Article URL: https://www.ycombinator.com/companies/pop-meals/jobs/aLbeAmT-chief-marketing-growth-officer-cmo

Comments URL: https://news.ycombinator.com/item?id=28125861

Points: 1

# Comments: 0

Article URL: https://www.ycombinator.com/companies/pop-meals/jobs/aLbeAmT-chief-marketing-growth-officer-cmo

Comments URL: https://news.ycombinator.com/item?id=28125861

Points: 1

# Comments: 0

But be aware of what secured business credit cards really are – and what’s a much better alternative to kickstarting a business credit profile.

Secured business credit cards are for businesses with no credit or a less than perfect credit history. An initial security deposit is necessary. This deposit establishes your card’s credit limit. Often a minimum deposit of $500 is necessary. Once you start making purchases you get invoices like a regular credit card. But this begs the question: what does it mean when a business credit card is unsecured?

An unsecured business credit card works like an unsecured consumer credit card. Credit limits are calculated from many factors, this depends on the card issuer. Factors in deciding credit limit can include personal credit and/or your company’s business credit scores. They can also include time in business, annual revenues, etc. These credit cards can give your business the opportunity to earn incentives and rewards.

There are a number of types of business credit cards. Some aren’t too different from secured cards. Or they may have some of the same results, where you can get credit when you normally couldn’t, and you may even have the opportunity to build business credit with such cards.

A prepaid business card works as a convenient alternative to carrying cash. In this way, it works a lot like a secured credit card. You add funds to your account. And then whatever amount you add is available for purchases. Sounds like a debit card, right?

But, a business debit card is a card that works a lot like a business checkbook. The limit is the amount of funds you currently have in your business checking account. Every time you use it to make a purchase, the amount you charge comes from your account as a deduction

Prepaid cards and debit cards are both widely accepted at merchants worldwide, but one is preloaded and the other is not. Debit cards are linked to a checking account, while prepaid cards aren’t and instead require you to load money onto the card

Not exactly. The salient difference between secured credit cards and prepaid debit cards has to do with whose money you’re spending when you use the card. With secured credit cards, you spend money borrowed from the credit card company. You pay that money back after the purchase. With prepaid debit cards, you’re spending your (or your business’s) own money. You load money onto the card before the purchase.

Because it involves borrowing and repaying money, a secured credit card can help someone (or a business) build their credit. It can also harm their credit if they don’t use the card responsibly. Prepaid debit cards have no effect on a credit score.

Another, similar-sounding card is a business charge card. A business charge card has all the convenience of a credit card. But it’s without the high price of interest. When using this card you must pay your balance in full each billing cycle.

Since you can’t carry a balance, a charge card doesn’t have a periodic or annual percentage rate. Hence there is no rate for a charge card issuer to disclose. Let’s look at some secured cards for business.

With this card, you can, “take control of your credit history and help rebuild your credit”. Request your own credit limit between $2,000 and $100,000, in multiples of $50, when you apply. Your credit limit is subject to credit approval and a security deposit.

Your security deposit is 110% of the amount of your credit limit. And you will earn interest on your security deposit. But there is a $39 annual fee. Pay a variable 20.24% APR on purchases and balance transfers based on the Prime Rate.

Get it here: https://www.fnbo.com/small-business/credit-cards/

With this card, you can, “start building credit for your business”. Get up to a $25,000 secured credit limit. You will pay a 13.99% variable APR on purchases and balance transfers. And pay a 5% balance transfer fee on each transfer, with a minimum of $10.

There is a 25.25% APR for cash advances. And there is a $30 annual fee. Also, Union Bank will demand immediate payment in full, if you use this business credit card for personal, family, or household purposes.

Get it here: https://www.unionbank.com/business/visa-credit-cards-all

Score the best business credit cards for your business. Check out our professional research.

A Wells Fargo business checking or savings account must be open before applying. Upon approval, your funds will be transferred from the deposit account to fund the credit line

Get a $500 to $25,000 credit line, based on the amount of funds deposited by you as security in a collateral account. Pay no annual fee, and no foreign transaction fee.

You can get up to 10 employee cards. Pay prime + 11.90% APR on purchases. And pay prime + 20.74% APR on cash advances. Cash advance or balance transfer fees may apply.

Choose between Cash Back or Rewards Points. There is no annual rewards program fee. And there are no required spending categories or caps. Earn 1.5% cash back for every $1 spent on net purchases. You can receive cash back automatically as a credit to your account or to your eligible checking or savings account each quarter.

If you choose rewards points, you will earn 1 point for every $1 spent on net purchases. Get 1,000 bonus points when your company spends $1,000 or more in any monthly billing period. Redeem points for gift cards, merchandise, airline tickets and more. Get a 10% points credit when you redeem points online. And you can earn extra bonus points or discounts from Earn More Mall® retailers.

Wells Fargo reports your payment and usage behavior to the Small Business Financial Exchange. Payment and usage activity of the Wells Fargo Business Secured card is not reported to the consumer credit bureaus, therefore it will not help build or rebuild personal credit history.

Wells Fargo will periodically review your account and recent credit history for an opportunity to upgrade to an unsecured business credit card. You may become eligible with responsible use over time. Being able to upgrade to an unsecured business credit card also depends on your FICO score, payment history and ratio of credit card usage to credit limit.

Get it here: https://www.wellsfargo.com/biz/business-credit/credit-cards/secured-card/

Score the best business credit cards for your business. Check out our professional research.

Wells Fargo is the best when it comes to annual fees (it’s hard to beat $0). For the highest possible credit limit, the FNBO Business Edition® Secured Visa® Card comes out on top,

with a $100,000 maximum.

For the best balance transfer rate, it looks like Union Bank® Business Secured Visa® Credit Card is the best. But keep in mind, they do charge a 5% balance transfer fee on each transfer,

with a minimum of $10.

New businesses can get credit from starter vendors, and often there’s no need to pay money to secure a card. Consider CEO Creative and Grainger Industrial Supply. Neither of them require a deposit to secure a card.

Let’s focus on another starter vendor: Supply Works. They are a part of Home Depot, and offer integrated facility maintenance supplies. But they will not accept virtual addresses. They will report to Experian. Terms are Net 30. You can apply online or over the phone.

You will need:

But at least there is no minimal time in business requirement.

Score the best business credit cards for your business. Check out our professional research.

For entrepreneurs just starting out, getting secured business credit cards may seem to be one of the only ways they feel they can get credit. But you can build business credit with starter vendors. Even if you start with lower limits, you often don’t have to secure those cards with a deposit. As a result, starter vendor credit is nearly always a superior alternative to getting secured business credit cards.

The post The Top 3 Secured Business Credit Cards appeared first on Credit Suite.

The post The Top 3 Secured Business Credit Cards appeared first on Automation For Your Email Marketing Sales Funnel.

The post The Top 3 Secured Business Credit Cards appeared first on Buy It At A Bargain – Deals And Reviews.

Take advantage of our research and check out the seven best cash back business credit cards we could find.

Cash back usually comes in the form of a low percentage rebate, such as 1 – 5%. Some card issuers offer unlimited cash back. Others offer bonus amounts for chosen category spending or meeting a spending threshold within a certain amount of time after account opening, like $750 if you spend $7,500 in the first three months after account opening. Statement credits and signup bonuses are similar, the main difference is how you get the money – check, credit, points, or something else.

There are differences among cash back business credit cards, and they go beyond the percentages. A high cash back credit card might require a very high spend in a short amount of time. Or a cashback credit card might not offer categories that work for you. Or cash back offers may come with too many strings attached. We sifted through over 100 business credit cards to find cashback credit cards to fit several different circumstances – including yours!

Terms and rates for cash back business credit cards are subject to change. In particular, many annual percentage rates are tied directly to the Prime Rate. Banks and other credit providers sometimes add or drop features, or even credit cards. The best source for all credit card information is always directly on the provider’s website.

Let’s start with three honorable mention cash back business credit cards.

Get to know the Zions Bank Visa Amazing Cash® Business Credit Card. You get 3% cash back on select business purchases, including office supplies, cell services, internet, telecom, and cable TV. And get 2% cash back on select business travel purchases, including airlines and vehicle rentals. Get 1% cash back on everything else. Pay a 0% introductory APR on balance transfers for the 12 months after account opening, then pay a 14.24% variable APR afterwards. A 3% balance transfer fee for each transfer ($10 minimum) applies.

Get a credit limit up to $250,000. You will pay no annual fee. There are no rewards fees. 0% introductory APR for the first 6 months after account opening, then 14.24% variable APR afterwards. It is entirely possible that some of the other reviewed cards have better upper limits, you will need to check when you apply.

Check out the PNC Bank Cash Rewards® Visa Signature® Business Credit Card. Get a $200 bonus if you spend $3,000 in the first 3 billing cycles after account opening. Get 1.5% cash back on net purchases, with no cash back limits. Pay no annual fee. You will pay a 0% APR for the first 9 billing cycles after account opening, then 10.99-19.99% variable APR, based on creditworthiness. It boasts mostly lower interest rates and a fairly easy to meet minimum spend. To get a bonus, this card is decent if you can’t or won’t spend too in such a short amount of time after getting the card.

The Capital One Spark Classic Business Credit Card (Visa) can work if you have fair credit. You can earn 1% cash back with every purchase, with no minimums. Pay no annual fee. You will pay 26.99% variable APR for both purchases and cash advances. The minimum credit line is $300.

The cash back percentage is low, and the interest rate is higher than for the other cards reviewed. But if your credit is only fair, or you don’t have a very long credit history, this card could be right for you.

Mastercard®

Mastercard®Check out the US Bank Business Cash Rewards World Elite Mastercard®. Earn to 3% cash back on eligible gas station, office supply store and cell phone/service provider net purchases. All other purchases earn 1% cash back. Purchases of gasoline greater than $200 will not be deemed to be a purchase of automotive gasoline, and as such will earn a reward of 1%.

Mastercard®. Earn to 3% cash back on eligible gas station, office supply store and cell phone/service provider net purchases. All other purchases earn 1% cash back. Purchases of gasoline greater than $200 will not be deemed to be a purchase of automotive gasoline, and as such will earn a reward of 1%.

Get $500 cash back if you spend $3,000 in the first 90 days from account opening. Earn a 25% annual bonus based on your prior year’s cash rewards, to $250. Pay no annual fee. You will have a 0% introductory APR for the first 12 billing cycles. After that, 13.99-22.99% based on creditworthiness.

To hit the bonus limit, you would have to have spent over $33,000 in the previous year. Still, the initial spend requirement isn’t too bad. You can meet it with purchases of computers or the like. The APR after the introductory period is acceptable. If your credit is such that you qualify for the lower APR, this card could turn out to be a better deal than our #6.

Score the best business credit cards for your business. Check out our professional research.

Check out the First Hawaiian Bank MasterCard Cash Rewards Business Credit Card. You get 3% unlimited cash back on gas and dining. Get 2% unlimited cash back on utilities, and 1% unlimited cash back on everything else. There is no annual fee.

Pay a 15.49% APR. Earn a $200 credit with a $2,000 spend in the first 3 months from account opening. With its fairly low spend requirement, no annual fee, and decent (but not exceptional) APR, this can be a good card. In particular, it can work well if your business requires you to travel by car and entertain clients on the road.

With the Citi Bank Costco Anywhere Visa® Business Card, get 4% cash back on eligible gasoline purchases, including buying gas at Costco. But this is only for the first $7,000 per year. After that, get 1% cash back. Get 3% cash back on restaurant and eligible travel purchases. Earn 2% cashback on all other purchases from Costco and Costco.com. Get 1% cash back on everything else.

There is no annual fee. There are no foreign transaction fees. But you must be a Costco member before applying. Pay a 15.24% variable APR.

While the 4% cash back offer is limited to just the first $7,000 per year, you will have to buy over 2,000 gallons of gasoline if they average $3.50 per gallon to hit the limit. If you think it’s unlikely you would meet that limit, and you’re a Costco member, this could be a good card. It’s got an APR that is decent but not as good as our #4’s rate.

Score the best business credit cards for your business. Check out our professional research.

With the Huntington Bank MasterCard Voice business credit card, earn 4% cash back on the first $7,000 spent per quarter in one category of your choice. There is a choice of 10 categories.. Hence the annual spend limit for 4% cash back is $28,000. Earn 1% cashback on all other purchases.

There is no annual fee, and no foreign transaction fee. Pay a 10.99-21.99% APR based on creditworthiness, tied to the Prime Rate. If you know you won’t meet the spend limit, and your credit is already good so the APR is on the lower side, this could be an outstanding card.

Get 5% cashback on Amazon purchases with the Amazon Prime Store Card. Pay no annual fee. You get a $60 Amazon gift card upon application approval. However, limits seem to be low. There are reviews on the Amazon website and you should check them before applying.

If your business makes a lot of Amazon purchases, this could be one of the best cash back business credit cards for you. If not, it likely has too many limitations.

The Bremer Bank Visa Max Cash Preferred card is particularly good if you can pay your credit bills on time and avoid paying interest. Earn a $150 bonus reward if you spend $500 in the first 90 days from account opening. The spending threshold required for a bonus is comfortably low. You will probably meet it if you charge a decent computer on this card. Also get 2% for one everyday category, otherwise get 1% unlimited cash back. There is no annual fee.

All annual percentage rates for interest will vary with the Prime Rate. Pay a 14.49-23.49% APR for purchases based on creditworthiness. Pay a 0% introductory APR for the first 12 billing cycles for balance transfers, and then 14.49-23.49% APR based on creditworthiness.

Note: Busey Bank offers the identical credit card, with the exact same rates and fees. The main difference is Bremer is headquartered in Minnesota, whereas Busey is based in Illinois.

First American Bank also offers the identical credit card – they are also based in Illinois.

Since there are no differences among these three offers, your best bet is to choose based on convenience or bank specialty or the like.

Score the best business credit cards for your business. Check out our professional research.

For good interest rates, and a high percentage in cash back, check out this card. Pay 0% APR on purchases for the first 12 months, and then 13.24-19.24%. Pay no annual fee.

With the Chase Bank Ink Business Cash® card, you get 5% cash back on the first $25,000 you spend on certain business products, i.e. office supply stores, internet, cable, and phone services. This works out to 4% additional cash back rewards on top of 1% cash back rewards earned on each purchase. The $25,000 flat spending limit resets every year. You can get $750 bonus cash back if spend $7,500 in the first 3 months after account opening.

But unlike with some other cards, it can be harder to hit the minimum spend amount. The agreement does not prohibit using your card to buy pricier items such as plane tickets, vehicle repairs, or even heavy equipment. Still, you may find that using other means, such as equipment financing or fleet credit, would make for a better deal for your business.

While we do feel this is the best of the cash back business credit cards we reviewed, if you cannot meet the spend minimum, our #2 choices are a lot better.

The business credit cards we reviewed offer cash back deals running from 1% to 5%. Annual percentage rates run from 10.99% t0 26.99%, with many cards offering a 0% introductory APR for a limited time. Some cards offer monetary bonuses, often dependent upon spending a minimum amount during a short window of time. Limits and qualifications were not easy to find online – so ask! And always check a provider’s website for the latest and most accurate details on any business credit card that interests you.

The post The Top 7 Cash Back Business Credit Cards appeared first on Credit Suite.

The New York Rangers locked up their goaltender of the future Monday by agreeing to re-sign Igor Shesterkin to a four-year $22.6 million contract.

Baffled By The Foreign Exchange Market? Have a look at These Tips Before You Trade!

Foreign exchange trading has actually come to be really preferred for individuals desiring to make added cash. The professional pointers in this short article can assist you find out exactly how to trade foreign exchange like a pro.

Stick to a pair of Forex sets. Research study the market, and also maintain points basic to start with.

Profession in prominent money. It can be hard to leave a very finely traded placement, compeling you to hold longer than you may desire.

Assume concerning authorizing up for a Forex workshop if you are brand-new to Forex. You can likewise do some study by yourself, however if you can manage a workshop, you will certainly gain from a full development. You will certainly prepare to begin after a couple of days of extensive training as well as not make usual newbies’ errors.

When trading money on the foreign exchange market ensure you constantly patronize a stop-loss order. This stops you from shedding excessive on a profession. Money are incredibly unstable and also it is very easy to shed your t shirt, yet as lengthy as you patronize a stop-loss order you can decrease losses.

When trading foreign exchange, do not obtain persuaded by the economic information maker. Keep knowledgeable about what’s taking place, however remain to work with establishing your very own tested techniques that concentrate on recognizing patterns as well as optimizing them. Pay much less focus to “traditional knowledge” and also a lot more focus to your digestive tract as well as tried and tested trading approaches.

When functioning with foreign exchange, attempt not to run the risk of even more than 2 to 3 percent of your complete trading account. You might shed whatever after just merely 15 professions if you aren’t viewing out for on your own.

When opening up an account with a broker to do foreign exchange trading, you ought to not just select the quantity of cash you will certainly take into trading yet additionally on the size of time you will certainly trade. This aids you conserve equity. Experience has actually confirmed that many individuals that take part in foreign exchange trading over an extended period of time are more probable to generate income.

While finding out to trade foreign exchange, there are some points you can do to boost your possibilities of generating income. You require to have the best details as well as training, in order to find out just how as well as when to trade. Make use of the details you have actually simply reviewed to find out exactly how to make foreign exchange benefit you.

The professional ideas in this post can aid you find out exactly how to trade foreign exchange like a pro. When trading money on the foreign exchange market make certain you constantly trade with a stop-loss order. Money are exceptionally unpredictable as well as it is simple to shed your t shirt, yet as lengthy as you trade with a stop-loss order you can reduce losses.

When opening up an account with a broker to do foreign exchange trading, you must not just choose on the quantity of cash you will certainly place right into trading however additionally on the size of time you will certainly trade. While finding out to trade foreign exchange, there are some points you can do to enhance your possibilities of making cash.

An internal site search is a must-have. However, it’s often viewed as an afterthought rather than a true conversion optimization tool – and that could be killing your conversion rate.

So what should you know about improving your site search? Here are a few tips on making the most of site searches.

Internal site search is a search bar many site users add to their website which allows users to search for news, topics, or products. It’s crucial for eCommerce sites, but can be incredibly useful for content-based sites as well.

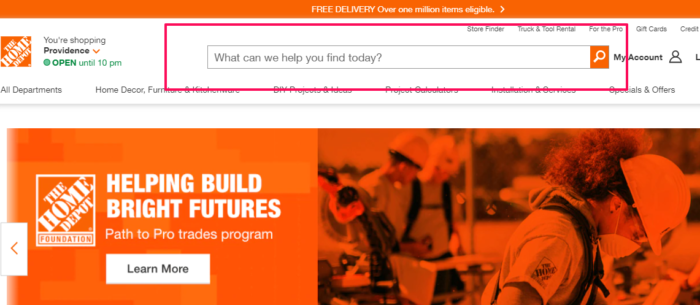

Many sites feature their site search front and center at the top of their homepage, as Home Depot does:

Adding internal site search to your website helps users find what they are looking for. However, it can also impact your bottom line.

According to research by eConsultancy, on-site searchers are 1.8 percent more likely to convert than regular users.

What’s more, Screen Pages found the average revenue from site search was significantly higher than regular users.

Despite the benefits of site search, a vast majority of sites don’t optimize their site search feature.

If you don’t have a site search–or if you aren’t making the most of it–you could be missing out on revenue.

If customers aren’t getting the results they expect from your site search (or worse, getting links to your competitor’s sites), they’ll simply go elsewhere.

That’s why it’s vital to start paying attention to your internal search engine – and making changes that can improved results and drive conversions. Here’s how to do it.

According to Forrester Research, which did an in-depth report on the importance of site search for retail, businesses should focus on “spearfishers” – those users who come to a site searching for a specific product. They found 43 percent of visitors go immediately to a search box, and searchers are two to three times more likely to convert.

That means we need to make it push-button simple for users to do a search right away. You can thank sites like Amazon and Google for making a prominent search box the first thing users see.

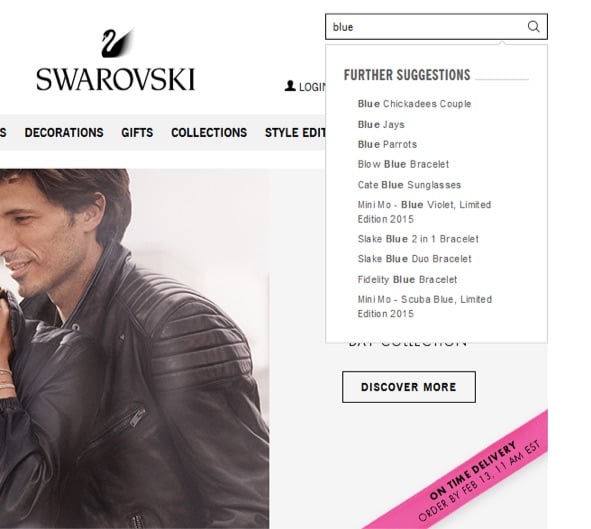

Going to the Swarovski.com website without a specific product in mind will instantly lead the user to suggestions. I typed in “blue” and got 10 product suggestions right away.

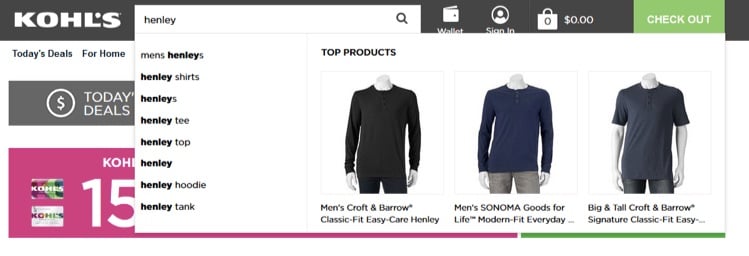

Kohl’s website goes even further to recommend (and show) specific products based on a basic search before the user ever hits enter:

By suggesting specific products (or even showing top results), you’re guiding the user along the path you want them to take before they even make a conscious decision to continue. Essentially, you’re planting product suggestion seeds and allowing them to branch out from there – putting your user one step closer to a conversion.

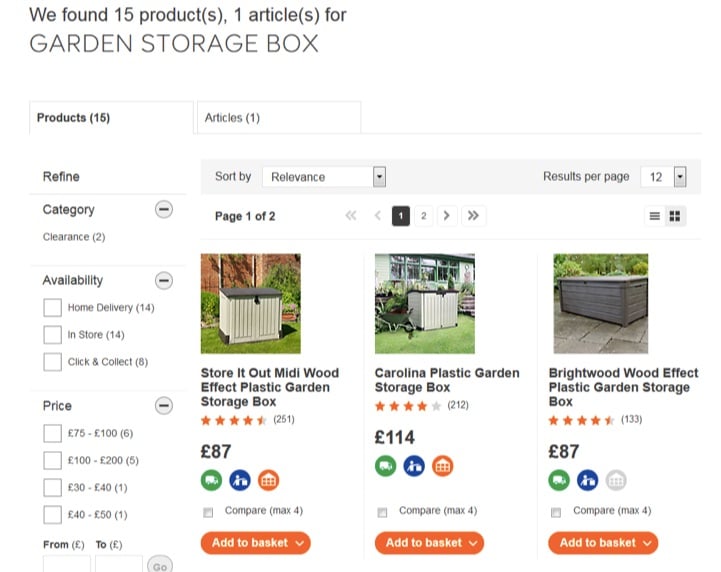

There’s nothing more frustrating than getting a million search results and having to sift through the clutter. U.K. site DIY.com helps users filter results search pages by offering a number of filters, including price, availability, and category. This lets users narrow down to precisely what they want and when they want it by.

Based on the data you collect from your site search engine, you may want to elevate certain products to get more exposure or demote others that may not be as popular. For products getting the bulk of the hits, consider creating a dedicated landing page to help it stand out from among a sea of similar items.

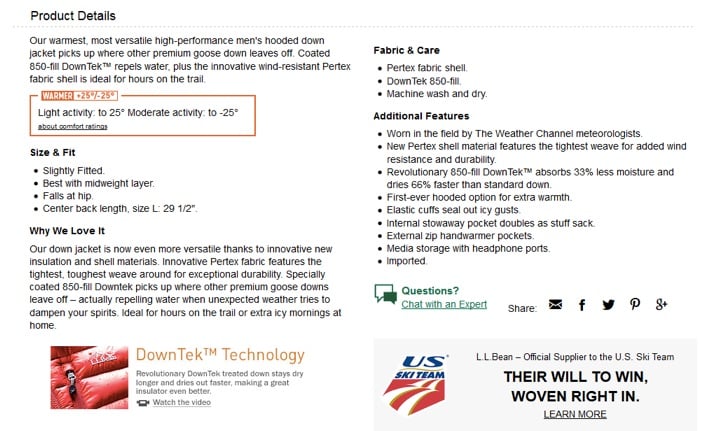

L.L. Bean has custom landing pages for many of its products which include not just the product details, but the best weather/activity levels, additional features, and even the technology behind the item:

Sometimes, despite your best efforts, products go out of stock or are discontinued. What happens when a user ends up on those pages? Sending them to a “product not available” page is a sure path to site abandonment. Instead, take a page out of Amazon’s book by offering users related suggestions and recommendations.

Bonus points if you can bundle products in a ‘Frequently Bought Together” option.

Don’t forget about mobile users. According to Statista, more than half of all internet traffic comes from mobile devices. Typing on a mobile device can be cumbersome at best, and misspellings often lead users to “Not Found” pages even if the product is available.

Test out your site search in a variety of devices for ease of use and fast loading. No mobile user is going to wait forever to see 1,000+ products load up on a results page. Consider limiting the number of suggestions and making sure your search bar is easy to use on mobile devices.

Now you know what users expect from a high-performing site search and how to use it to drive conversion. So, how do you implement it? There are plenty of free site search engines available – but here is one area where you definitely don’t want to skimp on features.

Here are a few of the more promising site search platforms available.

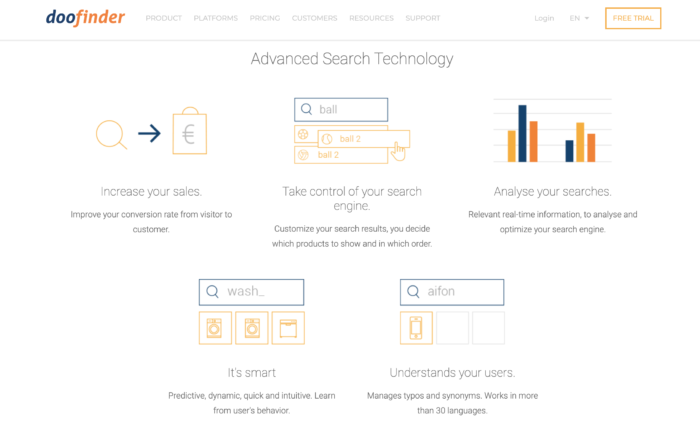

Doofinder created a cutting-edge site search tool that has been proven to increase conversions and boost sales on e-commerce sites. Combining artificial intelligence and machine learning, Doofinder is able to provide a fast, seamless, and effective search experience for users while helping sites sell more.

To make Doofinder even more exciting for users is that they offer both a free trial and a freemium version, making it easier for both small and large e-commerce sites to benefit from their impactful site search tool.

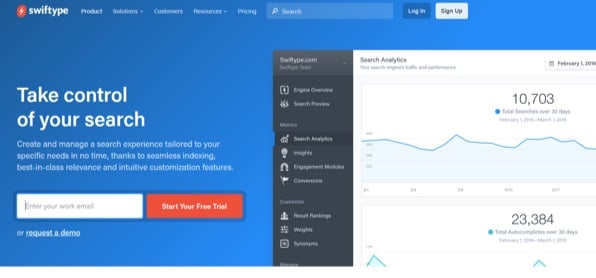

Swiftype integrates into many popular platforms including WordPress, Zendesk, Magento, and Shopify. With intelligent sorting, filters, spell check and autocomplete, it’s a solid search engine with fast indexing and fantastic relevance. Pricing starts at $79/month with a trial available if you’d like to test the waters.

SearchNode is made for e-commerce sites and integrates with common shopping cart platforms such as OSCommerce, Woo Commerce, OpenCart, and many more. It can be up and running in as little as five minutes with a JS code snippet. One of the main benefits that set SearchNode apart is the ability to use their site search tool in multiple languages.

SearchSpring is an enterprise-grade site search platform that combines search and merchandising tools into one package. It offers common features like auto-complete, product recommendations, and even product quizzes/product finders to help users find the right product for their needs by answering a few simple questions.

They also offer a ton of other eCommerce tools, including navigation, personalization, and advanced reporting tools. Pricing starts at $499.

Internal site search, sometimes called site search, is a search engine function on a specific website that allows users to search for content or products on that specific page.

Site search makes it easier for users to find content or products on a specific site. It can help drive conversions and provide site owners with data about the types of products users are interested in.

Search bars don’t have a specific SEO benefit. However, they improve the user experience and keep users on your site, which is beneficial to SEO.

Google’s Site Search feature was sunset in 2018 and is no longer available. However, there are several other options, including SearchSpring and SearchWP.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What is internal site search? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Internal site search, sometimes called site search, is a search engine function on a specific website that allows users to search for content or products on that specific page. ”

}

}

, {

“@type”: “Question”,

“name”: “What are the benefits of adding site search to my website? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Site search makes it easier for users to find content or products on a specific site. It can help drive conversions and provide site owners with data about the types of products users are interested in. ”

}

}

, {

“@type”: “Question”,

“name”: “Is adding a search bar to my site good for SEO? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Search bars don’t have a specific SEO benefit. However, they improve the user experience and keep users on your site, which is beneficial to SEO. ”

}

}

, {

“@type”: “Question”,

“name”: “Is Google Site Search a good tool? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Google’s Site Search feature was sunset in 2018 and is no longer available. However, there are several other options, including SearchSpring and SearchWP. ”

}

}

]

}

Site search is definitely not something you’ll want to overlook when it comes to new ideas to improve your conversion rate. By implementing a few simple steps to give users more control over their results, you’ll likely start to see conversions and revenue soar as customers find precisely what they need quickly and easily.

Search site doesn’t have direct SEO benefits, but it does improve user experience, which can indirectly impact the effectiveness of all your marketing efforts.

Do you use site search extensively on your site? What do you believe makes a good site search engine? Share your thoughts with us in the comments below!