DataOps Solutions: Software, Tools, and Alternatives

Data is changing the way we do business. The amount of information available to us as business owners and that we should be processing and using to our advantage is staggering.

The amount of digital data, made and distributed, is 79 zettabytes. A zettabyte is one sextillion bytes. It’s a lot. By 2025, that number may skyrocket to 181 zettabytes.

We call it big data, but even small data is coming at us faster and faster.

It’s what they do with data that matters. It doesn’t mean much unless it’s leveraged.

Data can provide invaluable insights into everything from demographics to customer behavior, even future sales forecasting and more. It can be an unparalleled resource for you as you make decisions moving forward with your business.

Furthermore, data can come in real-time, allowing you to make on-the-fly decisions and pivots to respond to the market and capture live opportunities.

Again, none of this matters if your data is out of data or too hard to access. That’s where DataOps comes in.

What Is DataOps?

DataOps is a relatively new term that encompasses a wide range of tools to solve the problems of what to do with data coming in and how to make it pertinent to those who need it.

When you’re working with a batch of data, there are a few things that need to happen to make it relevant:

- It needs to be organized in ways that make sense: This means pulling in the relevant data and weeding out unnecessary information.

- It needs to be analyzed: How does it compare to past data or concurrent data?

- It needs to be interpreted: What do all those numbers mean for your brand? What should you do in reaction? How can you be proactive knowing this data?

All those things need to happen quickly. Then it needs to continue happening as more data comes in. The cycle needs to continue at speed.

DataOps are the architectures and software developed to do all of this at scale, in an agile, responsive manner.

How to Implement DataOps

Whether you go with a DataOps tool or build something in-house to address your needs, there are a few steps you should take to ensure smooth and effective processes.

1. Use Automated Testing

To rely on your data and the DataOps that are delivering and activating processes, you need to know you can trust the information.

Run automated tests through the programs to look for bugs and ensure that data is coming through as you expect it to. This step is about making sure the actual tools are working properly.

2. Perform Data Monitoring

In addition to automated testing, you’re going to want to conduct data monitoring. Here you will be checking in on the quality of the data being processed.

This goes back to your goals. What are you trying to measure? Use your standards for what qualifies as “good data” and check in regularly. Ensure your processes gather and analyze “good data” and not be tainted by irrelevant or inaccurate information.

These regular check-ins improve confidence in the system.

3. Work in Multiple Environments

Just as in DevOps, DataOps should occur in various environments or spaces. Think of these as levels where you can experiment and test your DataOps. You’ll want environments for developing DataOps, for testing and analyzing, and for going live.

Keeping these separate gives you the freedom to develop new workflows or ideas in a staging environment before moving to a live one. This prevents your data from becoming skewed by bad development or bugs. You can work them out in an earlier environment.

This also allows your team to work concurrently in the early stages of development and idea testing through bug testing, all before you go live. Your team can also work on various ideas concurrently without crossing streams or backtracking, potentially messing up one another’s projects.

4. Containerize Code

A fundamental purpose of DataOps is to stay agile. Containerizing your code keeps it streamlined and simple. Containerizing means packaging in simple, reusable bits of code so that it can be used across platforms or languages.

It also means that it can be repurposed or tweaked slightly and rerun for another project. This keeps the whole operation agile, allowing you to act quickly with updates and new launches as you continue to hone your data operations.

5. Perform Regression Testing

As you’re moving forward with DataOps, regression testing is critical. With each new update and new operation you are utilizing, you’ll want to ensure new problems aren’t introduced and old problems aren’t reintroduced. Regression testing runs a program through its spaces to ensure that it’s still working properly with the new changes. If any bugs do crop up, you can step back to the previous version, ensure that it’s running properly, and then take the update back to development before introducing it again.

5 DataOps Tool Examples

As DataOps evolves, many programs and tools are being developed to support this approach to data analytics and processing. The software you pursue will depend on your goals, the amount of data you are dealing with, and other tasks or tools you need to integrate. Some of the options listed here may be bulkier than you need.

Before purchasing, read up on the features offered and how it works with tools you are already using to determine whether this is the right option for you.

You should know that while all of these promise a certain level of ease and approachability, they do start from a place of general knowledge and confidence with data software and API integration. You may want to turn to your web development team for support here. Some software developers listed here also offer in-house support and consultations that can help get your DataOps off the ground.

1. Fraxses

Fraxses promises to help brands who have access to lots of data, but need help with integrating that data in ways that actually work for them.

In a video example on their homepage, a retail brand was getting lots of great data, but didn’t have a way to access and integrate data directly from their customers that they could integrate in real-time on a single platform or dashboard.

Fraxses offers these kinds of solutions in the agile formatting required by DataOps. For example, the tool:

- doesn’t rely on a single language but can be written in whatever you need

- is decentralized

- is low code or no code

- can be democratized

Fraxses describes itself as a mesh or fabric you can lay over your existing data structures and platforms to pull together and interconnect the information you need.

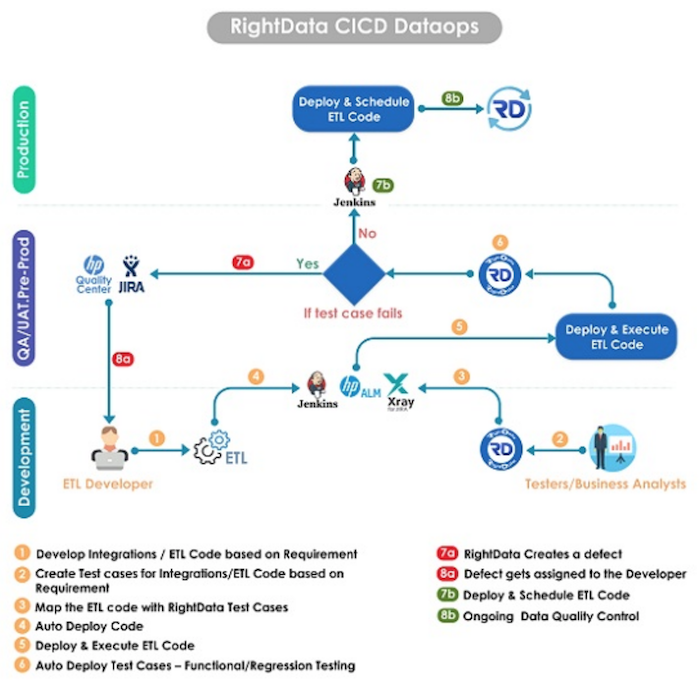

2. RightData

RightData describes DataOps as DevOps plus analytics. They offer brands DevOps level of support for their analytics and data management, with the constraints of DataOps, which includes:

- an agile approach

- continuous delivery of data

- a quick release times or sprints

RightData is a DevOps integration to support data and analytics management in your brand. Their promise is that they can keep up with the testing and monitoring part of the cycle after you’ve developed a system. This keeps your DataOps rolling forward and working seamlessly and quickly.

RightData also focuses on customer privacy and security, which is a key component to DataOps. Data breaches can cause an instant stop to your DataOps continuous processing and clog up the whole system. Maintaining security is key to moving forward in confidence.

Companies who want to learn more about working with the RightData DataOps tool can contact them directly for a demo and quote.

3. MLflow

MLflow stands for Machine Learning flow and it is a cloud-based platform on which you can run DataOps.

It’s an open-source platform, that can work on any language or with any coding. MLflow can be used by a single user or an entire company with many users.

It was created to solve the problem of too many data analytics tools making it too hard to move through a DataOps cycle with agility and continuity. DataOps relies on seamless reproduction to move ahead in quick sprints, not marathons of time waiting for data to be crunched while it grows irrelevant.

MLflow brings a solution to the community that brands are welcome to try, develop, and work together to make better.

If you’re into this kind of tinkering, you may want to explore MLflow.

4. K2View

K2View brings all the DataOps solutions that a brand needs under one roof so you don’t have to think about integrating this and that or whether your DIY DataOps fabric is covering all the bases.

Its premise is simple. They promise an all-in-one DataOps solution that brings you all the benefits including:

- a single dashboard to monitor and digest all the information you need, whenever you need it

- full, in-depth information on any product, customer, location or area, demographic, and more data that is up-to-the-minute and relevant, rather than lagging or growing old

- continuous delivery of data

- an adaptable and flexible framework that reacts to the data coming in

- security support

The various integrations also ensure that anyone at your company who needs access to the data gets the interpolated and real-time information they need, from marketing to point of sales, from management to the floor.

You can contact K2View for a quote and can also check out a Proof of Concept for free for two weeks.

5. Tengu

Tengu is another DataOps platform available to you as a brand owner. Also low or no code, Tengu promises to be an approachable, off-the-shelf option for someone looking to start working with a DataOps solution. It can be used in the cloud for remote or spread out teams or directly at a single physical location if you want something more secure.

Not wanting a lack of knowledge to be a limiting factor, Tengu is built around self-service so users can get access to the features you need, and you can set it up with little technical experience.

They also boast that they are more than just the technology they deliver. They support their customers with consulting on how they can be better using their data and what kinds of systems will help them do that.

Those interested in Tengu can contact them directly to learn more about Tengu’s pricing levels and various consulting services.

Frequently Asked Questions About DataOps

What Is DataOps?

DataOps is a type of agile and continuous methodology, for the managing and interpreting of data for a company. With this approach, brands can process their data faster and more pertinent to their needs.

Why Is DataOps Important?

DataOps works at scale to crunch data quickly and more efficiently, in repeatable sprints, so companies have access to the information they need in real-time, in a single location, across departments.

How Do You Use DataOps in Marketing?

You can continuously gather data from customers, their experiences, the products people are buying, and more to make real-time decisions about how to reach more of your target audience.

What Are DataOps Tools?

DataOps tools integrate into your existing data collection software to process and deliver data information in a primary platform or dashboard. Examples include FraXses, RightData, MLflow, K2View, and Tengu.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What Is DataOps?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

DataOps is a type of agile and continuous methodology, for the managing and interpreting of data for a company. With this approach, brands can process their data faster and more pertinent to their needs.

”

}

}

, {

“@type”: “Question”,

“name”: “Why Is DataOps Important?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

DataOps works at scale to crunch data quickly and more efficiently, in repeatable sprints, so companies have access to the information they need in real-time, in a single location, across departments.

”

}

}

, {

“@type”: “Question”,

“name”: “How Do You Use DataOps in Marketing?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

You can continuously gather data from customers, their experiences, the products people are buying, and more to make real-time decisions about how to reach more of your target audience.

”

}

}

, {

“@type”: “Question”,

“name”: “What Are DataOps Tools?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

DataOps tools integrate into your existing data collection software to process and deliver data information in a primary platform or dashboard. Examples include FraXses, RightData, MLflow, K2View, and Tengu.

”

}

}

]

}

Guide to DataOps: Conclusion

Data is critical to our sales and marketing cycles. While there are plenty of great data analysis software options, sometimes you need that information coming in faster. With speed comes the need for efficiency, accuracy, and security. DataOps is the answer, in flexible and agile environments, constantly dripping in reliable data your brand can use to build better sales processes, respond to customer needs and wants, and hit your goals with more efficiency.

Which DataOps tool are you going to try first?