Many people head to Chicago when visiting Illinois. Chicago is a lively city full of fun attractions, historic museums and observation decks that provide breathtaking views. Although Chicago is a popular city to go to when visiting Illinois, there is plenty to see throughout the state, such as the Abraham Lincoln Presidential Library and Museum … Continue reading 10 stops to make on your vacation to Illinois, including Chicago and beyond

Tag: Beyond

6 MarTech Trends in 2021 and Beyond

Are you hoping to identify MarTech trends that can help your campaigns be more effective and run more smoothly?

As our marketing capabilities evolve, so do the tools we use to measure our successes and how we achieve that success.

In this blog, we unpack the six biggest MarTech trends looming over the marketing industry and how you can use them to your advantage.

What Is MarTech?

Marketing technology, or MarTech, as it is more commonly known, refers to software and platforms that help individuals or organizations achieve marketing goals.

This term is very inclusive, covering everything from email templates to data analytics.

While every individual, agency, or company has unique MarTech needs, the constantly-growing field is making great leaps to fill any open niche.

Over the past twenty years, the field has seen truly exponential growth. Today, being a marketer doesn’t necessarily mean you have to be incredibly tech-savvy, but it does mean that you need to understand the benefits of tools that can improve your strategy and help you reach your goals.

Your competitors are likely using MarTech to help their campaigns succeed. If you’re not looking toward how you can automate, optimize, and ideate your campaigns through MarTech, it’s time to start.

Examples of MarTech

As we mentioned above, MarTech is a very wide umbrella. However, some forms of MarTech are more common than others. These include:

Email Marketing

With more than 50 percent of survey respondents copping to checking their email in excess of ten times a day, it’s no wonder that email marketing is an easy way to try to reach your target audience. While the operative word in that sentence was try, marketing automation tools can get you that much closer to your goals.

To reach them, you need tools and platforms that not only disseminate your emails but provide in-depth analytics that gives you a real-time view of reader practices and interactions. As email marketing continues to grow and evolve, the demand for personalization in this medium will also continue to grow.

Marketers should use automation and AI to deploy targeted emails engineered to attract a particular audience segment. To achieve successful personalization, use data to assess customer habits and preferences for each audience segment and then craft corresponding templates. Then your MarTech tool can do the rest.

Content Management

While managing your website content used to be a time-consuming, exhaustive process that took hours of coding, new marketing technology has automated cumbersome processes, allowing marketers to dedicate time to other important pursuits.

Content management systems (CMS) have evolved over the years, now equipped with the capabilities to develop the following kinds of websites (along with many others):

- social networking

- blogging platform

- static website

- news

- online store

Predicted to achieve a compound annual growth rate (CAGR) of 16.7 percent, as CMS capabilities grow, so will collaboration and planning tools that unite workflows to allow complete management of content from creative to back-end development.

Data Analytics

Today, marketers can harness the power of data analytics to gain an understanding of customer preferences and behaviors—including how they shop, where they spend their time, and how they discover new offerings—as well as market trends.

MarTech tools that allow marketers to dive deep into these data sets are invaluable, as they provide never-before-seen maps of how consumers operate online. By tracking online behaviors, marketers gain a deeper understanding of their customers.

As MarTech data tools become even more intuitive, marketers will have even more visibility of customer journeys, following them from initial interest to final purchase. These insights will be captured through cookies and CTR, among other trackers. As the tools become more refined, so will understanding of consumer behavior, allowing marketers to readjust their strategies.

6 MarTech Trends

To help you decide which MarTech offerings you want to add to your stack, we broke down the six biggest trends that are likely to impact both the MarTech world and the marketing world well beyond this year.

1. Increased Spending on Analytics

If you’re tempted to bypass adding an intuitive analytics tool to your MarTech stack, don’t. These tools can help you gain a better understanding of nearly every aspect of your marketing campaigns, from buyer behaviors to conversion rates.

In fact, researchers expect marketing analytics budgets to grow by 61 percent over the next three years.

That’s huge. You don’t want to miss out on getting in early on a tool that can quite literally change the way you see your business.

Some of the many benefits of marketing analytics tools include:

- viewing real-time, comprehensive outcomes of marketing efforts across channels

- improving lead generation through actionable insights

- gaining insights into customer behavior and preferences

- using predictive analytics to enable your business to be proactive rather than reactive

2. Higher Emphasis on Personalization

We nodded a bit toward the importance and growing prevalence of personalization in marketing campaigns.

In short, this strategy means delivering individualized content to audience members. This personalized route builds a connection with consumers, treating them as individuals rather than a mass market.

Some common (and growing) opportunities for personalization include:

- targeted emails

- custom video messages

- product recommendations

- social media

In the coming years, this prevalence will only grow, and marketers who don’t use tools to aid them in personalization will fall behind.

In fact, 99 percent of marketers claim personalization helps advance customer relationships, and 44 percent of consumers say they would be willing to switch to a brand that better personalized its marketing material.

If you’re not taking advantage of learning more about your would-be customers through tools and data, you’re missing out—not only on reaching customers more strategically but also on building relationships.

3. Transition Away From Third-Party Cookies

If you’re an advertiser or marketer who has relied heavily on third-party cookies, you may be in for a bit of a shock.

In 2020, Google announced its plan to phase out third-party cookies within two years. With Google Chrome composing almost 65 percent of the web browsing market according to statcounter’s data below, this move will have a dramatic impact on how marketers gather data.

If in the past, you relied on information from cookies to gain an understanding of consumer behavior and identity, you’re going to need to recalibrate your strategy.

Recently, Adobe found two in five brands are not prepared to transition away from cookies, indicating businesses do not have a strategy for gathering consumer data post-cookie.

After the transition is final, marketers will no longer be able to capture individual consumer data. To prepare for this future, digital marketers must align with the trend of personalization to reach and understand their intended consumers.

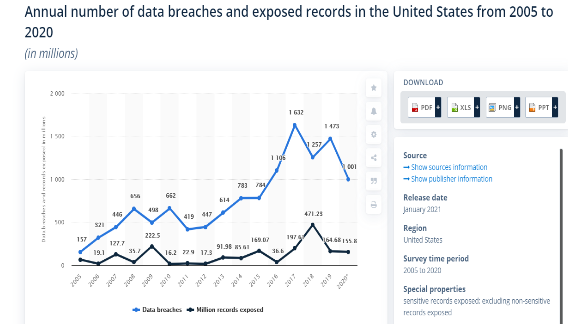

4. Higher Need for Data Privacy and Security

If you’ve been keeping an eye on the news, you know that data breaches are on the rise. The United States alone has seen data breaches grow from 660 annually to over a thousand within the past decade, according to Statista.

If you think this number doesn’t apply to you, think again. Your website and consumer data are among your business’ most valuable assets. You need to protect them from malicious attacks at all costs.

5. Increased Importance of Campaign Automation Tools

Marketing automation can make every aspect of your marketing campaign easy. By using these tools, you reduce time spent, error, and unnecessary cost.

We’re not the only ones who think this way: The marketing automation market is primed to grow 8.55 percent annually, with 51 percent of companies already taking advantage of these tools.

- Time-saving: With tools that automate time-consuming processes like project management, all members of your team will rejoice in the sheer amount of time they can reclaim after implementing these tools.

- More effective spend: By pinpointing processes that devour valuable time and treating them with automation software, you can use your budget much more effectively, saving both time and money.

- Scalability: MarTech automation tools scale with you. If you’ve got a big vision for your organization, these tools fit your business needs for today and tomorrow.

- Concrete measures of success: We’ve talked about the importance of data and metrics a lot in this article. All MarTech automation tools come with data insights that allow you to track everything from productivity to campaign spend.

As you assess your organization’s needs, look at how marketing automation tools simplify your processes and streamline campaign creation. The benefits of marketing analytics tools include:

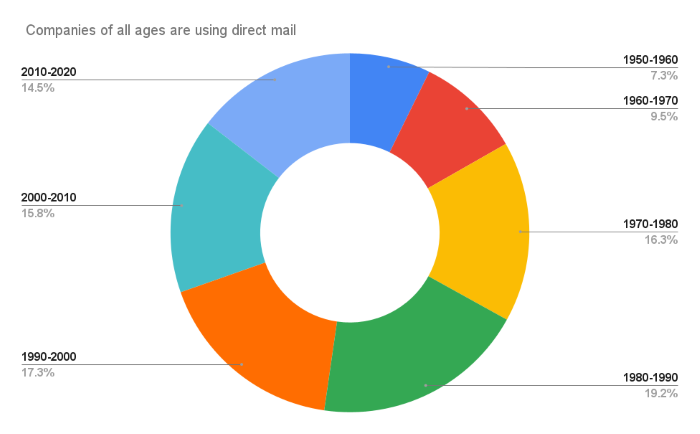

6. Growing Importance of Direct Mail

Thought direct mail was dead? Think again: Forty-two percent of direct mail recipients engage with your send either through reading or scanning.

Further, 73 percent of Americans prefer direct mail marketing, as it allows them to read the piece at their leisure rather than forcing immediate consumption.

This year and beyond, you should reassess your organization’s direct mail strategy to see if there are new (or overlooked) avenues for you to contact your prospects directly through their physical mailbox, according to Who’s Mailing What:

Outside of the above statistics, benefits of direct mail include:

- opportunities for personalization

- builds familiarity and trust

- easy to track

- complements your digital campaign

- cost-effective

MarTech Frequently Asked Questions

What Is MarTech?

Marketing technology, or MarTech, as it is more commonly known, refers to software and platforms that help individuals or organizations achieve marketing goals. This term is very inclusive, covering everything from email templates to data analytics.

Is MarTech a Good Investment for My Business?

Yes. With MarTech making up 30 percent of North American marketers’ business budget, you would be well-advised to take advantage of marketing automation tools and platforms that can help you take your campaigns to the next level.

What MarTech Trends Will Dominate the Market?

While there is a slew of MarTech trends that reshape the market year after year, we can confidently report that these six trends will be game-changers in the MarTech world:

- increased spending on analytics

- higher emphasis on personalization

- transition away from third-party cookies

- increased need for data privacy and security

- increased importance of campaign automation tools

- growing importance of direct mail

Is Direct Mail Still a Good Marketing Strategy?

In a word, yes. Direct mail is still an extremely effective marketing strategy. While there’s a lot of conversation around digital marketing, this classic mode of reaching potential customers is as effective as ever.

Want proof? Forty-two percent of direct mail recipients actually read what you’re sending them. Compare that to your average email clickthrough rate (CTR), and you’ll understand the true, measurable value of direct mail.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What Is MarTech?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Marketing technology, or MarTech, as it is more commonly known, refers to software and platforms that help individuals or organizations achieve marketing goals. This term is very inclusive, covering everything from email templates to data analytics.

”

}

}

, {

“@type”: “Question”,

“name”: “Is MarTech a Good Investment for My Business?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Yes. With MarTech making up 30 percent of North American marketers’ business budget, you would be well-advised to take advantage of marketing automation tools and platforms that can help you take your campaigns to the next level.

”

}

}

, {

“@type”: “Question”,

“name”: “What MarTech Trends Will Dominate the Market?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

While there is a slew of MarTech trends that reshape the market year after year, we can confidently report that these six trends will be game-changers in the MarTech world:

increased spending on analyticshigher emphasis on personalizationtransition away from third-party cookiesincreased need for data privacy and securityincreased importance of campaign automation toolsgrowing importance of direct mail

”

}

}

, {

“@type”: “Question”,

“name”: “Is Direct Mail Still a Good Marketing Strategy?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

In a word, yes. Direct mail is still an extremely effective marketing strategy. While there’s a lot of conversation around digital marketing, this classic mode of reaching potential customers is as effective as ever.

Want proof? Forty-two percent of direct mail recipients actually read what you’re sending them. Compare that to your average email clickthrough rate (CTR), and you’ll understand the true, measurable value of direct mail.

”

}

}

]

}

MarTech 2021 Trends: Conclusion

As marketing needs and customer predilections continue to change, so will the tools we use to meet them.

However, the six marketing trends outlined in this post are here to stay.

To help your organization grow with these MarTech trends, be sure to invest in software that can help you achieve all of your marketing goals. Tools are meant to be used—be sure you’re taking advantage of them to outmaneuver your competitors.

What’s your prediction for the biggest marketing trend in 2021 and beyond?

How to Navigate Google Analytics Like a Pro (Way Beyond the Basics)

Google Analytics (GA) is one of the most powerful tools on the web for website analysis. When properly set up and used, it allows you to break down your website traffic and gather vital information to power your digital marketing strategy. While GA has been around for some time, many people still don’t use it … Continue reading How to Navigate Google Analytics Like a Pro (Way Beyond the Basics)

Alfa Romeo to stay in F1 beyond 2021 with Sauber

Alfa Romeo will remain in Formula One beyond 2021 after extending its agreement with Sauber.

The post Alfa Romeo to stay in F1 beyond 2021 with Sauber appeared first on Buy It At A Bargain – Deals And Reviews.

Beyond a Simple Crowdfunding Definition: What You need to Know Now

Funding for businesses is needed now more than ever. Funding that does not have to be repaid is always in high demand, as is funding that does not require a stellar credit score. In the eyes of most, and rightly so, that is exactly what crowdfunding is. That is not the crowdfunding definition however. There is so much more to the whole crowdfunding scene.

Crowdfunding Definition: What It Is, What It Is Not, and What Your Other Options Are

According to Dictionary.com, the crowdfunding definition is:

“the activity or process of raising money from a large number of people, typically through a website, as for a project or small business.”

It sounds like a great plan, right? It is, until you know that the average success rate of crowdfunding campaigns is 50%. That said, 78% of crowdfunding campaigns reach their goal. Of course, that sounds better. Still, reaching your goal doesn’t guarantee success.

Check out our trustworthy list of seven vendors to help you build business credit. Conquer any recession!

Crowdfunding Definition: What Crowdfunding Is

The thing is, crowdfunding is definitely a viable option, but it is too risky to depend upon as your sole source of funding. For some, it works out to where you can get a whole business off the ground without any other funding source. For most, crowdfunding simply reduces the amount of debt you must take on. Yet, for many, there are not even enough funds raised from such campaigns to get started.

Crowdfunding Definition: What Crowdfunding is Not

Whether crowdfunding for startups or for an already existing business, it is not a legitimate only option. There needs to be a backup plan for either supplemental funds or full funding. If your credit score is good, there is no worry here as financing options abound. However, a not so great credit score can make a backup plan more difficult.

Crowdfunding Definition: Crowdfunding Platforms

While not an exhaustive list, these are some of the most popular crowdfunding platforms.

- Kickckstarter

-

- Indiegogo

- RocketHub

- CircleUp

- GoGetFunding

- Crowdfunder

- Fundable

- Fundly

Whichever platform you choose, whether one of these or one not on this list, remember there are a number of crowdfunding resources available to help you on this journey. You just have to look for them.

Crowdfunding Definition: Behind the Scenes

Now, the best way to find out about crowdfunding is to take a look at some actual campaigns. Here are some of the most notable, the good, the bad, and the ugly.

Now, the best way to find out about crowdfunding is to take a look at some actual campaigns. Here are some of the most notable, the good, the bad, and the ugly.

Pebble SmartWatch

Pebble actually has several of the top 10 campaigns ever on Kickstarter. Their 2nd campaign is the highest funded campaign to date, reaching over $20,000,000. That’s not too shabby for a goal of only $500,000. They blew it out of the water!

Are they still successful? Well, yeah, but not in the way you may think. They actually sold to FitBit.

FlowHive

This one is not one that most would expect to explode onto the scene the way it did. The FlowHive Indiegogo campaign definitely generated some major buzz. The idea was to find a way to get the honey from bees without harming the bees.

Traditionally, hives are simply broken open to obtain the honey. This process can kill the bees. FlowHive developed a fake hive of sorts, made from reusable plastic. Bees make honey in it, and the honey flows through a spout out into the world. The bees are safe and fresh honey is ours for the taking.

Apparently, beekeeping is growing in interest. This campaign raised $14,000,000. Though they won’t disclose exact numbers, the queen bees claim they are still buzzing and in the black.

CoolestCooler

The coolest cooler was a super cool Kickstarter campaign that came in at over $13.000,000 raised. The cooler boasted bluetooth and a blender among other things. Investors received a cooler for their donation toward the cause.

This one had some trouble when it wasn’t able to deliver investment rewards as quickly as promised and there was actually a lawsuit. In the end, everything worked out and everyone got their rewards.

BauBox Travel Jacket

This jacket has 10 different elements, including a drink holder and a neck pillow. They raised over $11,000,000 across 2 campaigns. It was a bumpy start, partially because the jacket was available on retail sites before investors even got theirs, but it is still selling today.

As you can see, while mostly successful, even these top campaigns had some pretty serious bumps along the way. You need to be prepared for the same, even if you reach your fundraising goals.

Crowdfunding Definition: The Backup Plan

Here are some options for financing. The one that will work best for your business will depend on your credit score, your business fundability, and how much you are able to raise through crowdfunding and other debt-free options.

Check out our trustworthy list of seven vendors to help you build business credit. Conquer any recession!

Traditional/ SBA Loans

These are lumped together because they each require working with a traditional lender and a decent credit score. However, it is important to remember that SBA loans typically require a lower credit score, although still good, as they are government backed business loans. A few examples of SBA loans that work great for starting a business include:

7(a) Loans

This one offers federally funded term loans of up to $5 million. Funds can be used for expansion, purchasing equipment, and working capital, in addition to startup. Banks, credit unions, and other specialized institutions, in partnership with the SBA, process these loans and disburse the funds.

504 Loans

The funds work well to purchase machinery, facilities, or land. They are generally used for expansion. Private sector lenders or nonprofits process and disburse funds. They are also good for commercial real estate purchases especially.

There is also a requirement you be in business at least 2 years, or that management has equivalent experience if the business is a startup.

Microloans

Microloans work for starting a business, purchasing equipment, buying inventory, or for working capital. Community based non-profits administer microloan programs as intermediaries. Financing comes directly from the Small Business Administration.

Credit Line Hybrid

A credit line hybrid is a form of unsecured business funding. With it, you can fund your business without putting up collateral. You only pay back what you use.

It is not as hard to qualify as you may think. Your personal credit needs to be good, as in at least 680. In addition, you can’t have any liens, judgments, bankruptcies or late payments. Furthermore, in the past 6 months you should have no more than 4 inquiries, and you should have less than a 45% balance on all business and personal credit cards. It’s also preferred that you have established business credit as well as personal credit.

However, if you do not meet all of the requirements, the credit line hybrid is still accessible. You can take on a credit partner that meets each of these requirements. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding. This makes a credit line hybrid an excellent option for bad credit business funding.

Credit Line Hybrid Benefits

There are many benefits to using a credit line hybrid. For example, it is unsecured, meaning you do not have to have any collateral to put up. Next, it is no-doc funding. This means you don’t have to provide any bank statements or financials.

Not only that, but typical approval is up to 5x that of the highest credit limit on the personal credit report. Also, it is possible to get interest rates as low as 0% for the first few months. That allows you to put that savings back into your business.

The process is usually fast, especially with a qualified expert to walk you through it. One other benefit is this. With the approval for multiple credit cards, competition is created. This makes it easier, and likely even if you handle the credit responsibly, that you can get interest rates lowered and limits raised every few months.

Alternative Lenders

These are also an option if your credit score is lacking. Remember, lenders change details such as requirements and rates frequently. Be sure to check with the specific lender for the most up to date information.

BlueVine

The minimum loan amount available from BlueVine is $5,000 and the maximum is $100,000. Annual revenue must be $120,000 or more and the borrower must be in business for at least 6 months. Your personal credit score has to be 600 or above.

Upstart

Upstart is an online lender unlike any other. It uses a completely innovative platform for loans. The company itself questions the ability of financial information and FICO, on their own, to truly determine the risk of lending to a specific borrower. Instead, they use a combination of artificial intelligence (AI) and machine learning to gather alternative data. Then, they use this data to help them make credit decisions.

This alternative data can include such things as mobile phone bills, rent, deposits, withdrawals, and even other information less directly tied to finances. The software they use learns and improves on its own. To be eligible for a loan with Upstart, you must meet the following qualifications:

- Credit score of 620+

- No bankruptcies or negative public records

- No delinquent accounts

- Meet debt to income standards (they only note they will check this ratio, not what their standards are.)

- Have fewer than 6 inquiries in the past 6 months on your credit report, not including those related to student loans, vehicle loans, or mortgages

These are the requirements they list on their website. One independent review said that the requirement for the debt to income ratio is a maximum of 45%. It also says that the minimum annual income has to be at least $12,000.

Check out our trustworthy list of seven vendors to help you build business credit. Conquer any recession!

Fora Financial

Founded in 2008 by college roommates, online lender Fora Financial now funds more than $1.3 million in working capital around the United States. There is no minimum credit score, and there is an early repayment discount if you qualify.

The minimum loan amount is $5,000 and the maximum is $500,000. The business must be at least 6 months in operation and the monthly revenue has to be $12,000 or more. There can be no open bankruptcies.

OnDeck

Obtaining financing from OnDeck is quick and easy. First, you apply online and receive your decision once application processing is complete. If you receive approval, your loan funds will go directly to your bank account. The minimum loan amount is $5,000 and the maximum is $500,000.

Just like any other online lender, they do have certain requirements to qualify for a loan. For example, a personal credit score of 600 or more. Also, you must be in business for at least 3 years. Annual revenue must be at or exceed $100,000. In addition, there can be no bankruptcy on file in the past 2 years and no unresolved liens or judgements.

Crowdfunding Definition: The Down and Dirty Truth

Knowing the crowdfunding definition is just the first step. As with most else in the world, a definition isn’t enough. Once you know the crowdfunding definition, the hard part starts. You have to figure out if it is right for you and your business. It may work great, or it may not. Plan for the best and hope for the worst is a great motto to live by here. Do your research on how to run a great campaign, and spend the time necessary to thoroughly research platforms and determine which one will work best for your needs.

Then formulate your backup plan. Do you need loans, a credit line hybrid, or some combination? The time to figure that out is on the front end, before you need it. By the time you see the need is a reality, it could be too late.

The post Beyond a Simple Crowdfunding Definition: What You need to Know Now appeared first on Credit Suite.

Gone beyond assumptions … $ 19,000.00 in Business Revenue …

Gone beyond assumptions … $ 19,000.00 in Business Revenue funding!

The post Gone beyond assumptions … $ 19,000.00 in Business Revenue … appeared first on Buy It At A Bargain – Deals And Reviews.

Beyond Mueller's 'Purview'

The post Beyond Mueller's 'Purview' appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND.

The post Beyond Mueller's 'Purview' appeared first on Buy It At A Bargain – Deals And Reviews.