Did You Know You Can Build Credit for Your Business?

Yes, you really can build credit for your business.

But let’s start with some definitions and background on business credit.

Business Credit

This is credit in a business’s name. It is not tied to the owner’s creditworthiness. Instead, business credit scores depend on how well a company can pay its bills. Hence consumer and business credit scores can vary dramatically.

Business Credit Benefits

There are no demands for a personal guarantee. You can quickly get business credit regardless of personal credit quality. And there is no personal credit reporting of business accounts. Business credit utilization won’t affect your consumer FICO score. Plus the business owner isn’t personally liable for the debt the business incurs. The same can be true for you as you build credit for your business.

Another advantage is that even startups can do this. Heading to a bank for a business loan can be a formula for disappointment. But building company credit, when done right, is a plan for success.

Consumer credit scores are dependent on payments but also additional components like credit use percentages.

But for business credit, the scores actually only depend on if a company pays its debts in a timely manner.

Business Credit Details

Being accepted for business credit is not automatic. Building business credit requires some work. Some of the steps are intuitive, and some of them are not.

Yet, it can be done easily and quickly, and it is much speedier than developing personal credit scores.

Merchants are a big component of this process.

Performing the steps out of sequence leads to repetitive denials. Nobody can start at the top with company credit. For example, you can’t start with retail or cash credit from your bank. If you do, you’ll get a denial 100% of the time.

Fundability is the Start of How to Build Credit for Your Business

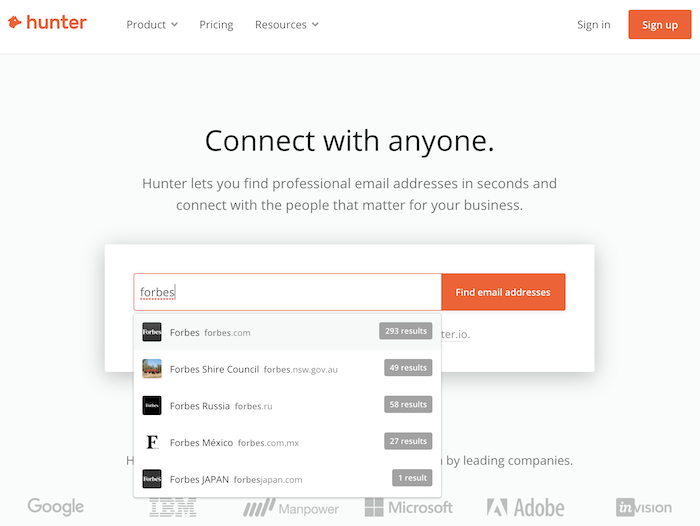

Fundability is the current ability of our business to get funding. Some factors are within your control. Others (like your time in business) aren’t. Your online presence and data are one area which is at or close to 100% with your control.

For example, a small business needs a professional-looking web site and e-mail address. And it needs to have site hosting from a supplier like GoDaddy.

Plus, business phone numbers should have a listing on 411. You can do that here: http://www.listyourself.net/ListYourself/.

Additionally, the business phone number should be toll-free (800 exchange or comparable).

A small business also needs a bank account dedicated only to it, and it needs to have all of the licenses necessary for operating.

Licenses

These licenses all have to be in the specific, correct name of the small business. And they need to have the same business address and phone numbers.

So keep in mind, that this means not just state licenses, but potentially also city licenses.

Keep your business protected with our professional business credit monitoring.

Build Credit for Your Business and Work With the IRS

Visit the Internal Revenue Service web site and get an EIN for the business. They’re free. Select a business entity like corporation, LLC, etc.

A company may start off as a sole proprietor. But they absolutely need to switch to a variety of corporation or an LLC.

This is to decrease risk. And it will maximize tax benefits.

A business entity matters when it involves taxes and liability in the event of a lawsuit. A sole proprietorship means the business owner is it when it comes to liability and tax obligations. Nobody else is responsible.

The best thing to do is to incorporate. You should only look at a DBA as an interim step on the way to incorporation.

Starting to Build Credit for Your Business

Begin at the D&B website and get a free D-U-N-S number. A D-U-N-S number is how D&B gets a small business in their system, to produce a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s sites for the company. You can do this at www.creditsuite.com/reports. If there is a record with them, check it for accuracy and completeness. If there are no records with them, go to the next step in the process.

By doing this, Experian and Equifax have something to report on.

Business Credit, Fundability, and Business Funding Applications

The better your business credit and fundability are, the more likely you will get approval for business financing. Consider your online presence.

Build Credit for Your Business with Your Professional Business Email and Website

There are some aspects of fundability where you should pay particular attention to what’s going on online. They include:

- Business owners listed and listed ownership uniform

- Business name and address uniform

- Industry aligned

- Company domain

- Information uniform on all records

Build Credit for Your Business with Your Business Ownership Listings

Records consistency matters here, too. Your website should show who owns your business. And that information needs to be consistent. So if the owner is named Susan Johnson on your website’s About page, then she can’t be listed as Sue Johnson on your Contact page. If your business ownership changes, you need to show that here.

Business Name and Address Uniformity

Abbreviations can be your downfall here, as can punctuation like hyphens, commas, and colons. If your Contact page says your main office is on Main Street, then your About page can’t say it’s on Main St.

If your business moves, or you add subsidiaries and other locations, then you need to update that information everywhere. This even means whether you use your 5-digit ZIP code, or a ZIP plus 4 code (9 digits).

Industry Alignment

If your business is over the road trucking, then it needs to be listed that way. Pro tip: when your industry can be called several different names, like long distance trucking, mention those other phrases on your website.

Your Company Domain

When your company domain matches your business name, it helps with fundability. Pro tip: try to match what people will be searching for online, so if (for example) the word ‘brothers’ is in your company name, then determine if ‘brothers’ or ‘bros’ will be used by people searching for your company and its goods and services online.

Keep your business protected with our professional business credit monitoring.

Your Email Address

Given that so much more of lending decisions is going on online these days, then your email address is an opportunity for your business to puts its best foot forward. Don’t squander this easy and free opportunity! General email addresses like admin@yoursite.com tend to be best.

With a general email address, if someone leaves your employ, another employee can seamlessly take over that email address. A username like admin, webmaster, or even hello is far, far better than cutiepie or the like, even if you’re in a playful industry that caters to kids. After all, your bank and banker aren’t.

Build Credit for Your Business with Records Consistency

Keep your records consistent! This includes your online records. LexisNexis and the SBFE (Small Business Financial Exchange) are looking at everything, so it had better match.

Inconsistent records will lead to a denial due to fraud because that’s how lenders interpret inconsistencies. This is a cause of denials which is in the business owner’s hands. You have the ability to change and correct this.

This means your business name, address, phone number – everything! – must look the same in these places and more:

- Every place your business has an online presence (your website, Yelp, SoTellUs, etc.)

- IRS records

- Your business’s records with Dun & Bradstreet, Experian, and Equifax

- All licenses needed to run your business

- Incorporation documents

Copy/paste this information; don’t chance it with retyping.

Starter Vendor Credit

First you ought to build tradelines that report. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can begin to get credit for numerous purposes, and from all sorts of places.

These types of accounts tend to be for things bought all the time, like marketing materials, shipping boxes, outdoor work wear, ink and toner, and office furniture.

But to start with, what is trade credit? These trade lines are credit issuers who give you starter credit when you have none now. Terms are generally Net 30, rather than revolving.

Therefore, if you get an approval for $1,000 in vendor credit and use all of it, you must pay that money back in a set term, like within 30 days on a Net 30 account.

Details

Net 30 accounts must be paid in full within 30 days. 60 accounts need to be paid completely within 60 days. Compared to revolving accounts, you have a set time when you have to pay back what you borrowed or the credit you used.

To kick off your business credit profile properly, you need to get approval for vendor accounts that report to the business credit reporting agencies. When that’s done, you can then use the credit.

Then pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Vendor Credit — It Helps

Not every vendor can help in the same way true starter credit can. These are merchants that grant approval with hardly any effort. You also need them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

As you get starter credit, you can also start to get credit from retailers. Here are some stellar choices from us: https://www.creditsuite.com/blog/5-vendor-accounts-that-build-your-business-credit/

Fleet Credit

Fleet credit is from service providers where you can buy fuel, and fix and take care of vehicles. You must use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, make sure to apply using the business’s EIN.

Keep your business protected with our professional business credit monitoring.

More Universal Cash Credit

These are companies such as Visa and MasterCard. You must use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, use your EIN instead.

These are commonly MasterCard credit cards.

Monitor Your Business Credit

Know what is happening with your credit. Make sure it is being reported and fix any mistakes ASAP. Get in the practice of checking credit reports. Dig into the specifics, not just the scores.

We can help you monitor business credit at Experian, Equifax, and D&B for a lot less than it would cost you at the CRAs. See: www.creditsuite.com/monitoring.

Update Your Records

Update the relevant information if there are errors or the info is incomplete. At D&B, you can do this at: https://www.dnb.com/duns-number.html. For Experian, go here: www.experian.com/small-business/business-credit-information.jsp. So, for Equifax, go here: www.equifax.com/business/small-business.

Fix Your Business Credit

So, what’s all this monitoring for? It’s to challenge any problems in your records. Mistakes in your credit report(s) can be corrected. But the CRAs typically want you to dispute in a particular way.

Get your small business’s PAYDEX report at: www.dnb.com/about-us/our-data.html. Get your company’s Experian report at: www.businesscreditfacts.com/pdp.aspx?pg=SearchForm. And get your Equifax business credit report at: www.equifax.com/business/credit-information.

Disputes

Disputing credit report inaccuracies usually means you mail a paper letter with copies of any proofs of payment with it. These are documents like receipts and cancelled checks. Never mail the original copies. Always send copies and retain the original copies.

Fixing credit report inaccuracies also means you precisely itemize any charges you challenge. Make your dispute letter as clear as possible. Be specific about the issues with your report. Use certified mail to have proof that you sent in your dispute.

A Word about Business Credit Building

Always use credit sensibly! Never borrow beyond what you can pay back. Track balances and deadlines for repayments. Paying on time and completely does more to increase business credit scores than just about anything else.

Establishing small business credit pays off. Great business credit scores help a business get loans. Your credit issuer knows the company can pay its debts. They understand the small business is bona fide.

The company’s EIN connects to high scores and loan providers won’t feel the need to ask for a personal guarantee.

Build Credit for Your Business: Takeaways

Business credit is an asset which can help your business for many years to come. Learn more here and get started toward establishing company credit.

The post It’s Time to Build Credit for Your Business appeared first on Credit Suite.