Ontario court freezes millions in trucker Freedom Convoy's crowdfunding account

A court in Ontario froze access to the millions of dollars in the GiveSendGo account of the Freedom Convoy 2022 on Thursday.

A court in Ontario froze access to the millions of dollars in the GiveSendGo account of the Freedom Convoy 2022 on Thursday.

Creating a successful startup is hard; it’s even harder without access to startup funds. However, if you’ve got a great business plan and the ability to create a buzz around your brand, equity crowdfunding could be the perfect option for your business.

New legislation is opening up this crowdfunding option and making it a more viable method of raising capital for thousands of businesses.

Equity crowdfunding enables members of the public to invest in a privately-owned company. An entrepreneur or a business, generally a startup, will use an equity crowdfunding platform to offer securities in return for an investment from members of the public.

Most commonly, that security will be in the form of shares, and as the company grows and prospers, the value of those shares increases, offering the investor a return on their investment.

Why is this important for businesses?

If you’ve ever started a business, then you know it’s not straightforward, and one of the biggest challenges is raising funds to get your company off the ground. In the past, if you wanted to raise funds through members of the public, then you would need to find a venture capitalist or angel investor (people with a net worth of at least $1 million, or with an annual income of at least $200k).

However, the introduction of the JOBS Act in 2012 opened the door for privately-owned companies to raise capital through regular members of the public.

On the other side of the equation, equity crowdfunding allows regular investors to get in on the ground floor of a business opportunity. Even the biggest companies in the world like Google and Amazon started off life as startups, and with equity crowdfunding, regular people have the opportunity to invest right at the beginning of a future Google’s journey.

For every Google or Amazon though, there are endless examples of startups that fail. In fact, the 2019 failure rate for startups was 90 percent, so investing through equity crowdfunding is a risk.

Many of the trends in equity crowdfunding stem from a need for consumer protection. When you invest in publicly-traded companies, you’re investing in an established, highly-regulated business, but it’s not necessarily the same story with equity crowdfunding.

It takes vast resources to become a publicly-traded company though, so it’s out of reach for startups and small businesses. Instead, they turn to alternative means of raising capital, such as equity crowdfunding, and while this offers regular investors great opportunities, it can also open them up to great risk.

This is why investing in startups was previously reserved for venture capitalists and angel investors because they were seen as having the means and experience to manage that risk. However, cutting the regular investor out of these options also created a two-tier system, where savvy investors couldn’t get in on enterprising startups.

While protecting investors is important, it meant that regular investors were missing out on promising opportunities, and startups were finding it hard to raise the capital needed to get their businesses off the ground.

This changed with the Jumpstart Our Business Startups (JOBS) Act, which set out legislation to open up the equity crowdfunding market.

Regulation remained strict, particularly compared with some other countries, but crucially, businesses could now reach out to “the crowd” for funding. With Regulation crowdfunding allowing companies to raise up to $1.07 million annually, and Regulation A permitting up to $50 million of funding each year, this offered businesses a viable option to raise capital.

In 2020, the Securities and Exchange Commission made some adjustments to the JOBS Act, raising the amount of capital businesses could crowdfund each year. Under the new regulations, businesses could raise up to $5 million annually through Regulation Crowdfunding and up to $75 million annually through Regulation A.

Since the average seed round in 2020 was $2.2 million, this made equity crowdfunding a much more feasible option for startups, allowing them to secure the funds they need to succeed in their business.

Equity crowdfunding is a relatively new market, and although it’s valued at over $10 billion, that’s a tiny drop in the ocean compared with the $282 billion raised through venture capital in just a year.

However, equity crowdfunding is growing quickly, and when you look to the markets in other countries, there are signs that this fundraising option could grow exponentially in the coming years.

Over in the U.K., equity crowdfunding is much more established. This is largely due to more favorable legislation that has allowed equity crowdfunding companies to grow much more quickly. However, with the update to the JOBS Act, it’s likely we might see a similar uptick in the U.S. startup market.

As you might expect with a growing market like equity crowdfunding, there are plenty of platforms to choose from. Each has its unique selling points, so it’s important to do your research and find the platform that’s going to represent the best deal for your business.

Once you’ve decided on a platform, you’ve got to apply, and this is a very important step. These platforms are extremely invested in protecting their investors, so they’re going to vet your application exhaustively. You’ll have to portray your business in a strong light, and offer up a business plan that represents value to the platform’s many investors.

If you’re accepted onto a platform, you can then decide on your terms (what type of security you want to sell, how much you want to raise, etc.). This is one of the big bonuses about equity crowdfunding because you’re in control of your terms.

You’re not negotiating with one single angel investor who might be able to negotiate you down. Instead, you’re putting your offer out to the crowd, and it’s up to each individual as to whether or not they take it up.

The last step is taking care of compliance by ensuring you have all the legal documents and pass the financial tests. For Regulation Crowdfunding (up to $5 million), you will need an independent financial review, but for Regulation A+ Crowdfunding (up to $75 million), you will need a full financial audit, which will take a bit longer.

If your business is found to be in good shape, then according to StartEngine you can be ready to raise funds through Regulation Crowdfunding in four to six weeks with very few costs, or through Regulation A Crowdfunding in about six months for a cost of roughly $50,000-$75,000.

Equity crowdfunding might be relatively new in the financial world, but plenty of companies have had huge success with it.

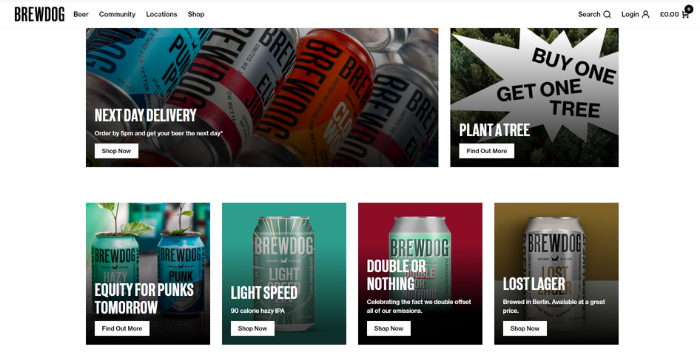

When we think of startups, our minds are generally drawn toward tech, but one of the greatest examples of equity crowdfunding comes from the world of beer.

Starting life in 2007 as two guys with a love of beer, BrewDog has developed into a $2-billion company, and equity crowdfunding has a lot to do with it. The privately-owned company is 22 percent owned by a collection of 120,000 investors who have put in around $95 million as of 2020.

In a world dominated by a handful of major brewers, this has allowed BrewDog to expand well beyond the reach of your average craft brewery, and they continue to use equity crowdfunding to invest in their green credentials.

Gaming company Paradox Interactive was able to raise $3 million in the first 8 minutes of its offer going live. This goes to show the power of crowdfunding and the ability it offers businesses to raise capital quickly.

Later that year, Paradox Interactive went public, listing on NASDAQ at a value of $420 million. This demonstrates that equity crowdfunding is more than just a tool for raising money, it’s also an opportunity to create a huge buzz around your business.

When someone invests in you, they’re going to become a brand advocate, and when you’ve got thousands of these people around the world, it can catapult your brand into the public consciousness.

Security technology company, Knightscope is a perfect example of the flexibility equity crowdfunding offers. Initially raising $150k in just 7 days, Knightscope used this to scale, and then came back to the table 6 months later to raise $1.1 million.

This was nothing compared to the $20 million they would raise just two years later.

CEO, William Santana Li specifically noted the effect equity crowdfunding had on amplifying the Knightscope brand. This, combined with the capital raised has allowed the company to grow, reaching an estimated value of over $320 million, and leading to speculation that the business might go public.

This is another example of how good equity crowdfunding can give a start-up an excellent platform to go on to much bigger things.

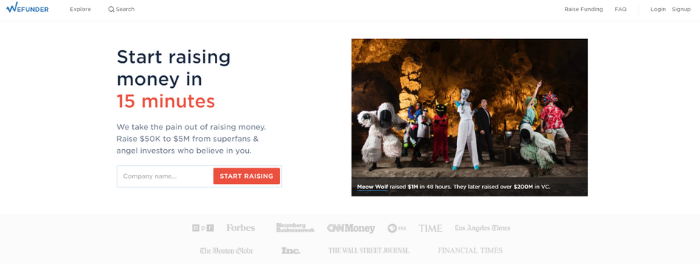

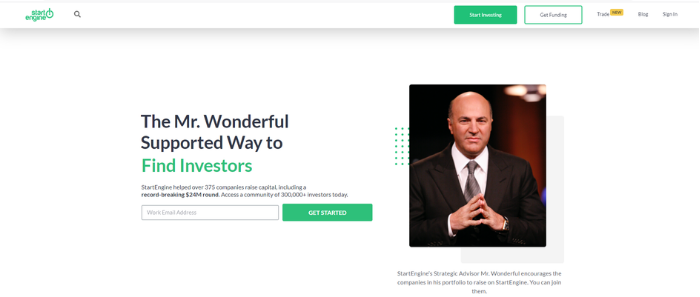

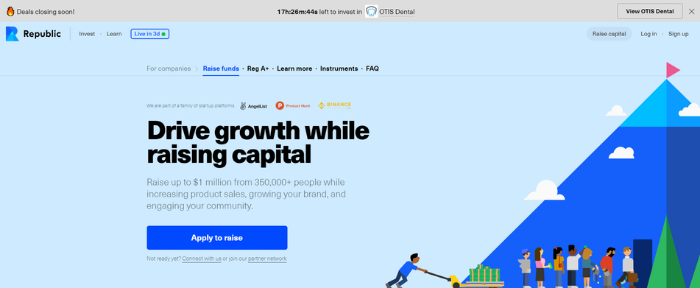

The U.S. equity crowdfunding market is largely dominated by three companies: WeFunder, StartEngine, and Republic.

The top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three companies.

WeFunder played a big part in lobbying the government over the JOBS Act and has been at the forefront of equity crowdfunding since its beginning. It has the biggest market share in terms of capital raised and can give your business excellent exposure.

One of the most appealing aspects of WeFunder’s offerings is the ability to sign up with no fees until you’ve successfully raised money.

This means you can dip your toe into the world of crowdfunding and focus on marketing your business as an investment opportunity before you have to worry about paying out.

StartEngine boasts a community of over 300,000 investors, which means it’s a great platform to get your startup noticed.

With over 375 successful raises, totaling over $250 million for its clients, StartEngine is one of the first places to look when it comes to equity crowdfunding.

StartEngine prides itself on helping you every step of the way, with a full-service plan that gives you complete control over your offer. It’s focused on keeping the power in the hands of the entrepreneur and allowing them to tailor their offer to suit their business needs.

Republic focuses on the ability of its platform to do more than just raise capital for your business. With over 350,000 investors, it touts its ability to create “true fans and engage supporters” all around the world.

This is certainly an underestimated part of equity crowdfunding, and it’s important to remember that it’s about more than just money. The exposure a successful crowdfunding campaign can bring you is a great source of marketing in its own right, and Republic is quick to highlight this.

On the face of it, crowdfunding sounds great, but as with anything, it has its drawbacks. When you’re weighing up how to get investment in your startup, you’ve got to look at the positives and negatives, and focus on how they fit in with your business plan.

Benefits of Equity Crowdfunding

Drawbacks of Equity Crowdfunding

When you compare crowdfunding with venture capital or angel investments, it’s clear where crowdfunding triumphs, though: control.

When you have thousands of small investors rather than a handful of large investors, the external pressures and potential influence of your investors are much smaller.

Thousands of small investors aren’t there telling you how to run your business, but they are going out into their communities and spreading the word about your business, which can have a huge impact.

Building a thriving startup isn’t easy, but when you don’t have access to capital, it’s a lot harder. In the past, private companies had limited options for raising funds, but with changes to legislation, equity crowdfunding gives startups access to thousands of investors who are looking for the next big thing.

Not only is this an opportunity to raise a large amount of capital, but it can also supercharge your marketing by creating a huge buzz around your brand.

When you raise millions of dollars from investors worldwide, people will start talking about your business and become brand advocates, which is almost as valuable as the money you raise.

What’s holding your startup back?

The post What is Equity Crowdfunding and How Can You Use it For Your Business? appeared first on Neil Patel.

Even during COVID-19, you can still get financing via crowdfunding. But you should know these recession crowdfunding terms.

Crowdfunding can seem to be a bit of a mystery. Why are people willing to part with their cash in this particular manner? There are a lot of recession crowdfunding terms thrown around all the time and they can sometimes get confusing. So consider this your primer on some basic crowdfunding terminology.

Because even if you do not think you will use this method of fundraising, you will probably encounter it all the same.

But before going any further, does crowdfunding ever actually, you know, work?

For some companies which crowdfund, the rewards are great. According to Crowdfunding Blog, the single most successful crowdfunding campaign was for the Pebble Time Smartwatch. And that was as of November of 2018. But before you run out and buy one, note that they are now a part of FitBit.

As in, they went out of business in July of 2018. And this is a business which raised over $20 million in 2015. That is no typo. And in point of fact, Pebble holds three of the top six spots in the biggest crowdfunding successes of all time. Together, these three crowdfunding campaigns took in a staggering $43.39 million. This is about $8 million more than the town of Huntington, New York (population 203,264) budgeted for highways in 2018.

Hence there is one thing that should be clear to all. Runaway crowdfunding success is no guarantee whatsoever of actual success.

But now it is time to get to the recession crowdfunding terms themselves.

A project is what you are asking for money for. Projects can take a few months or even years. The more complex your project, then (usually) the longer it will take. The person starting the project is generally called the project runner or the project creator.

Projects can be for goods or for services.

What frustrates you the most about funding your business in a recession? Tell us in the comments.

The people who donate to the project are called donors. Or sometimes they are referred to as contributors or backers.

On rare occasions, they may even be called investors. However, such a word connotes a far different relationship. Many crowdfunding platforms shy away from such a term. And this is for good reason. It is because investors and investments may come under the purview of the SEC. The Securities and Exchange Commission exists in order to protect investors. This is in ways not current available to donors 0r other contributors to the success of businesses.

Hence, unless the crowdfunding platform is specifically for investing in companies, more like angel investing, you are not too terribly likely to see the investor.

The act of requesting money on a crowdfunding platform is called a campaign. This is the soup to nuts of crowdfunding. So it covers everything from the first pitch to the final collection or perk distribution.

In general, donor levels refer to the amount of rewards which are on offer for a particular size donation. Note: I will get to rewards in a moment. Your donor levels might look something like this:

Donor levels are limited by your imagination and your capacity for handling complexity. After all, five separate donor levels mean you are keeping five separate lists. If you are well-organized, then this is possible. But it is not easy. Five separate donor levels are plenty, particularly for people running their first campaigns.

Truthfully, you will be a far happier person if you cut the number of donor levels to no more than three.

Of course, time and budget should be considerations for anyone. But that is not just the case for crowdfunding.

What frustrates you the most about funding your business in a recession? Tell us in the comments.

One basic about crowdfunding for creative projects is that you will need to provide incentives for your donors to open up their wallet. Crowdfunding to help someone with their medical expenses is a different animal. So let us get back to crowdfunding for business funds.

This is where perks come in.

Your rewards can be nearly anything. But it can quite literally pay to have them relate directly to your project.

For example, if you are crowdfunding to get enough money to back your new smart phone invention, then your rewards probably should not be your grandmother’s blueberry muffin recipe. And this is no matter how wonderful it may be. Instead, you could base your rewards around your invention. So this could be everything from offering a case to an extra battery or charger. Or you might even offer an app which only your donors can download.

Rewards are a very real part of crowdfunding and they can often be a part which project creators do not take into consideration. Sometimes, we think a product will go to market in, say, a year. But circumstances change, and now one year turns into two. So be it – this sort of thing happens all the time.

But it is an issue if your perks are dependent on your product going out the door. So if you need to fulfill perk promises to 10,000 people, you will likely find you need to do one of any of these things:

Reneging is not an option, and it can get you on the wrong end of a lawsuit if you are not careful.

A fourth option is delaying perk fulfillment. Not every donor will go for that.

Sending out so many perks is a major task. It can take months to get everything out the door.

Why does it take so long? Consider the degree of complexity. Let’s go with an easy number: 100. So let’s say you have 10 separate perk levels and they each have 10 slots. Once an eleventh person wants a certain perk level, they just plain can’t have it, as it’s gone. Are you with me so far?

Your ten separate perk styles may be of differing weights. So this means they will have different shipping costs. If any of your 100 donors are outside of the United States, then you will have to pay more to ship to them as well. Plus of course you have to make sure all of the addresses are complete and correct.

It becomes even more complex when your perks do not fit into such neat little buckets. This is where you have, say, eight perks. And you might have anywhere from 12 to 1,000 people who are supposed to be getting them. Plus some people may have donated twice and are waiting for two separate perks. Or maybe even more.

See how ugly and difficult this can get – fast?

What frustrates you the most about funding your business in a recession? Tell us in the comments.

The easiest way to get around these issues is to offer intangible perks. In our smart phone example, the exclusive app would fit the bill nicely. Your best bet is to make the intangible perk good for the largest number of donors possible.

Hence if your lowest level is $10, and you have 100 of those slots, then you could just give 100 people a download code. This is a lot faster than figuring out postage for all of those donors. Plus, with an intangible perk, technically the number of perks is effectively infinite. But scarcity gets people interested, so you might not want to make the downloads never-ending.

For the more tangible perks, leave them for far smaller groups, such as the 25 people who are at your two top donor levels. Mailing to 25 people is far easier than it is to mail to 10,000 people. And this is so even if the mailings are difficult.

No? Then what do you call a coupon sent in email? See, there are ways to offer intangible perks even when the entire business operation is very, very tangible. Coupons have been around, seemingly, forever. People will gladly print them off or carry them in their smartphones for scanning.

Or there can be discount codes, which are virtually the same thing, except with no designing of a coupon to be cut out or scanned. Amazon, for example, gives these out all the time. And the vast majority of backers will know exactly how to use them.

There is, of course, more to recession crowdfunding terms than this. But these should at the very least get you started. And as always, if you have any questions, please feel free to ask them in the comments section of this blog post.

In Part 2, we will talk about types of crowdfunding and types of platforms. There’s more to this unique form of financing than just recession crowdfunding terms.

The post Recession Crowdfunding Terms You Should Know, Unveiled appeared first on Credit Suite.

If you are considering equity crowdfunding for your business, then you are, by definition, considering equity crowdfunding sites. We take a look at the best out there and dig into their nuances and differences. Make a smarter choice – knowledge is power!

When you consider equity crowdfunding sites, you will need to take a number of factors into account. Crowdfunding is a way to get funds from a lot of people, versus one or two investors.

With equity crowdfunding, you raise cash through the sale of securities such as equity, debt, revenue share and more. These security sales would be coming from a company that is not listed on stock exchanges. Equity crowdfunding has been around for less than 10 years. It is not the same as rewards-based. Rewards-based crowdfunding comes from places such as Kickstarter.

What are the differences between equity crowdfunding and rewards-based crowdfunding? The major difference is what investors get for their investment. With reward based crowdfunding, investors generally receive some incentive for their donation. That incentive is not equity in the company. But with equity-based crowdfunding, the investor receives equity. That is, they get a share in the company.

Also, as a general rule, equity-based crowdfunding brings in larger amounts of money. This is because it draws a different type of investor. So, how come not everyone choose that? The key is some businesses are better suited for equity-based crowdfunding than others.

With equity crowdfunding sites, you raise capital from the crowd online. Potential investors visit a funding portal website. There, they can explore different equity crowdfunding investment opportunities. Note: there are limits on how much capital an individual can invest based on their income and net worth. Plus, investors must be 18 years old, or older.

The main purpose of equity crowdfunding is to sell securities in a business. Hence, this is also the main purpose of equity crowdfunding sites.

In contrast, with a platform such as Kickstarter, businesses make money by pre-selling their products. But on equity crowdfunding sites, companies sell securities, in the form of equity in the company. Or it can be in the form of debt, revenue share, convertible note, and more. Equity crowdfunding gives investors a stake in your business.

Equity crowdfunding investors are playing a long game. They stand to make a profit if they make a good investment, and the company they invested in grows. Here, the business can create hundreds of brand ambassadors who want to see you succeed. They are an audience the company can depend on to spread the word about their business and share the product with their own networks.

The ability to cultivate reliable brand ambassadors can be one consideration when trying to offset the cost of equity crowdfunding on a platform

The business owner gets to dictate terms. The entrepreneur raising capital has total control of the offering. So this is including what to sell, how much, and, at what price. The owner can set the terms, including their valuation and how much capital they hope to raise.

Companies can set a minimum funding goal along with their desired maximum. So if they do not fully reach their funding goal, the entrepreneur can still successfully raise capital. Those who want to invest can do so even if the market interest is not enough to reach the goal.

Businesses raising money via equity crowdfunding sites are private companies. A business using equity crowdfunding does not have to issue an IPO (initial public offering). The business does not have to become a fully reporting public company. this is helpful, as being a fully reporting public company is financially burdensome for most small businesses. Investors do not have to be accredited. A business can raise funds without having to turn to venture capitalists.

For more information, see forbes.com/sites/howardmarks/2018/12/19/what-is-equity-crowdfunding.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive

Crowdfunder is an equity crowdfunding platform. With Crowdfunder, investors purchase equity in promising companies. They consider campaigns to be deals, and its donors are investors.

Starter listings are $299 per month. Premium listings are $499 per month. In their community, there are over 130,000 entrepreneurs and investors.

Crowdfunder does not work with every industry.

The following are prohibited industries:

For more information, see crowdfunder.com.

Fundable is a crowdfunding for business platform. It allows companies to raise funds via equity sales. Those funds come from investors, customers, and friends. They have over $80 million in funding commitments.

Fundable will charge $179 per month to raise funds. Fees on rewards are: 3.5% + 30¢ per merchant processing transaction. They do not charge success fees.

Fundable is one of the equity crowdfunding sites (such as Crowdfunder and Fundrise, below) which seem to be more accessible to regular folks.

They do not seem to focus on just one specific industry.

For more information, see fundable.com.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive

What is so special about Crowdstreet?

The industry most likely to use equity crowdfunding is real estate. This is because real estate allows for a much larger asset to be there from the very start. For a startup company based upon an idea for a new product, there is extraordinarily little available to seize in case the investment goes south. Whereas with real estate, even if there is never any development, land has an intrinsic value no matter what.

Crowdstreet allows you to invest online in commercial realty. Investors can choose between direct investing, fund investing, or managed investing. Crowdstreet boasts over 101,000 investors and over 260 commercial real estate developers.

Direct investing has varied minimum investment amounts. The minimum for fund investing is $25,000. The minimum for managed investing is $250,000. Hence this is one of those equity crowdfunding sites that is more for professional investors.

For more information, see crowdstreet.com/marketplace/overview.

Real Crowd is another real estate investing platform, via equity crowdfunding. RealCrowd charges a technology access fee to the operating partner for their services. They do not charge investors any upfront fees, ongoing asset management fees or promote/carried interest in the investments.

You can browse offerings before you sign up. The information includes minimum investment and average returns. This allows for a lot of the decision making to happen before you even log in. Real Crowd offerings are open to accredited investors.

For more information, see https://www.realcrowd.com/how-it-works.

Fundrise is a great starter site for those that want to break into the world of equity crowdfunding. They do not require that you be an accredited investor. The minimum investment for the starter account level is $500. Minimum investment amounts go all the way up to $100,000 for the premium account level.

Fundrise will charge 0.15% in annual advisory fees for managing your account through the online platform. They do not charge any transaction fees, sales commissions, or additional fees for enabling features on an account, such as dividend reinvestment or auto-invest.

Fundrise will also charge 0.85% in annual management fees for managing a Fundrise portfolio. They could potentially charge other fees, such as development or liquidation fees, for work on a specific project. Dividends earned are net of any fund fees.

For more information, see: https://fundrise.com.

If you do not wish to give away any of your equity, then rest assured, you have other options. Build business credit is one option. And others include inventory financing, merchant cash advances (if you have sales coming in), and securities financing. With securities financing, you use your stocks, bonds, 401(k), or IRA as collateral for borrowing.

Another great option is our credit line hybrid.

A hybrid credit line could be just what you need.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive

The gist of a credit line hybrid is you can leverage good personal credit in order to get business funding. Because a good personal credit score is the main thing the lender is looking for, it can be perfect for a startup venture. So, it is another option to consider. You do not necessarily have to give up business equity in order to finance your entrepreneurial venture.

Equity crowdfunding involves calling on a crowd to invest in your project. Rather than pre-selling products, you are selling pieces of your business.

The industry most likely to use equity crowdfunding is real estate. But other industries can use equity crowdfunding. Be sure to check the platform and see if there are any restrictions. Some industries will not do well at all and may even be shut out by a platform. Fees and investment minimum amounts will vary widely.

If you are interested in equity crowdfunding for your business, the best thing you can do is to shop around. Rates vary dramatically. But also check on success rates. Many equity crowdfunding platforms are expensive, or they have high minimum investment amounts, or both. Do not waste your time and money if you are not sure there is a good fit.

And, if you decide equity crowdfunding is not for you – or even if you do but want a fall back – then consider other forms of business funding. That should always include building business credit.

The post The Best Equity Crowdfunding Sites – and How Equity Crowdfunding Can Work for Your Business appeared first on Credit Suite.

Crowdfunding has become all the rage and it’s not surprising. It’s (generally) free money which you do not have to repay. And you can get these funds without needing to give up any ownership or control over your small business. Additionally it can help you to determine the popularity of an idea or a prototype or invention. Because there is no sense in continuing if there is no interest in your design. Still, a lot of entrepreneurs can use crowdfunding to start a business in a recession.

You will need to make a lot of choices before you even launch a startup crowdfunding campaign. And this goes double in an economic downturn.

Your very first decision should be: just how much do I need to crowdfund? If you need $1 million, you are going to need to crowdfund more than that. Why? Because that is how crowdfunding platforms make their money– they take a percentage of any money you can raise. Thus, you will need to take that into consideration. Crowdfunding percent charges vary from 4% to 10%.

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet. Save your money during the recession!

Another decision has to do with how successful you think your campaign will be. If you are extremely confident that you will be 100% funded at the end of your campaign, then traditional funding is for you. If you are not sure, then try GoFundMe’s flexible funding.

With flexible funding, you, the campaign runner, can keep your donations even if your campaign falls short. However, for this benefit, you will have to pay a higher fee to GoFundMe. Other crowdfunding platforms like Kickstarter don’t offer this option.

Yes, you will have to offer perks to your donors. Perks can take many forms– buttons, tees, book marks – every one of those are possible tangible perks. Consider a perk format which can sync with your business. If you sell homemade jam, then perhaps create a unique flavor just for the campaign, and offer bigger and bigger-sized jars depending on donation amount.

If you are a horseback riding stable, offer a complimentary lesson or a postcard with a favorite horse’s image on it, or something like that. Does your startup flip houses? Then consider offering a coupon to a neighborhood home supply company (work with them beforehand, of course) or the like.

Physical perks are a pain! A lot of people love them, and they will stand out. However, you also have to ship physical perks. International shipping is extremely expensive, even for small items. So if you offer physical perks, specify whether you will allow international donor addresses.

Even if everything has to be shipped in the US, you are still left with working with a data base of names and addresses (a few of which might have misprints or be incomplete) and usually a range of available perks. Did Jane want the stuffed teddy bear or the book mark? Did Alan want the pennant or the tee shirt? Do Jane and Alan live at the same address so perhaps you could mail their perks out together? What if a perk is lost or broken in the mail? And what if it injures someone?

Because of this, if you can do it, try for digital perks. For a house flipping startup, you might record video footage about home design or repair. For a pastry shop, you could offer downloads of recipes. And for a health club, maybe offer digital coupons for a free month of membership.

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet. Save your money during the recession!

Your campaign’s success is far from assured. However, you can capitalize on a few proven approaches. First off consider these four feelings that you need to engender in donors. Use one or more of them as the focal point of your campaign as a starting point.

The first two and last two days of a crowdfunding campaign are pretty much always the days with the biggest payoffs. Often, lengthening the campaign doesn’t make you significantly more money. So why not open a campaign for only a week? Don’t let donors feel they can contribute any old time they feel like it.

If you have thousands of something or other to supply as a perk, it will not be as desirable. If you only have a few copies of a specific perk, that will instill a feeling in some potential donors that they just have to have it. Do this with your larger donation levels only. Therefore, you might want to establish a perk/donation level system similar to this:

| Donation Level | Number of Perks |

| Lowest | 1,000 |

| Second lowest | 500 (reward also incorporates lowest level reward) |

| Second highest | 50 (reward also includes two lower level rewards) |

| Highest | 10 (reward also incorporates all other levels’ rewards) |

Remember: a lot of variety in physical perks will make fulfillment a lot harder, so don’t work with greater than maybe five separate varieties of physical perks– and even that is pushing it.

If you are offering the identical thing as a thousand other places, no one will want to make a donation. Your widget needs to be lighter, hotter, cheaper, or more resilient. Your food should be reduced in calories or higher in nutrition or better-tasting. Or your professional services need to be delivered better or quicker, by friendlier and more skilled employees. And it should come with a money back guarantee your competition does not provide.

Is your product a work of art? Is it a new, gadget-like innovation? Then it may have a coolness aspect which you can construct your campaign around. But don’t be discouraged if it isn’t! These days, some of the most unforgettable advertising campaigns are based around a product the majority of people found uninspiring not ten years ago– insurance.

A few words on strategy:

Use an expert to film it and develop the script. Are you unable to pay for experts? Then try schools, both pupils and educators. Your script doesn’t need to be verbatim but you should have points you wish to make and not babble. Write a script and stay with it. This is not the right time to ad-lib.

Put it in your campaign video and on your campaign page. This means a picture of your health spa’s sign or a short video clip of your prototype robot. A number of people are naturally doubtful about crowdfunding. An image and a tangible thing will go a long way to assuring them that your project isn’t vaporware.

Say please, thank you, and you’re welcome to everyone. Use these magic words in your pitch and in your communications with your donors, even in the cover letters you deliver with your perks (even internet perks can include a cover email message). You do not have to be servile, but you absolutely must be diplomatic.

In particular, be courteous when you want to use crowdfunding to start a business in a recession. After all, you have no idea what people may be going through.

If you need $250,000 for your campaign, but you call for $1,000,000, that will not do anyone any good. You’ll just look like you want to leech off other peoples’ generosity. Instead, explain your expenses as plainly and transparently as possible.

And incidentally, if you misuse your funding, you may end up in an unpleasant meeting with your state’s attorney general. So be truthful!

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet. Save your money during the recession!

If you are crowdfunding for $100,000, a reasonably easy to attain stretch goal is $125,000. Pie in the sky going to be more like $300,000.

Make it abundantly clear what you will do with any added money if you are fortunate enough to get it. Will you buy the property your startup is in? Employ five more people? Replace your old equipment? Launch a brand-new market on another continent? Let your donors know what you are pursuing, so they can dream with you.

Even if you use GoFundMe’s flexible funding option, you still may not receive enough to make an appreciable dent in your funding requirements. If you wanted $100,000 and you just got $500, your best option is to simply give back the money.

If you nearly made it with $95,000, then thank everybody who donated. And see what you can possibly do, although there’s a deficiency. And let them know what you are doing! Maybe you’ll purchase your building next year, or hire four people rather than five.

Once more; give your donors a stake in and an inside look at your startup. This will enable them to feel invested. And they may just opt to make up the deficiency themselves. Even if your crowdfunding campaign concludes does not mean a donor cannot send a check or buy extra goods or services. If that comes about, then politeness is essential.

Tell your mother or your brother in law or your former high school soccer coach to postpone on handing over their $1,000 or $10,000 donation till you start your campaign.

And ask them (nicely!) to release their donation at a very precise time. Which time? The initial or final day of the campaign (split the funds as well as you can. If the split isn’t around half and half, then request the larger chunk of donations to come on the very last day of the campaign.

Make the most of the novelty factor of the first day of the campaign, or the urgency factor of the very last. Just like a busker with a couple of her own bucks in her hat, to motivate people to toss in a few bucks for a song, you want your biggest donors to demonstrate to other donors that they believe in you and in your project. And you also want them to suggest your other donors that they had best get in on investing in your startup before the opportunity ends.

And ask your family and friends to do so, too. Tweet the link. Incorporate it as a Facebook status. Make it a Tumblr post or a snap on Snapchat or create a blog post about it. Ask your network to publicize the link.

The most effective technique to get your network to help you out is by assisting them in return. If your relative’s rock band is on Facebook, share their page, or tweet about it.

Be a collaborative member of your own personal network. And then your contacts will be more likely to help you out when you ask.

And rerun these social media postings. Considering time zones and our all-too hectic lives, people may not see your message the first time around. Mix it up and deliver it at odd hours (you can oftentimes use scheduling software such as HootSuite for this), including what is the middle of the night where you live.

Finally, if your small business crowdfunding campaign succeeds, think about donating a few dollars to others’ campaigns. Because your business goodwill and a good reputation are priceless. And you never know when the economic pendulum will swing the other way.

The post How to Use Crowdfunding to Start a Business in a Recession – Amazing! appeared first on Credit Suite.

There are thousands of businesses using crowdfunding to raise money to fund their next business venture. For some entrepreneurs, crowdfunding is the ticket to financial independence. Starting a new business without adding debt or taking out equity, can be unheard of for startups. But with a little planning and creative marketing, starting a new business can be more enjoyable than disappointing. Yes, you can fund your business with crowdfunding, even during a financial recession.

The number of American financial institutions and thrifts has been decreasing slowly for a quarter of a century. This is from consolidation in the market along with deregulation in the 1990s, minimizing obstacles to interstate banking. See: https://www.fundera.com/blog/happened-americas-small-businesses-financial-crisis-six-years-start-crisis-look-back-10-charts

Assets concentrated in ever‐larger financial institutions is troublesome for local business proprietors. Big banks are a lot less likely to make small loans. Economic recessions imply banks become more careful with financing. The good news is, business credit does not count on financial institutions.

Crowdfunding gives today’s business owner a new way to build a successful business. Don’t be fooled. Not everyone with a campaign on a crowdfunding site becomes an automatic millionaire! Success on crowdfunding doesn’t happen overnight. In fact, being an instant success on a crowdfunding site doesn’t usually happen. To succeed at crowdfunding, do your due diligence. And see if you would be successful at crowdfunding.

Find which crowdfunding platform is best to use for your business. Kickstarter and Indiegogo are two of the most popular crowdfunding platforms to use. If you’re like most new business owners, you’re looking for investors. Before you start putting your campaign out there, make sure that you have everything ready and perfect. This way, you can get the investors that you want to fund your campaign.

Trying to get the investors you want will take time. You need to brainstorm, create, and perfect the right pitch that gets investors pouring money into your campaign. To help you get your campaign started in the right direction, use this quick guide.

Pick a Crowdfunding Platform. Before you get started with your campaign, pick a crowdfunding platform that’s the right fit for you. There are several crowdfunding platforms to choose from. Kickstarter and Indiegogo are two to start looking into.

And you need to be aware of what you are doing when you’re developing your campaign. If you’re raising rewards and not investments, then Kickstarter and Indiegogo should be on your list.

Kickstarter is great to use for creative projects, but it’s all or none. This means that if you don’t raise 100% of your initial funding goal, then you don’t keep the pledged money. Indiegogo is a little different from Kickstarter. If you choose to pay up to 9% of your funds raised, then you can keep the funds pledged to your campaign. The only drawback is that your project will need some minimum funding to work.

GoFundMe is another choice; they let you keep the money even if you don’t meet your goal.

Prepare and Get your Pitch Perfect. Remember that the content in your campaign is vying for the attention of your potential investor and client. There are so many other distractions that pull for the attention of your viewers. For this reason, your pitch and its messaging has to grab their attention immediately. Once you get their attention, you can’t stop there. You’ll want to keep your viewers engaged, which means that you need to have a great story to tell about yourself or your project.

Your pitch video will need to be good. Use a professional to film it and develop the script. Unable to afford professionals? Then try schools, both pupils and instructors.

Your script doesn’t need to be word for word but you must have points you want to make and not babble. Create a script and stay with it. This is not the right time to wing it.

If you have physical evidence of your project, then make sure to show it in your campaign video and on your campaign web page. This means an image of your spa’s sign or a short video recording of your prototype robot.

A great deal of people don’t trust crowdfunding. A photo and a tangible thing will go a long way to demonstrating to them that your project isn’t vaporware.

Say please, thank you, and you’re welcome to everyone. Use these magic words in your pitch and in your interactions with your donors. And use them in the cover letters you deliver with your perks (even virtual perks can include a cover e-mail). You don’t need to grovel, but you must be polite.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business. Get money even during the worst of a recession.

If you need $250,000 for your campaign, but you ask for $1,000,000, that does not do anyone any good.

You’ll just seem like you want to bum off others’ generosity. As an alternative, explain your overhead as transparently as possible. Because if you misuse your funds, you may find yourself in an unpleasant meeting with your state’s attorney general. So be truthful!

Focus On What You’re Giving to Your Investors. One of your goals in crowdfunding is to raise funding. But you need to focus on your investors. You want to create rewards or terms that will help you raise the money that you want. When developing the rewards for investors and backers, have your rewards tie back into your story.

One way to come up with a great reward for your campaign is to check out the most successful campaigns which raised the most money.

Line up the most significant and most reliable donors you can before you start. Tell your mother to postpone handing over her donation till you launch your campaign.

And ask them (nicely!) to release their money at a very specific time. Which time? The first or final day of the campaign. Separate the expected funding as well as you can. If the split isn’t around half and half, then ask for more to come on the final day of the campaign. Make the most of the novelty factor of the very first day of the campaign, or the urgency factor of the very last.

It’s like a busker with a few of her own dollars in her hat. To motivate people to donate, you want your biggest donors to show other donors that they believe in you and your project. It helps if they tell other donors that they’d best get in on investing in your company before the opportunity ends.

Get Supporter Engagement. Don’t make the common mistake of not engaging the people in your network of friends, family, and supporters. When creating a campaign, be ready to start funding once you launch everything. It’s especially important if you are using equity crowdfunding. Supporter engagement is vital. Because these people are your stakeholders, advisors, board members, partners, and existing investors.

Be gracious if your campaign fails. Even with GoFundMe (where you can keep the money even if you fall short), you still may not get enough to make a significant dent in your funding needs. If you wanted $100,000 and you only got $500, your best option may be to give back the cash.

If you almost got there with $95,000, then thank everybody who donated. See what you can do, although there’s a deficiency. And tell them what you are doing! Perhaps you’ll buy your building next year, or hire four people as opposed to five.

Once more, give your donors a stake in and an inside look at your startup. This will help them to feel invested. And they may decide to make up the shortfall themselves. Just because your crowdfunding campaign ends doesn’t mean a donor can’t send a check or buy more goods or services. If that comes about, then politeness is crucial.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business. Get money even during the worst of a recession.

Get to know Notable Investors. Get the attention of people who have never heard of your project before. One of your main goals should be to get people, organizations, and businesses that are familiar with you involved with your campaign. And ask them to spread the word. This sort of networking can only help you.

Share your campaign on social networks and ask your friends and family to do so, too. Tweet the link. Add it as a Facebook status. Turn it into a Tumblr blog post or a snap on Snapchat or publish a blog post about it. Ask your network to distribute the link. The best technique to get your network to help you out is by assisting them in return. If your nephew’s band is on Facebook, share their page, or tweet about it.

Be a cooperative member of your own personal community. Then your online community will be more likely to help you out when you ask. And rerun these social media posts. Consider time zones and our all-too busy lives. People might not see your message the first time around. Mix it up and send it at irregular hours. Use scheduling software such as HootSuite for this. This includes what is the middle of the night where you live.

Plan your Marketing and Outreach Strategy. You will need to put hours into creatively marketing your campaign before it launches. Successful campaign owners spend hours developing a plan that will market their campaign. And they have a defined goal that raises funding efforts both online and offline.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business. Get money even during the worst of a recession.

Your stretch goals should be a mix of easy to get and pie in the sky. If you are crowdfunding for $100,000, a pretty easy to meet stretch goal is $125,000.

Pie in the sky will be more like $300,000. Make it clear what you will do with any added cash if you are fortunate enough to get it. Will you buy the property your startup is in? Hire five more people? Replace your worn out equipment? Open a brand-new market on some other continent? Let your donors know what you are striving for, so they can dream with you.

Starting a new business venture doesn’t have to be restrictive or stressful. This is especially when you know how to use crowdfunding and its various platforms. Crowdfunding can be another way to fund your business or a new project without having to pay for upfront marketing costs. And you get to keep your equity!

As a business owner, you should always look for ways to grow your business. And by using crowdfunding you can provide your business with new avenues to get funding.

The post Fund your Business with Crowdfunding During a Financial Recession appeared first on Credit Suite.

If you have ever wondered how to use recession crowdfunding to finance your business, then this one is for you! But before you commit to numbers, perks, a pitch, or anything of the sort, be sure to read this first. And, in particular, be sure to read this if that last sentence made no sense to you. Seriously!

And don’t despair – even in a bad economy, crowdfunding is still possible. People still want to believe in your dreams. But you will probably need to lower your expectations on funding totals when everyone is feeling the pinch.

Crowdfunding has become all the rage and there is no wonder. It is (usually) free money which you do not have to pay back. And you can get these funds without having to give up any ownership or control over your small business.

Plus it can help you to gauge the popularity of an idea or a prototype or invention. Because there is no sense in continuing if there is no interest in your handiwork.

Before delving into how to do it, let’s first look at when and how crowdfunding came to be.

In a way, crowdfunding is the child of angel investing. But what is an angel investor?

According to Investopedia: “Angel investors invest in small startups or entrepreneurs. Often, angel investors are among an entrepreneur’s family and friends. The capital angel investors provide may be a one-time investment to help the business propel or an ongoing injection of money to support and carry the company through its difficult early stages.”

The term comes from Broadway theater. Angels were originally the investors who backed plays, and they still do so. Those people are also called patrons of the arts.

The Statue of Liberty was essentially a crowdfunded endeavor. And that was in 1885. But it goes back more than that, as war bonds are a species of crowdfunding. Plus in the 1730s, the London mercantile community saved the Bank of England by supporting the currency. This averted a confidence disaster.

Heck, even the bank scenes in It’s a Wonderful Life show a form of nascent crowdfunding, because the citizens of the town forego full payments to help each other out.

And then we get to crowdfunding on the internet. Kickstarter, for example, was started in 2009. And ArtistShare goes back to 2003. Today, there are several crowdfunding platforms. They handle everything from inventions to artistic endeavors to medical bills.

So let’s get started. But you will have to make a lot of choices before you even start a business crowdfunding campaign.

Your first decision should be: how much do I need to crowdfund? If you need $1 million, you are going to have to crowdfund more than that.

Why? Because that is how crowdfunding platforms make their money. They take a percentage of whatever money you can raise. Therefore, you will need to take that into consideration. Crowdfunding percentage charges range from 4% to 10%.

Another decision is about how successful you believe your campaign is going to be. If you are super confident that you will be 100% funded at the end of your campaign, then traditional funding will be for you.

But if you are not sure, then try something like GoFundMe’s flexible funding. With flexible funding, you, the campaign runner, can keep your donations even if your campaign fails. But for this privilege, you will have to pay a higher fee to GoFundMe.

Other crowdfunding platforms like Kickstarter do not offer this option.

Yes, you will have to offer perks to your donors. Perks can take several forms. Consider buttons, tee shirts, book marks – all of those are possible physical perks.

Think about a perk format which can dovetail with your business. If you sell homemade jam, then maybe create a special flavor just for the campaign. And offer bigger and bigger-sized jars depending on donation amount. If you are a horseback riding stable, offer a free lesson or a postcard with a favorite horse’s picture on it, or the like. Does your business flip houses? Then consider offering a coupon to a local home supply company or the like. But do work with them beforehand, of course.

Pro tip: physical perks are a pain! A lot of people love them, and they will attract attention. But physical perks also need to be shipped. International shipping is extremely expensive, even for small items. So if you offer physical perks, specify if you will allow international donor addresses.

And even if everything has to be shipped in America, you are still left with dealing with a database of names and addresses. And some of which might have typos or be incomplete.

Plus you often have to deal with a variety of available perks. Did Jane want the stuffed teddy bear or the bookmark? Did Alan want the pennant or the tee shirt? Do Jane and Alan live at the same address so maybe you can combine their perks?

What happens if a perk is lost or damaged in the mail?

Therefore, if you can do it, try for virtual perks. For a house flipping company, you might record videos about home decorating or repairs. Or for a bakery, you could offer downloads of recipes. And for a health club, maybe offer electronic coupons for a free month of membership.

There is absolutely nothing wrong with just going ahead and asking your potential donors about what they might like for perks. They might surprise you. Of course, the final decision will be your own.

But this is an excellent means of investing your donors and potential donors in the process. This is far more vital than you may think. That is because, when the donors are invested in your process, they will be invested in you. And they will want very badly for you to succeed. This will stand you in good stead if you have delays. And it will also help you out, big time, when your company is up and running.

Furthermore, if you ever crowdfund again, treating your donors right and giving them a seat at the table will assure that they just might follow you to your next campaign.

Your campaign’s success will be far from guaranteed. But you can take advantage of a few known strategies. First of all consider these four feelings that you want to engender in donors. Use one or more of them as the centerpiece of your campaign as a starting point. We will start with two today and the other two in the next post.

The first two and last two days of a crowdfunding campaign are nearly always the days with the biggest payoffs. Often, dragging out the campaign does not make you significantly more money.

So why not open a campaign for just a week? Do not let donors think they can contribute any old time they feel like it. If you give them the feeling that they had better act now, or else lose out, you will get more people to donate.

The fear of missing out is a very real thing.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business. Get money even during the worst of a recession.

If you have thousands of something or other to offer as a perk, it will not be as desirable to your donors. But if you only have one or two of a particular perk, that will create a feeling in some people that they just have to have it. Scarcity can create a bit of anxiety in your donors. And you do want that.

So do this with your higher donation levels only. Therefore, you might want to set up a perk/donation level scheme which looks something like this:

| Donation Level | Number of Perks |

| Lowest | 1,000 |

| Second lowest | 500 (this reward also includes the lowest level reward) |

| Middle | 100 (this reward also includes the two lower level rewards) |

| Second highest | 50 (this reward also includes the three lower level rewards) |

| Highest | 10 (this reward also includes all of the other level rewards) |

But be sure to remember: a lot of variation in physical perks will make fulfillment a lot harder. So do not work with more than maybe five separate types of physical perks. And even that is pushing it. After all, look at the complexity already inherent in five tiers (see the table, above).

Multiply that by all of the donors you get to your campaign. Larger platforms offer software for fulfillment purposes. It will nearly always be best to work with it.

But if you have to do it all yourself, then seriously consider no more than three tiers. Trust me. You will thank me later.

If you are offering the same thing as a thousand other places, no one will want to make a donation. Your widget has to be lighter, hotter, cheaper, or more durable. Your food has to be lower in calories or higher in nutrition. Or at least it should be better-tasting.

Or your services have to be delivered better, by friendlier and more knowledgeable people. And they should come with a money back guarantee your competitors just plain do not offer.

Think about how services or goods can differentiate themselves. Why do some people prefer Macs? Why do others prefer PCs? And why do some people want to get their insurance from Progressive? But others want theirs from Liberty Mutual.

Consumer choice, particularly in the United States these days, is huge! So offering true novelty can be a way to try to get beyond all of that clutter. And it is a lot of clutter indeed. Have you been to a toothpaste aisle in a drug store lately? Yeah. It is just like that.

Is your product a form of art? Is it a new, gadget-like invention?

Then it might have a coolness factor. And then you can build your campaign around that. But do not be discouraged if it is not! These days, some of the most memorable ad campaigns are based around a product most people found dull not ten years ago – insurance.

Now is the time for us to get back into the nitty gritty of the crowdfunding campaign itself.

Here are a few words on strategy.

You will not get anywhere without a pitch video. Yes, even you, you camera shy business owner, you!

Your pitch video needs to be good. Use a professional to film it and write the script. Can’t afford professionals? Then try schools, both students and teachers. Your script does not have to be word for word. But you should have points you want to make and not ramble. A script will help you to focus on exactly what you need to say. This is absolutely not the time to wing it.

Taking time with a script will show in every frame of the finished product. And your professional film maker? They might be charging you by the hour. So it is a really good idea to spend some time on a script or at least an outline of one. Do this before your professional film maker goes on the clock.

If you have physical evidence of your project, show it in your campaign video and on your campaign page. This means a picture of your health club’s sign. Or it could be a short video of your prototype robot.

A lot of people are understandably skeptical about crowdfunding. A picture and a tangible thing will go a long way to assuring them that your project is not vaporware.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business. Get money even during the worst of a recession.

Manners matter. ALWAYS. Say please, thank you, and you’re welcome to everyone. Use these magic words in your pitch and in your communications with your donors. And even use them in the cover letters you send with your perks. This is because even virtual perks can come with a cover email. And they should, as that is another chance to connect with your donors.

Do not get greedy! If you need $250,000 for your campaign, but you ask for $1,000,000, that does not do anyone any good. You will just look like you want to freeload off others’ generosity.

Instead, work hard to account for your expenses as clearly and transparently as possible. And by the way, if you misuse your funds, you might find yourself in an uncomfortable meeting with your state’s attorney general. So always, always, ALWAYS be honest!

If you need help, then hire an accountant or at least a bookkeeper. Much like with your pitch video, if you are low on cash, you can then try a local school.

Your stretch goals should be a mix of easily attainable and pie in the sky. If you are crowdfunding for $100,000, a fairly easy to attain stretch goal could be $125,000. Pie in the sky could be $300,000. Only you know your donors, or at least you know some of them. Be realistic about your prospects when it comes to your base. But for stretch goals, feel free to go just a little bit wild.

Make it abundantly clear what you will do with any extra cash if you are fortunate enough to get it. Will you buy the building your business is in? Hire five more people? Replace your old equipment? Open up a new market on another continent? Let your donors know what you are striving for.

This is also an excellent way to help get your donors to feel more invested in your project.

Be gracious if your campaign fails. Even if you use GoFundMe’s flexible funding option, you still might not get enough to make a dent in your funding needs. And of course with most forms of crowdfunding, you have to give everything back no matter what.

But let’s look at how to handle this kind of a situation if you took advantage of the flexible funding option.

Make an executive decision about the funds. If you wanted $100,000 and you only got $500, then your best bet is to just return the money. This kind of a shortfall should also give you a reason to take a good, hard look at your pitch, your campaign, and even your idea. Maybe you are being overly optimistic. A bad failure in crowdfunding can have a way of throwing a bucket of cold water on your dream, yes. But sometimes, that is exactly what you need.

If you almost made it with $95,000, then thank everyone who donated. And see what you can do, even though you have a shortfall. But also tell them what you are doing! Maybe you really will buy your building next year, or hire four people instead of five. Once again, get your donors invested in what you are doing. It will make an enormous difference.

Line up the biggest donors you can before you get started. Talk to your mother or your brother in law or your former high school football coach. And ask them to hold off on handing over their $1,000 or $10,000 donation until you start your campaign.

Also ask them (nicely!) to release their funds at a very specific time. Which time? The best times will always be the first or last day of the campaign.

Take advantage of the novelty factor of the first day of the campaign. Or take advantage of the urgency factor on the last day of your campaign.

Think about the busker (street musician) with a few of her own dollars in her hat, to encourage people to throw a few bucks for a song. Taking your cue from her, you want your biggest donors to show other donors that they have confidence in you and in your project.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business. Get money even during the worst of a recession.

Make sure to share your campaign on social media. And always ask your friends and family to do so, too. Tweet the link. Add it as a Facebook status. Make it a Tumblr post or a snap on Snapchat. Or write a blog post about it. Be proud of what you are doing! Tell the world!

Also, ask your network to circulate the link. The best way to get your network to help you out is by helping them in return. So if your cousin’s band is on Facebook, share their page, or tweet about it.

Be a cooperative member of your own personal community. And then your network will be far more likely to help you out when you ask.

Finally, if your small business recession crowdfunding campaign is successful, consider donating a few bucks to others’ campaigns. Or at least donate a few dollars to charity. And this is because business goodwill and a good reputation are going to be priceless. Karma in crowdfunding matters.

The post Be Amazing– Use Recession Crowdfunding to Finance Your Business appeared first on Credit Suite.

Funding for businesses is needed now more than ever. Funding that does not have to be repaid is always in high demand, as is funding that does not require a stellar credit score. In the eyes of most, and rightly so, that is exactly what crowdfunding is. That is not the crowdfunding definition however. There is so much more to the whole crowdfunding scene.

According to Dictionary.com, the crowdfunding definition is:

“the activity or process of raising money from a large number of people, typically through a website, as for a project or small business.”

It sounds like a great plan, right? It is, until you know that the average success rate of crowdfunding campaigns is 50%. That said, 78% of crowdfunding campaigns reach their goal. Of course, that sounds better. Still, reaching your goal doesn’t guarantee success.

Check out our trustworthy list of seven vendors to help you build business credit. Conquer any recession!

The thing is, crowdfunding is definitely a viable option, but it is too risky to depend upon as your sole source of funding. For some, it works out to where you can get a whole business off the ground without any other funding source. For most, crowdfunding simply reduces the amount of debt you must take on. Yet, for many, there are not even enough funds raised from such campaigns to get started.

Whether crowdfunding for startups or for an already existing business, it is not a legitimate only option. There needs to be a backup plan for either supplemental funds or full funding. If your credit score is good, there is no worry here as financing options abound. However, a not so great credit score can make a backup plan more difficult.

While not an exhaustive list, these are some of the most popular crowdfunding platforms.

Whichever platform you choose, whether one of these or one not on this list, remember there are a number of crowdfunding resources available to help you on this journey. You just have to look for them.

Now, the best way to find out about crowdfunding is to take a look at some actual campaigns. Here are some of the most notable, the good, the bad, and the ugly.

Now, the best way to find out about crowdfunding is to take a look at some actual campaigns. Here are some of the most notable, the good, the bad, and the ugly.

Pebble actually has several of the top 10 campaigns ever on Kickstarter. Their 2nd campaign is the highest funded campaign to date, reaching over $20,000,000. That’s not too shabby for a goal of only $500,000. They blew it out of the water!

Are they still successful? Well, yeah, but not in the way you may think. They actually sold to FitBit.

This one is not one that most would expect to explode onto the scene the way it did. The FlowHive Indiegogo campaign definitely generated some major buzz. The idea was to find a way to get the honey from bees without harming the bees.

Traditionally, hives are simply broken open to obtain the honey. This process can kill the bees. FlowHive developed a fake hive of sorts, made from reusable plastic. Bees make honey in it, and the honey flows through a spout out into the world. The bees are safe and fresh honey is ours for the taking.

Apparently, beekeeping is growing in interest. This campaign raised $14,000,000. Though they won’t disclose exact numbers, the queen bees claim they are still buzzing and in the black.

The coolest cooler was a super cool Kickstarter campaign that came in at over $13.000,000 raised. The cooler boasted bluetooth and a blender among other things. Investors received a cooler for their donation toward the cause.

This one had some trouble when it wasn’t able to deliver investment rewards as quickly as promised and there was actually a lawsuit. In the end, everything worked out and everyone got their rewards.

This jacket has 10 different elements, including a drink holder and a neck pillow. They raised over $11,000,000 across 2 campaigns. It was a bumpy start, partially because the jacket was available on retail sites before investors even got theirs, but it is still selling today.

As you can see, while mostly successful, even these top campaigns had some pretty serious bumps along the way. You need to be prepared for the same, even if you reach your fundraising goals.

Here are some options for financing. The one that will work best for your business will depend on your credit score, your business fundability, and how much you are able to raise through crowdfunding and other debt-free options.

Check out our trustworthy list of seven vendors to help you build business credit. Conquer any recession!

These are lumped together because they each require working with a traditional lender and a decent credit score. However, it is important to remember that SBA loans typically require a lower credit score, although still good, as they are government backed business loans. A few examples of SBA loans that work great for starting a business include:

This one offers federally funded term loans of up to $5 million. Funds can be used for expansion, purchasing equipment, and working capital, in addition to startup. Banks, credit unions, and other specialized institutions, in partnership with the SBA, process these loans and disburse the funds.

The funds work well to purchase machinery, facilities, or land. They are generally used for expansion. Private sector lenders or nonprofits process and disburse funds. They are also good for commercial real estate purchases especially.

There is also a requirement you be in business at least 2 years, or that management has equivalent experience if the business is a startup.

Microloans work for starting a business, purchasing equipment, buying inventory, or for working capital. Community based non-profits administer microloan programs as intermediaries. Financing comes directly from the Small Business Administration.

A credit line hybrid is a form of unsecured business funding. With it, you can fund your business without putting up collateral. You only pay back what you use.

It is not as hard to qualify as you may think. Your personal credit needs to be good, as in at least 680. In addition, you can’t have any liens, judgments, bankruptcies or late payments. Furthermore, in the past 6 months you should have no more than 4 inquiries, and you should have less than a 45% balance on all business and personal credit cards. It’s also preferred that you have established business credit as well as personal credit.

However, if you do not meet all of the requirements, the credit line hybrid is still accessible. You can take on a credit partner that meets each of these requirements. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding. This makes a credit line hybrid an excellent option for bad credit business funding.

There are many benefits to using a credit line hybrid. For example, it is unsecured, meaning you do not have to have any collateral to put up. Next, it is no-doc funding. This means you don’t have to provide any bank statements or financials.

Not only that, but typical approval is up to 5x that of the highest credit limit on the personal credit report. Also, it is possible to get interest rates as low as 0% for the first few months. That allows you to put that savings back into your business.

The process is usually fast, especially with a qualified expert to walk you through it. One other benefit is this. With the approval for multiple credit cards, competition is created. This makes it easier, and likely even if you handle the credit responsibly, that you can get interest rates lowered and limits raised every few months.

These are also an option if your credit score is lacking. Remember, lenders change details such as requirements and rates frequently. Be sure to check with the specific lender for the most up to date information.

The minimum loan amount available from BlueVine is $5,000 and the maximum is $100,000. Annual revenue must be $120,000 or more and the borrower must be in business for at least 6 months. Your personal credit score has to be 600 or above.

Upstart is an online lender unlike any other. It uses a completely innovative platform for loans. The company itself questions the ability of financial information and FICO, on their own, to truly determine the risk of lending to a specific borrower. Instead, they use a combination of artificial intelligence (AI) and machine learning to gather alternative data. Then, they use this data to help them make credit decisions.

This alternative data can include such things as mobile phone bills, rent, deposits, withdrawals, and even other information less directly tied to finances. The software they use learns and improves on its own. To be eligible for a loan with Upstart, you must meet the following qualifications:

These are the requirements they list on their website. One independent review said that the requirement for the debt to income ratio is a maximum of 45%. It also says that the minimum annual income has to be at least $12,000.

Check out our trustworthy list of seven vendors to help you build business credit. Conquer any recession!

Founded in 2008 by college roommates, online lender Fora Financial now funds more than $1.3 million in working capital around the United States. There is no minimum credit score, and there is an early repayment discount if you qualify.

The minimum loan amount is $5,000 and the maximum is $500,000. The business must be at least 6 months in operation and the monthly revenue has to be $12,000 or more. There can be no open bankruptcies.