and publish your content.

If you are new to writing blog posts, watch the video below. It breaks down my writing process.

Step #5: Promotion

I wish SEO was as simple as fixing errors and writing content based on popular keywords but it isn’t.

Remember how I had you create a list of sites that link to your competition?

You know, the ones you got from the “Top Pages” and “Content Ideas” reports.

I want you to start emailing each of the sites linking to your competition and ask them to link to you. See if someone else is linking to your competition. If they are, it shows you that they don’t mind linking to sites in your space. This means that there is a good chance you can convince them to link to you as well.

You’ll have to browse around their site to find their email. But once you do, send off a personal message explaining why your content will provide value to their readers and how it is different/better than what they are currently linking to.

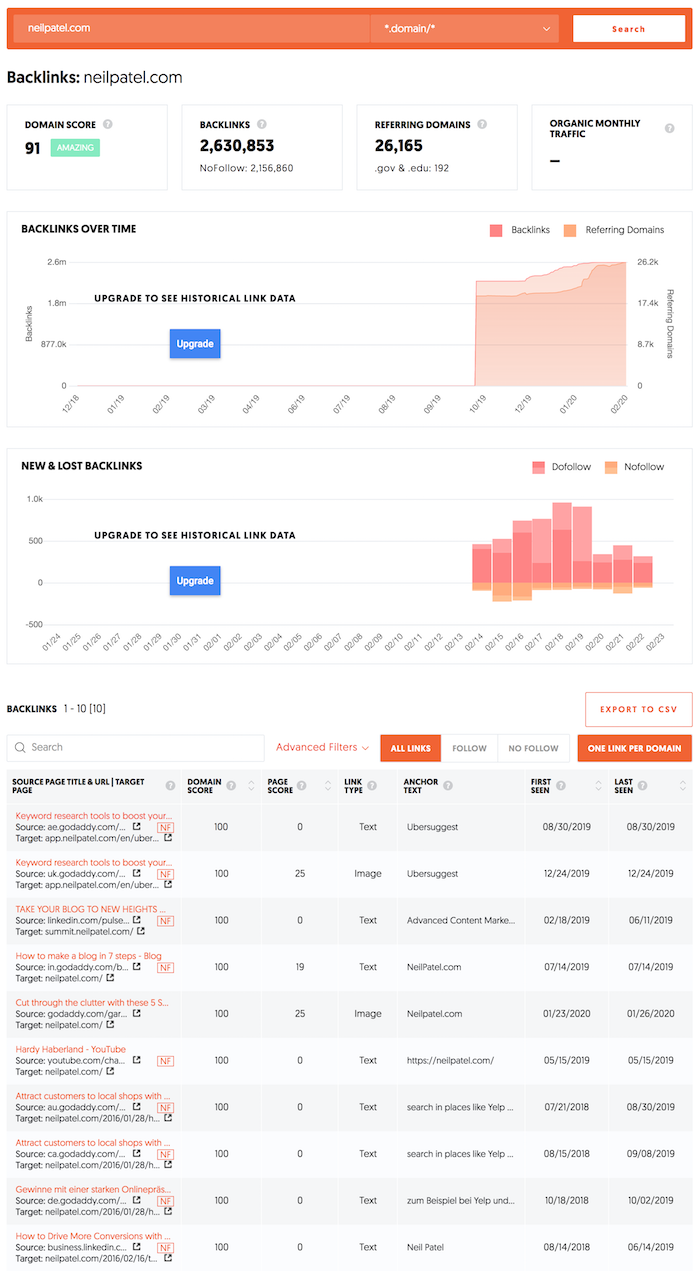

In addition to that, I want you to go to the “Backlinks” report. In the navigation bar, click on the “Backlinks” option.

In this report, I want you to type in your competitor’s domain. You’ll see a report that looks like this:

You’ll be able to see their total link count, link growth over time, and, most importantly, a list of sites linking to your competition.

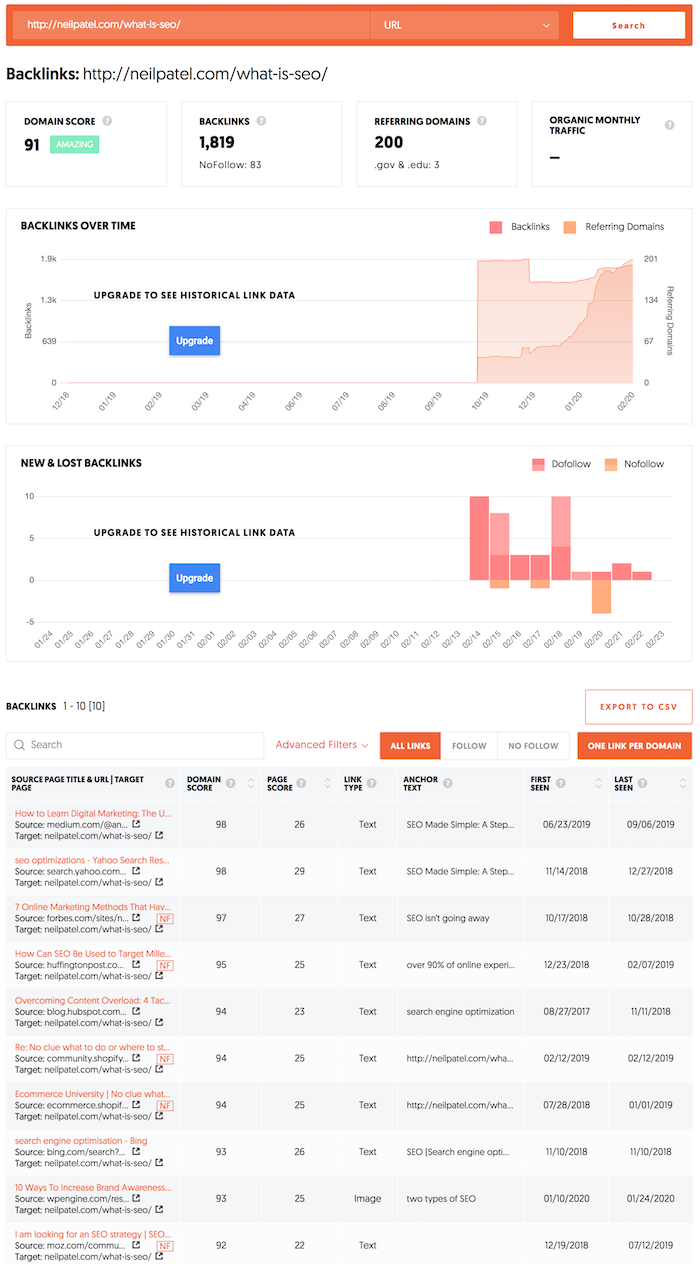

Now type in a URL of a blog post that your competition has written and that you know is popular (do this in the search bar). Next to it, in the search bar, change the drop-down to “URL” and click the “Search” button.

Once the report is done loading, you’ll see a new list of links pointing to that specific URL on your competition’s site.

I want you to do the same thing. Reach out to all of those

URLs and ask for a link as well.

When doing this, you’ll find that a lot of people will ignore you but you need to think of it as sales. You need to follow up and try to convince people. The more links you get, the higher your rankings will climb in the long run.

Even if you only convince 5 people out of 100 that you

email, it is still not bad as something is better than nothing.

Conclusion

My goal with Ubersuggest wasn’t to create too many reports, but instead, make the tool easy to use so you can generate more search traffic.

And as your rankings and traffic climb, you’ll see within your Ubersuggest dashboard how things are going.

What’s beautiful about this is that it will crawl your site automatically once you create a project. This way, when new SEO errors appear, Ubersuggest will notify you.

So, are you ready to improve your SEO traffic? Go to Ubersuggest and create a project.

The post A Step-by-Step Guide to Growing Your SEO Traffic Using Ubersuggest appeared first on Neil Patel.

Is Your Email Marketing Working?

Is Your Email Marketing Working? Inquiries concerning the efficiency of any kind of kind of advertising and marketing venture ought to be asked routinely to make certain the advertising and marketing initiatives are creating the wanted outcomes. Asking these concerns on a routine basis and also constantly reviewing the performance of the e-mail advertising project …