Article URL: https://jobs.lever.co/circlemedical/1b3fcca6-6246-40d9-b7c9-096f8dc1871f

Comments URL: https://news.ycombinator.com/item?id=35452614

Points: 1

# Comments: 0

Article URL: https://jobs.lever.co/circlemedical/1b3fcca6-6246-40d9-b7c9-096f8dc1871f

Comments URL: https://news.ycombinator.com/item?id=35452614

Points: 1

# Comments: 0

Does your company manage Google Ads for third parties, and do you maintain some success with the pay-per-click (PPC) platform? If so, you may want to become a Google Partner, the search giant’s members-only club.

Joining the Google Partners program can provide you with immense benefits, such as specialized training, invitations to exciting events, and focused instruction to help you boost your Google Ads performance.

You already know Google Ads work. They convert 50% better than organic traffic, and most businesses earn double their ad spend, making advertising on Google highly effective and a no brainer.

Almost anyone can use Google’s PPC system to advertise on Google and grow their business (with the right budget and know-how).

Only a select few applicants become Google Partners and earn the world’s most popular search engine’s endorsement and other significant benefits.

Here’s what to know about becoming a Google partner.

The definition of prestige on the search engine’s paid advertising platform is a Google Partner badge. Displaying the badge on your site shows that you’ve passed Google Ads product certification exams. It also tells customers you possess in-depth product knowledge, making you a Google PPC superstar.

As a Google Partner, you have the option of specializing in one or more Google Ads product areas. These include Search Advertising; Video Advertising, Display Advertising, and Shopping Advertising.

Let’s run through them one by one.

Applying to become a Google Partner is free, and anyone can try to join the program. Google gives you all the information you need to pass the exams and flourish in your chosen certification area. Whether or not you pass the certification exams is up to you.

Google wants you to pass the exams and be successful in your Google Ads endeavors. To help you out, Google gives you access to a range of essential benefits, including education, support, expanded reach, and other rewards.

Google has pulled out all the stops to ensure you get the best Google Ad education possible. Skillshop learning courses help you develop and hone your skills, while certifications are provided to prove your knowledge. Google also makes available a host of valuable case studies, access to like-minded professionals, and much more on Think with Google and Google Trends.

Google’s product support is available to help you by giving you access to relevant advice and a range of resources, including Google Ads Recommendations and Google Ads Help Center.

With Google Connect, you can display your thought leadership and host co-branded events. You can even onboard new clients or pitch potential ones with Google Ads promotional offers.

Google’s Acceleration program is a specialized online education system designed to help you boost your skills and business growth.

By taking part in the Google Partners Rewards program, you get a chance to expand your knowledge by engaging in a series of quarterly challenges designed to help you gain new clients, optimize campaigns, or obtain certification. You even get access to seasonal insights, pitch decks, product advice, and a suite of other exciting rewards. You also have a chance to win prizes.

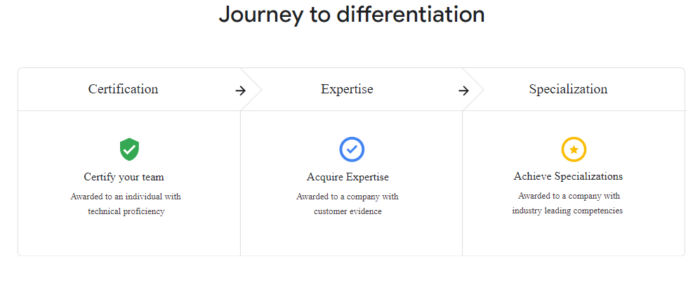

The first thing you’ll need to do is pass the required Google Ads certification courses for your specialty areas. You must also meet the spend requirement across your managed accounts.

Finally, you must demonstrate performance by consistently delivering strong client and company growth. In other words, you must become an active and exemplary Google Ads user.

Once you’ve become a Google Partner and have demonstrated your expertise in Google Ads, you can be considered for a Partner Badge. You’ll need to meet a few additional requirements to apply.

You must consistently show advancing ad revenue and growth, as well as an expanding customer base.

You must meet a 90-day ad spend requirement of $10,000 across your managed accounts. This sends a message to Partners that your company has a healthy level of activity. Google Partners will evaluate your account based on your manager account during an 18-month period.

Your company needs one user certified in Google Ads who has admin or standard access to the Google Ads manager account. It can also be any account linked to your manager account.

Be prepared for a new set of rules to qualify for a Partner Badge. Many of the basic rules will still apply, but you won’t be required to adopt all the recommendations or achieve a 100% optimization score to earn a badge.

Going forward, you must achieve a 70% optimization score to qualify. Google introduced this optimization score to help users understand what was working and what wasn’t, and how to fix elements that weren’t performing.

Pay close attention to any suggestions Google gives you, as advertisers who increase their optimization scores by 10 points see a 10% conversion boost, on average.

To qualify for a Google Badge in 2020, your Google Ad spend must be at least $10,000 in 90 days. In 2021, this requirement will change to a $20,000 ad spend over 90 days, across your managed accounts, to prove your company maintains healthy advertising activity.

This year, In 2020, your company needs a user to certify in Google Ads or have standard access to the Google Ads manager account. In 2021, half of your eligible users will have to obtain certifications from Skillshop. As a partner, you’ll need to demonstrate your proficiency consistently.

To meet the requirements for a Premier Partner Badge, you must deliver strong Google Ads revenue and growth, meet a higher ad spend across your managed accounts, and have two or more users in your company who are certified in Google Ads (or who have admin or standard status on your organization’s Google Ads manager account).

In 2021, once your company has succeeded in earning a Google Partners Badge, you have an opportunity to be chosen for Premier status. The program will grant Premier status to the top 3% of participating companies each calendar year. The companies are selected based on annual ad spend, client growth, client retention, and other information. The evaluation process is conducted annually and may exclude some markets.

When you become certified as a Google Ads Partner, you’ll be listed in the Marketing Platform Directory. Your listing will include your business name, a short description of your organization, partner type, and the product certifications you possess.

There are two types of marketing platform partners: Certified Companies and Sales Partners.

This descriptor means you’re educated about Google Marketing Platform products. You’re able to use your expertise to offer quality services to your customers, whether you’re consulting, training, implementing Google products, or offering technical support.

Certified Companies that help Google sell products are known as Sales Partners. Becoming one gives you access to special perks such as customer management tools, sales opportunities, and co-marketing opportunities.

Familiarize yourself with Google’s Partners Terms and Conditions. It is essential to read the document when you get time. You have a lot invested in Google Ads. The better you know the rules of the game, the more successful you can be at it.

Google will ask for your company’s size and structure, the services you provide, and pricing practices. You’ll be judged on your track record of client satisfaction and your consistent Google Ad investments’ success.

The reason for this level of scrutiny is that Google wants to work with forward-driven companies that maintain a healthy ad budget and use it wisely.

Google vets you for Partner certification by scouring the web for clear documentation that proves client engagement, planning processes, frameworks, and templates. Google wants to know your clients can rely on you for complex solutions and receive pleasing results.

Lastly, your website should be populated with useful content that clearly describes your offerings.

Certification rules stipulate you must have at least five local, full-time experts working with Google Marketing Platform products. Each must have passed an associated certification exam.

Google considers your team’s size, expertise, and rate of certification. The company notes that it does make exceptions for smaller companies who have difficulty meeting this particular requirement.

You’ll also need to submit a comprehensive review of each product you offer. The review is meant to represent advanced work that shows strategic planning and optimization toward your organization’s goals.

The review will also display your ability to go beyond basic or standard implementations and use and demonstrate your client’s goal through statistics and testimonials.

Google essentially wants a case study that proves you can walk the walk.

You applied for the Partners Program, and you’ve been waiting, but haven’t received a response. Take action and check the status of your certification. If you don’t receive certification, keep trying and using the resources Google gives you. Do that, and you’re sure to become a Google Partner before long.

Being vouched for by Google and having a Google Badge to show for it are just two of the benefits of becoming a Google Partner.

Being a Google partner also gives you access to easily consumable courses. Google gives you everything you need to maintain a Google Ads campaign and keep it growing far into the future.

And when customers see your Google Badge, watch out. That may be all they need to choose you for the successful future of their Google Ad campaigns.

Have you tried joining the Google Partners Program? What was your experience?

The post Become a Google Partner and Join the Google Ads Inner Circle appeared first on Neil Patel.

Article URL: https://jobs.lever.co/circlemedical/46d8485b-0092-48a5-8a26-96262438353d Comments URL: https://news.ycombinator.com/item?id=24299277 Points: 1 # Comments: 0

The post Circle Medical (YC S15) Is Hiring a Senior Front End Engineer in Montréal first appeared on Online Web Store Site.

Article URL: https://jobs.lever.co/circlemedical/46d8485b-0092-48a5-8a26-96262438353d

Comments URL: https://news.ycombinator.com/item?id=24299277

Points: 1

# Comments: 0

Looking for Funding Circle reviews? We took a look at this alternative lender to see if the information we had on them is still true. Welcome to Funding Circle reviews.

Funding Circle is one of several lending companies in the online space. They have loaned over $11.7 billion, with over 4.9 million loans under management. They work as a peer to peer lender.

In the US, Funding Circle leads the Marketplace Lending Association, along with LendingClub, Prosper, and Sofi.

Funding Circle is online here: www.fundingcircle.com/us/. Their physical addresses are in San Francisco, Denver, London, and Berlin. You can call them here: (855) 385-5356. Their contact page is here: www.fundingcircle.com/us/about/contact/. They have been in business since 2010.

Funding Circle has a business borrowers’ Bill of Rights, here: www.fundingcircle.com/us/business-borrower-bill-of-rights/

It says:

You have a right to see the cost and terms of any financing you are offered in writing and in a form that is clear, complete, and easy to compare with other options, so that you can make the best decision for your business.

You have a right to loan products that will not trap you in expensive cycles of re-borrowing. Lenders’ profitability should come from your success, not from your failure to repay the loan according to its original terms.

You have a right to work with lenders who will set you up for success, not failure. High loss rates should not be accepted by lenders simply as a cost of business to be passed on to you in the form of high rates or fees.

You have a right to fair and equal treatment when seeking a loan.

If you are unable to repay a loan, you have a right to be treated fairly and respectfully throughout the collections process. Collections on defaulted loans should not be used by lenders as a primary source of repayment.

At Funding Circle, you can borrow anywhere from $20,000 to $5 million from the SBA. Loan terms run for up to 10 years. Pay an interest rate of prime +2.75%. as of the writing of this blog post, that is 6%.

There are no prepayment penalties.

Funding Circle will charge a one-time origination fee on each loan they fund. This amount ranges from 3.49% to 6.99% of the approved loan amount.

Small businesses which meet the below criteria are eligible to apply for an SBA 7(a) loan:

Because these are SBA loans, Funding Circle must conform to the SBA’s requirements when it comes to industries. Therefore, they cannot lend to these industries:

As a part of working with the Small Business Administration, Funding Circle offers their COVID-19 relief, in the form of the Paycheck Protection Program.

What frustrates you the most about funding your business during a recession? Check out how our guide can help.

Apply online, and a personal account manager will reach out to you within one hour. They will ask about your business and request and collect documentation. They will decide on your loan in as little as 24 hours.

If you accept a loan offer, you can get funding in as little as one business day. You can return for more funding in as little as six months.

If your monthly payment is more than 10 days late, they may charge a late fee of up to 5% of each missed payment amount. The late fee will be payable immediately and is in addition to the missed payment.

They will place your loan into default if you miss three or more consecutive payments, four out of six monthly payments or do not comply with your loan agreement.

Funding Circle Reviews: Advantages

So the advantages include no prepayment penalty. There are also relatively fast decisions and funding. In addition, the Borrowers’ Bill of Rights is encouraging. The maximum rates you could pay are within reason.

Funding Circle Reviews: Disadvantages

So what are Funding Circle’s disadvantages? It should be obvious: fees, fees, and more fees. They are for origination, missing payments, and also for insufficient funds.

An Alternative to Funding Circle

Of course one great alternative to Funding Circle is to build business credit. But how do you do that? Fortunately, we have the method right here. And we’re more than happy to let you in on the secret.

Corporate credit is credit in a small business’s name. It doesn’t connect to a business owner’s personal credit, not even if the owner is a sole proprietor and the only employee of the business. Accordingly, an entrepreneur’s business and personal credit scores can be quite different.

The Advantages

Because small business credit is separate from individual, it helps to protect a small business owner’s personal assets, in the event of legal action or business insolvency. Also, with two separate credit scores, an entrepreneur can get two different cards from the same vendor. This effectively doubles buying power.

Another benefit is that even startups can do this. Visiting a bank for a business loan can be a formula for disappointment. But building business credit, when done the right way, is a plan for success.

Individual credit scores rely on payments but also other components like credit usage percentages. But for company credit, the scores actually only hinge on whether a company pays its bills in a timely manner.

The Process

Growing small business credit is a process, and it does not happen automatically. A corporation must proactively work to establish corporate credit. Having said that, it can be accomplished readily and quickly, and it is much more efficient than establishing individual credit scores. Merchants are a big part of this process.

Performing the steps out of order will cause repetitive denials. No one can start at the top with company credit. For instance, you can’t start with store or cash credit from your bank. If you do, you’ll get a denial 100% of the time.

Company Fundability

A business needs to be fundable to loan providers and vendors. For this reason, a business will need a professional-looking website and e-mail address, with website hosting bought from a supplier like GoDaddy. And company phone and fax numbers need to have a listing on ListYourself.net.

In addition the business telephone number should be toll-free (800 exchange or the like).

A corporation will also need a bank account devoted strictly to it, and it must have all of the licenses necessary for running. These licenses all must be in the specific, correct name of the company, with the same company address and telephone numbers. Bear in mind that this means not just state licenses, but possibly also city licenses.

What frustrates you the most about funding your business during a recession? Check out how our guide can help.

Working with the Internal Revenue Service

Visit the IRS website and acquire an EIN for the small business. They’re totally free. Choose a business entity such as corporation, LLC, etc. A business can start off as a sole proprietor but will probably want to change to a kind of corporation or partnership to decrease risk and maximize tax benefits.

A business entity will matter when it concerns tax obligations and liability in the event of litigation. A sole proprietorship means the entrepreneur is it when it comes to liability and tax obligations. Nobody else is responsible.

If you operate a business as a sole proprietor at least file for a DBA (‘doing business as’) status. If you do not, then your personal name is the same as the corporate name. Hence, you can find yourself being personally responsible for all small business debts.

In addition, per the Internal Revenue Service, with this structure there is a 1 in 7 possibility of an IRS audit. There is a 1 in 50 possibility for corporations! Avoid confusion and significantly decrease the odds of an IRS audit at the same time.

Note: any DBA filing should be a steppingstone to incorporating, which is best for building business credit.

Starting Off the Business Credit Reporting Process

Begin at the D&B web site and obtain a free D-U-N-S number. A D-U-N-S number is how D&B gets a business in their system, to generate a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s websites for the corporation. You can do this at https://www.creditsuite.com/reports/. If there is a record with them, check it for accuracy and completeness. If there are no records with them, go to the next step in the process. By doing this, Experian and Equifax will have activity to report on.

Trade Lines

First you must establish trade lines that report. This is also called vendor accounts. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can begin getting revolving store and cash credit.

These varieties of accounts have the tendency to be for the things bought all the time, like shipping boxes, outdoor work wear, ink and toner, and office furniture.

But first of all, what is trade credit? These trade lines are creditors who will give you initial credit when you have none now. Terms are often Net 30, versus revolving.

Hence if you get approval for $1,000 in vendor credit and use all of it, you will need to pay that money back in a set term, such as within 30 days on a Net 30 account.

Details

Net 30 accounts must be paid in full within 30 days. 60 accounts must be paid in full within 60 days. Compared to with revolving accounts, you have a set time when you have to pay back what you borrowed or the credit you made use of.

To launch your business credit profile properly, you need to get approval for vendor accounts that report to the business credit reporting agencies. Once that’s done, you can then make use of the credit.

Then pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Not every vendor can help like true starter credit can. These are vendors that will grant an approval with minimal effort. You also need them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

You want 3 of these to move onto the next step, which is revolving store credit.

Accounts That Don’t Report

Non-Reporting trade accounts can also be helpful. While you do want trade accounts to report to at least one of the CRAs, a trade account which does not report can yet be of some worth. You can always ask non-reporting accounts for trade references. And credit accounts of any sort ought to help you to better even out business expenses, thus making financial planning simpler. These are providers like PayPal Credit, T-Mobile, and Best Buy.

Revolving Store Credit

Once there are 3 more vendor trade accounts reporting to at least one of the CRAs, move onto revolving store credit. These are businesses which include Office Depot and Staples.

Use the business’s EIN on these credit applications.

Fleet Credit

Are there more accounts reporting? Then move to fleet credit. These are companies such as BP and Conoco. Use this credit to buy fuel, and to repair and maintain vehicles. Make certain to apply using the small business’s EIN.

Cash Credit

Have you been sensibly managing the credit you’ve up to this point? Then move onto more universal cash credit. These tend to be MasterCard credit cards. Keep your SSN off these applications; use your EIN instead.

If you have more trade accounts reporting, then these are in reach.

What frustrates you the most about funding your business during a recession? Check out how our guide can help.

Monitor Your Business Credit

Know what is happening with your credit. Make sure it is being reported and deal with any mistakes ASAP. Get in the habit of checking credit reports and digging into the specifics, and not just the scores.

We can help you monitor business credit at Experian and D&B for 90% less. Update the relevant information if there are errors or the data is incomplete.

Disputing Errors

So, what’s all this monitoring for? It’s to challenge any mistakes in your records. Mistakes in your credit report(s) can be corrected. But the CRAs usually want you to dispute in a particular way.

Disputing credit report errors typically means you send a paper letter with copies of any evidence of payment with it. These are documents like receipts and cancelled checks. Never mail the original copies. Always send copies and retain the original copies.

Disputing credit report errors also means you precisely spell out any charges you contest. Make your dispute letter as clear as possible. Be specific about the issues with your report. Use certified mail so that you will have proof that you sent in your dispute.

A Word about Building Business Credit

Always use credit smartly! Never borrow beyond what you can pay off. Track balances and deadlines for repayments. Paying off punctually and in full will do more to elevate business credit scores than almost anything else.

Growing business credit pays off. Excellent business credit scores help a business get loans. Your creditor knows the business can pay its financial obligations. They recognize the small business is for real. The small business’s EIN attaches to high scores, and creditors won’t feel the need to require a personal guarantee.

Business credit is an asset which can help your small business for years to come.

Funding Circle Reviews: Takeaways

Fees are high at Funding Circle, but at least they’re being transparent about them. Plus, there is no prepayment penalty – but there are late fees. Hence Funding Circle is best for companies which do not need to borrow much and can pay it all back not only on time, but early. Borrowers which need more time to pay a loan back would probably do better elsewhere.

Finally, read the fine print and do the math. Therefore, go over details carefully. And decide if this option will be good for you and your company. In addition, consider alternative financing options beyond lending. This includes building business credit, to best get the money you need. Funding Circle reviews should be just the beginning.

The post Get Better Financing with Funding Circle Reviews appeared first on Credit Suite.

Article URL: https://jobs.lever.co/circlemedical/6bc5ef92-faff-4929-bec0-41700e53a3e8

Comments URL: https://news.ycombinator.com/item?id=23333295

Points: 1

# Comments: 0

Everything has to start somewhere, with something. A flower starts with a seed. A book starts with the first letter typed, a house begins with the first nail hammered, and a move begins with the director’s word. When it comes to business credit, it all starts with business trade lines.

You have heard the adage you have to have money to make money. You have probably heard you have to have credit to get credit. While both of these are true to a point, seemingly catching us in a vicious circle, it isn’t entirely true with business credit.

A circle has no clear beginning. Business credit however, does. Just not very many people know about it, and it can be difficult to find. We know the secret though, and we are willing to share.

Of course, we all know that a lot of work goes in a house, a book, a garden, and a movie before that actual first nail, letter, seed, or director’s word. This prep work lays as solid foundation for the final masterpiece. There is a way to lay a solid foundation for business credit as well, before you even consider looking into business trade lines.

Research is how a book or movie starts, and any construction starts with clearing the area and dirt work. A garden spot must be tilled and fertilized before seeds can be planted. Something similar is necessary to establish and build business credit. You have to build a solid foundation for that credit to sit on. Now, that foundation is not necessarily your business. Your business and your business credit will grow together. You can start the prep work at the same time you are starting your business.

To be clear, if your business is already up and running you can still establish business credit. The foundation can still be built. In this way it is different than a building or a book. However, as with any first steps, it is much easier to take them in the beginning.

Before you consider business trade lines, you need to consider how your business is set up. For many new business owners, starting a business just kind of happens. You have something you do that you love, and you decide its time to use it to make money. You may find a location or start from your home. Likely you simply mingle funds in your personal bank account. You have a business name but the business address, email, and phone number are all the same as your personal contact information. It is sort of a natural progression.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

If you want to establish business credit, you have to be purposeful to set up your business separate from yourself. This means doing a few things differently.

First, you have to incorporate. Running as a DBA, sole proprietorship, or partnership really won’t cut it. You can choose from running as a corporation, S-corp, or LLC based on your specific needs, but it needs to be one of these three. Each one comes associated with a different cost and varying levels of protection, but each will serve the purpose of separating your business from yourself.

Next, establish separate contact information for your business. You need a business address, email, and phone number that is different from your personal address, email, and phone number. The phone number should be from a toll-free exchange, and your email address should be associated with your professional website. Do not use a free service such as Gmail or Yahoo, and don’t ignore the professional website part. These days, a poorly put together website can ruin a business.

After these first steps are complete you need to play the numbers game. In order to establish business credit, your business has to have two numbers associated with it. The first is an EIN. This is an identifying number for a business, similar to a social security number. You can get one for free on the IRS website.

The next is a DUNS number. This is a number assigned by Dun & Bradstreet, the largest and most commonly used business credit reporting agency. To have a business credit file with them, you must have a DUNS number. You can apply for it for free on their website, but note that they will definitely try to sell you other services. Be strong. The number is free and the other services are not necessary.

Open a separate bank account for your business. This is the account through which all business financial transactions should run. If your business is already up and running, it may take you some time to get everything switched over, but it will be worth it. Not only will is help separate your business from your personal credit, but it will also help tremendously when it is time to do your taxes.

Okay, so these steps ensure that your business is on record as a business at all the right places. As soon as something credit related is reporting, it will have a place to go. How do you get something reported though? You need accounts that will report your on-time payments. Lenders will not even consider extending you credit however, if you don’t have a credit score, or if your credit score is bad. How do you break into the circle?

You can find a tiny crack with business trade lines. These are vendors that sell things you use in the everyday course of business, and they are vital to building business credit. Here’s how it works. They will extend net30 terms on invoices, without a credit check, and then report your invoice payments to the business credit reporting agencies.

For most of these vendors, you will have to make a few initial purchases before they will extent net30 terms. Some want to see a minimum time in business or a certain revenue level as well. We have compiled a list of six easy approval business trade lines to help you get started.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

If you need computers or other electronics, this is the place to start. Newegg Business offers tons of electronic products, so there is something that pretty much any business can use. To open an account with net30 terms, you’ll need a DUNS number and a bank reference. Net30 accounts range from $500 to $1,000, and they report to Dun & Bradstreet.

This company sells eBooks, software, and even office supplies. You do have to register to see their products, but the process if fast and easy. You will have to make a $60 or more initial purchase to be eligible for a net30 account of up to $2,000. They report to Experian and Credit Safe.

Granger industrial supply sells industrial equipment for outdoors as well as standard tools, and more. To gain net 30 approval you will need a business license, a DUNS number, and bank reference. Their net 30 accounts range from $500 to $1,000 and they report to Dun & Bradstreet.

Another office supply provider, you can order anything from paper to staples, pens to printer ink, and pretty much anything you can think of in between from Summa. They require a $60 initial purchase, and will approve up to $2,000 on net 30 terms. They report to Dun & Bradstreet.

Quill also sells standard office supplies. You will need to make an initial purchase. They’ll usually put you on a 90 day prepay scheduled, but after ordering for 3 months in a row, they’ll typically approve net 30 term. They report to Dun & Bradstreet.

Uline sells a lot of things, but they specialize in packing and shipping equipment and janitorial supplies. You’ll need to place an initial order, and they do ask for a bank reference and two other references. They report to Dun & Bradstreet, so you’ll of course need a DUNS number too.

If you open accounts and get net 30 approval with each of these, you could have between $5,000 and $10,000 in accounts reporting to the credit agencies pretty quickly. Make your payment consistently, and that seed you planted with these easy approval business trade lines will sprout to the point you will be ready for the next step in building business credit before you know it.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

These business trade lines are all part of the vendor credit tier. After you have a few of these accounts reporting, you can apply for accounts in the retail credit tier, then the fleet credit tier, then the cash credit tier. Here’s what you need to know about each tier, and what happens when you get to the top.

This would be relatable to the editing stage of writing a book or a movie, the weeding stage of planting a garden, or the sheetrock stage of building a house. You’ve done the prework of research or preparing the ground, you have planted that first seed, banged out that first word, or hammered that first nail. So now, it is time to move on.

In building business credit, after you have enough business trade lines reporting, this means moving on to the retail credit tier. These are credit cards issued by specific retailers such as Amazon, Office Depot, and Best Buy. Apply for these accounts, purchase things you need in the everyday course of running your business, and make your payments on-time. Your business credit score will grow stronger by the day.

This is where you head into publication, start prescreens, water the garden daily, and start getting the inside of that house ready for move in with paint and appliances. These cards are issued by fleet companies such as Shell and Fuelman. They can be used to purchase gasoline or for automobile maintenance and repairs. Once you have enough of these accounts reporting, it’s time for the last tier.

The cash credit tier is the finished product. Your book or movie is out there for the public to enjoy, your garden is ready for harvest, and you can sleep comfortably in that house each night. The cash credit tier consists of the traditional Visa, Master, and American Express cards not associated with a specific store. Use this wisely, continue to make consistent, on-time payments, and your business credit will be rock solid.

You may be asking yourself the question, why bother? You may have personal credit that will allow you to get what you need to run your business without needing to work with business trade lines. It can take time, and better prices may be available elsewhere. What’s the point? Why do you need business credit?

The fact is, its never a good idea to have your business transactions on your personal credit report. There are a few reasons for this. First, if your personal credit takes a hit, it can affect your ability to run your business.

Also, business credit cards based on personal credit often have a lower credit limit, and business transactions are often very large. If you get close to your limit, your score will take a hit even if you make your payments like you should due to the high debt-to-credit ratio.

By having cards based on your business credit, you can get higher limits, and your personal credit will not be affected by business transactions. This way, you do not have to worry about business transactions keeping you from applying for personal credit you may need to purchase a car or make home improvements.

Regardless of your personal credit score, you really do have to work with business trade lines to start your business credit. After you establish your business and prepare the way for your business transactions to be reported to your business credit profile, you will need accounts to report. Most credit cards will not extend credit to a business with no credit, or bad credit. Working with business trade lines that do not do a credit check is a way around that. You can start building business credit in your business name without your personal credit score ever being involved. So it’s a win/win for you and for your business.

The post Break in to the Credit Circle: 6 Easy Approval Business Trade Lines appeared first on Credit Suite.