Article URL: https://www.culturebiosciences.com/careers?gh_jid=4712856003

Comments URL: https://news.ycombinator.com/item?id=28851061

Points: 1

# Comments: 0

Article URL: https://www.culturebiosciences.com/careers?gh_jid=4712856003

Comments URL: https://news.ycombinator.com/item?id=28851061

Points: 1

# Comments: 0

Article URL: https://www.ycombinator.com/companies/okay/jobs/0O0s8usap-fullstack-senior-engineer

Comments URL: https://news.ycombinator.com/item?id=28854628

Points: 1

# Comments: 0

When you get a credit card tied directly to a store, it’s called a retail credit card. Common examples include retail credit cards from Lowe’s and Office Depot. Generally, you can only use these accounts at the specific store that issues the card. Some stores offer credit accounts with net terms rather than retail credit cards.

There are a lot of steps to building a business credit profile that many business owners just don’t know. We do our best to help out in that area, but once you get started, you have to keep going. Building a fundable foundation is important, of course. You cannot have business credit without that.

Then, you have to get initial accounts reporting. That’s where starter vendors come in. Yet, you can’t stop there. That is just the effort it takes to build the snowball and get it to the edge. You have to push it down the hill if it is ever going to grow.

That is where you get to the next step after starter vendors. In the Business Credit Builder we call it Tier 2. This is where second step credit providers live.

There are various types of credit providers in the Tier 2 category. These are credit providers that will approve you with limited business credit history or a personal guarantee. What really sets them apart is that they will report your on-time payments to the business credit reporting agencies.

Not all business credit providers do that. Many will only report late or missed payments, if they report anything at all. However, if you find those that report positive payment history, your business credit profile continues to grow. Your business credit score continues to grow as well.

This is how your business credit score can really take off.

It can be a bit tricky to find these types of accounts. Despite the fact that most large retailers offer retail credit cards or net accounts, many do not make it easy to find out whether or not they will report. If you are working on building business credit, reporting on-time payments is vital.

That’s part of the value of the Business Credit Builder. There is a whole database full of Tier 2 vendors that report. We list them for you along with what it takes to get approval and which business credit agencies they report to.

Some will still extend credit, and still report to the business credit reporting agencies, even if you do not meet the requirements or do not have enough business credit history. The catch is, they will require a personal guarantee.

Others will not require a PG, but it will make it much easier to get approved with minimal business credit history. This is why the first steps of the Business Credit Builder are so important. Without a strong business credit profile, you may be able to get approval with a PG. In contrast, if you build a solid foundation and business credit score with starter vendors first, you can get approval without a PG.

That right there is the secret that no one wants to talk about when it comes to retail credit. You do not have to give a personal guarantee to get it. There is another way. You can build a strong business credit profile before you apply.

It’s not that a personal guarantee is bad, per se. Sometimes you may need it to get started. Still, it does add more liability to you personally. So, if you can get away without it, why not?

Here are just a few options from the Business Credit Builder.

Home Depot requires:

They also like to see a minimum of 2 accounts reporting. But, they will look at the merit of the overall application, so minimum accounts reporting isn’t necessarily a deal breaker.

They also require a business phone number listed in the 411 directory and at least 3 years in business. The minimum PAYDEX required is 80, and you must also have a good Experian business score. You can request Net 60 terms after the account is established.

If there is not enough business credit history or you have been in business for less than 3 years, a Personal Guarantee(PG) is required.

Quill.com sells supplies any business can use in day-to-day operations, including office and cleaning supplies. For approval, they want to see:

New businesses or businesses with no credit history with D&B may need to pre pay purchases for 3 consecutive months until Net 30 is approved.

To get approval for Net 30 with Office Depot you must have:

If any above criteria is not met, a Personal Guarantee (PG) is recommended but not required.

Once you’ve got your 5 (or more) starter vendors reporting, you should be eligible for credit from these retailers. That is, assuming you have handled your credit from starter vendors wisely. As you can see, exact requirements for approval vary by lender.

Many of these credit providers have more than one option for business credit. For example, they may offer net terms as well as a revolving account. If you do not qualify for the revolving account, you may qualify for net terms.

You can use the net account to help you build your business credit profile until you qualify for the revolving account. These examples can help you see what’s out there and what it takes to get approval. They make it crystal clear why building a fundable foundation and getting initial accounts reporting using starter vendors is vital.

Once you do so, you can get retail credit accounts from tier 2 reporting as well. This keeps the snowball rolling and growing allowing you to pick up bigger accounts with better terms. If done properly, the need for a personal guarantee can be kept to a minimum.

The post What No One Will Tell You About Retail Credit Cards appeared first on Credit Suite.

For going concerns with some time in business, cash flow financing can be a good way to fund expansion, growth, or everyday needs. But what IS cash flow financing? And where do you get it?

Fundability is the ability of a business to get funding. It covers all the points a lender or credit provider will check when trying to figure out if you’ll pay back a loan or credit extended to you. These include details you may not have thought about or might think aren’t so important. But they are!

When you think like a lender, you come to understand that all they want is to be sure that you’ll pay them back. Lenders look at one of three things for loan approval: cash flow, collateral, and/or credit. The more of these “Cs” you have, the more funding options are available. Let’s look at how cash flow financing can help your business.

Cash flow financing is a loan made to a company is backed by a company’s expected cash flows. A company’s cash flow is the amount of cash that flows in and out of a business. This is within a specific period. Cash flow financing or a cash flow loan uses generated cash flow as the way to pay back the loan. It’s one of the smarter financing activities you can do if you’ve got a going concern with predictable income.

Much of the time, you must have a few years in business. You may need a certain minimum credit score. You must prove historical cash flow, and present your accounts receivables and accounts payables, so the lender can determine how much to loan to your business.

You can use outstanding account receivables as your collateral for business financing. Receivables should be with the government or another business. If you also have purchase orders, you can get financing to have those filled. You won’t need to use your cash flow to do so. Get an accounts receivable credit line with rates of less than 1% with no consumer credit requirement.

Use your outstanding account receivables for financing. Get as much as 90% of receivables advanced ongoing or more, in less than 24 hours. The rest of the accounts receivable are released once the invoice is paid in full. Factor rates as low as 1.33%.

Terms are for Credit Suite account receivable financing. The only collateral necessary is your account receivables. Loan amounts run from $10,000 to $10 million. Up to 95% of receivables can be advanced within a week. Rates start at prime rate 2%. You must have a FICO score of 500 or better.

Receivables must come from another business or government agency, not an individual. Business must be open for at least one year to qualify. Medical receivables must have $1 million in annual sales or more. For the deal submission, you must provide the application, a breakdown of existing receivables, and a sample invoice.

Purchase order financing is advanced to a business with a large purchase order or contract, but the business is unable to fulfill it. A lender then loans the funds necessary to complete the order and charges a percentage for the service. Then the company can fulfill its order or contract.

The difference between purchase order and accounts receivable financing is purchase order financing involves a company lending you money to fulfill purchase orders. But accounts receivable financing involves a company buying your outstanding invoices. Still, they are both, at bottom, based on cash flow.

Terms are for Credit Suite purchase order financing. For approval, lenders will often review your outstanding purchase orders that need filling. They want to be sure the purchase orders are valid, and the suppliers you are dealing with are credible.

If so, then you can get approval, regardless of personal credit history. Rates tend to range from to 4%. In some instances, you can get 95% of your purchase order financed.

Demolish your funding problems with 27 killer ways to get cash for your business.

This is a way to raise capital from investors who get a percentage of the enterprise’s ongoing gross revenues, in exchange for money invested. In a revenue-based financing investment, investors get a regular share of business income until a predetermined amount is paid. Often, this predetermined amount is a multiple of the principal investment. It is often between 3 to 5 times the original amount invested.

Since repayment of the loan is comes from revenues, the time it takes to repay the loan will fluctuate. The faster revenue grows, the quicker you’ll repay the loan, and vice versa. The percentage of monthly revenues committed to repayment can be as high as 10%. Monthly payments will fluctuate with revenue highs and lows and will continue until you’ve paid back the loan in full.

All terms are for the Credit Suite business revenue lending program. Necessary collateral is consistent revenue verifiable through bank statements. Loan amounts run from $5,000 to $500,000. Terms are for 3 to 36 months. Pay a factor rate of 1.10 to 1.45%. Credit you must have a 500 credit score or higher, with no recent bankruptcies.

Business must earn annual revenue of $120,000 or more per year. You must be in business for a year or more. The business must do over 5 small transactions each month. Financial services industries are prohibited, damaged credit is acceptable. Or business must bring in at least $15,000 monthly revenue with 6 months’ time in business. To get this deal, you must provide the application and 6 months of business bank statements.

Get a line of credit from Fundbox. Fundbox just wants to know about your cash flow when deciding whether to fund your business. Fundbox will connect straight to your online accounting software. That’s all you need to do. You can get a revolving line of credit for up to $100,000. Fundbox will auto debit your weekly payment from your bank account. You don’t need to show a particular personal credit score. And you don’t need to show a certain time in business.

Pay in equal installments over the course of a 12 or 24 week plan. Available credit replenishes as you pay. There are no penalty to repay early. Your business must be American. You must have a 600 or better personal FICO score, and $100,000 or more in annual revenue. Also, you must have a business checking account. Ideally you must have 6 months in business or more.

Demolish your funding problems with 27 killer ways to get cash for your business.

You can get a loan from PayPal. But you must already have a PayPal business account. There is no personal guarantee. Loan amounts and eligibility depend on your sales via PayPal. So applying won’t result in a credit check.

The maximum loan amount depends on your PayPal account history. To be eligible, you must have a PayPal Premier or Business account for 90 days or more. Also, you must process at least $20,000 in annual PayPal sales if you have a Premier account, or at least $15,000 in annual PayPal sales if you have a Business PayPal account. Pay off any existing PayPal Working Capital loan.

Since automatic repayments get deducted as a percentage of each PayPal sale, the amount you repay each day changes with your sales volume. The more you sell, the more repayment progress you’ll make that day. On days without sales, you’ll make no payments, but you must repay something at least every 90 days.

Depending on the loan terms you choose, you must pay at least 5% or 10% of your total loan amount (loan + the fixed fee) every 90 days. The 5% minimum applies to loans estimated to take 12 months or more for repayment. This has a basis in your business’ past PayPal sales and other factors. The 10% option applies to loans estimated to be repaid within 12 months.

You can get loans through Square. Applying will not affect your personal credit score. Loan eligibility comes from several factors related to your business, including its payment processing volume, account history, and payment frequency.

You can get $300 to $250,000. Borrowers get a customized offer with a basis in their card sales through Square. Then they choose their loan size. You will pay no interest, just an ongoing flat fee

There are no ongoing interest charges. Instead, you will pay one fixed loan fee to borrow the loan. The fixed fee is the difference between the total owed amount and the initial loan amount. The fixed fee will never change, regardless of how fast or slow the loan is repaid. It is automatically deducted until you pay back your loan in full. If sales are up one day, you pay more; if you have a slow day, you pay less. At least 1/18 of the initial balance must be repaid every 60 days.

They don’t want collateral for business loans of $75,000 or less. For loans amounts over $75,000, they take a security interest in your business assets. Then they will file a UCC statement with the Secretary of State where your business is organized. There is no personal guarantee.

Demolish your funding problems with 27 killer ways to get cash for your business.

There are several options for business funding that depend on your cash flow. Some are available through Credit Suite. There are also online options, such as through PayPal and Square. Contact us today for help with your options.

The post Get Cash Flow Financing for Your Business – It Can Be a Great Way to Get Credit and Funding… appeared first on Credit Suite.

Article URL: https://deepnote.com/join-us Comments URL: https://news.ycombinator.com/item?id=28845019 Points: 1 # Comments: 0

Article URL: https://www.workatastartup.com/jobs/47069 Comments URL: https://news.ycombinator.com/item?id=28842116 Points: 1 # Comments: 0

Do you consider yourself a Google expert? Think you know all the ins and outs of the search behemoth?

If you answered yes to either of those questions, you might be in for a surprise.

Google contains myriads. The search giant constantly evolves its algorithms and offerings, from secret search functions to in-house SEO guides.

Read on to learn more about Google’s secrets.

We’re all incredibly familiar with the Google search bar, given that 84 percent of us admit to searching Google at least three times a day. However, the search engine also comes equipped with some pretty cool, advanced search functions many don’t know about. These built-tools range from a hashtag search function guides that enable users to optimize for search engine optimization (SEO) and everything in between.

Below, we break down the four most useful secret Google search functions so you can start mastering these secret tricks.

Adding “related:” to your search terms lets you include similar or identical topics. This can be beneficial in broadening your search but allow you to keep the results in the same thematic area.

This search feature can aid online business owners or marketers in identifying competitors. By assessing business type, content, and category, Google can show vendors offering similar products and services. This often makes research into competitor search ranking, social strategy, and other marketing functionality easier.

With over 49 percent of the global population using social media, it’s safe to say there’s an overwhelming amount of profiles to sort through.

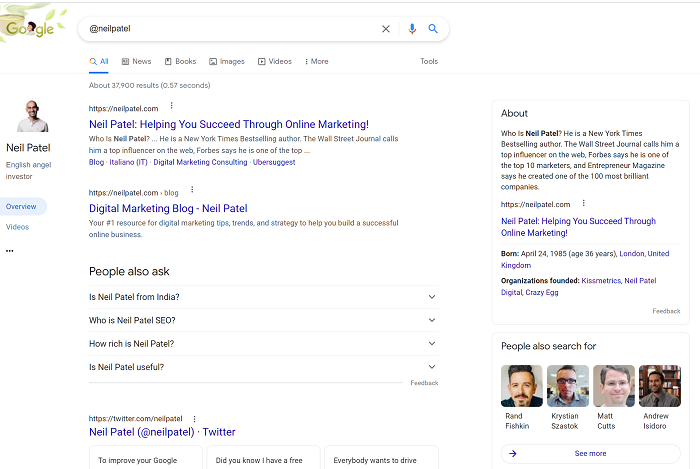

With the social media search Google secret, you can use the @ symbol followed by the handle of an account. Google will compile results for that user, including web pages and tweets.

You can also narrow your search by typing those terms followed by the site you want to search, like Twitter. This could show you the person’s account, mentions of their account, and accounts using similar handles or owned by people with the same actual name.

This can help you isolate mentions of competitors or brands you want to explore further.

Much like the above @ function, you can find much more than profiles with Google search functions.

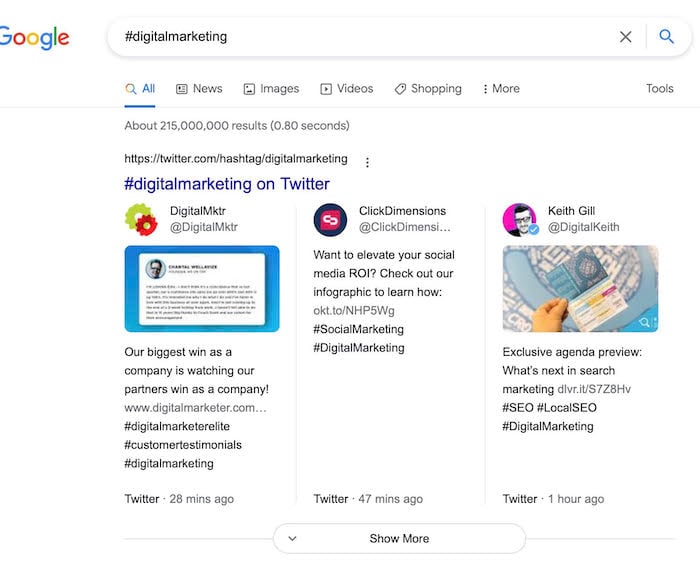

Use the # symbol to aggregate hashtag results, including the social presence associated with the words or phrases.

For example, if you search #digitalmarketing and change the search date to the past 24 hours under “Tools,” you’ll see the most recent posts across social media that discuss digital marketing.

If you want a tight lens, change the result type to verbatim using quotation marks—”#digitalmarketing”—to exclusively see the use of the hashtag.

This search functionality lets marketers see which keywords align with your brand’s message while simultaneously investigating how competitors use social media.

From identifying how frequently your site is crawled to relaying information about a page that’s currently down, you can learn a lot from caches.

To access the saved copy of a website, simply use the cache: search command before a site’s URL.

You can view the most recent version of a site within the cache copy, so don’t expect to find a years-old draft.

Within the cached copy, you can view the full version, text-only version, or view source. You will also see the timestamp and snapshot taken by Google.

While in its infancy, Google didn’t make many updates to its algorithms annually. Now, the algorithm is updated countless times a year.

Why should you care about this (fairly open) Google secret?

Updates mean changes to how pages display in the search engine result pages (SERPs) and can impact your search visibility.

While these updates have historically ranged from removing spam to ad placement on the SERPs, there’s a significant update on the horizon impacting how marketers gather information about their intended audience.

Google plans to remove all third-party cookies from its engine. Used as a tool for tracking individual movement across the web, cookies have not only long been a marketer’s best friend but also a security threat.

While cookie removal is a massive update, tons of additional updates can impact your digital strategy in other ways.

To stay ahead of these updates, take steps to ensure that you build agile, editable sites and pages that can roll with the changes, setting you up for digital success.

Have you struggled to boost email sign up, increase site search traffic, or get more leads?

If you answered yes, the root cause of your problem may be your bounce rate.

Your bounce rate refers to the number of individuals who visit your landing page and leave without conducting any other interaction.

Bounce rates are important metrics because they allow you to understand audience on-page behavior.

And Google has a clear record of this behavior through Google analytics.

If you’re experiencing high bounce rates and struggling to achieve your marketing goals, don’t fret. There are several steps you can undertake to reduce your bounce rate:

Does your content look like one big chunk?

If so, you need to break it up.

Ideally, your content should be quick and consumable. Here are a few tips for making your pages more readable:

Meta descriptions are HTML attributes that explain what a searcher can anticipate finding on a given page. Search engines use these descriptions to determine what your page is about.

Ideally, meta descriptions should be 155 characters long. If you exceed this length, the searcher will see an ellipsis (…) at the end of the description. This can result in a higher bounce rate since your site may not have been adequately described.

To optimize your meta descriptions, try to reach that ideal character length of 155 and include relevant keywords.

Are you looking to engage site visitors? There’s no better strategy than using interactive content.

Interactive content entices users to take action rather than simply bouncing from your site. This way, you can lead visitors to explore your site to learn more about your organization.

Examples of interactive content include infographics, e-books, lookbooks, quizzes, and checklists, all of which create and maintain engagement.

While some things at Google may seem hidden, Google releases its own SEO guides.

These tools vary depending on skill level and familiarity and even include a starter guide and developer guide.

These guides cover nearly everything you need to know about succeeding with SEO on Google.

For the last decade, Google has hosted an event dubbed Google Camp during the summer.

Don’t let the cutesy name fool you—this isn’t a bootcamp for coders or developers.

It’s a star-studded meeting of the minds that occurs during the summer months.

Annually themed, the camp has covered humanitarian topics like global warming and education.

You can find former presidents and current starlets, fashion designers, and tech leaders attending these events.

And while admittance to this event is highly selective (not to mention expensive), attendees allegedly enjoy in-depth conversation and relaxation.

While Google may be the world’s most-used search engine, it is also arguably the world’s most fun search engine. Chock full of Easter eggs that range from solitaire to the functionality to create a heart-shaped graph, you can find a way to entertain yourself when taking a break from customer research. We break down our current three favorite Easter eggs below.

Whether you’re teaching your kids the nuances among varying animal sounds or simply want to have some nature-themed time, this secret feature is endlessly delightful.

To access Google’s animal sounds feature, enter the search phrase “animal sounds” into the search bar and let the fun begin.

If you’re in search of another distracting Google Easter egg and are craving nostalgia, you can try your hand at a classic game of X’s and O’s.

Simply enter the term tic tac toe into the search bar, and you’ll be on your way to a competitive game with Google AI.

Found yourself sitting with a yes or no question that the flip of a coin can only decide?

If you don’t have a quarter on hand, don’t fret. Google has one for you. Simply enter the phrase flip a coin into the search bar, and you’ll have your answer.

While you probably use Google Maps in your day-to-day life, you can also score directions to any location directly from the search bar. For example, simply type “directions to [destination] from [location]” into the search bar, and Google will provide step-by-step directions. You can even choose whether you’d prefer directions by car, public transit, or foot.

If a website doesn’t include a search function, don’t fret. With Google, you can search a website’s content for a specific query. Simply add site:[website] to the beginning of your search, and you’ll be directed to results from that particular site rather than the entirety of the web.

While most Google users know how to conduct image and video searches, did you know you can further vary your search results by medium?

If you’re searching for a book, click the menu item entitled “More.” From here, you can select books, news, or movies and remove any other search clutter that gets in the way of your aim.

While we all aspire to land on Google’s first page, sometimes the information you need doesn’t land there. To view more search results, select “Settings” below the right-hand of your search bar on the results page. From here, you can adjust the number of search results that appear.

Yes! While you may be using standard search queries in the search bar, Google possesses deeper functionality than meets the eye.

Yes, and yes. Google makes thousands of updates to its search algorithm annually. These updates can significantly impact how your site manifests on the SERPs.

While the answer here is two-fold, we believe that the best offense is a good defense. While many of Google’s more extensive changes are publicized before they go into effect, some are not. By building an adaptive and agile site, you can prepare for whatever updates come your way.

Yes, they do. Every year, guests gather in the summer at a themed retreat focused on a humanitarian issue.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “Does Google Have Secret search functions?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Yes! While you may be using standard search queries in the search bar, Google possesses deeper functionality than meets the eye.

”

}

}

, {

“@type”: “Question”,

“name”: “Does Google update its search algorithm, and should I care?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Yes, and yes. Google makes thousands of updates to its search algorithm annually. These updates can significantly impact how your site manifests on the SERPs.

”

}

}

, {

“@type”: “Question”,

“name”: “How can I keep up with Google’s changing algorithm?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

While the answer here is two-fold, we believe that the best offense is a good defense. While many of Google’s more extensive changes are publicized before they go into effect, some are not. By building an adaptive and agile site, you can prepare for whatever updates come your way.

”

}

}

, {

“@type”: “Question”,

“name”: “Does Google Really Hold Secret Conferences?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Yes, they do. Every year, guests gather in the summer at a themed retreat focused on a humanitarian issue.

”

}

}

]

}

Regardless of whether you’re a digital marketer or a business owner, it never hurts to learn more about the search engine that drives the majority of traffic to your website.

If we’re honest, we all want more legitimate site visitors, better optimized SEO, and high-converting web pages, right?

As you learn more about Google secrets, you can use them to your advantage.

That SEO guide? We would suggest getting very familiar with its contents.

And while you may not find yourself in Southern Italy at Google Camp, you will have a much better chance at finding your site ranking on the first page of Google’s SERPs.

What Google secrets do you know?