Everyone wants the best of the best, and it should be no different when it comes to business loans. However, you may need to change your thinking about what actually makes the best business loans the best. Build Fundability So You Can Get the Best Business Loans For example, do great terms make a loan … Continue reading How Being Fundable Helps You Get the Best Business Loans

Month: August 2020

Circle Medical (YC S15) Is Hiring a Senior Front End Engineer in Montréal

Article URL: https://jobs.lever.co/circlemedical/46d8485b-0092-48a5-8a26-96262438353d Comments URL: https://news.ycombinator.com/item?id=24299277 Points: 1 # Comments: 0

The post Circle Medical (YC S15) Is Hiring a Senior Front End Engineer in Montréal first appeared on Online Web Store Site.

New comment by Dsuniga14 in "Ask HN: Who is hiring? (August 2020)"

Qualia | Sr. Security Engineer, Sr. Infrastructure Engineer, Sr. Full-Stack Software Engineers | San Francisco, CA or 100% remote in PST/MST time zones | Full-time, Salary + Options Qualia (qualia.com) is a startup making web applications for real estate professionals. We have raised over 95M in total funding, have not stopped hiring throughout COVID and …

The post New comment by Dsuniga14 in “Ask HN: Who is hiring? (August 2020)” first appeared on Online Web Store Site.

These Inspiring Entrepreneurs Are Crushing It On Instagram

We all have an entrepreneur inside of us. All it takes is daily inspiration and motivation to unleash it. Most especially, from those who have exciting success stories and are clearly passionate about what they …

The post These Inspiring Entrepreneurs Are Crushing It On Instagram appeared first on Paper.li blog.

New comment by kitline in "Ask HN: Who wants to be hired? (August 2020)"

Location: Italy

Remote: Yes

Willing to relocate: No

Technologies: Python, Css, Html, Webgl, git, scripting, foss

Résumé/CV: https://dueacaso.it/about/cv_adelina.pdf

Email: doncheva [dot] adelina [at] gmail.com

The post New comment by kitline in “Ask HN: Who wants to be hired? (August 2020)” appeared first on ROI Credit Builders.

How to Choose The Right SEO Agency

Today, there are hundreds, if not thousands, of SEO agencies out there.

And each one of them is good for something.

Thus, your question shouldn’t be, how do I find the right SEO agency, but how do I choose an SEO agency that’s right for me?

I’m glad you made it here, as I’ll guide you through how to avoid choosing an SEO agency that’s right for something not relevant to growing your business.

Deal?

Well, then, keep reading.

First things first, why do you need an SEO agency?

Know Your Goals and Desired Outcomes

Imagine you hurriedly booked a last-minute flight from New York to meet some business partners. Thankfully, the airplane you boarded flew fast with no delays.

And you land safely at the airport.

On arrival, the announcer congratulates you for a safe journey and welcomes you to Beverly Hills in Texas. Meanwhile, your intended destination was Beverly Hills in California.

You’ll regret the waste of your time, right?

Hiring SEO agencies is like boarding that airplane – each one could be great at flying your site’s organic ranking somewhere. Your first job before you start flying, therefore, is to ensure you choose and are on the right plane.

Thus, to choose and onboard an SEO agency that’s right for you, you must:

- Know your business destination (your goals), and

- What you want to achieve when you get there (your desired outcomes).

In SEO, where you’re going requires a different airplane (or agency). The main ones being:

- SEO-optimized content marketing

- Voice SEO

- Link building,

- Local SEO, and

- eCommerce SEO

And for outcomes?

You may need to:

- Rank your entire website or specific keywords higher

- Get more qualified traffic and leads, or

- Drive sales directly from organic search.

Your target business goals and outcomes determine what SEO strategies and tactics you’ll need.

And because no SEO agency is a one-size-fits-all for all strategies, industry verticals, and company sizes, knowing these basics lays the foundation for who you’ll partner with.

Let’s take some hypothetical examples.

Example #1

Pretend that your goal is to show up on Google’s 1st page when certain people use certain words to search for certain information relevant to your business.

And the outcome?

You want to attract this set of people, educate them with engaging content, and pull them into your sales funnels.

In this case, you’ll need an agency with expertise in SEO-optimized content marketing. And you’ll need one with proven results in helping other companies achieve similar results:

Example #2

Okay, let’s assume you have freelancers creating excellent content pieces for your site. But you realize Google isn’t ranking them for your target keywords.

Instead, when people search, content pieces below the quality of what you’re creating keep showing up on the top pages while yours languishes on Google’s 17th page.

This situation indicates your competitors probably have higher domain authorities or more backlinks pointing to their website and high-ranking content pieces.

In this case, to increase your website’s domain authority, get relevant links pointing to your content, and boost ranking, you’ll need an SEO agency with expertise in link-building:

As you saw in both examples above, it’s easier to know what type of SEO agency is worth considering when you’re definite about your goals and outcomes.

Taking this first step to look at yourself in the mirror and know exactly what you need streamlines the selection process.

It also ensures you only shortlist agencies with expertise and experience driving other businesses to your intended destination.

But, it doesn’t end there.

Even with only a few dozen agencies to consider, choosing one that’s right for you still demands you look out for characteristics that prove they walk the talk.

Doing this further helps you vet and choose an SEO agency that’s perfect for you.

6 Characteristics That Make a Great SEO Agency

Regardless of the specific SEO needs you have, you’ll still find dozens, if not hundreds of agencies, vying for your business.

The search engine optimization service providers’ industry is valued over $65 billion.

Thus, expect anyone with a laptop and internet access to make wild claims of being an SEO agency, as they yearn for a slice of the industry’s billions.

There are characteristics great SEO agencies possess. And you’ll find these traits in all the best SEO companies.

I’ll list the fundamental ones below.

Use them to vet an SEO agency from the list you shortlist before choosing to work with any.

1. A Defined Process to Execute SEO Strategies

Excellent SEO execution follows a battle-tested process.

As an SEO agency gains experience working with numerous clients, they outline their winning process to give potential customers a peek into how they deliver results.

Thus, each company with practical SEO experience has its own process. And this makes it a characteristic of SEO agencies with proven results.

For example, at Neil Patel Digital, our process follows eight unique steps:

2. A Diverse Team of Specialists

The next characteristic to look out for before choosing an SEO agency is the team to put their process and recommendations to work.

A lot of thought goes into SEO execution.

From strategic ideation and leadership to account management and execution specialists, ask for the team who’ll work with you to achieve your goals.

Again, experienced SEO agencies are proud to make their team public:

3. An Impressive Client Portfolio

Results-generating SEO strategies are hard to manage from ideation to execution, but they also take time and commitment.

Thus, as exceptional SEO agencies work with clients to achieve results, displaying their clientele has become a common characteristic.

Doing this does two things.

It shows you they’re experienced. And it helps your decision to choose, using the type of companies they’ve worked with as a benchmark:

4. Real Customer Testimonials

If an SEO agency helped increase your website traffic, leading to more sales, you’d be open to giving them a testimonial, right?

In the same vein, when choosing an SEO agency, scan their website for what past customers say about them.

A common characteristic you’ll find with the best SEO agencies is the proud display of what happy customers say about their service:

5. Industry-specific Thought Leadership

Exceptional SEO agencies are always on the forefront of the latest trends, especially how it impacts rankings, traffic, and business in general.

In most cases, you’ll find a top executive of the company sharing insights via blogs, social media, and research papers, which makes them maintain thought-leadership.

So, before you hire an SEO agency, check if they’re up to date and share recent trends about the SEO industry that help you keep pace with the market:

6. A Crisp-clear Company Culture

An SEO company may have the unique expertise you seek and all the characteristics listed above. Yet, their company culture may not fit with yours.

The truth is, exceptional SEO agencies don’t take on toxic clients; neither would you like to work with people whose values you don’t agree with.

To avoid this, top SEO companies have the characteristic of displaying their company culture, so potential customers can decide if working with them aligns with their culture:

How to Work With an SEO Agency

Most SEO agencies work as an extension of your in-house marketing team.

Thus, there are steps to working with an SEO agency that’s right for you. These steps are essential, as they ensure your collaboration with them is successful.

Let’s explore the major ones.

1. Prepare your in-house, front-facing team

Before you work with an SEO agency, get relevant teams in your company on the same page. Let them know why your company needs to hire SEO professionals and how working with them will impact your business.

Also, select those who’ll work directly with the SEO agency to drive the results you seek. The people you choose would help to bridge the communication gap between your company and the agency.

Doing this ensures that there’s always someone to keep the SEO agency in sync with your company culture, goals for working with them, expectations, and timeline.

2. Discovery session

Working with an SEO agency could be to rank higher for target keywords, generate more traffic, drive sales, or all three.

But, no business case and needs are precisely the same. And SEO strategies that worked for company A may not work for yours.

Thus, take the time to share everything about your business as it concerns SEO with an agency you choose to work with. Doing this helps them develop custom strategies and plans unique to achieving your goals.

Exceptional SEO companies allow you to share this information with them via a discovery session:

3. Research and Recommendations

After you share your business situation, needs, and goals with an SEO company, be on the lookout for what they do next.

Top SEO agencies don’t jump into sending you quotes and invoices.

They delve into research, using what you shared with them to gain the right context about your business situation. Doing this brings them on the same page with your company, target audience, business goals, and competition.

After this research, they usually share recommendations of what needs to be done to get maximum results. They can send this recommendation via a report sent over email or talk you through it over a phone call.

4. Contract with Deliverables

After your discovery call and follow-up conversations, expect to receive a contract with deliverables from an SEO agency, if working with you looks like a good fit.

It’s best to share this contract with relevant members on your team, especially those working directly with the agency. Ensure to go down to the nitty-gritty of the contract’s terms and conditions.

Also, share it with your legal department to avoid signing an agreement that hurts or binds your company in the future.

5. Onboarding, Project Scoping, and Management

To work with you, an SEO company would request access to some of your digital assets.

Depending on your work scope, such access could include your website or blog passwords, your analytics tools login codes, selected in-house staff, etc.

To kickstart a working relationship with your company, SEO agencies usually take you through a detailed onboarding process.

So, you should expect one.

Over this onboarding session, the scope of your project, delivery timelines, communication channels, and an understanding of how both parties manage your project is defined and communicated.

How to Find The Right SEO Agency For You

So far, I’ve outlined the characteristics of exceptional SEO agencies and walked you through some fundamentals steps to working with one.

But, as I established at the beginning of this guide, you don’t just need the right SEO agency, you need an SEO agency that’s right for you.

How do you find one?

To help you, we put together a list of companies that we believe to be the best in the business.

Also, we skipped SEO agencies who can’t even rank their site organically. Finally, we looked away from digital marketing generalists who do everything under the sun for a quick buck.

The result?

What follows is our vetted list of the five best SEO companies of 2020 by the types of projects they’re exceptional at working on.

The 5 Top SEO Agencies

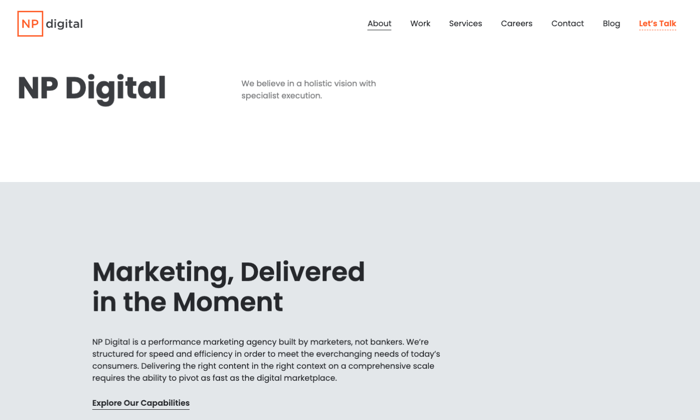

1. Neil Patel Digital – Best For SEO-optimized Content Marketing

At Neil Patel Digital, we’re great at SEO-optimized content marketing.

Our team of highly experienced SEO experts and content marketers brings decades of hands-on experience to the table. We believe brands can influence how their customers think through the creation of distribution of thoughtful, engaging content.

And we put this belief to work by partnering with forward-thinking companies to develop SEO-focused content, performance-based digital marketing strategies and programs that get the attention it deserves.

When you work with us, you’ll deliver content the right types of content to your target audience at the right time:

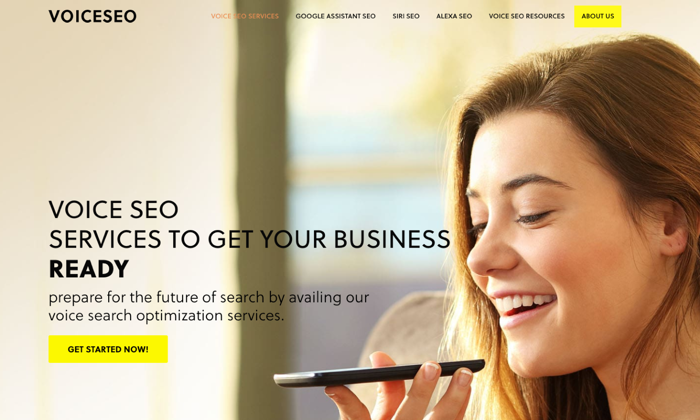

2. Voice SEO – Best For Voice Search

Voice SEO started as a small team of SEO experts. Initially, they focused on using their SEO skills to help businesses like them to grow online.

Through dedication and close observation of the ever-changing SEO industry, Voice SEO realized the growing use of devices such as Alexa, Siri, and Google Echo, to query search engines.

Seeing that 50% of all online searches in 2020 would be voice-based, a statistic in the upward trend, Voice SEO followed the highest standards in SEO to narrow its focus on helping companies with voice search engine optimization:

3. ReachLocal- Best For Local SEO

When it comes to executing best-in-class local SEO strategies, ReachLocal needs no introduction.

This SEO agency is responsible for generating over 201 million local leads for more than 19,000 clients across the globe.

Not only are they the go-to company for practical and strategic local SEO executions, but ReachLocal’s experience also spans over 15 years, and they have offices in five continents:

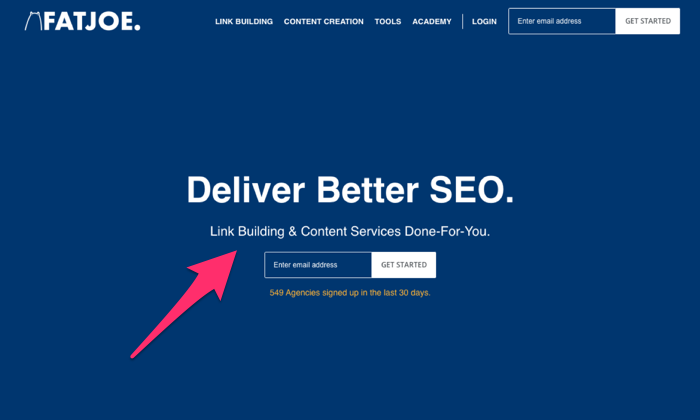

4. FATJOE – Best For Backlinks Acquisition

FATJOE comes highly recommended for acquiring backlinks for SEO. Turn to this SEO agency if you need help generating high-value backlinks.

And you can do this with the assurance that even other SEO agencies rely on them for the same.

FATJOE was founded in 2012. Today, they’ve grown to become one of the world’s biggest outsourced link building agencies, and they serve more than 5,000 clients:

5. OuterBox – Best For eCommerce SEO

OuterBox is our pick for eCommerce SEO.

They’re an SEO and performance marketing company focused on helping eCommerce brands drive growth through search strategy, design, and conversion rate optimization.

Irrespective of which eCommerce platform your business is built on—Magento, WooCommerce, Shopify, Drupal, or others; OuterBox’s eCommerce search engine optimization strategies and tactics are effective and reliable:

Conclusion: Be Patient with Your Chosen SEO Agency

Choosing and partnering with an SEO agency, even one that’s perfect for you, isn’t a get-rich-quick scheme.

It takes time before you’ll start seeing results.

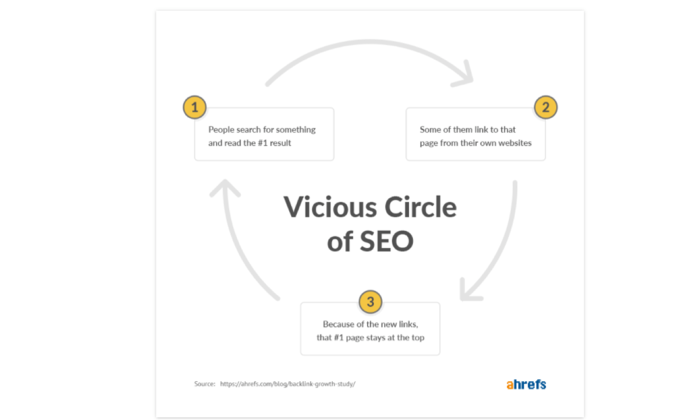

However, it is worth the wait because once things kick-off, SEO is like a flywheel that gets better by the day and works like a vicious cycle:

So be patient.

Only ensure you choose an SEO agency that’s right for you. And most notably, one with a diverse team of experienced experts who breathe SEO:

The post How to Choose The Right SEO Agency appeared first on Neil Patel.

Get the Skinny with Our Behalf Recession Funding Review

What Can Behalf Recession Funding Do for Your Business?

Behalf is an online lending company, among several other lending companies online. They offer purchase financing, and also have a virtual MasterCard in order to facilitate financing your purchases. We look at the specifics and drill down into the details of Behalf recession funding.

As of 8/24/2020 Behalf no longer reports. For more information on how to find accounts that report give us a call at 877-600-2487.

Behalf Recession Funding: Background

Behalf is located online here: https://www.behalf.com/.

Their physical address is:

126 5th Avenue

New York, New York 10011.

Behalf keeps their headquarters in New York City with offices in Tel Aviv. You can call them at: (877) 943-9962. Their contact page is here: https://www.behalf.com/help-center/. They have been in business since their founding in 2012. Behalf is backed by venture capital funds from Viola Growth, Spark Capital, Sequoia Capital, MissionOG, Victory Park, and Vintage.

Behalf Recession Funding: Purchase Financing

Behalf’s fees are based on the terms offered to customers. Their fees rise as the number of days to pay rise, with an apparent cap at 3%. This lender offers products to both merchants and their business customers. For business customers, you select the amount to finance, the amount of time to pay it back, and whether you will pay on a monthly or a weekly basis.

Since the end of 2017, all funding from Behalf is through FinWise, a Utah-chartered bank which is located in Sandy, Utah.

This online lender will make a hard inquiry on your personal credit when you first apply for financing.

There is a maximum line size of $50,000. It can extend this in instant purchase capacity to any business customer. Their minimum transaction size is $300. Plus there is no upper limit on individual purchase transactions.

Behalf Recession Funding: Fees

Monthly fees start at 1%, and there is a fixed monthly rate. There are no origination fees and no maintenance fees. You can save 10% on finance fees by choosing a weekly plan.

Behalf Recession Funding: Advantages

Advantages to online lender Behalf include a fixed monthly rate to make your budgeting easier. In addition, there is a discounted rate option if you select weekly payments.

Behalf Recession Funding: Disadvantages

Disadvantages include higher fees if you give your clients longer payment terms. As a result, your company will be penalized for providing better payment terms to your customers.

An Alternative to Behalf Recession Funding – Building Business Credit

Small business credit is credit in a company’s name. It doesn’t connect to an owner’s personal credit, not even when the owner is a sole proprietor and the sole employee of the business.

As a result, a business owner’s business and personal credit scores can be very different.

The Benefits

Due to the fact that small business credit is separate from consumer, it helps to safeguard an entrepreneur’s personal assets, in the event of court action or business insolvency.

Also, with two separate credit scores, a business owner can get two separate cards from the same vendor. This effectively doubles purchasing power.

Another benefit is that even start-ups can do this. Heading to a bank for a business loan can be a formula for frustration. But building company credit, when done properly, is a plan for success.

Consumer credit scores rely on payments but also various other considerations like credit utilization percentages.

But for business credit, the scores truly only depend on whether a company pays its invoices in a timely manner.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

The Process

Growing company credit is a process, and it does not occur automatically. A small business needs to proactively work to build company credit.

Having said that, it can be done easily and quickly, and it is much quicker than establishing personal credit scores.

Merchants are a big part of this process.

Undertaking the steps out of sequence will cause repetitive denials. Nobody can start at the top with business credit. For instance, you can’t start with retail or cash credit from your bank. If you do, you’ll get a rejection 100% of the time.

Company Fundability

A business has to be fundable to credit issuers and vendors.

Due to this fact, a small business will need a professional-looking website and email address. And it needs to have site hosting bought from a vendor like GoDaddy.

In addition, business phone and fax numbers should have a listing on ListYourself.net.

Additionally, the company phone number should be toll-free (800 exchange or similar).

A business will also need a bank account devoted purely to it, and it has to have all of the licenses essential for running.

Licenses

These licenses all must be in the particular, appropriate name of the small business. And they need to have the same small business address and telephone numbers.

So note, that this means not just state licenses, but possibly also city licenses.

Working with the Internal Revenue Service

Visit the Internal Revenue Service website and acquire an EIN for the small business. They’re totally free. Select a business entity such as corporation, LLC, etc.

A company can begin as a sole proprietor. But they will probably wish to change to a form of corporation or an LLC.

This is in order to limit risk. And it will maximize tax benefits.

A business entity will matter when it involves taxes and liability in case of a lawsuit. A sole proprietorship means the entrepreneur is it when it comes to liability and taxes. Nobody else is responsible.

Sole Proprietors Take Note

If you operate a business as a sole proprietor, then at least be sure to file for a DBA. This is ‘doing business as’ status.

If you do not, then your personal name is the same as the business name. Therefore, you can find yourself being directly accountable for all small business financial obligations.

Also, according to the Internal Revenue Service, using this arrangement there is a 1 in 7 possibility of an IRS audit. There is a 1 in 50 possibility for corporations! Prevent confusion and noticeably lower the chances of an Internal Revenue Service audit as well.

But keep in mind, any DBA filing should just be a steppingstone to incorporating.

Starting Off the Business Credit Reporting Process

Start at the D&B website and get a totally free D-U-N-S number. A D-U-N-S number is how D&B gets a company into their system, to generate a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s websites for the company. You can do this at www.creditsuite.com/reports. If there is a record with them, check it for correctness and completeness. If there are no records with them, go to the next step in the process.

By doing so, Experian and Equifax will have something to report on.

Vendor Credit

First you need to establish trade lines that report. This is also known as vendor credit. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can begin to get even more credit.

These sorts of accounts tend to be for the things bought all the time, like marketing materials, shipping boxes, outdoor work wear, ink and toner, and office furniture.

But to start with, what is trade credit? These trade lines are credit issuers who will give you initial credit when you have none now. Terms are frequently Net 30, instead of revolving.

Hence, if you get an approval for $1,000 in vendor credit and use all of it, you will need to pay that money back in a set term, like within 30 days on a Net 30 account.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Details

Net 30 accounts need to be paid in full within 30 days. 60 accounts must be paid fully within 60 days. Compared to with revolving accounts, you have a set time when you must pay back what you borrowed or the credit you used.

To kick off your business credit profile properly, you should get approval for vendor accounts that report to the business credit reporting agencies. Once that’s done, you can then use the credit.

Then pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Vendor Credit – It Helps

Not every vendor can help in the same way true starter credit can. These are merchants that will grant an approval with minimal effort. You also want them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

You want 3 of these to move onto the next step, which is retail credit. But you may need to apply more than one time to these vendors. So, this is to confirm you are dependable and will pay punctually.

Retail Credit

Once there are 3 or more vendor trade accounts reporting to at least one of the CRAs, then move to retail credit. These are service providers such as Office Depot and Staples.

Only use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, use the business’s EIN on these credit applications.

Fleet Credit

Are there more accounts reporting? Then move onto fleet credit. These are companies like BP and Conoco. Use this credit to buy fuel, and to repair, and take care of vehicles. Just use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, make certain to apply using the business’s EIN.

Cash Credit

Have you been sensibly managing the credit you’ve up to this point? Then move to more universal cash credit. These are companies such as Visa and MasterCard. Only use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, use your EIN instead.

If you have more trade accounts reporting, then these are attainable.

Monitor Your Business Credit

Know what is happening with your credit. Make sure it is being reported and deal with any errors ASAP. Get in the practice of checking credit reports and digging into the details, and not just the scores.

We can help you monitor business credit at Experian and D&B for 90% less.

At Equifax, you can monitor your account at: www.equifax.com/business/business-credit-monitor-small-business.

Update Your Records

Update the data if there are errors or the relevant information is incomplete. At D&B, you can do this at: https://iupdate.dnb.com/iUpdate/viewiUpdateHome.htm. For Experian, go here: www.experian.com/small-business/business-credit-information.jsp. And for Equifax, go here: www.equifax.com/business/small-business.

Fix Your Business Credit

So, what’s all this monitoring for? It’s to contest any errors in your records. Mistakes in your credit report(s) can be fixed. But the CRAs typically want you to dispute in a particular way.

Get your company’s PAYDEX report at: www.dnb.com/about-us/our-data.html. Get your company’s Experian report at: www.businesscreditfacts.com/pdp.aspx?pg=SearchForm. And get your Equifax business credit report at: www.equifax.com/business/credit-information.

Disputes

Disputing credit report mistakes commonly means you send a paper letter with duplicates of any evidence of payment with it. These are documents like receipts and cancelled checks. Never send the originals. Always send copies and keep the originals.

Fixing credit report inaccuracies also means you specifically itemize any charges you dispute. Make your dispute letter as understandable as possible. Be specific about the concerns with your report. Use certified mail so that you will have proof that you sent in your dispute.

Dispute your or your small business’s Equifax report by following the instructions here: www.equifax.com/small-business-faqs/#Dispute-FAQs.

You can dispute mistakes on your or your small business’s Experian report by following the instructions here: www.experian.com/small-business/business-credit-information.jsp.

And D&B’s PAYDEX Customer Service telephone number is here: www.dandb.com/glossary/paydex.

A Word about Building Business Credit

Always use credit sensibly! Don’t borrow more than what you can pay back. Keep track of balances and deadlines for payments. Paying off in a timely manner and completely will do more to increase business credit scores than nearly anything else.

Growing company credit pays off. Great business credit scores help a business get loans. Your credit issuer knows the business can pay its debts. They understand the company is bona fide.

The company’s EIN attaches to high scores and lending institutions won’t feel the need to require a personal guarantee.

Business credit is an asset which can help your company for many years to come. Learn more here and get started toward building company credit.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Behalf Recession Funding: Upshot

For companies just starting out, allowing for longer payment terms for customers can help to convert one-time customers into regulars. Because Behalf effectively penalizes a company for providing longer terms, this is a strike against using them if your company is a startup trying to build a reputation with your clients.

However, for a not so new company which can readily make payments, the discounted weekly payment plan (and rate) could be an attractive option, although companies with regular revenue and enough time in business tend to qualify for more traditional financing, including loans from the Small Business Administration.

And finally, as with every other lending program, whether online or offline, remember to read the fine print and do the math. Go over the details with a fine-toothed comb, and decide whether this option will be good for you and your company. In addition, consider alternative financing options that go beyond lending, including building business credit, in order to best decide how to get the money you need to help your business grow.

Maybe you won’t need Behalf recession funding after all.

The post Get the Skinny with Our Behalf Recession Funding Review appeared first on Credit Suite.

Get to Know Experian Commercial

What is Experian Commercial all about? What are details about its most important scores? Check out the details on this major business credit reporting agency. Plus, find out how to improve your business credit scores with Experian. And learn how to monitor your scores for 90% less than it would cost at that business CRA. Understanding and improving your business credit scores is more important than ever in a recession. With Experian, there is a lot you can do to keep your scores high.

So in particular, Experian reports on both business and personal credit. In fact, they blend the two. And this is virtually always what happens with startup ventures. Therefore, by keeping your personal credit scores high, you can directly influence your business credit scores.

Business Credit and Experian Commercial

Let’s look at business credit, even in a recession. Business credit is credit which is in a business’s name. So it is not tied to the owner’s creditworthiness. Instead, business credit scores mainly depend on how well a company can pay its bills. Hence, consumer and business credit scores can vary dramatically. So this is true for Experian as well.

Consider the main credit reporting agencies. There are three large business credit reporting agencies. So they are Dun & Bradstreet; Equifax; and Experian. There is also a FICO SBSS business score. But let’s concentrate on Experian Commercial today. Knowledge is power. And at no time is that more important than during a recession.

What Sort of Data Does Experian Commercial Use?

Experian, like the other business credit reporting bureaus, focuses on providing quality data and analytics. They offer this info to businesses to help them better assess risk. They have a massive consumer and commercial database. So they manage it to help businesses get the best and most up to date info. Experian extracts significant extra value with this data. So they do so by applying their own proprietary analytics and software.

Experian uses both consumer and business credit information to gauge risk.

“By combining personal and commercial credit information in one report, Experian provides a complete picture of the creditworthiness of small businesses”.

See: experian.ae/en/credit-services/index.

Experian PLC is listed on the London Stock Exchange (EXPN). And it is also in a constituent of the FTSE 100 Index.

Keep your business protected with our professional business credit monitoring. Save money even during a recession.

Experian Commercial: The Experian Intelliscore Plus℠ Score

Now let’s look at Experian’s Intelliscore Plus business credit score. For Intelliscore Plus, business credit scores range from 0 to 100. So 0 represents a high risk and 100 represents a low risk. The 0 to 100 part is a percentile score. It shows the percentage of businesses scoring higher or lower than the business under review.

Intelliscore Plus is widely used. Many large financial institutions around the world use it. So do more than half of the top 25 property and casualty insurers. And so do most major telecommunications and utility firms. Industry leaders in transportation, manufacturing, and technology also use Intelliscore Plus as their main risk indicating model.

Intelliscore Plus has more than 800 aggregates or factors. These affect business credit scores. There are scores on the millions of businesses in the Experian database. It is a percentile score.

What does Intelliscore Plus measure? It is a highly predictive score. It provides a detailed and accurate reflection of a business’s risk. Intelliscore Plus blends commercial data with the consumer data for the business owner or guarantor.

The Intelliscore Plus℠ Analytical Approach

Check out various Intelliscore Plus analytical approaches. Intelliscore Plus uses three separate analytical approaches to provide risk insights for small businesses.

The Emerging Market Model

The first analytical approach is business data including an emerging market model. That one is designed for microbusinesses.

The Blended Model

The second analytical approach is a blended one. This model incorporates business and consumer credit information on the owner or guarantor. Experian uses a cascading approach when combining the differing data sources.

The Consumer Data Only Model

So this third analytical approach is a consumer data only model. It is for startups because they have no business history.

For more information on these three analytical approaches, see: experian.com/content/dam/marketing/na/assets/bis/business-information/brochures/intelliscore-plus-v2-product-sheet.pdf

Get to Know the Data in an Intelliscore Plus℠ Report

So, which data is in an Intelliscore Plus report? The report contains key information like business address, how long a business has been in Experian’s database, etc. It also has legal filings and collections that may impact business performance. There is a summary of the number of trades, amount of credit extended, etc. And there is a summary of the owner or guarantor’s consumer credit account performance. This includes bank cards, revolving, auto lease, and real estate accounts.

More Data Details

More data includes business credit information like the number of days beyond terms. There’s also the Intelliscore Plus score and the business’s risk class. The report also has owner account information and derogatory information like collections, etc.

For more information on Intelliscore Plus reports, see: bci2experian.com/wp-content/uploads/2017/01/2013-06-Enhanced-Risk-Assessment.pdf

Keep your business protected with our professional business credit monitoring. Save money even during a recession.

Experian Commercial: The Experian Financial Stability Risk Score

Check out the Experian Financial Stability Risk Score (FSR). The FSR predicts the potential of a business going bankrupt or defaulting on its obligations. The score identifies the highest risk businesses by making use of payment and public records. These records include severely delinquent payments of 61 or more and 91 or more days. They also include high utilization of credit lines; tax liens; judgments; collection accounts; industry risk; and short time in business, etc.

The Financial Stability Risk Score shows a 1 to 100 percentile score, plus a 1 to 5 risk class. The risk class puts businesses into risk categories. So the highest risk is in the lowest 10% of accounts.

For more information on the Financial Stability Risk Score, see: experian.com/content/dam/marketing/na/assets/bis/business-information/brochures/financial-stability-risk-score-ps.pdf

What if you have a score of 66 to 100? And you have a risk class of 1? Then it means there is a low risk of default or bankruptcy. But what if you have a score of 1 – 3? And you have a risk class of 5? Then it means there is a high risk of default or bankruptcy.

Experian Commercial: Derogatory Data

So, how long does derogatory data stay in Experian’s database? Trade data stays on your report for 36 months. So does bank, government, and leasing data. Uniform Commercial Code filings stay on your report for 5 years. So note: Uniform Commercial Code filings are in support of loans.

Judgments, collections, and tax liens all stay on your report for 6 years and 9 months. And bankruptcies stay on your report for 9 years and 9 months.

For more information on derogatory data in Experian Commercial reports, see: experian.com/small-business/how-long-credit-report

Experian Commercial: Improving Your Company’s Experian Reports

To improve your credit terms, you should be looking at improving your company’s Experian reports. Also make sure vendors are reporting your payments. The more vendors which report a positive credit history to the credit reporting agencies, the better. Because then the higher your business credit rating will be. And this is not just the case with Experian.

So improving your scores is pretty straightforward. Always pay your bills early or on time and pay them in full. Try to maintain a balance at about 20 to 30% of your limits or less. Do not close positive accounts. And try to avoid derogatory report entries like tax liens.

This advice works just as well for personal credit as for business credit. Because Experian reports on both – and blends them – doing the same good things for both types of credit is helpful. Because it will help you even more.

Keep your business protected with our professional business credit monitoring. Save money even during a recession.

Experian Commercial: Business Credit Monitoring

To improve your Experian business credit scores, you should be looking into Experian business credit monitoring. Experian offers monitoring services. So these prices are current as of June 2020. Business Credit Advantage costs $189 per year. You can monitor business credit for one year. And you’ll get alerts of changes.

Business Credit Score Pro costs $249 per month. So it gives you access to multiple business credit reports. And Profile Plus costs $49.95 for a single report. So a Credit Score Report costs $39.95. With that one, you will get a credit summary report with a score. Or you can monitor your business credit with us for 90% less.

Experian Commercial: Takeaways

So Experian gathers diverse data to attempt to understand risk. And Experian works to predict a business’s chance of going delinquent on payments or bankrupt. They combine business and personal credit info for business owners or guarantors. This provides a more detailed picture of risk.

But derogatory data will stay on your Experian business credit reports for years. You can improve your Experian Commercial report by acting to better manage your finances.

And as you improve your personal credit scores with Experian, that will directly affect your business credit scores. Responsible financial stewardship is not just a good idea; it will likely save you money! So with better scores come better rates. Plus, you will have more choices. You will not have to settle for the one and only loan or credit card you can get.

Monitoring your business credit reports with Experian will also help you improve your reports. We offer competitively priced monitoring of your Experian business credit reports.

The post Get to Know Experian Commercial appeared first on Credit Suite.

Circle Medical (YC S15) Is Hiring a Senior Front End Engineer in Montréal

Article URL: https://jobs.lever.co/circlemedical/46d8485b-0092-48a5-8a26-96262438353d

Comments URL: https://news.ycombinator.com/item?id=24299277

Points: 1

# Comments: 0

New comment by nicknack2020 in "Ask HN: Who is hiring? (August 2020)"

DataFleets

About us: Federated Learning and privacy-preserving machine learning for the enterprise. Founded at Stanford in 2018.

We have several open roles

REMOTE with preference for SF Bay Area, NYC, London, Austin.

Details here https://www.datafleets.com/team and here https://angel.co/company/datafleets