What Is Find Places Through Reviews?

If you’re a local business that wants nearby customers to find you, then you know local SEO and Google Business Profile is where it’s at. Combined with tools like featured snippets, these are essential to getting your content in front of local customers.

As a small business owner, you also understand that good reviews are imperative to winning new customers.

Now, it looks like Google is planning a new SERP feature to get your products/services in front of keen customers called find places through reviews.

According to SEO consultant Brodie Clark on Twitter, the carousels are getting tested in various regions, and on mobile, too.

How would it work, and what does it mean for your business? Well, all that remains unclear for the moment. However, I can share what we know and explain why reviews are vital to your business.

Let’s get started.

What Do We Know About Find Places Through Reviews So Far?

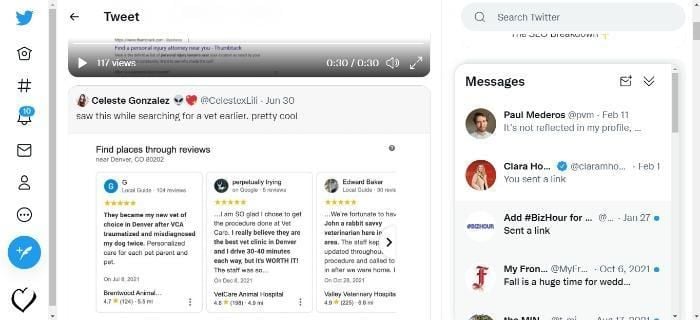

Speculation about find places through reviews began when local SEO specialists Andy Simpson and Celeste Gonzalez spotted the feature and posted the images on Twitter.

Gonzalez stated that the image appeared when she was looking for a local vet. As you can see, find places through reviews does pretty much what it says on the label.

You’d enter the search term, and relevant reviews from local companies appear.

The tweets soon got picked up by Seoroundtable.com.

There is speculation that it would be similar to search Google for nearby places, which now appears to be going under the new name of find places through photos.

Sounds great, doesn’t it?

I can certainly see the advantages of putting a search term in Google, getting instant reviews, and then clicking through to my preferred business/service, can’t you?

Now, assuming the find places through reviews become a firm feature, what does this mean for your business, and what can you do to prepare for it?

Well, it would put the focus on online reviews, and by that, I mean positive reviews.

How Could This Change Impact Your Google Business Profile Reviews?

First, let’s look at what Google has to say about customer reviews:

‘When you reply to reviews, it shows that you value your customers and their feedback. High-quality, positive reviews from your customers can improve your business visibility and increase the likelihood that a shopper will visit your location.’

I’ll look more at the importance of answering reviews later, but let’s just park that there for now.

Second, let me share a stat with you.

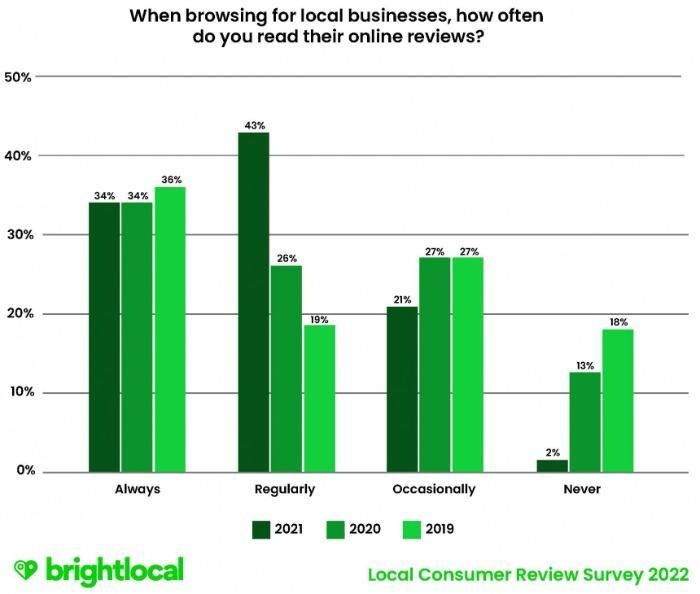

98 percent of people occasionally read reviews online. That’s an astonishing stat, right? Well, here’s another one: 77 percent of consumers always or regularly read reviews.

If you’ve ever wondered whether reviews matter to your business, Brightlocal’s research should leave you in no doubt, especially considering the role Google plays.

Here are some more stats to get your head around.

Analysis from Review Trackers estimates that 75 percent of new business is influenced by a handful of business review sites, and you don’t get any prizes for guessing which one dominates.

Yes, it’s Google with 73 percent, leaving others like Yelp! And Tripadvisor trailing far behind.

Now all of that tells me your Google business profile reviews will become even more important than they already are.

With a feature flagging what others are saying about you online when people look for a local business, positive feedback is imperative.

You’ll also want to dedicate more time to managing your profile, and combine this with resources like my guide to managing the SERPs to fully master how your business appears in Google.

Best Practices For Managing Google Business Profile Reviews

In the above section, I stressed how important Google reviews are to your business. Here, I focus on some best practices you can apply.

Respond To Your Reviews

This is review management 101.

I get it. Sometimes you don’t have the time or the energy. Other times, a buyer may have had a bad experience and left a negative review. However, whatever might be going on, you must take time to respond to reviews.

According to research from Uberall, larger global businesses respond to just nine percent of reviews.

However, this research shows that 86 percent of customers surveyed are more likely to buy from brands that do answer.

Want another reason to answer reviews? OK then. How does an increase in conversion rates grab you? Uberall also found that conversion rates (clicks on phone numbers, driving directions, and websites) increased measurably when companies answered.

When responding to reviews, always:

- Thank your customer for their feedback, even if it’s negative.

- Don’t use generic responses. Personalize your feedback to the reviewer’s specific points.

- Reply quickly (more about that later)

Encourage Customers to Leave Reviews

Sometimes customers just need a nudge in the right direction. Make leaving reviews easy with follow-up emails and a link. Just go to your Google Business Profile, choose ‘customers’, then ‘reviews’, then ‘get more reviews’ to get your link. However, don’t be too pushy in getting customer feedback; they won’t appreciate it. Perhaps send an email or message out with orders inviting customers to leave feedback if they’re happy with their experience. Also, add a note encouraging buyers to contact you if they’re unhappy in any way.

Verify Your Business Profile

Without verification, your business won’t appear in online maps, and you can’t answer reviews. If you haven’t done so already, here are some directions to claim your business profile.

Use Google’s Tools

You don’t have to launch your review campaign from scratch. Google’s Business Profile Marketing Kit, gives you free stickers, posters, and social media posts for sharing customer reviews.

Report Fraudulent Reviews

If you suspect fraudulent reviews, report them to Google. You can do this by going to your business profile, clicking on reviews, and selecting the one you want to report. Then, select the ‘more’ option and choose ‘report review.’ Finally, choose the violation you’re reporting.

Signs that a review could be fake/fraudulent include:

- Limited information or inconsistent statements

- Generic names, no names, and no images

- Repetitive statements or generic comments

- A user leaving numerous reviews

You can also check your database to see if the reviewer is a customer of yours.

Respond To Reviews Quickly

The quicker you respond to reviews, the better. Customers almost always appreciate a speedy response, especially if it’s to their negative feedback.

According to Review Tracker’s research, 53 percent of customers expect a response to negative reviews within a week, while 1 in 3 expects a response within three days or less.

Check your Google My Business account regularly to see what people write, then answer and thank them.

If the review isn’t so positive, don’t worry, there’s plenty you can do.

What To Do About Bad Reviews On Google

Dealing with negative reviews is something every business owner has to face at some point. However, as Google states, responding helps with trust-building, and there’s a simple reason why: it shows there’s a person behind the brand that cares what people think, and it humanizes your business.

Responding politely to negative feedback and offering possible solutions to solve the problem also demonstrates professionalism and that you’re keen to put things right.

Additionally, if you feel the review is unfair, replying gives you the chance to give your side of the story, and if the feedback is justified, responding positively and taking it onboard shows your business is willing to learn and improve.

Google has this advice for replying to negative reviews:

- Don’t take reviews personally. I know it’s hard, especially when you’ve put your heart and soul into your business. However, remember that most reviews aren’t personal attacks: it’s just business.

- Ensure you understand the customer’s experience before you answer. If a customer had a problem with your service or product, they’re entitled to share that experience online. Use negative feedback as an opportunity to investigate what happened, own the mistakes you’ve made (if any) and detail the actions you’ve put in place to stop similar problems from happening again.

- Apologize if appropriate. A simple, genuine ‘sorry’ can go a long way to winning a customer over. However, don’t apologize for things you can’t control.

- Talk it out. Sometimes people are just venting. We all get angry and frustrated, and sometimes we overreact. Put yourself in your customer’s shoes, understand that they might not be angry at you, just the situation, and offer to talk with them via email, phone, or even face-to-face.

- These days, shopping is often an impersonal experience. Use your name in emails and phone calls, so your reviewer knows they’re speaking to a real person that cares about putting things right.

Finally, whatever customers say about you, here are some templates to help craft answers.

FAQs

It’s a new feature that Google is testing to enable searchers to find a local business through online reviews.

To get the most from your reviews, encourage customers to leave them, send them a link to make it easier, include relevant keywords in responses, and add the reviews to your website.

If a review is fraudulent, Google has a removal request option where you can report a potential violation.

Conclusion

It seems Google is testing a ‘find places through reviews’ feature. A few SEOs have shared Tweets about it, and the feature appears to be a great addition to local search.

There’s limited information, so it’s hard to tell what this addition would mean for businesses and the impact it would have on them.

However, it’s clear it would put even greater importance on achieving positive reviews, and there’s plenty you can do to prepare.

Ensuring you answer reviews, responding proactively to negative feedback, and using Google’s tool to encourage customers to leave a review are just some of the things you can do.

What would find places through reviews mean for your business?