America’s top general said the United States could now face a rise in terrorist threats from a Taliban-run Afghanistan. That warning comes as intelligence agencies charged with anticipating those threats face new questions after the U.S.-backed Afghan military collapsed with shocking speed.

Tag: could

How an anti-gay chant could silence Mexico's World Cup fortunes

Is a four-letter slur in Spanish deployed at stadiums capable of sinking El Tri’s World Cup fortunes for the next two cycles?

The post How an anti-gay chant could silence Mexico's World Cup fortunes appeared first on Buy It At A Bargain – Deals And Reviews.

How Could Deepfakes Change Marketing?

Deepfakes are receiving a lot of bad press.

U.S. Sen. Marco Rubio (R-Fla.) called the technology a propaganda weapon.

Facebook’s COO Sheryl Sandberg said deepfakes raise the issue of not believing what you see.

Investigative journalist Rana Ayyub was targeted with a deepfake pornography video to discredit and silence her.

With so much negativity around the tech, is there any chance of it bringing good into the world?

Yes! The possibilities when you combine AI technology with marketing are exciting and can change how we speak with our customers forever.

When used with positive intent, they are a potent marketing tool.

Below, I’m breaking down exactly what these videos are, the drawbacks of using them, and the different ways marketers are currently using deepfakes to create stronger campaigns.

What Are Deepfakes?

Have you seen a YouTube video of Barack Obama calling Donald Trump a “complete dipshit?” What about Jon Snow apologizing for the disastrous season finale of Game of Thrones?

If you answered yes, you’ve seen a deepfake video.

The term “deepfake” was coined in 2017 and is a combination of “deep learning” and “fakes.” It uses deep learning technology (a branch of machine learning) to create the dupe.

Artificial Intelligence (AI) learns what the source face looks like at different angles and then superimposes it onto an actor’s face, essentially creating a mask.

For example, let’s say you have a database of audio clips or video files of a person. You could create a hyper-realistic fake video of celebrities discussing the future of cinema or revenge porn.

Hollywood has already taken advantage of deepfakes by transposing real faces onto other actors. The most notable example is bringing Carrie Fisher back to life for a short scene in Rogue One: A Star Wars Story.

While many fear the technology being used for nefarious ends (more on this below), deepfakes offer a range of intriguing possibilities. You can create apps to try a new hairstyle or use it to help doctors with medical diagnosis.

The Drawbacks of Using Deepfake Technology

With the rise of deepfake technology, it’s not hard to understand why some people are skeptical and even terrified of it becoming widely adopted.

After all, the advances in this technology make it harder to distinguish what is real and fake.

It can lead to serious dangers like fake news, putting words in politicians’ or celebrities’ mouths, and ruining someone’s life with fake pornography.

Lack of Trust

Deepfakes can breed a culture of mistrust and not knowing what to trust. If the president holds a press conference inciting violence, but it’s a deepfake, how do you know what to believe?

For example, a deepfake of Mark Zuckerberg made the rounds on the internet. The video shows Facebook’s CEO giving a speech about how the platform “owns” its users and crediting an organization called Spectre for Facebook’s success.

Increase in Scams

Another con is the opportunity it provides for scammers. Audio deepfakes have already been used to defraud people out of money.

For example, a German energy firm’s U.K. subsidiary paid nearly $243,000 into a Hungarian bank account after a scammer mimicked the German CEO’s voice.

The core message for both examples is not knowing what is real.

Consumers are already doubting what they are reading online with social media sites like Facebook, Twitter, and Instagram, adding fact-checking processes to content. Deepfakes can create more distrust of everyone around us and make us question everything we are seeing and hearing.

7 Ways Marketers Can Use Deepfakes

With all the backlash and potential pitfalls of deepfake technology, can marketers use it for good?

The answer is yes!

Some of the world’s biggest brands are already experimenting with deepfakes and using them to create unique and engaging content.

As long as you’re transparent about using the technology, you can create a more dynamic consumer journey.

1. Dynamic Campaigns With Influencers to Increase Reach

Imagine having an influencer agree to an ad campaign and only provide you with 20 minutes of audio content and a few video shots.

No lengthy photo shoot or filming days required.

Not only does it help you save time, but it opens the door to creating dynamic campaigns, a.k.a. microtargeted ads at scale.

Case in point: David Beckham’s 2019 malaria awareness ad. The deepfake had the soccer star speaking in nine languages and is an excellent example of how this technology can increase a campaign’s reach.

Translating an ad into multiple languages also allows brands to enter new markets seamlessly and speak to consumers in their native tongue while still benefiting from the influencer or celebrity’s likeness.

2. Hyper-Personalized Campaigns for Your Audience

While some people want to ban deepfakes because of how they can be used to deceive people, it’s a creative and groundbreaking technology for marketers when used for good.

If you’re in the fashion industry, you could easily show models with different skin tones, heights, and weights.

With the average person seeing thousands of ads per day, using this tech to create psychological ownership and see the product as an extension of themselves is vital to cut through the noise.

It also helps marketers create hyper-personalized ads. The benefits of creating a shopping experience catered to multiple segments mean you can reap the rewards of personalized marketing.

3. Product Ownership to Increase Sales

Another way to create ownership with deepfakes is using the technology to create personalized videos of your clients using or wearing your products.

For example, Reface AI lets users virtually try on the new Gucci Ace sneaker as part of a virtual try-on haul. Users can browse through the footwear options and view it on foot by pointing the phone at their feet.

Savvy marketers know the likelihood of a sale increases if people feel like they own the product. It doubles down on the sensory experience where the longer someone spends looking and holding a product, the more likely they will buy it.

Deep learning can help stimulate the same experience with a deepfake of the customer behind the wheel of the latest BMW or a makeup look with the newest MAC eyeshadow palette.

4. Host Exhibitions and Events Anywhere in the World

For the events and art industries, deepfakes open up a world of exciting possibilities. The technology can help you recreate objects or people anywhere in the world at the same time.

An example is the Dalí Museum in St. Petersburg, Fla., which uses a deepfake of Salvador Dalí to greet guests. It creates a more engaging experience for visitors and brings the surrealism master back to life.

Dalí’s video was created by using over 6,000 frames of video footage from past interviews and 1,000 hours of machine learning to overlay it onto an actor’s face. What makes the deepfake even more impressive is that Dalí is interactive. The video has more than 190,000 possible combinations depending on a person’s answers.

While we already have holographic concerts for iconic musicians like Michael Jackson, deepfakes would create a more hyper-real experience for attendees. Art exhibitions can use the technology to display artworks around the world simultaneously.

Marketers can take it one step further and create deepfakes of products prelaunch (like the new iPhone) to generate buzz and create an interactive Steve Jobs to answer questions about the latest device.

5. Use Deepfakes to Entertain Your Audience

Marketers can use deep learning to create ad campaigns we would have never been able to do 20 years ago.

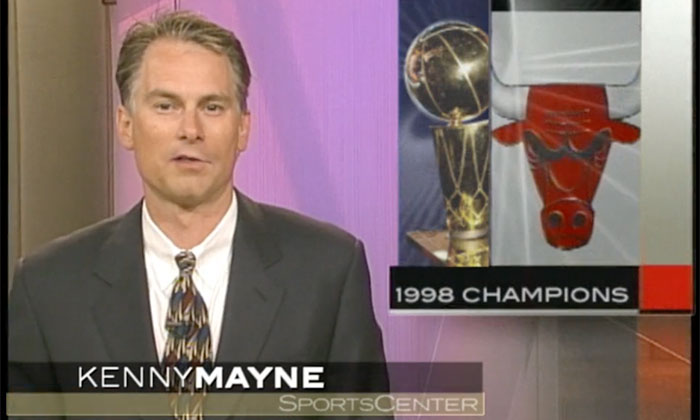

State Farm is leading the pack with its ad for The Last Dance, an ESPN documentary on Michael Jordan and the Chicago Bulls.

Using deepfake technology, State Farm superimposed 1998 SportsCenter footage to make it look like Kenny Mayne predicted the documentary.

The ad’s success led to a follow-up ad with Keith Olbermann and Linda Cohn “predicting” Phil Jackson’s success when he left Chicago to lead the Lakers.

These deepfakes serve to purely delight audiences and create a viral piece of content for the brand.

6. Market Segmentation and Personalization

One of the most successful deepfake examples using market segmentation is the 2018 Zalando campaign with Cara Delevingne.

The campaign’s concept was to create awareness around Zalando now delivering Top Shop fashion to people in the most remote parts of Europe.

With a single video shoot, they created 60,000 bespoke video messages for every tiny town and village in Europe using deepfake technology to produce alternative shots and voice fonts. Then using Facebook’s ad targeting, they showed users the specific video which mentioned their hometown.

The campaign received more than 180 million impressions, and Top Shop sales increased by 54 percent.

This can help marketers eliminate further customer generalizations or affinity grouping and create content that speaks to people on a more individual level.

7. Educating Consumers With Deepfakes

Do you have a product with a learning curve? You can use deepfake technology to educate your customers on how to use it and improve their skills.

For example, if you’re a camera brand like Canon, you can use an AI instructor to help novice photographers learn faster. The technology can point out compositional mistakes, advise on camera settings, and help them slowly master their device.

At trade shows, you could have potential customers practice taking photos, learning from the AI, or testing their skills against the deepfake. It can help create an interactive experience, put the product in the person’s hands, and start building brand loyalty.

Conclusion

Of course, there’s always going to be a few bad apples. While some people are causing mayhem with deepfakes, there are plenty of golden opportunities for marketers.

This technology allows you to create hyper-personalization, duplicate your marketing efforts instantly, increase brand loyalty, and use product ownership to increase sales.

What are your thoughts on using deepfakes in marketing? Do you think its potential to do good outweighs the bad?

Mail-In Voting Could Deliver Chaos

Delays will play havoc with federal Electoral College deadlines. Entire states could be disenfranchised. The post Mail-In Voting Could Deliver Chaos appeared first on ROI Credit Builders.

The post Mail-In Voting Could Deliver Chaos first appeared on Online Web Store Site.

The post Mail-In Voting Could Deliver Chaos appeared first on ROI Credit Builders.

Mail-In Voting Could Deliver Chaos

Delays will play havoc with federal Electoral College deadlines. Entire states could be disenfranchised. The post Mail-In Voting Could Deliver Chaos appeared first on ROI Credit Builders.

British GP could go ahead despite restrictions

Formula One is working to put on a British Grand Prix in July even if the country imposes quarantine measures on visitors during the coronavirus crisis, F1 sources said on Sunday.

The post British GP could go ahead despite restrictions appeared first on Buy It At A Bargain – Deals And Reviews.

Global investing under water? – Climate change could leave equities exposed

As impending global changes brought about by climate change loom, one issue in particular threatens to cause massive losses to institutional investors – rising sea levels. David Lunsford and Boris Prahl, of MSCI, explore where, despite the efforts of initiatives such as the Paris Agreement on climate change, institutional investors must protect their portfolios from physical climate risk, and why, when it comes to facing up to climate risk, inaction could prove catastrophic

The post Global investing under water? – Climate change could leave equities exposed appeared first on Buy It At A Bargain – Deals And Reviews.

You Could Take Over the World with Business Lines of Credit

Well, maybe not the entire world. However, you can definitely take your business to a new level. If it’s in trouble, business lines of credit could be just the thing you need to get you over the hump. But what makes this a better option than any other type of business funding? Furthermore, where do you find a business line of credit? Never fear. We have the answers you seek.

What You Need to Know about Business Lines of Credit

A business line of credit is similar to a credit card, so many think they work exactly the same. They really do not. There are some major distinctions between the two. These distinctions make each one better suited for specific situations. For this reason, it is not a bad idea to have both at your disposal for use as needed.

Find out why so many companies use our proven methods to get business loans.

Solving the Business Lines of Credit Mystery

Surprisingly, business owners often do not understand what business lines of credit really are. The simplest explanation is that they are a revolving line of credit. In fact, they are very much like credit cards. For example, like a credit card, you have a limit and continuous access to that limit. At the same time, you make payments only on the portion you use each month.

Consider the following example. You have a $1,000 line of credit. You can use however much of those funds you need each month for whatever you want, unless your lender restricts use. If you use $200, then when you get your statement you will have to pay $200 plus the interest. You will not owe or pay interest on the whole $1,000 loan.

If you were to spend the $200, then spend another $50, you would pay on the $250, minus any payment already made, the next month. Your payments change as your balance changes. Just like with a credit card.

Access is generally granted through checks or a debit card connected to the line of credit account.

Business Lines of Credit vs. Credit Cards

Business owners often ask what the difference is between business lines of credit and credit cards. Why is one better than the other? Truthfully, sometimes a credit card may work better. It just depends on your specific situation and needs.

The main differences you need to know are that a business line of credit typically has lower consistent interest rates. Also, there are none of the perks like 0% interest or cash back that you sometimes see with credit cards.

Unsecured Line of Credit vs Secured Line of Credit

There are two types of business lines of credit. You can get either an unsecured line or a secured line.

The fact is, an unsecured line of credit is harder to get. Also, it usually costs more than a secured line of credit.

This is due to the increased risk to the lender with an unsecured business line of credit. A secured business line of credit has the safety net of collateral. Therefore, if you cannot or do not pay, the lender can still use the collateral to recover.

Some business owners either do not have collateral to offer, or they have no interest in tying up their assets with financing. In this case, an unsecured line of credit may be an option.

An unsecured line of credit typically has strict approval guidelines and qualifications. Due to the increase in credit risk, they will also likely have higher interest rates and less favorable repayment terms.

3 Questions to Ask Yourself Before Looking for Business Lines of Credit for Your Business

While nothing is a guarantee, there are some things you can do to help ensure you get the best possible business lines of credit for your business. Start by asking yourself these questions.

-

Why Do You Need a Credit Line?

This is the basis of finding the best business line of credit for your needs. You have to actually know what your needs are. Here are some examples of how a business may use a line of credit.

- Buy or stock up on inventory, raw materials, or supplies while on sale. This can reduce cost of goods sold and consequently, increase the bottom line.

- Purchase or repair minor equipment when needed. This would be like a new printer or laptop. . Larger equipment, like an industrial freezer, would best be purchased with an equipment loan.

- Cover temporary gaps in cash flow or continuous, expected cash gaps due to timing issues. For example, if several bills are due at the beginning of the month and you know your largest contracts pay at the end of the month, you could cover those bills with the line of credit until your contracts are paid. The money is coming. It is reliable. However, the bills are due before the money comes. You can pay the bills with the line of credit. Then pay off the line of credit when the contracts pay.

Another example of this is a seasonal line of credit for a business that does the majority of its sales during a certain time of the year. A florist does a large percentage of sales during Valentine’s day, so a seasonal line of credit can come in handy to bridge the cash gap during other times of the year.

-

What is Available to You?

Shop around with different lenders to figure out which ones offer the best business lines of credit. You will want to look at factors such as interest rate and credit limit in relation to what you need and can afford.

Check with various types of lenders to get a feel for which ones offer what you need. Research larger banks, as well as small local institutions and credit unions. Don’t forget about online lenders either.

-

What is Your Business Credit Like?

Your ability to get approval for the best business line of credit will be directly related to your business credit. While lenders may also consider income and cash flow, they are going to rely most heavily on your business credit score when making an approval decision about a line of credit.

A lower business credit score does not necessarily mean you can’t get approval, but it could greatly affect your interest rate and credit limit.

Find out why so many companies use our proven methods to get business loans.

Consider signing up for a credit monitoring service that lets you keep tabs on your business credit and what is affecting it each month.

Once you have a handle on why you need a business line of credit, what is available, and what you may actually be eligible for, you can make a decision as to where you are going to apply and which product you are going to apply for.

Determining which of these lenders offers the best business lines of credit for your business goes back to knowing what you need, who has it, and who will approve you for it.

When Is a Line of Credit Better than a Credit Card?

If you are going to need to make payments, a line of credit is a better option. The reason is pretty simple. The credit rate is almost always lower. The few exceptions are those cards that offer 0% APR for a short period of time.

If you are going to use a credit card to make regular purchases that you are going to pay off immediately, and you qualify for a card with perks such as cash back, then you may find that you can benefit from using a credit card over a line of credit.

An example would be if you wanted to use your business credit card to make your monthly supplies purchase each month and then pay it off in the following month so that you could take advantage of the cash back.

To float a cash flow gap or make significant purchases that you will need pay out over a short amount of time, a line of credit is almost always the best choice.

Where Can You Find Business Lines of Credit?

Not all lenders offer them, but there are options available at many traditional and alternative type lenders. Which one you go with depends, again, on your specific situation.

Traditional lenders typically have the lowest interest rates. However, their repayment terms may be less flexible. They will also have harder to meet qualifications and a longer approval process. In addition, it can take several days after approval to have access to the funds.

An alternative lender will usually have easier to meet qualifications and more flexible repayment terms. The tradeoff is interest rates are much higher. The approval process is faster however, and in some cases, you can access funds in as little as 24 hours.

Where to Find the Best Business Line of Credit

Since most small businesses will have a hard time getting approval from a traditional lender due to poor credit or a lack of sufficient credit history, here are some examples of what some alternative lenders are offering currently.

Kabbage

Kabbage offers a credit line of up to $150,000 with no credit score required. The catch is that the interest rate is between 32 and 108%. The business must have been in existence for at least one year and have revenue of at least $50,000.

Due to the extremely high interest rate, this is really only an option for those businesses that cannot get financing due to a low or nonexistent credit score and need something immediately.

StreetShares

There is a credit line available at StreetShares of up to $100,000 for those who have a business credit score of at least 600, have been in business for at least one year, and have at least $25,000 in revenue.

It requires weekly repayment.

Due to the lower revenue requirement, this is a good option for smaller businesses that are okay in the credit department but have trouble meeting higher revenue criteria. Also, the interest rate minimum is lower, with the low end at 9%.

OnDeck

If you have a credit score of at least 500 you can get a credit line of up to $100,000 with OnDeck. There is a $20 per month maintenance fee, and weekly repayment. The interest rate is a little higher here than with those that require a higher credit score minimum. It ranges from 13.99 to 39.99 percent.

Again, due to the higher interest rate, this should only be an option if you cannot meet the higher credit score requirement.

Find out why so many companies use our proven methods to get business loans.

Lending Club

The credit line offer from Lending Club goes up to a limit of $300,000. It requires a credit score of 600, at least one year in business, and at least $50,000 in revenue. The repayment term is 25 months. Also, they require collateral for limits over $100,000.

This is a good option for those who meet the requirement as there is a higher limit available with collateral, and the interest rate can go as low as 6.25%. The repayment terms are much friendlier as well.

The Best Business Lines of Credit May Be Closer Than You Think

A business line of credit can be a great option for funding, depending on your specific needs. Ask yourself first if you need a credit card or a line of credit. The truth is, it doesn’t hurt to have both. Then, do your research. Start with the list above, but don’t stop there. Do some research and find a product that will really give you what you are looking for.

In doing so, don’t forget to take other funding options into account. Not only are there various types of loans available, but crowdfunding and grant opportunities exist as well. Find out more about the various options available for funding a business and you just might find that at this point, you really need something other than a business line of credit. At the very least, you’ll have the knowledge going forward, which can only aid in your ability to make better funding decisions for your business.

The post You Could Take Over the World with Business Lines of Credit appeared first on Credit Suite.

Financial Debt Or Credit Consolidation Could Be The Answer

Financial Debt Or Credit Consolidation Could Be The Answer

Customer financial obligation combination solutions give borrowers with therapy on monetary as well as financial debt monitoring as well as credit report education and learning. If you have actually been taking into consideration insolvency to resolve your exceptional financial obligation finances, you might desire to take into consideration financial obligation decrease loan consolidation solutions rather. Establish the objective of removing your unsafe financial obligation and also look right into customer credit history therapy as well as comparable solutions, consisting of financial obligation loan consolidation solutions.

Financial debt combination firms are established up with the objective in mind of decreasing your financial obligation, overall regular monthly repayments as well as rate of interest price. The loan consolidation firms will certainly examine your existing financial debt as well as economic scenario as well as create a suitable strategy. You might likewise be called for to authorize a declaration or letter validating your recognition, your complete financial obligation quantity, the names of your financial institutions and also your intent to reward the financial debt sustained.

Financial debt combination firms as well as customer therapy solutions attempt to aid you with your economic scenario, as well as are not just thinking about earning money. They will certainly likewise assist fix your credit history with numerous debt fixing solutions, consisting of the removal of the unfavorable ratings on your credit scores record because of late credit rating repayments. This can maintain your credit history value by dealing with the financial institutions to reveal you as a bill-paying customer.

All you need to do is get in touch with a financial debt combination firm or customer therapy company to boost your economic scenario as well as monetary future, resolve financial debt as well as fix your credit scores.

Customer financial debt loan consolidation solutions offer borrowers with therapy on economic as well as financial obligation administration as well as debt education and learning. If you have actually been thinking about personal bankruptcy to resolve your exceptional financial obligation car loans, you might desire to take into consideration financial obligation decrease loan consolidation solutions rather. Establish the objective of removing your unsafe financial obligation as well as look right into customer credit score therapy as well as comparable solutions, consisting of financial debt combination solutions. Financial obligation debt consolidation companies are established up with the objective in mind of minimizing your financial obligation, overall month-to-month repayments and also rate of interest price.

The post Financial Debt Or Credit Consolidation Could Be The Answer appeared first on ROI Credit Builders.

US-China cold war and rising protectionism could split world order

Experts say the world may face a "multi-dimensional cold war" as nations are "pressured to take sides" between the U.S. and China.

The post US-China cold war and rising protectionism could split world order appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND.

The post US-China cold war and rising protectionism could split world order appeared first on Buy It At A Bargain – Deals And Reviews.