How to Build Paid Ad Campaigns Around Typos, Misspellings, and More

We all make mistakes. It’s part of being human.

Unfortunately, in some cases, mistakes can be costly.

If you’re a marketer running paid campaigns, mistakes can actually be blessings in disguise. That’s because you can build paid ad campaigns around typos, misspellings, and other types of mistakes if you play your cards right.

Mistakes in ads have a high chance of going viral. People love making fun of other people’s mistakes. In today’s world, that means sharing your mistake with their network. An ad with a typo, misused apostrophe, incorrect homophone, or any other error could make more people aware of your brand than ever before.

Whether or not that’s a good thing largely depends on how you handle the issue. Rather than trying to cover up your mistake, take advantage of it.

While mistakes may be embarrassing and used well, they can also be a tool to shine the spotlight on your brand or product.

6 Clever Ways to Use Typos and Misspellings in Paid Ad Campaigns

Sometimes using conventional digital marketing practices only puts you in the same league as your competitors. In today’s crowded market, you may need to give yourself an edge.

Sometimes that involves leveraging mistakes in your paid ad campaigns, particularly your ad copy. Here are six ways you can use written mistakes to your advantage when engaging in paid advertising.

1. Poke Fun at Previous Mistakes

If your brand made a mistake in a previous campaign, go all in and make a joke of the mistake in your next paid ad campaign.

For best results, share the ad on the social media platforms where the mistake got the most coverage. Make sure to tag those who initiated the conversation around the mistake and any influencers who joined the chat.

There are two big reasons you should lean into your previous mistake.

It Humanizes Your Brand

Admitting to your mistakes can be a great way of showing the human side of your brand. One particularly human trait that will stand out is humility, a quality that will help you earn your customers’ trust.

Great Way to Fan the Flames of a Viral Brand Awareness Campaign

The conversation around your first paid ad mistake is a spark you can fan into a blazing brand awareness inferno. Unless your error made your ad offensive, instead of apologizing, poke fun at yourself. Think of how many of the most beloved comedians are self-deprecating!

The next time one of your paid ads goes out with a mistake, take it as an opportunity to run a fun campaign.

2. Incorporate Common Brand Name Misspellings

Some brand names were designed to be spelled wrong. Take, for example:

- Dunkin’ Donuts

- Kool-Aid

- Froot Loops

- Play-Doh

These were purposely misspelled for brand “stickability” so people remember them.

What happens if people often misspell your brand name?

Use that to your advantage by incorporating those wrong spellings in your paid ad campaigns.

A little humor here will go a long way. Humorously call out the misspelling of your brand name. When people search for your brand using the wrongly spelled version of your brand name, your ad may pop up.

It’s a win-win situation. Your customers still get to find you, and you’ll still get the traffic you would have otherwise missed due to the typo.

Let’s face it. No matter how much you may try and educate people about the correct spelling of your brand name, you’ll always find those who still misspell it.

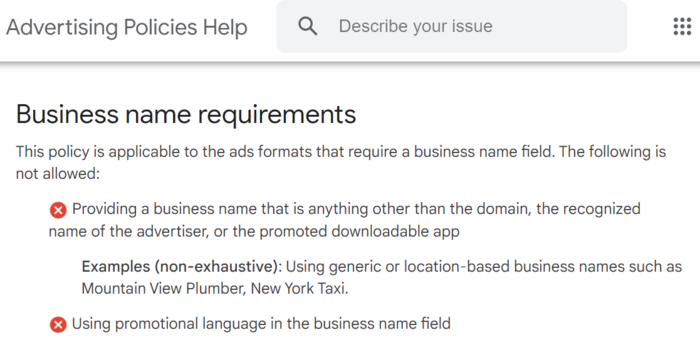

That said, when creating your ad, make sure not to use the wrong spelling of your brand name in the business name field. This could get you in trouble as it goes against Google’s editorial guidelines.

3. Use a Word With a Double Meaning

Creativity is an essential element of creating paid ads that work. One creative hack you can use to boost your campaigns is using homonyms in your ads. These are words that are spelled and sound the same but have more than one meaning. Examples of homonyms include:

- bark

- arm

- pen

Words with more than one meaning can make your ad memorable when used well.

That said, be sure your target audience will appreciate the joke. Consider their preferences before going with something a little “scandalous,” for instance.

4. Use Sensational Spelling to Make an Effect

Sensational spelling is an excellent marketing gimmick you can leverage to differentiate your brand, products, and even ads. If you’re wondering, sensational spelling refers to the deliberate deviation from the standard spelling of a word while still maintaining its pronunciation. Common examples of sensational spellings include:

- Blu-ray

- Fiverr

- Krispy Kreme

The purpose of sensational spelling is more for special effect than anything else, and that effect works on two primary levels:

Visual Impact

The visual effect of sensational spelling is a powerful tool for stopping searchers in their tracks. Moreover, because the spelling looks out of the ordinary, it evokes a sense of curiosity.

Emotional Effect

Because they look cool, words that leverage the device elicit positive emotions from your target audience when they see your ads. This helps create an emotional attachment that works in your favor by giving your conversion rate a push.

5. Use Common Typos and Misspellings in Keywords

Keyword research plays a huge role in any digital marketing campaign. While it’s common to use exact match keywords and synonyms, marketers rarely consider using typos and misspelled keywords.

When conducting keyword research, take note of wrongly spelled keywords that have a decent volume. Chances are that few brands are incorporating them into their campaigns. Therefore, bidding on them won’t be as expensive as bidding on the correctly spelled version.

Including these types of keywords in your targeted keyword list will extend the reach of your ads while still keeping your ad spend relatively low.

Bidding on typos and misspelled words is an excellent way of tapping into premium traffic. However, you must be careful to execute your campaign strategically. Otherwise, it might backfire. For example, avoid using dynamic keyword insertion when running a paid ad campaign with typos or misspelled words. Using dynamic keyword insertion will result in the correctly spelled version of your keyword being placed in your ad.

All that said, intentionally misspelling words often can lower trust in your attention to detail, and you don’t want to resort to unsavory techniques to include these misspelled keywords without them being visible to users.

Are there words that are commonly misspelled that you might use in your content? Then find ways to work them in naturally! For instance, if your company’s mascot says “Voila!” a lot, you could write something like “Voila, pronounced ‘walla’…”

Take advantage of them and build some paid ad campaigns around them.

6. Misquote Popular Quotes

People love quotes. They spice up conversations, are a great source of inspiration, and can help build effective paid ad campaigns.

Yes, you read that right.

Misquoting a well-known quote in your niche disrupts your readers’ thought processes and gets them to focus on the message you’re trying to convey. It may also make them chuckle.

For your next campaign, consider taking quotes from a popular movie or public figure and incorporate and put your own twist on it.

Remember—make sure your audience knows you’re in on the joke. Otherwise, they could end up thinking you just didn’t pay attention.

2 Examples of Paid Ad Campaigns With Intentional Typos

Need a couple of examples of paid ad campaigns built around typos?

I’ll do you one better and show you two.

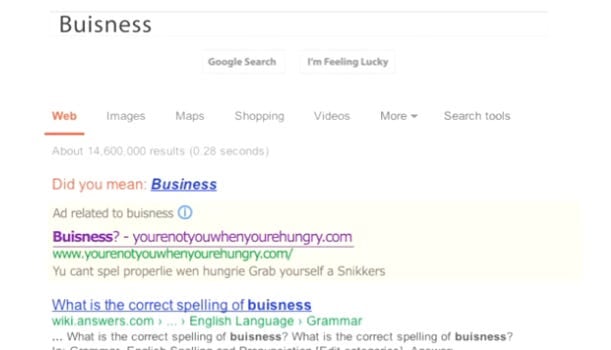

1. You’re Not You When You’re Hungry—Snickers

A classic example of a paid ad campaign that intentionally used a typo is the Snickers’ “you’re not you when you’re hungry” campaign.

The campaign involved the brand bidding for about 25,000 of the most popular grammatical errors and misspelled search terms. Each time a person typed one of those in the search bar, the first ad would direct them to Snickers’ website.

One factor that made this campaign a success is the humorous nature of the campaign. Snickers even went as far as misspelling their name (and many other words too). For example, take a look at the ad below:

An interesting element about this campaign is that Snickers didn’t build their campaign solely on brand or product-related misspellings. To widen the reach of their campaign, they targeted words that are commonly misspelled by people searching on Google.

Now that’s what I call thinking out of the box.

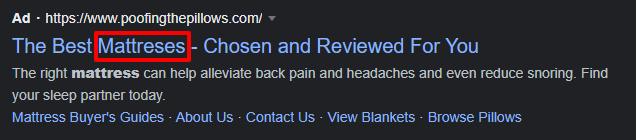

2. Sleep Easy on a Spelling Slip—Poofing Pillows

Ten percent of search queries contain a spelling mistake. Knowing the common spelling mistakes for your product can give you the advantage of utilizing them in your paid ad campaigns.

Here’s an example from Poofing Pillows:

As you can see, Poofing Pillows clearly knows how to spell “mattresses.” However, they’ve used the common misspelling and the correct spelling in their paid ad to hit both keywords.

Make sure to create a different ad group for these types of ads for better tracking and management.

Frequently Asked Questions About Paid Ad Campaigns

Before we wrap up this interesting discussion on building paid ad campaigns around typos, misspellings, and mistakes, let’s quickly answer a few FAQs about paid ad campaigns.

How do paid campaigns work?

Brands bid for keywords on search engines, social media, and other advertising platforms. The ad that wins the bid gets displayed.

Are paid ads still worth it?

Despite the stiff competition for keywords, paid ads are still a great way to generate leads and drive sales.

How can I make my paid ads stand out?

Be different. One way you can do that is to deliberately use typos and misspelling mistakes. People might stop to take a closer look.

Do paid ads with typos work?

If done well, paid ads with typos can work. They help you tap into a segment of traffic that few are looking to tap into. You can also get to spark interesting conversations around the typo, leading to a boost in brand awareness.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “How do paid campaigns work? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Brands bid for keywords on search engines, social media, and other advertising platforms. The ad that wins the bid gets displayed.

”

}

}

, {

“@type”: “Question”,

“name”: “Are paid ads still worth it?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Despite the stiff competition for keywords, paid ads are still a great way to generate leads and drive sales.

”

}

}

, {

“@type”: “Question”,

“name”: “How can I make my paid ads stand out? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Be different. One way you can do that is to deliberately use typos and misspelling mistakes. People might stop to take a closer look.

”

}

}

, {

“@type”: “Question”,

“name”: “Do paid ads with typos work?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

If done well, paid ads with typos can work. They help you tap into a segment of traffic that few are looking to tap into. You can also get to spark interesting conversations around the typo, leading to a boost in brand awareness.

”

}

}

]

}

Paid Ad Campaigns: Conclusion

Paid ad campaigns. Typos. Misspellings. Grammar errors. Can anything good come out of these combinations?

The simple answer is…possibly.

It all depends on how you build your campaigns. Using the tips and strategies outlined above, you can create paid campaigns around typos, misspellings, and other types of mistakes.

These campaigns could help you drive brand awareness, boost sales, and achieve many other business and marketing goals.

Have you ever made a typo or other glaring mistake in your paid ads (intentionally or not)? How did that work out?