You know that today’s market demands every advantage you can get for your organization to succeed. So what can you do to gain an edge? Dive into the world of influencer marketing. Influencer marketing for small business is one of the most powerful marketing methods available for small companies. With more than 4.26 billion social … Continue reading Influencer Marketing for Small Businesses

Tag: Businesses

Influencer Marketing for Small Businesses

You know that today’s market demands every advantage you can get for your organization to succeed.

So what can you do to gain an edge?

Dive into the world of influencer marketing.

Influencer marketing for small business is one of the most powerful marketing methods available for small companies. With more than 4.26 billion social media users across the world in 2021, it’s no wonder that influencers are used by small and large businesses alike to promote their products.

But what is influencer marketing, and how can it actually help your business?

Goal Setting for Small Business Influencer Campaigns

Influencer marketing is the process of working with well-known social media personalities to promote your business. Before you get started with an influencer, first ask yourself: what are my goals?

When it comes to influencer marketing, the biggest mistake you can make is to have an unclear campaign goal.

Think about it: if you post without a plan, you’ll have a hard time explaining to an influencer what you want to accomplish, let alone analyzing your campaign’s success afterward.

That’s why it’s a good idea to understand the purpose of your campaign. What are your marketing goals? If your purpose is to increase followers, the strategy will look different than if you want to boost engagement or generate leads.

Physical goals, like higher sales or increased traffic to your business, should be included in your campaign plan. Remember, the whole point of influencer marketing is to help you make more money.

Once you have clear campaign goals, it’s time to connect with influencers.

Influencers: Not Just for Big Businesses

You don’t have to own a giant corporation to benefit from using influencers in a marketing campaign. In fact, influencer marketing can be a huge boost to your small business campaign!

Build awareness around your brand by allowing influencers to use their voices to spread your message. Through their own pages, each influencer has cultivated audiences with similar interests. With 10k-100k followers, even a micro-influencer can help grow your base at a reasonable price.

By working with influencers, you also gain access to new audiences at a fraction of the price of traditional marketing banners.

How much more effective is influencer marketing? On average, brands earn over $5 for every $1 spent on an influencer marketing campaign. That’s 11x the ROI of using traditional banner advertisements!

Finding the Right Influencers for your Business

So you’ve got your campaign goals set. Now what?

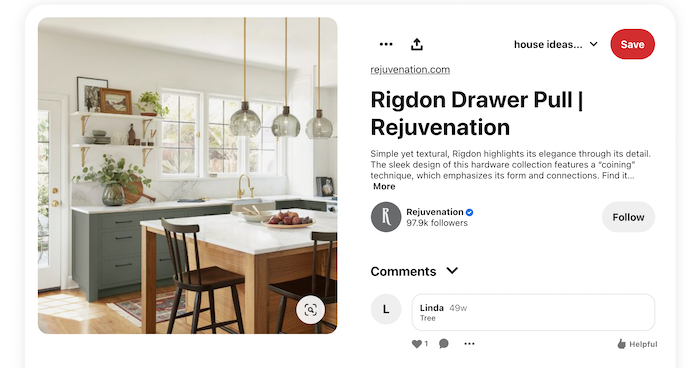

The next step is to find the influencer that fits best with your campaign. When researching influencers, the best influencer marketing platform for small businesses is Instagram, with 79% of brands considering it the most important platform for them. However, Tik Tok is a rising star in the social media world and could eventually become the next top dog. As of January 2022, Tik Tok has 1 billion monthly active users who spend an average of 850 minutes on the app each month!

With so many influencers online, it can appear overwhelming to find one to work with. Don’t let that hold you back, though! There are a few easy ways to narrow down your search.

Search your own social media pages:

- People who are already interested in your brand will be more passionate about collaboration.

- It will also have a more natural feel when a collaboration is announced.

- Look for people who consistently comment on your posts.

- Check and see if your account is tagged in posts. Anyone who regularly engages with your brand is a potential candidate.

- Don’t be afraid to ask your audience.

- Framed in the right way, like with a question sticker or poll, you can find an influencer and increase follower engagement at the same time.

Search hashtags related to your business:

- Don’t have a big following? That’s okay! Influencers in your niche are already broadcasting their interest in products similar to yours.

Peek at the competition:

- Work smarter, not harder! If you have competition, look through their social media accounts for influencers.

Review Your Influencer Options

By now, you’ve combed through your account, searched hashtags, and even took a peek at the audiences of the competition to find influencers. Are you ready to reach out? Not quite yet.

Before contacting your list of influencers, you take some time to inspect their accounts on a deeper level. Also known as influencer targeting, being selective with who you choose to work with is key to any successful influencer marketing campaign.

Make sure that the influencer’s audience is similar to yours. What is their geographic location? What is their age? Do they speak the same language as your market demographic? The goal here is to discover where your audiences overlap with each other.

Next, confirm that your potential influencers are legit. This is one of the few instances where the phrase ‘fake it till you make it’ is counterintuitive. Currently, followers can be bought to artificially inflate audience numbers. Thankfully, there are a few ways to detect “fake” followers:

Demographics. Look at where an influencer’s followers are located. Overall, are they in the same place as the influencer?

- Check how many of their followers have profile photos. How many followers have names that consist solely of random numbers and letters? These are all indicators of a phony following.

Engagement. In addition to the size of an influencer’s audience, you need to pay close attention to engagement rates.

- A huge following is useless unless that audience is engaged. High engagement rates mean followers are tuning in and taking action.

- To calculate an engagement rate, take the number of likes or comments on an influencer’s posts, divide it by their number of followers and then multiply by 100 to get a percentage.

- In general, you want to see at least 2-3% engagement for a worthwhile influencer. 5% engagement is considered great, while anything above 10% is viral and likely some stellar content creation.

Content. The last thing you want to double-check is the content style and quality of the influencers on your list.

- Do they align with your brand?

- Which influencers deliver high-quality content?

- What are their videos like?

- Are they high-end videos, or do they look like they were put together by an amateur?

- Ask questions like these when considering using influencer marketing for your small business.

Influencer Marketing Platforms for Small Businesses

As influencer marketing grows in popularity and scale, it can be difficult for small businesses to navigate these waters alone. That’s why so many companies are turning to influencer marketing platforms for small businesses

These platforms are designed to take the legwork out of the influencer review process.

Right now, the best influencer marketing platform for small business is Upfluence. Upfluence has tons of information on influencers and their relevant statistics. Users can search for influencers easily with their followers, interests, and engagement all available in one spot.

Don’t worry if Upfluence isn’t for you: there’s more than one influencer marketing platform for small business: in fact, there are quite a few! Sparktoro is a great audience research tool. Brandbassador is another influencer marketing platform for small e-commerce businesses, connecting them to potential influencers that can serve as brand ambassadors for their product, increasing their reach.

Another potential option is influencer engagement marketplaces, where businesses can post the type of needs they have and influencers can reach out if they think they can be a good fit.

Don’t want to deal with the hassle at all? I don’t blame you. Thankfully, there are full service influencer marketing agencies for small businesses as well!

An influencer marketing agency for small business works at all levels of the influencer collaboration process, including:

- Set the target audience for your campaign.

- Locate the right influencer for the job.

- Build a relationship with the influencer

- Set ideal campaign goal strategies

- Help influencers to create better content

- Monitor the campaign

Whether you go with an influencer marketing platform or agency, or if you decide to work in-house, you’ll still benefit from knowing how to reach out and work with influencers.

How to Start Working with Influencers

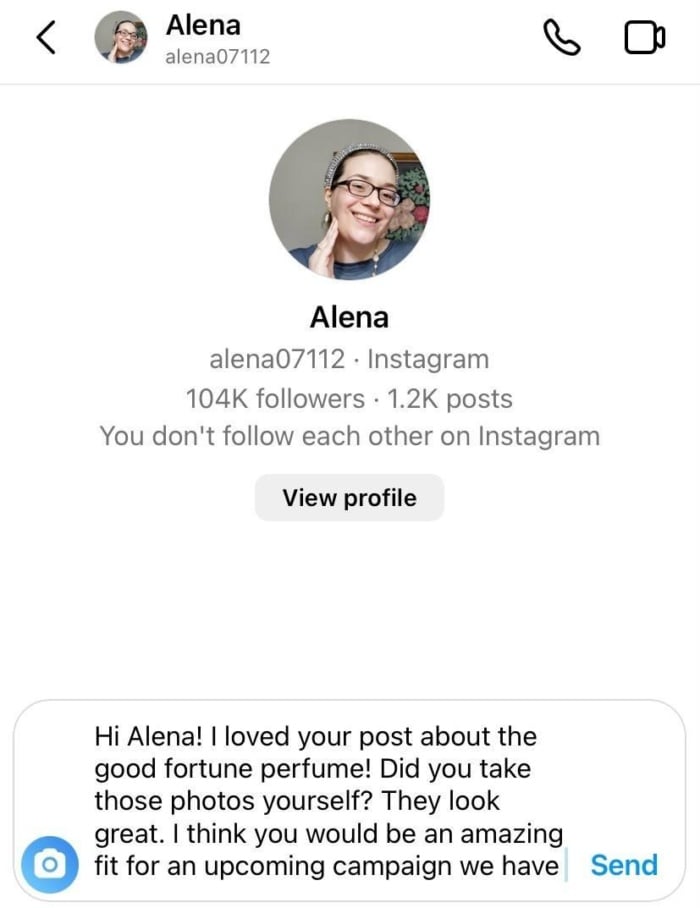

Now that you or your agency has found influencers to work with, it’s time to reach out.

A good rule of thumb is to check their account or webpage for an email contact. Make sure you introduce yourself personally so that they feel like they know who they’re talking to. This should make them more comfortable and willing to ask questions about your project.

Most professional influencers have a media kit of some kind. Asking for one is a great way to see if you are working with a serious influencer.

Once you’ve made introductions, talk about your campaign. Explain the direction of the campaign and be as transparent as possible about the timeline for the project, important dates, and rates.

What to Avoid When Reaching Out

As with any endeavor, there are certain practices that should be avoided when pursuing influencer marketing for a small business. For example, never use a bot to contact influencers. They come off as impersonal at best and spam at worst, pushing away potential collaborations. Instagram also penalizes bot behavior, which is why it’s best to avoid this practice.

Never reach out via a comment on a post. It’s unprofessional, so instead, stick to email or direct messages.

Another thing to do is never copy and paste the exact same message to every influencer. Again, it comes off as spammy and unprofessional. A better way to approach outreach is to add a few personal touches to your introductory message for each influencer.

Want to go that extra mile? Add some details about their page or their work. To get influencers to work with you, emphasize how they personally would be a great asset to your campaign. Trust me, it goes a long way.

The last thing to avoid is unrelated influencers. What good does talking to a cooking influencer do if you are running a campaign about 3D printing?

When it comes to the world of influencer marketing for small business, unrelated influencers are a waste of time! Confirm that potential collaborators fit your brand.

Best Practices for Small Business Influencer Campaigns

By now you’ve set up your campaign, found an influencer and are ready to start collaborating. Here are a few tips to help your campaign flourish.

- As you enter into negotiations, you’ll want to remain as open and transparent as possible. While rates vary, clear expectations of the influencer should always be made.

- How much you will pay, tasks and deadlines are mapped out ahead of time to avoid confusion down the road.

- Especially with larger projects, think about creating a formal contract for your influencer that outlines the requirements of the project.

- Share your resources! The easier you make it for influencers, the better results you’ll get. If you have a brand style guide that contains your logo, brand colors and taglines, influencers can use that to hit the ground running.

- Communicate your campaign goals, as well as any frequently asked questions about your campaign to streamline things.

- Track campaign metrics to ensure your project is reaching the goals you set out to achieve.

Once your campaign is complete, share the results with your influencers. This not only strengthens professional co-working relationships but can also get influencers to work with you in the future. In addition, you might also get insightful feedback from your influencer team. Used wisely, this can consistently improve future campaigns!

You should note that the FTC requires disclosures of endorsed relationships with businesses any time there is a material connection. This includes payments and gifts. When developing campaigns, make sure you are compliant with all laws and regulations.

FAQs

Influencers can be broken into groups by follower size. Nano-influencers have 1k-10k followers. Micro-influencers have a 10k-100k audience size, while macro-influencers are followed by 100k-1M people. The largest type is a mega-influencer, which is a person with over 1 million followers.

That’s not a problem at all! Gifting products through ambassadorships or referral programs is pretty common among smaller brands. Brandbassador is a prime example of an influencer marketing platform for small business that helps manage ambassadors for your brand.

Working with an influencer can boost your campaigns, increase brand awareness, give you access to new audiences and expand your base.

When it comes to using influencers for your brand, do your research! Make sure you are working with an influencer who has a real following, aligns with your brand, and has the skills needed to reach your campaign goals.

On average, brands earn over $5 for every $1 spent on an influencer marketing campaign. That’s 11x the ROI of traditional banner ads!

Conclusion

Adding influencers to your marketing campaigns can be the next big game changer for your business. However, with so many moving parts, it can be tough to even get influencers to work with you.

Let our agency know if you want help with your next influencer marketing campaign and we’ll be your guide.

Which influencers in your audience fit your brand?

10 Branding Strategies Helpful For Small Businesses

Many small business owners and entrepreneurs have a stigma that only big companies like McDonald’s and Disney can do branding. “It costs a lot of money,” they believe. But that is not entirely true. Brand …

The post 10 Branding Strategies Helpful For Small Businesses appeared first on Paper.li blog.

10 Best Email Marketing Softwares for Small Businesses

Ninety-nine percent of email users check their inbox every single day.

That’s more high-intent traffic than any other avenue or platform you can use to reach your audience.

When people sign up for your email list, they are giving you permission to sell them. You can market to them for as long as you want until they unsubscribe.

Today, some small businesses have fallen into the trap of believing that email marketing isn’t beneficial. Don’t be one of them.

Eighty-one percent of small businesses see great results when they use email to acquire customers, giving them a key competitive advantage.

Let’s look at the best email marketing software you can use to achieve your goals.

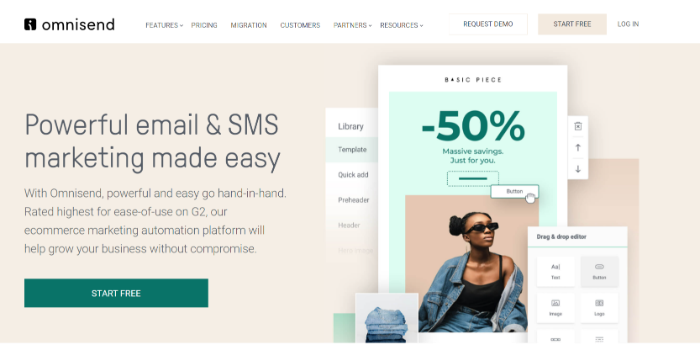

1. Best Email Marketing Software for Multi-Channel Marketing: Omnisend

Omnisend is a popular marketing tool that caters primarily to small e-commerce businesses. It helps put everything in one place including your:

- SMS marketing

- social media marketing

- email marketing

A study performed by Dot Digital shows the importance of email marketing in the e-commerce niche. They found that email yields an approximate 42 dollar return on every dollar spent.

With Omnisend, you can easily create emails using a variety of templates and drag-and-drop editing tools—perfect for new and novice marketers.

This email marketing software is also great at helping you increase conversions by using discount codes, scratch cards, and various informative add-ons (like PDFs).

Key Features:

- Pre-built templates for attractive emails without coding or advanced email knowledge.

- Workflows that help you replicate top-converting email strategies.

- Lead generation pop-ups that increase ROI.

- Analytics dashboard for fixing mistakes and identifying opportunities.

Pricing:

One of the best features of Omnisend is its pricing structure. It’s free for up to 500 emails per month (perfect for small businesses) and 60 text messages. This includes automation, recommended workflows, and A/B testing.

2. Best Email Marketing Software for Free Users: MailChimp

At one time, MailChimp was exclusively used as an email newsletter platform.

Today, it’s a complete CRM platform that allows you to design landing pages, email capture forms, and much more. Its range of features helps small businesses stay organized and execute marketing strategies.

However, be warned. MailChimp does have limitations on the number of lists you can create and how accurately you can segment your audience.

This requires you to have a firm understanding of your customer avatar.

Key Features:

- Loaded with hundreds of integrations (for sites like Shopify).

- Boasts a CRM product suite of automation tools, behavioral targeting, and more.

- Provides appointment booking.

Pricing:

If you need an email marketing tool to help you scale on a low budget, MailChimp is a great option. When you are just starting out, you can access its wide range of features for free.

However, when your list is scaling and you’re ready to start spending, you can purchase plans for up to 10,000 emails a month. With email users expected to climb to 4.6 billion by 2025, now’s the time to act.

3. Best Email Marketing Software for Segmentation: ActiveCampaign

ActiveCampaign is the best email marketing tool for selling products to lots of different target audiences.

Its segmentation capabilities allow you to easily separate your contacts into lists and customize your marketing for hyper-personalization (which reduces opt-out rate by 50 percent.)

Using “[Name]” at the beginning of an email simply isn’t effective anymore. You need to actively write a copy that caters to an individual’s specific pain points and concerns.

ActiveCampaign helps you organize your list, target effectively, and create emails that convert.

Key Features:

- Design and write emails that convert for specific audiences.

- Personalize emails based on various audience segmentation variables.

- A/B test to identify what converts and what doesn’t.

- Landing page builder.

Pricing:

While ActiveCampaign doesn’t offer a free plan, it is transparent and upfront with its costs. For $9 per month, you get email automation, content creation support, unlimited sending, templates, newsletters, and data-backed reporting.

4. Best Email Marketing Software for Scaling Up: Drip

An average cart abandonment rate of 69.82 percent leads to missed sales opportunities that small businesses can’t afford to lose.

When you want to scale, Drip is one of the highest recommended platforms out there. It has plans for businesses of all sizes, so your spending will only grow as you do.

The cost is uniquely catered to you based on the size of your list at the time you subscribe.

If you’re simply “dabbling” into email marketing, you can get started with Drip. If you already have a list of 10,000 email subscribers that you want to start making use of, don’t worry, they have a plan for you too.

Key Features:

- The editor has both templates and drag-and-drop features.

- Data insights provide behavior-based automation.

- Email and website integrations.

- Industry-leading customer service.

Pricing:

Drip offers a 14-day free trial and, from there, it determines how much you pay based on the size of your list.

For example, at $19 per month, you can have 1,500 contacts and unlimited emails. At $209 per month, you can have up to 15,000 contacts and unlimited emails.

5. Best Email Marketing Software for Email Design: Stripo

Not every business needs complicated email software. Stripo does one thing and does it well.

It’s an email builder designed to integrate with other platforms like GetResponse and MailChimp. Use Stripo to access beautiful templates that allow you to create on-brand marketing messages.

Key Features:

- Thousands of templates in paid plans.

- Simple to use and easy to get started.

- Offers HTML options for those who can code.

- Integrates with other email marketing tools for automation.

Pricing:

Stripo offers a “free for life” plan that provides access to free email templates, learning software, and email support. From there, you’ll have to upgrade to the basic plan of $15 per month.

6. Best Email Marketing Software for Lead Generation: OptinMonster

At one time, OptinMonster was nothing more than a WordPress plugin.

Today, it’s a standalone email marketing tool with many features like opt-ins, pop-ups, triggers, templates, testing tools, integrations, and analytics.

It’s the best option for businesses that want to generate leads simply because of the versatility of the campaigns you can run. Examples include an exit-intent popup, floating bar, or fullscreen slide-in.

They have a lot of gamified options as well. If most of your target audience is Gen Y or Z, their attention spans are between 8-12 seconds. Not quite long enough to read an email.

Gamification increases retention times, click-throughs, and conversions.

Key Features:

- Great drag-and-drop templates.

- Extensive integrations.

- Gamified emails.

- HTML and Java editing.

Pricing:

OptinMonster is so much more than an email marketing software. At just $9 per month for the basic plan, you gain unlimited access to marketing campaigns, segmentation, integrations, and a website if you don’t already have one.

7. Best Email Marketing Software for Contests and Promotions: Wishpond

Wishpond is one of the most comprehensive email marketing tools we’ve looked at so far. If you can dream it, they offer it.

Wishpond has integrations for e-commerce, email marketing, and automation.

It also has a comprehensive landing page builder loaded with features including promotions, and a dashboard for implementing social media growth into your email marketing.

The tool also offers online forms for you to do surveys and ask your audience what they’d like to see or hear more of. It’s a great option for small businesses with high-ticket offers.

Key Features:

- Landing page builder with templates and customizations.

- Easy-to-design contests and promotions.

- Referral suite with lead captures, generation options, pop-ups, and link sharing.

Pricing:

Wishpond is $75 per month for the basic plan.

This price tag comes with a red flag: don’t use this tool if you don’t already have an established email list of at least 100 people.

8. Best Email Marketing Software for Automation: Sendinblue

Sendinblue’s goal is to help you automate email marketing to save costs and protect your bottom line. It offers a comprehensive CRM, email templates, landing pages, and even social media integration—all in one place.

Email has a 60 percent conversion rate compared to social media’s 12.5 percent, but it can take a long time to design and execute a successful strategy. With Sendinblue’s guidance, you can truly have the “best of both worlds” with this email marketing tool.

Automation is the main thing that stands out about Sendinblue with its great workflow, targeted campaigns, triggers, and lead scores.

Key Features:

- Integrations with e-commerce platforms.

- Automation elements.

- WordPress plugin with a 4.5-star rating.

- Free CRM system.

- Multi-channel marketing.

Pricing:

Affordability takes centerstage with Sendinblue. Their free plan contains an email template library, email personalization, design tools, campaigns, and up to 300 emails a day. From there, the light plan is $25 per month with no sending limits.

9. Best Email Marketing Software for Funnels: GetResponse

Sometimes you need to build your sales funnel before you build an email list, and that’s what GetResponse is all about. You can build your entire funnel using its email marketing software, and even implement a live chat feature on your site.

Key Features:

- Powerful automation enables detailed list segmentation.

- Plenty of testing options to figure out what converts.

- Funnel and landing page builder.

- Live chat, social media, and SEO features.

Pricing:

GetResponse has a complicated pricing structure simply because of everything it offers. If you simply want to send emails and build one landing page, you can use the free plan for up to 500 contacts. If you want to unlock the automation and segmentation features, you’ll need to get their “Marketing Plan” at $48 per month.

10. Best Email Marketing Software for Content Creators: ConvertKit

According to ConvertKit, creatives sent 16 billion emails in 2021. That’s 530 every second.

How do you get noticed among all that noise?

When you want your personal brand to stand out, ConvertKit’s features will appeal to your audience. It offers a landing page builder, solid deliverability, and support for content creators.

The downsides are limited templates, lack of reporting, and a hefty price tag.

Key Features:

- Run targeted campaigns.

- Sell digital products and build your subscriber/follower base.

- Simple to use and super basic.

Pricing:

ConvertKit offers a free plan but it’s incredibly limited. From there, your email list determines a price. When you hit 3,000 subscribers you need to upgrade to a $49 per month plan, allowing you to use funnels and sequences. To get newsletters and any decent data reporting, you’ll have to purchase a premium plan.

Frequently Asked Questions About Email Marketing Software for Small Businesses

What’s the best email marketing software for small businesses?

Omnisend is the best email marketing tool for small businesses because it combines the right amount of features with an attractive price. Through it, you can execute a multi-channel marketing strategy and scale your revenue.

Is email marketing beneficial to small businesses?

Email marketing is an incredible tool for small businesses and personal brands. Its average ROI of $36 for every $1 spent means that you are likely to see great business success from investing in high-quality and well-written emails.

Can my small business use email marketing software for automation?

Absolutely, tools like Sendinblue and Drip offer great email automation and triggers that help you make the most of your marketing efforts without requiring lots of time and attention.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What’s the best email marketing software for small businesses? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Omnisend is the best email marketing tool for small businesses because it combines the right amount of features with an attractive price. Through it, you can execute a multi-channel marketing strategy and scale your revenue.

”

}

}

, {

“@type”: “Question”,

“name”: “Is email marketing beneficial to small businesses?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Email marketing is an incredible tool for small businesses and personal brands. Its average ROI of $36 for every $1 spent means that you are likely to see great business success from investing in high-quality and well-written emails.

”

}

}

, {

“@type”: “Question”,

“name”: “Can my small business use email marketing software for automation? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Absolutely, tools like Sendinblue and Drip offer great email automation and triggers that help you make the most of your marketing efforts without requiring lots of time and attention.

”

}

}

]

}

Conclusion: Email Marketing Software Drives Real Results

It’s clear that email marketing software can help small businesses grow.

When someone subscribes to your email list, you have their permission and it shows that they’re interested in whatever it is you offer.

Why not make the most of their engagement and sell to them?

Use the best email marketing software to build your list, increase your conversions, and ultimately, generate more revenue.

Which email marketing software have you used? What do you like most about it?

12 Local SEO Tips For Small Businesses You Can’t Ignore

As a small business, ranking for keyword terms can be difficult. With larger, more resourced businesses targeting those same terms, it can seem impossible to nudge your way to the top of the search engine results pages (SERPs).

How are small businesses expected to rank highly on SERPs? Fortunately, with the use of local SEO, there’s more than a good chance.

If there’s one thing that’s certain, it’s that local SEO has never been more important for small businesses than it is now. Just consider that “where to buy” + “near me” mobile queries have grown by over 200 percent from 2017 to 2019.

In addition, a recent study found that 69 percent of digital traffic is organic and local—meaning it’s more important than ever that your small business tightens up its local organic SEO strategies.

This guide will introduce local SEO for small businesses. We’ll then cover 12 local SEO tips and the tools you need to begin your journey.

What Is Local SEO for Small Business?

Search engine optimization (SEO) is the process of improving your website to increase the chances of it being seen when people search terms related to your business. Local SEO is a similar venture but with a particular focus on local keyword terms.

The goal is to drive local traffic to your website—traffic that’s more likely to convert, whether online or offline.

Why Is Local SEO Important for Small Businesses?

With more people relying on online information to make offline purchases, local SEO for small businesses has never been more important. In fact, one study found 78 percent of local searches on mobile result in an offline purchase. You can’t argue with those results!

Other reasons to optimize your website for local SEO include the opportunity to build your website up as an authority and educate your target audience on your products and services.

Your local SEO efforts don’t have to center around increasing sales. You can also use local SEO strategies to drive traffic to your website for the purpose of informing or educating.

12 Local SEO Tips for Small Businesses

Many local SEO tips can be implemented within minutes, while others take considerably more time. However, each of the tips below can greatly benefit your local business, both online and offline.

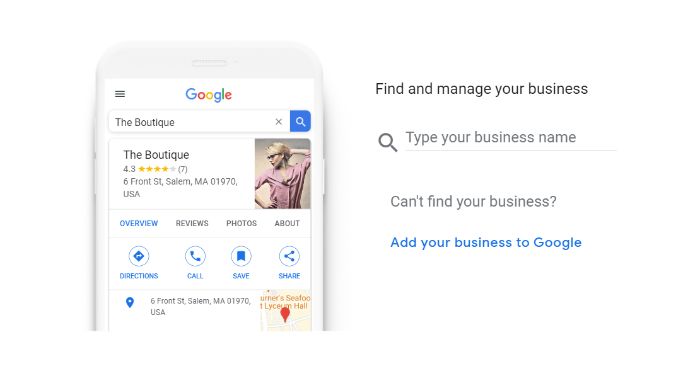

1. Optimize for Google My Business

Google My Business is a business directory owned and operated by Google. The goal of the platform is to provide the most accurate business information for local businesses to searchers.

With this in mind, most businesses will have a Google My Business listing within a year or so of starting their business. This is done automatically as Google learns of your business through its website crawl bots.

The problem with an automated listing, though, is that information may not be complete or accurate. Only when you claim your listing can you ensure you’re getting the most from the platform.

If you need even more reason to claim or create your own listing, then consider that businesses with 4 or more stars on Google My Business outrank those with less than 4 stars by about 11 percent. As a small business, you can’t afford to lose out on that edge.

How can you completely optimize your Google My Business listing? Here are a few essential steps to get you started:

- Claim or create your Google My Business listing.

- Complete profile data and publish your listing.

- Add photos and videos of your business and offerings to your profile.

- Respond to ratings and reviews in a professional and timely manner.

It’s important that your business information is accurate and updated. You should ensure updates are made at least monthly, though weekly monitoring of your listing is important to success.

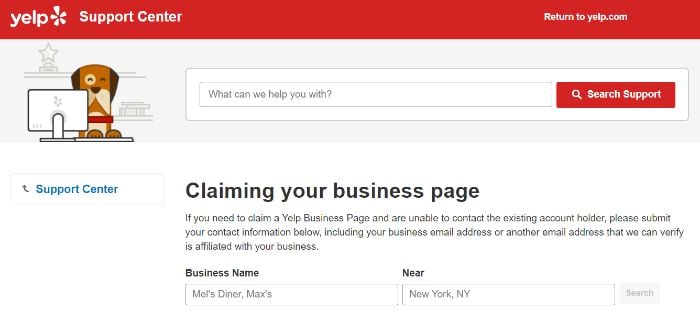

2. Claim All Business Directories

Speaking of business directories, you must be sure to stake your claim in all business directories. The most popular include Google My Business mentioned above and Yelp.

You may think that a Google Business Profile is sufficient to bring in traffic, both online and in-store. However, consider that a Yelp page is present in the top 5 results for 92 percent of search queries that contain a city and business category.

What difference does it make for your listing to be in the top 5 results on Google? The top 5 results on the SERPs account for 80 percent of click-throughs on the first page of Google. The first organic result alone accounts for almost 40 percent.

All of this to say, you can’t afford to not claim your business on all directories wherever possible.

Fortunately, business directories make it easy to claim your listings. To claim your Yelp business page, for example, you can begin the process by verifying your business information.

While Google and Yelp are the big dogs, other business directories to consider are Facebook, Bing, Yahoo, and Yellow Pages.

3. Perform a Local SEO Audit

Now that you’re established on business directories, it’s time to understand the landscape. This enables you to see what your competitors are doing so you, too, can make the same improvements (and better) on your website.

Results on the first page of SERPs provide the most insight and inspiration. After all, the first three positions alone account for 66.5 percent of the click-throughs on the SERPs!

As you begin your audit, first consider free tools and analyzers like the SEO Analyzer. These tools give you a detailed overview of your website’s current status and what you can do to optimize.

Next, use your target keywords (which you’ll work out in the next section), and compare your website to the top five of each SERP. Consider types of content, website structure, page elements, and keyword density.

I would recommend keeping a spreadsheet of your findings to easily track and implement your changes.

4. Target Local Keywords

As a small business, keyword targeting can be daunting. You know you’ll be lost in the sea when you target high-volume keywords, but lower-volume keywords tend to yield little return.

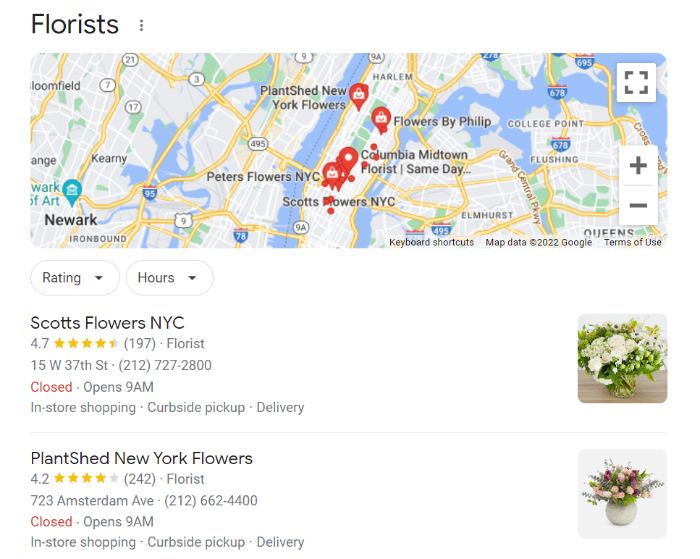

As a local business, you actually have an edge when it comes to keyword targeting. “Near me” search term variations increased as little as 150 percent (e.g. “near me now”) to as much as 900 percent (e.g. “near me today/tonight”) in just a few years. This means that targeting a combination of high volume and local keywords can work in your favor.

What do I mean in practice?

Let’s say you own a local flower shop. Your website naturally contains many high-volume keywords, such as “florist,” “flower shop,” and “flowers for sale.” The fact is you’re unlikely to beat out national flower providers, like 1-800-Flowers and Sam’s Club, with those keywords.

The goal should be to optimize your website with local keywords.

For example, search your website for every instance of “flowers for sale.” You’ll want to be wary of keyword stuffing, but take care to change most of these instances to more specific, local terms, such as:

- “flowers for sale in [city or zip code]”

- “[city or zip code] flowers for sale”

- “flowers for sale [city or zip code]”

You don’t have to target only your specific town and zip code, though. Consider areas within 10 or 15 miles of your business and target those local keywords, too. This is especially good practice if you live in a smaller town outside of a larger city or metro area.

5. Encourage (and Reward) Customer Reviews

When was the last time you visited a restaurant or purchased an item without researching ratings and reviews? If you’re like 82 percent of consumers performing an online local search, then the answer is never.

Customer reviews are the lifeblood of your business. This is particularly true for new and small businesses.

How can you obtain online customer reviews?

First, ensure there is a place for customers to leave reviews. If you’ve claimed your Google My Business profile and Yelp business listing, then you’re off to a great start.

Second, offer an incentive to customers who leave reviews. Whether by word of mouth or marked on in-store receipts, let customers know they will receive a discount or a complimentary item for their rating and review.

The work doesn’t stop there, though. You must respond to all reviews, negative and positive. This gives you an opportunity to engage with your customers, and it can also instill faith in your brand by those who have yet to purchase.

6. Create Local Content

Above we talked about targeting local keywords while avoiding keyword stuffing. The best way to do this is to create local content for your website or website’s blog.

Local content can be a blog post, a news release, or a static web page. You can use these various content types to highlight local events (past and upcoming), local offerings, local business roundups (e.g., local businesses that complement but don’t compete with yours), or even to educate the public on your product or service.

The more natural content you have on your website, the more easily you can target local keywords. It can also help to establish you as an expert in the field, which is crucial for small business owners competing against larger businesses.

Continuing with the example of a flower shop, here are a few content ideas that will naturally target both the audience and the keywords:

- Blog post: #X [your state] Flowers for Year-Round Decorating

- Static web page: Our Local [your state] Flower Offerings

- Static web page: [your state] Garden Flower Offerings

- Blog post: [your state] Flower Events for [season/year]

7. Implement a Local Backlink Strategy

A backlink is a link to your website from another site. Depending on the quality of the third-party websites and the number of links to your website, this can have a considerable impact on your website’s authority.

Authority is a critical piece in determining how high your website ranks on the SERPs. How do we know this? Consider that the #1 result in Google has an average of 3.8x more backlinks than positions #2 to #10.

How can a small business website begin to build its backlink profile? A few things to consider are:

- writing guest posts for relevant, high-quality websites in your industry

- engaging in influencer outreach

- participating in link outreaches

- “listening” for brand mentions

- writing shareable content

Speaking of shareable content, the key to any successful backlink strategy is quality, reasonably lengthy content. After all, it’s known that long-form content receives 77.2 percent more backlinks than short articles.

You don’t want long content for content’s sake, so keep the post relevant, valuable, and free of fluff.

8. Become Mobile-Friendly

Considering 82 percent of smartphone shoppers conduct “near me” searches, you can’t afford not to have a mobile-friendly site.

The hard work isn’t getting traffic to your site, but instead keeping it there once it arrives. If your site isn’t mobile-friendly, then local searchers will quickly leave your site and consider a competitor instead.

What is a mobile-friendly site? The four basic elements that every mobile-friendly site should contain include:

- responsive page display

- readable fonts

- proper text formatting

- optimized media display

Beyond a mobile-friendly website, you must also produce mobile-friendly content. The good news about mobile-friendly content is that it’s also viewable for desktop readers.

What does such content consist of?

- short paragraphs

- white space

- subheadings

- a summary

- images

- lists

- styling (e.g., bold, italics)

If you’re not a web developer, the idea of creating a mobile-friendly website can be daunting. The good news is that most website platforms incorporate mobile-friendly elements into their themes and overlays. Keep an eye out for “responsive” as an indicator of such options.

9. Optimize Page Structure

Local SEO for business goes beyond business listings and content. An often-overlooked element is page structure.

Page structure includes title tags, headers, meta description, and URL. When used correctly, these can further enhance your content and improve your rankings on SERPs.

Perhaps you’re wondering just how much of an impact these elements can have on your rankings. Here’s the deal: To employ elements that your competitors may not be, you can get ahead.

Which page structure elements are most overlooked by small businesses? From greatest to least, here is what percentage of small business owners use the following key SEO features:

- Title tag: 99 percent

- Robots.txt: 88 percent

- Sitemap.xml: 73 percent

- Meta description: 72 percent

- H1: 68 percent

- Schema.org: 44 percent

You can address the title tag, meta description, and H1 most easily. However, robots.txt, sitemap.xml, and schema.org also have their place on a well-structured website.

10. Get Involved on Social Media

Social media isn’t just for big brands and influencers. A local business page can benefit from social media usage, too.

More specifically, a local business page can be a great place to keep customers up-to-date on the latest sales, events, and changes (e.g., hours of operation). That’s because even with a website, a social media profile is more like a “living” version of your business.

Perhaps Facebook users benefit most from local business pages. After all, ⅔ of Facebook users across all countries surveyed say they visit the Page of a local business at least once a week. However, other social media platforms like Instagram and TikTok can also offer your business an edge.

A few examples of the benefits of maintaining social media profiles for your small business include relationship building, trend tracking and analysis, and social commerce.

Here’s how small businesses can get involved on social media:

- Decide which platforms are right for your business based on features and target audience.

- Post quality content on a regular basis.

- Use scheduling and automation tools to test and improve engagement.

- Participate in local events and roundups.

- Make it easy for customers to purchase your products and services online.

Depending on your business and target audience, social media may or may not make up a large percentage of your sales and traffic. However, either way, a strong social media presence is a must for small businesses.

11. Participate in Local Business Events

Would you be surprised to learn you can do a lot offline to improve your website’s local SEO? 48 percent of marketers invest at least 20 percent of their marketing budget in live events.

Participating in local business events, especially those with a strong social media presence, can help grow your business in a few ways. They’re an opportunity to market your business but also are an easy way to get to know your audience and the community you serve. There’s likely to be a return on such events, too.

As a small business, you have the versatility to host your own event or sponsor and join with larger community events. An event you host yourself would likely yield a larger return, but a community event may be ideal for smaller budgets.

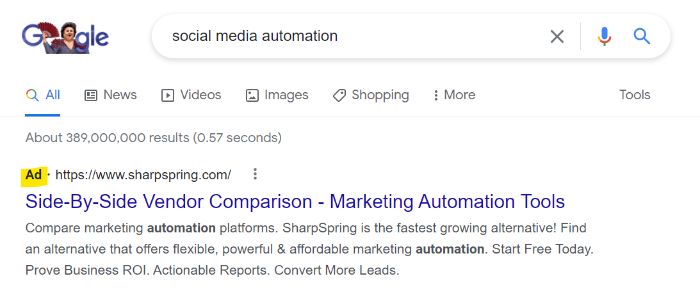

12. Invest in Google Ads With Local Keywords

Small business usually means small budget. It’s important that you invest wisely in the growth of your business online. Where should you hedge your bets? For most businesses, Google Ads is a good place to start.

Google Ads is a paid advertising platform that enables you to appear in prominent places on the SERPs.

You may think that you could never compete against big businesses. One way around this is to highlight your local status by targeting local keywords and local audiences. For example, instead of targeting “flowers for sale,” target “flowers for sale in [your city or zip code].”

How can we know this will be successful? According to Think with Google, 72 percent of computer or tablet users and 67 percent of smartphone users want ads that are customized to their city or zip code. Users want to find the options most local to them, so give them what they want.

It’s true that starting with Google Ads can be daunting, but fortunately, you have the option to invest in an advertising agency to help you set up and manage your account and keywords. If you want to go it alone, though, follow these essential steps:

- Conduct keyword research: This will include keywords you want to target but also keywords you want to exclude from your campaigns (negative keywords).

- Decide how your ad groups will be structured: Ad groups are ad campaigns grouped by a common element, like target audience, target keyword, or even location. Decide how your groups will break down so you can begin to create your campaigns.

- Create your first campaign: A campaign is a step above ad groups in that it encompasses a larger target audience. For example, you can have a “Wedding Flowers” campaign that includes ad groups like “Wedding Flowers in Queens” and “Wedding Flowers in Brooklyn.” This is where you will set campaign-level goals and settings.

- Create your first ad: Google Ads has multiple ad types. A text ad is a good place to begin, though your ad groups can contain multiple ad types, and it’s important to experiment with what works for your audience.

Continuous monitoring and tweaking of your campaigns are necessary for success.

Local SEO Tips for Small Businesses Frequently Asked Questions

As a small business, should I get an agency to help with my local SEO?

As a small business, budget can be a constraint. While you can make many changes yourself, a consulting agency can offer invaluable advice and resources.

How does local SEO help small businesses grow?

With local search intent being what it is, local SEO can be a boon to small businesses. It can put you on the map (or SERPs, as it happens) for keywords you may not have ever ranked for on a larger scale.

How much should a small business pay for local SEO?

The amount you invest will vary depending on what you find to be meaningful and valuable to your business. If you must invest, I recommend you do so in two places: 1) in an SEO consulting agency, and 2) in paid advertising.

What kind of small businesses need local SEO?

Local SEO can benefit small businesses of all kinds. If you provide products or services in a specific area (or multiple areas), then you can benefit from its use.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “As a small business, should I get an agency to help with my local SEO?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

As a small business, budget can be a constraint. While you can make many changes yourself, a consulting agency can offer invaluable advice and resources.

”

}

}

, {

“@type”: “Question”,

“name”: “How does local SEO help small businesses grow?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

With local search intent being what it is, local SEO can be a boon to small businesses. It can put you on the map (or SERPs, as it happens) for keywords you may not have ever ranked for on a larger scale.

”

}

}

, {

“@type”: “Question”,

“name”: “How much should a small business pay for local SEO?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

The amount you invest will vary depending on what you find to be meaningful and valuable to your business. If you must invest, I recommend you do so in two places: 1) in an SEO consulting agency, and 2) in paid advertising.

”

}

}

, {

“@type”: “Question”,

“name”: “What kind of small businesses need local SEO?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Local SEO can benefit small businesses of all kinds. If you provide products or services in a specific area (or multiple areas), then you can benefit from its use.

”

}

}

]

}

Conclusion: Local SEO for Small Business

As a small business owner, you know that hard work and dedication is needed to grow your sales. Much the same can be said for local SEO. While SEO can take time and patience, it can pay off in the long run.

With the 12 local SEO tips outlined above, even the smallest businesses can benefit. From keyword research to social media marketing to paid advertising, you can begin to make changes today to see benefits in the future.

Which of these local SEO tips for small businesses will you implement first?

Remi Labs (YC W22) is hiring to build NFTs for ecom businesses

Article URL: https://www.workatastartup.com/jobs/50556 Comments URL: https://news.ycombinator.com/item?id=30586733 Points: 1 # Comments: 0 The post Remi Labs (YC W22) is hiring to build NFTs for ecom businesses first appeared on Online Web Store Site.

The FTC to Dun & Bradstreet—Stop Deceiving Businesses About CreditBuilder Services and Pricing

CreditBuilder Issues Finally Resolved

The Federal Trade Commission (FTC) recently settled a case against Dun & Bradstreet, the business credit bureau. The case was about its CreditBuilder product.

To settle Federal Trade Commission charges that it engaged in deceptive and unfair practices, D&B agreed to an order. This order required major changes in its operations. The idea is to benefit small- and mid-sized businesses. Under the proposed order, D&B (the Respondent) will also refund some businesses that bought the company’s products. Businesses bought these products, believing they would improve business credit scores and ratings.

The initial complaint goes back to at least 2019 and refers to D&B business practices from 2015 and later. In this case, the FTC is the complainant and D&B is the respondent.

The Facts of the Case

Per the complaint (paragraph 2):

From at least May 2015, D&B sold and distributed products to small and mid-sized business consumers. These included products D&B claims will help a business monitor, manage, and build its business credit report. D&B claims the products offer an easy way to provide positive payment history. This is history otherwise unreported by D&B. The aim is to improve the business’s credit report.

But in fact, D&B rejects most of the submissions. Thousands of businesses that have paid for these products cannot get even a single payment experience added to their reports.

D&B’s Claims About its CreditBuilder Line of Products

The complaint (paragraph 16) also said:

Respondent has routinely deceptively claimed that if an affected business would simply purchase a CreditBuilder Line product and provide information to Respondent, Respondent would verify that information and add it to the credit report. For example, in pitching … (these) … products, Respondent’s telemarketers have made specific deceptive claims including, “we will contact those companies that you add … [and] verify that payment history going back a full 12 months,” and “[i]t’s a really easy process[,] I just need a little bit of information from you and we basically take over the rest from there.”

Pricing

CreditBuilder and related products were already expensive to begin with. They cost almost $900/year. And in 2018, after selling ever more expensive products, D&B came out with Credit Essentials Plus (after releasing CreditBuilder Plus and other products). It had a price tag of almost $2,500. But in 2013, CreditBuilder cost $948.

Hence, in five years, the price of the information and features in this product rose by over 163%. In contrast, the actual inflation rate for this five-year span was less than 3%.

Selling a CreditBuilder Account as a Way to Add Trade References

Many times, telemarketers for D&B told business owners that using CreditBuilder would be a fast and easy way to add trade references. But such was not the case.

In paragraph 51, the complaint says that often and for various reasons, D&B rejected trade references added by CreditBuilder Line customers. And they didn’t include this information on their credit report.

Issues

D&B employees convinced business owners to sign up for expensive services. And then they never bothered to do what they promised to do, anyway.

Hence, beyond the issue of hard selling services which entrepreneurs didn’t need, there’s also an issue of breaking their promises. D&B was paid for services it didn’t render. And this doesn’t even get into what looks an awful lot like price gouging.

Furthermore, entrepreneurs had to spend considerable time and money correcting several errors on D&B’s part.

And finally, these issues may even date back at least to 2013.

Arguments

There don’t appear to have been too many arguments by Dun & Bradstreet in favor of its practices. The Federal Trade Commission makes arguments like the issues listed above.

Holding and Rationale

The matter was settled, and Dun & Bradstreet agreed to:

- Change operational practices to help businesses correct their reports. This includes deleting or reinvestigating disputed data within certain time periods. Plus, a way to receive free results of revised data.

- Clearly disclose its limited involvement in adding to a customer’s history of payment information. And disclose its rates of accepting customers’ requests to add payment information.

- Provide disclosures for automatic renewals. And do so without placing a customer’s subscription level to a more expensive one not ordered; and

- Give customers refunds or allow them to cancel a current subscription.

By the looks of the above proposed order, D&B conceded on pretty much everything.

What This CreditBuilder Case Means for You, the Small Business Owner

Per the FTC, business owners should review credit card statements often and with care. And consider any and all subscriptions on a regular basis. If the subscription isn’t needed, then get rid of it. The same goes for subscriptions you were signed up for without your knowledge and consent. If you have no idea what a subscription is for, or how it got on your bill, don’t hesitate to ditch it.

At Credit Suite, we help you monitor your business credit reports. This could help you spot charges you don’t recognize. But any way you monitor, we encourage you to review all statements, bills, and reports. Do so before anything like this has the potential to happen again.

And finally, we still believe trade references are an excellent addition to any business credit report. We hope Dun & Bradstreet will improve its means of adding trade references. Small business owners should be able to reap the benefits of such added data on their business credit reports.

The post The FTC to Dun & Bradstreet—Stop Deceiving Businesses About CreditBuilder Services and Pricing appeared first on Credit Suite.

Overcome The Unique Challenges of Financing New Businesses & Startups with These 5 Financing Options

New businesses and startups face plenty of unique challenges when it comes to financing options. For example, lack of business credit history, no or low business credit score, and not being set up properly can all lead to reliance on personal financial resources.

There are financing options that can work despite these challenges however. We have a list of both general and specific resources to ensure you can get the funds you need to start and grow your business.

5 Financing Options to Overcome the Unique Challenges New Businesses and Startups Face

There are a number of possibilities here. Which one will work best for your business depends on your individual circumstances and situation.

#1 Traditional Loans

Of all the financing options most consider when it comes to new businesses and startups, traditional loans are the most common. They can take many forms.

Choices include:

- SBA loans

- Collateral loans

- And loans that require a personal guarantee

Traditional term business loans require a good personal credit score. This is regardless of whether you have business credit history, or even a business credit score at all.

If you have either collateral, a good personal credit score, or both, term loans may be the first and best option for you when it comes to new business funding. That is, unless you want to avoid using your personal credit or collateral. If that is the case, there is another choice which in some instances may be better.

#2 Retirement Plan Financing

Retirement plan financing is not a loan from your retirement plan. As a result, you will not have to pay an early withdrawal fee. You will not have to pay a tax penalty. There will not even be any interest.

The type of financing we are referring to here is a Rollover for Working Capital program. The IRS calls this type of program a Rollover for Business Startups (ROBS).

According to the IRS, a ROBS qualified plan is a separate entity, with its own set of requirements. The plan, through its stock investments, owns the business, not an individual.

#3 Alternative Lenders

If a traditional loan option is not going to work, and you do not have a qualifying retirement plan, it may be time to consider alternative lenders. They often have less stringent requirements than banks and credit unions.

Here are some options to consider.

BlueVine

BlueVine offers both invoice factoring and lines of credit.

For invoice factoring:

- Your business must have been in operation for at least 3+ months

- You need to have a personal credit score of 530 or more

- Your business must generate at least $10,000 in monthly revenue

For the BlueVine line of credit:

- Your business must have been in operation for at least six months

- Be a corporation or LLC

- Have a personal credit score of 600+ or more

- And your business must generate at least $10,000 each month in revenue

Due to regulations, they cannot provide lines of credit to the following states: Nevada, North Dakota, South Dakota, or Vermont.

OnDeck

OnDeck requires a personal credit score of 600 or more to qualify for funding. Also, you must be in business at least one year and have an annual revenue of at least $100,000. They report to the standard business credit bureaus, and they also cannot lend to businesses in Nevada, North Dakota, or South Dakota.

Fundbox

Fundbox requires a minimum time in business of 6 months. In addition, your accounting or invoice software must be compatible and must be in use for at least 3 months. Your credit score must be 600 or above, and you need at least $100,000 in annual revenue.

Other Options

While most alternative lenders, including these, have less stringent credit requirements, many do require a minimum time in business and minimum revenue. If you do not meet these requirements, there are other financing options available.

#4 Credit Line Hybrid

A credit line hybrid is a form of unsecured funding. Our credit line hybrid has an even better interest rate than a secured loan. Not only that, but you can get some of the highest loan amounts and credit lines for businesses, and sometimes with 0% interest!

This is a credit card stacking program, and many of these cards report to business CRAs. That means you can build business credit at the same time. This will get you access to even more cash with no personal guarantee.

You or a guarantor need a FICO of at least 680 to qualify. No financials are required, and you can often get a loan of up to $150,000. Be aware, some cards may report on your personal credit.

#5 Crowdfunding

Crowdfunding sites allow you to tell thousands of micro investors about your business. Anyone who wants to donate, or invest, can do so. They may give $50, they may give $150, or they may give over $500. In contrast, it might just be $5.

Most entrepreneurs offer rewards to investors for their generosity. Usually, this comes in the form of the product the business will be selling. Different levels of giving result in different rewards. For example, a $50 gift may get you product A, and a $150 gift will get you an upgraded version of product A.

Keep in mind that a crowdfunding campaign can easily become another full-time job, and that there are no guarantees of success. We suggest only considering crowdfunding if you realistically believe your chances of succeeding are over 50%.

There are a lot of crowdfunding platforms out there. Here are a few to consider.

Kickstarter

This is the largest crowdfunding platform, and they require a prototype. Projects cannot be for charity, although nonprofits can use Kickstarter. Equity cannot be offered as an incentive.

Taboo projects and perks include anything to do with:

- Contests and raffles

- Cures and medicines

- Credit services

- Live animals

- Alcohol

- Weapons

There is a 5% fee on all funds which creators collect.

Indiegogo

The minimum goal amount for an Indiegogo campaign is $500. There is a 5% platform fee and 3% + 30¢ third-party credit card fee. Fees are deducted from the amount raised, not the goal you set. So, if you raise more than your goal, you will pay more in fees.

A flexible funding option allows campaigns to keep any money they receive even if they do not reach their goal. This is notably different from some other platforms.

RocketHub

RocketHub is specifically for entrepreneurs who want venture capital. The platform is exclusively for business owners working on projects in these categories:

- Art

- Business

- Science

- Social

If you reach your fundraising goal, there will be a 4% fee, and there is a separate 4% credit card handling fee. If you do not reach your goal, the fee increases to 8% plus the credit card handling fee.

Financing Options Are Available for New Businesses & Startups

While it is much harder for new businesses and startups to get funding, there are options out there. Remember, the best way to ensure you have access to the financing options you need in the future is to build a fundable business. That starts now. Contact us today for a free consultation on how to do it.

The post Overcome The Unique Challenges of Financing New Businesses & Startups with These 5 Financing Options appeared first on Credit Suite.

5 Ways Small Businesses Can Benefit from a 2021 Credit Review

What is a 2021 Credit Review and Why Should You Do One?

In a time when the economy is tumbling toward a recession, it’s important for small businesses to get their finances in order. Here are tips on how to do that by doing a 2021 credit review.

Also, we’ll show you how this can give your business an advantage over competitors who are not aware of what they’re missing out on. And why financial experts recommend this type of review. So look at the 5 ways a 2021 credit review can help your business. Get more information about what you need to do now so you don’t have any regrets later!

All year, we’ve been talking about building business credit. And we’ve talked about business credit reporting agencies and their reports. But do you know how to read your business credit reports? And do you know what to do with the information you might find?

The Benefits of Doing a 2021 Credit Review

Knowing what’s in your business credit reports can only help you. Learning what the CRAs are scoring you on will help focus your efforts. For example, if on-time payments matter to a CRA more than utilization percentage, then wouldn’t it be a good idea to concentrate on paying your credit bills on time? <Spoiler alert> they do.

Why it is Important for You to Know About Your Business Credit Scores

Business credit is an actual asset, and it is worth money! That means you can factor business credit into the cost of your business, should you ever decide to sell. Plus, what you do to build business credit will often help you build a clientele!

Better business credit scores will help you get business financing. They will help you get better financing, with lower interest rates and payback terms. For some entrepreneurs, better business credit scores are the difference between getting some financing….

Or none.

What Information Should be Included in Your Review

You want to be looking at your actual, full business credit reports, which are more than the scores. It’s time to look at the details. These should be reports from:

- Dun & Bradstreet

- Experian and

- Equifax

About the Process

Get your D&B business credit report by signing into the D&B website. You want their CreditMonitor product, which shows the most scores. Get your Experian credit report by running a search for your business. You want their CreditScoreSM Report. To get your Equifax business credit report, you’ll need to contact them. Specify that you want a single Equifax business credit report.

product, which shows the most scores. Get your Experian credit report by running a search for your business. You want their CreditScoreSM Report. To get your Equifax business credit report, you’ll need to contact them. Specify that you want a single Equifax business credit report.

How to Get Started with a 2021 Credit Review Now

If a highly detailed report isn’t in the budget right now, at least a shorter summary report will keep you informed. And it will get you in the habit of checking your credit reports. Today, we’ll look at high level information. This is what you absolutely need to know right now.

#5 Way a 2021 Credit Review Can Benefit Small Businesses: Get to Know Your Dun & Bradstreet Business Credit Report

It always makes sense to start with D&B. They are the biggest business CRA in the world, by far! You need a D-U-N-S number to start building business credit. If you don’t have a D-U-N-S number, you’ll need to get one; they’re free. This number gets your business into their system.

But your business will not get a PAYDEX score, unless there are at least 3 trade lines reporting, and a D-U-N-S number. Your business must have BOTH to get a D&B score or report.

D&B Data

D&B’s database contains hundreds of millions of companies around the world, both active and out of business. So D&B lists over a billion trade experiences. It works to improve its analyses to assure the greatest degree of accuracy possible. To ensure as accurate a report as possible, give D&B your company’s current financial statements.

Predictive Models and Scoring

D&B takes historical information to try to predict future outcomes. This is to identify the risks inherent in a future decision. They take objective and statistically derived data, rather than subjective and intuitive judgments. There are sample reports online available on the D&B website.

D&B Reports

D&B offers database-generated reports. These help their clients decide if your business is a good credit risk. Companies use the reports to make informed business credit decisions and avoid bad debt. Several factors go into creating such a report.

In general when D&B does not have all the information that they need, they will show as much in their reports. But missing information does not necessarily mean your company is a poor credit risk. Instead, the risk is unknown.

Executive Summary

The report starts with basic company information, like:

- Number of employees

- Year your business was started

- Net worth

- Sales

D&B Rating

This rating helps companies check your business’s size and composite credit appraisal. Dun & Bradstreet bases this rating on data in your company’s interim or fiscal balance sheet plus an overall evaluation of your business’s creditworthiness. The scale runs 5A—HH. Rating Classifications show your company size based on worth or equity. D&B assigns such a rating only if your company has supplied a current financial statement.

The rating contains a Financial Strength Indicator. It is calculated using the Net Worth or Issued Capital of your company. Plus there’s a Composition Credit Appraisal. This number runs 1 through 4, and it shows D&B’s overall rating of your business’s creditworthiness.

The scores mean:

- 1—High

- 2—Good

- 3—Fair

- 4—Limited

A D&B rating might look like 3A4.

D&B PAYDEX

This part shows two gauges: an up to 24 month PAYDEX, and an up to 3 month PAYDEX. As a result, you can see recent history and your company’s performance over time.

Both gauges have the same scores:

- 1 means greater than 120 days slow (when it comes to your business paying bills)

- 50 means 30 days slow

- 80 means prompt payments

- 100 means anticipates

100 is the best PAYDEX score you can get. The PAYDEX score is Dun & Bradstreet’s dollar-weighted numerical rating of how your company has paid the bills over the past year. It shows how well your company pays its bills.

Predictive Analytics

This next section shows the chance of business failure. It also shows how often your business is late in paying its financial obligations. These are comparative analyses: the Financial Stress Class, and the Credit Score Class.

Financial Stress Score

This section shows your Financial Stress Class, and a Financial Stress Score Percentile. The Financial Stress Class runs 1—5, with 5 being the worst score.

Financial Stress Score Percentile

It is a comparison of your business to other businesses. The percentile contains a Financial Stress National Percentile. The Financial Stress National Percentile shows the relative ranking of your company among all scorable companies in D&B’s file. It also contains a Financial Stress Score. The report shows the probability of failure with a particular score.

Financial Stress Score Percentile Comparison

So the idea behind the score is to predict the chances your business will fail over the next 12 months. The average probability of failure comes from businesses in D&B’s database. It is provided for comparative purposes. The Financial Stress Score offers a more precise measure of the level of risk than the Financial Stress Class and Percentile. It is meant for customers using a scorecard approach to determining overall business performance.

Credit Score Class

The Credit Score Class measures how often your company is delinquent in paying bills. Overall numbers run 1—5. 1 is businesses least likely to be late. More granular scores run 101—670. 670 is the highest risk.

Credit Limit Recommendation

It shows a spectrum of risk. Your risk category can be:

- Low

- Moderate or

- High

D&B checks risk using their scoring methods. It is one factor used when creating recommended limits.

D&B Viability Rating

This section contains:

- Viability Score— to show risk

- Portfolio Comparison—also a demonstration of risk

- Data Depth Indicator—descriptive vs. predictive

- Company Profile—showing if financial data and other info was available

Credit Capacity Summary

This part repeats the D&B Rating above. It includes financial strength, the composite credit appraisal, and payment activity

Business History and Business Registration

This section contains information on ownership. It also shows where your corporation is filed (i.e. which state). This includes the type of corporation, and the incorporation date

Government Activity Summary and Operations Data

This section gives basic information on if your company works as a contractor for the government. It also shows the kind of industry your company is in. It shows what the facilities are like, including general data on its location.

Industry Data and Family Tree

The section shows your business’s SIC and NAICS codes. It also shows where your branches and subsidiaries are. This list is limited to the first 25 branches, subsidiaries, divisions, and affiliates, both domestic and international. D&B offers a Global Family Linkage Link to view the full listing.

Financial Statements

This section is devoted to financial statements D&B has on your business. It shows assets and liabilities, with specifics like equipment, and even common stock offerings.

Indicators and Full Filings

This part shows public records, like:

- Judgments

- Liens

- Lawsuits

- UCC filings

This part also breaks down where filings are venued, like the court or the county recorder of deeds office. It shows if judgments were satisfied (paid). It also shows which equipment is subject to UCC filings.

Commercial Credit Score

This part shows the Credit Score Class again. It also shows a comparison of the incidence of delinquent payments. It also includes key factors to help anyone reading the report interpret these findings. And it explains what the numbers mean.

Credit Score Percentile Norms Comparison

Here, your company is compared to others based on:

- Region

- Industry

- Number of employees and

- Time in business

Financial Stress Score and Financial Stress Percentile

This section shows a Financial Stress Class and a Financial Stress Score Percentile. The Financial Stress Class runs 1—5, with 5 being the worst score. he Financial Stress Score Norms calculate:

- An average score and percentile for similar firms

- The norms benchmark where your business stands

This is in relation to its closest business peers.

Financial Stress Score Percentile and Financial Stress Score Percentile Comparison

These two scores are a repeat of the Financial Stress Score section, above.

The average probability of failure is based on businesses in D&B’s database. t is provided for comparative purposes. The Financial Stress National Percentile shows the relative ranking of your company among all scorable companies in D&B’s file. And the Financial Stress Score offers a more precise measure of the level of risk than the Financial Stress Class and Percentile. It is meant for customers using a scorecard approach to determining overall business performance.

Advanced PAYDEX + CLR

This section repeats the 24 month and 3 month PAYDEX gauges. It also includes a repeat of the Credit Limit Recommendation. There is also a PAYDEX Yearly Trend. It shows the PAYDEX scores of your business compared to the Primary Industry from each of the last four quarters.

PAYDEX Yearly Trend

The PAYDEX Yearly Trend is a graph. It includes detailed payment history, with payment habits and a payment summary. It helps show if your business pays the bigger bills first or last.

Let’s look at an Experian business credit report.

#4 Way a 2021 Credit Review Can Benefit Small Businesses: Explore Your Experian Business Credit Report

Experian offers data and analytics to businesses to help them better gauge risk. They have a massive consumer and commercial database for checking risk. They have found that blended data and reports work a lot better for them. For troubled businesses, blended scores dropped an average of 30% over the four quarters leading up to a bad event. But the owner’s consumer scores showed no statistically significant decline during the same period. Their best known and most widely used score is Intelliscore Plus℠, a percentile score.

Experian offers data and analytics to businesses to help them better gauge risk. They have a massive consumer and commercial database for checking risk. They have found that blended data and reports work a lot better for them. For troubled businesses, blended scores dropped an average of 30% over the four quarters leading up to a bad event. But the owner’s consumer scores showed no statistically significant decline during the same period. Their best known and most widely used score is Intelliscore Plus℠, a percentile score.

A Typical Experian Business Credit Advantage SM Report

Experian provides a sample report where you can get an idea of what to expect. The best, most accurate and up to date source for this information is the Experian website itself.

Business Background Information

The first part of a report contains:

- Basic details like business name, address, and main phone number

- Experian BIN (Experian’s BIN is like Dun & Bradstreet’s D-U-N-S number. It’s a unique identifier for each business in the database)

- Annual sales

- Business type (corporation, etc.)

- Date Experian file established

- Years in business

- Total number of employees

- Incorporation date and state

Experian Business Credit Score

Business Credit Scores run 1—100; higher scores mean lower risk. This score predicts the chance of serious credit delinquencies in the next 12 months. It uses tradeline and collections data, public filings as well as other variables to predict future risk.

Key Score Factors:

- Number of commercial accts with terms other than Net 1—30 days

- The number of commercial accounts that are not current

- Number of commercial accounts with high utilization