The Very Best Way To Get A Budget Home Owner Insurance Quote Comparison The rate of a house proprietor insurance policy quote plays a huge function in choosing to buy a specific house proprietor insurance coverage plan, there are several various other contrasts you must make. Instead of pick your property owner insurance coverage based …

Month: April 2020

2 New Ways To Increase Residual Income

2 New Ways To Increase Residual Income In today’s globe, a growing number of ladies are coming to be monetarily smart as well as searching for brand-new methods to raise recurring revenue. When I was more youthful, I never ever came across words “recurring earnings”. My daddy strove, made little as well as battled economically. …

The Most Effective Way To Get A Budget Home Owner Insurance Quote Comparison

The Very Best Way To Get A Budget Home Owner Insurance Quote Comparison

The rate of a house proprietor insurance policy quote plays a huge function in choosing to buy a specific house proprietor insurance coverage plan, there are several various other contrasts you must make. Instead of pick your property owner insurance coverage based upon cost alone, do some window shopping with numerous various property owner insurer as well as the quotes they provide you.

Get in touch with your state’s division of insurance coverage and also locate out if the house proprietor insurance policy firms you are contrasting are certified to do company in your state. Several have actually dropped sufferer to unprofessional residence proprietor insurance coverage business that take a trip to their locations supplying unbelievably affordable house proprietor insurance policy quotes without legitimately being enabled to do so.

Search for a couple of independent research study business as well as learn the monetary ranking of the resident insurance provider you are contrasting. The economic ranking of a homeowner insurance provider informs you the economic stamina of the property owner insurance provider, and also monetary toughness is very important.

When you have a checklist of feasible house proprietor insurance coverage business that are accredited to do company in your state as well as have solid monetary rankings, offer them a phone call. A certain residence proprietor insurance coverage business will not shy away from these inquiries.

Ask your next-door neighbors regarding their house proprietor insurance policy when all is stated and also done. Referral is the truest kind of ad.

Get in touch with your state’s division of insurance coverage as well as locate out if the residence proprietor insurance coverage business you are contrasting are certified to do company in your state. Numerous have actually dropped target to unprofessional residence proprietor insurance policy business that take a trip to their locations providing unbelievably inexpensive residence proprietor insurance policy quotes without lawfully being permitted to do so.

As soon as you have a listing of feasible residence proprietor insurance coverage business that are accredited to do service in your state as well as have solid economic rankings, offer them a phone call.

The post The Most Effective Way To Get A Budget Home Owner Insurance Quote Comparison appeared first on ROI Credit Builders.

LogDNA (YC W15) – Is Hiring Senior Engineer (Remote)

Article URL: https://boards.greenhouse.io/logdna/jobs/4703358002

Comments URL: https://news.ycombinator.com/item?id=22809710

Points: 1

# Comments: 0

How to Adapt Your Marketing During the Coronavirus (COVID-19)

It’s been roughly a month now since the Coronavirus started to flip our lives upside down.

From having to practice social distancing and getting used to life without the outdoors to continually washing our hands and wearing masks and seeing loved ones and friends getting sick, the Coronavirus is something none of us expected.

Even our businesses are suffering. Just look at the Coronavirus marketing stats I shared a few weeks ago. The results are devastating.

It’s why I decided to change Ubersuggest and make it more free to help small businesses out.

Since then a lot has changed and there are new opportunities that have come around when it comes to your online business and marketing activities.

Opportunity #1: Help others selflessly

My ad agency has thousands of clients around the world. We lost a ton, but we still have enough to see trends in what’s happening.

When I saw businesses starting to lose a lot of money, I decided to give more of Ubersuggest’s premium features for free. That means it would take me much longer to break even, but that isn’t something I am worried about right now.

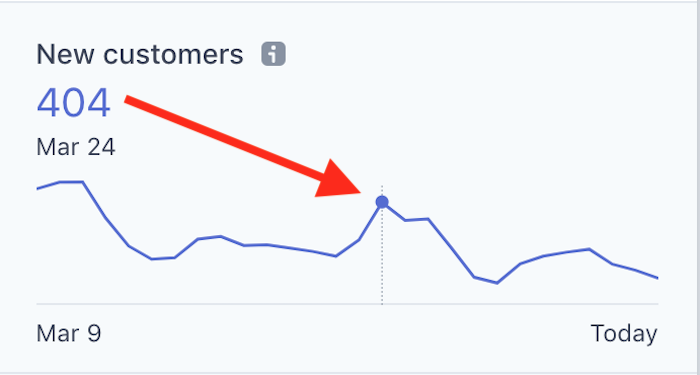

Take look at the image below… you’ll see something interesting.

The chart breaks down how many free-trial signups Ubersuggest has received throughout the past month.

Keep in mind, new customers means free trials… a large portion of free-trial users doesn’t convert into paying customers but still, the more trials you get in theory, the more paid customers you will eventually get.

As you can see, the chart is declining. That’s because I opened up more of Ubersuggest’s paid features and made them free.

What’s interesting is you (and other community members) helped support me.

The moment I blogged about more features being opened up for

free, many of you decided to purchase a paid subscription.

I received dozens of emails from the marketing community thanking me and letting me know that they appreciate everything that I was doing AND they purchased a paid plan to help me out.

Now granted, in general signups are down, but that’s what happens when you decide to give away more for free. I didn’t do it because I am trying to leverage Coronavirus or look good, instead, I am just trying to help people out just like I’ve been lucky enough to have had people help me out during my times of need.

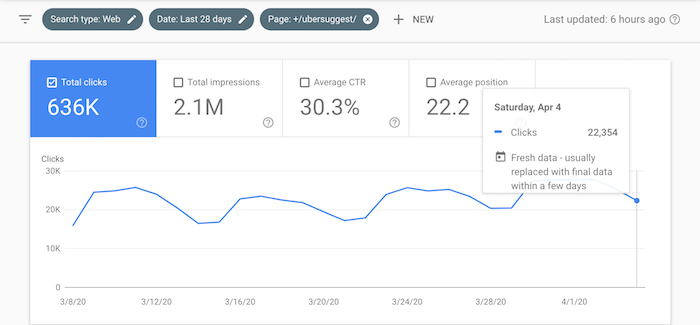

But here is what’s interesting… my traffic started to go up

on Ubersuggest the moment I

told everyone that I am giving more away for free.

I’m not the only one who experienced this.

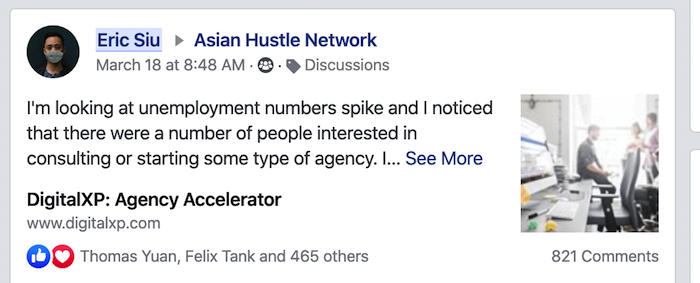

Eric Siu decided to give away a course that teaches people how to start a marketing agency for free (he normally charges $1,497) and a bit more than 250 people have taken Eric up on his offer.

This has led Eric to gain more social media fans and it’s

given him an opportunity to do a webinar about his product/services to a new

audience of 50,000 people.

Similar to me, Eric wasn’t trying to do this to gain

anything, he is just trying to help people out.

I also know someone in the health space who did something similar and one person in the employment space.

They all saw the indirect benefits of helping people out.

In all cases that I have seen, the result is more traffic.

With your website and business, consider what you can give away for free. Anything you can do to help people out is appreciated, especially during this difficult time. You’ll also find that it will drive you more visitors, which is a nice indirect benefit.

Opportunity #2: Paid ads are really, really cheap

The latest trend we are seeing is that paid ads are becoming cheaper.

It makes sense because the way these big ad networks make money is through an auction system. They need small businesses to drive up the cost per click (CPC) for ads so that way the big, billion-dollar corporations have to spend more money on ads.

If you don’t have as many small businesses advertising (like we are experiencing now) there isn’t as much competition for the inventory, so the cost per click decrease.

But the virus has been causing us to spend more time online, so much so that companies like Netflix have had to reduce their streaming quality to help.

In other words, traffic on the web is up and there are fewer advertisers. This means ads are cheaper.

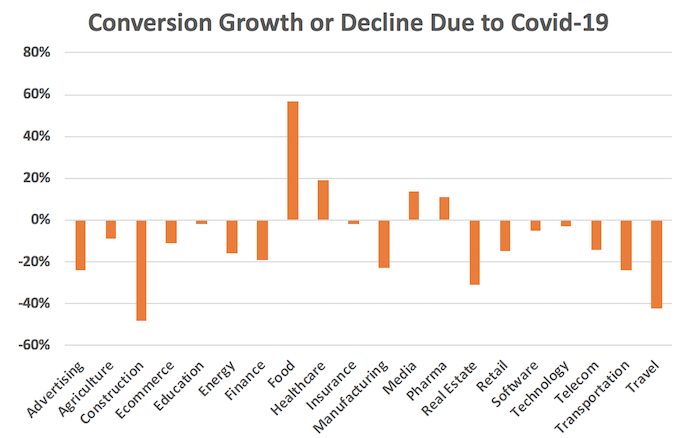

Now we are also seeing conversions rates dropping in certain

industries, but nowhere near at the same rate as the CPCs.

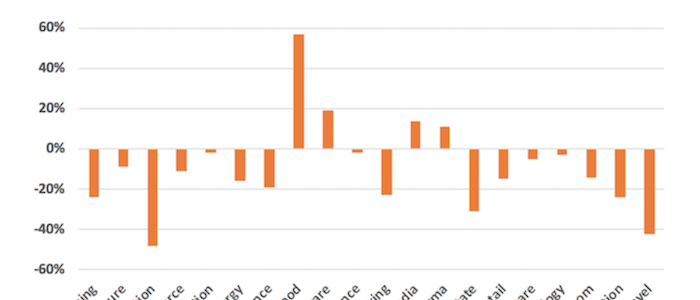

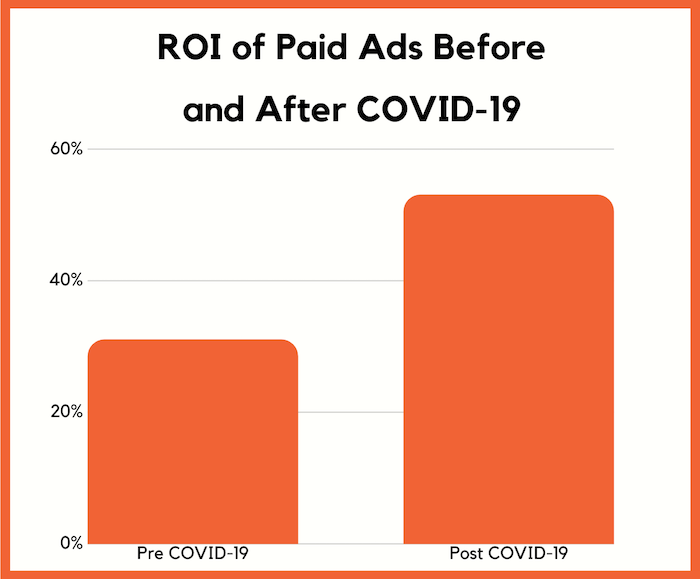

When we average things out per industry and globally, we are seeing paid ads producing a much higher ROI than before the Coronavirus hit. Just look at the chart below.

Our clients, in general, have seen their ROI go from 31% to 53%. That’s a 71% increase in ROI.

If you haven’t tried paid ads yet, you should consider it. If you do, consider ramping up as there is more excess inventory than there has been in years.

Opportunity #3: Conversions are down, but there’s a

solution

For many industries, conversion rates are down. Here’s a

quick snapshot of what it looked like right after the first big week in the

United States.

Since then, things have changed. For some industries, it has gotten better, but for others like travel, it’s still terrible and will be for a while. Delta Airlines is currently burning $60 million a day.

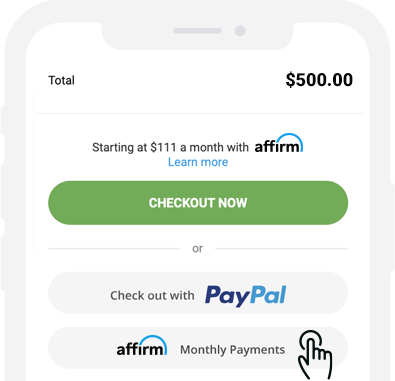

But we found a solution that has boosted conversion rates by 12% on average.

If you are a store selling something online, consider offering payment plans through services like Affirm.

Payment plans reduce the financial burden your customers

will face in the short run.

And you don’t have to be an e-commerce company to leverage payment plans. If you are selling consulting services, you can accept money over a period of a year.

If you are selling ebooks or digital courses, you can also

have a monthly installment plan.

When I sold digital products on NeilPatel.com, I found that roughly 19% of people opted in for my payment plan.

It’s an easy way to boost your conversion rates, especially in a time where many people are looking to reduce their cash spend in the short term.

Opportunity #4: Offer educational based training

If you are looking for a good opportunity, consider selling

your audience educational based courses.

With unemployment

numbers reaching all-time highs, more people than ever are looking for new

opportunities.

Many of these opportunities are in fields like high-tech

that not everyone has experience in.

And, of course, going back to school can be expensive and is time-consuming. Plus, let’s face it… you can probably learn more applicable knowledge on YouTube than sitting in a college class for 4 years (at least for most professions).

So, where do people go to learn? Any online education

website offering very specific, niche advice and courses.

Whether that is Udemy or you are selling your own courses, people are looking for help.

If you don’t know how to sell online courses in mass quantity, follow this. I break it down step by step and even give you the templates you need to be successful. It’s the same ones I used to reach over $381,722 a month in sales.

Opportunity #5: Geography diversification

COVID-19 is a global issue. But it is affecting some

countries worse than others.

For example, South Korea has had better luck controlling the spread of the virus compared to many other countries.

And countries like the United States and Italy have exploded

in daily cases.

With over 84,000 new cases a day and growing quickly, the spread of the virus or the slowdown of the virus can affect your traffic drastically.

For that reason, you should consider diversifying the

regions you get your traffic from.

Through international SEO, you can quickly gain more traffic and be less reliant on one country’s economy.

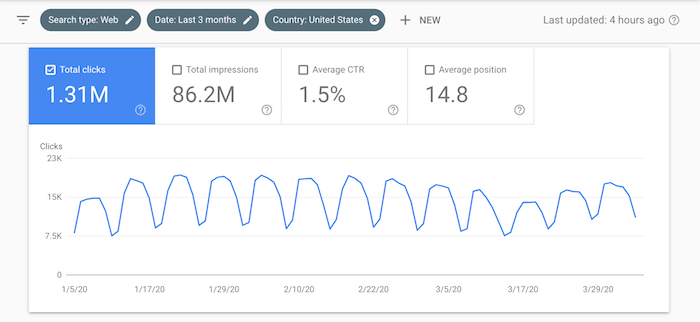

For example, here is my traffic swing for my SEO traffic in

the United States over the last few months.

The US traffic is slowly starting to climb back. It’s still not back to where it was during my all-time highs, but it’s not as low as when the Coronavirus first hit the United States.

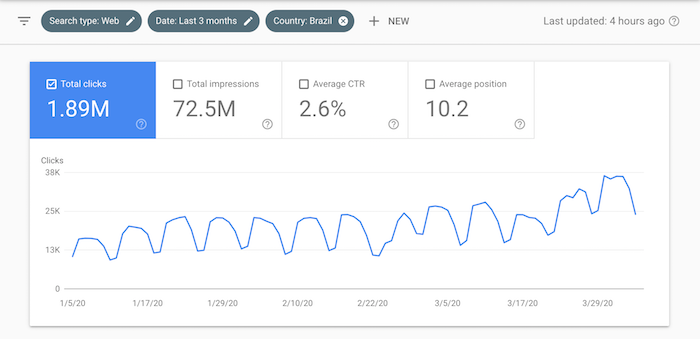

On the flip side, our traffic in Brazil has been going through the roof.

We haven’t changed our strategy, it’s not algorithm related… we haven’t produced more content than usual… we’ve just seen an increase.

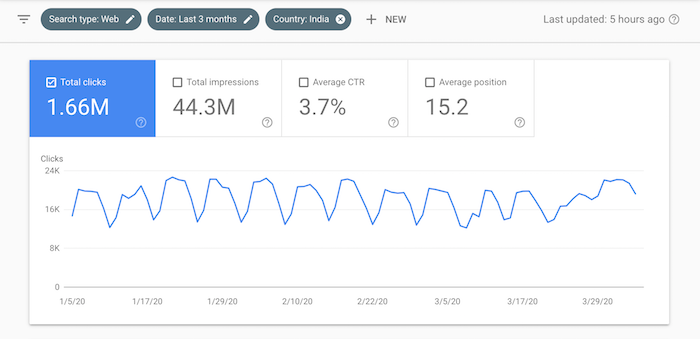

We are also starting to see a nice increase in India.

By translating your content for other regions and leveraging international SEO, you can quickly grow your traffic.

Sure, it may take 6 months to a year to start seeing results in the United States, but that isn’t the case with regions like Brazil where there isn’t as much competition.

If you want to achieve similar results to me, follow my global SEO strategy.

It works well… just look at the images above.

Conclusion

Sadly, the next few months are going to get worse. The daily

count of new Coronavirus victims is growing.

From a personal standpoint, all you can do is stay indoors and practice social distancing.

But from a marketing, business, and career perspective, you can make a change.

You should have more time now (sadly), so use it to your

advantage. Put in the effort so you can grow, that way you’ll come out of the

Coronavirus stronger.

So which one of the above opportunities are you going to implement first?

The post How to Adapt Your Marketing During the Coronavirus (COVID-19) appeared first on Neil Patel.

Individual Liability on Business Credit Cards

Individual Liability on Business Credit Cards

If business does not fulfill these requirements, business bank card companies will certainly make use of the credit rating of the primary making business charge card application as their basis for reviewing credit rating threat.

Do note that a lot of service bank card companies will certainly not authorize your application for an organisation charge card unless you consent to the individual responsibility arrangement. This basically makes an organisation charge card the like an individual bank card from an individual obligation viewpoint. Whenever your company stops working to settle the service credit history cards, the company might conjure up the individual obligation arrangement in order to gather repayment from the organisation credit report card principal.

Your individual credit score records will certainly additionally have a document of your company credit rating card background due to the fact that of this individual obligation arrangement on your service credit score card application. If you make late repayments on your company credit rating cards, you will certainly as a result harm your individual credit report rating. It will certainly inflate your individual financial debt worry as well as create you to show up exhausted if your organisation collects a huge financial debt.

If you can reveal that you faithfully make your routine repayments, you must be able to encourage the company of service credit rating cards to eliminate the stipulation after a couple of years. Whatever the situation might be, undertaking to have the company develop its very own credit rating background. This will ultimately enable you to divide your tiny service credit history card from your individual debt documents.

You need to be mindful that considering that service credit rating cards are not planned to be made use of by customers, the customer securities appropriate to individual debt card are not always existing in service debt cards. When making usage of individual debt cards, the regulation gives you the right to conflict payment mistakes on your account within the specific duration of time.

When you obtain purchased product in bad problem, you can not contest the fees as well as in instance the supplier rejects to comply, ask for business bank card business to interfere in your place– as they perform in the situation of individual bank card. With service charge card, you are greatly by yourself.

Should you lug a little organisation credit report card instead than an individual credit score card? When your company has actually developed its track document, you can divide individual and also company financial resources.

Do note that many organisation debt card providers will certainly not authorize your application for a service credit report card unless you concur to the individual obligation stipulation. Whenever your service stops working to settle the company credit report cards, the provider might conjure up the individual obligation arrangement in order to gather repayment from the organisation credit score card principal.

Due to the fact that of this individual responsibility arrangement on your service credit report card application, your individual credit report records will certainly additionally consist of a document of your service debt card background. You should be conscious that given that service credit rating cards are not meant to be made use of by customers, the customer securities suitable to individual credit scores card are not always existing in service credit history cards.

Crucial Events Of The Stock Market Timeline

Crucial Events Of The Stock Market Timeline

A thorough securities market timeline would possibly require to be performed in quantities. In the following numerous hundred words I will certainly try to describe essential occasions of the stock exchange timeline you may desire to called a basic inquisitiveness.

Our securities market timeline starts in 1790, with the federal government issuance of $80 million in U.S. bonds.

In 1792, there are 2 federal government bonds and also 3 financial institution supplies traded for a total amount of 5 protections.

Our securities market timeline relocates right into the 1800s with federal government bonds, financial institution supplies, as well as insurance coverage supplies trading after the War of 1812.

In 1817, a constitution as well as guidelines are created for doing supply profession. Right now, the New York Stock as well as Exchange Board is officially arranged.

Our securities market timeline currently relocates us to the opening of the Erie Canal in 1825, when New York State bonds are released to money the building.

In 1850 the shares quantity gets to 8500, which stands for a fifty-fold boost in just 7 years.

In 1836, the NYS&EB forbids it subscription from trading supplies in the road.

Throughout the panic of 1857, the Ohio Life Insurance as well as count on Company collapses as well as the marketplace recognizes a 45% given that the beginning of the year.

In 1863, the New York Stock and also Exchange Board comes to be the New York Stock Exchange.

In 1903, the New York Stock Exchange and also our securities market timeline step right into the twentieth century. The stock exchange commemorates this by transferring to its present home at 18 Broad Street.

Among one of the most notable events of our stock exchange timeline is the panic of 1907, throughout which troubles at Knickerbocker Trust trigger a work on all the city financial institutions. J. P. Morgan enters as well as bolster funds as well as finishes the work on the financial institutions.

The Federal Reserve is developed in 1913.

The stock exchange timeline sees Wall Street end up being the financial investment funding of the globe, replacing London at the end of World War I.

A 23-storey workplace tower with extra trading area is constructed beside the initial framework.

In 1923, a historical advancing market run starts that will certainly extend our securities market timeline for a lot of the following 6 years.

Black Thursday begins the securities market timeline on Thursday, October 24, 1919 when supply rates drop greatly on a document quantity of 13 million shares.

The securities market timeline has its most critical day on Tuesday, October 29, 1929, when the stock exchange accidents and also notes the begin of The Great Depression.

In 1990, 10 years prior to our stock exchange timeline brings us right into the 21st century, greater than 50 million Americans very own supply.

On May 17, 1992, our securities market timeline notes both a century wedding anniversary of the NYSE.

On October 27, 1997, the Dow Jones collisions 554 factors and also sets off the very first breaker security that shuts the NYSE at 3:30 PM.

Our securities market timeline relocates us right into the 21st century in which we experience several of the most awful economic times because our securities market timeline left the Great Depression. We have actually currently been presented to federal government financial institution bailouts as well as taxpayer-owned firms. Just time will certainly inform where out stock exchange timeline takes us next off.

The post Crucial Events Of The Stock Market Timeline appeared first on ROI Credit Builders.

Do You Understand Your Commercial Credit Report?

Lenders often look at your commercial credit report in addition too, or in lieu of, your personal credit score. As you know, they use the information on the report to help them decide if your business is a good credit risk, or a bad one.

Your Commercial Credit Report Can Affect the Fundability of Your Business

So, why is it important to understand your commercial credit report? The answer is, because what your commercial credit report says greatly affects the fundability of your business. Of course, there are many factors that affect fundability, and it is important to understand each of them. However, there are many pieces to the fundability puzzle and it is best to understand each one individually.

Keep your business protected with our professional business credit monitoring.

Commercial Credit Report: Dun & Bradstreet

Dun & Bradstreet offers six different reports. Truly, the one utilized most often by lenders is the PAYDEX. Honestly, this is probably because it is the one most like the consumer FICO score. You see, it measures how quickly a company pays its debt on a scale of 1 to 100. For reference, lenders like to see a score of 70 or higher. To put it in perspective, a score of 100 reveals the firm makes payments ahead of time. A rating of 1 shows they pay 120 days late, or more.

Together with PAYDEX, they offer the following scores and reports.

Delinquency Predictor Score

As you might imagine, this rating determines the chance the company will not pay, will be late paying, or will come file for bankruptcy. For scoring, the range is 1 to 5, with 2 being a good score.

Financial Stress Score

Not surprisingly, this is a measurement of the pressure on a firm’s balance sheet. It shows the possibility of a closure within a year. The range is 1 to 5, and a 2 is good.

Supplier Evaluation Risk Rating

This is a ranking that predicts the odds of a firm surviving one year. Similarly, it ranges from 1 to 9, with a 5 being a good score.

Credit Limit Recommendation

As the name implies, this is a recommendation for the amount of debt a company can handle. Financial institutions usually use it to establish how much credit to extend.

D&B Credit Rating

This is an estimation of overall business risk on a scale of 4 to 1, where a 2 is considered good. The smaller the number the better. The rating is given as a combination of numbers and letters, which together show a company’s net worth.

Consequently, if there isn’t enough data on a business to assign a regular rating, an alternative score is assigned. This is called a credit approval score. It is based on the number of employees. They will use any data they have available to calculate this alternative rating. That means, a company can control this to a point by ensuring D&B has all of the information they need.

Commercial Credit Score

Along with the PAYDEX, Dun & Bradstreet releases a commercial credit report in three components. Each part shows how likely the business is to default on expenses or become seriously late on payments.

Commercial Credit Score

On a range of 101 to 670, the commercial credit score anticipates the likelihood of a firm making late payments. A rating of 101 indicates it is very likely that the company will be late with payments. Likewise, a score of around 500 is good.

Commercial Credit Percentile

For this measurement, the scale runs from 0 to 100. It shows the chance of delinquency too. However, it determines this probability versus other companies in the Dun & Bradstreet system. A rating of 1 is the highest possible probability in relation to other companies. The majority of loan providers consider a rating of 80 or higher to be an advantage.

Commercial Credit Class

In contrast to the other reports, this is an approach of dividing businesses into classes based on the chance of delinquency. Firms in class 1 are the least likely to be overdue. Likewise, if you are in class 2, that’s still good.

What Goes into the D&B Commercial Credit Report Ratings Calculation?

The exact formula used by Dun & Bradstreet to calculate their ratings is proprietary. What we do know is what information they look for and where they get it. The initial source of this information is the business itself.

A business must submit a financial statement to D&B before getting a full rating. Without that, a business gets a limited rating based on the number of employees. For example, the rating would be 1R if the business has 10 employees or more. But it’s 2R if they have fewer than 2 employees.

With no financial statement, a composite credit appraisal can still be issued. However, a business is only eligible for a rating up to a 2 in this case. They are ineligible for a 1 rating without a financial statement.

Businesses can also submit trade references to Dun & Bradstreet themselves. The catch is, it costs money to do so. Furthermore, there is no guarantee it will result in a score increase. Anyway, if you are properly building business credit it will happen for free.

Keep your business protected with our professional business credit monitoring.

Besides getting data from the business, Dun & Bradstreet also accesses public records. They look for liens and bankruptcies, and anything to show creditworthiness, or a lack thereof. They also partner with the Small Business Finance Exchange to access data from their records.

Commercial Credit Report: Experian Business Credit Scores

Experian gathers data from a lot of the same sources as Dun & Bradstreet. As a result, their reports are similar. There are a few key differences in sources, calculation, and also presentation however.

Intelliscore Plus

Experian uses the Intelliscore Plus credit score, which shows a statistics-based credit risk. The result is, it is a highly predictive score that can help users make well-informed credit decisions.

The Intelliscore scores range from 1 to 100, with a higher score indicating a lower risk class.

Score Range Risk Class

| Low Risk | 76-100 |

| Low-Medium Risk | 51-75 |

| Medium Risk | 26-50 |

| High-Medium Risk | 11-25 |

| High Risk | 1-10 |

Exactly How Does Experian Compute the Intelliscore Rating?

One of the things Intelliscore is most known for is the list of specific key factors they use that can indicate how likely a business is to pay its debt. In fact, over 800 variables go into the Intelliscore Plus calculation. Many of them are from the general information all credit agencies look at. However, some are unique to Experian. Here’s a breakdown.

Payment History

As you might imagine, this is your current payment status. That means, it shows how many times accounts have become delinquent. It also shows how many accounts are currently delinquent, as well as the overall trade balance.

Frequency

Frequency shows how many times your accounts have gone to collections. In addition, it notes the number of liens and judgments you have. Also, it shows any bankruptcies related to your business or personal accounts.

It also incorporates information about your payment patterns. Were you regularly slow or late with payments? Did you decrease the number of late payments over time? That affects your score.

Monetary

This specific factor focuses on how you use credit. For example, how much of your available credit are you utilizing right now? Do you have a high ratio of late balances when compared with your credit limits?

Of course, if you are a new business owner, a lot of this information will not exist yet. Intelliscore Plus handles this by using a blended model to identify your score. This means your personal credit score becomes part of determining your business’s credit score.

Experian’s Blended Score

Surprising to some, the blended score is a one-page report that provides a summary of the business and its owner. A combined business-owner credit scoring model works better than a business or consumer only model. In fact, blended scores have been found to outperform consumer or business scores alone by 10 – 20%.

Experian Financial Stability Risk Score (FSR)

FSR predicts the potential of a business going bankrupt or not paying its debts. Consequently, this score identifies the highest risk businesses by using payment and public records. They look at a number of factors, some of which include:

- high use of credit lines

- severely late payments

- tax liens

- judgments

- collection accounts

- risk industries

- length of time in business

Commercial Credit Report: The Equifax Service Credit Rating

Similarly, Equifax shows three different points on its commercial credit report. These include:

Equifax Payment Index

Similar to PAYDEX, Equifax’s payment index is a measurement on a scale of 100. It shows how many of your small business’s payments were made on time. Like the others, it uses data from both creditors and vendors. However, it’s not meant to anticipate future behavior. That is what the other two scores are for.

Equifax Credit Risk Score

This score shows the likelihood of your company becoming severely delinquent on payments. Scores range from 101 to 992 and include an evaluation of:

Keep your business protected with our professional business credit monitoring.

- Available credit limit on revolving credit accounts, including credit cards

- Company size

- Proof of any non-financial transactions (like merchant invoices) which are late or were charged off for two or more billing cycles

- Length of time since the opening of the earliest financial account

Equifax Business Failure Score

Equifax’s business failure score takes a look at the risk of your business shutting down. Similar to others, it runs from 1,000 to 1,600 and bases its scoring on these factors:

- Total balance to total current credit limit in the past three months

- The amount of time since the opening of the oldest financial account

- Your small business’s worst payment status on all trades in the last 24 months

- Proof of any non-financial transactions, like merchant invoices, which are late or are on a charge off for two or more billing cycles

For the credit risk and the business failure scores, a rating of 0 means bankruptcy.

Equifax Scores

A positive Equifax score for your business is as follows:

- Payment Index 0 to 10

- Credit Risk score 892 to 992

- Business Failure score 1400 to 1600

Are These the Only Agencies Where You Can Get a Commercial Credit Report?

Actually, there are multiple other agencies that will issue a commercial credit report. It’s just that these three are the most commonly used. Still, there has been an increase in the use of another option recently. It’s the FICO SBSS.

Commercial Credit Report: What is the FICO SBSS?

The FICO SBSS is the business variation of your personal FICO credit report. Unlike your personal FICO, the SBSS reports on a scale of 0 to 300. The higher the score the better. However, the majority of loan providers demand a rating of least 160.

How Do They Come Up with The FICO SBSS Score?

Surprisingly, it is significantly different from other business credit scoring designs. The SBSS utilizes your corporate credit score and personal credit rating. It also makes use of monetary details like business assets and income. As you can see, the goal is to give an overall financial picture rolled into one rating.

Unfortunately, business owners cannot access their FICO SBSS by themselves. There is a proprietary formula for score computations. Furthermore, they do not make that data public. As a result, you go into lending institutions blind as to what your FICO SBSS credit rating might be.

Complicating things even more, lenders can choose how certain factors are weighted in the calculation of your score. This means your FICO SBSS could actually be different from one lender to the next. For example, one lender could put more weight on your business payment history, while another could lean more on your personal credit score.

How Does Your Commercial Credit Report Affect Overall Fundability?

As I said before, overall business fundability is an intricate web woven out of your business information, business credit, organization, personal credit, public records and more. Your business credit, though only one part, is a large part of the fundability puzzle. This means, you need to know what your commercial credit report says, why it says it, how it is affecting the fundability of your business, and how to make changes when necessary.

The post Do You Understand Your Commercial Credit Report? appeared first on Credit Suite.

IndyCar cancels Detroit double, adjusts schedule

With the IndyCar series on hold due to the COVID-19 pandemic, Roger Penske said he had no choice but to cancel the doubleheader race at Detroit. The tentative start to the season is June 6 at Texas Motor Speedway.

The post IndyCar cancels Detroit double, adjusts schedule appeared first on Buy It At A Bargain – Deals And Reviews.

New comment by freelancesecops in "Ask HN: Freelancer? Seeking freelancer? (April 2020)"

SEEKING WORK | Utrecht | Local or remote Seeking work as a freelance DevOps engineer. Technologies: • Ansible (RHCE) • Docker Containers and Docker Swarm • Linux (RHCSA) • Scripting in Python, Javascript, Bash • CI/CD pipelines with Jenkins, Gitlab • Terraform My main drives are to build clean IaC, automate everything that can be …