Jimmy Lai is charged under a security law for criticizing China.

The post Hong Kong's Freedom Fighters appeared first on ROI Credit Builders.

Jimmy Lai is charged under a security law for criticizing China.

The post Hong Kong's Freedom Fighters appeared first on ROI Credit Builders.

New shutdown orders punish minorities and low-income workers.

The post The Restaurant Lockdown Massacre appeared first on ROI Credit Builders.

Article URL: https://jetpackaviation.com/career/

Comments URL: https://news.ycombinator.com/item?id=25399846

Points: 1

# Comments: 0

Romain Grosjean has posted pictures of his burnt right hand sustained in a fiery crash at the Bahrain Grand Prix.

The post Grosjean shares photo of right hand burns appeared first on Buy It At A Bargain – Deals And Reviews.

The best pay-per-click (PPC) campaigns catch the eye, target relevant audiences, and motivate users to click or buy. Buzzwords are one way to reach these goals in the brief amount of time someone may spend looking at an ad.

Effective PPC marketing will always come down to compelling language. No matter how many features you use or Google Ad extensions you add, the best ads will always be the ones with the most powerful ad copy.

Buzzwords are popular or trendy words or phrases. They are sometimes referred to as “jargon” or “business jargon.”

A buzzword can be a single word, a short phrase, or an acronym that gains popularity and replaces more traditional words.

Is buzzword marketing effective in business? It can be. There are several instances where marketing with jargon can be appropriate. For example, if you want to show your audience you belong and understand their problems or when you want to filter out irrelevant readers who aren’t likely to buy from you.

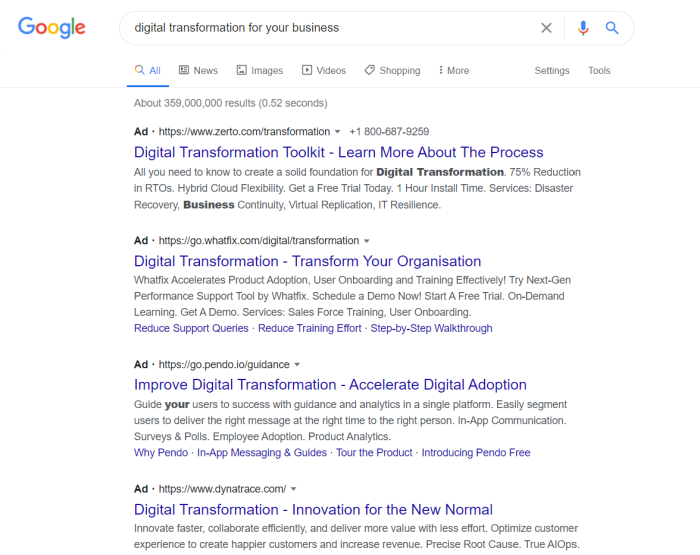

Take a look at these ads for companies offering digital transformation. Are they written for a wide audience?

No. They are clearly making an effort to stand out to a very particular audience, and use buzzwords they know will jump out at a potential customer.

These ads don’t explain or define these terms because they know their ideal client already understands them.

When you only have a moment to make an impression, buzzwords can have a big impact. They become popular for a reason, and they are often catchy and memorable.

We tend to develop a preference for things that sound familiar, and that includes language. This is called cognitive fluency. When we’re familiar with words, we find them easier to understand — and easier to remember.

Countless ads are competing for users’ attention. Your PPC ads need to make a big impact in a small space. Buzzwords can help your ad stand out while appealing to the people most likely to become customers.

Here are some of the benefits of using buzzwords in your PPC campaigns:

Most readers only skim ads or read the first few words before moving on. Buzzwords can attract attention and quickly target relevant audiences due to swift recognition of the terms.

If you could only use a word or two to catch the attention of your customers, do you think your ad would stand out if you use words like quality, sell, buy, and fast — words used by every industry or business? Probably not.

It would be more effective to let them know your ad is relevant to them by using buzzwords they’ll recognize from their industry or interests.

Buzzwords can show up in timely searches for hot topics. You can then direct users to landing pages with content that uses less flashy language.

You can also use varying headlines on multiple ads with attention-getting buzzwords and change them as language evolves.

A specialized audience who connects with your ad copy can become a highly motivated and well-targeted audience. Buzzwords allow you to signal that you’re an insider speaking to other insiders, and communicate value quickly based on that status.

PPC is about marketing, but your ads are being read by humans who can be swayed by psychological impulses. Most are making practical decisions based on their emotions, whether they realize it or not.

People use this language because they want to belong. When you use the same language, you’ll tap into a psychological need to feel heard. They’ll respond to make sure they aren’t left out of the latest movement.

If your ad can create an emotional response that fills one or more of these needs, you’re likely to inspire action.

Customers are looking for reasons to buy from you. Reassuring them that you know what they’re facing and can solve their problems encourages them to buy from you.

The best way to find buzzwords that your customers will recognize is to pay attention to the language they use.

What do your customers say when they email or call your business? What language do they use to describe their pain points and the frustrations they face? What are they asking for when they ask for solutions? What words do they use when they write reviews?

Talk to your service department. They talk to your customers all day long, and they’re used to hearing your customer’s language. If you can address these concerns in your ad, you’re one step closer to showing your customers you are listening. This is a powerful shift.

You can also look at conversations in the communities you serve. What are your customers or audience saying online? What are your competitors saying? What topics are at the center of the most active conversations online?

If you want to use buzzwords in your PPC marketing, you should have a good understanding of the structure of an ad. Each ad you write will be made up of a few elements: headline 1, headline 2, and a description.

You may find that your customers only read the headline of your ad, or that some devices cut off portions of your ad due to space constraints. If you use buzzwords to add impact, make sure your customers will actually see them.

Ready to get started with buzzwords? Here are 20 ways to make the most of them in your paid ads.

Buzzwords are trendy words that attract a lot of attention — but only for a short period of time. They are not necessarily language that will stay fresh, and could eventually become stale or develop negative connotations. Buzzwords are ideal for short content that needs to make a fast impression, like your PPC ads.

Hashtags are words or phrases written without spaces after a hash sign (#) in social media posts. They allow you to tag your content so people can find your posts when searching for those topics online. Using hashtags on social platforms can ensure you show up in the right conversations online and grow your social media following.

Keywords are the search terms you want to research when trying to show up on the search engine results pages (SERPs.) While keywords are likely to be used in your ads and your site content and may help your content rank over time, they likely aren’t as trendy and short-lived as buzzwords might be.

From real estate to sales, healthcare, insurance, or the auto industry, every industry has its own specific advertising buzzwords.

Where else does language change quickly? Anywhere there is a lot of innovation in new areas and new capabilities being developed.

For example, in technology circles, if you aren’t using the terms your industry is throwing around, you’ll be left behind.

If your customers see you selling without language that positions you as an expert and trusted authority, they’ll go elsewhere. Buzzwords signal to your audience that you are part of the specialized group they want to be in.

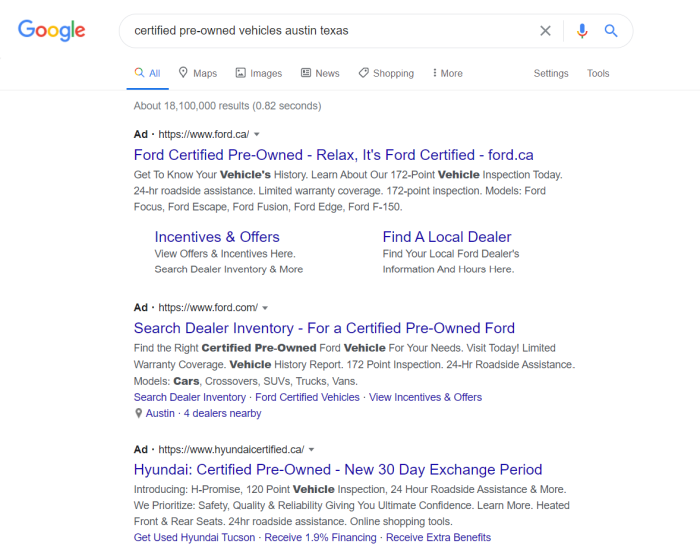

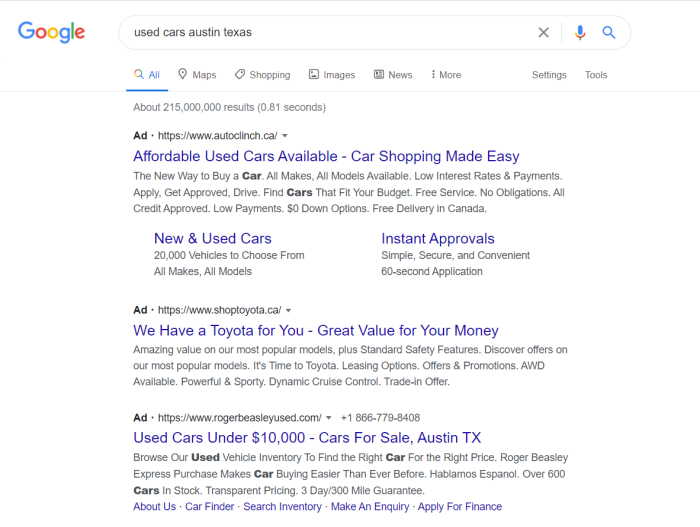

In the auto industry, people have sold used cars nearly as long as cars have been on the road. However, the use of the term “certified pre-owned” vehicles is an example of how marketing language has evolved over time.

Whether you like the term or not, most people will have a different reaction to ads for “used cars” compared to “certified pre-owned” vehicles.

Without using the new term, you might struggle to sell used cars at the same level as dealers who have adopted it. In this case, not using a buzzword could hurt you.

Using buzzwords is a powerful way to boost your ad copy and quickly attract attention from specific audiences. However, be sure the buzzwords you use are relevant, widely used by your audience, and don’t have multiple meanings.

Don’t use buzzwords for communities you aren’t a part of or that will confuse your customers. They want to hear the language THEY use, not the language you use internally.

Ad copy needs to make a point at a glance, and without context, so your buzzwords will need to fit these parameters as well. If it needs explaining, it doesn’t belong in an ad.

If your value proposition isn’t clear in the first few seconds, your ad will likely miss the mark.

Avoid using buzzwords in your landing pages and content marketing. Buzzwords often sound dated after a few months, and it’s time-consuming to update pages of content on a regular basis.

Your ads can be updated and refreshed any time there is a change in language or the general response to popular buzzword changes.

Using too many buzzwords in your writing can turn people off and make them think your content lacks substance. Some buzzwords are so overused that they may turn people off entirely.

Examples of buzzwords to avoid include:

Using buzzwords in your PPC campaigns can help you target specialized audiences swiftly and effectively. When used carefully, they can effectively trigger an emotional response in your customers and move them to action.

While using compelling language in your ad copy is essential, remember that plain language will always win out over complicated jargon.

Don’t clutter your ads with multiple buzzwords or try to cram unrelated buzzwords into single ads. Let them stand on their own, craft compelling copy for the rest of the ad, and watch your relevance.

Ad copy is a specialized skill, and many business owners find PPC consulting helpful to see results faster. My team offers PPC management if you’d like to get in touch.

Have you tried using buzzwords to boost results in your PPC marketing? What results have you seen?

The post 20 Buzzword Ideas for Your PPC Campaigns appeared first on Neil Patel.

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

You know the revenue is out there and you know an email campaign can help you get it. But how do you keep a strong handle on your campaign as it plays out over weeks and months?

Email autoresponders can save you a ton of time and deliver huge returns on campaign investment. Yet automation can be a double-edged sword.

The sad truth is that many thoughtful email campaigns become inbox wallpaper. It only takes a few mistimed or off-target emails before your audience starts to tune them out.

A good email autoresponder gives you the ability to connect with customers, at scale, without overwhelming them.

Or your team, for that matter. These products eliminate many of the tedious and repetitive tasks that are so essential to building relationships at scale.

Delight your customers with content they’re interested in. Get full visibility into your open and click-through rates and watch them climb.

Let’s walk through the best email autoresponders, what they can do for you, and how to select the right one.

Email autoresponders can help your teams get more done in less time, without sacrificing the personal touch that drives clicks. However, not all email autoresponders are created equal.

Some will work well for a brief series of 3-5 emails that welcome a new contact and warm them to your products—good for a simple customer journey.

Others help you set up complex automated workflows that respond to customer behavior, shopping tendencies, and other triggers you define.

The end goal is setting up something that automatically sends the right message, to the right customer, at the right time.

Here are the major features of email autoresponders that are helping companies increase their chances of success:

It’s right there in the name—the big boon of autoresponders is automating menial, manual campaign tasks.

However, the more robust tools tie into your customer databases or CRM, and let you define triggers based on a range of highly-personalized criteria.

Some of the popular automation capabilities you will see include:

A really good autoresponder lets you build out workflows within a visual editor, giving you a bird’s eye view of each trigger and step of the process.

Make sure you pick something with the capabilities you need to design each customer’s entire journey.

Don’t forget about crafting great emails. They have to be appealing from the subject line to the CTA, and every element must be optimized for web and mobile.

Good email autoresponders make these challenges much easier. My favorite products have intuitive visual email builders that help you make content that converts.

Beyond designing beautiful emails quickly, you can add buttons, embed content, and preview exactly what your email is going to look like from a customer’s point of view.

Find an autoresponder with an email editor that your employees enjoy using that also delivers predictable results.

With it, you’ll find that your teams will be able to quickly generate on-brand emails, consistently building out the perfect message for each step of a customer’s journey.

The contacts who make up your list are different people. That should go without saying.

But, even today, many companies rely on email blasting their full list to get the word out.

Effective email campaigns are based on putting things in front of customers that they actually want.

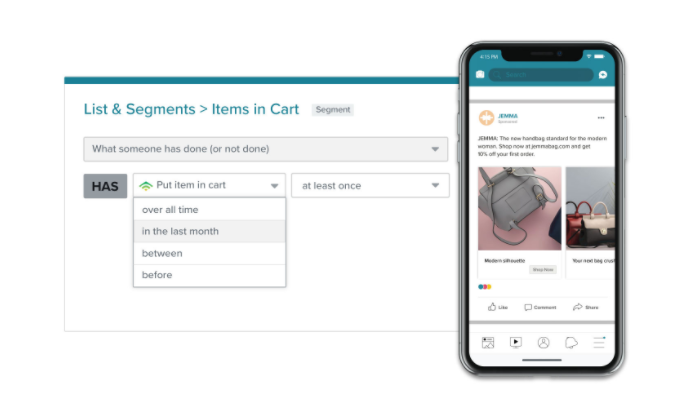

Email segmentation allows you to leverage customer data in service of better targeting, through which you can differentiate your contact list into groups based on:

Companies like Starbucks are sending weather-appropriate discounts on drinks: it’s no accident when their emails entice consumers to warm up on a rainy day or cool off when the temperature spikes.

This is a whole new way to approach customers where they are.

Every company defines their important segments differently. The richer your customer data, the easier it will be to use email segmentation to increase your conversion rate.

Automated, personalized emails go well beyond using a contact’s name in the subject line.

With Klaviyo, for example, you can automate the inclusion of product recommendations in the body of your email based on a contact’s location, past purchases, current weather, and so on.

Some autoresponders leverage machine learning to suggest products that other shoppers with similar tastes have ordered.

The best tools help you nail the easy stuff—like greeting subscribers by name and remembering their birthdays—while helping you convert customer data into revenue.

Tip: the better your email segmentation strategy, the easier it will be to leverage personalization, especially at scale.

As your contact list grows, it’s going to include more diverse customers at different stages of their buying journey.

You are going to want an email autoresponder that gives you the ability to manage this growing list and provides visibility into the ongoing performance of your campaign.

We all know about open rates and click-through rates. Those are important, but make sure you find something that lets you drill down into what matters at the end of the day, like sales per email, ROI per email, and total sales per email sent.

Staying effective in the long term means making adjustments. Campaign management tools help you figure out what’s working and what to change.

Typically, email autoresponder pricing is based on the number of subscribers you have and the number of emails you send each month.

This should be a pretty straightforward consideration. But if your goal is growth, factor in how many more you’re looking to add to your list over the next month, quarter, or year.

If your email marketing strategy takes off and you need to bump up into a higher pricing tier, will that be a problem for your budget and ROI?

Email autoresponders have been around for a long time. These days, virtually all of your best options are going to come as one component of a larger email marketing service.

That said, you can still find tools that will help you automate email marketing without requiring you to incorporate new services into your business processes.

The questions you need to answer are: Are you looking for basic email autoresponder features that help you automate specific workflows? Or are you looking to automate complex email workflows that dovetail into your larger marketing strategy?

If you answer yes to the first question, a dedicated email automation tool should be able to help you accomplish your goals. If you answered yes to the second question, you are going to want to skip ahead to the bundled products that will better meet your needs.

Exemplary products: MailerLite, Mailchimp (Free & Essentials), GetResponse (Basic), Moosend (Free)

Free email autoresponders and lower-tier plans allow you to build out simple workflows. This might be a welcome series, an automated response to a new customer or purchase, or a follow-up with someone who just reached out to customer service.

These dedicated email automation tools are great because they’re so easy to use. Virtually any member of the team can put together workflows that save time each day.

Of course, these options don’t come with as many features to segment your list, personalize emails, or manage a campaign.

Another potential problem is that it’s harder to assess your campaign performance and make adjustments without advanced tracking and reporting.

That said, dedicated email automation tools allow individuals to accomplish far more than they could ever do manually.

If you already have a suite of online marketing tools that are working well and all you need is the email automation, these products can work wonders without a significant outlay.

Exemplary products: Klaviyo, Mailchimp (Standard & Pro), Moosend (Pro & Custom)

To provide a more complete tool for the job, there are a range of autoresponders that offer automation bundled with email marketing tools.

These products make it easy to track customers, analyze behavior, and revise your campaign strategies accordingly.

Tools like Klaviyo, for example, integrate directly with your customer data, giving you powerful segmentation and personalization capabilities with hardly any extra work.

They also let you build complex workflows that let you tailor your automation strategy to your specific needs. Often, they will include a visual builder that makes it much easier to design and manage flows.

With email marketing services, it’s important to recognize that lower-tier plans are going to function more like simple automation tools, even if it’s the same product.

Mailchimp, for instance, lets you create multi-step journeys with their Essentials tier, but you can’t include branching points unless you get their Standard plan. If you want to take advantage of all the segmentation features—which will make your multi-step journey more effective—then you will have to get their Premium plan.

Mailchimp is a powerful product that hasn’t lost its simple feel, though it has grown considerably since it first hit the market in 2001.

Today, it functions as an integrated marketing platform, taking on way more responsibility than the email automation it became famous for.

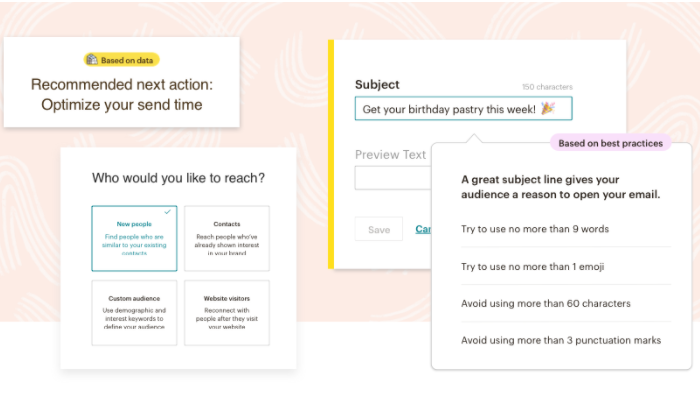

Despite its depth, I like Mailchimp as an email autoresponder for beginners because it’s constantly offering user recommendations based on intelligence from billions of email interactions.

Subject Line Helper, for instance, offers data-driven insights about how to increase open and click rates.

There are plenty of other excellent features, including:

Mailchimp offers a free forever version that’s limited to 2,000 contacts, but comes with features like a marketing CRM and landing pages that you won’t get with other freemium email autoresponders.

To get the Customer Journey Builder, which lets you construct workflows in a visual editor, you will need one of the paid plans:

Some of the aforementioned features, like predicted demographics or the lookalike audience finder, are only included with Standard and Premium.

Millions of companies have seen Mailchimp increase their ROI. You can get started with the free version today, knowing that they also have tools to help you grow.

MailerLite is used by more than one million companies, startups, and freelancers because it is an intuitive, budget-friendly platform that delivers results.

Its free version lets you send 12 emails per month to 1,000 subscribers, which might be all some people need to get started.

For an email autoresponder that’s easy to use, MailerLite comes packed with simple, yet powerful features that help you optimize your campaign.

I like using A/B split testing to send two variations of an email and see which one performs better.

The clean MailerLite interface gives your teams the control they need to communicate effectively with your subscribers.

Some of its best features include:

MailerLite also comes with features to customize your website experience, like pop-ups and embedded forms, as well as an amazing drag-and-drop editor to craft striking newsletters.

Better still, it’s very affordable beyond the free version.

As a free email autoresponder, MailerLite is hard to beat for any small business. You get a free website with five landing pages, a drag-and-drop visual email editor, and advanced segmentation features.

It’s almost unreasonably generous.

For organizations that need the paid plans, the price is still very competitive and the premium features will pay for themselves many times over.

Klaviyo ties into a CRM or ecommerce platform and makes it easy to deliver ultra-personalized content via email.

No more unfocused email blasts to the public. Instead, Klaviyo allows users to build out unique customer journeys for long-time fans and first-time window shoppers.

Because it has native integration with customer data sources, you can get pretty fine-grained with the segmentation.

And, with the simple user interface, anyone on your team can start maximizing the relevant content every visitor sees.

Klaviyo iworks across many channels, allowing you to expand your subscriber base via Facebook, for example.

Nurture individual leads from a 10,000-foot view by using the features in Klaviyo’s extensive toolkit:

The free plan for Klaviyo maxes out at 250 contacts and 500 emails, after which you will be asked to upgrade. Paid plans start at $20/month for up to 500 contacts and unlimited email sends, climbing higher depending on the size of your contact list.

GetResponse has provided one of the simplest, most effective email autoresponders for more than 20 years. Over that time, they’ve added features and evolved the UI to keep it one of the most useful products on the market.

Their experience shows. They know what works, why, and how to help you get set up.

For one, GetResponse offers hundreds of professionally designed templates to communicate with customers at every step of their journey.

The built-in sales features are also really nice, and really set GetResponse apart from the other easy-to-use autoresponders. Even their Basic plan comes with a sales funnel, unlimited lead funnels, and unlimited landing pages.

With other email autoresponders, you’re going to have to integrate your pipeline. With GetResponse, you can keep daily operations under one roof.

Along with a flexible email autoresponder, GetResponse has a number of other useful features to help you connect with customers:

GetResponse doesn’t have a free forever plan, though they do offer a free trial. Pricing starts at $15/month for 1,000 contacts with their Basic plan, which comes with all the features listed above.

And much more. Honestly, the Basic plan is far from basic.

At the Plus and Professional pricing tiers, you have more features like webinars, as well as greater degrees of customization.

Their top tier plan, Max, comes with a dedicated IP address, SSO, and other features designed to secure and streamline enterprise email marketing and sales.

Moosend is an affordable email automation tool with an almost nonexistent learning curve. Yet for how easy it is to get started, Moosend users wind up automating their email marketing in really impactful ways.

It’s sad to think, but some companies spend thousands of dollars a month on ultra-powerful marketing automation software that they don’t really need. Plus, that stuff can be really hard to use.

With Moosend, you get a lot of freedom to customize your email marketing automation. There’s a rich set of triggers and actions all managed in a drag-and-drop interface. Workflows can be shared among team members, who can leave notes.

The Moosend interface itself is great at educating users how to automate and fine-tune customer journeys. With templates, preset workflows, and rich tracking capabilities, Moosend makes it simple to find what works for your unique subscriber base.

Leverage the AI to hyper-personalize your emails based on similar consumer preferences and other behavioral analytics.

They’ve recently added “And/Or” expressions to custom fields. This allows for a lot more customization in terms of defining triggers. Custom fields don’t have to be just one thing any more!

Without writing a single line of code, you can gain quick mastery of a deep set of email automation features that include:

Moosend has a free forever plan, which is capped at 1,000 subscribers, and comes with many of the best features. For additional subscribers, you’ll need a Pro plan, which starts at $8/month.

The exact price will depend on the number of subscribers you need to accommodate. For example, 25,000 subscribers is $100/month. The Pro plan maxes out at 200,000 subscribers ($608/month), with custom plans available to reach an audience of any size.

Compared to other, more expensive options, Moosend tends to be much easier to use even with many of the same essential features.

Many people begin the search for an email autoresponder only to discover that what they actually need is an email marketing platform.

The closest option on this list to a dedicated email autoresponder is MailerLite, which still comes with way more than simple email automation capabilities. It’s a really good option (and price) for companies that already have great CRM software and really just need the email autoresponder capabilities.

Mailchimp and Moosend are more feature-rich than MailerLite, but both remain incredibly easy to use for non-specialists.

GetResponse works well for sales teams because you’ve got conversion funnels and the ability to host webinars is baked in.

Klaviyo is probably the most comprehensive tool on this list, and it works incredibly well at automating the processes necessary to run a successful email ecommerce campaign.

I like all of these email autoresponders because they help you benefit from the unavoidable trial-and-error associated with email marketing.

No campaign is ever going to be perfect, but the right tools will help you continually evolve your strategy to meet your customers where they are.

The post Best Email Autoresponder appeared first on Neil Patel.

Can you get the recession-proof best business credit cards with no annual fee? Absolutely! No matter what the economy is doing, you can get cards just like these.

Are you looking for the recession-proof best business credit cards with no annual fee?

According to the SBA, business credit card limits are 10 – 100 times those of personal cards! This means you can get a lot more cash with company credit.

And this also means you can have personal credit cards at shops, and now have an alternate card at the same retail stores for your company. And you will not have to put up collateral, cash flow, or financial information to get small business credit.

Features vary, so be sure to select the benefit you prefer from this array of alternatives.

Check out the Ink Business Unlimited℠ Credit Card. Beyond no annual fee, get an introductory 0% APR for the initial one year. Afterwards, the APR is a variable 14.74 – 20.74%.

You can get unlimited 1.5% Cash Back rewards on every purchase made for your corporation. And get $500 bonus cash back after spending $3,000 in the initial three months from account opening. You can redeem your rewards for cash back, gift cards, travel and more using Chase Ultimate Rewards®. You will need excellent credit scores to get this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/unlimited

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines.

Have a look at the Capital One® Spark® Cash Select for Business. It has no yearly fee. You can get 1.5% cash back on every purchase. There is no limit on the cash back you can earn. Also get a one-time $200 cash bonus once you spend $3,000 on purchases in the first 3 months. Rewards never expire.

Pay a 0% introductory APR for 9 months. Then pay 14.49% – 22.49% variable APR afterwards.

You will need good to excellent credit scores to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash-select/

Check out the Brex Card for Startups. It has no yearly fee.

You will not need to provide your Social Security number to apply. And you will not need to provide a personal guarantee. They will take your EIN.

Nonetheless, they do not accept every industry.

Additionally, there are some industries they will not work with, as well as others where they want added documentation. For a list, go here: https://brex.com/legal/prohibited_activities/.

To determine creditworthiness, Brex checks a corporation’s cash balance, spending patterns, and investors.

You can get 7x points on rideshare. Get 4x on Brex Travel. Also, get triple points on restaurants. And get double points on recurring software payments. Get 1x points on everything else.

You can have bad credit scores (even a 300 FICO) to qualify.

Find it here: https://brex.com/lp/startups-higher-limits/

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines.

Check out the Capital One® Spark® Cash for Business. It has an introductory $0 yearly fee for the first year. Afterwards, this card costs $95 each year. There is no introductory APR offer. The regular APR is a variable 18.49%.

You can get a $500 one-time cash bonus after spending $4,000 in the first 3 months from account opening. Get unlimited 2% cash back. Redeem at any time without minimums.

You will need great to outstanding credit to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash/

Take a look at the Discover it® Business Card. It has no annual fee. There is an introductory APR of 0% on purchases for 12 months. After that the regular APR is a variable 14.49 – 22.49%.

Get unlimited 1.5% cash back on all purchases, with no category restrictions or bonuses. They double the 1.5% Cashback Match™ at the end of the first year. There is no minimum spend requirement.

You can download transactions| quickly to Quicken, QuickBooks, and Excel. Keep in mind: you will need great to exceptional credit scores to get approval for this card.

https://www.discover.com/credit-cards/business/

Check out the Ink Business Cash℠ Credit Card. It has no annual fee. There is a 0% introductory APR for the first year. Afterwards, the APR is a variable 14.74 – 20.74%. You can get a $500 one-time cash bonus after spending $3,000 in the first 3 months from account opening.

You can earn 5% cash back on the initial $25,000 spent in combined purchases at office supply stores and on web, cable, and phone services each account anniversary year.

Get 2% cash back on the initial $25,000 spent in combined purchases at filling stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases. There is no restriction to the amount you can get.

You will need outstanding credit to get this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/cash?iCELL=61GF

Take a look at the Bank of America® Business Advantage Cash Rewards MasterCard® credit card. Get an 0% introductory APR for the initial 9 billing cycles of the account. Afterwards, the APR is 13.74% – 23.74% variable. There is no yearly fee. You can get a $300 statement credit offer.

Get 3% cash back in the category of your choice. So these are gas stations (default), office supp ly stores, travel, TV/telecom & wireless, computer services or business consulting services. Earn 2% cash back on dining. So this is for the initial $50,000 in combined choice category/dining purchases each calendar year. After that earn 1% after, with no limits.

ly stores, travel, TV/telecom & wireless, computer services or business consulting services. Earn 2% cash back on dining. So this is for the initial $50,000 in combined choice category/dining purchases each calendar year. After that earn 1% after, with no limits.

You will need exceptional credit to qualify.

Find it here: https://promo.bankofamerica.com/smallbusinesscards2/

Check out the Capital One® Spark® Classic for Business. It has no annual fee. There is no introductory APR offer. The regular APR is a variable 24.49%. You can get unlimited 1% cash back on every purchase for your company, without minimum to redeem.

While this card is within reach if you have average credit scores, beware of the APR. But if you can pay in a timely manner, and completely, then it’s a good deal.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

Take a look at the Plum Card® from American Express. It has an introductory annual fee of $0 for the first year. After that, pay $250 each year.

Get a 1.5% early pay discount cash back bonus when you pay within 10 days. You can take up to 60 days to pay without interest when you pay the minimum due by the payment due date.

You will need great to excellent credit to qualify.

Find it here: https://creditcard.americanexpress.com/d/the-plum-card-business-charge-card/

Take a look at the Blue Business® Plus Credit Card from American Express. It has no yearly fee. There is a 0% introductory APR for the first twelve months. Afterwards, the APR is a variable 14.74 – 20.74%.

Get double Membership Rewards® points on everyday business purchases like office supplies or client dinners for the first $50,000 spent annually. Get 1 point per dollar afterwards.

You will need great to exceptional credit to qualify.

Find it here: https://creditcard.americanexpress.com/d/bluebusinessplus-credit-card/

Also check out the American Express® Blue Business Cash Card. Note: the American Express® Blue Business Cash Card is identical to the Blue Business® Plus Credit Card from American Express. However its rewards are in cash rather than points.

Get 2% cash back on all qualified purchases on up to $50,000 per calendar year. Then get 1%.

It has no annual fee. There is a 0% introductory APR for the first one year. Afterwards, the APR is a variable 14.74 – 20.74%.

You will need good to exceptional credit to qualify.

Find it here: https://creditcard.americanexpress.com/d/business-bluecash-credit-card/

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines.

Your recession-proof best business credit cards with no annual fee with depend on your credit history and scores. Only you can make a decision on which rewards you want and need, so make sure to do your research.

And, as always, make sure to build credit in the recommended order for the best, fastest benefits. Check out how this will help your company get the recession-proof best business credit cards with no annual fee.

As the economy continues to change, you can still get financing for your small business. Let us show you how.

The post The Recession-Proof Best Business Credit Cards with no Annual Fee appeared first on Credit Suite.

There are so many different types of business loans out there, it can be hard to figure out which type you actually need. Even harder is figuring out which type you actually qualify for. For example, if you need to buy new equipment, equipment loans would seem to be the way to go, right? Even then, do you go with SBA loans, traditional loans, private lenders?

The truth is, it’s not always so simple. Sometimes, traditional loans work best for equipment purchases. However, there are occasions when other options may fit your specific situation. But, when are those times? Furthermore, what are the other options?

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

Equipment loans, whether SBA loans or not, are loans that are secured by the equipment being financed. For example, if you bought a new industrial freezer and financed it with an equipment loan, then the freezer would serve as collateral for that loan.

The beauty of equipment loans is that you get the lower interest rates and better terms that typically come with secured financing. The problem is, that isn’t always enough to qualify.

Equipment is not attached to the property, but the assets are longer term generally speaking. This includes things like heavy duty copy machines, industrial freezers and ovens, and more. These things can be used as collateral to secure a loan to purchase them.

Using the equipment as security doesn’t get you out of needing to meet requirements like minimum credit score and income. However, if you do meet these requirements and therefore qualify for the loan, the collateral can help you snag better terms. Interest rates will almost definitely be lower, depending on other factors.

What if you don’t meet traditional requirements for equipment loans? There are other options.

The SBA has a few loans programs that work well for equipment financing.

This is the main program at the Small Business Administration. Through it, borrowers can get federally funded term loans up to $5 million. This money is available for expansion, working capital, and other things as well as, purchasing equipment. Banks, credit unions, and other specialized institutions in partnership with the SBA process these loans and disburse the cash.

The minimum credit score to qualify is 680. There is also a required down payment of at least 10% for the purchase of a business, commercial real estate, or equipment. The minimum time in business is 2 years. In the case of startups, business experience equivalent to two years will work.

This is the most popular SBA loan program. THis is due in part to the fact that funds are allowed to be used toward a broad range of projects, including buying equipment.

The 504 loan program offers loans up to $5 million. Money can buy equipment, as well as facilities or land. Generally, these loans are used for expansion. Private sector lenders or nonprofits process and disburse the funds. This program works well for commercial real estate purchases especially, but also for equipment.

Terms for 504 Loans range from 10 to 20 years, and funding can take from 30 to 90 days. They require a minimum credit score of 680, and collateral is the asset it is financing. There is also a down payment requirement of 10%, which can increase to 15% for a new business.

There is a requirement you be in business at least 2 years, or that management has equivalent experience if the business is a startup.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive

Microloans are just what they sound like. They are small loans, up to $50,000, that can be used to purchase equipment, start a business, buy inventory, or just as working capital. Community based non-profits administer microloan programs as intermediaries. The financing comes directly from the Small Business Administration. They can take upwards of 90 days to fund, and the minimum credit score is 640.

If SBA loans will not work for your equipment needs, a credit line hybrid might. It allows you to fund your business without putting up collateral. Furthermore,you only pay back what you use. It is unsecured, no-doc funding. That means you do not have to turn in any financials.

How hard is it to qualify? Not as hard as you may think. You need good personal credit, but that is relative. Your personal credit score should be at least 685, which is lower than what is required by most traditional lenders. In addition, you can’t have any liens, judgments, bankruptcies or late payments.

Also, in the past 6 months you should have fewer than 5 credit inquiries. You need to have less than a 45% balance on all business and personal credit cards as well. It’s preferred that you have established business credit, but not absolutely necessary.

Now, if you don’t meet all of the requirements, you can take on a credit partner that does. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding.

There are a ton of benefits to using a credit line hybrid. Most notably, it is unsecured, meaning you do not have to have any collateral to put up. Then, as mentioned, the funding is “no-doc.” This means you do not have to provide any bank statements or financials.

Not only that, but typically approval is up to 5x that of the highest credit limit on the personal credit report. Additionally, often you can get interest rates as low as 0% for the first few months, allowing you to put that savings back into your business.

The process is pretty fast. One other benefit is this. The approval for multiple credit cards creates competition. This makes it easier, and even likely if you handle the credit responsibly, that you can get interest rates lowered and limits raised every few months.

Another option if SBA loans will not work is an online lender. This is especially true if your personal credit score isn’t great.

Even if you have great business credit, most term loans and many lines of credit require a personal credit check. They may take your business credit into account, but if your personal credit stinks, it won’t help you much. Online lenders tend to have lower minimum personal credit score requirements than traditional lenders.

An added benefit is, an online lender will typically send you the funds faster. Sometimes you can have the money in as little as a few days, with approval coming in as little as 24 hours.

An Online Lender Could be the Answer to Your Funding Needs

If you can go with a traditional lender, great. They often have better rates and terms. However, if you, like many business owners, do not have that option, an online lender may be the perfect solution for equipment financing. Approval requirements allow many more borrowers to get their funds quickly and easily. Take into account the following factors:

It’s also important to note, there are a lot of predatory lenders online. You have to be careful. The list above is a great starting point, but don’t stop there. There are a lot of options, so be sure to research.

Founded in 2008 by college roommates, online lender Fora Financial now funds more than $1.3 million in working capital around the United States. There is no minimum credit score, and there is an early repayment discount if you qualify.

The minimum loan amount is $5,000 and the maximum is $500,000. The business must be at least 6 months in operation and the monthly revenue has to be $12,000 or more. There can be no open bankruptcies.

Obtaining financing from OnDeck is quick and easy. First, you apply online and receive your decision once application processing is complete. If you receive approval, your loan funds will go directly to your bank account. The minimum loan amount is $5,000 and the maximum is $500,000.

Just like any other online lender, they do have certain requirements to qualify for a loan. For example, a personal credit score of 600 or more. Also, you must be in business for at least one year. Annual revenue must be at or exceed $100,000. In addition, there can be no bankruptcy on file in the past 2 years and no unresolved liens or judgements.

Kabbage is an online lender. They offer a small business line of credit that can help businesses meet their goals quickly. The minimum loan amount is $500, and they do not exceed $250,000. You must be in business for at least one year and have $50,000 or more in annual revenue, or $4,200 or more in monthly revenue, over the last 3 months.

Kabbage is great if you need cash quickly. Also, their non-traditional approach puts less weight on your credit score, so they may work better for some borrowers than other lenders.

Rates start at 6% and go up to 22%. APR works out to 8 to 25%, and there is a 3 to 5 % origination fee.

Advantages are the soft credit pull and the fact that they will look at factors other than your personal credit if your FICO score is low. Another benefit is that Bond Street can offer very large loans if you qualify. Disadvantages are the longer time in business requirement and high APR.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

Popular online lender Lending Club offers term loans. Business loans from $5,000 to $300,000. Loan terms are 1 to 5 years.

Get a quote in less than 5 minutes. Funds are available in as little as 48 hours if approved. There are no prepayment penalties.

Annual Revenue must be $75,000 or more. You must be in business for 2 years or more. Personal FICO score of 620 or better is required.

Rates of 5.99% to 29.99%. Total annualized rates starting at 8%.

Advantages are that the annual revenue requirement isn’t too high. Funds are available quickly. Disadvantages include high maximum rates.

Funding Circle is a way to apply for SBA funds online. To get started with Funding Circle, you must meet the following requirements.

Traditional equipment loans are the lowest cost way to finance equipment. They won’t work for everyone though. If they will not work for you, there are other options. The SBA offers loan programs that work well for equipment financing, and online lenders can be a possibility as well.

Perhaps the most unique and under-utilized option is the credit line hybrid. When you use this option, you do not have to use the equipment as collateral, and sometimes you can get 0% interest, at least initially.

It will likely take some time to figure out which option for equipment loans will work best for your business. The first step is finding out that there are, in fact, options.

The post SBA Loans for Equipment Loans? appeared first on Credit Suite.

SEEKING WORK | GMT-3 (Brazil) | Remote

I’m part of a team of +50 developers with a 10-year background working together on high-visibility projects for Fortune 500s, Inc 5000s, internationally renowned names such as the UN & the IOC, and high-growth startups coast-to-coast.

We are now focusing on helping several early-stage startups to build their digital platforms/products using tech like React, React Native, Node.js, Laravel, AWS, ElasticSearch, and more.

If you’re a founder/CTO that’s got a great product, is a cool person, and could use some help hitting product milestones faster or launching your product on time and within budget, we can probably help.

All of our team members are internal employees (no freelancers) with proven experience working with major organizations worldwide.

Rates are $39/hr, being in Brazil and sharing our profits with our devs, we can afford to be very competitive on pricing, especially considering our expertise & portfolio.

Reach out @ hi@nextly.team to see some of our previous work or to chat.

The post New comment by heliasvieira in “Ask HN: Freelancer? Seeking freelancer? (December 2020)” appeared first on ROI Credit Builders.

SEEKING WORK | GMT-3 (Brazil) | Remote

I’m part of a team of +50 developers with a 10-year background working together on high-visibility projects for Fortune 500s, Inc 5000s, internationally renowned names such as the UN & the IOC, and high-growth startups coast-to-coast.

We are now focusing on helping several early-stage startups to build their digital platforms/products using tech like React, React Native, Node.js, Laravel, AWS, ElasticSearch, and more.

If you’re a founder/CTO that’s got a great product, is a cool person, and could use some help hitting product milestones faster or launching your product on time and within budget, we can probably help.

All of our team members are internal employees (no freelancers) with proven experience working with major organizations worldwide.

Rates are $39/hr, being in Brazil and sharing our profits with our devs, we can afford to be very competitive on pricing, especially considering our expertise & portfolio.

Reach out @ hi@nextly.team to see some of our previous work or to chat.

The post New comment by heliasvieira in “Ask HN: Freelancer? Seeking freelancer? (December 2020)” appeared first on ROI Credit Builders.