Article URL: https://jobs.lever.co/revenuecat/c77633a8-2047-4082-9cc6-91de1c13c68e

Comments URL: https://news.ycombinator.com/item?id=25206622

Points: 1

# Comments: 0

Article URL: https://jobs.lever.co/revenuecat/c77633a8-2047-4082-9cc6-91de1c13c68e

Comments URL: https://news.ycombinator.com/item?id=25206622

Points: 1

# Comments: 0

Inventory loans are short term loans that business owners can use to purchase inventory. The inventory is the security for the loan. By taking out this type of loan, a business can stay ahead of demand. It also allows for taking advantage of special pricing, thus increasing profit.

Investopedia defines inventory financing as:

“… a revolving line of credit or a short-term loan that is acquired by a company so it can purchase products for sale later. The products serve as the collateral for the loan.”

These types of loans are a type of inventory financing. Seeing as these are, at their core, secured loans, it stands to reason that they are easier to get than unsecured loans. However, that is not always the case.

The idea of inventory as collateral for the financing used to buy it sounds simple enough. However, after the hard economic downturn of 2008, lenders are much stingier with this type of small business financing. During that time, it was painfully evident that, if your loan was secured by non-staple items, there was about to be trouble.

Non-necessities do not sell well in a recession. If you can’t sell, the bank cannot either. That means the security is pretty much worthless.

Another issue is that inventory depreciates. As security, it’s basically on the clock. If it depreciates to the point of not being worth the amount of the loan, it is worthless as security. There is also the idea that it may be a fad that is going to quickly go out of style, also not selling.

These are just a few of the reasons lenders are reluctant to approve loans secured by inventory. Typically, they approve these types of loans on a case by case basis, taking all of these factors into account. Even when they grant approval, it is typically for only around 50% of the cost.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

There are some things you can purchase with inventory loans that may surprise you. For example:

The point is, funds for these loans can purchase items that are not specifically inventory in terms of things that you sell to the public. They can also purchase supplies for any services you may offer.

How do you fill in the gap for the other 50% of inventory costs? Further, how can you finance inventory if you cannot get any type of funding at all? There are some other options.

A credit line hybrid is essentially an unsecured line of credit. It allows you to fund your business without putting up collateral, and you only pay back what you use. The funds can be used for many things, including inventory financing.

It’s super easy to qualify. You need a personal credit score of at least 680, and you can’t have any liens, judgments, bankruptcies or late payments. Furthermore, in the past 6 months you should have less than 4 credit inquiries, and you should have less than a 45% balance on all business and personal credit cards. It’s also preferred that you have established business credit as well as personal credit.

I know, that doesn’t sound all that easy. Here’s the catch. If you do not meet all of the requirements, it’s okay. You can take on a credit partner that meets each of these requirements. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding.

There are many benefits to using a credit line hybrid. First, it is unsecured, meaning you do not have to have any collateral to put up. Next, this is no-doc funding. That means you do not have to provide any bank statements or financials.

In addition, typical approval is up to 5x that of the highest credit limit on the personal credit report. Often, you can get interest rates as low as 0% for the first few months, allowing you to put that savings back into your business.

Here is another benefit of the credit line hybrid. With the approval for multiple credit cards, competition is created. This makes it easier, and likely even if you handle the credit responsibly, that you can get interest rates lowered and limits raised every few months. The process is generally quick, especially with a qualified expert to walk you through it.

Alternative lenders generally operate online. They tend to reduce risk by increasing interest rates rather than relying completely on credit information. This means that they can be an option for those businesses and owners that either have bad credit or have not yet built strong enough credit to qualify for financing with traditional lenders. Here are a few options.

Fundbox offers a line of credit rather than a loan, but it is a great funding option because there is no minimum credit score requirement.

They offer an automated process that is super-fast. Repayments are automatic, meaning they draft them electronically, and they occur on a weekly basis. One thing to remember is that you could have a repayment as high as 5 to 7% of the amount you have drawn currently, as the repayment period is comparatively short. This means you need to be sure you have enough funds in whatever account you connect them to so that it can cover your payment each week.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Upstart is an online lender that uses a completely innovative platform for loans. The company itself questions the ability of financial information and FICO on their own to truly determine the risk of lending to a specific borrower. They choose to use a combination of artificial intelligence (AI) and machine learning to gather alternative data instead. They then use this data to help them make credit decisions.

This alternative data can include such things as mobile phone bills, rent, deposits, withdrawals, and even other information less directly tied to finances. The software they use learns and improves on its own. You can use their online quote tool to play with different amounts and terms to see the various interest rate possibilities. Typically, business loans are available up to $50,000. Interest rates vary greatly, ranging from 7.5% to 35.99%. Repayment terms can be either 3 -year or 5-year.

Founded in 2008 by college roommates, online lender Fora Financial now funds more than $1.3 million in working capital around the United States. There is no minimum credit score, and there is an early repayment discount if you qualify.

Obtaining financing from OnDeck is quick and easy. First, you apply online and receive your decision once application processing is complete. If you receive approval, your loan funds will go directly to your bank account.

Offering term loans of up to $1 million, Bond Street terms are for up to 1 to 3 years. They will ask for both EIN and SSN.

Popular online lender Lending Club offers term loans. Business loans go up to $300,000 and terms from 1 to 5 years are available.

Quarter Spot is an online lender that offers short term loans up to $150,000. The terms are 9 to 18 months.

Rapid Advance offers standard, select, and preferred loans. For standard loans, amounts up to $1 million are available. Their terms are 4 to 12 months.

Kiva is an online lender that is a little different. For example, the interest rate is 0%, so even though you have to pay it back it is absolutely free money. They don’t even check your credit. However, there is one catch. You have to get at least 5 family members or friends to invest in your business. In addition, you have to give a $25 loan to another business on the platform. It’s like a crowdfunding, 0% interest loan.

If your personal credit is okay, Accion may be a good fit for inventory financing. It is a microlender, a nonprofit, that offers installment loans to both startups and already existing businesses. You don’t have to already be in business, but if you are not, you must have less than $500 in past due debt. In addition, your business needs to be home or incubator based.

Credibly is also a good option if you are already generating some revenue. They offer short term loans for both business expansion and working capital.

Details related to loan amounts, eligibility requirements, and interest rates change frequently, so it’s best to get that information from the lender’s website directly. However, many of these either do not check credit or will work with a credit score of less than 600. Though interest rates are higher than with traditional lenders, they often offer options where there seem to be none.

In a pinch, you can handle inventory financing with credit cards. If you pay attention, you can get good introductory rates and rewards. However, you have to pay attention so you don’t get stuck with high rates once the introductory rates are over. A better bet is the credit line hybrid, because you can take advantage of all the benefits with an expert to walk you through the process and make sure nothing is missed.

In some situations, this can be an option for inventory financing. This is how it works. If you take credit card payments, you can get financing based on the average of daily credit cards sales. Then, payment is taken from future sales.

The thing is, if you are in a recession, credit cards sales may not be that great, and future sales may not be solid. However, it is an option that bears mentioning.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

The fact is, every business is likely to need some type of inventory financing in the course of their business. The problem comes when lenders envision large amounts of inventory sitting in a warehouse not selling. If it’s not selling, then the business isn’t making money and the lender is not getting paid.

If you sell staples that are needed in most any type of economy, inventory loans can be a good option. With strong fundability, you may not have any issue getting loans secured by inventory. However, this is not the case with many businesses. A lot of business owners find their fundability is not up to par, and they didn’t even realize it. Couple that with the already unsure nature of getting approved for business loans, and it may be best to go with an alternative.

While alternative loans are a viable option, the first stop for most business owners should be the credit line hybrid. It is available to absolutely anyone. Even if your own credit is not great, the option to take on a credit partner can make this funding source an option for almost anyone.

The best part is, using the credit line hybrid helps to build the fundability of your business. This is because the experts that walk you through the process help ensure that, not only get the funds you need right now, but also that your business is set up and prepared to qualify for any type of funding you may need in the future.

All businesses need inventory funding. If inventory loans won’t work, there are other options.

The post What Are Inventory Loans and How are They Affected by the Recession appeared first on Credit Suite.

MediKeeper | Full-Stack Engineer / QA Engineer / UX Designer | San Diego, CA | REMOTE (US only) | Full-Time | https://www.medikeeper.com

Medikeeper helps millions of employees and health plan members engage in preventative wellness programs and actively close gaps in their health care. You can find out more about our products, here: https://medikeeper.com/products/

We’re looking for proactive, quality-oriented engineers who are excited to work closely with a smart product team. We’re a small company with lots of planned, funded growth, so this is an opportunity to get in early and grow with the company!

Here’s the full-stack engineer posting at Stack Overflow and Women Who Code (the WWC ad outlines our interview process):

https://stackoverflow.com/jobs/422397/full-stack-net-enginee…

https://www.womenwhocode.com/jobs/7305

We’re also hiring for QA Engineers and a UX Designer.

I’m the hiring manager for our engineering/QA team and I’m assisting with the UX role, so if you’d like to learn more about any of these openings, please do feel free email me directly at the address in my HN profile, or apply for the engineering role via WWC or Stack Overflow. Happy to take questions directly! Please mention that you saw this post on HN.

MediKeeper | Full-Stack Engineer / QA Engineer / UX Designer | San Diego, CA | REMOTE (US only) | Full-Time | https://www.medikeeper.com Medikeeper helps millions of employees and health plan members engage in preventative wellness programs and actively close gaps in their health care. You can find out more about our products, here: https://medikeeper.com/products/ We’re … Continue reading New comment by bflowers in "Ask HN: Who is hiring? (November 2020)"

No doubt this is a hard time to grow a local business. Coronavirus has likely forced you to make big changes to the way you operate. It’s almost certainly hit your bottom line too. However, it’s still absolutely possible to grow your local business at a time like this. You just have to be smart … Continue reading How to Grow Your Local Business During Uncertain Times

Develop Your Marketing Machine to Plan for Marketing Success Do you ever before really feel like you’re continuously running about, attempting to obtain your advertising products placed with each other and also out the door? Or are you continuously jumping on the newest advertising concept, and also tossing away your time as well as cash …

The post Produce Your Marketing Machine to Plan for Marketing Success first appeared on Online Web Store Site.

The post Produce Your Marketing Machine to Plan for Marketing Success appeared first on ROI Credit Builders.

MediKeeper | Full-Stack Engineer / QA Engineer / UX Designer | San Diego, CA | REMOTE (US only) | Full-Time | https://www.medikeeper.com Medikeeper helps millions of employees and health plan members engage in preventative wellness programs and actively close gaps in their health care. You can find out more about our products, here: https://medikeeper.com/products/ We’re …

The post New comment by bflowers in “Ask HN: Who is hiring? (November 2020)” first appeared on Online Web Store Site.

Develop Your Marketing Machine to Plan for Marketing Success Do you ever before really feel like you’re continuously running about, attempting to obtain your advertising products placed with each other and also out the door? Or are you continuously jumping on the newest advertising concept, and also tossing away your time as well as cash …

The post Produce Your Marketing Machine to Plan for Marketing Success first appeared on Online Web Store Site.

The post Produce Your Marketing Machine to Plan for Marketing Success appeared first on ROI Credit Builders.

If you want your business to succeed, you’ll need to pay close attention to your brand strategy. And that strategy starts with a free brand logo.

A strong brand creates instant recognition in the marketplace, especially amongst your customers.

It also builds loyalty and shows you share your customer’s values. Do this right, and both your customers and your competitors will always remember you.

If you’re yet to define and build your brand, this guide can show you where to start.

One of the best ways to leave a positive and lasting (visual) imprint of your brand is to create a unique brand logo.

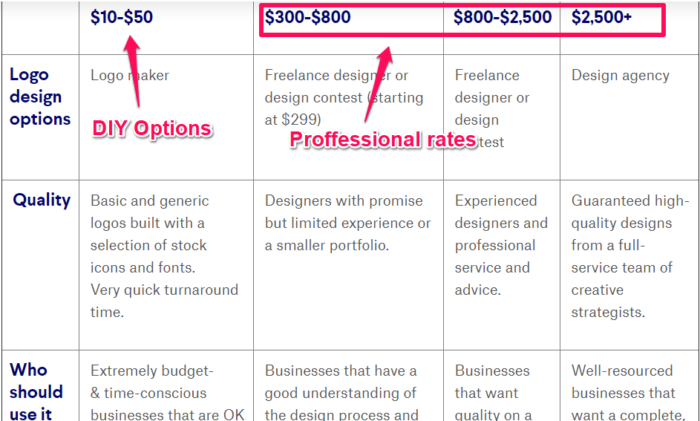

Getting your brand logo professionally designed can be expensive.

Look at 99Designs research. They found that a professionally-designed logo can cost you anywhere from $400 up to $2500+, with the quality varying depending on the actual cost.

That sounds pricey, right?

You could take it upon yourself to design your logo from scratch by investing time in learning graphic design.

I could even show you where to find some free fonts you could use.

Or, I could show you how to design a free brand logo for your company with minimal effort on your part.

You see, gone are the days when your only option was to get a graphic designer to create your logo. They usually came with a hefty price tag.

Now, you can use online resources to design and create your very own brand logo for free.

And you can literally do it within a few minutes.

Some of these companies will even allow you to download your logo without having to invest any money.

In this article, I’ll walk you through five ways to create a free brand logo for your company in just minutes.

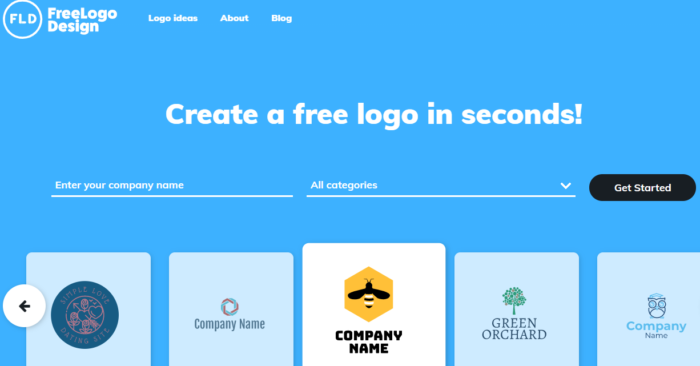

Free Logo Design is a free brand logo creator that allows you to create a brand logo of your own and incorporate it into your business.

You can do this in a few simple steps:

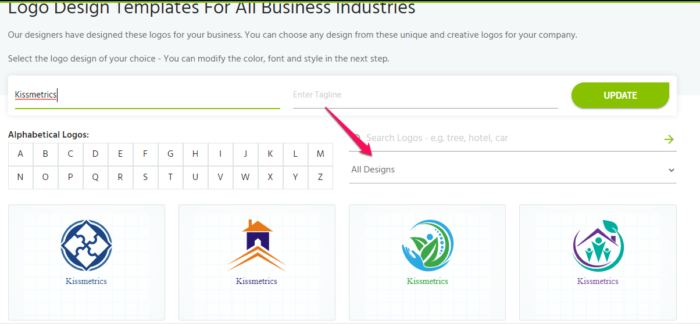

First of all, you’ll need to go to the homepage and enter your company name, as shown.

You should notice right off the bat that Free Logo Design gives you several design options as you type.

These images are too generic. You’ll want to be more specific.

So, pick a category from the drop-down menu and click “Start.”

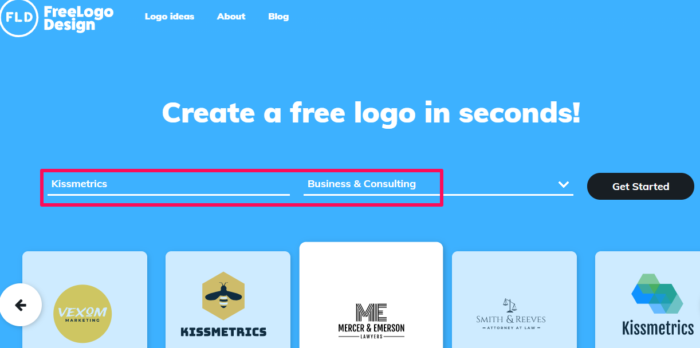

For the “new” Kissmetrics brand logo, I’ll pick “Business & Consulting.”

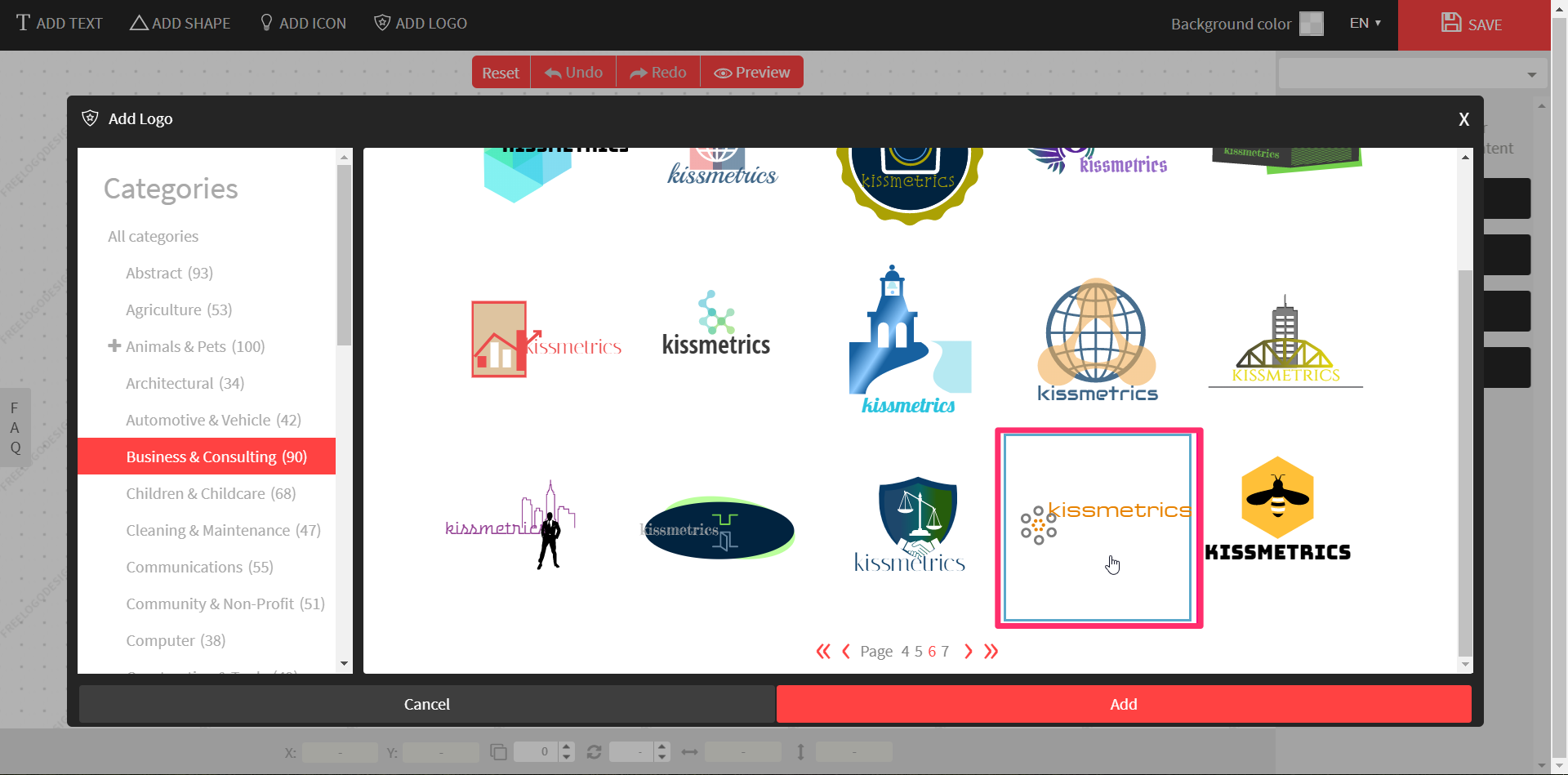

Once you’ve clicked “Get Started,” it will bring you to the design page where a pop-up platform will display auto-generated logo templates from existing images.

You’ll see some containing your company’s name.

In the “Business & Consulting” category, the software generated 90 designs, with a maximum of 15 per page.

For the next step, go through all of the designs and find a logo that you think will:

Once satisfied with your decision, select the desired logo, and click “Add.”

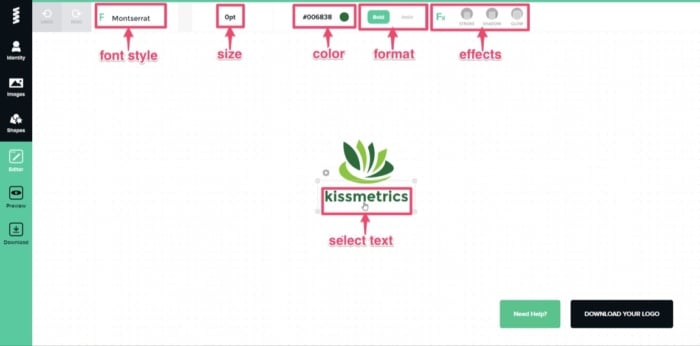

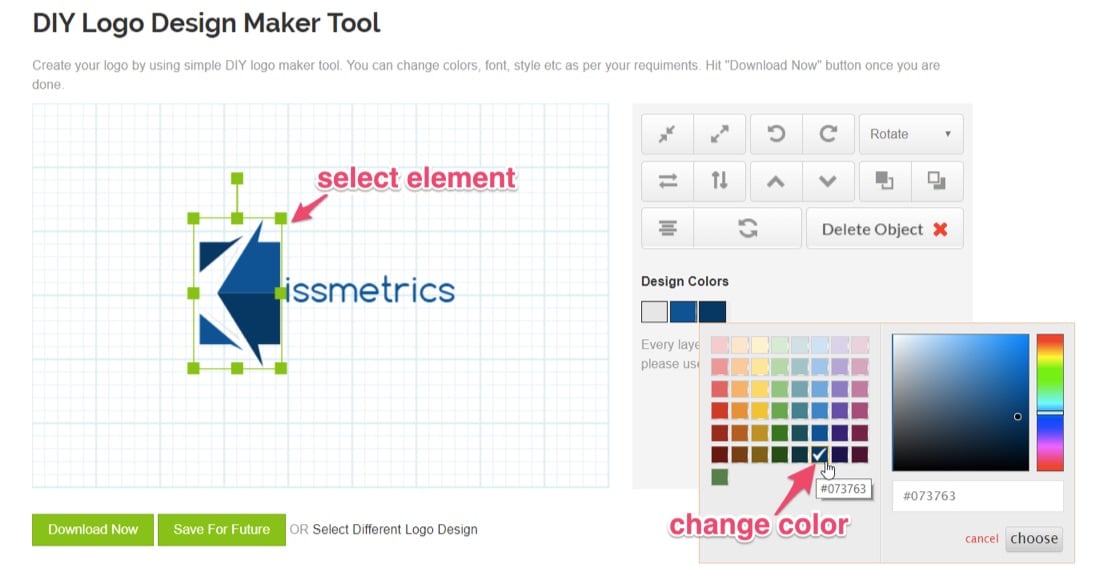

From there, it will take you to the logo editor, where you may notice that the text and graphics are overlapping or jumbled up.

Each part of the graphic is an individual element, but the text is grouped as one.

This is your default logo.

You could leave it as it is, but, quite frankly, it won’t look great.

In this case, I’d like to move the text under the graphic and center it.

Select the text and drag it into position.

Once the text is aligned and looks pleasing to the eye, I’ll select all elements and move back to the center of the screen.

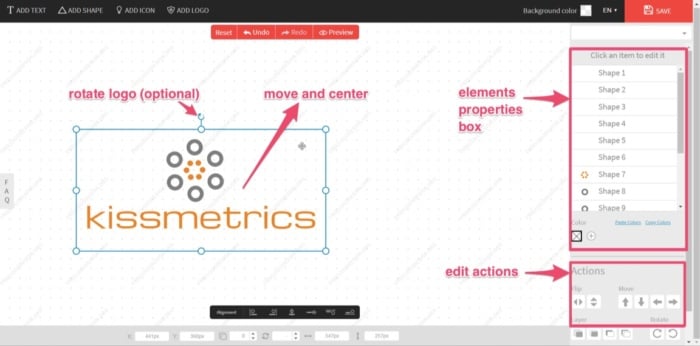

To do so, click and drag the cursor over the elements you want to move.

This creates a selection box of all elements that you can move (or rotate if required). A properties box that shows each element individually will also appear.

If you need to edit these elements, you can do so under the “Actions” toolbar.

An element’s colors can be edited, moved, flipped, and rotated.

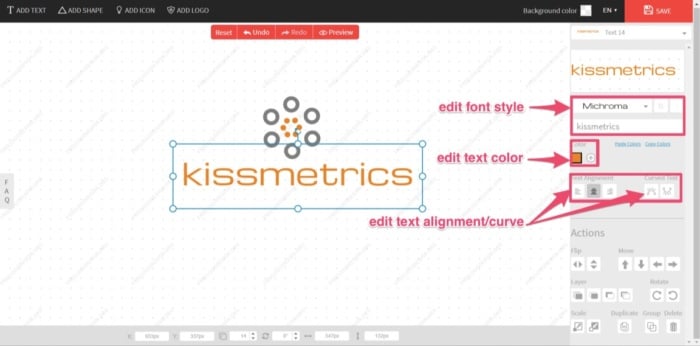

You can also edit the color, alignment/curve, and font style of the text if you’re not quite happy with it.

Or you can add an extra logo, icon, shape, or more text from the options on the right.

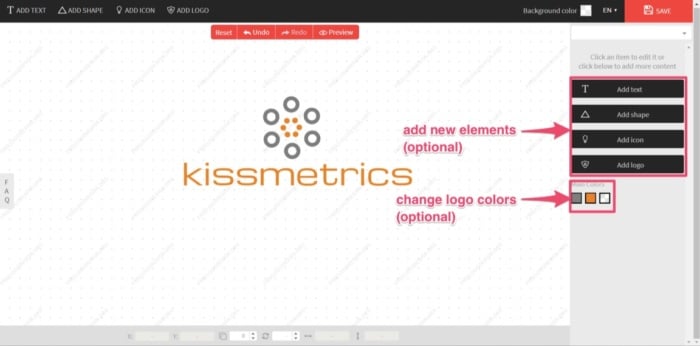

Add an extra element or edit logo color if required.

Sometimes you can get stuck tweaking your design, potentially for hours.

For the “new” Kissmetrics brand logo, the goal is to create a completed logo design in only a few minutes.

And that’s all that’s needed. I’m happy with the design.

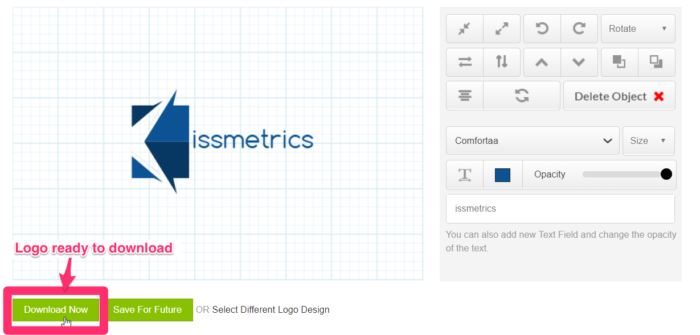

Now, with the design complete, it’s time to download your new brand logo. You can easily do this by clicking “Save” at the top-right corner of the screen.

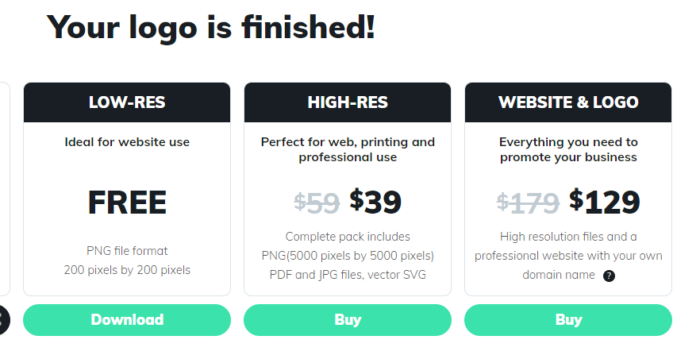

Free Logo Design will then prepare your logo for download. Once ready, it will give you the following options:

Click “Download” and enter your name and email address.

The finished logo will now be sent to you, free of charge.

Although the free PNG file is of a low-resolution, it’s ideal for website use and email signatures.

Even the high-resolution download is reasonably priced. Currently, at $39, this includes a PDF, EPS, and vector SVG file.

This is a steal compared to the prices I mentioned earlier for a professional design, and it’s very cost-effective for a bootstrapping business startup.

Whether you’re a bootstrapping startup or not, realizing your brand’s importance can play a major role in your business’s success.

By equipping your company with a new brand logo, you’ll be one step closer to achieving this success.

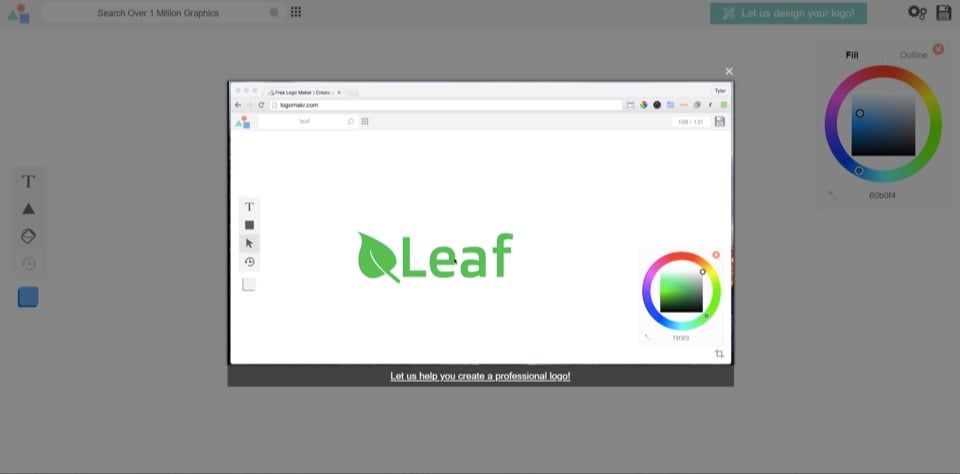

Another free resource with a hands-on approach is Logomakr.

With Logomakr, you can instantly make a brand logo for your company.

Most of these free online logo makers use similar concepts when designing and editing. They use existing templates on a user-friendly design platform.

To create your design with Logomakr:

Go to their homepage, and it will greet you with an instructional video. This will quickly run through the simple process of using their platform to design a logo.

It also presents you with the following design advice to consider:

With your concept in mind, you’ll need to pick a graphic for your logo.

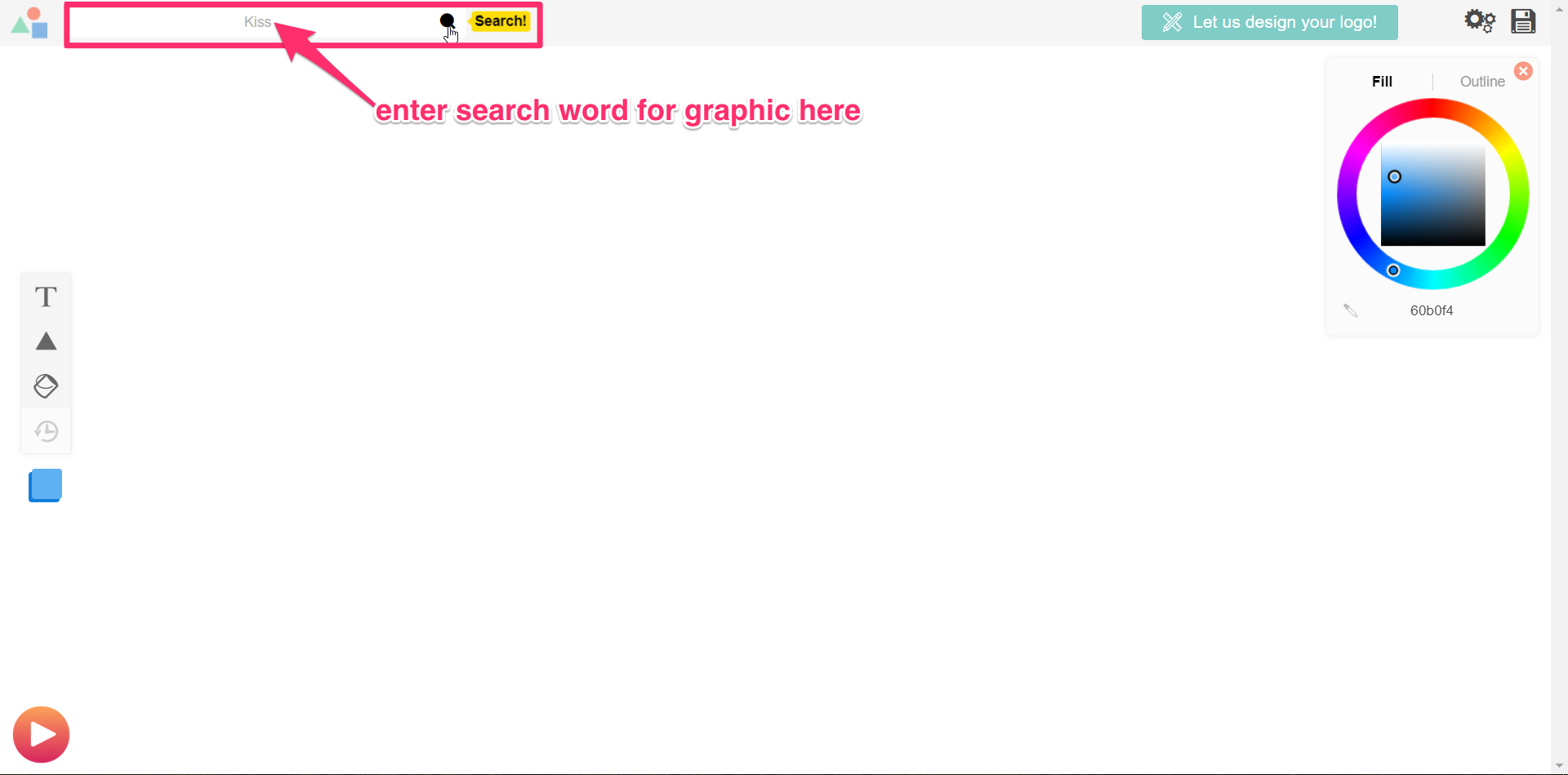

Next, search the million or more graphics in Logomakr’s database by using the search bar at the top left of your screen.

For my design, I’ll search “kiss.”

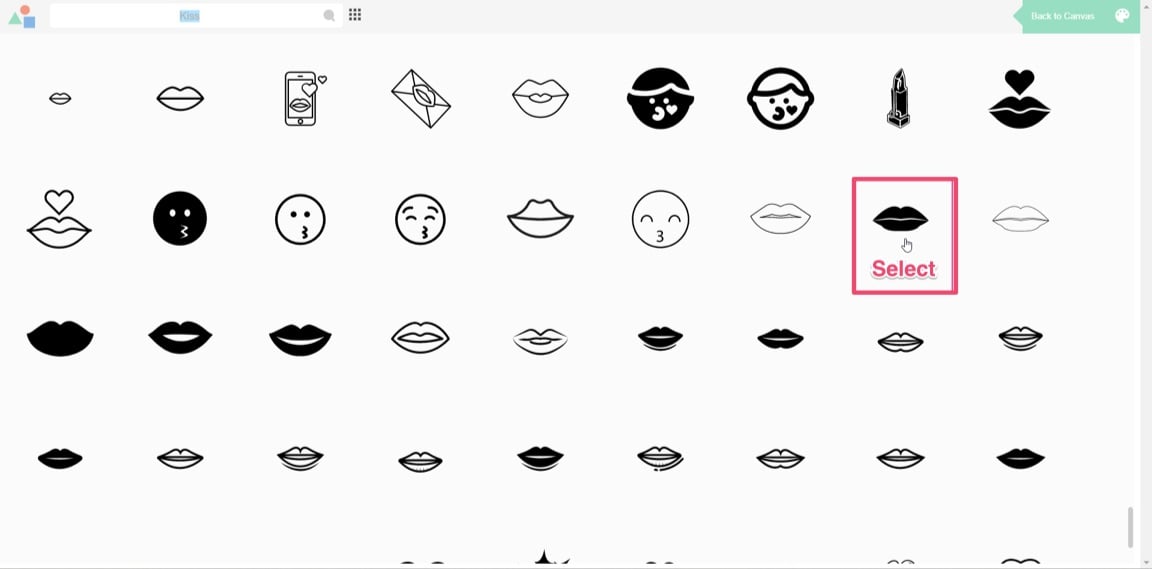

The database should then give hundreds of free-use images to choose from (for that particular search word).

Scroll through the results and select the image you’d like to use.

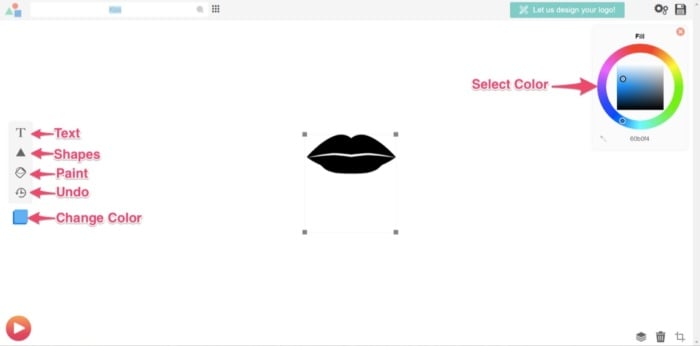

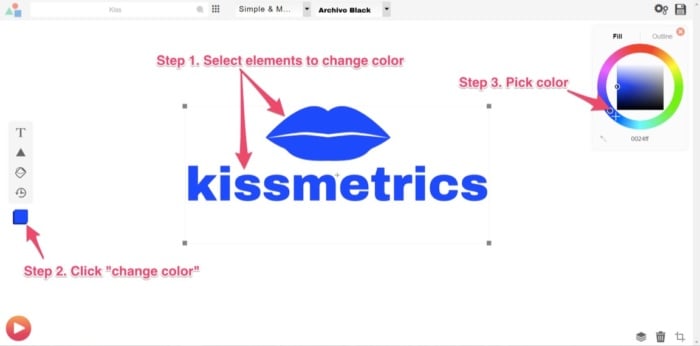

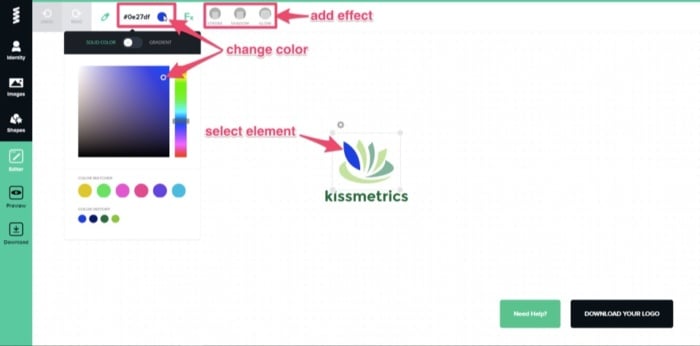

You’ll then return to the editing page, where you’ve multiple options to edit your design.

You can add text, shapes, paint, scale, move, or change your graphic color.

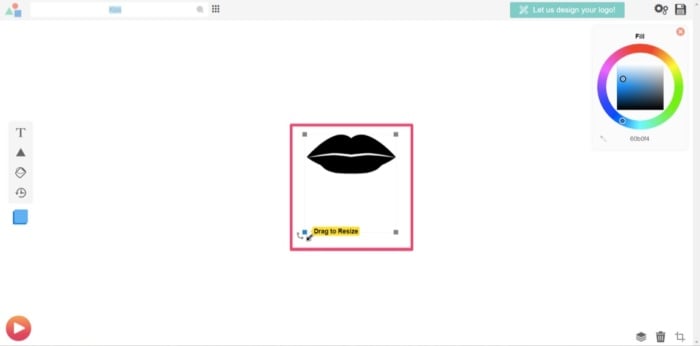

For this example, I’ll scale up the graphic to be larger. That way, it’ll stand out more.

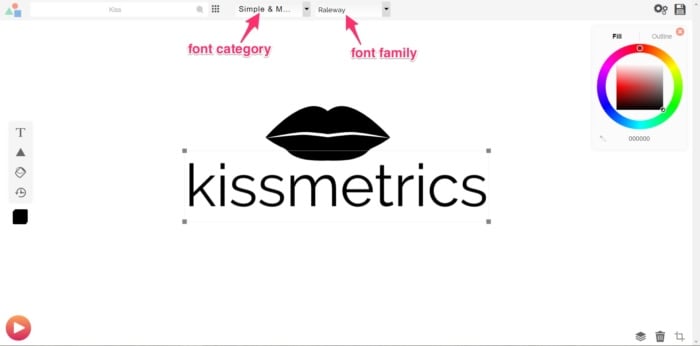

Next, you’ll need to add your company name. Using the “add text” function, I’ll add “kissmetrics.”

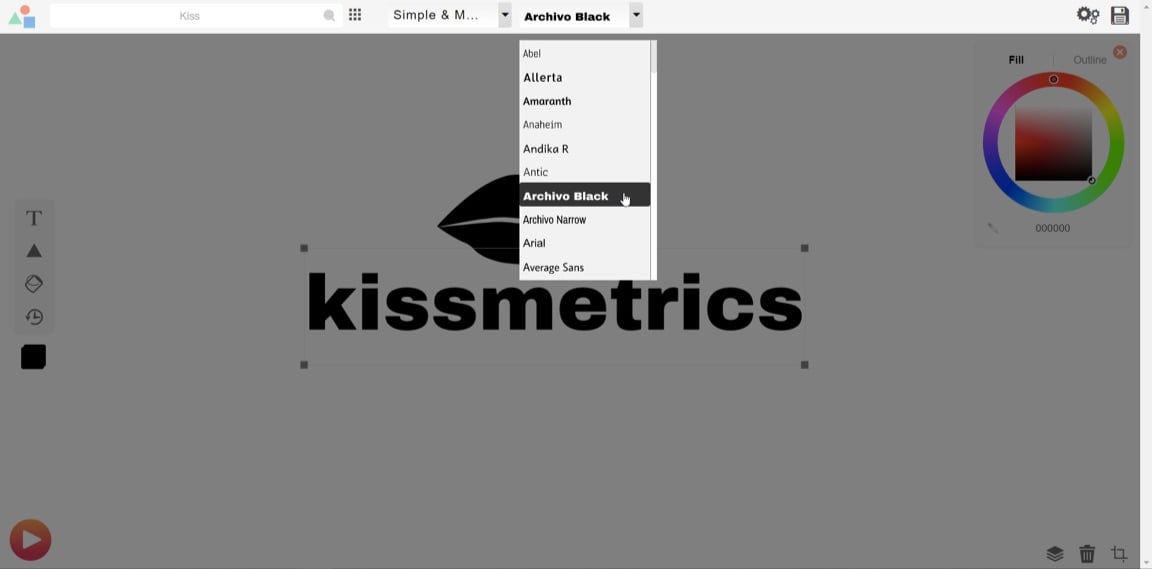

Once you’ve added the text, you’ll notice two drop-down menus at the top of the screen.

One is for the font category, and the other is for the font style.

Select the font style or category that you think will have the best visual impact on your design.

You can play around with the text and the scales of the elements (text, image, or shapes) so they sit proportionate to each other.

Once you’re satisfied, consider the colors you’ll use in the final design and how that ties in with your branding strategy’s overall color scheme.

At Kissmetrics, I’m partial to the color blue.

You can change the color in three steps:

Once done, you’re ready to save and download a copy. Do this by clicking on “Save Logo” at the top right corner of your screen.

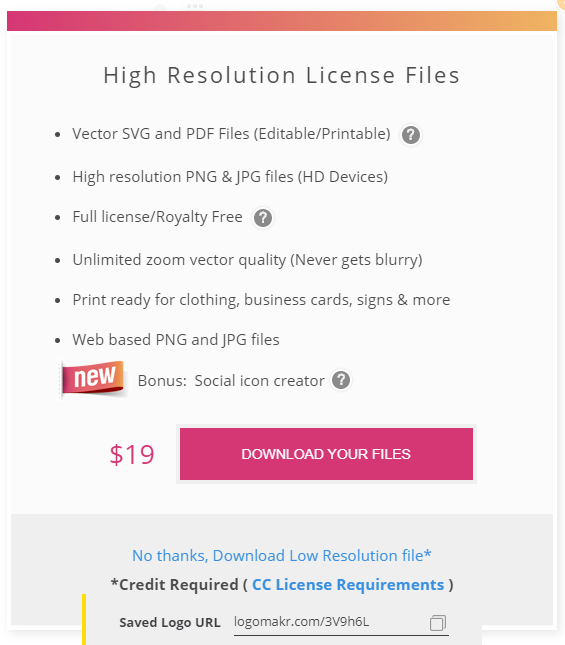

This will then bring you to your final set of options, depending on the logo’s use.

To opt for the free version, you’ll need to download and give credit to Logomakr.

For this design, I’ll click on “Download And Agree To Give Credit.”

Again, to download a higher-res image than the one provided for free, you’ll need to pay a premium. In this case, it’s $19.

With the high-res image, you’ll be able to use it on banners, company clothing, and for printing purposes.

If you’ve followed the simple steps above, you should now have a free brand logo that you can use as many times as you like.

You can do all of that in under 5 minutes, too.

Next on the list of software that offers free downloads is Canva.

If you’re not familiar with Canva, it’s simple design software that is quite popular with graphic designers and bloggers to create high-quality images like infographics and featured images.

Its popularity is due to its simplistic drag-and-drop design tools and a huge collection of photos, graphics, and fonts.

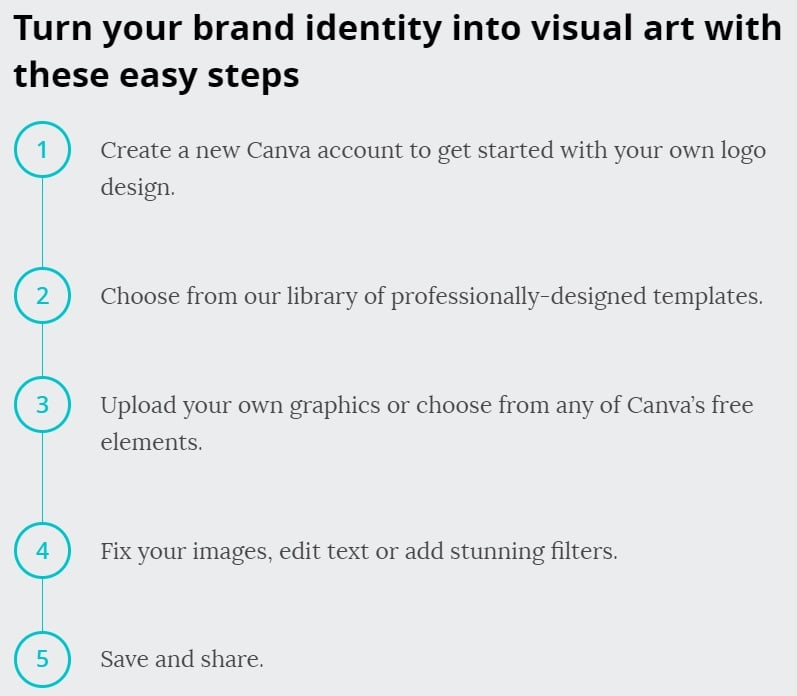

With the easy-to-use platform, you can create your brand logo in five easy steps:

Go to Canva’s Online Logo Maker and create an account.

Once you’re done, click on the “Start Designing A Custom Logo.”

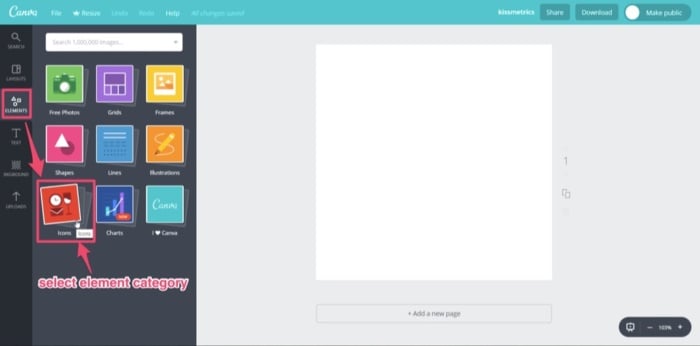

The first thing you’ll want to do is select “Elements” from the toolbar and decide on a category. For this design, I’ll use an image from “Icons.”

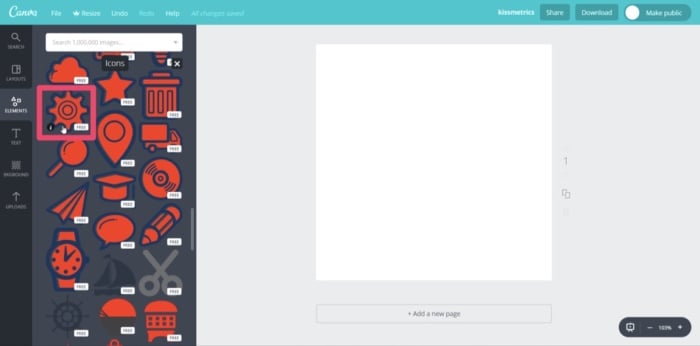

A library of multiple icons will then appear. Scroll through them until you find an image you can use. Then, select it.

Some elements have the word “free” beside them. These are free-use graphics that you can use in your logo design.

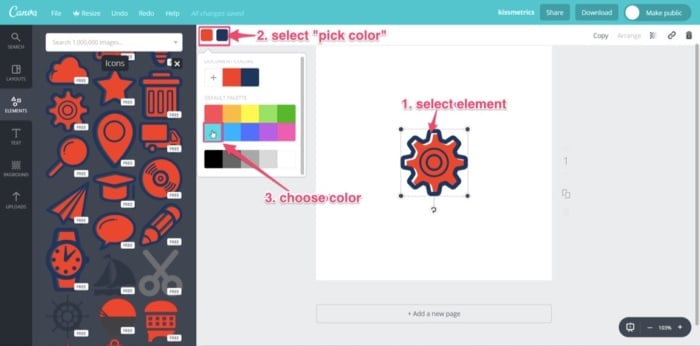

Now that you have the main graphic for your logo, select the element, and change the color.

Remember: always keep your branding theme in mind. So, once again, I’ll use blue.

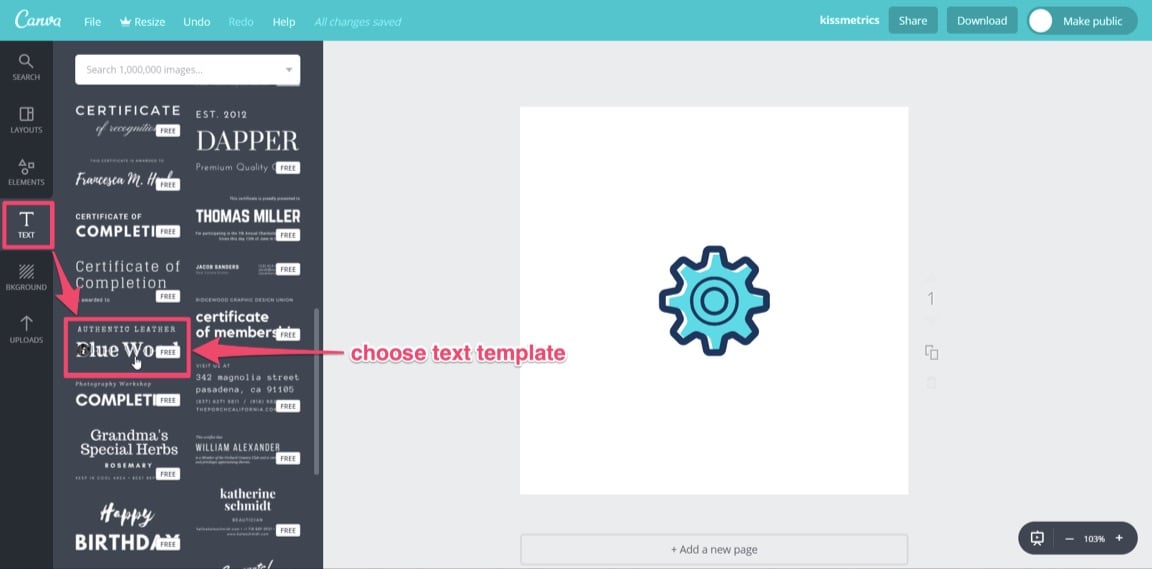

Next, you’ll want to add your company name by selecting the “Text” tool from the toolbar. Similar to “Elements,” you have a library of templates to choose from.

Scroll through to find a text that will fit your brand, keeping in mind the “free-use” templates.

Find your favorite and click on it. I’ll use “Blue Wood.”

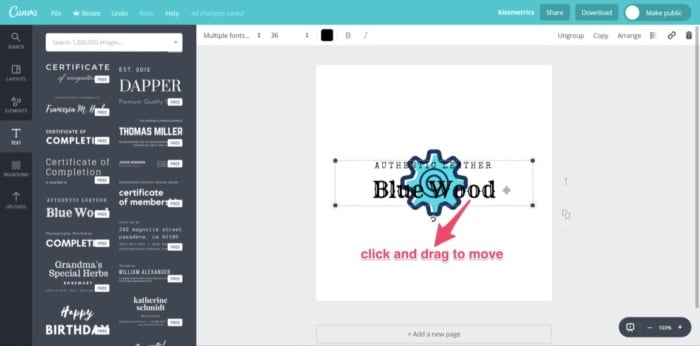

You’ll notice that the text will center on top of the logo element. Click on it and drag it to where you want it.

Move both text and element so that they align with the center of the design template.

Once satisfied, it’s time to edit the text.

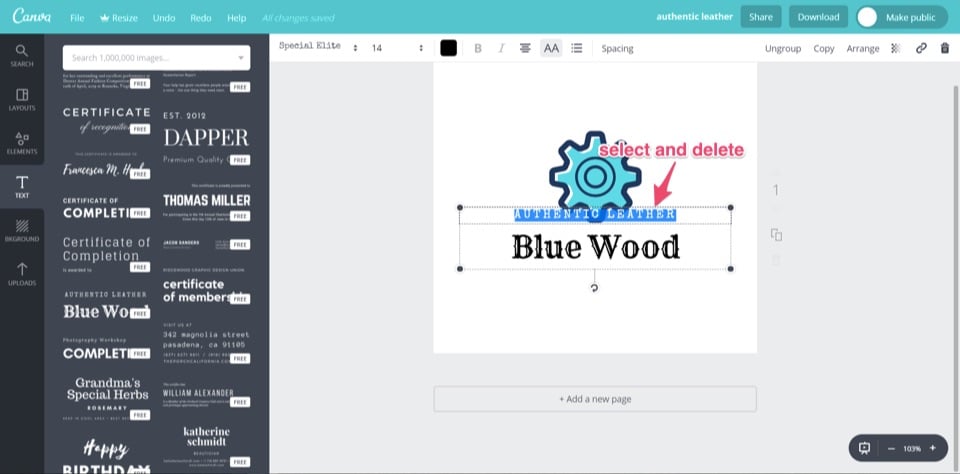

Click on and select the small text above “Blue Wood.” Delete this text.

Click on and select the text “Blue Wood” and replace it with your company name, “kissmetrics.”

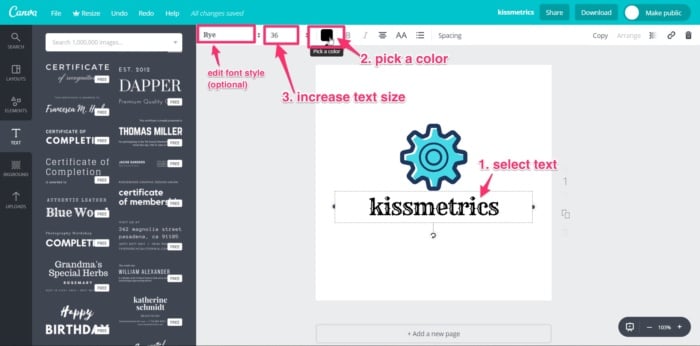

Next, edit the text’s color and size by selecting the text and using the text toolbar at the top of your screen.

You also have the option to change the font style using the drop-down menu.

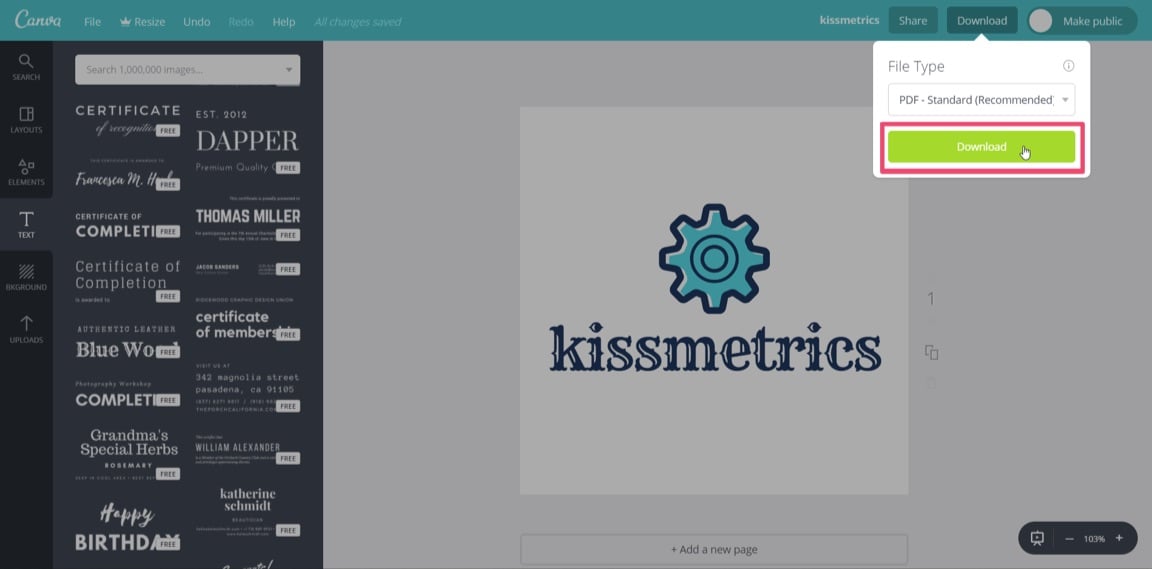

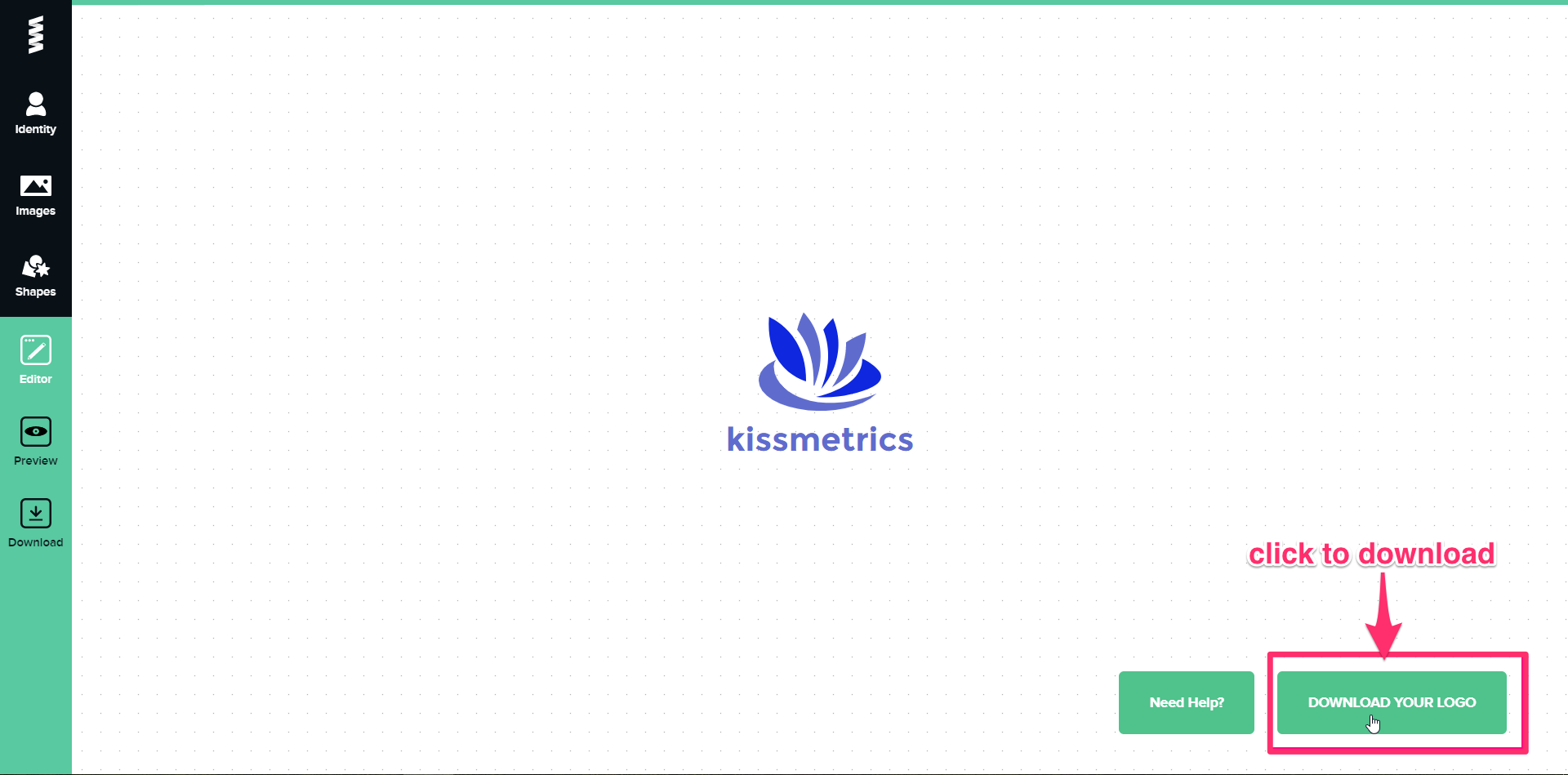

Your logo should now be ready to download. Click the “Download” button at the top right of the screen.

You’ll be given different file types to select for download.

The file types available are JPG, PNG, PDF standard, and PDF print. For the Kissmetrics logo, I’ll choose PDF standard.

Once downloaded, you’ll be able to view your new brand logo in a PDF reader.

Canva doesn’t yet support exporting logos in a vector format.

For higher-res graphics, you should make your logo as large as possible and download the PDF print version.

Don’t worry; with a PNG file, you’ll be able to add your logo to your website.

Another quick, simple, and free way to create a brand logo for your company.

GraphicSprings is software that allows you to use their platform to design and create a logo for free.

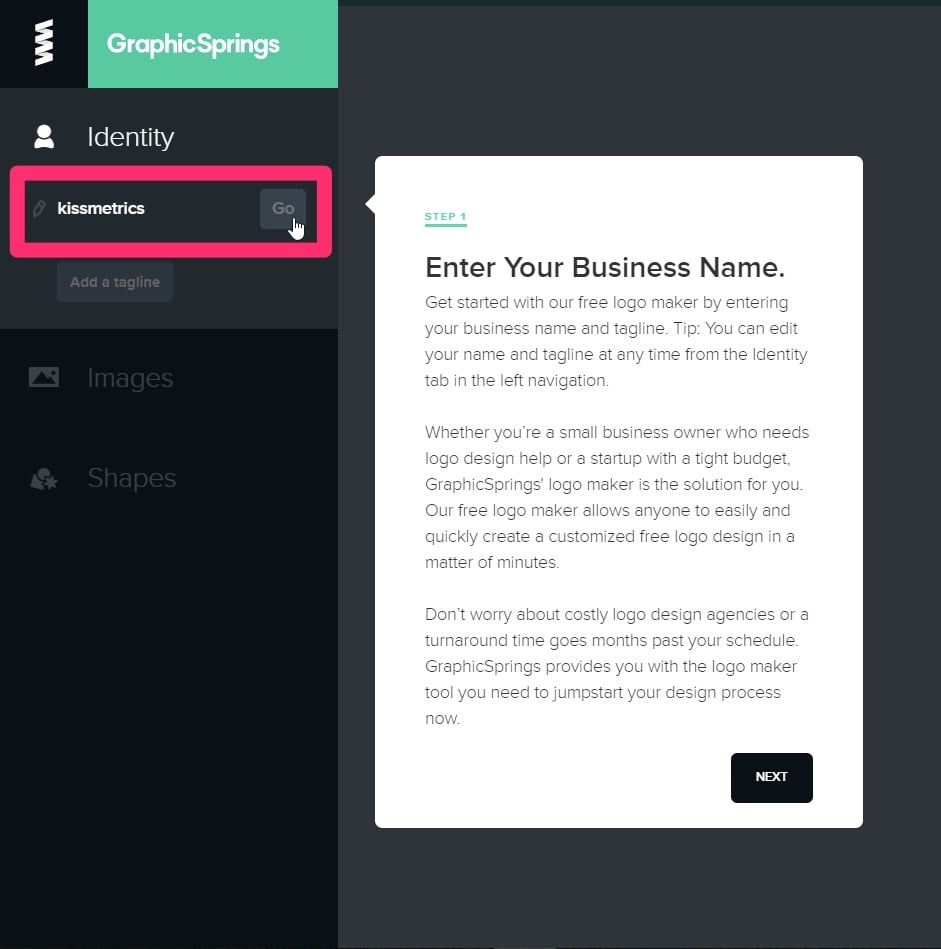

To begin your design, go to their logo design page and enter your company name.

Next, add an image from the database by selecting “Choose Your Graphic” from the side toolbar, left of the screen.

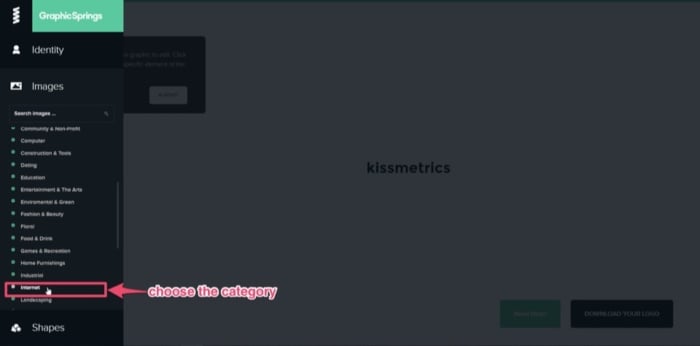

A sub-search bar will pop-up under your last selection, with a list of categories underneath.

If you know the graphic you’d like to add, enter it into the search bar.

GraphicSprings have included an “Internet” category, which is quite fitting, so I’ll use that.

Click the category you want, and a database containing stock images or graphics will appear.

(Just like the previous software).

Can you spot a common theme yet?

This simple concept works across each platform, eliminating the need to “reinvent the wheel.”

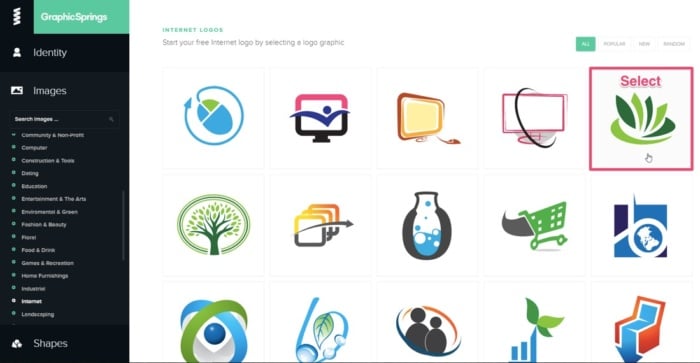

Search through the results, and once you see an image that you’d like to use, select it.

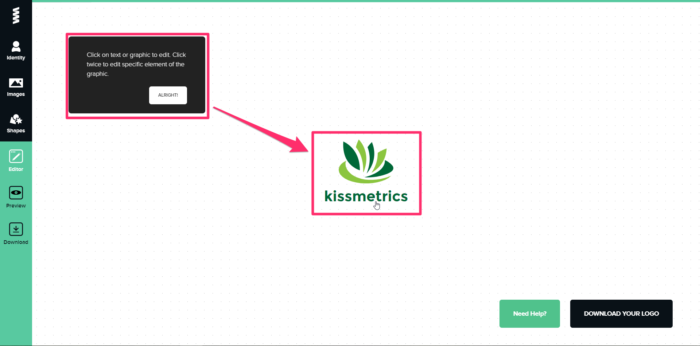

After choosing a graphic, the software will create your design and take you to the editing page. Once you’re there, it will prompt you to select the elements for editing.

Click on the text to edit it. It will allow you to change the font style, size, and format. You can also add some cool effects like stroke, shadow, or glow.

For simplicity, I’ll leave it as it is.

The options for editing are also basic. You have the ability to change the color and add some effects.

Canva will break the graphic into different elements (similar to Free Logo Design), so you can edit each piece individually.

I’ll stick with the color theme of blue, but I’ll keep the two-tone effect.

Next, select each element and change the colors accordingly.

Once the editing is complete and you’re satisfied with the design, click “Download Your Logo” at the bottom right of the editing page.

It will take you to the payment page, where you can buy the high-resolution image for as low as $19.99.

To access the vector files with the ability to edit after you purchase it, you’ll need to pay for the standard package, which costs $39.99.

With this option, you’ll have the ability to make aftermarket changes to your logo whenever you please.

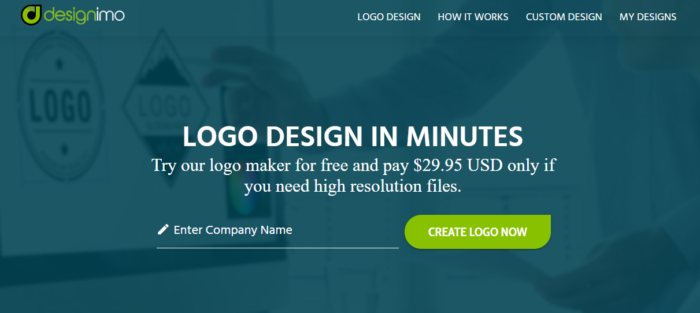

Designimo also requires payment once the design is complete, but you can use the design tools for free to create the graphic for your logo.

They previously offered a low-res free download, but they now produce high-res images only.

Designimo is similar to Free Logo Design and GraphicSprings in that you enter the name of your company into the search bar and select a category that fits your needs.

It’ll then auto-generate multiple graphics using a huge database of existing designs.

Again, the level of editing is basic, but the results are solid.

It also follows the simple process that Free Logo Design uses:

For a quick video tutorial to help you use the platform, check out how it works here.

To ensure your design goes as smoothly as possible, I’ll walk you through the process below.

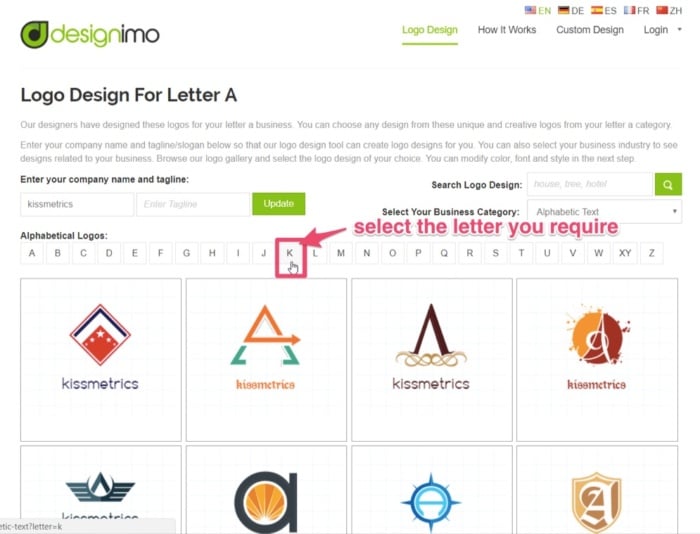

First, go to the homepage, add your company name, and click “Create Logo Now.”

Then, select a category from the drop-down menu, ranging from “Alphabetic Text” to “Travel & Hotel.”

For this example, I will use the category “Alphabetic Text.”

Designimo will provide you with numerous individual designs under each category.

While the other categories use existing graphics made up of symbols, the “Alphabetic Text” generates logos in the shape of the letter selected (hence the name).

It also files them alphabetically.

For the Kissmetrics logo, I’ll select the letter “K,” and go through the results. Each letter has multiple pages of designs, so navigate through them.

Once you’ve found the one you’d like to proceed with, select the graphic.

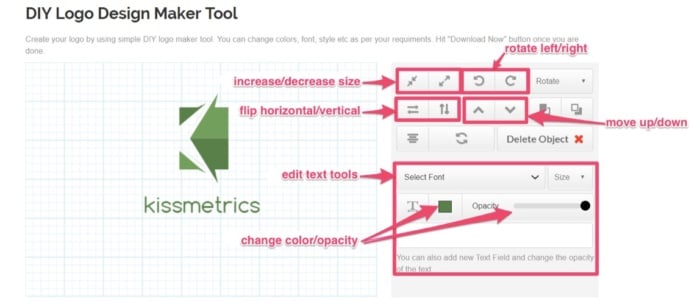

You’ll then land on the editing page, equipped with basic design and editing tools. Using the tools available, you can:

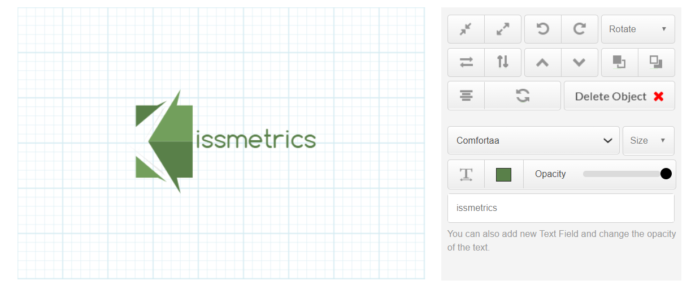

For this alphabetical logo, I’ll be a little creative and use the symbol shaped as “K” and use it to start the company name, “Kissmetrics.”

By deleting the “k” from the text, I now have a completely different and unique looking logo.

Edit the text size or font style, if required.

The default font is OK, so I’ll leave it as it is.

Next, change the colors to match your theme.

If you’re happy with the design, your new brand logo should now be ready to download. Click on “Download Now” or “Save For Future” (if you’d like to come back and work on it).

First, you’ll need to register your details and sign up for an account to download your image.

You’ll then be brought to an order confirmation page, to confirm and proceed to checkout.

Pay and download.

The cost for a high-res image, including PNG, JPG, and EPS Vector files, is $29.95.

Although not free, the brand logo you can create and download using this software is a high-quality graphic at a relatively low price.

When it comes to starting a new business, the tasks on your to-do list, along with the costs of setting everything up, can be overwhelming.

But creating a brand logo for your company doesn’t have to be.

Branding should be the core of your company’s marketing strategy.

Your brand should tell a story, and part of that story is your logo.

Being an expert in graphic design or outsourcing to a professional was once the norm (and it still is for many brands).

But now, the Internet is full of innovative people with new ideas and free software that can help new businesses reduce their startup costs.

With user-friendly tools, it’s possible to create a free brand logo for your company in minutes.

These platforms also help prevent you from being paralyzed by options.

Previously, you may have been up all night studying “how-to-design” videos on YouTube.

Now you don’t have to.

These platforms do most of the designing for you and, and they’ll even give you some quick tutorials. All you have to bring to the table is a good idea and an eye for a visually-pleasing design.

With your brand’s color and theme in mind, pick the software that is easiest for you and get started designing a free brand logo today.

In terms of user-friendliness, design results, or cost, which free brand logo software would you recommend?

The post 5 Free Brand Logo Tools For Your Company appeared first on Neil Patel.

Suddenly you notice that none of your social media activity seems to be showing up at all. It’s like you don’t even exist on the site… Weird!

Is it a bug? Every website suffers from them sometimes, and the interactive features can often be the first to go haywire. Server maintenance could also be the culprit.

But another possibility is that you might have been “shadowbanned” (previously called ghostbanned).

Accounts that are shadowbanned are put into a kind of invisible mode. In other words, they become a “shadow” that no one can see.

In this post, we’ll talk more about what exactly shadowbanning is, and how you can tell if it happened to you.

Shadowbanning is when your posts or activity don’t show up on a site, but you haven’t received an official ban or notification.

It’s a way to let spammers continue to spam without anyone else in the community (or outside of it) seeing what they do.

That way, other social media users don’t suffer from spam because they can’t see it. The spammer won’t immediately start to look for ways to get around the ban, because they don’t even realize they’ve been banned.

Now, all of this might sound a little odd or shady. Since many websites and apps deny that they shadowban, there’s no way to know for sure that it’s happened.

If you suspect a shadowban, a change in the website’s search or newsfeed algorithm might actually be to blame. And since the algorithms are the property of social media companies, it’s not in their best interest to reveal everything about them publicly.

Regardless of whether you’ve been penalized deliberately or accidentally, the effect is still the same… no one can see your posts.

There’s no way of getting a full list of sites that shadowban people, since the practice isn’t entirely out in the open.

However, shadowbanning has been reported before under certain circumstances, on sites and apps like Facebook, Instagram, and TikTok, among others.

Respondents to a survey called Posting Into the Void reported four general types of shadowbans:

Here’s how to tell if you’ve been shadowbanned on some popular social media sites:

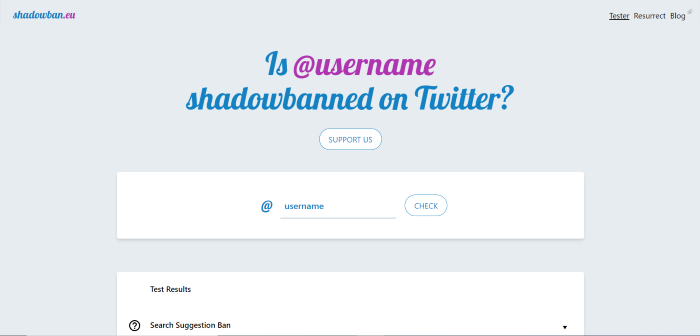

Does Twitter actually shadowban people? Well, yes and no.

In a blog post, Twitter claimed that they don’t “deliberately make people’s content undiscoverable to everyone except the person who posted it”, and they “certainly don’t shadowban based on political viewpoints or ideology.”

However, they did say they “rank tweets and search results” to “address bad-faith actors”. Basically, if Twitter thinks you’re a spammer or a troll, its algorithm will penalize your content.

Twitter lists these as some of the factors they use to tell if you’re a “bad-faith actor” or not:

To avoid getting shadowbanned on Twitter, you should confirm your email address and upload a profile picture.

Don’t spam people and don’t be overly promotional. If you’re trying to sell a product or service and are posting too much, other users might block your content, causing a shadowban on your account.

You should also try to avoid trolling, getting into online arguments, or being too confrontational in your posts and comments. This can lead people to mute or block you.

There’s no way to tell for sure if you’ve been shadowbanned on Twitter. However, you could try using the site Shadowban.eu, which claims to be able to detect a shadowban.

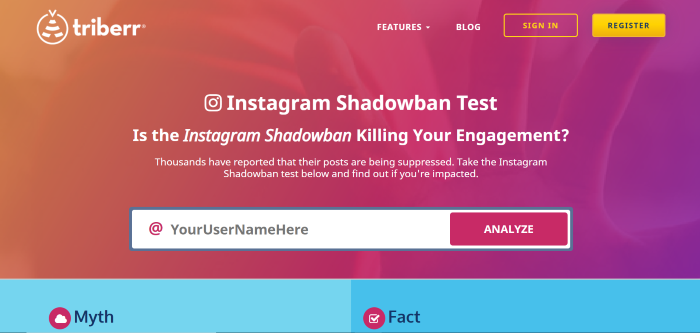

How frustrating is it to work hard at building up an Instagram following, only to see that your posts suddenly aren’t showing up?

Like with Twitter, Instagram’s CEO has publicly claimed that “shadowbanning is not a thing”, but as with Twitter, that’s not entirely true.

While you personally might not be being shadowbanned, the algorithm could still be hiding your posts.

Instagram’s algorithm is designed to remove certain content. Namely, the algorithm penalizes content that Instagram considers “inappropriate”, even if the content doesn’t go against the app’s Community Guidelines.

Specifically, they mention sexually-suggestive content. According to their Community Guidelines, spammy content and content associated with illegal activity or violence is also a no-go.

Instagram prefers “photos or videos that are appropriate for a diverse audience”… so less family-friendly content may be at risk of a shadowban.

There’s no surefire way to tell if you’ve been shadowbanned on Instagram, but there are sites that say they can test it. Triberr is one option.

Shadowbanning on Reddit is a bit different from shadowbanning on other social media sites. Up until 2015, Reddit openly shadowbanned users who broke the site’s rules by hiding their posts.

Reddit then announced that the shadowbanning system had been replaced with an account suspension system. Basically, some Reddit staff thought that the shadowban tool had been useful for dealing with bots, but that banning real human users without telling them what they did wrong was unfair.

However, the site appears to still occasionally be using shadowbans, with the r/ShadowBan subreddit still active.

According to their official content policy, Reddit may enforce their rules by “removal of privileges from, or adding restrictions to, accounts”, and also by “removal of content”, among other methods.

Of course, to avoid getting shadowbanned on Reddit, you’ll need to follow their rules. But one tricky thing about that is that the rules on Reddit actually depend on the subreddit you are submitting to.

You’ll want to read and comment a lot first before submitting your own links. Watch how people react to various types of submissions within a specific subreddit, and then act accordingly.

You can also check out this unofficial guide on how to avoid being shadowbanned. Some key points:

To find out if you’re shadowbanned on Reddit, make a post in the r/ShadowBan subreddit. A bot will respond to you, letting you know if you’re shadowbanned.

Even if you’re not, the bot will tell you which posts of yours have been removed recently (if any).

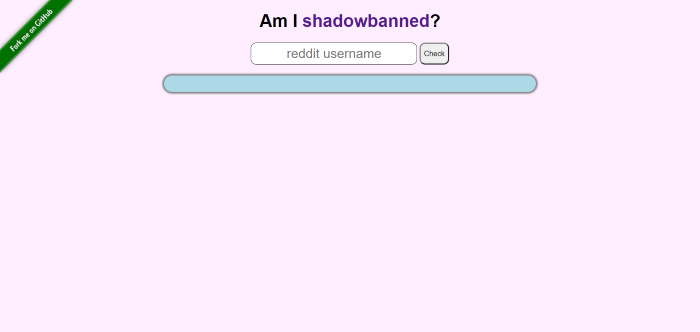

You could also use a third-party tool, like Am I Shadowbanned?

TikTok is a popular social network for sharing short videos. Unfortunately, you can get shadowbanned there too (kind of).

While there’s no official mention of the term “shadowban” in TikTok’s Community Guidelines, like other social media networks, TikTok uses algorithms to privilege certain content. If you get on the wrong side of the algorithm, fewer people might see the content you post.

To have more people see your content and avoid penalties, try to follow best practices for TikTok’s recommendation algorithm, and always follow the Community Guidelines.

Stay away from illegal material, violence, hate speech, spam, and other similar topics.

To check if you’ve been shadowbanned on TikTok, look at your pageviews and “For You” page statistics. You can also use a hashtag and see if your post shows up under that hashtag.

Facebook calls its content moderation policy “remove, reduce, and inform.”

Basically, content that violates Facebook’s Community Standards will be removed from the site, while other undesirable content (like misleading information) may be less visible on Facebook or have a warning label placed on it.

If Facebook is consistently “reducing” your content, that could be considered a type of shadowban.

The main thing you can do to trigger a shadowban on Facebook is to share links to fake or misleading information. Content on the site is checked by independent fact-checking organizations.

Facebook also penalizes links from websites that its algorithm considers clickbait. Low-authority websites without a lot of inbound and outbound links that generate a lot of clicks on Facebook may be considered clickbait.

Facebook groups where a lot of misleading links and clickbait are frequently shared may be shadowbanned.

If you’re worried your personal page, business page, or group might have been shadowbanned on Facebook, check for a change in engagement levels on your recent posts.

While people don’t often think about getting shadowbanned on LinkedIn, it’s possible for your content’s reach to be throttled there.

Like other social media sites, LinkedIn has Community Policies that all members need to follow to avoid problems.

Since LinkedIn is a professional site, its content policies are even stricter than other platforms. Not only should your content be safe, legal, and appropriate, it has to be professional as well.

Although LinkedIn is obviously a place for career growth and self-promotion, spamming people is still a no-go.

You’ll need to respect others’ privacy and intellectual property. You should also avoid harassment or unwanted romantic advances towards other members.

If you violate LinkedIn’s policies, they may “limit the visibility of certain content, or remove it entirely.”

That said, the LinkedIn algorithm is pretty complicated. Even if your content is perfectly professional and high-quality, it might still not be getting the reach you want.

Engagement and relevance are the top two factors to keep in mind when creating content for LinkedIn.

While it’s not exactly a social network, it’s definitely still a site where people go to learn and share content. Can you be shadowbanned from YouTube?

Well, YouTube shadowbanning has been in the news because of popular creator PewDiePie. According to his fans, the Swedish videogame YouTuber’s channel was penalized in YouTube search.

YouTube’s official response was that it doesn’t shadowban channels, but that some videos might be flagged and need to be reviewed before they show up in search.

In an interview with Polygon, they said they were “currently working on fixing the issue.”

Different social networks have their own opinions on what type of violations merit a shadowban. However, we can definitely see some general trends that are worth noting.

Adhere to these guidelines if you want to be safe from a shadowban:

You may not have any idea you are being shadowbanned. At least not at first… though over time, you may begin to suspect it.

What you should do to protect yourself is to be careful that what you post isn’t against the terms and conditions of the site or app. Also, try to avoid spamming content, starting fights with and trolling other users, or posting things that might be considered inappropriate.

A shadowban can be frustrating, especially if you don’t feel like you deserve one. Maybe you don’t agree with the social media algorithm about what is or isn’t inappropriate, or maybe you think you were having a constructive debate while the algorithm thinks you were being a troll.

However, hopefully the tips in this guide can help you avoid being shadowbanned in the future, so your content can get better engagement.

What other ways can help people know if they’ve been shadowbanned? Let us know in the comments.

The post How to Tell if You’re Shadowbanned on Social Media appeared first on Neil Patel.