The Ultimate Guide to Customer Acquisition: Examples, Tips, and Resources

Customer acquisition is a huge pain point for many business owners. Even more difficult is developing a consistent way of bringing in new business.

Your goal should be to put together a system that acquires customers almost on autopilot. That’s easier said than done, though.

This guide should help get you started.

What Is Customer Acquisition?

Customer acquisition is your business’s process of bringing in new customers. The goal of every business is to create procedures that make acquiring new customers simple and systematized. Unfortunately, many small businesses and freelancers have a hard time developing a process for bringing in new clients.

An important piece of the puzzle is a business’s ability to measure its customer acquisition cost. In the digital marketing realm, this is often referred to as “CPA” or “cost-per-acquisition.”

It applies across the board, whether you’re using paid advertising, organic reach, print, radio, TV, or anything else. You should know how much you need to spend to acquire a customer. Once you determine that, it becomes much easier to scale up your marketing because you know you can pump more dollars into your campaigns and get XYZ in terms of customers out the other end.

What Is the Purpose of Customer Acquisition?

The purpose of customer acquisition is self-explanatory. Without a customer, you don’t have a business. Without consistent customers, you don’t have a stable business.

A little caveat here is businesses should also focus on customer retention, which is different from an acquisition. Retention is your effort to keep the customers you already have rather than going through the vicious cycle of constantly needing to acquire new ones. Increasing your retention by only five percent can increase your profits by as much as 95 percent.

When you combine customer acquisition and retention, you have a sure-fire recipe for success. Here’s why:

- It helps you make the money you need to cover costs and pay employees, allowing you to reinvest in the business and drive better results for your clients.

- It shows steady growth and success to partners, investors, and outside influencers.

Being able to continually drive new business towards your company keeps everyone happy, but it’s not the end goal. The goal is to retain the customers you have as long as you can. Although it costs money to acquire new ones, it doesn’t cost anything to keep them.

Customer Acquisition Versus Lead Generation

There may be some confusion about the difference between the two, but it’s actually simple: Lead generation is one step of the customer acquisition funnel. A person or entity must first become aware of your business before they can buy anything from you. This generally happens as a result of lead generation.

For example, let’s say your business is running a Facebook ad. This usually happens to cold traffic (people who have never heard of you). They see your ad and pause to look for a second. They’ve now become a lead and are no longer cold traffic because they are aware of you.

Maybe they click the ad, fill out a form, and end up having a conversation with you. All of these are steps in the overall customer acquisition funnel. Lead generation is simply one step.

How to Create a Customer Acquisition Plan

Now let’s talk about some of the actionable steps you can take to develop the best customer acquisition strategies.

1. Identify Your Customer Avatar

The first step for every business (before they’re even a business!) should be to create a customer avatar or buyer persona. This is your ideal customer: who they are, what they like, their problems, and their demographic information.

It’s a great strategy for a business to know who their customer is as early as possible. For example, if you sell anti-aging cream, you have a very clear audience who would be interested in that product. Your audience might be women ages 40+ who have a developed skincare routine but are looking for a little extra help. They might be middle to upper-middle class and can’t afford surgery or cosmetic procedures, but they can afford your cream.

If you know exactly who your target is, you’ll have a much easier time acquiring them because your ad copy, text, images, and products will speak their language.

2. Determine Goals

Once you have your customer avatar, jot down some goals and objectives. What are you trying to achieve with your marketing efforts? Here are some examples:

- Awareness: Are you trying to spread awareness of a cause, shed light on something, or make yourself known to a specific audience?

- In-person: Does your business require people to physically come into a brick-and-mortar location?

- Phone call: You might need to convert the online traffic into a phone inquiry.

- Form: Is your traffic still in the early stages of learning about you? If so, you might just want them to complete a form.

- Conversion: If the traffic you’re targeting already knows who you are, you might simply be trying to get them to convert into a sale.

Regardless of what your goal is, you need to have one. The clearer the direction you take, the easier it will be to convey the proper message and get your audience to do what you want them to.

3. Choose a Platform or Avenue

Once you’ve figured out who your audience is and what you want them to do, you need to determine what method to use to reach them. There are many different customer acquisition channels, both online and offline. Here are some of the most popular:

Content Marketing

Content marketing is a great long-term way to develop customer relationships and drive traffic to whatever it is you’re looking to accomplish. Best of all, there’s no right or wrong way to do it because you can put together content based on your niche.

Just keep in mind that content marketing isn’t as simple as blogging on your website and expecting people to find it. You need to understand basic SEO and realize that this is a long-term strategy and can take months before you see results.

Social Media

Acquiring customers on social media offers a few different avenues. You can use paid ads, which I’ll discuss shortly, or you can do it the slow way by building up an organic following, posting regularly, and reaching out to people to start conversations.

I like using social media in the most natural way possible, and that’s by “being social.” Start conversations, send messages, and provide value to people. They will respond. Seventy-three percent of marketers find social media “somewhat effective” or “very effective” in their business. It all starts with a conversation.

Paid Advertising

Whether you choose PPC on Google or social media ads like Facebook, paid advertising is a great way to get your business in front of the right audience right away. Keep in mind that Google Ads have a 100 percent ROI, but that does require you to understand how to do it right.

4. Set a Budget

You need to have a budget and customer acquisition cost formula if you plan to have success. Marketing can quickly run more expensive than you expected if you don’t have a set budget in place ahead of time.

Start with a small budget and work your way up as you start to experience success.

5. Optimize and Tweak

Once you’ve had a chance to compile data on how people are receiving your ads, pieces of content, etc., you can optimize and tweak as necessary. For example, if you find that a specific demographic is converting the best on a social media ad, you might want to allot more ad spend to those people and take some away from the people who aren’t converting.

3 Examples of Successful Customer Acquisition

One of the best ways to understand how to implement and measure customer acquisition is to see other companies do it successfully. Here are some examples you can piggyback off of:

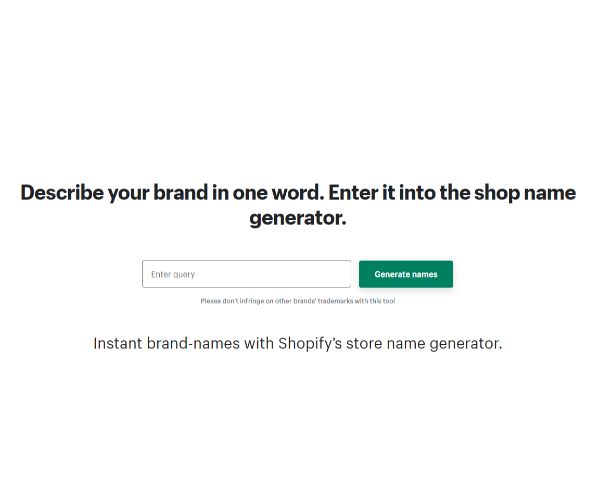

Shopify: Interactive Content

Shopify is the e-commerce giant responsible for thousands of successful e-commerce stores. One great way that they drive customers towards the site is with interactive content such as business name generators, quizzes, and even product choice suggestions. This is not only fun, but it keeps you on the site longer, which looks good to Google.

The content you create needs to be interesting and unique. The internet is a highly competitive environment, and you can’t just post anything and expect people to read it and react.

Turbotax: Free, Free, Free

Turbotax is a great example of using multiple platforms to convey your message. We’ve likely all seen their ads somewhere when they talk about how their service is free for individuals and always will be. If you understand neuro-linguistic programming, you know that “free” is a big buzzword.

Make sure you’re offering enough value to your customers in exchange for what you’re asking. Advertising has changed, and it’s no longer as simple as telling people what you do. You need to provide value.

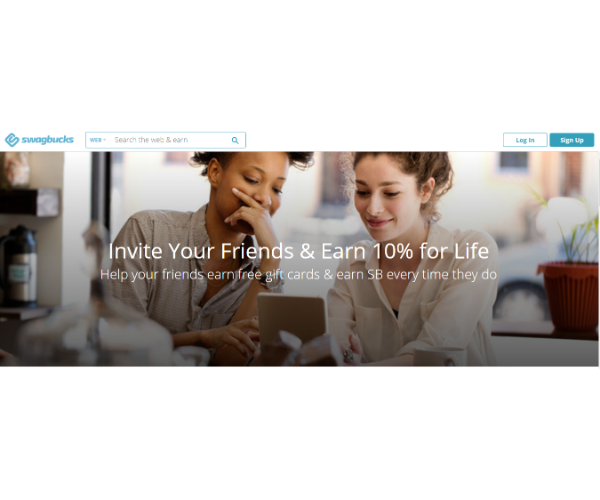

Swagbucks: Referral Marketing

One of the best ways to get more customers is to have your customers get them for you. Referral marketing is a powerful method because it doesn’t cost much, and you’re rewarding the customers you already have, which can help increase customer retention.

This method is especially useful at the beginning of a business’s life when you’re trying to grow your network and establish credibility. Offer something to your customers for every lead they bring your way.

5 Tips to Improve Your Customer Acquisition Strategy

Here are some bonus tips to help you nail down your customer acquisition:

1. Master the CTA

Your call-to-action (CTA) needs to be perfect once you know your audience and have traffic. At this point, it becomes all about what you’re doing to convert the traffic you have. Conversion rate optimization becomes the key, and it usually starts with having a crystal clear and persuasive CTA.

2. Track Everything

You should be tracking every little detail about your prospective customers. Most importantly, focusing on the right metrics will take things to the next level. Demographic information, heat maps, abandoned carts, retargeting—all of these are important. This data can help you understand more about your audience so you can further optimize the ads for future success.

3. Make Sure the UX Is Perfect

If you’re getting traffic, the ads are working, and everything seems to be going well, but you still don’t have customers, there could be another reason. Make sure your site is fully functional, mobile-optimized, fast-loading, and easy to use.

4. Be Patient

It can take as long as a week to build up enough data on Google ads. If you change or cancel an ad before that time, you might be shooting yourself in the foot. The same applies to content marketing. It takes a long time for Google to recognize your content and index it properly.

5. Diversify

I believe in spreading yourself around and making sure you’re reaching as many people as you can. If you think some of your audience would respond to a different method of customer acquisition, set a budget for it, and give it a go.

Customer Acquisition FAQs

Below, see some of the most frequently asked questions about customer acquisition.

What is a good customer acquisition cost?

A good customer acquisition cost is whatever you need to be profitable. It will vary from business to business. All that matters is that you’re not spending more to acquire a customer than they will pay you. Keep in mind operating costs as well.

How do you manage customer acquisition?

Many businesses have people in charge of this or an entire department. Of course, it can be difficult for small businesses, so it might make more sense to outsource it.

Is it more cost-effective to keep a customer than to acquire a new one?

Acquiring new customers has been deemed the “startup killer” for a reason. It’s much cheaper to retain than acquire, but you can’t have one without the other. Make sure you’re focusing on both.

What is acquisition rate?

Find this number by dividing the total number of people who opted into your campaign by the total number of people who saw it.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What is a good customer acquisition cost?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “A good customer acquisition cost is whatever you need to be profitable. It will vary from business to business. All that matters is that you’re not spending more to acquire a customer than they will pay you. Keep in mind operating costs as well.”

}

}

, {

“@type”: “Question”,

“name”: “How do you manage customer acquisition?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Many businesses have people in charge of this or an entire department. Of course, it can be difficult for small businesses, so it might make more sense to outsource it.”

}

}

, {

“@type”: “Question”,

“name”: “Is it more cost-effective to keep a customer than to acquire a new one?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Acquiring new customers has been deemed the “startup killer” for a reason. It’s much cheaper to retain than acquire, but you can’t have one without the other. Make sure you’re focusing on both.”

}

}

, {

“@type”: “Question”,

“name”: “What is acquisition rate?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Find this number by dividing the total number of people who opted into your campaign by the total number of people who saw it.”

}

}

]

}

Summary of The Customer Acquisition Guide

There are many ways to approach customer acquisition, and while most of the methods lead to the same place, there is no one-size-fits-all solution. You need to figure out what marketing method works best for your business and how you can implement it consistently.

Most importantly, understanding your customer and their objective is crucial. Once you’ve done that, the rest falls into place.

What customer acquisition methods do you use in your business?