Article URL: https://www.solosuit.com/careers#se

Comments URL: https://news.ycombinator.com/item?id=28012294

Points: 1

# Comments: 0

The post SoloSuit (YC W21) is hiring a remote senior engineer appeared first on ROI Credit Builders.

Article URL: https://www.solosuit.com/careers#se

Comments URL: https://news.ycombinator.com/item?id=28012294

Points: 1

# Comments: 0

The post SoloSuit (YC W21) is hiring a remote senior engineer appeared first on ROI Credit Builders.

Are you making the most out of the data you can get about your website from Google Analytics (GA)?

The free tool gives you valuable insights into metrics like conversion rates, traffic sources, engagement, audience demographics, and more.

Let’s learn what GA is and how to use it to improve your website’s metrics.

Google Analytics is a free tool to track user behavior on your website. With a range of metrics to explore, you can start to get a picture of how people use your website and how you can make changes to increase sales.

On a basic level, you can track how many visitors you have, how they found you, the number of views a page receives, and more.

In many ways, Google Analytics is the portal giving you insider, back end, and real-time access to what your users want.

Google Analytics is the most powerful tool to track website metrics, and it comes from the king of search engines. On top of that, it’s free.

Although it takes some work to get set up, there are plenty of online tutorials and resources to walk you through the process. Once you get Google Analytics connected to your site, you can head to the Google Analytics dashboard and start checking things out. It can’t go back in time, though, so you will have to wait for data to gather.

Google Analytics can free you from relying on gut checks and intuition and instead tell you what pages and which content hit the mark or fall short. In this way, you can make informed choices.

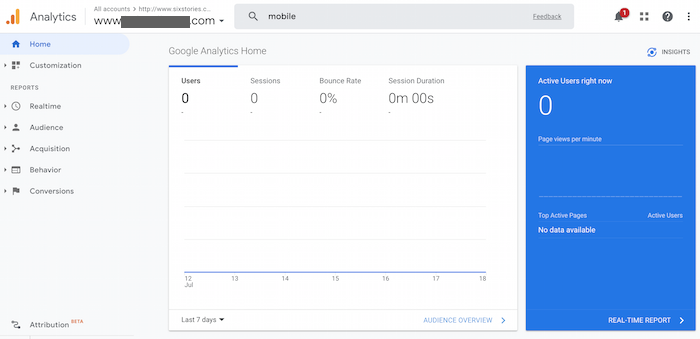

Once you set up your Google Analytics account, you can connect different URLs and choose which one to explore from the drop-down.

The first thing Analytics shows is basic traffic data, including dates. You can alter the dates based on your needs.

On the left side of the screen, Google Analytics provides a list of report options. This is where you can start to get into the details.

On the far right, there’s a blue box with real-time metrics showing how many people are on the site, how many pages are viewed per minute, and the most popular pages to view. You can then click on the blue box to learn more about the data.

If you’re looking for something specific, just type it into the handy search bar.

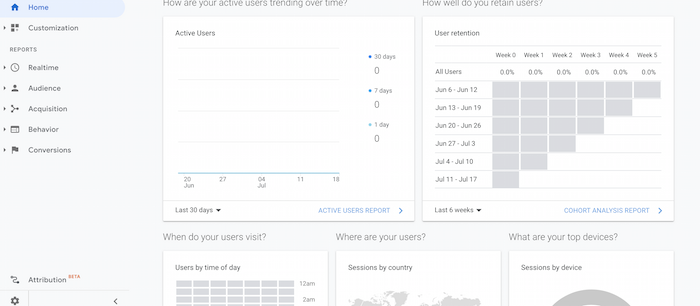

As you scroll down, you can check out different analytics, including where your users come from and what devices they use.

There are many metrics you can track using Google Analytics.

No matter which type you focus on, you need to choose a time frame for your data. This way, you can check a specific timespan against prior spans to see what’s changing and if what you’re doing is working.

As you analyze the data, try to remember what your marketing goals are. Otherwise, you may get overwhelmed by the whirlwind of numbers.

Let’s look at some of the most popular metrics just to get you started.

Tracking visitors shows who’s visiting, how many visitors you have, and what they’re doing on your website. This includes factors like bounce rates and session durations.

These metrics are anonymous and vague. You can’t gather personal details for specific visitors to your website.

To dig deeper, you can go to the “Audience” section of Google Analytics.

Another powerful metric Google Analytics can provide is traffic sources. It answers the question, “how are people finding my website?” You can find this information under the “Acquisition” tab.

For instance, you can find out how much traffic comes from social media, Google Ads, and the Google Search Console. Knowing where your visitors are coming from and what they do once they get to your site can help you know where to focus your marketing efforts.

Google Analytics can help you understand how well different pieces of content perform by tracking user behavior. For example, are they visiting certain pages more often than others? Is on-page time higher on some types of content? This can help you determine what works and what doesn’t, which you can use to inform future content creation and marketing choices.

You can find this information under the “Behavior” section.

Let’s get down to brass tacks here. Are people buying (or doing whatever else you want them to do) once they land on your website? That’s what conversion metrics on Google Analytics can tell you.

These metrics are not automatically generated like the previous ones. Instead, conversion analytics requires you to set goals, typically using the pages visitors are directed to once they convert. Telling Google Analytics to follow users to these final pages can provide more specific information about how people are getting there, how many are converting, and more.

As mobile use becomes the norm, you may want to see how well your website performs on mobile devices.

These metrics can be found in the “Audience” section under “Mobile.” Here, you can see website metrics broken down by device categories. For example, if you find certain device users are spending less time or money on the site, look into how your site looks and behaves on that type of device.

As you get a handle on following your website’s metrics, you may find you need custom Google Analytics reports. Custom reports can help you check specific metrics more efficiently, using apples-to-apples comparisons between periods, campaigns, and more.

These custom reports may help when presenting information to your department, organization, leadership, or investors thanks to the hard numbers you can compare and the visual reports you can run. Of course, not everyone may fully understand what you do, but many are likely to understand the basics of what these numbers and graphs mean.

Google Analytics is constantly rolling out new features that may help you meet your marketing goals. Let’s dive into a few.

If you have a lot of content on your website, you may have a search function available to users. Knowing what people type into that search function can help you understand why visitors are on your site, allowing you to plan for and create more relevant content.

Under the “Behavior” area, click “Site Search” to view this information.

Is there content on your website that’s just not performing? Then, you may benefit from optimizing those pages for SEO, deleting useless content, or creating entirely new work.

To learn which pages are not performing, go to “Behavior,” then “Site Content.” From there, click on the arrow to reorder the pages by popularity. This shows which pages get the fewest views. Do with that information what you will—though perhaps consider finding a cause before throwing the page into the abyss.

People abandoning shopping carts while shopping is a typical e-commerce problem. If you can find where visitors are dropping off your website, you can make improvements to help convert them.

First, set up your goals using a sales funnel. Include each step of your check-out process, including cart, check-out, shipping, and confirmation, in the pages you plan to monitor. Then, click to “visualize your funnels” to see how people behave as they move through the funnel.

You may see a pattern regarding when people abandon carts begin to emerge and make updates accordingly.

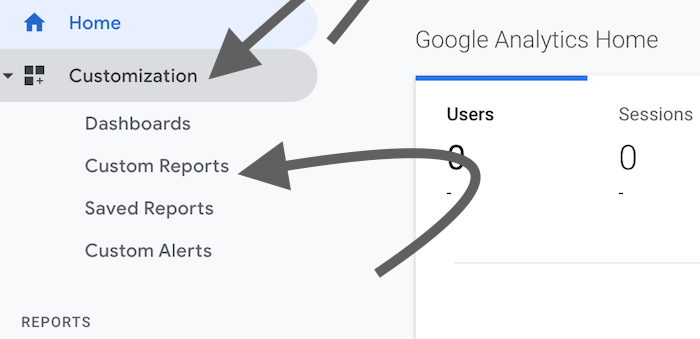

As we talked about above, Google Analytics places many of the most common analytics on the dashboard. However, you can set up a custom dashboard to see exactly what you need. Under the “Customization” tab, find the link for “Dashboards.” You can use a dashboard template or create your own.

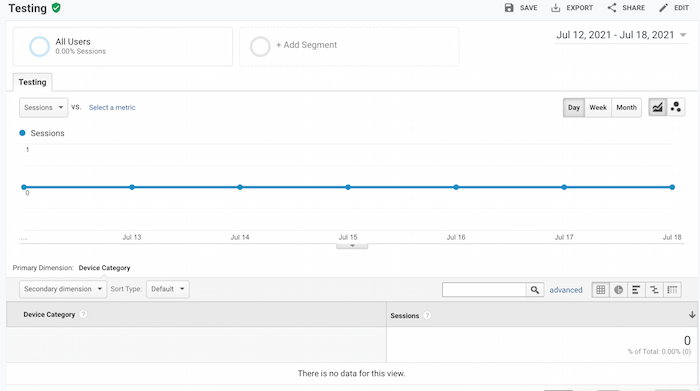

Google Analytics makes it easy to create custom reports for your own use or presentations.

You can name your custom report, as well as each tab you want to create if you want different variables in the same report.

If you scroll over the question mark in the dropdown, you can learn more about each choice.

Start with all, if you’re not sure. Now click “Save.” You’ll be taken to a page with the data automatically. From here, you can save, export, share, or edit the report.

If you save it, you can find this report under “Saved Reports.”

To rerun this custom report, go to “Custom Reports.”

Google Analytics can give you information about who visits your website, how many views your website receives, which content is the most popular, and more.

You can learn more about the basics of Google Analytics from Google themselves.

Google Analytics uses a tracking ID, which you place in the code of your website or a plugin to allow Google to receive information about your website.

Most of the benefits of Google Analytics are free, though you can choose to purchase upgrades.

Google Analytics provides in-depth information on how well your website is performing.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What are some basic things you can do with Google Analytics? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Google Analytics can give you information about who visits your website, how many views your website receives, which content is the most popular, and more.”

}

}

, {

“@type”: “Question”,

“name”: “What is the best way to learn Google Analytics?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “You can learn more about the basics of Google Analytics from Google themselves.”

}

}

, {

“@type”: “Question”,

“name”: “What is a Google Analytics tracking code?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Google Analytics uses a tracking ID, which you place in the code of your website or a plugin to allow Google to receive information about your website.”

}

}

, {

“@type”: “Question”,

“name”: “How much does it cost to use Google Analytics?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Most of the benefits of Google Analytics are free, though you can choose to purchase upgrades.”

}

}

, {

“@type”: “Question”,

“name”: “What is the benefit of using Google Analytics?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Google Analytics provides in-depth information on how well your website is performing.”

}

}

]

}

Google Analytics provides nearly endless amounts of information about your website’s data. Once you set up Google Analytics on your website, you can access metrics covering nearly every part of your customers’ journeys.

You can create custom reports to analyze how well your strategies work. This may help you make informed changes to your website, which may, in turn, draw even more people to your brand and via your analytics-driven marketing strategy.

What’s your favorite Google Analytics feature?

A conversion funnel is a visual representation of the stages in a buyer’s journey, from the moment they land on your page until they complete a purchase. How do you create a conversion funnel, though, and how do you get the most from this tool? Let’s take a look.

The AIDA model is the traditional way to track the customer journey. It’s based on the four classic stages people move through during the buying process: awareness, interest, desire, and action.

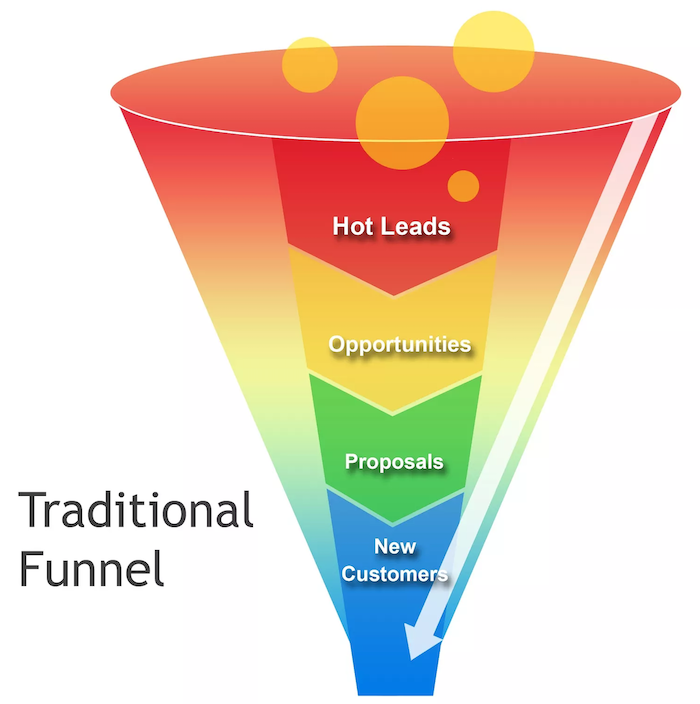

Realistically, not everyone who visits your website will convert to a paying customer, which is why we use a funnel shape. Based on the AIDA model, then, a traditional-style sales marketing funnel might look something like this:

The problem? This is a rigid and fairly unrealistic way to view how people move through the stages of a sales cycle.

Leads are human, and the sales process is rarely linear. Often, people loop back to different stages in the sales cycle before they’re ever ready to complete the sale. In other words, people need nurturing before they’ll buy a product. As a marketer, you must understand their behaviors, their personalities, and their needs to convert them into paying customers.

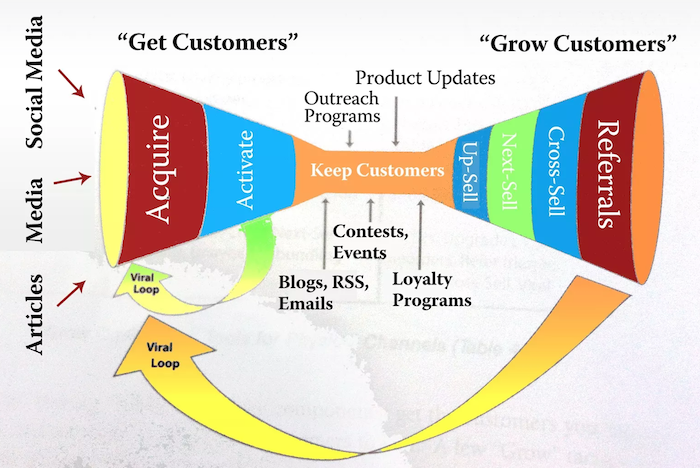

Rather than a straightforward sales funnel, you need a more flexible conversion-based funnel, which will look something like this:

Don’t let the graphic intimidate you! While you might be tempted to start with a simple sales funnel, you’ll increase your chances of success if you start with a more flexible conversion funnel. Let me take you through exactly how it’s done.

There are nine main steps to creating a successful conversion funnel, based on a blend of AIDA and less restrictive techniques.

The point of a conversion funnel is to build an effective buyer’s journey and increase your conversions. To increase your conversions, you must first identify your starting point and your end goal. In other words, you must identify three things:

Once you’ve identified what your end goal is, you can map it out as a conversion funnel. Visualizing or mapping out your funnel can help you stay on track further down the line.

Think of your funnel in three separate parts: the top, middle, and bottom.

Decide what you want from each stage of the funnel; for example, maybe you want to increase your traffic at the top of the funnel, boost your engagement rate in the middle, and increase your conversions at the end.

Once you’ve set some concrete goals, consider using tools to track your progress and ensure you’re meeting those objectives. For example, you might use Google Analytics or email automation software to measure your success rates.

Unless you’re clear on what you need from each stage in your funnel, it’s impossible to know if you’re meeting your targets. Spend some time reflecting on your overall goal before you build a conversion funnel.

Each part of the funnel (top, middle, bottom) requires its own marketing plan to keep prospects moving from one stage to the next.

The first stage is all about building brand and product awareness. You’re trying to generate some buzz and encourage prospects to learn more about your company and how your products can help them.

At this early stage, use visually engaging content such as videos, short blog posts, and social media posts to introduce your company and emphasize your brand story.

You have a person’s attention, so now it’s time to gain their trust and show them why they need your product.

A prospect could ultimately be in this stage for a while, so the focus should be on creating valuable, informative, and reliable content such as case studies, video tutorials, and downloads.

The final stage should be focused on giving prospects a reason to buy your product, sign up for your service, or take any other action you desire. Marketing strategies at this stage could include free trials, actionable emails, and CTAs, or calls to action.

At this first stage in your funnel, you’re trying to build hype around your brand and product. Why should a customer care about your company? How do your products solve the problems they have? Answer these questions to help build a content strategy for this stage.

Do some competitor research, too. Consider what you can learn from their landing pages, social media channels, and blogs. How are they reeling in potential customers?

With all these questions in mind, here are some examples of ways you might generate awareness and create appropriate content for the first stage of a conversion funnel.

Other ways you might build interest in your brand include, for example, trying influencer marketing, hosting interviews, creating informational guides, and designing printable checklists.

While the AIDA model labels “interest” and “desire” as two separate outcomes, in real terms, they’re the same thing.

Generating interest, or building desire, comes down to one key thing: creating compelling content. You build some awareness around your brand, you show people why they “need” what you’re selling, and as a result they decide they “want” your product.

How do you create great content to nudge people along this stage of your funnel? Here are some ideas.

There are some other ways you can generate interest, too, such as starting a podcast, creating some product guides, running a free trial program, or offering product samples.

At the end of the funnel, your goal is to convert a lead into a customer by encouraging the required action. While you could skip this step in the funnel if it works for your business, here are some ways you might optimize your strategy for this stage.

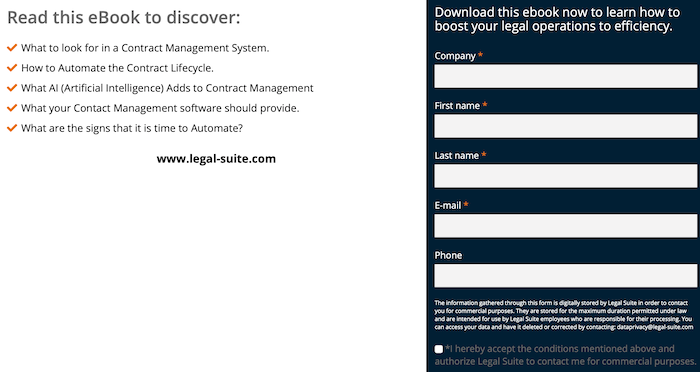

Put together some valuable content in a PDF download and offer it in exchange for their contact details. Make sure your document promises to answer common questions your customers have, to encourage them to actually download it.

Here’s an example from LegalSuite, a legal services provider. Their customers typically want help with streamlining their operational efficiency. To help their customers, LegalSuite offers a free eBook with ways to make their legal operations run more efficiently.

The catch? Prospects must provide some contact details, which means that LegalSuite can follow up with them:

This is a great example of how to encourage an action without being pushy.

CTAs clarify the action you want people to take, so don’t forget to add them to the content you create.

At this stage of the funnel, you’re trying to entice customers to take a final step to complete the cycle, so give your CTAs a sense of urgency. Emphasize how your product can solve their problem and why they should act now.

Make it easy for customers to act by displaying the CTA somewhere prominent, like the top of a landing page, the end of a guide post, or in a colorful, clickable button at a strategic point in a YouTube video.

Finally, remember to test your CTAs to identify which strategy resonates most with your audience.

In many ways, great marketing is all about helping people help themselves.

Send them clear, concise, actionable emails emphasizing how they can solve their problems through buying your products or using your services.

Again, ensure there’s an obvious CTA so potential customers know what action you expect them to take.

Did you know that 72 percent of customers won’t make a purchase until they’ve read some reviews? Give those customers the reassurance they need to take the final step by adding some testimonials to your page.

You can either just ask customers for reviews, or you can take a look at your existing reviews on websites like Facebook and LinkedIn and ask for permission to share them in your content.

Where should you display testimonials?

It all depends on your audience, brand goals, and marketing strategy. You could, for example:

Finally, you might offer other incentives like free trials, competitor comparison guides, demo videos, and product samples to nurture leads into becoming paying customers.

Great marketing is not just about finding customers. It’s about retaining them, too. Here’s why.

Sounds great, right? Here are some strategies for retaining those all-important loyal customers.

Next-selling is when you follow up with a customer after a purchase and offer them a similar product with, perhaps, an attractive discount attached. Not only does this allow you to communicate with your customer and make them feel valued, but it’s a way to potentially increase revenue.

Say you want to know whether customers who buy coffee machines are more likely to buy a discounted toaster. You can send the customers who bought a coffee machine a discount code for toasters, and send a control group a full price ad on toasters.

Next-selling can provide you with helpful data to build effective funnels.

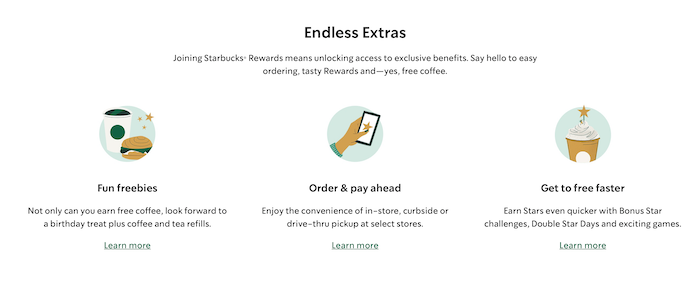

Loyalty programs are crucial to any customer retention strategy, with 81 percent of millennials spending more money when they’re a member of a loyalty scheme. However, since loyalty schemes are nothing new, you need to get creative if you plan on building a winning program.

When you’re creating your own program, consider:

Amazon Prime, for example, stands out because customers enjoy benefits like free same-day delivery, exclusive savings, and access to members-only shopping events.

With the Starbucks Rewards program, members pay through the Starbucks app, and they earn points towards perks like free food and drink. What’s really great about this scheme, though, is how it’s centralized through the app, meaning Starbucks can access large volumes of data about user behavior to inform their marketing strategy:

Make your loyalty program work for you by using it to monitor customer preferences and buyer behavior.

When you update your products, you’re keeping up with evolving customer demands and changing expectations. You’re showing your loyal customers that you value their continued loyalty.

For example, maybe you can update an app glitch, based on user feedback. Or, you could launch an add-on to improve a software download.

In short, product updates are a great way to improve the user experience.

How else can you keep those all-important customers? Well, you can try marketing strategies such as:

Finally, don’t forget to capitalize on your existing customers by encouraging them to make more purchases. There are a few strategies you can try, so here’s a rundown of your best options.

With cross-selling, you look at a customer’s most recent purchase and show them similar products they might be interested in. Or, during the sales process, you offer them other items which complement the item they’re currently buying.

For example, say someone buys a laptop from your website. As part of your sales funnel, you might also recommend a charger or laptop case to go along with their purchase.

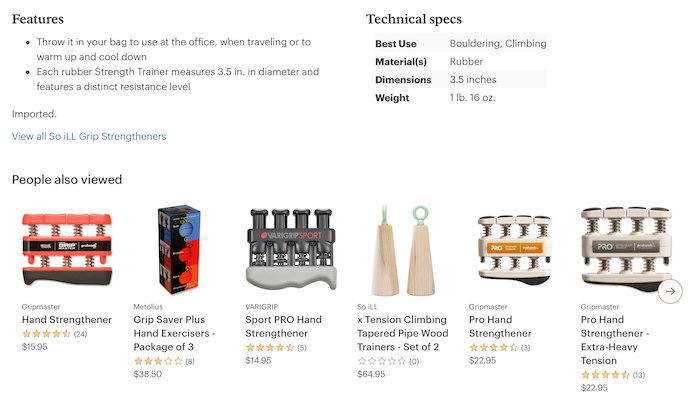

Here’s a real example from REI Co-op. Say, for example, a lead decides to view a set of strength trainers. Under the product listing, there’s a “people also viewed” list, which highlights similar products the lead might be interested in:

It’s not a pushy strategy, but it nurtures leads in the right direction.

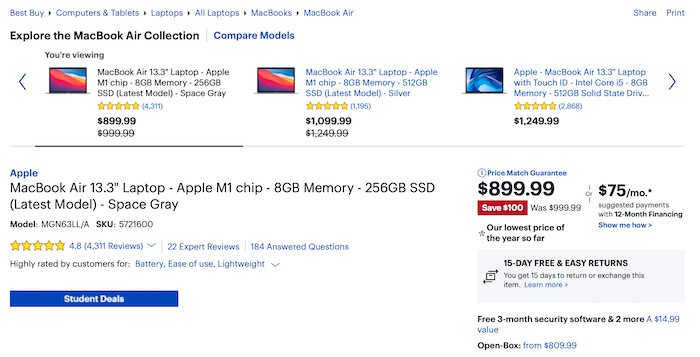

Upselling means offering a customer a more expensive alternative to the item or service they’re interested in.

For example, if someone selects a free subscription to your service, you might highlight the cheapest paid subscription option to them.

Just remember, though, to avoid being too pushy at all times when you’re upselling.

Here’s a good example from Best Buy. The customer views an entry-level MacBook Air. Above the product, they see other more expensive products from the MacBook range, one of which also has an enticing discount attached to it:

The products advertised aren’t massively different in price from the viewed product, and it’s a good, subtle example of upselling.

There are a few other strategies you can try to grow your customer base and build your business, including:

Test out a few strategies and identify which ones resonate best with your customers.

In reality, there’s no such thing as a perfect funnel. However, if your funnel is underperforming, it could be due to common errors such as:

To find out why your funnel isn’t working optimally, you need to run some A/B testing or use an analytics tracking tool like Google Analytics (GA) or Hotjar.

Alternatively, you can perform some lead outreach. Send out surveys or ask for feedback about the website user experience, and always take negative comments on board when you’re refining your funnel. They’ll give you very clear insight on what your audience does or doesn’t want.

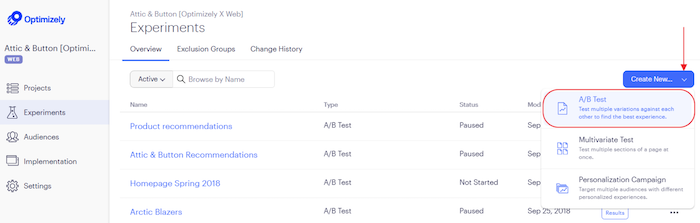

Want to experiment with different funnel variations and track their performance? Give Optimizely a try.

It’s easy enough to use. Once you’ve registered, simply head to your “Experiments” dashboard, select “Create New,” and choose whichever experiment you want to run, such as A/B testing or a personalization campaign:

After you create your experiments, you can track them from your dashboard and make whatever changes best suit your marketing strategy. For example, you might refine your CTA or emphasize a new product. You can run multiple variations simultaneously, too, and track which one works best.

Whatever your conversion goal, Optimizely can help you realize it. Sign up for a free version, or choose a paid subscription with more advanced features if your marketing budget can stretch to it.

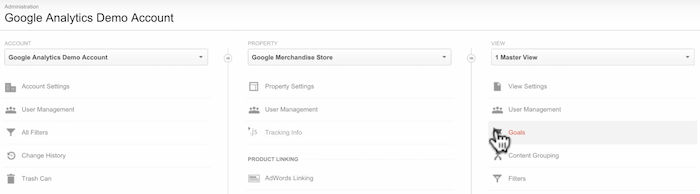

Google Analytics is another handy tool for funnel tracking. With GA, you can easily track customers from the moment they visit your page to whenever they decide to either abandon their journey or complete the purchase.

Since we’re trying to visualize a funnel, you want to set a “Destination” goal such as registering for a newsletter.

From here, you can identify where people leave your funnel or where they loop back to different stages.

The four stages are “Attention,” “Interest,” “Desire,” and “Action.” You’re trying to attract attention, generate interest, encourage the customer to want the product, and have them take the desired action.

The goal is the objective you’re trying to achieve e.g., a customer completing a sale. The funnel is the journey the prospect takes to reach this goal.

Start by checking out funnel visualization tools like Google Analytics.

A conversion funnel shows you the paths people take on their journey from visiting your website to becoming paying customers.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What are the four stages of the AIDA model?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The four stages are “Attention,” “Interest,” “Desire,” and “Action.” You’re trying to attract attention, generate interest, encourage the customer to want the product, and have them take the desired action.”

}

}

, {

“@type”: “Question”,

“name”: “What’s the difference between goals and funnels?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The goal is the objective you’re trying to achieve e.g., a customer completing a sale. The funnel is the journey the prospect takes to reach this goal.”

}

}

, {

“@type”: “Question”,

“name”: “How do you visualize a funnel?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Start by checking out funnel visualization tools like Google Analytics.”

}

}

, {

“@type”: “Question”,

“name”: “What is the purpose of a funnel?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “A conversion funnel shows you the paths people take on their journey from visiting your website to becoming paying customers.”

}

}

]

}

Think of your conversion funnel as an evolving process. Just as your customers want and need change over time, so should you adapt your goals and funnel strategy to match.

When you strive to give your customers the user experience they’re hoping for, you won’t just build a loyal client base: you’ll stand out from your competitors, too.

Have you built your first conversion funnel yet?

You may be surprised at the many kinds of financing for a small business there are.

Any discussion of business financing has to start with fundability. Fundability is the ability of a business to get funding. It covers all the points a lender or credit provider will look at when they’re trying to figure out if you’ll pay back a loan or credit extended to you. These include factors you probably haven’t thought about or might think aren’t so important. Business details like address and entity all matter. But there’s more.

When you think like a lender, you realize they just want to be sure that you’ll pay them back. Lenders look at one of three things for loan approval: cashflow, collateral and/or credit. The more of these “Cs” you have, the more funding options are available. For the forms of funding we’re showcasing today, we show you exactly what you need to have for approval.

If you have absolutely none of the 3 Cs, there are still two other options: selling a part of your business or grants and crowdfunding. Let’s look at types of funding covering all of these options. We’ll start with financing via your business’s cash flow.

A loan made to a company is backed by a company’s expected cash flow. A company’s cash flow is the amount of cash that flows in and out of a business, in a specific period. Cash flow financing (or a cash flow loan) uses generated cash flow as a means to pay back the loan.

Often you will need to have a few years in business. You may need to meet a certain minimum credit score requirement. You will need to prove historical cash flow and present your accounts receivables and accounts payables. This way, the lender can determine how much to loan to your business.

An MCA technically isn’t a loan. Rather, it is a cash advance based upon the credit card sales of a business. A small business can apply for an MCA and have an advance deposited into its account fairly quickly. So you can offer Net 30 terms but not have to wait a month to get paid.

A merchant financing program is ideal for business owners who accept credit cards and are looking for fast and easy business financing. An MCA program is designed to help you get funding based strictly on your cash flow, as verifiable per your business banks statements. Hence lenders in general will not ask for any burdensome document requests.

A lender will review 3 months of bank and merchant account statements. They are looking for is consistent deposits. And they want to see deposits showing revenue is $50,000 or higher per year. They will also verify time in business of 6 months or more.

Lenders are also looking to see that you don’t have a lot of Non-Sufficient-Funds (NSFs) showing on your bank statements. They want to see you don’t have a lot of chargebacks on your merchant statements. And they want to see that you have more than 10 deposits in a month going into your bank account. They want to see that you manage your bank and merchant accounts responsibly. And they want to see that have a decent number of consistent credit card transaction deposits each month.

Let’s move onto funding based upon collateral – either yours, or a credit partner’s, or from the business itself.

Demolish your funding problems with 27 killer ways to get cash for your business.

Inventory financing is a revolving line of credit or a short-term loan acquired by a company so it can purchase products for sale later. The products serve as the collateral for the loan. There may be restrictions on the type of inventory you can use. This can include not allowing cannabis, alcohol, firearms, etc., or perishable goods. There can be revenue requirements. And there may also be minimum FICO score requirements.

Get approved for a line of credit for 50% of inventory value, regardless of personal credit quality. Rates are usually 5 – 15% depending on type of inventory. You can get funding within 3 weeks or less. But it can’t be lumped together inventory, like office equipment.

You can use outstanding account receivables as collateral for financing. If you also have purchase orders, you can get financing to have those filled. You won’t need to use your cash flow to do so. Get an accounts receivable credit line with rates of less than 1% with no consumer credit requirement. Receivables should be with the government or another business.

Get as much as 80% of receivables advanced ongoing in less than 24 hours. Remainder of the accounts receivable are released once the invoice is paid in full. Factor rates are as low as 1.33%. You can get an accounts receivable credit line with rates of less than 1% with no consumer credit requirement.

Now it’s time to move onto funding with good personal credit (FICO) scores.

A credit line hybrid is a form of unsecured funding. Our credit line hybrid has an even better interest rate than a secured loan. Get some of the highest loan amounts and credit lines for businesses. Get 0% business credit cards with stated income. These report to business CRAs. You can build business credit at the same time. This will get you access to even more cash with no personal guarantee.

You need a good credit score or a guarantor with good credit to get an approval (a FICO score of at least 680). There are no financials required. You can often get a loan of five times the amount of current highest revolving credit limit account. So this is up to $150,000.

A bridge loan is a short-term loan used until a person or company secures permanent financing or removes an existing obligation. It allows the user to meet current obligations by providing immediate cash flow. Bridge loans are short term, up to one year. They have relatively high interest rates. And they are often backed by some form of collateral, like real estate or inventory.

The Credit Suite Credit Line Hybrid has a term loan program. This bridge loan works as either an add-on to, or in lieu of, the program, when the applicant meets eligibility and is agreeable to either a portion (or all) of their funding, supplied in the form of cash term loans. There is a fixed monthly repayment.

The Credit Suite program is an aggregate program requiring multiple accounts to meet our prequalification. Get $25,000 to $300,000 per applicant. The APR is 7 – 24% depending on creditworthiness and selected term. Terms are 3, 5, or 7 years. You must have a 680 FICO or better, and over $35,000 in adjusted gross income. Actual pre-qualification will depend on Debt-to-Income ratio.

Starter vendors are open to working with most businesses, even startup ventures. Make sure vendors report to the CRAs – not all do. Vendors report to the business CRAs within 60 days. They help you build your business credit profile and score. Terms will vary depending on the vendor, but they tend to be Net 30. And you will not need collateral, good personal credit, or cash flow.

Retail credit comes from major retailers. Buy everything from office supplies to power tools. Retailers will check whether your business information is uniform everywhere. They will also check whether your business is properly licensed

Qualifications will vary, and there can be a minimum time in business requirement. There may even be a minimum number of employees requirement, or a minimum annual sales requirement. Terms can be revolving. You will need at least 3 (5 is better) accounts reporting to the business CRAs.

Fleet credit is used to buy fuel, maintain vehicles of all sorts, and repair vehicles. Even businesses which don’t have big fleets can still benefit. These are usually gas credit cards. Requirements will vary. There may be a minimal time in business requirement. If your business doesn’t make the time in business requirement, you may be able to instead offer a personal guarantee or give a deposit to secure the credit.

More bank credit cards are more universal, like MasterCard. So they can be used pretty much anywhere. These cards may even have rewards programs. Terms can be revolving. Usually, you will need to have at least 14 accounts reporting to the business CRAs. There can be longer time in business requirements. And there may also be minimum number of employee requirements.

Now let’s look at financing you can get if you’re all right with sharing the profits and ownership of your business.

Demolish your funding problems with 27 killer ways to get cash for your business.

Angel investors invest in small startups or entrepreneurs. Often, angel investors are among an entrepreneur’s family and friends. The capital they provide may be a one-time investment to help the business get started, or an ongoing injection of money to support and carry the company through its early stages. Angels are not covered by the Securities Exchange Commission’s (SEC) standards for accredited investors.

Angels could be friends or colleagues sitting on home equity, or local professionals who are looking to invest. Consider people you know well and people you don’t know so well. But keep in mind, you’re giving up part of your ownership in your business.

Angels are informal investors so there really aren’t any terms. Technically, there is nothing done for qualifying although investors may (probably should) insist on a valuation of your business. But no matter what, it’s always a good practice to get everything in writing.

This is not the same as reward-based crowdfunding (like from Kickstarter). Equity crowdfunding is a stock offering from a company that is not listed on stock exchanges. Equity crowdfunding has been around for less than 10 years. Potential investors visit a funding portal website. There, they can explore different equity crowdfunding investment opportunities. Note: there are limits on how much capital an individual can invest based on their income and net worth. Equity crowdfunding gives investors a stake in your business.

Equity crowdfunding tends to be covered by complex federal law. It is best practices to consult with an attorney well-versed in federal law, specifically, securities and corporations when it comes to interpreting terms and qualifications. A lawyer will also be able to comprehend any changes that may be made to these aspects of the law in the future.

Let’s move onto kinds of funding you don’t need to pay back.

Federal grants generally do not have to be paid back. Try HUD (Housing and Urban Development) for urban projects. Try the USDA (Department of Agriculture) for rural projects. Federal funding means paperwork. You often must show experience in what you are proposing.

Grants have varying qualifications. They are very competitive. Be sure to check information thoroughly. This includes due dates and any necessary paperwork. Some grants may offer preferences to businesses with minority, female, veteran, or disabled ownership.

You can get money from the crowd for your business. Start with a service like Kickstarter. But make sure you read the fine print (always a good idea!). Many crowdfunding platforms make you give all the funding back if you do not make your goal by the end of the campaign. But Indiegogo has a flexible funding option.

Crowdfunding platforms will take a percentage of the donations. That’s how they make their money. Crowdfunding platforms may push to have you deliver on your promises. So you’ll have to actually manufacture a product or do whatever else your business is supposed to be doing. Given how much social media we’re all bombarded with these days, it should come as no surprise that donors can become weary of crowdfunding pitches.

Crowdfunding tends to work best when donors can personally connect with a product or service. Straightforward businesses may not do so well. The kinds of businesses which do the best often associate with products not quite on the shelves yet, or artistic endeavors. But standard widgets will most likely not attract brand ambassadors. They probably won’t get donors too fired up. Because crowdfunding campaigns are time-consuming, it doesn’t make sense to try this form of funding unless you realistically feel your chance of success is better than 50%.

Terms will differ depending on which platform you use. Check and make sure your platform of choice will allow your industry to work with them. For example, even though recreational cannabis use is legal in Massachusetts, Kickstarter (for example) doesn’t allow fundraising for drugs, nicotine, tobacco, vaporizers, and related paraphernalia. Any major crowdfunding platform has a section for rules, a FAQ, or ‘how it works’. Be sure to read such a section thoroughly so you know exactly what you’re getting yourself into.

And now let’s look at funding via creative and different means you may not have considered or heard of before.

Demolish your funding problems with 27 killer ways to get cash for your business.

This is not a loan. You will not have to pay an early withdrawal fee or a tax penalty. You put the money back by contributing, just like with any 401(k) program. This means you won’t lose your retirement funds. This is a 401(k) Rollover for Working Capital program. The IRS calls it a Rollover for Business Startups (ROBS).

Per the IRS, a ROBS qualified plan is a separate entity with its own set of requirements. The plan, through its company stock investments, rather than the individual owns the trade or business. Therefore, some filing exceptions for individuals may not apply to such a plan. This type of financing isn’t a loan against, your 401(k), so there’s no interest to pay. It does not use the 401(k) or stocks as collateral. Instead, this is simply a movement or change of custodian.

Pay low rates, often less than 5%. Your 401(k) will need to have more than $35,000 in it. You can usually get up to 100% of what’s “rollable” within your 401(k). The lender will want to see a copy of your two most recent 401(k) statements. You can get 401(k) financing even with severely challenged personal credit. The 401(k) you use cannot be from a business where you are currently employed. You cannot be currently contributing to it.

Microloans are business loans with relatively low interest rates. Generally, these loans are offered to small or developing businesses with modest capital requirements and little to no revenue history. Microloans — as the name suggests — are smaller loans than a traditional bank loan. They generally offer anywhere from $500 to $50,000 in business financing.

Terms and requirements vary among providers. Kiva, for example, charges 0% interest. The Opportunity Fund provides loans to low- and moderate-income immigrants, women, and other underserved small business owners. Accion requires a cosigner. Check the specific requirements of any microloan program that interests you

This the SBA’s most popular loan. The SBA guarantees 85% for loans up to $150,000. They guarantee 75% for loans greater than $150,000. The SBA makes the lending decision, but qualified lenders may be granted delegated authority to make credit decisions without SBA review.

The maximum amount on offer is $5 million. You will have to provide Articles of Organization, business licenses, documentation of lawsuits, judgments and bankruptcy or other pertinent documentation. Lenders are not required to take collateral for loans up to $25,000. For loans in excess of $350,000, the SBA requires that the lender collateralize the loan to the maximum extent possible up to the loan amount.

There are all sorts of amazing ways to get business funding. You can find the one which fits your circumstances. This includes your strengths in areas like personal credit, collateral, cash flow, selling a part of your business, and getting grants or crowdfunding. Let us help!

The post 10 Kinds of Financing for a Small Business – Including Options You’ve Probably Never Heard Of appeared first on Credit Suite.

Article URL: https://jobs.ashbyhq.com/zendar/ca3dde1b-ad32-43e2-bcde-7bb3c404017c

Comments URL: https://news.ycombinator.com/item?id=28019820

Points: 1

# Comments: 0

Article URL: https://www.ycombinator.com/companies/compose-ai/jobs/syPzbAB-senior-frontend-engineer

Comments URL: https://news.ycombinator.com/item?id=28021520

Points: 1

# Comments: 0