It won’t do to oppose them only when Democrats are passing costly legislation in times of crisis.

The post Republicans Need to Get Their Story Straight on Deficits appeared first on ROI Credit Builders.

It won’t do to oppose them only when Democrats are passing costly legislation in times of crisis.

The post Republicans Need to Get Their Story Straight on Deficits appeared first on ROI Credit Builders.

It’s hard to grow any business, whether new or established, without the necessary equipment. However, some of it can be expensive. For a new business specifically, affording equipment can feel impossible. Still, you need that equipment to make money, which lends itself to a frustrating cycle. The answer may be equipment financing and leasing.

Equipment financing is when you use a loan or lease to purchase or borrow hard assets for your business. You can use it to buy or lease any physical asset. This can include items like an industrial freezer in a restaurant or an oven or a company car, you name it.

A recent report, the Equipment Leasing and Finance Association (ELFA) survey, found that 80% of American businesses lease a portion of their equipment. The list of companies using leasing includes everything from Fortune 500 companies to mom and pop shops.

There are many benefits to equipment financing and leasing. For example, you will pay a set amount each month, which makes budgeting easier. Also, you can build business credit if your creditor reports your payment to the business credit reporting agencies. The equipment is the collateral. That means you do not have to potentially sacrifice any other assets.

Find out why so many companies use our proven methods to get business loans.

In addition, it’s easy to upgrade equipment after your lease ends. This can be helpful if your equipment is something like a computer which quickly becomes obsolete.

Of course, nothing is perfect. You may have to make a large down payment. Furthermore, you will often need to have good personal credit in order to qualify. If your financed equipment becomes outdated, your business is stuck with it until the end of the lease or loan. Sometimes, leases can end up actually costing more than purchasing. When the lease ends, you have to get a new lease or to make other arrangements. Whereas, if you buy the equipment outright you can sell it if you want.

There are a few different types of leases. Which one will work best for you will depend on a number of factors.

This is also called an FMV lease. With an FMV lease, you make regular payments while borrowing the equipment for a set term. When the term is up, you have the option to return the equipment or purchase it at its fair market value.

$1 Buyout Lease

This is a type of capital lease in which you pay off the cost of the equipment plus interest over the course of the lease. At the end, you owe only $1. Then, when you pay the $1 you fully own the equipment. This is similar to a loan in structure, and cost as well.

10% Option Lease

This lease is the same as a $1 lease, except at the end of the term you can buy the equipment for 10% of its cost. These leases typically have lower monthly payments than the $1 buyout option.

Of course it varies, but here is an example. Say the total cost of the equipment you are leasing is $25,000. If it is a 10% option with a 36 month term, with an interest rate of 15%, it looks like this:

Find out why so many companies use our proven methods to get business loans.

In this case, you would be paying an extra $5,579 over the course of the lease. That is over 1/5 added to your total cost for the equipment. If you bought the equipment outright you would pay $25,000. Of course, you would then be out $25,000 cash all at once. When you are leasing equipment, you pay out over the life of the lease and thus keep more working capital actually working for your business.

You can take advantage of our equipment financing and leasing programs if you have been in business at least one year. Even if your credit is not the greatest, we have options that may work. Even better, approval takes as little as 24 hours.

The minimum personal credit score requirement is 550. Generally speaking, this is considered a fair credit score, and thus much lower than what many lenders will want to see. You will also need to provide details on the equipment you are getting. You can be approved for as much as $10,000,000 in equipment financing after a quick credit review. This type of financing often affords more favorable terms than typical business financing programs and better benefits. Our equipment financing programs work for both established and startup businesses. We work with hundreds of lenders, and we can help you find the perfect one for your needs.

You can qualify with only two monthly payments as a down payment. Rates are affordable, and interest is 100% tax deductible. In addition, there is no application fee. Furthermore, the time from application to funding is generally 2 weeks or less.

Interest rates range from 7% to 25%, and depending on the amount of the loan and risk factors, you may have to provide 2 years of corporate and personal tax returns.

Of course, we already mentioned paying cash and taking out a traditional loan. If you have accounts receivables you can do receivables financing. That’s really better for funding cash gaps. However, if you need to collect receivable to be able to afford your equipment, it could work.

Another option is the Credit Line Hybrid. This is unsecured business financing. There are no documents required, and you can get up to $150,000. You do have to have a credit score of at least 680 and meet some other requirements. However, if you do not qualify on your own, you can take on a credit partner that does meet the criteria. One bonus of this option is that you can purchase the equipment outright. Since many of the cards that are part of the Credit Line Hybrid sometimes offer low introductory rates for a short time, you could save on interest.

Find out why so many companies use our proven methods to get business loans.

The short answer is, it depends. That begs the question, what does it depend on. Well, first, do you need equipment? That’s what this type of financing is best for. Then, do you need to finance equipment? If you have the cash on hand, you need to consider it carefully. Financing can be a good idea if you would deplete your cash reserves paying cash for equipment.

Of course, you could just take out a traditional loan. However, you may have to come up with other collateral. If you need finance equipment, using that equipment as the collateral is the easiest solution. The collateralization allows for generally better rates and terms than you would get otherwise. Contact Credit Suite today to find the best option for equipment financing for your business.

The post How to Use Equipment Financing and Leasing In Your Business appeared first on Credit Suite.

Federato | Head of Software architecture | Senior SWE | Remote |Full-time | www.Federato.ai We are an impact driven startup helping insurance companies optimize their portfolio through reinforcement learning and dynamic optimization. We’re an early stage startup backed by VC’s in the Bay area. We’re looking for: Head of software architecture: has experience designing software …

The post New comment by WilliamSteen in “Ask HN: Who is hiring? (March 2021)” first appeared on Online Web Store Site.

The post New comment by WilliamSteen in “Ask HN: Who is hiring? (March 2021)” appeared first on ROI Credit Builders.

If a user clicks through to a page on your website and finds themself waiting more than a few seconds for your page to load, they are likely to leave your page and can cost you a conversion.

Luckily there’s a remedy to increase page speed, but it involves the identification of the issue or issues causing slow lead times.

Since it can be difficult to pinpoint what’s wrong, you can use tools such as Google’s PageSpeed Insights to help. Google PageSpeed considers several factors for an overall score load time score. When you analyze page speed, Google gives you a list of metrics that contribute to the score. Let’s find out what those metrics are.

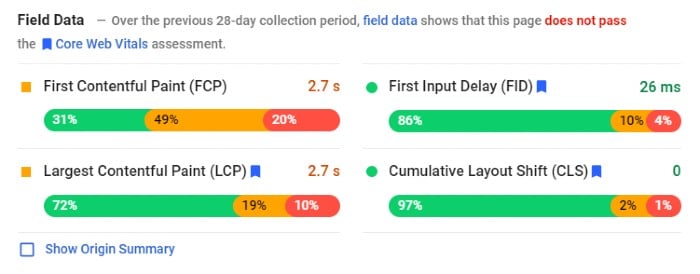

The first set Google PageSpeed Insights gives you is called field data. This includes a variety of aspects of your site. (You can also learn more about core web vitals and how it will affect speed and SERP performance.)

FCP is when your browser renders the initial information. That includes text, images (including background images), non-white canvas, and scalable vector graphics (SVG).

LCP is a Google experience metric that measures the time it takes for the largest bit of information on the page to load. Google uses LCP as a ranking factor for pages.

CLS is another ranking factor for Google. It’s an unexpected shift—meaning jumping around to other locations on your screen—of page elements as it loads. It’s an indication of poor coding and can be caused by images, ads, videos, contact forms, and fonts.

FID measures site response time when a user first interacts with it. If your user clicks on a video, the time it takes to play a video is your FID.

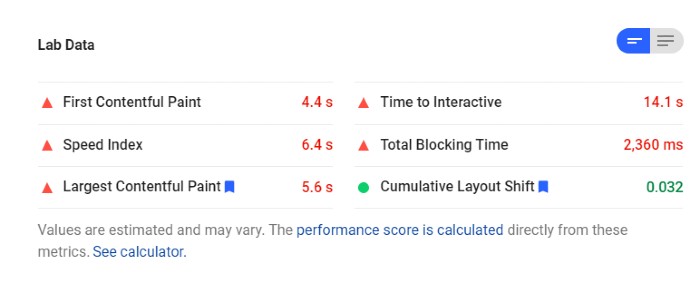

The second set of elements is called lab data. It includes the elements above, as well as total blocking time, time to interactive, and speed index.

SI measures the average time it takes for all elements on a page to become visible. Measured in milliseconds, it calculates the time it takes for visual elements to load above the fold—the part of a webpage seen before a user has to scroll.

TTI measures how long it takes for all of the interactive elements on a page to become fully functional. It’s the time between the First Contentful Paint to the time the page can handle the user’s input.

TBT measures the time between time to first contentful paint and the time a site becomes interactive.

Page speed affects user experience, which can make or break your site. Faster page speed makes for a better user experience and can increase page views and conversions and reduce bounce rate. Let’s get into more detail on the benefits of improving page speed.

According to our research, 47 percent of consumers expect a website to load in no more than two seconds.

Every second afterward damages user experience. Viewers don’t want to wait for your page to load, and they’ll often bounce to find another business with a better user experience.

You might have noticed that some of the metrics I mentioned above, namely LCP and CLS, affect Google page ranking. In their quest to provide high-quality search results for users, Google includes metrics measuring load times. So, the better your page speed, the better ranking you may get on Google.

If your pages load quickly, it stands to reason your users will be happier and more willing to turn into customers. In 12 case studies conducted by HubSpot, they found decreasing page load time increased conversions by anywhere from three to 17 percent.

We did the math. If you’re an e-commerce site making $10,000 a day, a one-second page delay could cost you $2.5 million per year.

According to Think with Google, when your page load time increases from one second to three seconds, the probability of bounce increases by 32 percent. If it rises from one to five seconds, that probability increases 90 percent.

The difference of a few seconds is the difference between keeping and converting users and watching them go elsewhere.

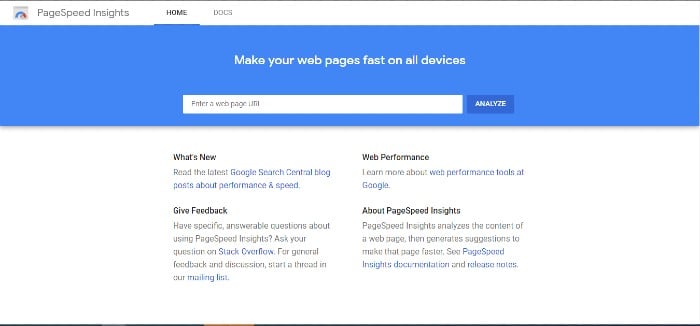

To get a baseline for your current page speed, test your site using a tool like Google PageSpeed Insights.

It will prompt you to enter a URL, then take a few minutes to analyze your page.

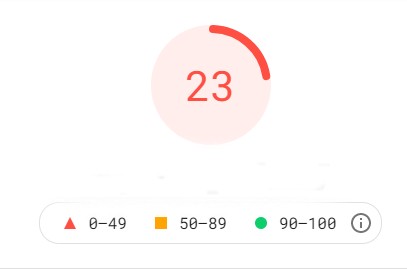

When it’s done, you’ll get an overall score that looks like this.

This is a pretty low score, but don’t panic. Google explains a number of factors can affect the final score and even cause it to fluctuate. Some of these factors include:

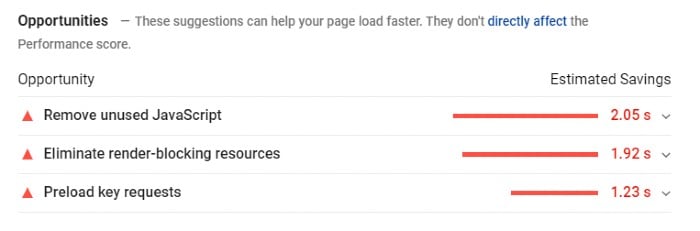

Google can analyze these factors and serve you a list of opportunities and diagnostics to help you speed up your page load time.

You can also try the following actions to increase page speed:

The more redirects you have, the longer it takes the server to find and load the correct page. Eliminate unnecessary redirects wherever you can.

Don’t forget to include the trailing slash at the end of the URL. By doing so, you’re telling the server there are no file directories to search, and this page is the final destination.

So, instead of www.neilpatel.com/ubersuggest, your URL should read www.neilpatel.com/ubersuggest/.

It will shave a fraction of a second off your load time, where every millisecond counts.

Large image files or a lot of images can take up a lot of your page load time. Make sure all your images are resized and compressed correctly.

They should be saved in the right format as well. PNG and JPEG files are the most easily compressed, and every browser supports them.

Compressing an image reduces the size of the file and is represented in kilobytes and megabytes. As a general rule, high-quality images can be compressed by 60% to 80%. You should never have an image larger than 1MB.

Resizing changes the size of the image on the page. Hero images may take up the entire width of your site (or about 1900 pixels), while smaller images should be 700 pixels or fewer. You can always size down, but it’s very difficult to size up without an image looking pixelated.

With a CDN, a network of servers hosts your site locally to speed up page load times. A user in Dublin accessing a website hosted in Los Angeles, for example, wouldn’t have to ping the server of origin but rather a closer one in Ireland.

By spreading out the content on multiple servers, it reduces the number of requests to the server of origin, which slows down load times.

Plugins, JavaScript, and other extra elements add to page load time. Include only those elements that are necessary for your page.

Of course, there are plugins made to help with site speed. Plugins that automatically resize images, minify code, and defer JavaScript loading can help with page speed. You have to determine if the bells and whistles these plugins allow are worth the trade-off with page speed.

When you minify your site’s code, you take out all the spaces, notes, and extra markup developers use to make their code readable and easier to work on down the road. A server doesn’t need all that to read HTML, JavaScript, or CSS, and it can get in the way when it tries to load a page.

There are tools to help you minify your sites:

When a site caches, the server saves copies of its pages, so it doesn’t have to start from scratch every time it loads the site. By using caching, you can reduce time.

When it comes to web hosting, you get what you pay for. Cheaper plans may not be able to handle as much traffic, which could slow your page speed.

There are four kinds of web hosting services you can choose from:

To choose the right hosting service for your site, consider the sizes of your site and budget.

A fast load time has always been an important component of user experience. Now that it’s one of Google’s components in its ranking algorithm, page speed has become critical for ranking and page views.

To improve page speed, look out for common issues that cause pages to load slowly like the images too large or you’re using too many plugins.

If you are unsuccessful or overwhelmed by following practices that increase page speed, our agency is here to walk you through the steps.

Have you taken a look at your site speed? What were the most common causes of slower load time for you?

The post How to Increase Page Speed appeared first on Neil Patel.

croit | REMOTE | PART or FULL TIME

We are a smaller but very skilled and ambitious consulting and product development company in the area of software defined storage solutions based on Ceph. Our goal is to simplify the usage of complex technologies to address a broader market. The beauty of that: We get to play around with complex technologies the whole day.

To grow our Development team, we would like to hire especially Java/Kotlin Backend developers.

Here are some job offers:

* Kotlin Developer: https://croit.io/career/kotlin-developer

* Frontend Developer: https://croit.io/career/frontend-developer

* C++ Ceph Developer: https://croit.io/career/ceph-developer

If you are interested, reach out to us at jobs@croit.io.