Article URL: https://www.ycombinator.com/companies/great-question/jobs/rbDFLOP-founding-engineer-rails

Comments URL: https://news.ycombinator.com/item?id=26799244

Points: 1

# Comments: 0

Article URL: https://www.ycombinator.com/companies/great-question/jobs/rbDFLOP-founding-engineer-rails

Comments URL: https://news.ycombinator.com/item?id=26799244

Points: 1

# Comments: 0

Ocient | Senior/Principal/Distinguished Software Engineer | Full-time | $130-215k + stock | USA, Chicago / Remote (US) | https://ocient.com

We’re building the word’s most scalable and efficient data warehouse. The founding team’s previous startup was acquired by IBM for $1.4B. Recently raised $40M.

Our Stack: Modern C++, Linux, etc.

Apply at https://ocient.com/careers. Send your questions to starzia at ocient.com.

Article URL: https://www.ycombinator.com/companies/great-question/jobs/rbDFLOP-founding-engineer-rails Comments URL: https://news.ycombinator.com/item?id=26799244 Points: 1 # Comments: 0

Article URL: https://www.streak.com/careers/product-engineer Comments URL: https://news.ycombinator.com/item?id=26791030 Points: 1 # Comments: 0 The post Streak (YC S11) looking for a senior front end engineer (remote only) first appeared on Online Web Store Site.

Some of the world’s wealthiest nations are grappling with stubborn coronavirus rates, but a brightening outlook and historic stimulus packages will boost economic activity and oil demand this year, the Organization of the Petroleum Exporting Countries said.

The post OPEC Sees Oil Demand Boosted by Stimulus, Vaccine first appeared on Online Web Store Site.

There are tons of articles on the internet about how to make working from home work for you. How to run a business from home is a popular topic. You don’t need me to give you more ways to organize your work space or keep yourself out of the fridge. No one needs more work from home tips on how to schedule your day and avoid distractions. There are plenty of places to get those.

I’m going to give you something you can’t in every internet search that includes “work from home” and “tips.” I’m going to tell you how to get the funds you need to run your home based business now, and how to ensure you’re set up properly to get more funds in the future.

You may think you can just go to the bank and get a home based business loan just like any other loan. However, you may be wrong. If your personal credit score is really high, it’s possible. Yet, home based businesses do not traditionally bode well with lenders. These work from home tips can help your business appear fundable to lenders. They can help you build your business credit score. Even better, they can point you in the direction of the best funding options for work at home businesses.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

This tip comes before all the other tips because frankly, some of them are almost impossible to pull off without a business credit expert. This is someone who can help you:

Working on fundability is essential. This is a tip for any business, but fundability is something that many home based businesses struggle with. There are many factors that affect fundability. Still, home based businesses struggle with a few specifically more than others.

The thing is, a major aspect of fundability is to appear to lenders to be separate from the owner. They want to see that a business is fundable on its own. For this to happen, the first thing you have to do is set up your business to be separate from you the owner.

What makes this an exceptional issue for home based businesses? Well, it’s no secret that one of the major benefits of working from home is not having to pay for an office space. There is no lease, no extra utilities, you just use the space you already have.

In fact, most home-based businesses are run as sole proprietorships with the same contact information as the owner. Many do not even open a separate business bank account at first. Also, it’s quite common for sole proprietor’s to simply use their social security number rather than using an EIN from the IRS.

While there is nothing wrong with any of this, it does not suit the purpose of separating your business from yourself for fundability. To do that, you need a separate phone number and address for your business. Do not think that means you have to have a separate location. You do not. There are ways to get a business home phone number and even a separate business address and still run your business from home. You also need an EIN and business bank account.

You also really need to incorporate as an S-corp, LLC, or corporation. For fundability purposes, it doesn’t matter which one you choose. Discuss the options with your tax professional and attorney. They can help you determine which one is best for your budget and needs for liability protection.

If you set your business up to be fundable, it will also be set up the way it needs to be to establish a business credit profile. This means you can start to build your business credit score separate from your personal credit score.

Here is how it works. You have to open accounts in your business name, using your business contact information and your EIN, not your SSN. The catch is, they need to be accounts that will report to the business credit reporting agencies.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

This is easier said than done, as most vendors do not make it easy for the general public to figure out whether they do this. In fact, many do not report, which makes this particular tip harder. In the beginning, you have to find vendors that will extend credit and report payments without checking your credit. That is, if your personal credit isn’t good.

This is one tip where a business credit expert can be especially helpful. These experts know many vendors that will report. They also know which ones you qualify for an account with right now. Even better, they know how to position you so that you can be eligible for more accounts in the future.

With strong fundability you’ll be able to get pretty much any funding your business could ever need, even if it is a home-based business. However, in the beginning, some loans are going to work better than others. Here are some examples.

With the Credit Line Hybrid, you can usually get a loan of 5x the amount of your highest revolving credit limit account, up to $150,000. Honestly, this is more than what you could get on your own when applying for credit cards. Furthermore, you can get cash out on this program.

Also, there is no impact on your personal credit with this type of financing. You need a 680+ credit score, but if you don’t meet that you can take on a credit partner who does. A lot of business owners use the good credit of friends or family to help them get the funding they need.

It does not affect your personal credit score at all. In fact, it can help build your business credit score if your business is set up properly as mentioned above.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

The SBA offers federally funded term loans up to $5 million. The funds can be used for expansion, purchasing equipment, working capital and more. Banks, credit unions, and other specialized institutions process these loans and disburse the funds.

Credit Suite business credit experts can help you with these types of funding and more!

While there are plenty of work from home benefits, there are also some disadvantages of working from home. If you want to work from home, you have to find a way to overcome these work from home challenges. If you are running your business from home, one of the greatest of these challenges is funding your business. A Credit Suite business credit expert can help.

The post 4 New Work from Home Tips To Get The Funding You Need appeared first on Credit Suite.

Did you know that it’s possible to get a credit card for bad credit score? Yes, really!

We researched lots of company credit cards for you. So, here are our choices.

Per the SBA, business credit card limits are a whopping 10 – 100 times that of personal credit cards!

This shows you can get a lot more money with company credit cards.

And you will not need collateral, cash flow, or financials to get small business credit.

Benefits can vary. So, make sure to pick the benefit you would prefer from this selection of alternatives.

And always check rates on the appropriate website.

Look into the Brex Card for Startups. It has no yearly fee.

You will not need to provide your Social Security number to apply. And you will not need to supply a personal guarantee. They will take your EIN.

Nevertheless, they do not accept every industry.

Likewise, there are some industries they will not work with, as well as others where they want more paperwork. For a list, go here: https://brex.com/legal/prohibited_activities/.

To determine creditworthiness, Brex checks a company’s cash balance, spending patterns, and investors.

You can get 7x points on rideshare. Get 4x on travel. Likewise, get triple points on restaurants. And get double points on recurring software payments. Get 1x points on everything else.

You can have bad credit (even a 300 FICO) to qualify.

Find it here: https://brex.com/lp/startups-higher-limits/

Have a look at the Capital One® Spark® Classic for Business. It has no annual fee. There is no introductory APR offer. The regular APR is a variable 26.99%. You can earn unlimited 1% cash back on every purchase for your company, without any minimum to redeem.

While this card is within reach if you have average credit scores, beware of the APR. However if you can pay on schedule, and completely, then it’s a bargain.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

Score the best business credit cards for your business. Check out our professional research.

Check out the Capital One® Spark® Miles for Business. It has an introductory annual fee of $0 for the first year, which after that rises to $95. The regular APR is 20.99%, variable due to the prime rate. There is no introductory annual percentage rate. Pay no transfer fees. Late fees go up to $39.

This card is great for travel if your expenses do not fall into standard bonus categories. You can get unlimited double miles on all purchases, with no limits. Earn 5x miles on rental cars and hotels if you book via Capital One Travel.

Get an introductory bonus of 50,000 miles. That’s the same as $500 in travel. But you only get it if you spend $4,500 in the initial 3 months from account opening. There is no foreign transaction fee. You will need a good to excellent FICO score to qualify.

Earn 50,000 bonus miles if you spend at least $4,500 within 3 months of your rewards membership enrollment date

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-miles/

Score the best business credit cards for your business. Check out our professional research.

American Express® Card

American Express® CardTake a look at the Marriott Bonvoy Business Card from American Express. It has a yearly fee of $125. There is no introductory APR offer. The regular APR is a variable 15.74 – 24.74%. You will need good to superb credit to get this card.

Card from American Express. It has a yearly fee of $125. There is no introductory APR offer. The regular APR is a variable 15.74 – 24.74%. You will need good to superb credit to get this card.

You can earn 100,000 Marriott Bonvoy points after using your card to make purchases of $5,000 in the initial 3 months. Get 6x the points for qualified purchases at participating Marriott Bonvoy hotels. You can get 4x the points at United States restaurants and filling stations. And you can get 4x the points on wireless telephone services purchased directly from American service providers and on American purchases for shipping.

Get double points on all other eligible purchases.

Also, you get a free night every year after your card anniversary. And you can earn one more free night after you spend $60,000 on your card in a calendar year.

You get free Marriott Bonvoy Silver Elite status with your Card. Also, spend $35,000 on qualified purchases in a calendar year and get an upgrade to Marriott Bonvoy Gold Elite status through the end of the following calendar year.

Find it here: https://creditcard.americanexpress.com/d/bonvoy-business/

Our Credit Line Hybrid could be within reach. But the trick is to work with a credit partner.

If your credit partner has good personal credit, then a hybrid credit line could be the perfect solution.

You can get up to $150,000, even if your business is a startup.

To qualify, your credit partner’s personal credit score should be at least 685. And they can’t have any liens, judgments, bankruptcies, or late payments. Plus, in the past 6 months they should have fewer than 5 credit inquiries. And they should have less than a 45% balance on all business and personal credit cards.

It’s better if you or they have established business credit as well as personal credit. See creditsuite.com/business-loans.

Score the best business credit cards for your business. Check out our professional research.

Your personal credit score comes from a few basic measurements.

One is the mix of credit you’ve got. Hence, if you only have a credit card, getting an auto loan can enhance your credit mix.

Another is the number of recent inquiries. This is about the best argument against credit shopping. And inquiries stay on your personal credit report for years! So try to curb any tendencies you might have to shop around for credit.

The average age of your accounts also comes into play. Therefore, if you aren’t using a card anymore – do not cancel it! But recognize that, eventually, the credit issuer will close it. As a result of this situation, if you won’t be tempted to overspend – try to use a less often used card maybe once every couple of years.

Yet another factor is your utilization percentage. That’s a simple math formula – it’s just used credit divided by total available credit. And this is for both individual cards and all of your credit. Try to keep this percentage under 30% if you can.

We saved the best for last! Your best way to improve your personal credit score is to just pay your bills on time, and in full. Just paying the minimum amount every month will never get you out from under debt. It’s essentially designed to keep you in debt, indefinitely.

Responsible financial stewardship will never steer you wrong – and then you’ll have a lot more credit card choices.

Your straight-out ideal company credit cards depend upon your credit history and scores.

Just you can choose which features you want and need. So, to do your research. What is outstanding for you could be disastrous for another person.

And, as always, make sure to develop credit in the recommended order for the best, speediest benefits.

The post Credit Card for Bad Credit Score appeared first on Credit Suite.

Influencers are everywhere.

There are roughly 37 million influencers on Instagram, and around 1.5 million of them work on YouTube.

Every day, these creators promote brands across social media, talk up great products, and directly influence how people spend their hard-earned money.

Sounds great, right? There’s just one problem.

It’s really hard to actually find a great influencer to grow your business.

Whether you’re digging through social media platforms for ideas, or spending hours pitching creators, it’s a time-consuming process. In fact, according to Mediakix, 61 percent of marketers struggle to find the best influencers for their campaigns.

What’s the answer?

You need a more effective means of sourcing influencer talent and making connections. Influencer marketplaces can help you do just that, so let me show you how they work.

Before we get started, let’s touch on influencer marketing more generally. Is it worth your time, or should you leave the influencer trend behind?

While influencer marketing isn’t for everyone, I think you should give it a go if it makes sense for your business.

Why? Because influencer marketing works.

While I’m not suggesting you should rely solely on influencer-based marketing, the trend is here to stay, and it’s worth trying.

If you’re still not convinced, here’s another way to think of it. Around 26 percent of consumers use ad blockers to hide ads and improve their browsing experience.

There’s a high chance those ads you’re paying for won’t reach their intended audience! For sales-based companies, influencer marketing could be a promising alternative.

Ready to find influencers for marketing campaigns? Let’s explore the mysteries of the influencer marketplace.

You can find influencers online in four major ways:

Although we’re focusing on influencer marketplaces, remember it’s not the only strategy for finding influencers to market your business.

Influencer marketplaces match businesses with influencers working in their niche, whether it’s beauty, fitness, food, and so on.

It’s a simple premise. You sign up and post a brief describing the services you’re looking for and wait for influencers to respond. If you find an influencer you’re happy with, you can hire them to create content, promote your brand and, well, influence people to buy your products.

You’re not limited to one influencer, either. You can work with multiple influencers across the platform, and you can recruit more talent as you go.

The upshot? Whether you’re running a one-off product campaign or you’re looking for a more stable relationship, influencer marketplaces could work for you.

Some of the more popular influencer marketing platforms include:

It’s common for influencers listed on marketplaces to work across two or more social media platforms. For businesses, this is great news because you can use one or two trusted influencers for all your content marketing.

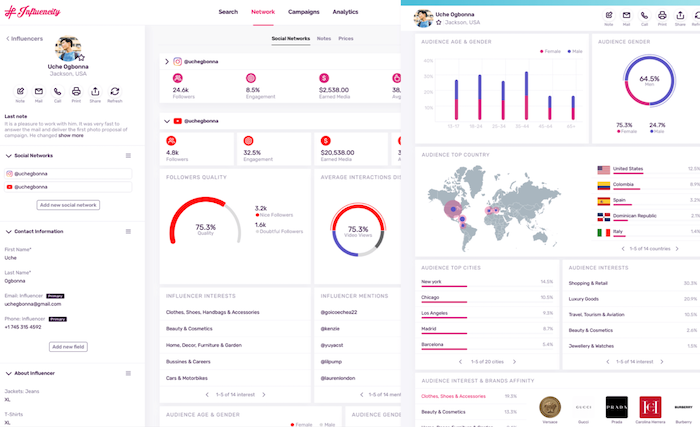

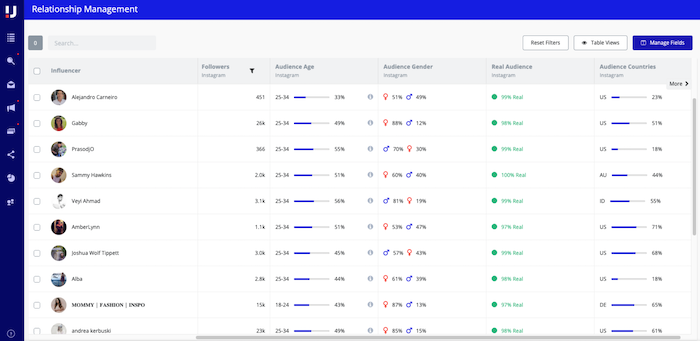

Upfluence, for example, primarily pairs businesses with Instagram influencers, but there’s some scope to access influencers working on TikTok and Facebook, too:

While HypeAuditor matches you with influencers working across the likes of Twitch and YouTube:

There’s a huge range of marketplaces out there, so be sure to explore your options. Here are a few things to consider:

Whichever marketplace you choose, you’ll usually pay a fee for signing up and using their services, so be sure to factor in the cost before you join.

Some platforms, though, like Influence, let you set up a basic account for free. The problem? You’re limited in terms of how many messages you can exchange each month, and how many profiles you can see in the search results. While this might work for one-off campaigns, it may be less sustainable for long-term influencer marketing.

Weigh up the pros and cons of the different fee structures before you commit.

We touched on this earlier, but to be clear, influencer marketplaces and influencer agencies are totally different things.

You can use both marketplaces and agencies if it suits your marketing strategy. Just bear in mind that they’re not the same thing.

In short, think of influencer marketplaces like a matchmaking service. While there’s no guarantee you’ll find the right influencer to collaborate with, there is a chance you’ll find a long-term creative partnership.

Are you excited to give influencer marketplaces a try? Great! Before you jump into a subscription, though, here are some steps I suggest you work through.

Before you even join an influencer marketplace, be clear on what you’re trying to achieve. For example, are you trying to increase sales, generate hype around your brand, or boost your engagement levels?

Jot all your goals down and try to identify which one is your priority.

Next, clarify your target audience and how they best respond to influencer marketing. That way, you can figure out precisely what role the influencer will play in your campaign.

As an example, say you’re a brand looking to launch a new product aimed at millennials on Instagram. You want to build hype and increase sales. Your main goal is to sell the product, so you’re looking for influencers who can not only help you but who can speak your target audience’s language.

Once you know what you need from an influencer marketplace, it’s time to set your budget. How do you know what’s a “fair” amount to pay your influencer, though? Unfortunately, there’s no right answer, but asking yourself the following questions can serve as a guide.

First, what kind of content do you need? You might, for example, pay more for an in-depth product review video than a few short posts on Instagram.

Next, which platform are you targeting? Each platform requires different creator resources, so they command different rates. On average, you might pay an influencer $10 per 1000 followers for an Instagram post, but that goes up to $25 for a Facebook post.

How big is the influencer’s audience? The bigger the influencer, the more they can charge for their time.

Finally, is it a one-off or long-term campaign? You could potentially get better rates if the influencer knows they’ll get steady work from you. Seasonal campaigns could cost you more, since there’s higher demand around this time.

Don’t forget you’ll need to budget for a monthly or annual marketplace subscription, too. Be sure you can afford the fee before you sign up.

Should you join every influencer marketplace out there? No.

Instead, research your options and choose one or two platforms to start out with. Here are some tips for moving forward.

My suggestion? Look to see if a marketplace offers a free trial, or at least a free membership option, before you commit to a paid plan. This lets you test out the platform without putting a dent in your marketing budget.

Remember, if you’re unhappy with the results, you can always review your strategy and try out different marketplaces. Influencer marketing is flexible like that.

You’ve set a goal, determined your budget, and signed up with a marketplace. Next comes the hardest part: finding the best influencer for your needs.

Honestly, there’s no “right” way to go about this. However, here’s what is most important to consider when shopping for an influencer.

If followers engage with an influencer, for example, by leaving comments or sharing their content, there’s a good chance you’ll see better engagement on your content. Influencers with large follower counts but low engagement levels may not be the best fit.

Authenticity matters. In fact, according to Stackla, 90 percent of customers value authenticity when choosing which brands to buy from, so any influencer you work with must come across as “real” and authentic.

To be clear, you don’t need influencers with millions of followers. For some niches, it’s even better to target influencers with much smaller audiences, but higher engagement levels.

As a general guide, reach matters, but it may be less important than engagement.

Does the influencer resonate with your brand identity? If not, it doesn’t matter how impressive the influencer’s follower count is: they won’t help your marketing strategy in the long run, and they may actually deter your target audience from shopping with you.

You need to find a way to track your marketing campaign to ensure it’s working for you. How do you do this? By tracking key performance indicators, or KPIs.

The KPIs depend on your overall goal, but common metrics worth tracking include your impressions, engagement levels, follower count, and conversions.

Ultimately, it’s an influencer’s job to leverage their followers to your advantage, so if you’re not getting more traffic than usual, there could be a problem with your strategy.

Here’s the bottom line, though. You’ll know if your influencer marketing is working if you achieve your goal. In other words, if you set out to sell more products, the campaign most likely worked if you sold more products!

Unsure how to measure your performance? Be sure to check out our consulting services.

Just because an influencer comes across well on a marketplace doesn’t mean they’re the best fit for your business. Maybe their communication style doesn’t mesh well with yours, or you just find them difficult to work with.

Whatever the reason, it’s okay to cut ties. Just remember that if you do end your contract with an influencer, do it professionally. Influencers talk, and you don’t want a reputation as a difficult client!

Influencer marketplaces make it easy to match influencers and promoters who can help grow your business and generate hype around your products. That said, these marketplaces aren’t for everyone, and you might prefer curating your list of influencers and reaching out to them directly.

My suggestion? Spend some time researching the different marketplaces before you commit to a subscription, and remember to keep a close eye on your metrics to ensure your influencer partnership is working for you.

Have you tried an influencer marketplace yet?

Are you in a crowded industry and can’t seem to stand out? Does your brand operate in a niche with a small audience? If you answered yes to one of those questions, then you know reaching your target audience is no walk in the park. That’s exactly why you must leverage niche marketing. What Is …

The post How to Do Niche Marketing For Tiny Audiences first appeared on Online Web Store Site.

The post How to Do Niche Marketing For Tiny Audiences appeared first on ROI Credit Builders.

Diane talks with Rep. Jamie Raskin, Democratic Congressman from Maryland, about leading the second impeachment of Donald Trump and his hopes for the new Biden administration.

The post A Conversation With Maryland Congressman Jamie Raskin appeared first on Buy It At A Bargain – Deals And Reviews.