Get Your First Time Business Loan

Can You Get a First Time Business Loan for Your Startup Business?

When it comes to a first time business loan, what are your best choices for your startup?

What are All the Different Types of Business Loans?

There are several different types of business loans out there. Startups can have more trouble getting funding. This is because you don’t have a business credit history – and you don’t have inventory or cash flow. But those aren’t the only way to get a first time business loan. Check out what else you can do.

Choosing Among the Many Different Types of Business Loans Means Knowing What’s Right for You

Knowing the different types of small business loans is only half the battle. You have to know how to figure out which one is right for you. The answer to that will vary based on a number of factors, and it may even change over the course of your business.

But the right type of loan for your business now may not be the right type for your business later. The best way to start figuring out which loan is right for your business is to figure out what’s available. Did you know that traditional bank loans are not the only option?

Types of Small Business Loans

There are many more, including:

- Securities-Based Financing

- 401(k) Financing

- The Credit Line Hybrid

- SBA Loans

- Equipment Financing

- Traditional Lines of Credit

Let’s dive in to each one and figure out which one is best for your business right now

Get a First Time Business Loan with Securities-Based Financing

Use existing stocks as leverage to get business financing. Borrow as much as 90% of their value. You continue to earn interest on the stocks pledged as collateral. Closing and funding takes less than 3 weeks.

Rates can be as low as 1.6%. This is a working capital line of credit. You will have challenged personal credit.

And if you do not have this type of securities, you can still get great funding if a credit partner (guarantor) has them.

Get a First Time Business Loan with 401(k) Financing

Use your existing 401(k), or IRA as collateral for business financing. This program uses IRS proven strategies. You will pay no tax penalties.

You still earn interest on your 401(k). pay low rates, often less than 5%. Close and fund in less than 3 weeks. You can usually get up to 100% of what’s “rollable” within your 401(k).

Follow these steps. A new corporation is formed; a retirement plan is created to allow for investment into the corporation; funds are rolled over into the new plan. Then the new plan purchases stock in corporation and holds it. The corporation becomes debt free and cash rich.

And, as before, if you don’t have an appropriate IRA or 401(k), you can still get this kind of funding if you’ve got a credit partner with the right stuff.

Demolish your funding problems with 27 killer ways to get cash for your business.

For an Alternative to a First Time Business Loan, get to know Our Hybrid Credit Line Program

Check out this form of unsecured funding. Unsecured funding does not require collateral, but the lender’s risk is mitigated by higher interest rates. Our credit line hybrid has an even better interest rate than a secured loan. Yet you can get the money faster and easier than any type of traditional funding. Get business funding without having to supply bank statements or credit stubs. You can get funding in a few days rather than weeks without supplying any collateral or documents.

You can get some of the highest loan amounts and credit lines for businesses. Get 0% business credit cards with stated income. No financials required. These report to business CRAs. You can build business credit at the same time. This will get you access to even more cash with no personal guarantee.

You can often get a loan of 5 times the amount of current highest revolving credit limit account. This is up to $150,000. Easily five times what you could get on your own when applying for cards. Get cash out on this program as well.

Advantages

There will be NO impact on your personal credit with this type of financing. You need a good credit score or a guarantor with good credit to get an approval. With good personal credit, get unsecured credit cards with a personal guarantee. And with good business credit, get unsecured credit cards without a personal guarantee.

Check out business credit. It should be your goal to build business credit, even if you can get funding elsewhere. Business credit will help your company for years to come. Business credit is credit linked to your EIN and not your SSN.

This credit is available without a personal guarantee. It is available regardless of personal credit. You can get business credit immediately. Business credit is the only way to get money for a business when you don’t have collateral, cash flow, good personal credit, or a guarantor.

Get a First Time Business Loan Through SBA Loans

Guaranteed by the federal government. Issued by participating lenders, usually banks. They offer a lot of the perks of traditional loans, such as lower interest rates and favorable terms. Due to government guarantee, lenders are able to offer them to those with a lower credit score than would typically be required.

Eligibility for SBA Loans

Lenders and loan programs have unique eligibility requirements. In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Hence even those with bad credit may qualify for startup funding.

Normally, businesses must meet size standards, be able to repay, and have a sound business purpose. The lender will provide you with a full list of eligibility requirements for your loan. See www.sba.gov/document/support–table-size-standards.

More About Eligibility for SBA Loans

General eligibility also includes:

- Being a for-profit business – the business must be officially registered and operating legally

- Doing business in the US – the business must be physically located and operating in the US or its territories

- Having vested equity – the owner must have invested their own time or money in the business

- Exhausting other funding options – the business must not be able to get funds from any other financial lender

Ideal credit scores for an SBA loan are 680 or above. There are a number of SBA loan programs, each one designed to work for different needs and situations. Some of the most common SBA loan programs include:

- 7(a) loans

- 504 loans

- Microloans

- Disaster loans

- Express loans

These are just a few the of the options available. Find out more at SBA.gov.

Demolish your funding problems with 27 killer ways to get cash for your business.

Which SBA Loan is Best?

The thing about SBA loans is that they each have a specific purpose. For example, if your business has suffered due to a natural disaster, you need a disaster loan. If you need $50,000 or less, a microloan may be the best option. But the 7(a) loan program is the most versatile.

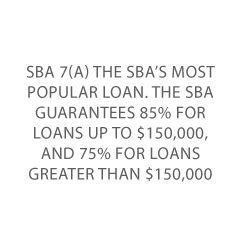

SBA 7 (a) Loan Program Details

A standard 7(a) loan can be for up to $5 million. The maximum SBA guarantee is 85% for loans up to $150,000 and 75% for loans greater than $150,000. The interest rate varies but cannot exceed the SBA maximum. The turnaround is 5 – 10 business days. These funds can be used for a number of things, and the minimum credit score is 640. But of course the higher the better.

Who Do SBA Loans Work Best For?

These loans work well for those that are not in a hurry to get funding

The approval and funding process can take a while, especially with the government red tape required for the government guarantee. If you can wait, meet all the requirements, and want a more traditional type of loan, SBA loans are an option.

Get a First Time Business Loan with Equipment Financing

Businesses looking to buy or lease equipment can use equipment financing. Rates vary widely depending on risk factors. You usually can get approval with a 650 or better credit score. This is for major equipment only, not a combination of a lot of small equipment. These loans work well for those that have good credit and just need to finance some equipment. The equipment is the collateral, so that helps out some with rates.

Demolish your funding problems with 27 killer ways to get cash for your business.

Get a First Time Business Loan with a Traditional Line of Credit

This is similar to a traditional term loan in terms of where you get it, and approval requirements. However, it is revolving financing more like a credit card. Typically have better interest rates that credit cards. They work well for those who qualify for traditional term loans but want revolving credit rather than a term loan.

Which Types of Small Business Loans are Best for Your Business?

If you know what types of business loans are available to your business, you can make a more educated decision about which types of business loans will work best for you. Knowing what’s out there is only half the battle. You also have to understand your own eligibility and funding needs.

Get a First Time Business Loan: Takeaways

All businesses need funding. Traditional term loans are not the only option. Other options exist to help you money faster. Or funding despite bad credit. And you can better rates and terms than you would get with a traditional term loan.

The post Get Your First Time Business Loan appeared first on Credit Suite.