Article URL: https://www.notion.so/keepertax/Come-work-with-us-98a6be20e7e44922be6291f5513af40d?p=894daaeed38e4c7989e6d718d509ab91

Comments URL: https://news.ycombinator.com/item?id=27197609

Points: 1

# Comments: 0

Article URL: https://www.notion.so/keepertax/Come-work-with-us-98a6be20e7e44922be6291f5513af40d?p=894daaeed38e4c7989e6d718d509ab91

Comments URL: https://news.ycombinator.com/item?id=27197609

Points: 1

# Comments: 0

SIRUM is making medications affordable for all.

We’re a small (~25) but quickly growing team that’s passionate about our mission of reimagining healthcare access for those in need. We like to work hard, solve tough problems, and are determined to improve healthcare access for families who have trouble affording the medications they need to stay healthy.

We’re currently hiring for both our Palo Alto and Atlanta offices, as well as some fully remote roles. We have opportunities for senior software developers, software architects, sales, communication, and many other positions and are especially interested in anyone with pharmacy experience.

If you want to work in healthcare, love mission-driven work, and thrive in a startup environment, then we may be a good fit. Check out our open roles at https://www.sirum.org/about#careers.

Even if you don’t see something that’s the right fit right now, we love hearing from folks on Hacker News who share our mission.

Comments URL: https://news.ycombinator.com/item?id=27201040

Points: 1

# Comments: 0

Going after the “low-hanging fruit” is common advice in the SEO world. Ranking for those terms will help you rank for bigger terms down the line, at least that’s the standard belief.

Do you think that’s true?

There might be some truth to it, but there are many reasons to target low search volume keywords whether your site is brand-new or well-seasoned.

In this guide, I’ll cover why low search volume keywords are crucial to SEO and show you how to find them.

There are many scenarios where you would want to target low search volume keywords. Let’s take a look at six of my most prominent reasons.

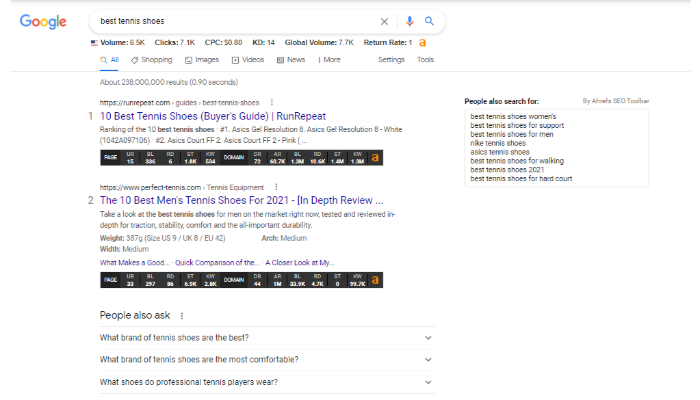

User intent refers to the reason why someone is searching a specific phrase into Google. For example, when someone searches for the “best tennis shoes” versus “tennis shoes,” each of these keywords has a different intent.

Someone who searches for the best tennis shoes is likely looking for reviews of tennis shoes. When we put that into Google, the results prove to be true.

The majority of results Google provides are reviews of the best tennis shoes because that’s what people want. This tells us most people who search this phrase end up clicking reviews.

If we change the search to “tennis shoes” the results are dramatically different. Now we’re not receiving results for reviews of shoes, but we’re receiving results of places to buy shoes and different brands instead.

What does this mean?

It means the keyword “best tennis shoes” has an informational-based search intent. This could mean the person is interested in buying shoes but hasn’t entirely decided on a brand or a location to buy them.

They might want to read reviews, surf the web, and shop around a little before making a final decision.

When someone searches “tennis shoes,” it’s clear they’re ready to buy and they know what they want. This is considered transactional intent — meaning they want to make a purchase.

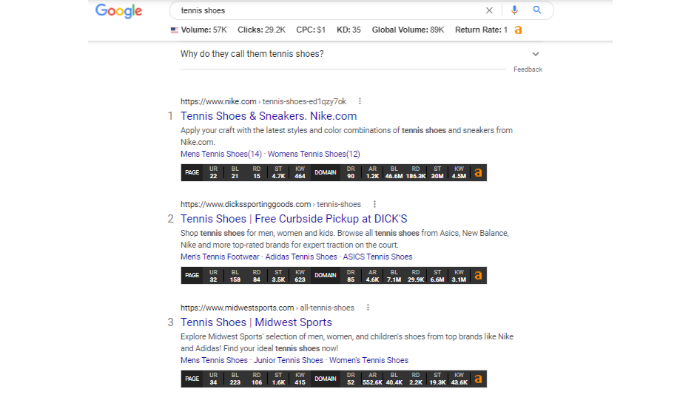

If we’re writing a review on the best tennis grips and we’re trying to get people who are researching rather than buying, we may want to target the following keywords.

The keyword “best tennis grips for sweaty hands” is a very specific keyword. Even though it only averages 140 searches per month, it could still be a worthwhile long-tail keyword because it’s highly targeted and the search intent is spot on.

Search difficulty refers to how difficult it will be for you to rank for a specific keyword. One of the main reasons people target low keywords is because it’s easy for them to rank quickly without much work.

If you refer back to the previous image, you’ll see “best tennis grips” has a search volume of 320 with a difficulty of 41. This means the keyword might be challenging to rank, and would require more backlinks and higher authority.

The keyword below it, “best tennis grips for sweaty hands” will be much easier to rank for because it only has a search difficulty of 18. As you can see, it has a lower search volume, though.

One of the basic principles of SEO is to find as many low competition keywords as possible and include them in your content as naturally as you can. By doing this, you might spread yourself wide over many different keywords, but they’re all low competition so you’ll be able to rank quickly, get traffic on your site, and increase your domain authority to begin to target more competitive keywords.

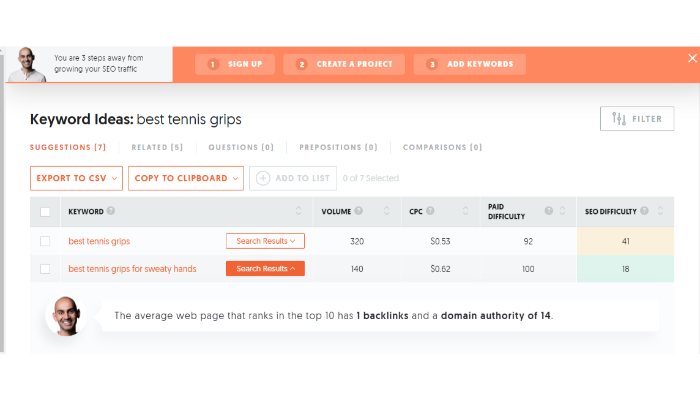

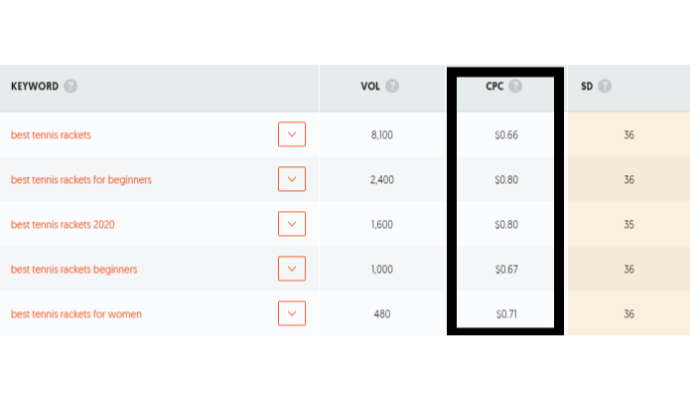

Take a look at the list of keywords above. These all have low search volume. If you look at the one highlighted with a rectangle around it, you’ll see it contains nine words, which makes it a “long-tail keyword.” Long-tail keywords are phrases that contain more than four words and oftentimes, they contain a high search volume keyword in the middle.

That’s the case with this example.

While “what is the best tennis racket for intermediate players” may only get 20 searches per month, the keyword “best tennis rackets” gets 8,100 searches per month. As a result, you may want to target these long-tail keywords and position an entire piece of content around them with the intent of eventually getting the high-volume keyword.

When you’re starting out with a newer site or trying to grow an existing one, you’ll target these types of keywords that contain the high search volume keyword because they offer you a way to get both of them without having to go all in on the highly competitive phrase. The same goes for high search volume, low competition keywords.

If we continue on with the tennis example, tennis is considered a niche topic. It’s something that doesn’t interest everyone, but those who enjoy it will want to know as much as possible about the sport. They’re highly interested in it and will spend a lot of money to purchase products to make them better at it.

As a result, it is beneficial to go after low search volume keywords even if they don’t bring about a lot of traffic. Google is putting a lot more emphasis on the comprehensiveness of a website and rewarding those who cover topics to the fullest extent.

In fact, a great example of this came in a 2021 update where they targeted affiliate websites with “thin content.” Thin content refers to pieces that don’t add a lot of value or personality to the products or services they promote.

Affiliate marketing websites are notorious for this.

Let’s say you have a site and you’re promoting tennis rackets on Amazon. Some affiliate sites will simply copy everything in the Amazon product description over to their site and slap an affiliate link on it.

You can’t do this, according to Google. They refer to it as “scraped content” and while they won’t penalize you for it, they’re rewarding sites that add insight and interesting anecdotes in addition to product specifications.

How does this tie into low search volume keywords and niche topics?

Targeting low search volume keywords isn’t always about traffic. The goal of your site should be topic mastery and expertise. Google is paying a lot more attention to this nowadays. You can’t simply be the best keyword research expert and expect to rank right away anymore.

Google wants to see you actually understand the topic and are passionate about it. As a result, you can cover extensive topics by researching low search volume keywords that provide a well-rounded piece of content for the reader. Doing so shows you not only understand SEO but understand the topic you’re covering as well.

The cost-per-click is the average cost an advertiser pays to get someone to click on their Google ad. If certain low search volume keywords also have a low cost per click you might want to target them because it would be easy for you to beat out the competition and get to the top of the SERP even if it’s only for 50 people a month.

Keywords that have a high CPC are more competitive and will cost more to get you one click. For example, if you’re targeting a keyword with a $4.00 CPC, chances are you’ll have to have a large budget and be willing to pay more than that per click if you expect to get on the first page.

That cost can add up quickly and it doesn’t mean a conversion. You’re paying more than $4.00 just to get someone to click through to your website. The rest is up to you.

By going after low search volume keywords, there is less competition and the cost of getting someone to your website is lower.

We all know link building is an important piece of the SEO puzzle and acquiring as many high-quality backlinks as possible is crucial if you expect to ever rank for anything. One way a lot of people acquire backlinks is through manual outreach.

You reach out to website owners in your niche to see if they’re interested in either including a link to your content on their site or fixing a broken link by replacing it with your great piece of content.

For this to work, you need to have a great piece of content with traffic that shows the website owner you’re worth their time.

A great way to do this is targeting a bunch of low search volume keywords that are relevant to your niche but might not be the most competitive. By doing so, you’re creating a piece of content that is topically relevant and interesting to the person you’re reaching out to. This increases the chances of them including a link on their site.

Ubersuggest is a great tool and is pictured above in many of the images. All you need to do is input a phrase and the tool will provide relevant keywords as well as their search volume.

There’s really no specific volume because the goal is to find a keyword with as low competition by high search volume as possible. If you can do that, you’ll have an easier time ranking in a shorter amount of time.

Finding low search volume keywords with high traffic isn’t easy. If it was easy, you wouldn’t have thousands of people competing against each other, and we’d all get to rank for whatever keywords we wanted. Utilize Google Trends, research using tools like Ahrefs, and spy on your competition by seeing what keywords they rank for.

Finding the search volume of a keyword is as simple as punching it into one of the various tools. You can use Ubersuggest, Ahrefs, SEMRush, and even Google Keyword Planner. All of these tools will display search volume. Keep in mind these are estimates so the results may vary from tool to tool.

Finding low search volume keywords is a great way to get traffic to your website whether you’re just starting out or making sure your site is topically relevant. There are many pieces to the SEO puzzle and we’re always trying to figure out how to get ahead of our competition.

If you’re struggling to figure out keyword research and SEO, we can help. Be sure to keep these tips in mind as you conduct your research and put together the next list of keywords you plan to target.

Do you think low search volume keywords can help you rank for higher search volume keywords? Let me know why in the comments.

Your website can be your strongest sales asset or your weakest link.

A high-converting website works even when you’re sleeping, bringing in sales and growing your business 24 hours a day.

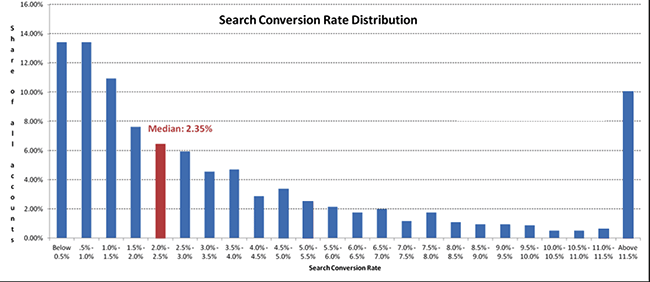

While the average conversion rate is around two to five percent, some of the highest performing websites online see conversion rates as high as 11 percent.

This means top advertisers are outperforming competitors by more than double.

If you want to increase your conversion rates, you need a strong CRO program to guide you.

A CRO program can improve ROI for your e-commerce business by targeting website performance and testing user experience methods that encourage online conversions.

Below, we’ll cover why CRO programs matter, how to create them, and what success in this space really looks like.

Conversion Rate Optimization (CRO) programs are digital marketing strategies that help to improve conversion rates on websites or apps.

Usually, a CRO program finds drop-off points or obstacles on a website, analyzes how and why they are occurring, and then helps you develop new ways to ensure future conversions.

This is done through A/B testing, data analysis, customer journey mapping, consumer research, and more.

The key is to figure out:

From there, tactics such as analytics, PPC tracking, heat mapping, and user recordings help read on-site behaviors.

Using a combination of these tools and pairing them with a testing schedule is one of the most effective ways to improve your website conversion rates.

CRO programs are essential to growth because they improve customer experience, conversions, and sales.

Conversion rate optimizations can even lower your customer acquisition cost by improving conversion rates with visitors already on your site.

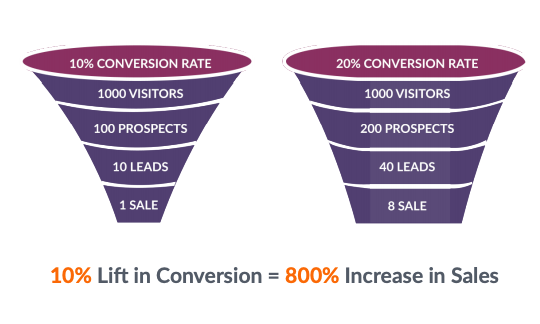

For example, if your website gets 1000 visitors a month and has a five percent conversion rate, you’ll get 50 conversions per month. If you can increase your conversion rate by five percent, you’ll double your monthly conversions without spending more to acquire new customers. You can see this at work in this conversion rate optimization funnel.

CRO programs give you insights into what is working on your website and what is not, allowing you to optimize your budget allocations.

As competition online grows, CRO programs are becoming increasingly important.

These days, it isn’t enough to offer a good product or service; you also need an engaging website that loads quickly, funnels users towards your end goals, and offers value and insight.

According to Unbounce, 70 percent of consumers report a slow load time decreases their chance of buying. From that same cohort, 32.3 percent claimed they are only willing to wait four seconds for a page to load.

Seventy-seven percent of mobile shoppers say they are more likely to purchase from websites that allow them to purchase quickly.

Well-placed CTAs can increase website conversions by 232 percent.

A strong CRO program can tackle all of these solutions while putting user experiences first and creating a clear framework for improving on-site experiences.

Once you understand how, when, and why your customers enter or exit your site, you’ll be able to make improvements to help it reach its maximum potential.

With a well-structured CRO program, you have the ability to:

Any business that wants to improve its online conversions can benefit from a CRO program.

More specifically, CRO programs are great for e-commerce businesses, businesses with email marketing programs, and businesses involved in paid media programs, as CRO is a natural accompaniment to these programs.

CRO programs can also improve SEO efforts, as they improve page load times, on-page performance, UX/UI, and readability.

Any business looking to improve its online conversions or SEO can benefit from a CRO program. This list can include:

Businesses that stand to see the largest benefits from CRO programs are those that have a large number of monthly web visitors.

CRO programs usually work best with scale. For example, a five percent increase in conversion rate on a site with 100 monthly visitors is only five extra conversions per month. Yet, a five percent increase on a site with 100,000 monthly visitors is 5,000 extra conversions per month.

Additionally, CRO programs are most effective for websites with one clearly defined goal. For example, an e-commerce website looking to sell more products, a B2B business may want to increase demo appointments or drive email sign-ups. Whatever your goal, it should be obvious to incoming visitors.

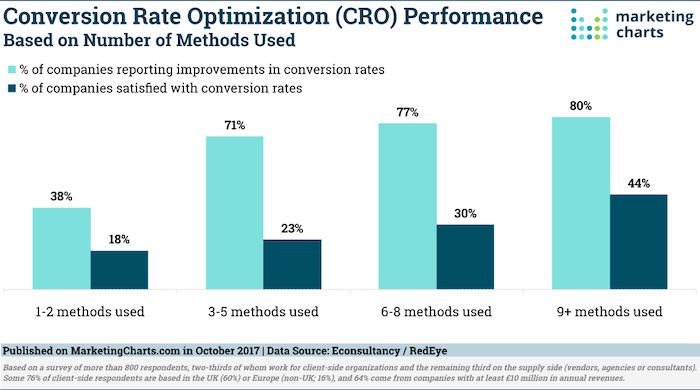

Keep in mind CRO programs are best suited for businesses seeking to build long-term value. Clients need to understand the value of their website and how it affects consumer relationships. Using several CRO strategies, for example, is often more effective but those strategies take time.

While CRO programs can be incredibly helpful to growing businesses, there are some drawbacks.

First, CRO programs can be costly and time-consuming. It’s not about quick wins, but rather ongoing testing, optimization, and education.

Many businesses don’t have the internal expertise to launch a CRO program. This often means hiring third parties is necessary, which increases the cost.

For those with in-house expertise, it can be difficult to shift resources towards a dedicated CRO program.

For businesses on a tight budget, or those without time to oversee these programs, CRO programs may end up being unfulfilling.

That said, creating a structured CRO program can alleviate some of the costs and drawbacks associated.

Below, we’ll outline some of the steps needed to integrate a CRO program into your business.

Research shows that the top marketers in the world set clear goals and that goal-setting marketers are 375 percent more likely to report success.

If you’re ready to start your own CRO program, you’ll want to lead with strategy.

Here’s how to get started.

For a CRO program to be successful, you need buy-in from top members of your organization and staff.

Top management controls budget, resource allocation, and sign-offs for your programs. Cooperation on this level is essential to see a CRO program through from start to finish.

Likewise, coordination with team members and among departments will be necessary to complete your program. CRO programs often include members of data management teams, UX teams, webmasters, and customer support.

To ensure your CRO program runs smoothly, educate all team members and higher-ups on the goals and benefits of the CRO.

CRO programs often involve data, strategy, design, copywriting, and web development.

If you know your company is interested in CRO, establish this in your hiring processes.

Even better, search out top talent well-versed in CRO and consult their expertise when considering new team members.

The more alignment you have with your team from the start, the more likely you will see success in your CRO program.

A successful CRO program requires a well-defined process.

This process should start by outlining key issues on your existing website and how they contribute to gains and losses in your conversion funnel.

From there, develop hypotheses to tackle these issues, and design a calendar to keep your team on schedule.

Your entire process should revolve around A/B testing. Once you start testing, you’ll likely find more places to optimize. Document these opportunities in as much detail as possible, then add them to your calendar.

Pay attention to any new opportunities for optimization and ensure every decision is data-backed and aligned with your overall business goals.

Whether you plan to watch visitor activities on your website through heatmaps or want to know how your lead forms are performing, CRO tools are an essential part of your program.

CRO tools show an average ROI of 223 percent, so don’t be afraid to invest a bit of money to get the tools you need.

Here are a few CRO tools to consider:

-heat maps

-scroll maps

-A/B testing tools

-multi variant testing tools

-split testing tools

-funnel analysis tools

-Google Analytics

-form analysis tools

-visitor recording tools

All good CRO programs start with research.

This can come in three forms:

-experience research

-qualitative research

-quantitative research

Experience research usually involves site walkthroughs, usability analysis, and heuristic analysis to understand the workings of your existing site.

Qualitative research may use online surveys, polls, customer support insights, and user testing to understand how your users interact with your site and what makes them leave.

Quantitative research involves web analytics and mouse tracking to see exactly where and how users convert.

This data will give you the foundation for your CRO program and let you know exactly where to focus your efforts.

From there, it’s all about testing, re-testing, and optimizing your website.

While increased conversions are the most obvious metric of CRO success, too much focus on conversions can lead your CRO program astray.

Other metrics, such as bounce rates, time on site, shopping cart abandonment, cost per conversion, and clicks should be considered when measuring the success of your CRO program.

Remember, what matters most is the quality of conversions, not the quantity.

It often costs far more to bring in new customers than to keep the ones you already have. Similarly, a five percent increase in customer retention can increase your profitability by 75 percent.

Focus your CRO program on customer engagement, experience, and retention, and you’ll be on the road to success.

CRO programs are an effective tool to improve online conversions.

While they are a big investment, both in time and money, a good CRO program can uncover so many opportunities for business growth.

Whether you choose to run your CRO program in-house or hire a dedicated CRO company, this guide will set you up for success.

As a final note, remember that CRO and SEO can work hand-in-hand when done right.

Don’t be afraid to test and experiment widely with both. You never know what you might uncover.

Have you found success in a CRO program?

Can you improve your chances of getting a loan from small business lenders?

Of course you know your business needs money. But business lending doesn’t just come from banks. Still, working to make your business more attractive to lending institutions isn’t just an end unto itself. It will also help your company also become more attractive to nontraditional lenders. It may even help make your business more attractive to prospects. There are factors which are within your control and you can help your business right now.

Once you understand what banks and lenders are looking for, you can address their concerns directly. Many of these are actions you only need to take one time, and many of them will also help you to convince prospects to buy from you, thereby helping you recoup any incurred costs.

Fundability is the ability of your business to get funding. When lenders consider funding your business, does it appear to them to be a good idea to make the loan? What do they look at to make that determination? Fundability means recognizing what’s important to lenders, and then giving them what they want.

You probably already know that a great business credit score is important. But many of the aspects necessary for a strong business credit score work for fundability as well. A potential creditor or lender needs to see your business is legitimate and profitable. Many loan applications get denials due to fraud concerns. Others, simply because something didn’t match up and threw up a red flag.

A business must be set up to appear to be a fundable entity separate from you, the owner. The first step is to ensure your business has its own phone number and address. That doesn’t mean you must get a separate phone line, or even a separate location. You can still run your business from your house or on your computer.

You can get a business phone number that will work over the internet instead of phone lines. This is called a VoIP (voice over internet protocol). The phone number will forward to any phone you want it too so you can use your personal cell phone or landline if you want. Whenever someone calls your business number it will ring straight to you.

Use a virtual office for a business address. A virtual office is a business that offers a physical address for a fee. They sometimes they even offer mail service and live receptionist services. There are some that offer meeting spaces for those times you may need to meet a client or customer in person.

But not every vendor will accept a virtual address.

A business website can affect your ability to get funding. But a poorly put together website that appears unprofessional will not help you with customers or potential lenders. Spend the time and money necessary to ensure your website is professionally designed and works well.

Along these same lines, your business needs a dedicated business email address. Make sure it has the same URL as your website. Don’t use a free service like Yahoo or Gmail.

Demolish your funding problems with 27 killer ways to get cash for your business.

All your business information should be the same everywhere you use it. But when you start changing things up like adding a business phone number and address or incorporating, you may find that some things slip through the cracks. This is a problem because many loan applications fail each year due to fraud concerns simply because things do not match up.

Consider all the places where this information could be.

Credit providers won’t stop to consider all the ways you could list your business. If you write Incorporated in one place, and Inc. in another, it can be enough to trigger a denial. Consistent and congruent information makes it fast and easy for credit providers and lenders to find your business and its payment history.

Consider all the places where your business has a listing. It’s your website, credit applications, even places like Yelp and Google Reviews. Take the time to keep records of all of these places, so Google your business often. Claim your profile on review sites to better control how your business name, address, and other particulars are presented. Copy and paste your information. Don’t chance an error with typing it out. This also means updating info whenever it changes.

An EIN is an identifying number for your business that works like how your SSN works for you personally. Many sole proprietorships and partnership use their SSN for their business. But it can cause your personal and business credit to get mixed up. When you are looking to increase fundability, you need to apply for and use an EIN. Get one for free from the IRS.

Demolish your funding problems with 27 killer ways to get cash for your business.

A lot of businesses start off as sole proprietorships. But there’s no separation between the owner and the business with this setup. Partnerships are another entity where the ownership and the business are more intimately connected. With either entity, any other efforts at separating business and personal credit could be all for naught.

A corporate structure truly separates business and personal credit and finances. This is because a corporation is considered to be its own entity. Should you choose a C-corporation, an S-corporation, or a limited liability corporation? That’s up to you to decide. We highly recommend working with a corporate lawyer or an accountant to determine what’s best for your particular situation.

When you incorporate, you become a new entity. Hence if you haven’t incorporated ASAP, you lose the time in business that you have and must start over. You also lose any positive payment history you may have accumulated.

Hence you must incorporate as soon as possible. It’s not just necessary for fundability and for building business credit. Time in business is also vital. The longer you have been in business the more fundable you appear. That starts on the date of incorporation. This is regardless of when you actually started doing business.

There are business owners who pay for business expenses with personal credit cards and checks. But a business’s credit file is only supposed to reflect the financial performance of the company itself. Using personal payment methods can muddy the waters. Resist the temptation to pay for any business expenses with personal credit or checks.

Your business must stand or fall on its own financially. Once you get credit from starter vendors or any other business or lender, use it on your business, and stop floating what are essentially interest-free loans to your business.

Another way to assure your finances get and stay separate is separate bank accounts. Often, a starter vendor will want for your business to have its own bank account anyway. While you’re at it, open a merchant account so you can take credit cards from your customers. Customers will spend more if they can pay with plastic.

Fundability means being a legitimate business. For a business to be legitimate it must have all of the necessary licenses it needs to run. If it doesn’t, red flags will fly up all over the place. Do research to ensure you have all the licenses necessary to legitimately run your business at the federal, state, and local levels. Being properly licensed can help assure skittish prospects that you and your business are legit.

In addition to the EIN, there are identifying numbers that go along with your business credit reports. Some are assigned by the agency, like the Experian BIN. Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Every credit file in their database has a D-U-N-S number. To get a D-U-N-S number, you must apply for one through the D&B website.

Demolish your funding problems with 27 killer ways to get cash for your business.

The key to keeping records consistent is to monitor your reports frequently. Monitoring your credit means you know what’s going on with it. You can pounce on errors quickly. Yes, the business CRAs make them, but they are all committed to accuracy and want to correct those mistakes ASAP.

When it comes to business credit reports, you can monitor through the reporting agencies directly. But that’s expensive! Or you can save 90% and monitor through Credit Suite.

Your credit history has a lot to do with your credit score. It is a huge factor in the fundability of your business. The more accounts you have reporting on-time payments, the stronger your credit score will be.

Your credit history consists of a number of things including:

Personal credit scores come from several metrics. But business credit mainly depends on one thing, how early or late you pay your credit bills. Paying late will damage your business credit scores at all three of the major CRAs.

Here are a few suggestions on how to improve your company’s payment history:

Business credit is credit in the name of the business, not its owner(s). It’s a measure of how well your business (not you) pays its bills. Properly created business credit separates personal and business credit completely. So if your business defaults on payments or goes bankrupt, it protects your personal assets.

Good business credit is the way to qualify for funding without good personal credit, collateral, cash, or a guarantor. Here are some tips on building business credit to improve your chances for financing from small business lenders.

While many vendors and credit providers don’t report all payment experiences, they have no problem reporting late and missing payments. So, seek out and mainly (if not 100%) work with vendors which report. These are called starter vendors. Their requirements change all the time. Fortunately, we know which vendors report, and we keep up with their ever-changing requirements.

Asking for too many lines of credit at once signals that you’re desperate and could be overextending yourself. Building a successful business takes time. In the same way, so does building a good business credit profile. As a result, spread your applications for additional lines of credit over time.

Applying for a lot of credit at once also means you’ll have a number of brand-new accounts, which will bring the average age down. Not using your credit can result in credit providers closing inactive accounts. This, too, brings the average age down.

Business credit isn’t going to be built if you get cards and then forget about them and never use them. The business credit reporting agencies are calculating your scores based on the credit you use. Using your credit, and paying on time, is positive fodder from business credit scores and reports. You can’t control the passage of time, but you can control card usage and not apply for every credit card you see all at once.

Do you need a traditional loan or a line of credit? Would a working capital loan or expansion loan work best for your needs? Choosing the right product to apply for can make all the difference. Don’t waste yours and the lender’s time by not considering the best loan product to apply for.

There are steps you can take to make it more likely your business will get a loan. These steps may also help your business become more appealing to prospects. They also help with building business credit. And applying for the right loan product will also help improve your chances of getting a business loan from small business lenders.

The post Improve Your Chances of Getting a Loan with Small Business Lenders appeared first on Credit Suite.

Absolutely! Flexible financing exists for virtually any business – even startups! You just need to know your strengths.

When you think like a lender, you realize they just want to be assured that you’ll pay them back. Lenders look at one of three things for loan approval: cashflow, collateral, and/or credit. The more of these “Cs” you have, the more funding options are available. For the many forms of funding we’re showcasing today, we show you exactly what you need to have for approval.

Flexible financing can absolutely be yours.

Fundability is the ability of a business to get funding. It essentially covers all the points a lender or credit provider will be looking at when they’re trying to figure out if you’ll pay back a loan or credit extended to you. These include factors you probably haven’t thought about or might think aren’t so important. But they are!

The fundability of your business will affect your terms and how much you can get. For flexible financing, you want to be as fundable as possible.

When it comes to flexible funding, let’s look at what you can get with good personal credit. Good personal credit is always an asset and will always help you out. If you don’t have good personal credit, you can often use a credit partner or guarantor who does.

A credit line hybrid is a form of unsecured funding. Our credit line hybrid has an even better interest rate than a secured loan. Get some of the highest loan amounts and credit lines for businesses. Get 0% business credit cards with stated income. These report to business CRAs. You can build business credit at the same time. This will get you access to even more cash with no personal guarantee.

You need a good credit score or a guarantor with good credit to get an approval (a FICO score of at least 680). No financials required. You can often get a loan of five times the amount of current highest revolving credit limit account. This is up to $150,000.

Traditional term loans are also looking for good personal credit.

Banks are often the first place we think of when we thinking of financing. But big banks only sign off on about 25% of the small business loan applications that come their way. Term loans often have lower interest rates than many other funding options. They also tend to be for higher loan amounts.

Generally speaking, the companies banks end up funding have very strong financials and near-perfect credit scores. You will most likely have to undergo a personal credit check. These kinds of loans may require collateral. Term loans tend to not be terribly flexible financing.

Demolish your funding problems with 27 killer ways to get cash for your business

Building business credit will always be a good idea. In particular, it can make your funding options far more abundant and flexible.

It should be your goal to build business credit, even if you can get funding elsewhere. Business credit will help your company for years to come. It is credit linked to your EIN and not your SSN.

This credit is available without a personal guarantee. It is available regardless of personal credit. You can get business credit immediately. Business credit is the only way to get money for a business when you don’t have collateral, cash flow, good personal credit, or a guarantor.

Starter vendors are open to working with most businesses, even startups. Make sure vendors report to the CRAs – not all do. When they do report, it’s within 60 days. They help you build your business credit profile and score.

Terms vary depending on the vendor, but they tend to be Net 30. And you will not need collateral, good personal credit, or cash flow.

Retail credit comes from major retailers. Buy everything from office supplies to power tools. Retailers will check if your business information is uniform everywhere. They will also check whether your business is properly licensed.

There can be a minimum time in business requirement. There may even be a minimum number of employees requirement, or a minimum annual sales requirement. Terms can be revolving. You will need at least 3 (5 is better) accounts reporting to the business CRAs.

Fleet credit is used to buy fuel, maintain vehicles of all sorts, and repair vehicles. Even businesses which don’t have big fleets can still benefit. These are usually gas credit cards.

There may be a minimal time in business requirement. If your business doesn’t make the time in business requirement, you may be able to, instead offer a personal guarantee or give a deposit to secure the credit.

Cash credit comes from universal-type credit cards like MasterCard. So they can be used pretty much anywhere. These cards may even have rewards programs.

Terms can be revolving. Usually, you need at least 14 accounts reporting to the business CRAs. There can be longer time in business requirements. And there may also be minimum number of employee requirements.

Having collateral can help you get many types of financing.

This is not a loan. You will not have to pay an early withdrawal fee or a tax penalty. You put the money back by contributing, just like with any 401(k) program. This means you won’t lose your retirement funds. This is a 401(k) Rollover for Working Capital program. The IRS calls it a Rollover for Business Startups (ROBS).

Per the IRS, a ROBS qualified plan is a separate entity with its own set of requirements. The plan, through its company stock investments, rather than the individual owns the trade or business. Therefore, some filing exceptions for individuals may not apply to such a plan. This type of financing isn’t a loan against, your 401(k), so there’s no interest to pay. It does not use the 401(k) or stocks as collateral. Instead, this is simply a movement or change of custodian.

Low rates, often less than 5%. Your 401(k) must have more than $35,000 in it . Can usually get up to 100% of what’s “rollable” within your 401(k). The lender will want to see a copy of your two most recent 401(k) statements.

Get 401(k) financing even with severely challenged personal credit. The 401(k) cannot be from a business where you are currently employed. You cannot be currently contributing to it.

Equipment financing is when you use a loan or lease to purchase or borrow hard assets for your business. It is a business financing option you can use to buy any physical asset. Physical assets can include items like a restaurant oven or a company car. You pay predictable amounts every month. You can build business credit on a program such as this.

All terms are for equipment financing through Credit Suite. Companies must have at least one year in business. You can get approved even with challenged credit. You won’t need financials to secure equipment financing. Approvals take as little as 24 hours.

If you already own your equipment free and clear you can use that as collateral for financing. Sell equipment to a lender for cash. Then lease it back from them. You can unlock Section 179 tax savings, and depreciate your entire equipment purchase in the first year.

Term lengths and the amount you can finance will vary. You’ll need at least one larger piece of higher value equipment to qualify. Funding can be in as little as 3 weeks. In general, a lender wants to be sure your equipment does not have any liens against it.

Demolish your funding problems with 27 killer ways to get cash for your business.

Inventory financing is a revolving line of credit or a short-term loan acquired by a company so it can buy products for sale later. The products serve as the collateral for the loan. There may be restrictions on the type of inventory you can use. This can include not allowing cannabis, alcohol, firearms, etc., or perishable goods. There can be revenue requirements. And there may also be minimum FICO score requirements.

Get approved for a line of credit for 50% of inventory value, regardless of personal credit quality. Rates are usually 5 – 15% depending on type of inventory. Get funding within 3 weeks or less. It can’t be lumped together inventory, like office equipment.

With Shopify Capital, you can get inventory financing with 12-month terms. Pay back with a percentage of daily sales. Borrow between $200 and $1 million. The total owed and daily repayment rate depend on risk profile.

OnDeck offers inventory loans and business lines of credit. Term loans runs $5,000 to $250,000, with 12-month terms paid back daily or weekly. Lines of credit run from $6,000 to $100,000. Pay back over 12 months, with automatic weekly payments.

Demolish your funding problems with 27 killer ways to get cash for your business.

If you can prove your business has good cash flow, several options open up to you.

A loan made to a company is backed by a company’s expected cash flows. A company’s cash flow is the amount of cash that flows in and out of a business, in a specific period. Cash flow financing (or a cash flow loan) uses generated cash flow as a means to pay back the loan.

Often you will need to have a few years in business. You may need to meet a certain minimum credit score requirement. You will need to prove historical cash flow. Present your accounts receivables and accounts payables. This way, the lender can determine how much to loan to your business.

Use outstanding account receivables as collateral for financing. Receivables should be with the government or another business. If you also have purchase orders, you can get financing to have those filled. You won’t need to use your cash flow to do so. Get an accounts receivable credit line with rates of less than 1% with no consumer credit requirement. Receivables should be with the government or another business.

Use outstanding account receivables for financing. Get as much as 80% of receivables advanced ongoing in less than 24 hours. Remainder of the accounts receivable are released once the invoice is paid in full. Factor rates as low as 1.33%. you can get an accounts receivable credit line with rates of less than 1% with no consumer credit requirement.

Amazon Lending launched in 2011 and partners with Bank of America Merrill Lynch. This allows Amazon to reduce its risk and access capital specifically to provide credit to more merchants so they can get inventory. Amazon Lending is an invitation-only program. Participants get exclusive price and quantity discounts on over 5 million products. See amazon.com/b?ie=UTF8&node=17906292011.

Eligibility is (in part) tied to cash flow). The program makes loans of $1,000 to $750,000. Its terms are for up to a year. These loans are for companies that may have difficulty landing traditional business loans. Within 5 days of being approved, you can get 20% off your first $500.

Currently, lines of credit are offered by Marcus by Goldman Sachs. Get access to loan funds within 5 days. Goldman Sachs will check your creditworthiness. No prepayment penalty. See sell.amazon.com/programs/amazon-lending.html.

If your business is eligible, you will see funding options when you log into Seller Central. Loans come from Amazon Lending – specific terms are tailored to the business. Amazon may review your business credit history with one or more credit bureaus. Get 3-, 6-, 9-, or 12-month term loans for working capital needs.

Got an online business? Then you can get a revolving credit line. Enjoy 24/7 Customer Service. For customers with over $100,000 annual spend on their accounts, they can work with an account specialist assigned specifically to the account. Amazon will proactively help you maximize the value of your line of credit and adopt new product features.

Get 55-day payment terms. Pay 12.99% purchase APR (minimum interest charge is $1). There is an option to apply as a personal guarantor to build business credit. You can make minimum payments or pay in full monthly.

Fundbox will connect directly to your online accounting software. That’s all you need to do. You can get invoice financing or a line of credit. See fundbox.com.

Get a revolving line of credit for up to $150,000. Fundbox will auto debit your weekly payment from your bank account. You don’t need to show a minimum personal credit score, and you don’t need to show a minimum time in business.

An MCA technically isn’t a loan. Rather, it is a cash advance based on company credit card sales. A small business can apply for an MCA and have an advance deposited into its account fairly quickly. So you can offer Net 30 terms, but not have to wait a month to get paid.

A merchant financing program is ideal for business owners who accept credit cards and want fast and easy business financing. An MCA program is designed to help you get funding, based strictly on your cash flow as verifiable per business bank statements. Hence lenders in general will not ask for any burdensome document requests.

A lender will review 3 months of bank and merchant account statements. They are looking for consistent deposits. And they want to see deposits showing revenue is $50,000 or higher per year. They will also verify time in business of 6 months or more.

Lenders are also looking to see that you don’t have a lot of Non-Sufficient-Funds (NSFs) showing on your bank statements. They want to see you don’t have a lot of chargebacks on your merchant statements. And they want to see that you have more than 10 deposits in a month going into your bank account.

In essence, they want to see that you manage your bank and merchant accounts responsibly. And they want to see that have a decent number of consistent credit card transaction deposits each month.

Get a loan from PayPal. Loan amounts and eligibility depend on your sales via PayPal. You will need to be in business for at least 9 months. See paypal.com/us/webapps/mpp/paypal-business-loan.

Get from $5,000 to $500,000. The highest loan you can get goes up to 35% of your annual PayPal sales. If you apply for a PayPal loan, credit checks and other public records checks will be performed which may impact your credit score.

The Small Business Administration has several options which could work for you. You usually need to show good cash flow, good personal credit, and have collateral. Having good business credit will also help your cause. But it’s not terribly flexible financing.

This the SBA’s most popular loan. The SBA guarantees 85% for loans up to $150,000, and 75% for loans greater than $150,000. The SBA makes the lending decision, but qualified lenders may be granted delegated authority to make credit decisions without SBA review.

The maximum amount on offer is $5 million. You will have to provide Articles of Organization, business licenses, documentation of lawsuits, judgments and bankruptcy or other pertinent documentation. Lenders are not required to take collateral for loans up to $25,000. For loans over $350,000, the SBA requires that the lender collateralize the loan to the maximum extent possible up to the loan amount.

This is an economic development loan program offering long-term, fixed-rate financing used to acquire fixed assets for expansion or modernization.

Use it to buy currently existing buildings, construct new buildings, and more. See sba.gov/offices/headquarters/ofa/resources/4049.

For corporations, anyone with a 20% ownership stake (or more) must fill out the application. In general, the SBA provides 40% of the total project costs, a participating lender covers up to 50% of the total project costs, and the borrower contributes 10% of the project costs. Under certain circumstances, borrower may have to contribute up to 20% of total project costs.

There are four kinds of CapLines: Contract, Working Capital, Builder’s, and Seasonal. For all of them, you can get a loan up to $5 million. Qualification requirements are same as with other SBA programs. Builder’s loans cannot exceed 5 year terms; the others can go up to 10 years. Holders of at least 20% ownership in the applicant business are required to guarantee these loans. Most loans can be revolving or non-revolving.

This loan finances direct labor and material cost, associated with performing assignable contracts.

Borrowers must use loan proceeds for short term working capital/operating needs.

This one is for general contractors or builders who are constructing or renovating commercial or residential buildings. It finances direct labor-and material costs. The building project serves as the collateral.

Advances against anticipated inventory and accounts receivables, or in some cases associated increased labor costs. It is meant to help seasonal businesses.

SBA microloan lenders are nonprofit community-based organizations with experience in lending as well as management and technical assistance. The SBA provides funds to specially designated intermediary lenders. These intermediaries administer the microloan program. It is to help small businesses and certain not-for-profit childcare centers start up and expand.

Get loans for up to $50,000. The average microloan is about $13,000. Generally, intermediaries require some type of collateral as well as the personal guarantee of the business owner. See sba.gov/loans-grants/see-what-sba-offers/sba-loan-programs/microloan-program%20

Grants are exceptionally competitive but there’s little wonder – you never have to pay them back! But they are also the antithesis of flexible financing – you will need to meet requirements and jump through a number of hoops.

For urban projects, try HUD (Housing and Urban Development). For rural projects, try the USDA. But federal funding means paperwork. You often must show experience in what you are proposing. See grants.gov.

Grants have varying qualifications. Check information thoroughly, like due dates and any necessary paperwork. Some grants may offer preferences to businesses with minority, female, veteran, or disabled ownership.

Your local government also provides grants. See grantwatch.com. Also try city and state websites. These are often less restrictive than federal grants. It helps if you can show you will help the community. Try to partner with a local business.

Just like with federal grants, check all requirements and other information carefully. You may need to be a resident of the state or city or county in question. Or your business may need to be headquartered there.

Angel investors invest in small startups or entrepreneurs. Often, angel investors are among an entrepreneur’s family and friends. The capital they provide may be a one-time investment to help the business get started, or an ongoing injection of money to support and carry the company through its early stages.

Angels are not covered by the Securities Exchange Commission’s (SEC) standards for accredited investors. Angels could be friends or colleagues sitting on home equity, or local professionals who are looking to invest. Consider people you know well and people you don’t know so well.

Angels are informal investors so there really aren’t any terms. Technically, there is nothing done for qualifying, although investors may (probably should) insist on a valuation of your business. No matter what, it’s always a good practice to get everything in writing.

Angel investing can practically be the definition of flexible financing, seeing as it’s so informal.

Venture capitalists give money to help build new startups, if the VCs believe a company has both high-growth and high-risk potential. These tend to be fast-growth companies with an exit strategy already in place. Venture capitalists often look to recover their investment within a 3-5 year time frame.

VCs will also, often, want to own a large piece of a company if not a controlling stake. They want game-changing businesses, so straightforward businesses won’t be on their radar unless it’s shifting the paradigm. VCs often want a larger share of your business than angel investors do.

Since venture capitalists are more formal investors than angels, a valuation of your business is likely to be necessary. Specific terms will be spelled out in your agreement with them. The SEC will also have requirements. It is best practices to consult with a lawyer well-versed in business law before you sign anything.

Equity crowdfunding is a stock offering from a company that is not listed on stock exchanges. It has been around for less than 10 years. It’s not the same as rewards-based (which comes from places like Kickstarter). Rather, potential investors visit a funding portal website. There, they can explore different equity crowdfunding investment opportunities. But note: there are limits on how much capital an individual can invest based on their income and net worth. Hence equity crowdfunding gives investors a stake in your business.

Equity crowdfunding tends to be covered by numerous federal regulations. See: law.cornell.edu/cfr/text/17/227.100.

Federal law can be complex. It is best practices to consult with an attorney well-versed in federal law, specifically, securities and corporations, when it comes to interpreting terms and qualifications (and any changes that may be made to these aspects of the law in the future).

This is an enormous buffet of business funding choices! But how do you select the one(s) that’s best for your particular situation? This is where our Advisory Team comes in extremely handy. Or help yourself with our Business Credit Builder. It’s your choice.

There are all sorts of amazing ways to get business funding. You can find the one which fits your circumstances, including your strengths in areas like:

Or build business credit for even more choices. Now that’s flexible financing.

The post Is it Possible to Get Flexible Financing for Your Business? appeared first on Credit Suite.