How to Leverage Ubersuggest SEO Reports to Keep Your Strategy in Check

There are no two ways about it: SEO works. It’s one of the main tools I used to build this site, and I’ve seen it work for hundreds of clients around the globe.

However, SEO is complicated. It requires data insights, analytics, tracking, and constant upkeep. While there are plenty of SEO tools on the market, many of them are expensive and hard to use.

This is why I created Ubersuggest—to help marketers and business owners get access to the SEO insights they need to drive massive amounts of traffic and increase revenue.

Why Should You Use Ubersuggest SEO Reports to Support Your Digital Marketing and Content Strategy

Ubersuggest’s SEO reports provide a massive amount of insights into the overall health of your website, including SEO opportunities, backlinks, content ideas, and a whole lot more. Why should you use it?

If your SEO is lacking, you risk losing traffic to your competition. Consider these statistics:

- 75 percent of users never scroll past the first page of search results.

- Organic traffic is responsible for 53 percent of all site traffic.

- The typical person will search Google four times a day.

If you want traffic to your website, you need to be on top of your SEO game—and Ubersuggest can help. More than 50,000 users, from small businesses to enterprise companies, currently use Ubersuggest.

Why do they love it? Here are a few reasons:

- Ubersuggest is 70 percent cheaper than alternative SEO tools.

- It’s easy to use, and we provide tons of support to make sure you can make the most of it.

- We keep adding features, which means you’ll always have access to the tools you need to drive traffic and improve your SEO.

- Gain access to tools, worksheets, and templates to increase the ROI of all your digital marketing efforts.

If you’re just getting started in SEO, I highly recommend watching the video below to understand the basics. Keep reading if you want to learn how SEO reports from Ubersuggest can help increase your SEO ROI.

Ubersuggest is a full-featured SEO tool that offers tons of SEO reports and tools to help your site succeed. Here are seven ways Ubersuggest will help you stay on top of your SEO game.

1. Use Ubersuggest SEO Reports to Identify Top SEO Opportunities

The first five organic results account for 67.60 percent of all the clicks, while results ranking 6 to 10 account for only 3.73 percent of clicks. This means if you want traffic, you need to find and leverage SEO opportunities.

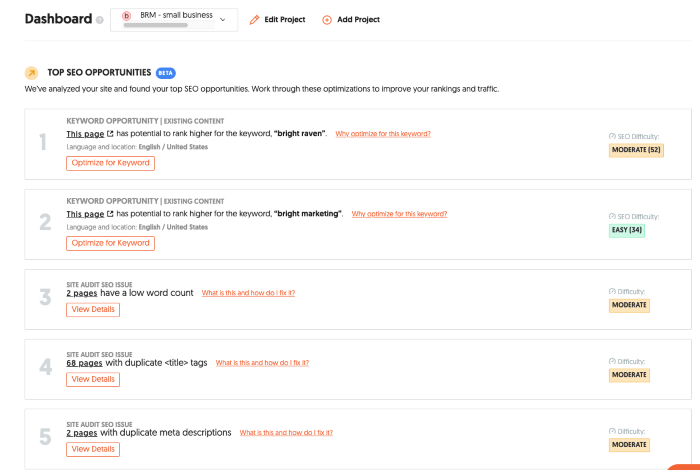

Ubersuggest makes this process simple with our Top SEO Opportunities report. Here’s how to access it:

Sign in to Ubersuggest, then look at the Top SEO Opportunities in your dashboard. This list serves as a checklist to improve your current SEO strategy. The list will automatically update as you make changes and as new opportunities arise. For example, if a competitor starts to gain traffic with one of your core keywords, we’ll let you know.

Check it at least once a week, and try to tackle at least one suggestion a week from the list to keep your momentum going.

This report doesn’t just tell you what’s wrong—it also tells you how to fix it. Take a look at the screenshot above. If you click “Optimize for Keyword,” Ubersuggest will tell you what topics to cover and even provide a basic outline you can use to create the high-quality content Google loves.

It’s kinda like having your own personal SEO consultant keeping an eye on your website 24/7.

2. Use Ubersuggest to Perform Monthly SEO Audits

SEO audits should be performed regularly to ensure your website stays in good SEO standing. Most businesses, however, only perform an SEO audit two to four times a year.

It’s easy to understand why SEO audits are time-consuming and difficult, especially if the process is unfamiliar.

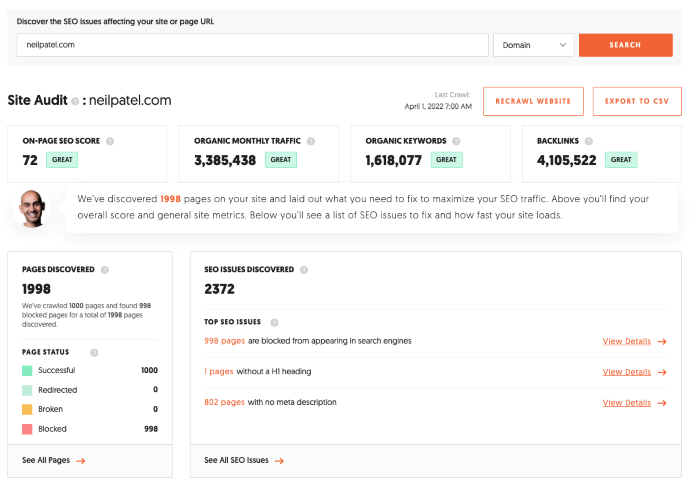

SEO audits don’t have to be a pain. With Ubersuggest, you can easily perform an SEO audit in just a few minutes. Here’s how:

- Log into your Ubersuggest dashboard.

- Click on the “Site Audit” button in the left sidebar.

- Enter your website URL.

That’s all you have to do. Ubersuggest will crawl your website and deliver a detailed SEO audit. If you have a large site, this could take a few minutes, so be patient.

Ubersuggest shows your on-page SEO score, organic traffic, number of backlinks, organic keywords you are ranking for, insights into load time, and SEO issues.

This is a great place to go to understand the current state of your website. You will get a detailed SEO overview of your website, as it stands today, so you can understand your technical strengths and weaknesses.

You can use this information to prioritize what’s most important and create monthly to-dos to tackle.

If you decide to hire someone to help with your website, just hand over the prioritized list to them each month. We tell you what changes will make the most impact on your website and how difficult the updates are, so you can decide what to tackle yourself and what to outsource.

3. Use Ubersuggest SEO to Find Profitable Keywords and Track Your Progress

Keywords are the backbone of a solid SEO strategy. However, finding the right keywords can be a challenge. Just because a keyword has a high search volume, for example, doesn’t mean it will drive traffic to your website.

You should perform keyword research on at least a monthly basis. The good news is that Ubersuggest can do it for you.

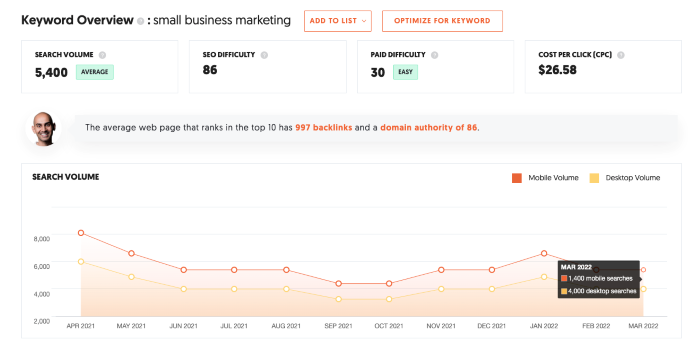

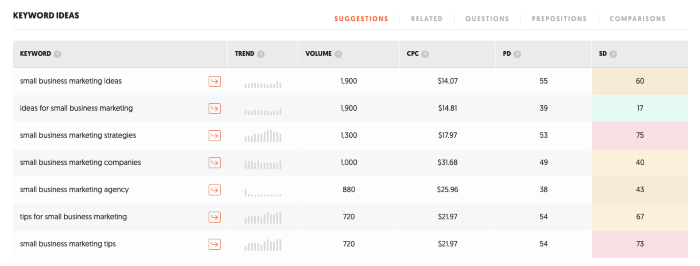

Use the Keyword Overview report to understand search volume trends, SEO, and paid difficulty, plus the average CPC for your targeted keywords.

This will help you find other keyword ideas that might be easier to rank for within the Overview report (think lower volume, lower-paid and SEO difficulty, lower CPC.)

Note, these change with seasonality for a lot of companies, so check this at least once a month.

You’ll also see a table of Keyword Ideas. Keep special note of the keywords that have a low SEO difficulty, as these are generally easier to rank for. If you don’t currently have content covering that topic, now is the time. Just make sure those terms are relevant to your customers.

You can also see what keywords drive traffic to your competitors’ websites with the Keywords by Traffic report. I recommend checking this monthly to see how keyword trends change for them as well.

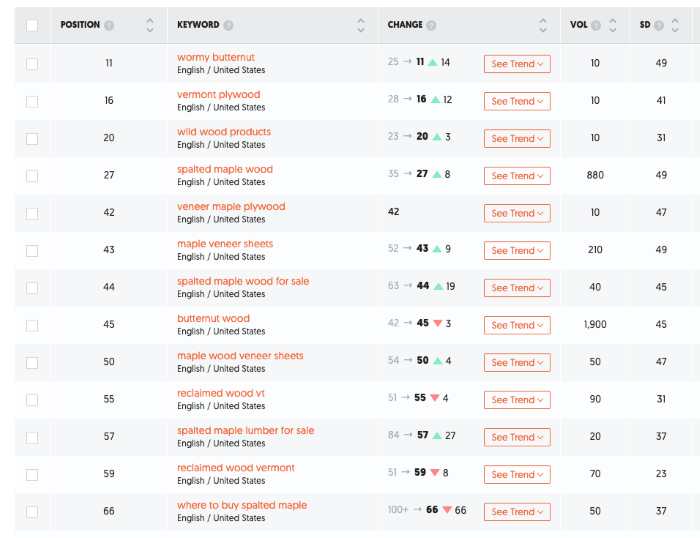

Track how you perform for your targeted keywords with the Rank Tracking report. It’s best to have at least 30-50 keywords saved in any given month and to check weekly to ensure you aren’t losing ground with keywords you’ve worked hard to rank for.

You’ll also see which keywords you are ranking well for. If you’ve recently updated content, earned new backlinks, or made other changes, this data will tell you it’s working. (And that you might want to use those same strategies on other pages.)

4. Use Ubersuggest SEO to Discover New Content Ideas as Your Company Grows

Every day, more than 6 million blog posts are published on the internet. That makes finding new content ideas a challenge. If it feels like every topic has already been covered, you’re not alone.

Finding new content ideas is challenging, but Ubersuggest can make it a lot easier.

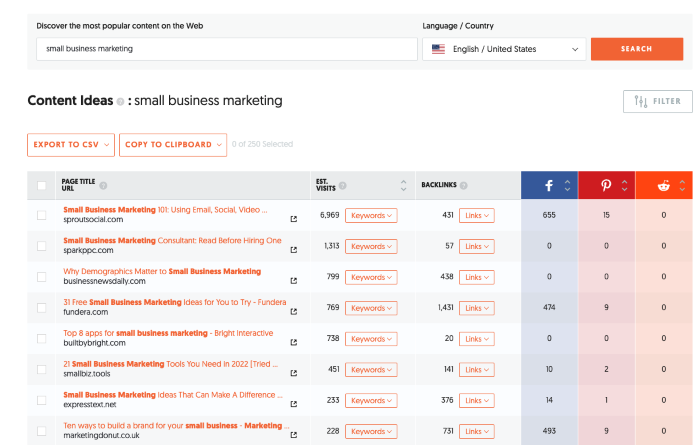

Use the Content Ideas report to discover what types of blogs are popular on the internet. Get inspiration from the list and choose topics you’re comfortable writing about that you may have a different angle to talk about.

This report also helps you to stay away from writing about a topic that others have already covered and are ranking well for, which makes them harder to compete with.

Don’t ignore topics that have already been covered. Instead, look for ways to create better or more in-depth content. For example, you could:

- Write a longer post that covers a topic in more depth.

- Share insights or case studies that show how to implement a strategy.

- Consider other content formats, such as videos, infographics, or white papers.

The list of ideas in this report is ever-changing, giving you endless ideas to work from.

5. Use Ubersuggest SEO to Identify Backlink Opportunities

According to research by Backlinko, the number of domains linking to a page has the highest correlation to Google ranking. In fact, the number one result in Google has an average of 3.8 times more backlinks than those in positions 2 through 10.

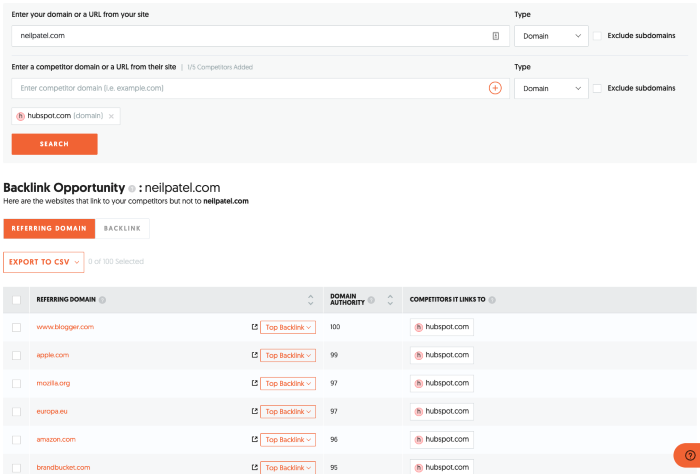

One of the best ways to improve your SEO is to increase your backlinks—the right way. Buying links, trading links, and other black hat strategies won’t deliver the results you want. Instead, I recommend using the Ubersuggest Backlinks report to see how your competitors are performing and find opportunities for your own site.

Links to both your and your competitors’ websites change regularly (for some, it’s happening daily). Head to the Backlinks Opportunities report often to see who’s linking to your competitors but not to you, then reach out to those companies with similar (not the same) content and ask them to link back to you.

Not sure what to say? Here’s a link to backlinks email outreach ideas and templates

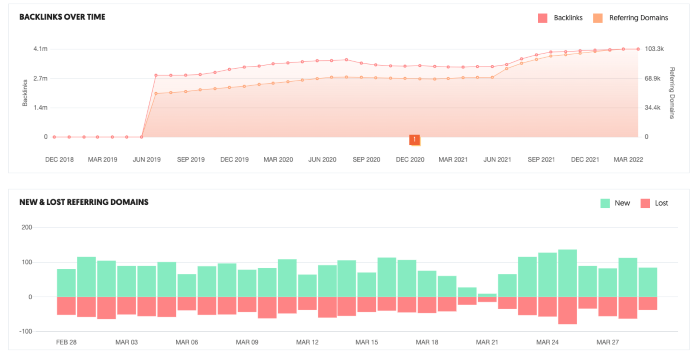

Once you’ve gained some momentum, check your Backlinks Overview report at least monthly and pay special attention to the Backlinks Overtime report. This will show your backlinks growth and understand how many new websites are linking to you each month (and how many you’ve lost).

This can also help you find other websites similar to the ones linking to you already, and you can reach out to the ones who stopped linking to you to understand why.

6. Use Ubersuggest SEO for Weekly Check-ins for the Biggest Impact

Google’s algorithm uses more than 200 factors to determine which website to rank for a specific search, and those factors are constantly changing. This means the most effective SEO strategies are constantly changing, too.

So how do you keep up? By using Ubersuggest to get weekly notifications about the health of your site’s SEO.

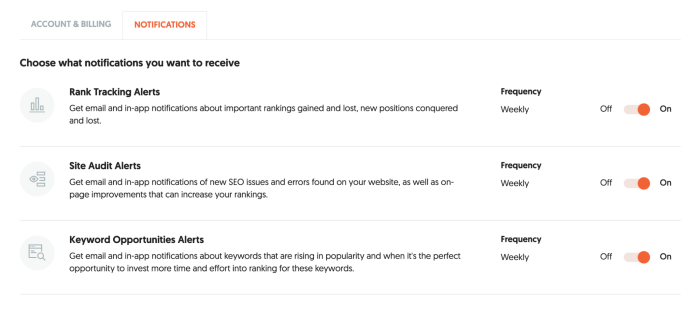

Turn on weekly notifications here to get a quick view of the following:

- Rank Tracking Alerts: Get email and in-app notifications about important rankings gained and lost, new positions conquered and lost.

- Site Audit Alerts: Get email and in-app notifications of new SEO issues and errors found on your website, as well as on-page improvements that can increase your rankings.

- Keyword Opportunities Alerts: Get email and in-app notifications about keywords that are rising in popularity and when it’s the perfect opportunity to invest more time and effort into ranking for these keywords.

Successful SEO is an ongoing process, but that doesn’t mean you have to spend hours every week digging into analytics. These SEO ranking reports allow you to keep an eye out for issues while you stay focused on your long-term goals.

7. Use Ubersuggest Support for Personalized Assistance

We’ve covered how to use Ubersuggest to pull the best SEO reports you need to track your performance. What happens if you have a question or aren’t sure what a suggestion means? The Ubersuggest team is here to help.

In fact, there are five ways to get additional SEO support from Ubersuggest, including:

- Coaching Call: If you get stuck with anything, Ubersuggest offers monthly coaching calls where you can call in and get your questions answered by one of their SEO experts. Register here.

- SEO Unlocked 8-week Free, self-paced course: My course covers everything you need to know about SEO, from what SEO is to performing keyword research and optimizing your website.

- Customer Support: Have issues with Ubersuggest or aren’t sure where to find something? Submit a ticket and my team will get back to you ASAP.

- Knowledge Base: This post covers the SEO reports in Ubersuggest, but there are even more features to love. Search in the Knowledge Base here to learn more.

- Chat: Want immediate help? You can ask a question in the chat box at the bottom right of any page in Ubersuggest.

SEO Reports Frequently Asked Questions

What should an SEO report include?

A good SEO report should include overall traffic, keyword ranking, a list of backlinks, time on site and bounce rate, top traffic by page, keyword search volume, competitor data, SEO tasks to complete, and an overview of the entire SEO report.

What does a good SEO report look like?

A good SEO report should provide the data and insights you need to improve your ranking in search engines. Ideally, it should cover overall traffic, keyword ranking, backlinks, traffic per page, and SEO errors. The format should be easy to use and understand. With Ubersuggest, you can view all this data in the dashboard or screenshot the charts and embed them in a Google Slides presentation.

How do you read SEO reports?

It depends on the report you’re viewing and what type of data you need. I recommend starting with the overview of the SEO ranking report, then drilling down into specific areas based on your goals and needs. For example, if your overall traffic is dropping, the SEO errors are a good place to start as there might be an issue impacting your entire website.

How do you create an SEO report?

The best way to create an SEO ranking report is to sign up for Ubersuggest, add your website, and use the SEO report tools to pull the data you need to drive traffic. Alternatively, you can dig into Google Search Console and Google Analytics to pull the relevant data. However, those tools often don’t provide the level of detail or recommendations you need to drive SEO success.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What should an SEO report include?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

A good SEO report should include overall traffic, keyword ranking, a list of backlinks, time on site and bounce rate, top traffic by page, keyword search volume, competitor data, SEO tasks to complete, and an overview of the entire SEO report.

”

}

}

, {

“@type”: “Question”,

“name”: “What does a good SEO report look like?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

A good SEO report should provide the data and insights you need to improve your ranking in search engines. Ideally, it should cover overall traffic, keyword ranking, backlinks, traffic per page, and SEO errors. The format should be easy to use and understand. With Ubersuggest, you can view all this data in the dashboard or screenshot the charts and embed them in a Google Slides presentation.

”

}

}

, {

“@type”: “Question”,

“name”: “How do you read SEO reports?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

It depends on the report you’re viewing and what type of data you need. I recommend starting with the overview of the SEO ranking report, then drilling down into specific areas based on your goals and needs. For example, if your overall traffic is dropping, the SEO errors are a good place to start as there might be an issue impacting your entire website.

”

}

}

, {

“@type”: “Question”,

“name”: “How do you create an SEO report?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

The best way to create an SEO ranking report is to sign up for Ubersuggest, add your website, and use the SEO report tools to pull the data you need to drive traffic. Alternatively, you can dig into Google Search Console and Google Analytics to pull the relevant data. However, those tools often don’t provide the level of detail or recommendations you need to drive SEO success.

”

}

}

]

}

Conclusion: Get the Best SEO Reports from Ubersuggest

The cost of SEO varies based on the size of your site and your goals. However, the average small business can expect to pay between $750 and $2,000 per month for ongoing SEO support or up to $35,000 for one-time projects.

Despite the importance of SEO, those rates can be difficult for many businesses to manage. Luckily, Ubersuggest’s SEO Reports can provide visibility into your SEO for just a few dollars a month, and you won’t have to sacrifice results.

If you’d rather have an SEO expert do the work for you, we’re happy to help. Reach out to my team, and let’s talk about your SEO goals.

Have you used Ubersuggest’s SEO reports? What is your favorite feature?

Foundation

Foundation