How We’re Going to Use X Reality (XR) in Business

Are you ready for X reality? It’s coming, too, along with a host of exciting business and marketing opportunities.

Here is what it is, why it matters, and how to use it to grow your business.

What Is X Reality?

X reality is short for extended reality. Sometimes called cross reality, it’s a convergence of the real, physical world around us and a digital world or space.

One way to think about it is combining a digital or virtual experience with a physical one. There are many different ways this plays out, but as the technology develops, the opportunities explode.

To get a better picture of what we’re talking about, let’s take a moment to imagine. Have you ever taken a tour through a museum with a set of headphones that give an audible experience as you walk along? Suddenly, it sounds like you are walking through the Wild West or wherever this experience is taking place.

Now add visuals and other physically interactive elements. Maybe you can actually touch the doors of the saloon or watch the scenes change as you walk down the dusty road. You can draw your pistol for a duel.

Imagine having these experiences, even when you aren’t at the museum. Maybe it’s in your own backyard. Or your hometown main street. Your reality has merged with the virtual. Your reality is extended.

The technology that allows for these immersive reality experiences is constantly evolving, bringing our reality closer to the virtual experience.

To get the full X reality experience, certain hardware may be required. Again, think about enhancing the physical with the digital. You may need tools to provide that combined experience. Typical hardware may include a tablet, such as an iPad, a smartphone, a headset, earphones, or other body wear, including gloves, etc.

The specifics reflect the specific experience, and what you are trying to achieve for the user. Some extended reality experiences are simpler, while others are more involved and more immersive.

In so many ways, it is the future of marketing. Whatever marketing campaign you’re developing, the goal is to get your brand out there and help your target market see how they can’t live without your brand. Extended reality opens a world of opportunities to interact with products, services, and brands.

It’s not just in the sales funnel at an introductory level where X reality can support your brand growth. It can help you build brand awareness, customer satisfaction, customer loyalty, word of mouth, and referrals, and more.

Here are a few ways it can be used in your business:

- Train your staff to prepare for difficult or tricky customer service situations.

- Arm your sales team with tools to connect customers with the best options.

- Let customers “try out” a product beforehand.

- Connect in-person shoppers with digital information.

- Create new designs or products in a virtual world.

- Bring a certain layer of fun to your brand.

As X reality continues to expand, the entire marketing ecosystem will evolve as well, calling us to respond. Everything from brick-and-mortar experiences to SEO will be impacted by X reality.

AR vs. VR vs. MR: The Three Types of X Reality

X reality is an overarching term that can refer to each of these: augmented reality (AR), virtual reality (VR), and mixed reality (MR). While these are sometimes used interchangeably, the specifics can vary, and they do have exact definitions. Let’s dive in.

Augmented Reality

Augmented reality is about overlaying the real world and the experiences of the physical world around us with virtual or digital enhancements. Augmenting means to make something bigger or better, so augmented reality is about making the things you see around you somehow better, depending on your definition of better.

It’s a way of interacting with the people and things around you and a digital space simultaneously, often using the camera of a smartphone or mobile device to interact.

Virtual Reality

Virtual reality refers to interactive, immersive experiences that are computer-generated. Virtual reality experiences are about full digital worlds that are a sort of escape or separation from the real world, rather than an overlay. Virtual reality requires hardware to help the user jump into the virtual world. These tools may include a headset, viewers, glasses or goggles, as well as other items like gloves. With these, the user is able to simulate experiences in their virtual world, incorporating their own bodies and movement.

Mixed Reality

Mixed reality is exactly as it sounds. It’s a mix of the virtual world with the physical. According to Microsoft, when it comes to the spectrum of physical and virtual worlds, mixed reality sits in the middle. It’s also in the middle of virtual reality and augmented reality. It takes place with one foot, or one digital foot, in each space.

Mixed reality is where a lot of technology evolution is pushing right now. While it’s easy to come up with examples of AR or VR, mixed reality is more about pressing those concepts together, using all the tools and technologies we have to create even more exciting experiences.

How AR, VR, and MR Differ

While these three concepts differ slightly in their starting points, and the tools needed to make them work, they do have one thing in common: They are about extending a digital world into our everyday lives with greater ease and more seamless connections.

These three types of X reality are ripe with the ability to bring better user experiences to your customers throughout the sales process, to help you ultimately reach your own brand goals.

5 Ways to Use X Reality in Business

As much as there are fun and entertaining ways to use X reality, there are also powerful and exciting ways to integrate the technology into your business to support your sales goals. Using extended reality keeps you on the cutting edge, setting you apart from your competition who may be slow to adopt it.

It also equips your customers and your team with opportunities. Here are just a few ideas to get you thinking.

1. Product Content Management

When it comes to staying organized with everything you are creating and selling, your product content management system is the heartbeat of it all. Whether it’s a spreadsheet or integrated software, it’s the place where you keep all the details, facts, and data behind each product.

Here’s where X reality can take your product management system to the next level. Imagine being able to react to your customers’ needs and product demands in virtual 3D space. This interactive design is growing in popularity, allowing teams to make tweaks or try new designs, simulating a real-world without the cost or ability to actually create items.

This is particularly useful for products at scale that are too large or expensive to create prototypes of. It also gives the whole team an opportunity to actually interact with a product, so you don’t have to slow down, collect questions, run the numbers, and make necessary edits. It’s a time-saver and brings proof of concept faster.

There is an added benefit of these digitally connected X reality systems. They can connect with your product content management system and share data. You can keep track of all the specs of your current products, as well as all the information about products in development, in real-time.

2. Remote Team Building and Collaboration

Remote teams benefit from a host of technologies that allow them to communicate and stay in touch, including video meetings and instant messaging.

Yet nothing beats speaking in person, interacting with the rest of the team and the actual products. PromoLeaf did a survey and found that 72 percent of respondents preferred an in-person conference in their industry, rather than one online. In the youngest crowd they surveyed, ages 16-24, 84 percent preferred to be in-person.

X reality can help merge those opposing options by making it seem like remote employees are in the same location working together on projects.

3. Product Preview

We’ve all experienced the itch to “try before you buy” when it comes to new products. It’s just not apparel, tools, or the latest smartphone. How about furniture, automobiles, homes, and more? Does that seem too far out of reach?

Not with X reality. Using up-and-coming technologies, brands can create apps that allow you to view and interact with a product for yourself. Now you can test our furniture in your own home before buying. You can drive your ideal car through the streets of your morning commute before it’s even created. You can walk through your dream home, while still on the other side of the country or the world. Just imagine all the possibilities.

From in-app devices to headset-enabled simulators, you can “be there” without being there and trying it, even before it exists.

4. Interactive Advertisements

X reality has so many fun benefits to get people talking. Sometimes those features alone can be the reason to adopt them.

Using X reality in your advertising can allow the public to interact in different ways and help you seem more authentic than other ads. It can also get people talking and give your ad extra exposure.

Brands have tried all kinds of things, including bringing a printed item to life through an app. Suddenly your magazine or brochure is interactive or other videos. Other brands have used augmented reality and large screens to welcome passersby and onlookers to interact with virtual characters. Others use social media filters and other features to showcase their brands.

5. Train Your Team

Business is full of training. From safety and regulatory training to sales conversion and customer service training, arming your team with the most relevant information possible is critical.

With X reality, your team can do more than just talk about situations. They can walk through them together, interacting with people and products. You can even simulate potentially dangerous situations without putting one in harm’s way, and still gain the experience and confidence they need to be ready for real life.

Examples of X Reality

Have you experienced reality for yourself yet? Here are a few examples of some of the most talked about.

Pokémon Go

Pokémon Go put augmented reality on the radar for all of us. Through the lens of a mobile device, the world could suddenly be full of Pokémon characters. This game showcased how entertainment and X reality can boost small local businesses, with real-world locations signing up as Pokéstops and Gyms.

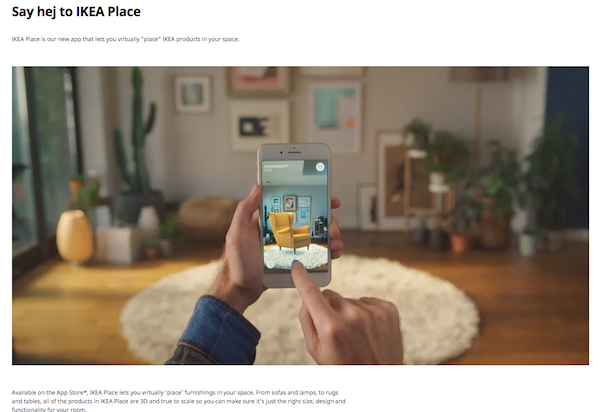

IKEA App

IKEA Place allows customers to “place” IKEA furniture in their own space, and see how it will look and fit. It sets the bar for other furniture makers by offering a service that others may not have incorporated yet. Plus, it’s kind of fun to use, so even when people aren’t ready to buy, they may still play around on the app just to see what it’s all about.

Warby Parker

Warby Parker has also cashed in on the opportunity to let customers try on before they buy. Using an app, customers can view themselves in any number of Warby Parker glasses.

It’s not just a snapshot with the frames overlaid, but an interactive, real-time experience where customers can move their head, look from all angles, and then throw on another pair.

Conclusion

X reality is a fun idea that seems primed for gaming and entertainment, but it’s tailor-made for business and online marketing. From product development to customer service, extended reality can change the way we interact with our brands, our customers, our team, and our world.

As the world of business continues to evolve, there are many reasons to believe extended reality will be part of that equation.

How will you incorporate X reality into your brand?