30 Ways to Become a More Successful Entrepreneur

Whether you’re just starting out or are an old pro, who doesn’t want to be a more successful entrepreneur?

Owning a business gives you a sense of freedom and empowerment. You can build things and watch them grow.

Entrepreneurs make decisions for themselves, realize their creative visions, and develop lasting relationships with other entrepreneurs, customers, and vendors.

It’s a great way to live. That’s why I’ve founded so many companies — I can’t get enough.

I’ve put together these tips to help you to become more successful, too.

1. Get Gritty

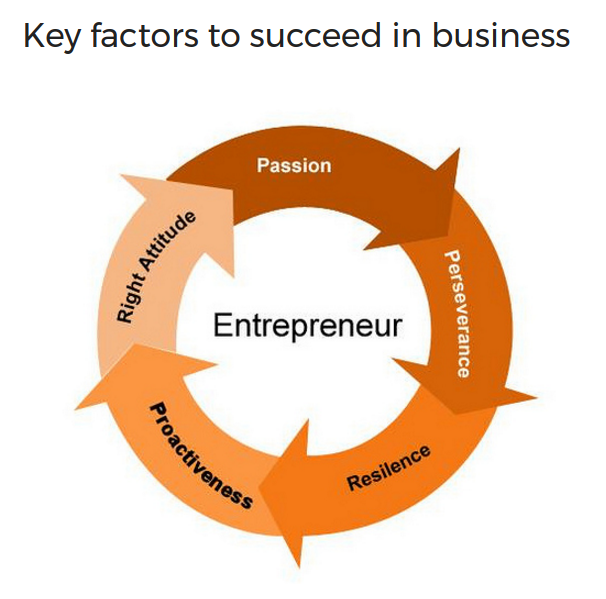

Grit is perseverance. Grit is the go-get-’em attitude that we expect of entrepreneurs. Grit is the ability to keep working when everyone tells you that you should give up.

If you want to be a successful entrepreneur, you have to be gritty.

Honestly, without hard work and perseverance, you’re not going anywhere in the entrepreneurial world.

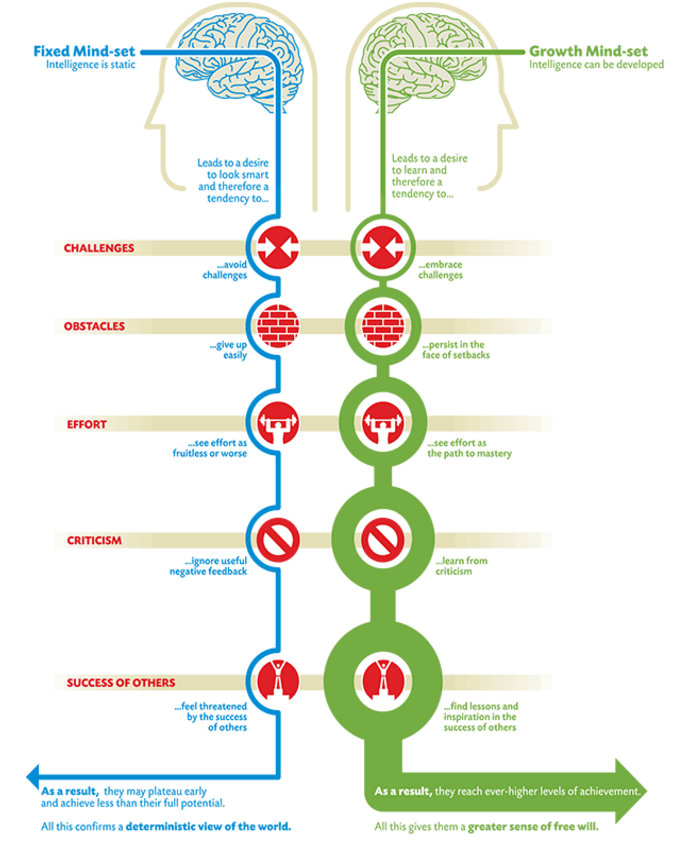

2. To Become a Successful Entrepreneur, You Must Challenge Yourself

If you want to be a successful entrepreneur, you have to challenge yourself. No one else is going to push you, so it’s up to you to do it.

Challenges keep entrepreneurs nimble and on their toes. If you’re constantly looking for the next challenge, you’ll always be prepared for what comes your way.

Consider this example:

You’re going to the gym to build your upper body strength. You start doing bicep curls with a 10-pound weight. It feels pretty heavy at first. As you build up your strength, it gets easier.

Would you stop there? No!

Then it’s time to do bicep curls with a 20-pound weight. Once you’ve done bicep curls with a 20-pound weight, going back to a 10-pound weight will feel easy.

Challenging yourself with new and difficult tasks will make your other tasks seem even simpler. As an entrepreneur, you always have to be looking for the next big challenge.

3. Successful Entrepreneurs Are Passionate about Their Work

If you don’t love what you do, don’t do it. I truly believe it’s as simple as that.

As an entrepreneur, you’re going to have to put in long hours and make sacrifices for your business.

When you’re passionate about what you do, putting in the long hours won’t feel like a sacrifice anymore.

If you’re not passionate about what you do, you’re not going to have the motivation to keep going when you’re stressed and tired.

Have you ever noticed those entrepreneurs who never seem to get tired? Those entrepreneurs who get that gleam in their eye when they talk about what they do? That’s passion.

If you’re passionate about what you do, being an entrepreneur gets just a little bit easier.

4. To Become a Successful Entrepreneur, You Must Take Risks

Humans are generally risk-averse, but part of being an entrepreneur is recognizing the risks that you should take.

Successful entrepreneurs take risks. It’s part of the job.

Successful entrepreneurs also know which risks to take and which they shouldn’t. Learn to recognize the risks that will benefit your business and take them.

Taking risks has a dangerous side, but the opportunities they present often far outweigh the potential dangers.

Learn how to identify which risks are worth taking and you’ll likely become a more successful entrepreneur.

5. Trust Yourself

If you don’t believe in yourself, who will?

Being a successful entrepreneur means that you’ve learned to listen to your intuition and rely on your wisdom when making decisions.

Your ability to trust and believe in yourself will show your confidence. People are more likely to follow and trust confident leaders.

Trusting in your own skills will also take some of the pain of uncertainty out of being an entrepreneur.

When you feel uncertain, remember how much experience and knowledge you have. Most entrepreneurs start their business after years of experience working for someone else.

There’s nothing wrong with asking for help when you need it or turning to a mentor for advice, but you also have to learn to trust yourself and your own judgment without input from others.

Learn to trust yourself and you’re already starting down the path of entrepreneurial success.

6. Reduce Fear

Fear stops action. Entrepreneurs have to be able to pivot and quickly take action when they see an opportunity or recognize a mistake.

With fear riding on your shoulder, you won’t be a successful entrepreneur.

As an entrepreneur, if you let fear be your guide, you won’t be able to listen to your intuition, you’ll be afraid to take the necessary risks, and your judgment will be clouded by emotion.

If you can find ways to reduce and manage your fear and you’ll be a much more successful entrepreneur.

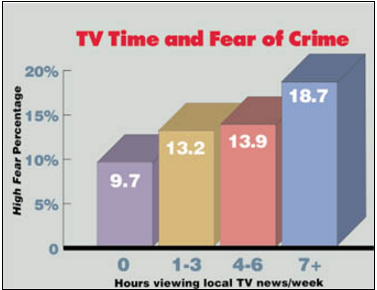

Keep in mind that fear has to do with your perspective. For example, studies have shown that the more true crime you consume, the more scared you are of crime.

My favorite tip for managing fear as an entrepreneur is to do confidence-building exercises.

For me, I like to take a few moments at night to think of the decisions I made that day that had a successful outcome.

Thinking each day about the decisions that you made that benefited you, others, or your business will help you to quickly build your confidence and reduce fear.

7. Successful Entrepreneurs Visualize their Goals

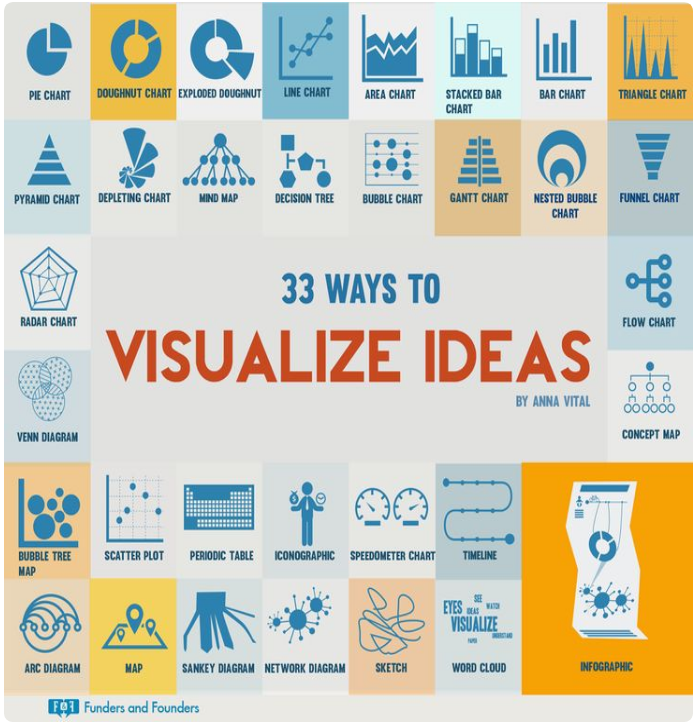

This tip is less abstract than you might think, so bear with me.

When I recommend that entrepreneurs visualize their goals, I don’t intend for them to close their eyes and see the goal in front of them.

What I want you to do to visualize your goal is to define it so clearly that it’s real and tangible.

For example, which of these is a more accomplishable:

- I want to become a successful entrepreneur.

- I will become a successful entrepreneur by starting a business that solves a problem for this specific niche of my audience.

The second one, right?

When you can clearly articulate and visualize your goal, it becomes more achievable.

There are many ways to visualize your goal if you aren’t sure how to start. You can write it down or draw it out.

You can tell someone, such as a friend or business partner, or take photographs that represent your goal. Go with your strengths.

When you ask a successful entrepreneur what their goal is, they can tell you in great detail what it is that they’re working to achieve.

8. Hire Great Partners to Help You Become a Successful Entrepreneur

I’ll admit that this one might be a little bit obvious.

Successful entrepreneurs aren’t successful within a vacuum. We all have a great team and support network behind us.

When I recommend hiring great partners, I don’t just mean someone who can do the job you’re hiring them for. You should seek partners who have great character and whom you like and respect.

You and your partners will be working long hours together and making stressful decisions. If you don’t respect your partner(s), your team won’t last long.

Fill your team with people who have great character and you’re well on your way to success.

When choosing your partners and team members, always remember that you can teach skills, but you can’t teach character.

9. To Become a Successful Entrepreneur, You Must Act Fast

Talk only delays action.

Successful entrepreneurs act.

It’s easy to get wrapped up in planning, considering potential failures, discussing funding, and talking in meetings with board members. If all you do is talk, you’ll get nothing done.

At some point, you have to halt the talking and make something happen.

10. Successful Entrepreneurs Spend Time on Important Tasks and Are Patient to See Results

Do you think that there’s such a thing as an overnight success? I recommend that you take a closer look.

Upon examination, the people and businesses that became “overnight sensations and successes” actually worked really hard and long for their achievements.

When you think you’ve found an overnight success, check again and examine closely the hours, days, and years that went into their success.

Take a look at their life, the things they learned, and how many times they failed.

Successful entrepreneurs take the time that’s required to reach success. And many of them have failures along the way.

If you think it’s taking too long to find success, give yourself a break.

Keep plugging along, putting in the hours, and before long, you’ll be a successful entrepreneur.

Just imagine looking back at all the hard work and knowing it paid off. Keep that image in your head to motivate you forward through the long, slogging hours.

11. Plan Your Finances

Startups and entrepreneurial businesses need money. It’s just a part of the lifestyle.

Many entrepreneurs spend too much time looking for money and not enough acting, but that doesn’t mean that you can leap into the abyss without a plan.

There are a few ways you can fund your business.

Decide which is best for you, and plan out your finances in the beginning. Try to stick to your budget, but know that the plan will have to be adapted along the way.

12. Who’s Your Customer? Successful Entrepreneurs Know the Answer

One of the most common reasons that entrepreneurial businesses fail is that there isn’t a customer.

If you start a business or make a product but don’t know who will buy it, that person might not actually exist.

Before you make a financial plan, raise capital, or even choose a name, make sure that there’s a customer who would buy your product or use your services.

Without a customer, you don’t have a business.

Successful entrepreneurs know who their customers and target market are.

13. Successful Entrepreneurs Listen to Complaints

This is one of the tips that I think is the most important for entrepreneurs to learn.

Your customer’s complaints are how you identify your business’s weaknesses.

Similarly to the last tip, without customers, you can’t have a successful business. There’s another possible scenario, though.

You might have customers who are interested in your product or service, but if you don’t listen to their complaints, you soon will have no customers.

Take your customers seriously, treat their complaints with respect, and listen.

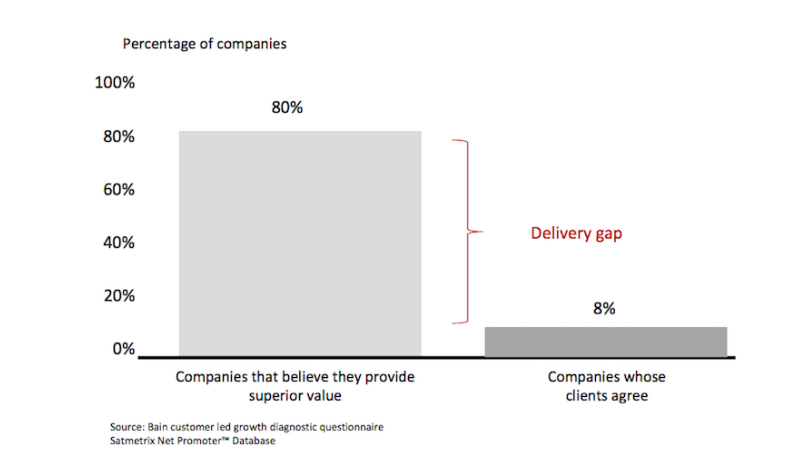

You might think you’re giving them value, but they may not agree.

Your customers know what they want, and they’re going to tell you what they think.

A smart and successful entrepreneur listens to those complaints and uses that information to fix the business’s weaknesses.

14. Exceed Everyone’s Expectations

If you deliver more than you promised, you’re sure to have satisfied customers, investors, and business partners.

Making promises and not delivering is a quick way to lose your business.

In contrast, successful entrepreneurs exceed expectations.

15. Manage Risks to Become a Successful Entrepreneur

Remember when I said that you should take risks? You should, though you shouldn’t take every risk that presents itself. Instead, manage your risks.

As a successful entrepreneur, you need to learn how to identify which risks to take but also when to take these risks.

Be sure to recognize where you are in the entrepreneurial cycle when calculating which risks to take.

16. Read Case Studies

As an entrepreneur, you’ll be inundated with your business, needing to take care of it all the time. When you get home and have some leisure time, you might be tempted to read fiction or books for entertainment.

Instead, I encourage you to read case studies. Read biographies of successful entrepreneurs. Read everything you can get your hands on about those who have already been successful.

There’s always something to learn from those who have already done it.

I especially think it’s important to learn from the mistakes of others. If you learn from their mistakes, you won’t have to make those mistakes yourself.

And if you do make mistakes yourself, definitely learn from those.

The more you learn from their mistakes and successes, the faster you can grow your business and become a successful entrepreneur.

17. Successful Entrepreneurs Self-Promote

Many people don’t want to self-promote or talk about their business too much for fear of sounding like an egomaniac; but if you don’t promote your business, who will?

Egotistical self-promotion and self-promotion can be differentiated.

Know your business, know some key stats, and have your 15-second elevator pitch polished and ready to go. Then, when someone asks you about your business, you can promote it factually and quickly.

Another way to self-promote without sounding cocky is to know what your customers say about your business. When someone asks how your business is going, you can tell them your customer feedback.

Don’t forget to provide some of the bad as well as the good.

18. Successful Entrepreneurs Set and Oversee a Positive Company Culture

There may have been a time when company culture wasn’t important, but with social media and the 24-hour news cycle, your company and employees are always under scrutiny.

Set a positive company culture from day one and you’ll be more likely to work with people you enjoy and who inspire you as well as attract great customers.

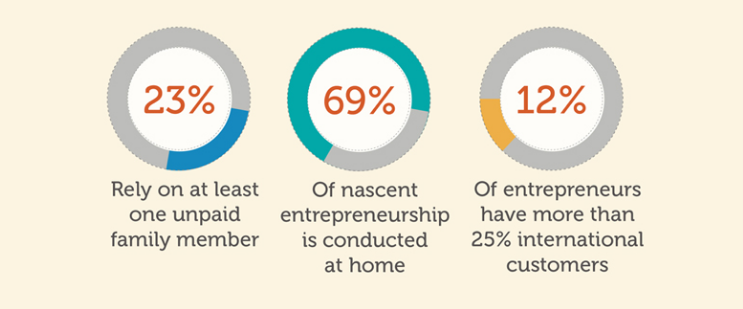

Many entrepreneurs are working with family, from home, and even across borders. It’s important to set and know what you want your company culture to look like.

19. Network, Network, Network

There is no such thing as too much networking (well unless it’s getting in the way of building your business, of course).

What I mean to say is that you shouldn’t ever stop networking because you never know where your next lead will come from.

Chances are, if you network with enough people, you’ll bump into another entrepreneur who might have the ideas and connections you need.

You might find a new connection while grabbing a beer at the airport bar, you might meet your next business partner in an elevator on your way to a meeting, and you just never know who’s sitting next to you on the bus.

Meet everyone you come into contact with and have a short chat. You never know who you’re sitting next to and what connections or resources they might be able to offer you.

20. Learn and Create

The successful entrepreneur mindset is that of learning and creation. As an entrepreneur, you always want to be taking in new information and creating.

This type of mindset can be draining and tiring, but without it, you’re not going anywhere.

To stay in the learner and creator mindset, stay away from TV, social media, and movies. These types of entertainment cause us to be passive and just take in information.

Pursue everything in moderation, but in general, these activities are time-wasters for entrepreneurs. Limiting your entertainment time is a sacrifice that must be made to become a successful entrepreneur.

Instead of watching TV and movies, read case studies and meditate. Take care of your mind and body in constructive, healing ways.

It may “feel good” to watch TV, but it’s not actually a rejuvenating way to relax.

To be a successful entrepreneur, find relaxing activities that help to restore your learner and creator mindset.

21. Successful Entrepreneurs Deliver, Not Sell

Honestly, no one likes to be sold to. I mean seriously, who enjoys going to the car lot and buying a new car? We all know what we’re getting ourselves into and dread it.

Instead of selling to your potential customers, deliver. Offer them a free trial and deliver a great product.

When your company delivers a great product or service, you’ll build customer loyalty faster than you can say, “successful entrepreneur.”

22. Take Baby Steps to Become a Successful Entrepreneur

Building a successful entrepreneurial business can seem daunting, and that’s okay. Building a business from the ground up is a massive undertaking.

Luckily I have a foolproof tactic: break it down.

Any problem that seems insurmountable, break it down into baby steps.

Once you’ve broken it down into baby steps, take them one at a time. Before you know it, just by placing one foot in front of the other, you’ll be halfway up the mountain.

With grit and perseverance, baby steps will get you far toward becoming a successful entrepreneur.

23. Put Everything on Your Calendar

You think I’m kidding, but I’m not. Put every single thing on your calendar.

Think something doesn’t need to be on your calendar? It does.

Put your meetings, quiet work periods, time with friends, happy-hour business meetings, kids’ soccer games, workouts, meal times, and anything else that you do on your calendar.

Once something is on your calendar, then everyone who needs to meet with you knows that time isn’t available.

An additional benefit is that once everything is on your calendar, there aren’t excuses for not getting things done.

I want to also draw your attention to one of the items I included: quiet work time. That is time when you can work, solve problems, or think creatively without being interrupted.

Everyone needs these periods of time. To be a successful entrepreneur, guard your quiet work times with your life. The success of your business may depend upon them.

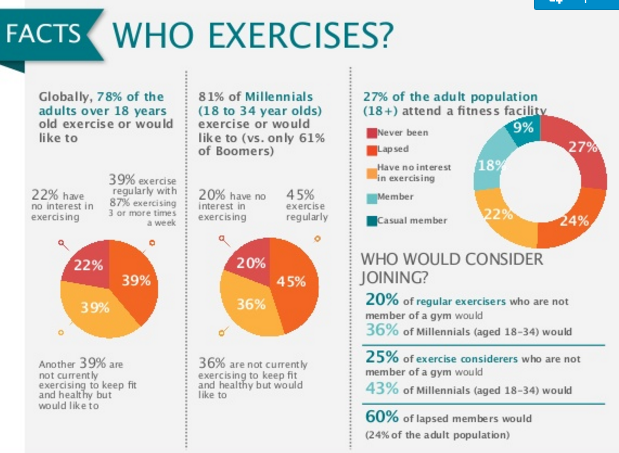

24. Exercise to Become a More Successful Entrepreneur

Did you know that sitting down all day long is bad for your health? It is.

Being a successful entrepreneur doesn’t just mean running a profitable business. Run yourself too ragged managing that business and you might not be around to enjoy its success.

You must take care of yourself as well as your business. One of the many self-care tasks that I recommend is exercise.

Make sure to book time in your calendar to get in some exercise and get out of your chair.

Maybe you go to yoga, walking meetings, climb the stairs instead of taking the elevator, or simply go to the gym.

Build time into your calendar every week (dare I hope for every day?) to be physically active and take care of your body as well as your business.

A sick or unhealthy entrepreneur isn’t a successful entrepreneur.

25. Successful Entrepreneurs Stay Focused

The life of a successful entrepreneur can feel scattered and disjointed, but it’s important to limit your time spent multitasking.

Research has shown time and time again that multitasking doesn’t work. Humans aren’t capable of it.

And yes, multitasking includes being distracted by your phone and email tabs. Close them and put them away.

Learn to focus and take time to do just one task. Giving one task your full attention will mean that you’re more likely to get it done and do it well.

It’s also important to know that too many tasks on your to-do list can make you ineffective and distracted.

Learn to focus your to-do list on the tasks that you’re capable of finishing in the amount of time you’ve allotted for them.

For example, each night, set the three tasks that you’ll complete the following day. Each month, set the overarching goal for your company that you want to achieve in the next 30 days.

These techniques can help you to learn how to focus and more effectively manage your business.

26. Take Time Off

We finally made it to the tip that I think it the toughest for successful entrepreneurs to put into practice.

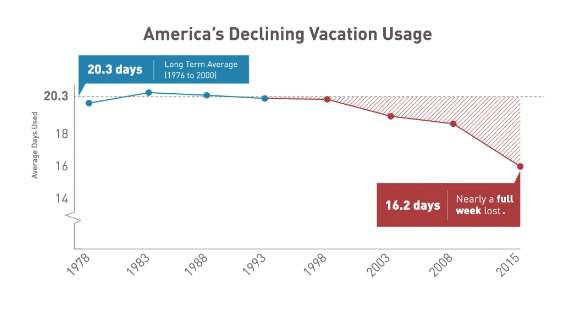

I really mean that you need to take time off. Americans don’t do it enough.

You might not need time off every day or every week, but you do need to take time off. If all you do is work, you’ll burn out. Fast.

I think this is the most challenging for entrepreneurs because they often see themselves as invincible or believe that they must be invincible. This just isn’t true; we’re all humans and we need time off.

Time off allows your brain to roam, to rest, and to think. Ever wonder why you think of so many ideas in the shower? It’s because your brain has free range to just think and roam.

Even the most successful entrepreneurs don’t work all the time. Everyone needs time off, so don’t shame yourself for being human and normal.

When you do take time off, notify your staff ahead of time and let them know why it’s important to you.

Teaching your staff the importance of time off will help them to respect your time away and to recognize when they need time off.

By the way, you should allow your staff time off too. They also are human and will occasional breaks.

Take time off before you need it and recognize that it’s important for healing, creating, and becoming a more successful entrepreneur.

27. Successful Entrepreneurs Ask Questions

You don’t know everything. No one does.

You should ask for help, advice, mentors, and everything else you need as you get your business set up and running. Asking questions is a valuable skill to have as an entrepreneur.

The more information you have, the more you will know and be able to take into consideration.

Asking questions also helps you to remain in a learner mindset, ready to accept advice and information.

Learners and those who ask questions are more likely to become successful entrepreneurs.

28. Learn From Your Failures

Better to accept it now then later. You will fail at some point. It’s how you adjust to these failures that will make or break your business.

Failure is an aspect of becoming a successful entrepreneur, so you’d better get used to it now.

If your first business does fail, keep in mind that you can create another with the lessons you learned from your first.

29. Get Inspired

Being an entrepreneur is a creative pursuit. As an entrepreneur, you have to make connections, solve problems, and create new things that no one has thought of before.

Creators and creatives need to be inspired.

Successful entrepreneurs take time for the things that inspire them.

Maybe your inspiration comes from being in an art museum, maybe it’s reading books, maybe it’s doodling —whatever it is that inspires you, do it. It’s good for your business.

Successful entrepreneurs are inspired. Don’t let that magic slip for too long. Whenever you can, and definitely when you’re feeling burned out, get out there and get inspired.

Inspiration is the spark for ideas. Ideas make successful entrepreneurs.

30. Successful Entrepreneurs Lend a Helping Hand

Entrepreneurs are busy, so this tip sometimes trips them up. It’s easy to think, “I don’t have time to help anyone else! I’m so busy already!”

However, helping others can be inspiring and massively beneficial. It makes you feel good.

Furthermore, as an entrepreneur, you have a network with whom you can share your expertise and jobs you can hire people for. Why wouldn’t you help out when you can?

When you help someone, they will likely find a way to help you. It might not be today or tomorrow, but somewhere in the future, they will be there to help you when you need it.

Helping others is also a great way to build a loyal and supportive network around you.

Conclusion

Succeeding in business doesn’t come overnight. It takes a lot of planning, preparation, creativity, grit, and patience to become a successful entrepreneur.

The 30 tips I provided in this guide will help you with a long-term strategy and build it in baby steps until your business becomes a success.

If you need help defining and implementing a digital strategy as you start to build your business, let us know if we can assist you. We even offer custom packages for businesses on a strict budget!

What makes you a successful entrepreneur?

The post 30 Ways to Become a More Successful Entrepreneur appeared first on Neil Patel.