Everyone knows there are advantages of working from home. In the post COVID-19 pandemic world, the disadvantages have become clear as well. However, working from home and running a business from home are two very different things.

Do the Advantages of Working from Home Apply When Running a Business?

The short answer to this question is yes. The advantages of working from home are still there when running a home based business. In fact, the same disadvantages are present as well. What many do not realize is that there are some unique disadvantages to working from home while running a business. However, they are not impossible to overcome.

Clear Advantages of Working from Home

It’s not hard to find information on the advantages of working from home. The internet is full of articles and blogs on why working at home is great and how to make it even better. All you have to do is search “work at home tips” and a plethora of information will be at your fingertips. You save money on overhead. You save money and time not commuting. Clothing costs are significantly cut. Eating out is not as huge as a temptation so you can save money and your waistline.

Of course each of these advantages of working from home can be a disadvantage as well. For every meal you don’t have to eat out you can make as many trips to your fridge as you want and get whatever you want. That can add to your waistline and your grocery bill. Some are not as productive when they are wearing pajamas. Despite the savings, a lot of people would rather have the commute time to wind down after a long day. It all depends on the individual.

Unique Disadvantages of Working from Home Running a Business

Sometimes it can be hard to determine if the advantages of working from home overcome the disadvantages. Loneliness and isolation, lack of physical activity, distraction caused by everyday activity in the home, and lack of accountability are all well documented disadvantages of working from home. However, running a home-based business out of your house comes with a unique set of disadvantages.

Harder to Manage Employees

First, if you have employees, you no longer have to worry only about your own productivity. You have to ensure they are being productive as well. That’s a challenge, but technology has come a long way in that area. There are a number of options for daily contact and project management that can reduce the issues caused by this.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Fundability is More Difficult to Achieve

The truth of the matter is, you achieve fundability the same way regardless of whether you run your business out of your home or from a separate location. The difference is, running a business from home may tempt you not to bother with some things that actually have a huge impact on fundability.

For example, for a business to appear fundable to a lender, it needs to be totally separate from the owner. This means having separate contact information, an EIN, being incorporated, and having a separate business bank account amount other things. These are all things that a lot of home-based business owners do not worry about in the beginning.

I mean, running your business from your home is an easy way to start. You can just use your own phone number and address, use your SSN and not worry about an EIN, and use your own bank account because it’s your money anyway.

This is perfectly legal and definitely the easiest way to do things. But the easiest ways are not always the best ways. If you set your business up to be a separate, fundable entity from the start, you are much more likely to be able to get the funding you need.

How to Overcome the Work from Home Challenges of Running a Home Based Business

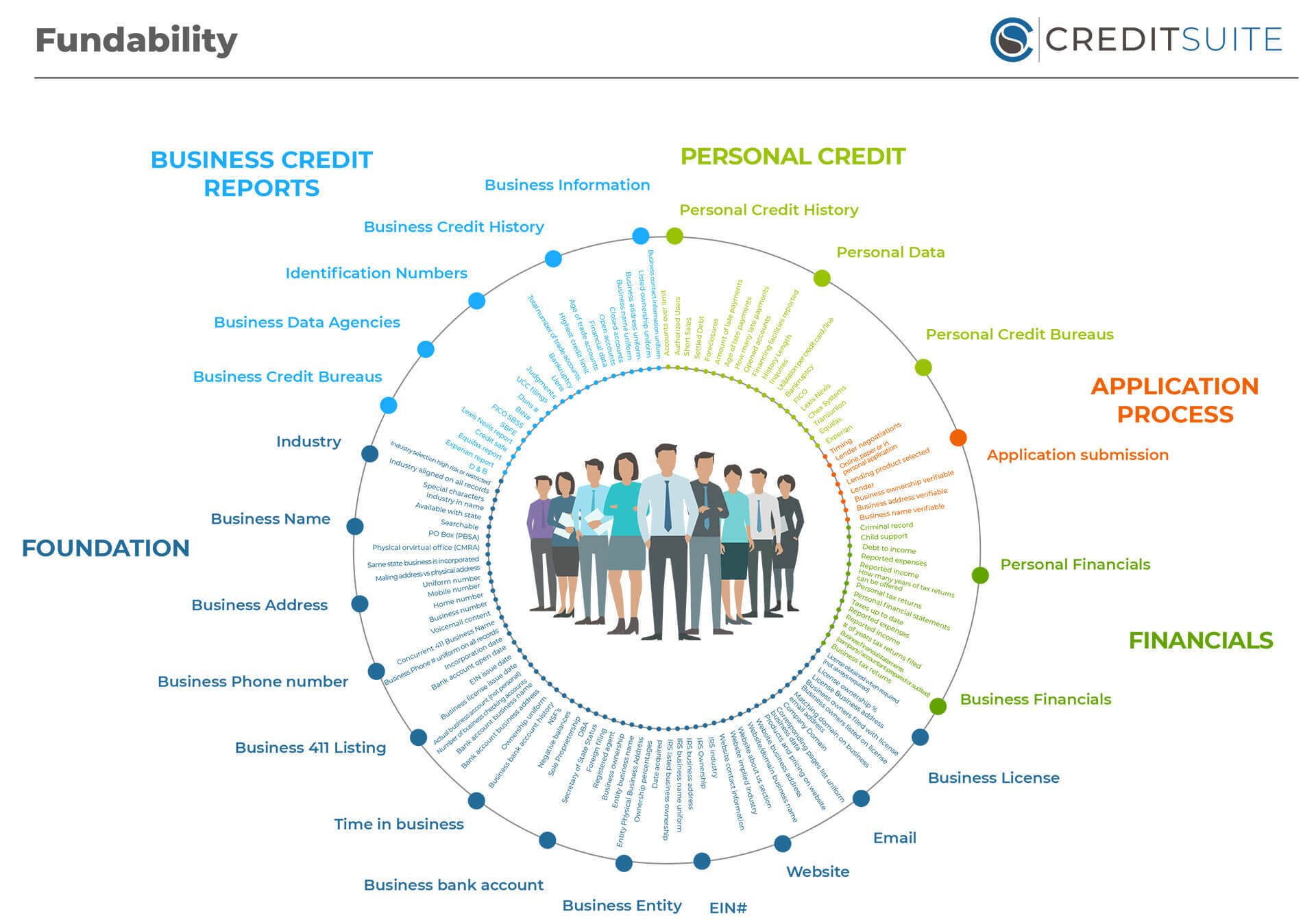

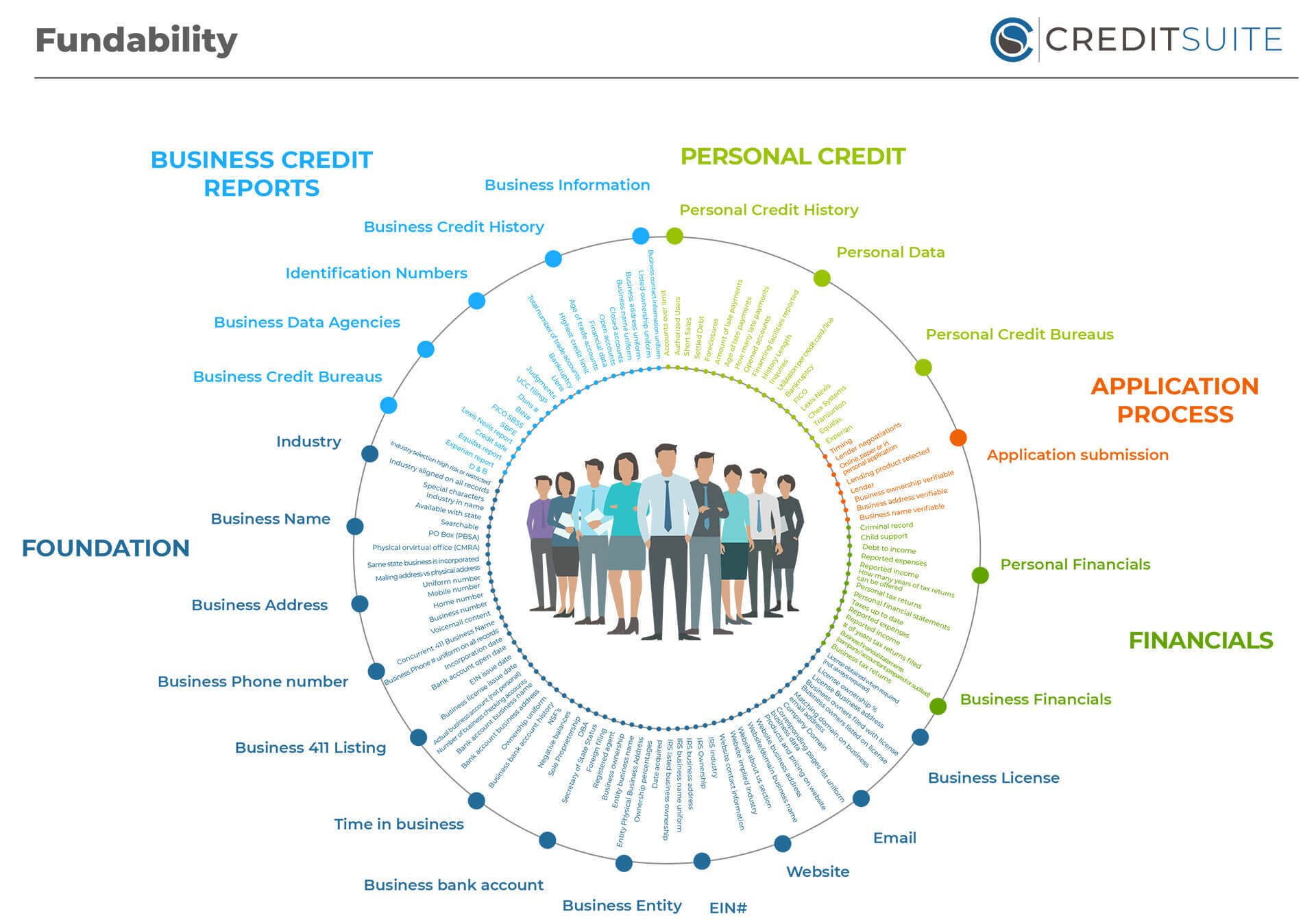

This potential lack of fundability can make it much harder to get approval for home based business loans and other types of business funding. There is a way to overcome this issue, but you need help. There are over 100 factors that affect fundability. It is virtually impossible for a business owner to keep tabs on all of them on their own.

In fact, the secret sauce required by each lender is typically known only to that lender. That is, unless you can find a business credit expert to help you navigate. This is someone who not only understands all the ins and outs of fundability, but knows how to access it for your business. They have the knowledge and relationships necessary to know where to look and who to talk to to get the information you need to establish and build strong fundability.

They can also help you find financing that you qualify for right now, while you work on building the fundability of your business. Here are some examples.

Best Home Based Business Loans

Despite the fact that one of the biggest advantages of working from home is cost savings, getting funding is an issue. When running a home based business, you have a few options. If your business is set up to be fundable, you have a lot more. The key is to find the funding you can get now, and work on fundability in the meantime.

Resist the urge to get a personal loan if you can find another possibility. Funding your business with personal credit should be a last ditch effort. It can have a serious negative impact on your personal credit score and financing in general. Here are a couple of things to try first.

Credit Line Hybrid

A credit line hybrid lets you fund your business without putting up collateral, and you only pay back what you use. You need a personal credit score of at least 680. In addition, you can’t have any liens, judgments, bankruptcies or late payments. Furthermore, in the past 6 months you should have less than 4 credit inquiries, and you should have less than a 45% balance on all business and personal credit cards. It’s also preferred that you have established business credit as well as personal credit.

If you do not meet all of the requirements, it’s okay. You can take on a credit partner whomeets each of these requirements. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

What are the Benefits of a Credit Line Hybrid?

There are many benefits to using a credit line hybrid. First, it is unsecured, meaning you do not have to have any collateral to put up. Next, the funding is “no-doc.” This means you do not have to provide any bank statements or financials.

Not only that, but typically approval is up to 5x that of the highest credit limit on the personal credit report. Additionally, often you can get interest rates as low as 0% for the first few months, allowing you to put that savings back into your business.

The process is pretty fast, especially with a qualified expert to walk you through it. Also, the approval of multiple credit cards creates competition. This makes it easier, and likely even if you handle the credit responsibly, that you can get interest rates lowered and limits raised every few months.

The best part is, these accounts report to the business credit reporting agencies, which helps you build your business credit score. A strong business credit score strengthens fundability.

401K Plan Financing

401(k) plan financing is not a loan. You will not have to pay an early withdrawal fee, and you will not have to pay a tax penalty.

Our 401(k) plan financing offers a powerful and flexible way for new or existing businesses and franchises to leverage assets that are currently in a 401(k) plan or IRA. In as little as 3 weeks you can invest a portion of your retirement funds into your business. This gives you more control over the performance of your retirement plan assets. And it gives you the working capital you need for business growth.

What About the IRS?

This is a 401(k) Rollover for Working Capital program. The IRS calls it a Rollover for Business Startups (ROBS). According to them, a ROBS qualified plan is a separate entity with its own set of requirements. The plan, through its company stock investments, rather than the individual, owns the trade or business. Therefore, some filing exceptions for individuals may not apply to such a plan. As always, it is going to be best to check with an expert.

401K Financing Details

This type of financing is not a loan against your 401(k), so there is no interest to pay. It does not use the 401(k) or stocks as collateral. Also, it’s quite easy to qualify for. You will not need financials or good credit to get approval. All the lender will require is a copy of your two most recent 401(k) statements.

If your plan has a value of more than $35,000, you can get approval even if your personal credit score is bad. You can receive whichever percent of your 401(k) is “rollable” as financing. In many cases, you can secure a low-interest credit line or loan for 100% of your current 401(k) value.

The 401(k) you use cannot be from a business where you are currently working. Also, you cannot be currently contributing to it.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Enjoy All the Work from Home Benefits While Running Your Own Business

It is harder for a home-based business to get funding. This stems from the fact that it is harder to separate the business from the owner for fundability purposes. That does not mean that you cannot enjoy all the advantages of working from home while running a business however. It can be done. You can build business fundability while running your business from home. You just have to be intentional. A business credit expert to walk you through the process is a must. Do not fall into the trap of thinking you can do this on your own.

This is someone who can not only help you assess and build fundability, but they can also help you find the financing you can get right now easier and faster. Find out more today.

The post Advantages of Working from Home Running a Business appeared first on Credit Suite.