Location: Wilmington, DE

Remote: Yes

Willing to relocate: No

Technologies: JS, node.js, Python, Flask and Django

Résumé/CV: https://www.linkedin.com/in/mark-hamilton-a62340134/

Email: markhamilton3325 (@) gmail (dot) com

Author: Leon Villarreal

6 Timely SEO Strategies and Resources for Voice Search

Are you missing out on traffic because people aren’t searching the way you think they are?

If your website isn’t optimized for voice search, then this could be the case. These six timely SEO strategies and resources for voice search will not only help you get more traffic from people using Siri and Alexa, but they will also become important pillars of your entire SEO strategy.

What Is Voice Search?

Voice search is a way of searching the internet through speech. Using artificial intelligence, a device can recognize your voice and put the query into a search engine.

Voice recognition has been around for a long time (since the early 1950s), but it wasn’t until 2011 when IBM’s Watson (you may remember it beating contestants on Jeopardy!) came out that it had practical real-world significance.

Today, voice search is everywhere. An eMarketer’s survey revealed that almost 40 percent of internet users in the U.S. use voice search, which highlights the ubiquitous nature of voice search-enabled devices.

Popular Voice Search Devices and Search Engines

If you look in your pocket or on your desk right now (perhaps even on your hand), there’s a good chance you’ll find a voice search device. One reason voice search is so popular is because the technology is in almost every device we use, making it super easy to access.

Here are some of the most popular voice search devices and the search engines they use:

- Google Home: Google

- Amazon Echo/Alexa: Bing

- Google Assistant: Google

- iPhone/Siri: Safari

- Android phones and devices: Google

- Microsoft Cortana: Bing

This means whether it’s your phone, TV, portable speaker, or any other device, it’s got the ability to search the internet through speech.

How Does Voice Search Affect SEO?

When you type a query into Google, what do you want it to do?

First, it’s got to understand what you mean by your query (helping it to understand the type of results you want to see), and then show you the best results that match your search query.

The way we type queries into Google is quite different from the way we talk to our voice assistants. For example, if you’re looking for a local restaurant to dine in, your searches might look a little like this:

- typed: “Restaurants near me”

- voice: “What are some good restaurants in my local area?”

When we type, we tend to use very keyword-based searches, but when we use voice search, our searches become much more conversational. This means search engines have had to become very good at semantics: understanding the meaning behind words.

The way we use language is complicated, and it’s not easy for machines to understand the meaning behind words (just think how many words have multiple meanings). Voice search has forced search engines to get much better at this though, and Google has led the way with key updates like Hummingbird.

This update and other previous ones have changed SEO, taking the focus away from keywords (in the early days, people would simply stuff keywords into their articles) and much more toward user experience.

Voice search has played a part in this shift, and it continues today, with a consistent focus on experience, rather than just keywords.

6 Ways to Optimize for Voice Search

Voice search is here to stay. Everywhere you look, there are voice search-enabled devices, and the percentage of voice searches as a share of total searches continues to grow (usage grew by eight percent between September 2018 and early 2019).

The good news is you don’t have to tear up your current SEO strategy to optimize for voice search. Voice search plays into the overall trend of matching user intent and providing the best possible user experience, so the tactics you use to optimize for voice search will benefit your SEO in general.

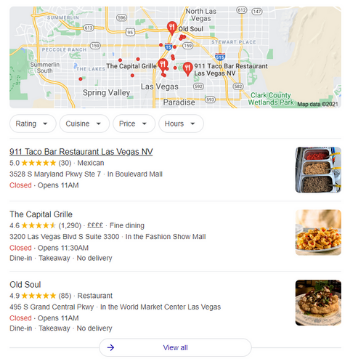

1. Optimize for Local Search

Many voice searches are for local information; they are three times more likely to be local searches than text-based ones.

If you think about it, this makes sense. When you’re out and about, and want a quick answer to your question, it’s easy to get out your mobile device and ask a question. This means it’s important you focus on the local element of your SEO.

For many businesses, local SEO is a fundamental part of digital marketing anyway. Local searches make up around 46 percent of total searches, and these are extremely engaged buyers. Local people are the people who will drop into your store and make a purchase there and then, and this means showing up in the local search pack is essential, especially if you’re a brick and mortar business.

Local SEO follows the same principles as regular SEO, and the key thing (that many websites neglect) is consistently telling people you’re a local business. Make sure you’re creating content that’s relevant to your local area and integrating local keywords into your copy.

Check out Ubersuggest to get local keyword ideas and make sure you’re answering the questions local people have:

- phrases people use to describe the neighborhood around your location

- “near me” in your title tags, meta description, internal links, and anchor text

- landmarks around your business location

- the titles of local institutions that are relevant to your business

Focusing on your local SEO will help your voice search, so check out my Definitive Guide to Local SEO.

2. Create Conversational but Concise Content

The days of stuffing your content with keywords simply to please crawlers are long gone. To be successful with SEO, you’ve got to be authentic, use language naturally, and offer valuable content.

Essentially, you have to be human (we all are, so this shouldn’t be a problem).

Voice search typifies this because when people search through speech, they tend to talk in a more natural way than they do when they’re typing a query into the search engines. Your content should match the conversational way people ask questions to their voice assistants, but not just for voice search reasons.

Today’s rankings are user-experienced-focused. The pages that answer people’s questions in the best way while sharing the best experience, will rise to the top of the rankings.

To do this, you’ve got to give people quick access to the information they need (being concise) and do it in an enjoyable way (natural, conversational language). When you’re doing this, you’re not just matching the language people have used in their voice search (user intent), but you’re also driving engagement through your authentic brand voice.

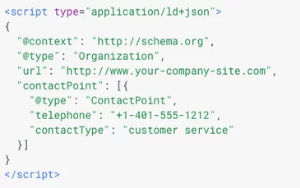

3. Use Structured Data

Ask your voice-controlled device this question: “Who was the first President of the United States of America?”

What happens?

Chances are your device will start reading out an answer about George Washington.

This information is taken from a long page about George Washington though, so how does it know which bit of text to read? The answer probably lies in structured data.

Search engines look at a bunch of factors besides content to determine a page’s relevance and position in their search results. Professional SEOs leverage these additional factors to further optimize their content for search engines.

Schema markup, also known as structured data, is one such factor. It does not affect the rankings directly, but it can give you an edge over your competitors, particularly when it comes to voice search.

Essentially, it is metadata: data about the information on your site. It goes into your site’s source code. The visitors don’t see it, but microdata helps search engines to organize and classify your content. It is an underutilized strategy because it requires work.

Do you want an example?

The following markup classifies your contact details page as containing contact information.

Now, let me guess your next question: How is microdata relevant to voice search?

When users search for local businesses, they often look for operational hours, contact information, address, directions from highways, and the like.

You can use microdata to ensure that search engines classify this information.

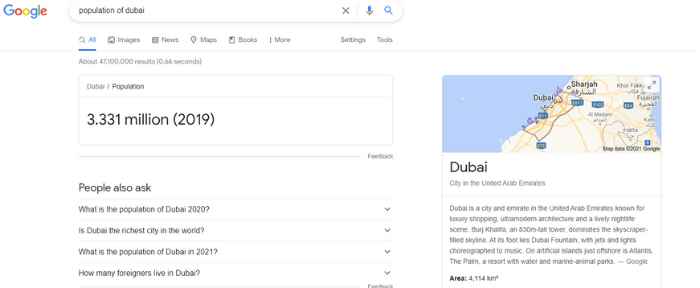

Let’s search for the population of Dubai.

Google quickly retrieved the figure because of a markup.

Need another reason to work on your structured data?

A study found that over 40 percent of voice results were pulled from the featured snippet. Just like with voice search, featured snippets need to pull the exact information you’re looking for, so it’s likely they look at structured data to decide what information should be shown.

If you want a step-by-step guide on implementing schema markup, check out my guide to using Schema Markup.

4. Claim Your Google My Business Listing

Your Google My Business Listing is an essential part of local SEO and voice search.

Because voice searches are often used to find out important details about your business, such as contact number, address, and opening hours, Google must have accurate information on these details.

Your website and structured data go a long way in making sure Google has the right information about your business, but Google wants to be super accurate, and the way it does this is by looking at your Google My Business listing.

This will give Google all the information it needs to understand what your business does, who it’s for, when it opens, where it is, and much more. This is the exact information voice searches are asking for, so it’s a quick way to get accurate results to people’s questions.

5. Be Mobile Friendly

How are most voice searches made?

You want to show up in results through mobile devices, and you’ve got to offer a good mobile experience. This is a key part of Google’s algorithms, but there are still websites out there that aren’t optimized for mobile.

If this is the case with your website, people are going to click on your site and leave immediately because the page doesn’t work properly on their device. This is a big sign for Google that your page isn’t worthy of ranking, and it’s going to hurt you for both voice search and traditional queries.

I mentioned modern SEO is all about user experience and with the majority of traffic (and virtually all voice traffic) coming from mobile devices, this is something you have to be on top of.

There are lots of little things you can do to make your site more mobile-friendly, so make sure your website is offering the right experience for people who use voice search.

6. Create Content Answering Your Audience’s Frequently Asked Questions

People tend to use questions when making voice searches.

The great thing about this is Google gives you a great insight into the questions people are frequently asking.

Type a question that relates to your website, and take a look at the results. The chances are, you will see a box titled “people also ask.” The FAQ’s feature displays for many queries, and it shows you the questions your target audience is regularly asking.

With a clear picture of the questions people are using to search for information, you can start creating amazing content that answers those questions. As I’ve said throughout this article, it’s all about user experience, and the first thing you need if you’re going to give someone the right experience is valuable content.

Answer people’s questions, help solve their pain points and make it enjoyable. If you can do this better than all the other websites, then it’s going to give you an excellent chance of ranking.

Voice Search FAQ’s

Voice search SEO is the practice of optimizing your website to show up in search engine results pages for voice searches.

Voice search has had an impact on SEO. It’s all about understanding the meaning behind words, and this is a fundamental part of all SEO.

Devices with voice search capabilities are everywhere. This has led to huge growth in voice searches. If you’re not optimizing, you might be missing out on a big chunk of your audience.

Google has suggested 27 percent of mobile searches are voice searches.

Voice Search Conclusion

If you want to grow your organic traffic, then you should be aiming to rank well for voice searches. Not only are there a huge number of voice searches happening every day, but the techniques you use to optimize for these queries are a fundamental part of modern SEO.

Voice search has changed the way people search for information, and search engines have responded with updates to their algorithms. You need to respond as well, and by matching searcher intent and providing the right user experience, you can make sure you’re getting more organic traffic through voice search.

Are you optimizing for voice search yet?

UPchieve (YC W21) Is Hiring a Mobile Engineer (Remote)

Article URL: https://upchieve.welcomekit.co/jobs/mobile-engineer_brooklyn

Comments URL: https://news.ycombinator.com/item?id=27855382

Points: 1

# Comments: 0

Smarking (YC W15) Is Hiring a Head Engineer to Scale and Lead the Eng Team

Article URL: https://jobs.lever.co/smarking/91ecceff-db7b-463f-bd6e-c348bcaec567

Comments URL: https://news.ycombinator.com/item?id=26464927

Points: 1

# Comments: 0

What is Equity Crowdfunding and How Can You Use it For Your Business?

Creating a successful startup is hard; it’s even harder without access to startup funds. However, if you’ve got a great business plan and the ability to create a buzz around your brand, equity crowdfunding could be the perfect option for your business.

New legislation is opening up this crowdfunding option and making it a more viable method of raising capital for thousands of businesses.

An Overview of Equity Crowdfunding

Equity crowdfunding enables members of the public to invest in a privately-owned company. An entrepreneur or a business, generally a startup, will use an equity crowdfunding platform to offer securities in return for an investment from members of the public.

Most commonly, that security will be in the form of shares, and as the company grows and prospers, the value of those shares increases, offering the investor a return on their investment.

Why is this important for businesses?

If you’ve ever started a business, then you know it’s not straightforward, and one of the biggest challenges is raising funds to get your company off the ground. In the past, if you wanted to raise funds through members of the public, then you would need to find a venture capitalist or angel investor (people with a net worth of at least $1 million, or with an annual income of at least $200k).

However, the introduction of the JOBS Act in 2012 opened the door for privately-owned companies to raise capital through regular members of the public.

On the other side of the equation, equity crowdfunding allows regular investors to get in on the ground floor of a business opportunity. Even the biggest companies in the world like Google and Amazon started off life as startups, and with equity crowdfunding, regular people have the opportunity to invest right at the beginning of a future Google’s journey.

For every Google or Amazon though, there are endless examples of startups that fail. In fact, the 2019 failure rate for startups was 90 percent, so investing through equity crowdfunding is a risk.

Trends in Equity Crowdfunding

Many of the trends in equity crowdfunding stem from a need for consumer protection. When you invest in publicly-traded companies, you’re investing in an established, highly-regulated business, but it’s not necessarily the same story with equity crowdfunding.

It takes vast resources to become a publicly-traded company though, so it’s out of reach for startups and small businesses. Instead, they turn to alternative means of raising capital, such as equity crowdfunding, and while this offers regular investors great opportunities, it can also open them up to great risk.

This is why investing in startups was previously reserved for venture capitalists and angel investors because they were seen as having the means and experience to manage that risk. However, cutting the regular investor out of these options also created a two-tier system, where savvy investors couldn’t get in on enterprising startups.

JOBS Act 2012

While protecting investors is important, it meant that regular investors were missing out on promising opportunities, and startups were finding it hard to raise the capital needed to get their businesses off the ground.

This changed with the Jumpstart Our Business Startups (JOBS) Act, which set out legislation to open up the equity crowdfunding market.

Regulation remained strict, particularly compared with some other countries, but crucially, businesses could now reach out to “the crowd” for funding. With Regulation crowdfunding allowing companies to raise up to $1.07 million annually, and Regulation A permitting up to $50 million of funding each year, this offered businesses a viable option to raise capital.

JOBS Act Update 2020

In 2020, the Securities and Exchange Commission made some adjustments to the JOBS Act, raising the amount of capital businesses could crowdfund each year. Under the new regulations, businesses could raise up to $5 million annually through Regulation Crowdfunding and up to $75 million annually through Regulation A.

Since the average seed round in 2020 was $2.2 million, this made equity crowdfunding a much more feasible option for startups, allowing them to secure the funds they need to succeed in their business.

A Growing Market

Equity crowdfunding is a relatively new market, and although it’s valued at over $10 billion, that’s a tiny drop in the ocean compared with the $282 billion raised through venture capital in just a year.

However, equity crowdfunding is growing quickly, and when you look to the markets in other countries, there are signs that this fundraising option could grow exponentially in the coming years.

Over in the U.K., equity crowdfunding is much more established. This is largely due to more favorable legislation that has allowed equity crowdfunding companies to grow much more quickly. However, with the update to the JOBS Act, it’s likely we might see a similar uptick in the U.S. startup market.

How to Get Equity Crowdfunding for Your Startup

As you might expect with a growing market like equity crowdfunding, there are plenty of platforms to choose from. Each has its unique selling points, so it’s important to do your research and find the platform that’s going to represent the best deal for your business.

Once you’ve decided on a platform, you’ve got to apply, and this is a very important step. These platforms are extremely invested in protecting their investors, so they’re going to vet your application exhaustively. You’ll have to portray your business in a strong light, and offer up a business plan that represents value to the platform’s many investors.

If you’re accepted onto a platform, you can then decide on your terms (what type of security you want to sell, how much you want to raise, etc.). This is one of the big bonuses about equity crowdfunding because you’re in control of your terms.

You’re not negotiating with one single angel investor who might be able to negotiate you down. Instead, you’re putting your offer out to the crowd, and it’s up to each individual as to whether or not they take it up.

The last step is taking care of compliance by ensuring you have all the legal documents and pass the financial tests. For Regulation Crowdfunding (up to $5 million), you will need an independent financial review, but for Regulation A+ Crowdfunding (up to $75 million), you will need a full financial audit, which will take a bit longer.

If your business is found to be in good shape, then according to StartEngine you can be ready to raise funds through Regulation Crowdfunding in four to six weeks with very few costs, or through Regulation A Crowdfunding in about six months for a cost of roughly $50,000-$75,000.

Successful Equity Crowdfunding Case Studies

Equity crowdfunding might be relatively new in the financial world, but plenty of companies have had huge success with it.

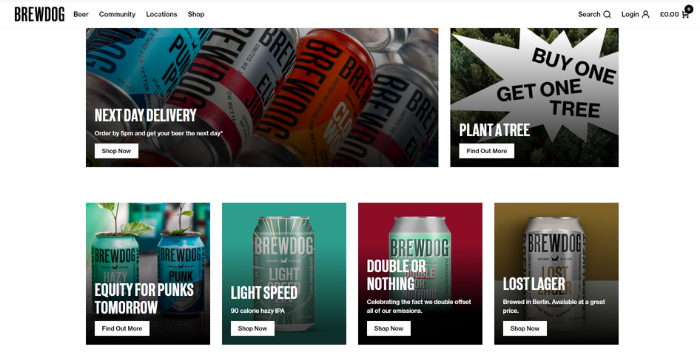

BrewDog

When we think of startups, our minds are generally drawn toward tech, but one of the greatest examples of equity crowdfunding comes from the world of beer.

Starting life in 2007 as two guys with a love of beer, BrewDog has developed into a $2-billion company, and equity crowdfunding has a lot to do with it. The privately-owned company is 22 percent owned by a collection of 120,000 investors who have put in around $95 million as of 2020.

In a world dominated by a handful of major brewers, this has allowed BrewDog to expand well beyond the reach of your average craft brewery, and they continue to use equity crowdfunding to invest in their green credentials.

Paradox Interactive

Gaming company Paradox Interactive was able to raise $3 million in the first 8 minutes of its offer going live. This goes to show the power of crowdfunding and the ability it offers businesses to raise capital quickly.

Later that year, Paradox Interactive went public, listing on NASDAQ at a value of $420 million. This demonstrates that equity crowdfunding is more than just a tool for raising money, it’s also an opportunity to create a huge buzz around your business.

When someone invests in you, they’re going to become a brand advocate, and when you’ve got thousands of these people around the world, it can catapult your brand into the public consciousness.

Knightscope

Security technology company, Knightscope is a perfect example of the flexibility equity crowdfunding offers. Initially raising $150k in just 7 days, Knightscope used this to scale, and then came back to the table 6 months later to raise $1.1 million.

This was nothing compared to the $20 million they would raise just two years later.

CEO, William Santana Li specifically noted the effect equity crowdfunding had on amplifying the Knightscope brand. This, combined with the capital raised has allowed the company to grow, reaching an estimated value of over $320 million, and leading to speculation that the business might go public.

This is another example of how good equity crowdfunding can give a start-up an excellent platform to go on to much bigger things.

Equity Crowdfunding Companies

The U.S. equity crowdfunding market is largely dominated by three companies: WeFunder, StartEngine, and Republic.

The top 10 platforms raised $209 million in 2020 and over $177 million of that was raised by these three companies.

WeFunder

WeFunder played a big part in lobbying the government over the JOBS Act and has been at the forefront of equity crowdfunding since its beginning. It has the biggest market share in terms of capital raised and can give your business excellent exposure.

One of the most appealing aspects of WeFunder’s offerings is the ability to sign up with no fees until you’ve successfully raised money.

This means you can dip your toe into the world of crowdfunding and focus on marketing your business as an investment opportunity before you have to worry about paying out.

StartEngine

StartEngine boasts a community of over 300,000 investors, which means it’s a great platform to get your startup noticed.

With over 375 successful raises, totaling over $250 million for its clients, StartEngine is one of the first places to look when it comes to equity crowdfunding.

StartEngine prides itself on helping you every step of the way, with a full-service plan that gives you complete control over your offer. It’s focused on keeping the power in the hands of the entrepreneur and allowing them to tailor their offer to suit their business needs.

Republic

Republic focuses on the ability of its platform to do more than just raise capital for your business. With over 350,000 investors, it touts its ability to create “true fans and engage supporters” all around the world.

This is certainly an underestimated part of equity crowdfunding, and it’s important to remember that it’s about more than just money. The exposure a successful crowdfunding campaign can bring you is a great source of marketing in its own right, and Republic is quick to highlight this.

Crowdfunding, VC Capital, or Angel Investments: Which is Right for Your Business?

On the face of it, crowdfunding sounds great, but as with anything, it has its drawbacks. When you’re weighing up how to get investment in your startup, you’ve got to look at the positives and negatives, and focus on how they fit in with your business plan.

Benefits of Equity Crowdfunding

- Create thousands of brand advocates around the world.

- Gain public validation from a successful crowdfund.

- Boost brand awareness.

- Maintain control over your business (you’re not offering investors a say in how the business is run).

Drawbacks of Equity Crowdfunding

- You have to be in the right stage of your business development.

- You’ve got to create a buzz around your brand.

- It often takes prealigned investment to get people interested in your offer.

- It can be a time-consuming process.

When you compare crowdfunding with venture capital or angel investments, it’s clear where crowdfunding triumphs, though: control.

When you have thousands of small investors rather than a handful of large investors, the external pressures and potential influence of your investors are much smaller.

Thousands of small investors aren’t there telling you how to run your business, but they are going out into their communities and spreading the word about your business, which can have a huge impact.

Conclusion

Building a thriving startup isn’t easy, but when you don’t have access to capital, it’s a lot harder. In the past, private companies had limited options for raising funds, but with changes to legislation, equity crowdfunding gives startups access to thousands of investors who are looking for the next big thing.

Not only is this an opportunity to raise a large amount of capital, but it can also supercharge your marketing by creating a huge buzz around your brand.

When you raise millions of dollars from investors worldwide, people will start talking about your business and become brand advocates, which is almost as valuable as the money you raise.

What’s holding your startup back?

The post What is Equity Crowdfunding and How Can You Use it For Your Business? appeared first on Neil Patel.

The Muse (YC W12) Is Hiring a Director of Account Management

Article URL: https://www.themuse.com/jobs/themuse/director-account-management

Comments URL: https://news.ycombinator.com/item?id=24594046

Points: 1

# Comments: 0

Dover (YC S19) is hiring engineers to build a truly modern recruiting agency

Article URL: https://www.dover.io/open-roles/senior-software-engineer

Comments URL: https://news.ycombinator.com/item?id=24084626

Points: 1

# Comments: 0

The post Dover (YC S19) is hiring engineers to build a truly modern recruiting agency appeared first on ROI Credit Builders.

Hidden Bank Loan Charges That Would Make a Pick-Pocket Envious

Hidden Bank Loan Charges That Would Make a Pick-Pocket Envious

There can be much more to a financial institution company funding than making passion and also primary settlements. When you uncover the surprise costs as well as fees, your company might obtain a fantastic price on its brand-new credit report line or term finance yet you might weep on the method residence.

Also experienced consumers can be captured off-guard. Loaning prices can be improved by countless bucks and also the reliable price on the financing raised by numerous basis factors as an outcome of these concealed fees.

Right here are several of the costs as well as fees that can boost your company’s prices on small business loan:

Dedication costs

Numerous financial institutions bill dedication charges of 1/2% – 1% or even more to release a dedication to offer cash. The charge is relied on the offered debt quantity. Dedication costs substantially raise the efficient price on impressive car loans.

These charges can be worked out. If your company has a solid credit score account or if the competitors amongst financial institutions in your location is tough, request a reduced dedication cost or ask to have it forgoed.

Non-use costs

These charges might be butted in lieu of or along with dedication costs Non-use costs typically vary from 1/4% to 1/2% of the extra credit report center. These costs are much less difficult than dedication charges, they likewise raise the efficient loaning price.

Similar to a dedication cost, you might have the ability to obtain the non-use charge forgoed or decreased if your company has a solid credit scores account or if the financial atmosphere is really affordable.

Restructuring charges

When your company has factor to reorganize an existing finance, you can anticipate your financial institution to bill a restructuring charge for the advantage. If your business has factor to transform a temporary car loan right into a lasting one, it will possibly be billed for this restructure.

These charges can vary from 1/2% to 2% or even more plus any kind of financial institution lawful charges or out-of-pocket expenditures. You might be able to get rid of the charge or discuss if your company has actually been a lasting financial institution consumer in excellent standing. Do not anticipate to remove the financial institution’s lawyer costs as well as out-of-pocket expenditures.

Financial institution lawyer charges

When the financial institution utilizes an outdoors legislation company, Attorney costs generally come right into play. Making issues worst, several outdoors financial institution lawyers call for a customer to employ an outdoors lawyer to release a point of view letter covering the purchase.

Typically, just the best debtors in really affordable financial scenarios can entirely get rid of paying financial institution lawyer costs. If your company is a valued client, your financial institution might be eager to have these costs minimized or topped. Usually financial institutions have some utilize with their law practice to obtain a discount rate.

Appraisal/environmental examination charges.

These charges are billed on several asset-backed lendings. They typically include generating an outdoors specialist to assess devices or property. These costs can be substantial, relying on the sort of assessment or setting problem.

Like lawyer charges, assessment or atmosphere assessment costs are generally for the account of the customer. Maybe the very best result one can anticipate is to have these charges topped or have the loan provider divided the quantity somehow.

Unforeseen audit expenditure

Numerous financial institutions book the right to investigate customers or to send out financial institution employees in for examinations. Some financial institutions need outdoors audits by CPA companies in link with expanding credit history.

Prior to finalizing, examine your funding arrangement meticulously to determine any type of audit or financial institution evaluation need. Attempt to obtain it removed or attempt to discuss limitations if your financial institution needs an audit or evaluation that you did not prepare for. You might have the ability to obtain a less-stringent demand or to discuss a less-expensive option to the audit or assessment called for by your financial institution.

Attempt to obtain audit or assessment charges covered if all else falls short.

Late costs

Fees for making late settlements to your financial institution are normally in your control. These fees can be difficult and also can include dramatically to your company’s loaning price. It is not uncommon to see financial institutions tack 300 basis factors onto a consumer’s interest rate for overdue repayments.

While it is beneficial throughout the bargaining phase of the lending to request a reduced late- settlement cost, the most effective option is to attempt to prevent these costs. Attempt to obtain the late-payment price knocked down to 75 to 150 basis factors over your loaning price if you can.

Expiration of or Failure to Get a Rate-lock

In a steady price setting, lots of financial institutions are ready to secure the price on fixed-rate credit rating deals. Rate-locks are not unusual in genuine estate financings and also tools installation fundings.

Attempt to bargain a rate-lock if your company is working out a fixed-rate funding. You might pay lending passion that is a little bit greater, however a secured price can get rid of an undesirable rates of interest swing.

Attempt to remain within the holding duration for shutting the purchase as soon as you have actually secured the price. A lot of financial institutions will excitedly and also strongly hand down price walks in a climbing price market, if you stop working to conform.

Lots of surprise financial institution charges and also costs can be minimized or gotten rid of if you intend in advance as well as are prepared to work out. You can additionally ask your financial institution to prepare a different checklist highlighting all possible costs as well as fees.

Lots of financial institutions bill dedication charges of 1/2% – 1% or even more to provide a dedication to offer cash. These charges are much less burdensome than dedication costs, they additionally boost the reliable loaning price.

These charges can vary from 1/2% to 2% or even more plus any kind of financial institution lawful costs or out-of-pocket expenditures. If your company has actually been a lasting financial institution consumer in excellent standing, you might be able to get rid of the charge or work out. Several surprise financial institution costs as well as costs can be minimized or removed if you prepare in advance and also are prepared to work out.

The post Hidden Bank Loan Charges That Would Make a Pick-Pocket Envious appeared first on ROI Credit Builders.

Sterblue (YC S18) Is Hiring a Senior Front-End Engineer

Article URL: https://www.sterblue.com/jobs#rt-jobs-1

Comments URL: https://news.ycombinator.com/item?id=23419570

Points: 1

# Comments: 0

BuildZoom (a better way to remodel) is hiring a remote growth associate

Article URL: https://jobs.lever.co/buildzoom/0e86e9ea-a3eb-4f19-8697-425db484942f

Comments URL: https://news.ycombinator.com/item?id=23095073

Points: 1

# Comments: 0