Article URL: https://www.ycombinator.com/companies/veryfi-inc/jobs/aWDu3no-account-executive-ae

Comments URL: https://news.ycombinator.com/item?id=30358914

Points: 1

# Comments: 0

Article URL: https://www.ycombinator.com/companies/veryfi-inc/jobs/aWDu3no-account-executive-ae

Comments URL: https://news.ycombinator.com/item?id=30358914

Points: 1

# Comments: 0

A court in Ontario froze access to the millions of dollars in the GiveSendGo account of the Freedom Convoy 2022 on Thursday.

Twitter announced Sunday that it had permanently suspended the personal account of Rep. Marjorie Taylor Greene, R-Ga., over alleged COVID-19 “misinformation.”

If you still think Facebook and Twitter are the be-all and end-all of social media marketing tools, think again.

Say “Hi” to your business’s new best friend: business Pinterest accounts.

Eighty percent of Pinterest pins are repins, which means this is a platform that values sharable content. The average lifespan of a pin is three months which is much longer than Facebook which averages five to six hours, and Twitter which averages at 15-20 minutes..

Since Facebook purchased Instagram, Pinterest has become the hot ticket item for business marketing.

That’s for good reason. If an increase of 30% in Pinterest accounts over the last year isn’t an indication that your business should be joining over 250 million monthly active users, I don’t know what would be.

Aside from feeding obsessions with exotic destiny vacations and gourmet food, the real strength of Pinterest is the integrated features of its business accounts. Join the businesses with Pinterest for Business accounts, and you’ll get added marketing features to promote your brand on one of the fastest growing and insanely popular social media platforms.

If you don’t have an account already, or if your account is personal, you’re going to need to sign up for an official Pinterest for Business account to tap into the full potential of Pinterest’s marketing potency. With your business account, you get:

The terms of service are a little bit different for a business, so be sure to read through them. The difference comes from the fact that you are using the account commercially.

You’ve still got the same Acceptable Use Policy and Pin Etiquette Policy, but there are a few guidelines for commercial use:

Pinterest doesn’t just give you the platform, they create educational marketing materials to teach you how to maximize its effectiveness for marketing your business.

They offer:

You can also check out the Pinterest Blog to stay updated on when these materials will be out and get some basic tips.

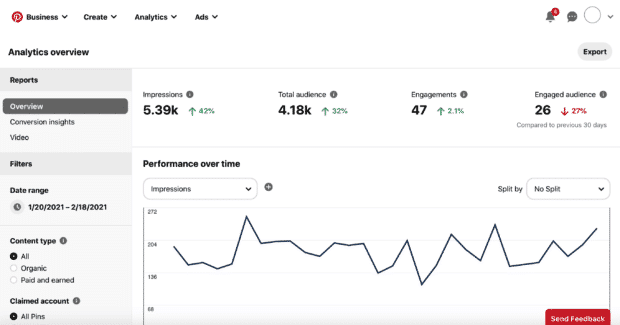

Pinterest Analytics is one of the newest and most awesome features of a Pinterest for Business account. When you verify your account, you get access to important tracking information. You’ll be able to see which strategies and content work so you can constantly improve your marketing.

There are five different types of Rich Pins, all loaded with more information than your average pin for serious sales power. They include real-time price and stock updates, direct links to your site, and interactive map locations. There will be more details on Rich Pin strategy later.

Pinterest has promised some new tools exclusively to business accounts in the future. As of right now, that includes buyable pins for e-commerce, Promoted Pins, the Pin It Button, and the Widget Builder. As new tools are being added, you can stay updated by joining the Pinterest newsletter.

You get to use your business name instead of the typical First + Last Name formula. This means your Pinterest account won’t have an automatic link to your Facebook account, so you should add a Facebook tab to your Pinterest home page.

Your pins can get engagement for your business if you execute them right.

Pinterest has been described by the Social Media Examiner as a visual search engine. Just like when you are writing your blog articles or posting on your business Instagram account, you want your content to be searchable.

If it’s not searchable, then it won’t be found or seen.

Therefore, before you grab that mouse to start pinning, you have to understand the Pinterest culture, AKA what your followers search for, and learn how to create popular pins.

If you know what the most popular Pinterest categories are, then you’ll have a better idea of which boards will work for your business.

Most of Pinterest users, 71.1 percent to be exact, are female. Males users only account for 14.9 percent of the audience. Pinterest posts are categorized, so if your business doesn’t have anything to do with DIY crafts, then don’t have a board dedicated to the art of glue-gunning. Pick the most relevant popular ones!

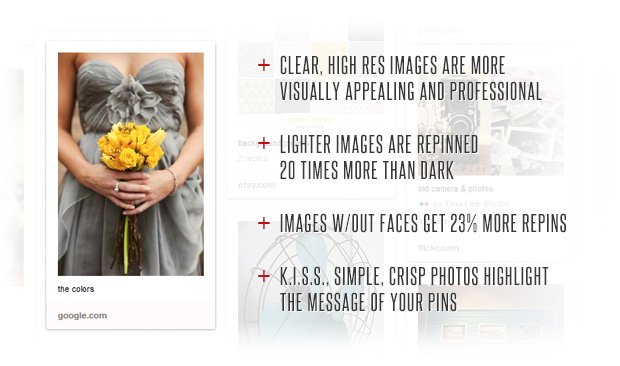

One quick perusal of Pinterest and it’s clear how visual a site it is. With such an emphasis on visual impact, your images are the cornerstone of any pin you share.

What makes the top Pinterest pins so popular?

All pins have the same width, with an unlimited length. A good size to shoot for is 736×1102 pixels for a typical pin. It’s not too big, and not too small. Canva’s Pinterest template is this size and makes sizing your images a lot easier.

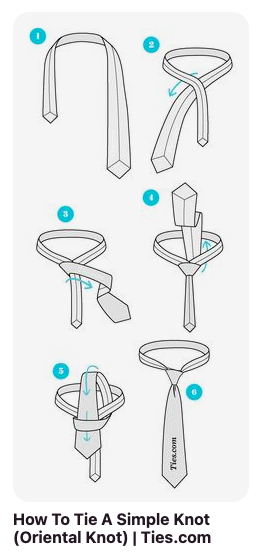

Sometimes it’s good to take advantage of the longer length allotment. The term “instructographic” was coined by Pinterest and it is another name for infographics. These are popular because of their DIY, how-to nature, which we know is popular on Pinterest.

It’s one thing to create a fantastic pin, but it’s a whole other game to get it seen and shared. No one is going to find your pin if you don’t optimize for engagement.

The best times to pin depend on your target audience’s habits, so you should always test for your specific optimal posting times. On average, the best times to post are 2 PM – 4 PM EST and 8 PM – 1 AM EST; and, research by HubSpot says Saturday morning is THE best time to post.

Add a hovering Pin It button to any image on any of your sites or your phone app through Pinterest directly. If you use WordPress, there’s a Pinterest Pin It Hover button plugin.

These simple-to-integrate buttons direct your site visitors to either check out your Pinterest account or actually pin your site’s content on their own accounts. If you don’t have these buttons, there is little chance your site will bring ANY interaction with your Pinterest account.

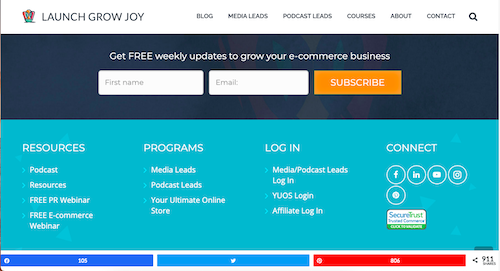

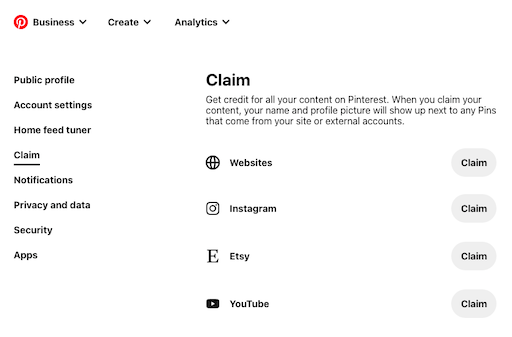

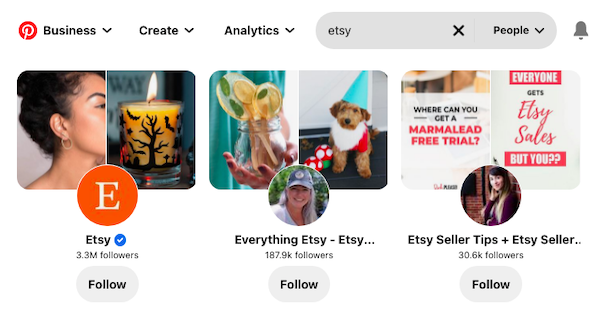

You don’t want to have to start over with followers when you create a new social media account. It’s super easy to connect your Instagram, Youtube and Etsy accounts to your Pinterest for Business account.

This will help you get more followers by tapping into the ones you already have on other platforms. It also will help spread your content across platforms so more eyeballs see it. It will add relevant buttons to your Pinterest account.

To connect your social media accounts:

Take the difficulty out of getting people to find your pins by sending the pins straight to them! Your newsletter is the perfect place to throw in a couple of your latest pins and direct subscribers to your Pinterest account. Try this:

“Our most popular pins from this week. Head on over to our Pinterest for even more!”

You have to use some SEO strategy to get your pins discovered by the eyes of your target audience. Don’t worry, it doesn’t take much to optimize your pins in regard to Pinterest searches. Just follow these steps:

As with any SEO you use, make sure not to sound too “keywordy.” Don’t go too crazy and add three keywords to your title and descriptions like a robot would. Optimize and still sound human by simply adding a strong keyword within the right context.

In the same way you use a call-to-action in your ad copy, a call-to-pin will significantly increase the engagement of your pins. In your pin’s description, add a little something like:

“Repin to your own inspiration board.”

Now that you know what kinds of pins are popular and how to get your pins seen, the next step in Pinterest marketing is to use your pins to build relationships with followers and influencers that will grow your reach.

As we all know, more reach = more success.

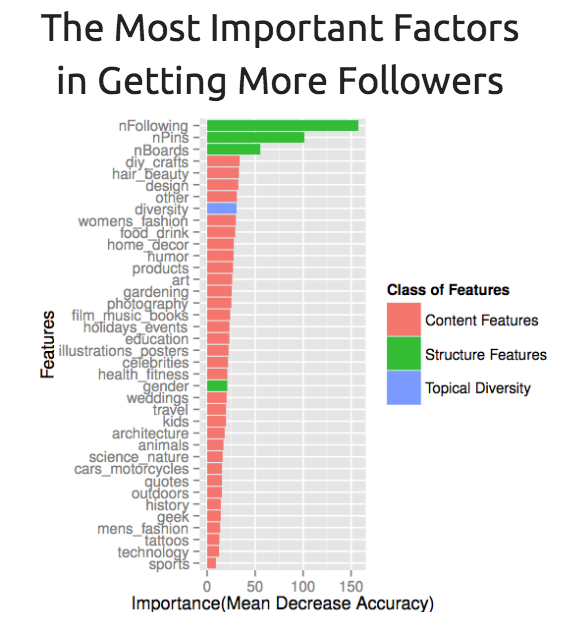

Knowing what users look for when following other accounts will allow you to give them what they want and, in turn, grow your following. A little mind-reading never hurt anyone.

The University of Minnesota’s Pinterest study found that the three main factors that Pinterest users take into consideration in the should-I-follow-or-not decision-making process are:

To be on top of those factors and build relationships to grow your reach, you need to:

To get more Pinterest followers, you should post between 5-30 new pins every day. Make sure you are not just repinning the content of others, but also pinning your own unique pins with your own content.

Warning! Avoid a major Pinterest faux pas: don’t pin all 30 new pins within 5 minutes. Spread your pinning throughout the day.

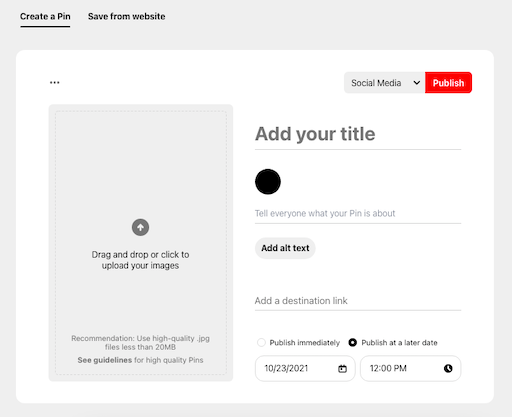

Tip! You can schedule pins with a business account.

Just like you respond to tweets, Facebook posts, and Instagram comments, engage with your followers directly by answering their questions and responding to their comments. Go the extra mile and address them directly, using their names to really take your customer service to the next level.

Engagement is a two-way street. You need to reach out to your followers’ boards as well. Leave comments on their pins so they’ll feel some love. Their followers will see your brand, too!

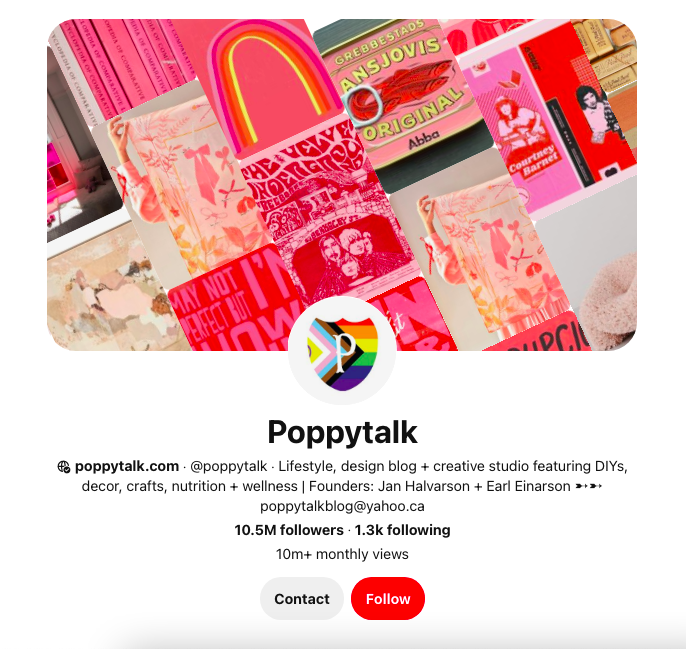

The best way to see a successful Pinterest strategy in action is to follow and engage with popular boards. You can learn a lot from the big dogs. See what kinds of pins they pin, what kinds of boards they have, and how much engaging they do. Your goal is to get on that level!

If you are commenting on these popular pins, your brand name will be seen by the huge number of people who follow those boards.

Tip! It’s a good idea to follow popular boards because they are relevant to your industry and business as opposed to “just because” they are the most popular. If your business has literally nothing to do with wedding fashion, you can do yourself a favor and follow the boards that have a following closer to yours. Those are the people you want to connect with anyway.

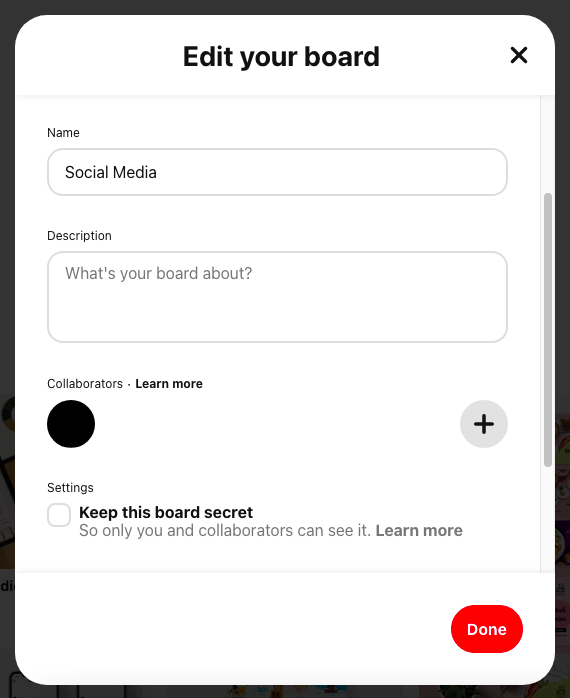

Another cool board feature for marketing is the Open Board, which allows users to contribute their own pins. All you have to do is give them pinning access by adding their name or email. You, as the creator, of course, have full veto power, and your contributors aren’t able to change the board name or description.

This feature is great for marketing because you get your community involved in a personal way.

Invite your followers and get big authority brownie points if you can get industry experts and leaders to contribute to your boards!

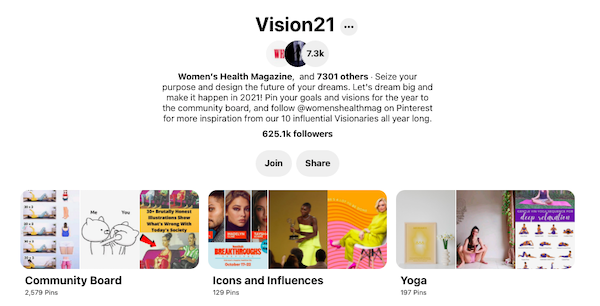

Women’s Health Magazine created an open board called “Vision 21” where their followers pin their goals and visions. It promotes fan interaction and the brand at the same time! Talk about win-win.

Reach a wider audience and gain more followers by reaching out to influencers in your field.

Start by following their boards, repinning their pins, and leaving engaging comments on their pins. Once you’ve dropped your name that way, you can initiate a bigger collaboration.

Ask if they will post on a board of yours, or offer to contribute to one of their boards. Offer ideas for their boards and show that you are familiar with their content when initiating collaboration, and you’ll be closer to that “yes” you’re looking for.

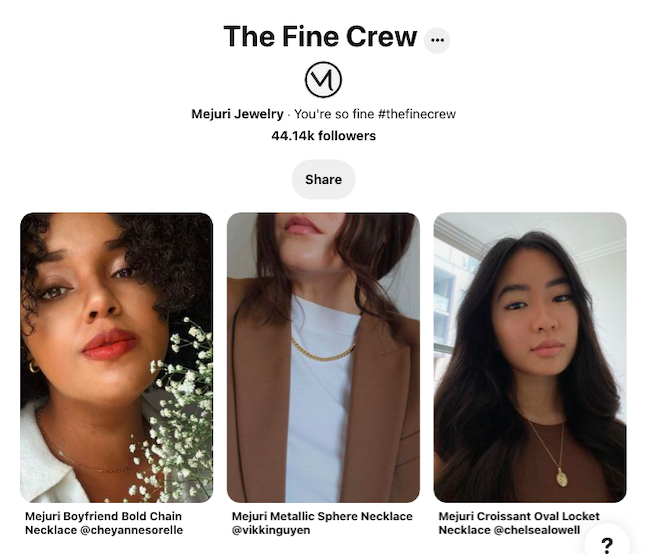

Mejuri set themselves up for some great collaboration with their board dedicated to their community with the #thefinecrew. The Fine Crew board showcases their products worn by their community. Small influencers and brand partners are featured in Mejuri’s Instagram and Pinterest making it a great opportunity for cross-promotion.

You know that when you create a new account with Instagram or another social media platform, they ask if you want to “Find Friends” using your phone’s contacts or Facebook friends.

Well, to save time and get a solid starting foundation of followers, Pinterest allows you to search for existing accounts.

My friends, I would like to introduce you to Rich Pins. Trust me, they have earned their name.You’ll see the big brands like Target and Wal-Mart taking advantage of Rich Pins,and, you should, too!

I’m not guaranteeing that you will be rolling in a pile of Benjamins with just a couple of Rich Pins, but there is a reason they are called “Rich Pins.” They are full of valuable, traffic-generating information; and, right now, they are the best direct strategy for growing your sales in the Pinterest sphere.

Rich Pins come in 3 different flavors: recipe, article, and product, all fully loaded with their own set of valuable features that will boost your engagement and direct traffic to your site.

When you apply for Rich Pins, you’ll get real-time information automatically updated on your pins and more ways to direct people to your site because your site will be linked to your Rich Pins. No hassle, no fuss. Just leads.

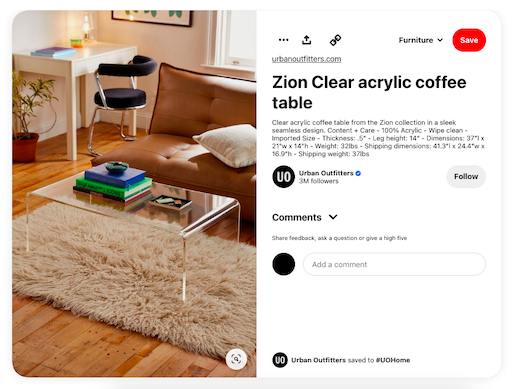

This example, from Urban Outfitters, shows the features of a “product” pin at work. You’ve got an official link to the store’s site, as well as updated live price and stock availability information.

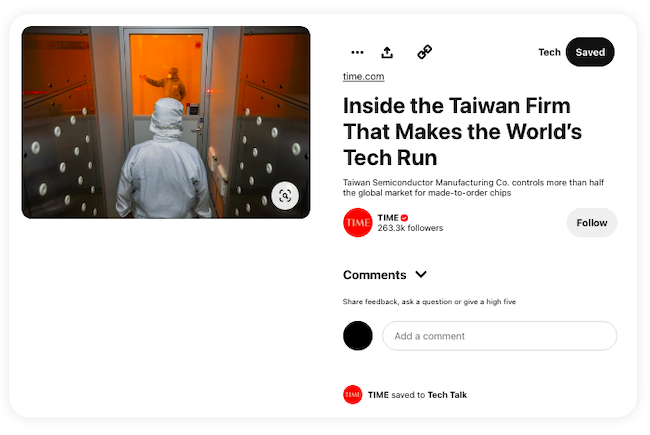

“Article” pins are also valuable in that they can promote your blog posts and direct Pinterest users to your blog. Article pins come with a larger title with your brand’s logo, a description, and a call-to-action at the bottom with a direct link to your original site.

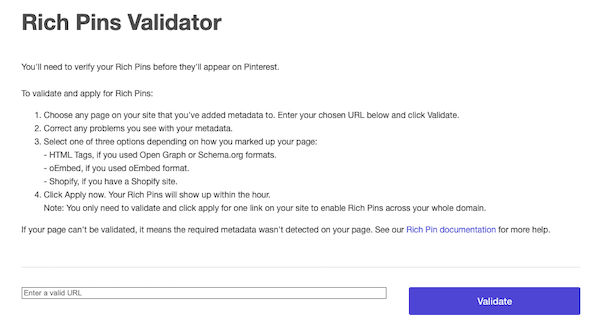

For any of your Rich Pins to have even the potential to direct traffic to your site, you need to get them validated on the Pinterest site itself. (If you aren’t the most tech-savvy, you’ll probably want some help from your web developer…it involves meta tags.)Here’s how to do it:

Once your Rich Pins are approved by Pinterest, they will be out there for the entire Pinterest world to see, to repin, and to be directed to your site.

I’m not telling you that you should think about using Rich Pins because it would help your business. I’m telling you that you NEED Rich Pins if you want to keep up in the crazy social media marketing world.

The Fortune 500 companies are all using Rich Pins. Follow the big boys, and you’ll have the potential for some serious growth.

The rule for all social media is to mix up your content. You will lose the interest of your followers and lose your chances of gaining any new ones if your content is static and not diverse enough.

Please, whatever you do, don’t just post product photos. Do you remember that study done by The University of Minnesota? Well, the diversity of pins was the 8th most important factor when users were deciding whether to follow an account. Throw in some other boards that give your followers added value to avoid coming off as overly salesy.

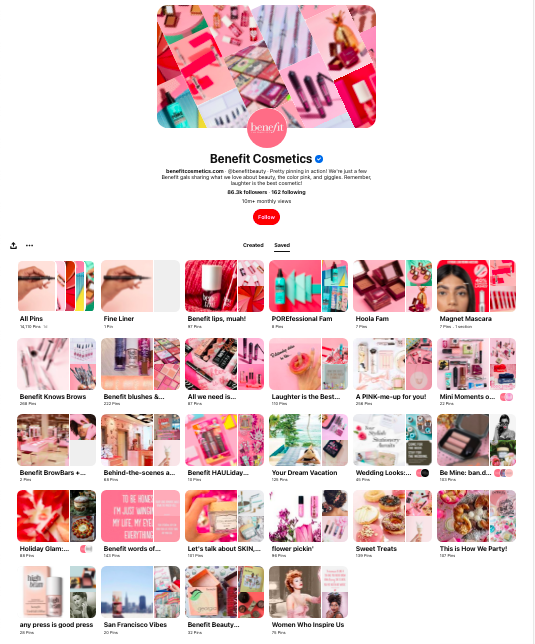

The official Benefit Cosmetics Pinterest does a great job of mixing up their content without stepping outside their niche. They have boards dedicated to their latest and hottest products, like “POREfessional Fam” and “Hoola Fam,” but also have a board just for “Behind-the-scenes at Benefit.”

All of these boards relate to their cosmetic products; but, by giving “A PINK me-up for you!,” they aren’t just saying “buy our makeup,” but “see how our makeup can help you.”

Not all of your pins are going to make sense as Rich Pins. (Product photos, events, and articles benefit from the added information provided with Rich Pins, but not all of your content will.)

It’s all about context.

When you are pinning images to your “brand inspiration” board, you don’t need Rich Pins. Relevant quotes to your business definitely wouldn’t call for a Rich Pin.

There is one piece of information that comes with Rich Pins that your other “simpler” pins need, too: a direct link to your site.

Even your inspirational pins need a link to your site because if one quote you posted last Tuesday changed one of your followers’ lives, they likely will want to check out your brand. If you have a link to take them to your site, they don’t have to go searching for information, and you increase the chances of them finding your site.

Simply include the link in your pin description, and you’re good to go.

Over time, you’ll be able to see which boards are more popular and get more engagement. Put your best foot forward and move these boards to the top of your page so when users come to your page, they will see your best material.

Another way to keep your content fresh is to piggyback off of holidays, seasons, and events. Like the Benefit Cosmetics’ss “Holiday Glam: LEAF x Benefit,” the more specific boards add more relevancy and catch attention because they make those products even more specific and create a sense of urgency. Take advantage of that!

Grab all those article Rich Pins you have, and organize them into their very own board! You’ll want to put this board at the top of your page so your followers will see it first thing. This will help draw traffic to your site and make it easier for users to find your content since it’s all in one easy-to-find-board. They will thank you.

One of the newest features on Pinterest for Business is the super helpful Pinterest Analytics. This feature is only for business accounts and allows you to see:

Why are these statistics important to you?

Because they will help your account and your reach grow.

The information gained from your Pinterest Analytics shows you which strategies work and which ones don’t. Knowing this, you will be able to build your future Pinterest strategy based on hard facts. The strategies that work are proven because you proved them.

To get access to your Pinterest Analytics, you’re going to need to verify your website first.

There is another reason verifying your account is a good idea. It will help you gain authority and build trust. When Pinterest users see that little globe icon with a checkmark next to your website, they know you’re legit.

You can verify your website in the settings section by adding a meta tag. This will give you a verification badge, and you’ll be official. If you choose not to verify your site, you can still include a link to your site on your page, but you won’t be able to use Pinterest Analytics.

Don’t miss out on the crucial information Pinterest Analytics will give you. Verify your account!

I just threw a lot of information at you, I know. Don’t feel overwhelmed. The aspects of this guide are all totally necessary and can be broken down easily.

Just to quickly recap…

Your Pinterest for Business account comes with a ton of marketing power that’s completely different from a personal account. To tap into that power, you need to:

If you follow the strategies here and learn from the engagement you get, your Pinterest for Business account will continue to develop for the better, attract more of your target audience, and direct people to your site.

Happy Pinning!

A business account on Pinterest is an account that gives users special access to features like analytics, pin scheduling, and business resources.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What is a business account on Pinterest?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

A business account on Pinterest is an account that gives users special access to features like analytics, pin scheduling, and business resources.

”

}

}

, {

“@type”: “Question”,

“name”: “What is the difference between a personal account and a business account on Pinterest?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

”

}

}

, {

“@type”: “Question”,

“name”: “Are business accounts on Pinterest free?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

”

}

}

, {

“@type”: “Question”,

“name”: “How do I make popular Pinterest pins?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

”

}

}

]

}

Social media marketing is crucial to building brand awareness and steady relationships with customers. Pinterest is one channel that can help you do the same thing for your business. As a visual platform, it stands out because it acts like a visual search engine tailored to user interests. With the right strategy, Pinterest can improve your SEO, your customer outreach and help your business gain new fans.

How will you use a Pinterest business account to amplify your marketing?

If you still think Facebook and Twitter are the be-all and end-all of social media marketing tools, think again. Say “Hi” to your business’s new best friend: business Pinterest accounts. Eighty percent of Pinterest pins are repins, which means this is a platform that values sharable content. The average lifespan of a pin is three … Continue reading How to Use a Business Pinterest Account For Marketing and Brand Growth

Article URL: https://apply.workable.com/assemblyai/

Comments URL: https://news.ycombinator.com/item?id=28042576

Points: 1

# Comments: 0

Starting your own business is one of the most rewarding ways to make a living. You get to see profits and growth as a direct result of the hard work you put in. But being a small business owner – or freelancer – comes with all sorts of unique challenges. In addition to selling your product or services, you also have to handle scheduling, bookkeeping, and financials for yourself.

Making sure you’ve got the right tools in place can make a huge difference to the success of your business. One of the tools you’re going to need: a solid business bank account. Below we take a look at why you need a business bank account, how to make the best choice when deciding on which business bank account to choose, what features you should be looking for, and how to make sure you’ve got a solid application for approval.

First off, let’s take a look at some of the reasons you need to open a business bank account in the first place.

It helps you keep your personal finances and business finances separate

The main advantage of having a business banking account is that it allows you to separate your personal finances from the finances of your business. If you’re a freelancer or sole proprietor, this saves you time and energy come tax season. If you’ve got employees then having a business bank account is something you’re definitely going to need.

Check out our professional research on bank ratings, the little-known reason why you will – or won’t – get a bank loan for your business.

It Lets You Maintain Better Bookkeeping for Taxes

Did we mention that taxes are important for small businesses? They are. Having a separate account for your small business lets you easily know what is a business expense and what isn’t. That makes for a streamlined process when filing taxes or handing them off to an accountant. The process saves you time and money. Also, mixing up personal and business finances is one of the easiest ways to get yourself in trouble with the IRS.

It Makes You Look More Professional to Customers, Clients, and Peers

Opening a small business account means you accept payments to your business name. This means if a customer were signing a check to your company they’d make it out to the name of your business, rather than to your name personally. That perception matters.

A small business bank account is the cornerstone to building your business credit. This allows you to apply for things like business credit cards, mortgages in the business name, and business lines of credit. All of these are important things for growing your company in the future.

Just because you’d like to open a business bank account doesn’t automatically mean you’re going to be able to. When you apply for a business bank account the bank will do background checks to make sure that you’re going to be a good customer.

Common reasons why someone might be denied a business bank account include poor personal or business credit history, the registered location of the company, engagement in banking activities that are deemed high risk, and association with high-risk industries. The last issue can be a particular problem for folks trying to open up a small business. While their own activities might be perfectly legal – or legal in their own state – association with an illegal business can sometimes lead to rejection.

For instance: when a person is selling CBD they might get rejected for its association with marijuana, which remains illegal at a federal level. Another example of high-risk clients for banks is any company that may have a high degree of chargebacks from customers, like the travel industry.

Check out our professional research on bank ratings, the little-known reason why you will – or won’t – get a bank loan for your business.

There are a couple of things you can do to help your high-risk business get approved for a bank account. The first is very basic: make sure you have got all of your legal documentation – and other material needed to sign up for a bank account – in perfect working order when going through the application process.

Being meticulous about what your business is and how it operates makes it harder to be turned down. You can also look for merchant accounts that specifically deal with high-risk clients, though those accounts can come with greater fees.

There are a number of different factors to consider when looking for a business bank account. Here are some things you’re definitely going to want:

You shouldn’t have to go into a brick-and-mortar location to do your banking. Being able to bank on the internet – and on your phone – means that you can get your banking done anytime and from anywhere.

If you’re able to bank on your phone, you also want to be able to deposit checks through the app. That way you’re not encumbered with going into a physical location every time you have a check to cash.

When running a business you’re going to want easy access to all the money going in and out of your account for bookkeeping purposes. Having easy access – and easy to understand – transaction records makes that a lot easier.

Having sub-accounts within your main account where you can automatically allocate money for taxes, savings, and expenses makes it easier to make sure you’re actually turning a profit with your business. It’s also imperative to the wildly popular profit-first model.

Understanding what you’re paying for each month and how much it costs allows you to save for the future. With tons of great options for a business bank account, you shouldn’t be putting your hard-earned money towards paying unnecessary banking fees.

Check out our professional research on bank ratings, the little-known reason why you will – or won’t – get a bank loan for your business.

After you’ve decided which business bank is right for you, you’re going to want to look at what you need to open for a business bank account. The type of information varies depending on whether you are a sole proprietor, LLC, corporation, or partnership. You can double-check that you have the proper documentation necessary by taking a look at this article. In general some things you’re going to want the following:

Here are some common reasons why you might be denied a business bank account:

Getting started with a business baking account can seem intimidating at first, but having a business account for your company will save you a lot of time and hassle in the long run.

Graham Isador is a writer in Toronto. His work has appeared at GQ, VICE, and Men’s Health, among other places.

Graham Isador is a writer in Toronto. His work has appeared at GQ, VICE, and Men’s Health, among other places.

The post How to Choose the Right Business Bank Account appeared first on Credit Suite.

A derogatory account on credit report doesn’t have to sink your chances for getting business funding. But let’s start with fundability.

Fundability is the ability of a business to get funding. This is everything from getting credit to business loans. Because every business needs money, it quite literally pays to enhance your fundability whenever and wherever you can.

In addition to how well your business pays its bills, and your personal credit score, and whether your industry is a risky one, there’s the matter of public records.

Public records include bankruptcy (both personal and business), liens, judgments, and UCC Filings.

Errors in any of these kinds of public records will affect fundability, so correcting such mistakes will enhance your ability to get funding.

Bankruptcy is a process a business goes through in federal court. The idea to help a business eliminate or repay its debt under the guidance and protection of the bankruptcy court. Business bankruptcies are often described as liquidations or reorganizations. This depends on the type of bankruptcy an entrepreneur takes.

There are three main kinds of business bankruptcy:Chapter 7, Chapter 11, and Chapter 13. The type to use will depend on organizational structure. See thebalancesmb.com/what-is-business-bankruptcy-393017.

Corporations are legal business entities separate from their owners. They are more truly separate than partnerships. But in the event of a bankruptcy, either type of structure commonly will file of Chapter 7 (bankruptcy protection), or Chapter 11 (reorganization). The chapters refer to the US Bankruptcy Code.

This one may be the best choice when the business has no viable future. It is typically used when the debts of the business are so overwhelming that restructuring them is not feasible. Chapter 7 bankruptcy can be used for sole proprietorships, partnerships, or corporations. It is also appropriate when the business does not have any substantial assets. For Chapter 7, see: law.cornell.edu/uscode/text/11/chapter-7.

If a business is a sole proprietorship, and an extension of an owner’s skills, it often does not pay to reorganize it. Hence Chapter 7 would be appropriate.

Before a Chapter 7 bankruptcy gets approval,the applicant is subject to a “means” test. If their income is over a certain level, their application does not get approval. But if a Chapter 7 bankruptcy gets approval, the business is dissolved.

In a Chapter 7 bankruptcy, the bankruptcy court appoints a trustee. The trustee’s job is to take possession of the assets of the business and distribute them among all of the creditors. The order in which creditors get their payments can depend on the type of debt (secured vs. unsecured).

After the distribution of the assets, and the trustee is paid, a sole proprietor receives a “discharge” at the end of the case. It means that the owner of the business is released from any obligation for the debts. But partnerships and corporations do not receive a discharge.

Keep your business protected with our professional business credit monitoring.

Chapter 11 may be a better choice for businesses with a realistic chance to turn things around. It is usually a choice for partnerships and corporations. It can also be an option for sole proprietorships if their income level is too high to qualify for Chapter 13 bankruptcy. For Chapter 11, see: cornell.edu/uscode/text/11/chapter-11.

Chapter 11 is a plan where a company reorganizes and continues in business under a court-appointed trustee. The company files a detailed plan of reorganization explaining how it will deal with its creditors. The company can terminate contracts and leases, recover assets, and repay some of its debts, while discharging others to return to profitability.

The business presents the plan to its creditors who will vote on the plan. If the court finds the plan is fair and equitable, it will approve it. Reorganization plans provide for payments to creditors over some time. Chapter 11 bankruptcies are rather complex and not all of them succeed. It usually takes over a year to confirm a plan.

The Small Business Reorganization Act of 2019 enacted a new subchapter V of Chapter 11. This subchapter of Chapter 11 seems to favor the side of the applicant for business bankruptcy. But it only applies if the applicant wants it to apply. See cornell.edu/uscode/text/11/chapter-11/subchapter-V.

For example, subchapter V does not require the appointment of a committee of creditors, or that creditors have to approve a court plan. Per the U.S. Department of Justice, the act:act: “imposes shorter deadlines for completing the bankruptcy process, allows for greater flexibility in negotiating restructuring plans with creditors, and provides for a private trustee who will work with the small business debtor and its creditors to facilitate the development of a consensual plan of reorganizations. See justice.gov/opa/pr/us-trustee-program-ready-implement-small-business-reorganization-act-2019.

Chapter 13 bankruptcy is a form of bankruptcy for individuals. Since a sole proprietorship is an extension of its one owner, the owner is responsible for all assets and liabilities of the firm. It is most common for a sole proprietorship to take bankruptcy by filing for Chapter 13. This is a reorganization bankruptcy. See Chapter 13: law.cornell.edu/uscode/text/11/chapter-13.

Chapter 13 is good for small businesses when a reorganization is the goal instead of liquidation. The entrepreneur files a repayment plan with the bankruptcy court. This details how they are going to repay their debts. Note: Chapter 13 and Chapter 7 bankruptcies are very different for businesses.

Chapter 13 is vital for individuals whose personal assets are tied up with their business assets, because they can avoid problems like losing a house if they file Chapter 13 versus Chapter 7. Chapter 13 lets a business stay in business and pay its debts. But Chapter 7 does not.

There are two other forms of individual bankruptcy. These are less common. Chapter 12 is bankruptcy protection for family farmers and family fisherman. See uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-12-bankruptcy-basics. Chapter 15 is bankruptcy protection when a bankruptcy matter involves people from another country. See uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-15-bankruptcy-basics.

In general, to correct bankruptcy issues, all you or your lawyer will need to do is file an amendment to your bankruptcy petition. These can be errors like forgetting to list an item of property, or disclosing an incorrect property value, or forgetting a creditor or income from a side business. See alllaw.com/articles/nolo/bankruptcy/bankruptcy-petition-mistake.html.

Keep your business protected with our professional business credit monitoring.

Per Investopedia, “A lien is a claim or legal right against assets that are typically used as collateral to satisfy a debt. A lien could be established by a creditor or a legal judgement. A lien serves to guarantee an underlying obligation, such as the repayment of a loan. If the underlying obligation is not satisfied, the creditor may be able to seize the asset that is the subject of the lien. There are many types of liens that are used to secure assets.”

Some of the worst errors when it comes to liens can involve real estate if land was used to secure a debt. Minor or typographical errors are called Scrivener’s errors. You can often fix them through either rerecording the deed of trust or by recording an instrument explaining and correcting the error. You cannot cure more substantial errors except by a Reformation lawsuit. This type of lawsuit asks a court to correct the deed of trust to reflect the parties’ intent.

Keep your business protected with our professional business credit monitoring.

The main ways you can lose in court are if you: default at the start and never answer a summons and complaint, lose a motion for summary judgment brought by the other side, lose a bench or jury trial, or exhaust all appeals and end up on the losing end.

If you or your business lose in court, then you may have a judgment entered against you. Judgments generally take the form of paying damages (money), or specific performance where you must do (or not do) something. Or the court enters an injunction and to prevent you from doing something. A civil judgment can’t send you to jail (that’s criminal, which is rather different).

Errors can take the form of a judgment entered against the wrong person and/or company. Or they can be a typo in the amount of money damages in the court’s records. Maybe there’s a judgment is entered but it’s already been satisfied (paid). Or there can be fraud or other misrepresentation on the part of one of the parties, or excusable neglect. For example, a city recovering from a major hurricane might not make the proper clerical entry of judgments a priority.

Correcting these errors can take several forms. Different states have differing rules. But every state wants their records to be right. They just have different ways you need to go about correcting the record.

For example, in Massachusetts, you or your lawyer will need to make a motion before the court under Rule 60(a). See mass.gov/rules-of-civil-procedure/civil-procedure-rule-60-relief-from-judgment-or-order. In Texas, you or your lawyer would need to file a motion for judgment nunc pro tunc (a motion to have the judgment corrected). See texaslawhelp.org/article/correcting-clerical-error-court-order-answers-common-questions#toc-9.

In Georgia, correcting a judgment comes under the general umbrella of relief from judgments. See law.justia.com/codes/georgia/2010/title-9/chapter-11/article-7/9-11-60. In Louisiana, it falls under an Amendment of Judgment, and you can correct calculation or language errors via motion. See law.justia.com/codes/louisiana/2015/code-codeofcivilprocedure/ccp-1951.

Like with most things, the faster you work to correct a legal judgment, the less it will cost you. In particular if the wrong person (you) is the defendant in a lawsuit, acting as fast as possible will save you in legal fees. Ignoring these problems will not make them go away.

When you secure a loan with property, creditors can tell other creditors about any of your assets in use as collateral for the secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the creditor of the creditor’s interest in the property. It’s in a creditor’s best interests to check for UCC filings, so they can make sure they’re the only creditor with a claim on that collateral.

Like anything else, there can be typographical errors in UCC filings. But the law says that, unless the errors “make the financing statement seriously misleading”, the UCC filing is still in effect. So if you’re depending on a typo to get out of a UCC filing, you might want to rethink that strategy. See law.cornell.edu/ucc/9/9-506.

For the most part, unless the errors are seriously misleading, the UCC says you don’t have to correct them. This is because the policy behind the law governing secured transactions under the UCC explains financing statements provide notice of a transaction. They give enough information to later potential creditors that the debtor’s property may be covered by an earlier creditor’s security interest. Essentially, a financing statement is the starting point in a later creditor’s due diligence process, not the conclusion. See jdsupra.com/legalnews/it-may-be-foul-but-there-is-no-harm-not-11403.

You can fix errors in public documents like judgments and UCC filings, but the mechanism for doing so will differ. This depends on the error, the type of record, and the jurisdiction. The faster you act, the better (and cheaper). Ignoring these mistakes will not make them go away. Correcting mistakes can make your business more fundable.

The post Credit is More Than a Score: How to Address a Derogatory Account on Credit Report When You’re Fighting a Public Record appeared first on Credit Suite.

Article URL: https://app.beapplied.com/apply/mortet0smh Comments URL: https://news.ycombinator.com/item?id=27012938 Points: 1 # Comments: 0

Article URL: https://docs.google.com/document/d/1kksPsH76klEYp6A-0c-ilcV-pBN2ldbAYWaeuPOM9OM/edit?usp=sharing Comments URL: https://news.ycombinator.com/item?id=26659368 Points: 1 # Comments: 0

The post By 10 (YC S17) Is Hiring Recruiting Account Manager first appeared on Online Web Store Site.